Bitcoin mining company holdings and production capacity report: the total holdings of the top 14 mining companies are far less than MicroStrategy

Original author|CoinGeckoWinifred Amase

Compilation|Odaily Jessica

Amount of BTC held by Bitcoin mining companies

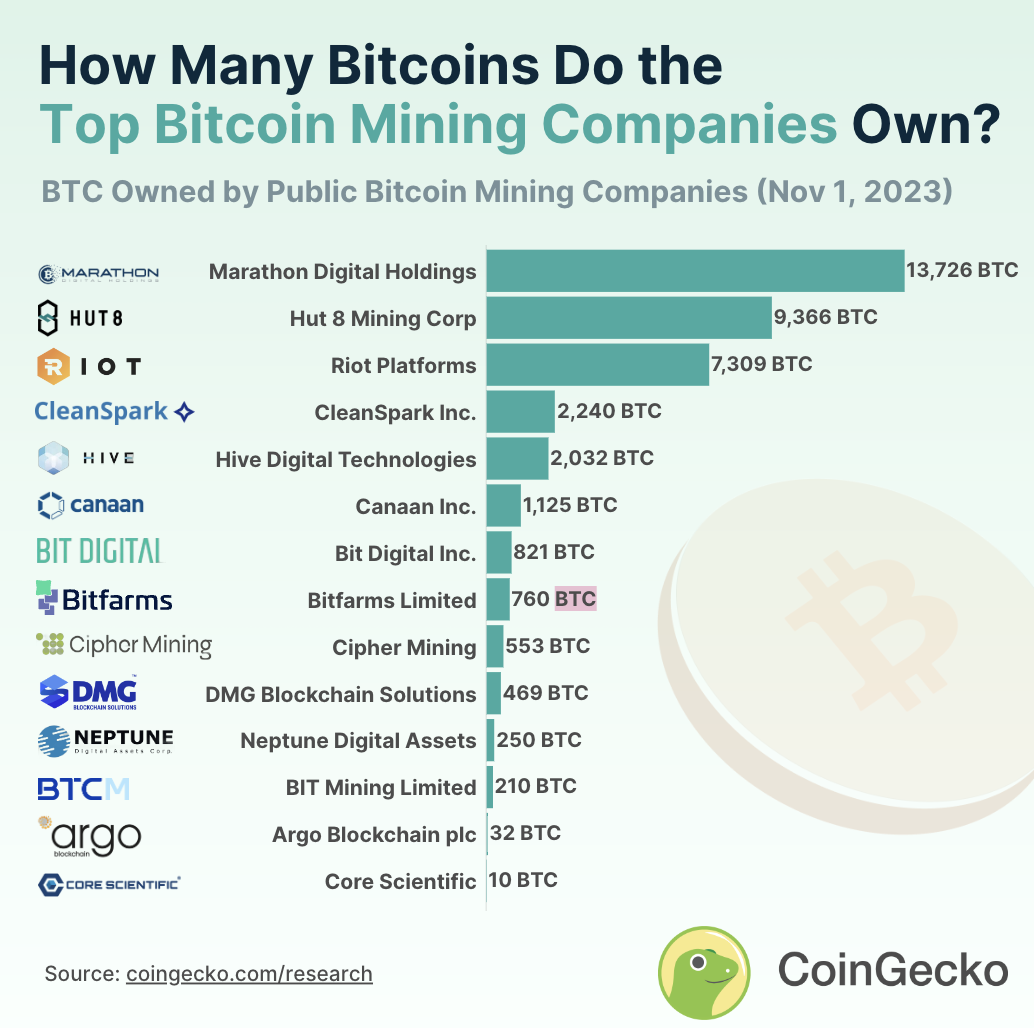

The Bitcoin mining company that holds the most BTC is Marathon Digital Holdings, which holds 13,726 BTC, accounting for 35% of the BTC holdings of all well-known Bitcoin mining companies.

It operates over 150,000 mining rigs with a total hashrate of 23.1 EH/s and accounts for 4.8% of the global Bitcoin network. Marathon Digital has a market capitalization of $1.64 billion.

The leading Bitcoin mining companys TTM revenue in the past 12 months was US$17 million, an increase of 47.8% from the previous period.

Currently, the top 14 Bitcoin mining companies hold a total of 38,903 Bitcoins. However, this only accounts for 0.18% of Bitcoin’s maximum supply (21 million), which is far less thanMicroStrategy’s 152,333 Bitcoin holdings。

Marathon Digital, Hut 8 Mining Corp and Riot Platforms are the three largest publicly traded Bitcoin miners with the largest holdings of Bitcoins. These three companies hold a total of 30,401 BTC, accounting for 78% of the total BTC holdings of leading miners.

The top three Bitcoin mining companies each hold more than 3,000 Bitcoins. In comparison, the remaining 11 companies hold less than 3,000 BTC each, for a total of 8,502 BTC.

Riot has the highest market cap, but only holds 7,309 BTC

Riot Platforms has the largest market capitalization among Bitcoin mining companies, reaching $1.94 billion, 18% higher than Marathon Digital. Although Riot Platforms reported TTM revenue of $250 million, 47% higher than Marathon Digital. But Riot Platforms only holds 7,309 BTC, which is about half of Marathon Digital’s Bitcoin holdings.

Among the listed mining companies holding 1,000 to 3,000 Bitcoins, CleanSpark (2,240 BTC) has the highest market capitalization at $625 million, surpassed by the other two companies (Hive Digital Technologies - 2,032 BTC, Canaan Inc. - 1125 BTC). However, Canaan Inc. has the highest revenue at $270 million TTM, which is 93% higher than CleanSpark and 226% higher than Hive Digital Technologies.

It is worth noting that CleanSpark produced a total of 5,327 BTC throughout the year. This shows that they are actively leveraging their Bitcoin holdings operationally. In comparison, Hive Digital Technologies produced 1,889 Bitcoins during the same period but holds a slightly higher number of Bitcoins.

The remaining nine listed Bitcoin mining companies own the smallest number of Bitcoins, each holding less than 1,000 BTC. Bit Digital Inc., Bitfarms Limited and Cipher Mining, which hold 821, 760 and 553 BTC respectively.

Bit Digital stands out because it operates a massive fleet of 44,886 mining rigs, approximately 99% of which run on carbon-free energy. By comparison, Bitfarms has 62,300 miners and generates 78% of its energy from hydroelectric power. In September 2023, despite having fewer miners and lower computing power (1.19 EH/s), Bit Digital still produced 821 BTC, while Bitfarms had a higher computing power of 6.3 EH/s and produced 411 BTC in the same month.

Looking at companies holding less than 500 BTC, DMG Blockchain Solutions holds 468 BTC, followed by Neptune Digital Assets Corp with 250 BTC, which is 46% less than DMG’s holdings. Bit Mining Limited, holds 210 BTC. All three companies have market capitalizations below $50 million.

Meanwhile, Argo Blockchain and Core Scientific Inc. hold the least amount of Bitcoin, with 32 and 10 BTC respectively. Core Scientific, once the largest publicly traded miner, has been in bankruptcy proceedings since December 2022, leading to a decline in its Bitcoin holdings.

Note: This study examined the Bitcoin holdings of publicly traded Bitcoin mining companies based on SEC filings, financial reports and the latest company news articles as of November 1, 2023. The study excluded Bitcoin mining companies for which public data was not available, including but not limited to private companies, Bitdeer Technologies Group, TeraWulf, BIGG Digital Assets, BitNile Holdings, and Iris.