Arbitrums pledge proposal starts voting, will ARB be issued additionally?

Original - Odaily

Author - Azuma

On the evening of October 30, the proposal put forward by PlutusDAO to launch the Arbitrum governance token ARB staking function began to vote. The proposal set up 100 million ARB incentives, 125 million ARB incentives, 150 million ARB incentives, 1.75 There are five options: 100 million ARB incentives and No incentives provided.

Currently, the “175 million ARB incentive” option proposed by PlutusDAO has the highest vote rate, with a support rate of 87.56%.

ARB additional issuance? Just a misunderstanding!

Odaily found that regarding PlutusDAO’s proposal, the current rumors in many communities are somewhat biased from the facts - some Arbitrum community users believe that the ARB tokens used for staking incentives come from the 2% annual inflation minting of Arbitrum DAO Right, so this is interpreted as an increase in the issuance of ARB tokens, but this is not the case.

Odaily checked the historical proposals of PlutusDAO and found that,The reason for this misunderstanding is that some users impressions of the proposal are still stuck on the initial version in September, but in fact PlutusDAO has extensively modified the proposal content in October.

As shown below, the September version of the initial proposal described it this way:

Arbitrum DAO has the right to mint 2% of the total supply of ARB every year as inflation and to use it in a way that the DAO sees fit. This feature already exists in the ARB token contract, and the optional time for the first minting of tokens is March 15, 2024, as this casting function can only be called once per year.PlutusDAO proposes to remint 1.75% of the total supply of ARB and distribute it as staking incentives within one year.

In the version that was finally launched for voting in October, the proposal description has been modified to:

Arbitrum DAOs capital reserves are growing rapidly, but this growth is not currently shared with ARB token holders. Arbitrum DAOs treasury address holds 3.54 billion ARB tokens, and 64 million ARB tokens have recently been unclaimed. The airdrop has also been transferred to the treasury address. Arbitrum DAO is very well funded, and all surplus income will be attributed to the DAO, including Layer 2 sorter income.”

「We believe ARB needs a staking mechanism... and recommend requesting 1.75%, 1.5%, 1.25% or 1% of the supply of ARB reserves from the Arbitrum DAO treasury as an incentive budget to be distributed to ARB stakers within 12 months these tokens.」

By comparing the above two versions of the proposal, it can be seen thatThe source of staking incentives has been changed from inflation casting to treasury payment, so it will not involve any new ARB issuance.——This does not mean that Arbitrum DAO will not perform inflationary minting for other reasons, the two things are completely independent.

How will the actual circulation of ARB change?

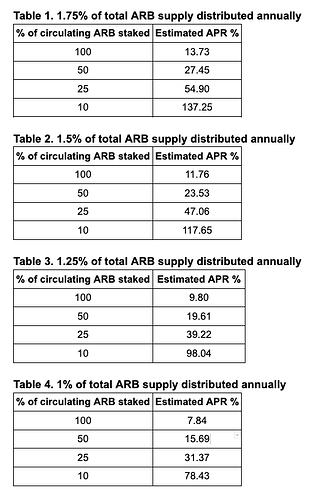

Combined with some calculations by PlutusDAO, we can simply estimate the changes in ARB circulation after the proposal is passed.

In the short term,It is foreseeable that a large number of ARB holders will consider staking for incentive benefits, which may effectively reduce the actual circulation of ARB.

Depending on the specific incentive levels, the income expectations corresponding to different pledge rates are as follows. Odaily predicts that if the final incentive level of governance investment is 1.75%, the ARB pledge rate will most likely exceed 50% (corresponding to an annualized return of 27.45%), which means that the circulating supply of ARB can be reduced by more than 50% in the short term.

In the medium term (within one year),As the incentive shares continue to be released, the actual circulation of ARB will theoretically increase. However, PlutusDAO has designed a hard and soft lock-up control mechanism to hedge against this growth.Specifically, pledgers can choose pledge cycles of different lengths, corresponding to different levels of incentive coefficients. The longer the pledge time, the higher the rate of return; at the same time, early cancellation of pledges will face a penalty of up to 60% of the principal. (The intensity of punishment is linearly related to the remaining time).

In the long term (one year),Since PlutusDAOs proposal only involves a one-year staking activity, the circulating supply of ARB will inevitably grow as the staking ends (current circulation + incentivized circulation).However, this can also be solved through the continuation proposal. PlutusDAO hopes to use the first year of the staking cycle as an experiment. Whether to continue in the future will depend on the situation.

ARB’s utility upgrade

Overview of the content of PlutusDAOs proposal, which essentially gives ARB a new function based on governance - sharing the benefits of Arbitrum DAO.

According to ARB’s token economic model,The use of fund reserves in Arbitrum DAO should be decided by the governance of the community (i.e. ARB holders), so the current proposal support rate indicates that the community is quite in favor of the proposal.

However, one thing that needs to be made clear is thatThis round of voting on Snapshot is just Arbitrum DAO conducting a poll on the proposal, and subsequent real on-chain voting needs to be completed on Tally., the specific time plan is as follows.

Forum posts to solicit opinions and feedback (completed);

Popularity check and opinion poll (ongoing, 1 week);

Officially launch AIP and call for voting (to be conducted, lasting 3 days);

Formal on-chain voting on Tally (pending, 14 days);

Deployment execution.

This also means that even if this round of public opinion polls is passed, it will take more than half a month for the proposal to be implemented at the earliest. Whether it can pass the formal on-chain voting on Tally is the biggest test facing the proposal.