SignalPlus Volatility Column (20231030): IV rebounded sharply, ushering in the release of heavy data this week

Announced last FridayU.S. economic data were broadly in line with market expectations, personal income and PCE annual rates are 0.3% and 3.7% respectively; the University of Michigans 1-year inflation forecast is 4.2%, much higher than the market expectation of 3.8%. In the stock market, the three major U.S. stock indexes had mixed gains and losses, with the Nasdaq rising 0.38%, while the Dow Jones and SP 500 fell 1.12% and 0.48% respectively.This week’s focus will be on the release of ADP, JOLTS, ISM, FOMC interest rate decisions and non-farm payroll data.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

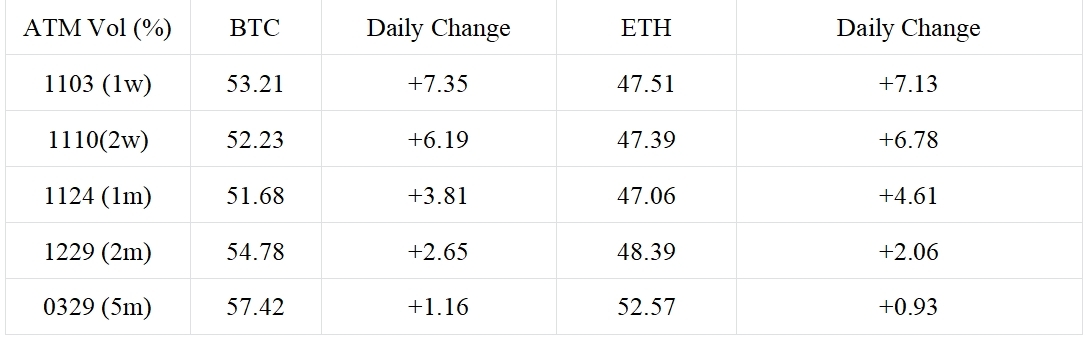

In terms of digital currencies, although BTC/ETH is stillWhole plateThe market is in the market, but the implied volatility experienced a weekend decline on the 28th.sell offfall back to40% Volof lowsThen with the arrival of a new weekClimbing again to a level of around 50% Vol, among which the recent IV has further risen due to this week’s FOMC meeting and the release of a series of blockbuster data.The mid-front IV curve is in an inverted shape。

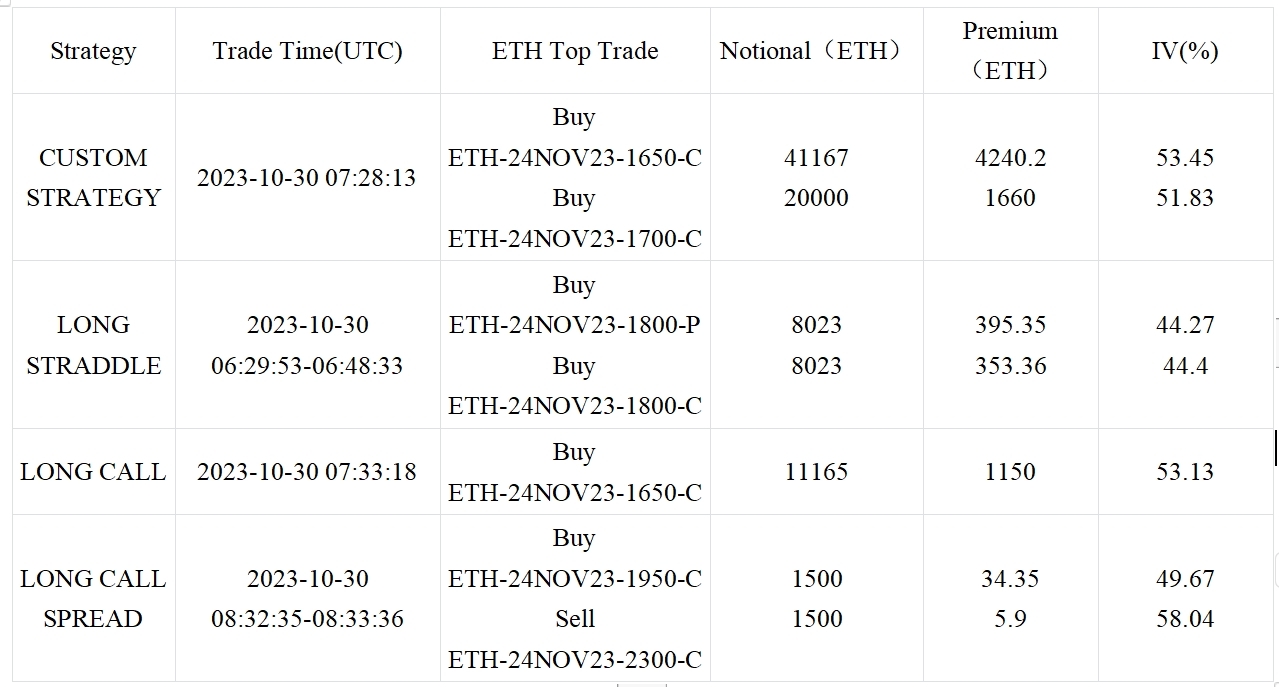

On the trading front, Buy Call Spread was the hot spot. BTCShort-term bullish sentiment rising, the transaction volume of buying short and selling 3 Nov 35500 C vs 10 Nov 39000 C reached 1305 BTC. During the same period, there were nearly 200 transactions of 3 Nov 35500 vs 39000 Call Spread; most of the Call Spread transactions on ETH were atend of november, such as 1500 group 24 Nov 1950 vs 2300 Csprd.

In addition, ETH had a large number ofbullish volatilityLong Straddle strategy with a total trading volume of over 26 K ETH.

Source: Deribit (as of 30 Oct 16:00 UTC+8)

Source: SignalPlus

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com