YBB Capital: A new journey for digital gold, Bitcoin ecological diversification exploration and protocol innovation

Original author: YBBCapital Researcher Ac-Core

Preface

The concept of Bitcoin was first proposed by Satoshi Nakamoto on November 1, 2008, and Bitcoin was officially born on January 3, 2009. After decades of industry development, Bitcoin has been sprinting on the road to value storage and digital gold. Its value has also increased from the past 10,000 Bitcoins in exchange for a pizza to the current market value of $664.2 2B. But judging from the current development of the BTC ecosystem, this is just a small attempt. In addition to the value of BTC itself, we still need to be more patient in exploring the future. This article will analyze other BTC application ecosystems.

BTC Overview

In 2009, a cryptographer named Satoshi Nakamoto published a paper called Bitcoin: A Peer-to-Peer Electronic Cash System, which described an electronic currency system implemented through peer-to-peer technology, which enabled Online payments can be initiated directly by one party and paid to another party without going through any financial institution. Subsequently, Bitcoin gradually spread around the world and received widespread attention. It has at least three attributes: technical, sociological and financial.

Technical properties:

From the perspective of Bitcoins technical logic, Bitcoins network protocol is a decentralized, point-to-point transmission protocol. It can be briefly understood as a huge public accounting system that is not controlled by any third party and cannot be tampered with. It relies on Blockchain technology records all transactions in the entire network database to ensure that duplicate or false payments will not occur;

Sociological attributes:

Compared with todays Internet, the blockchain itself uses distributed ledger technology, and the digital transaction records shared through the network are decentralized, non-tamperable, and non-changeable, making it possible to liberalize information brought by the Internets attributes. Ideological trends are also affecting everyone. Bitcoin, a completely decentralized electronic currency, does not rely on any single authority for issuance, and can achieve value transfer without going through the banking system during cross-border and cross-currency transfers. Its information liberalization and cross-border payments giving it more sociological attributes;

Financial attributes:

From a financial perspective, Bitcoin can be used as an investment in digital gold or a global standardized digital asset. Compared with gold, it has a constant total amount, is easy to carry, has low transaction costs, and has a young audience. Characteristics such as globalization have made more and more investors and traditional investment institutions believe in its investment value. Because it relies on the global circulation of the Internet, it can be used as an efficient and low-cost payment tool and means of circulation in certain specific scenarios (such as cross-border payments and virtual economic transmission media). For example, in January 2015 at the New York Stock Exchange, Nasdaq entered the Bitcoin field for the first time, and recently Grayscale Fund, BlackRock, etc. have begun to deploy Bitcoin-related ETFs.

Looking at the current development of the entire blockchain, compared with the prosperity of Bitcoin, there are very few ecological projects. The Lightning Network launched in 2019 has shown a new development trend. In addition, in 21 years The launch of Stacks, the Taproot Assets mainnet recently released by Lightning Labs, and the Turing-complete Bitcoin contract BitVM have also become highlights of the Bitcoin ecosystem.

BTC Bitcoin Ecological New Pattern

BitVM:

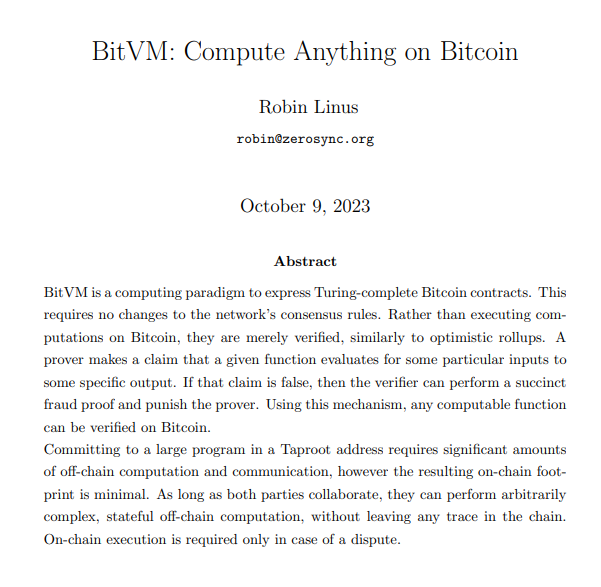

Image source: BitVM white paper

Recently, Robin Linus, the leader of the ZeroSync project, published a white paper titled: BitVM: Compute Anything On Bitcoin, which sparked heated discussions. BitVM is the abbreviation of Bitcoin Virtual Machine. It proposes a Turing-complete Bitcoin contract solution without changing the Bitcoin network consensus, allowing any computable function to be verified on Bitcoin, allowing developers to run on Bitcoin Complex contracts without changing the fundamental rules of Bitcoin.

However, we are well aware that the programmability of Bitcoin is very limited. Blockchain has a classic impossible triangle problem: decentralization, security, and scalability. However, Bitcoin is only designed to take into account decentralization and security. , abandoning scalability to a certain extent. Because it only provides three forms of input scripts: Pay to Publish Key, Pay to Publish Key Hash, and Multi-Signature Script (Pay to Script Hash).

Pay to Publish Key: This contract is used to send Bitcoin to a Bitcoin address;

Pay to Publish Key Hash: This contract is used to send Bitcoin to a Bitcoin address;

Multi-signature Script (Pay to Script Hash): An application form of multi-signature.

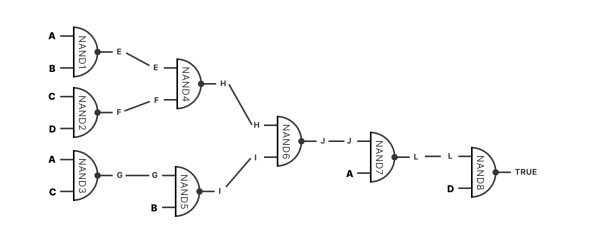

The reason why Bitcoins programming capabilities are very limited is that it only supports simple logic and limited operation codes on Script scripts. Therefore, complex smart contracts cannot be developed on the Bitcoin network. This is also because the Turing of Bitcoin scripts is incomplete. The ability to perform arbitrary calculations or loops greatly ensures safety. The difference between BitVM and directly performing calculations on Bitcoin is that it only verifies calculations (this is similar to many expansion plans that do not destroy the native Bitcoin system), and it is stated in the white paper mainly through OP-Rollup and fraud proof. Implemented with Taproot Leaf and Bitcoin Script.

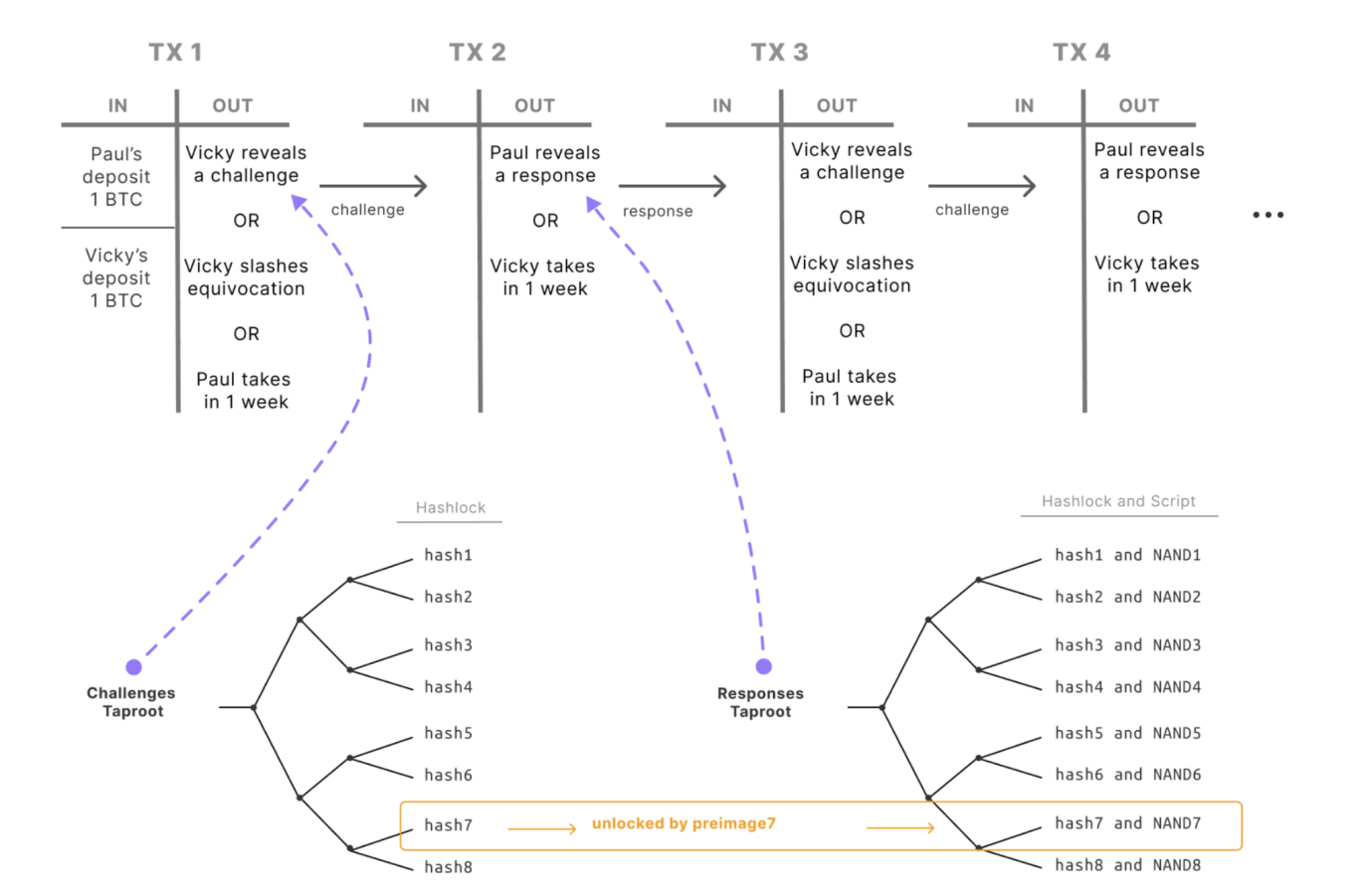

Image source: BitVM white paper

Bitcoin had many limitations on complex calculations and smart contracts at the beginning of its design, and BitVM uses its unique solution to expand this. Its main roles include:

Prover and verifier: The former will use information input from a certain system to create a proof, and the latter will verify the calculation results of this proof, but cannot know the specific content of the information to ensure that the calculation results are accurate;

Off-chain calculations and on-chain proofs: Without changing the Bitcoin consensus, BitVM undoubtedly needs to transfer a large amount of calculations and expansions off-chain to improve flexibility. As for the controversial on-chain proof, a verification method similar to a fraud proof of data validity used by Optimistic Rollup will appear between the serious one and the prover to ensure security. The special feature of BitVM is that it implements various program instructions similar to binary circuits through Taproot address matrix or Taptree, which are combined with each other to execute a complete contract [1].

Image source: BitVM white paper

But the controversial one is:

BitVM writes a simple code in the Script at the Taproot address, and treats it as a UTXO (see explanation below) to execute conditional instructions. Script is the basic script supported by the Bitcoin network itself. Although it is also a type of Output, the smart contract mentioned by BitVM only uses Outputs custom script and then parses it in a centralized form. The difference is that one is Bitcoin When analyzing the next block on the network, who is defining who will analyze it? In order to realize the normal operation of smart contracts, BitVM can only use Output instead of Script. Whether there is a centralized operation method here is worth thinking about.

Lightning Network Taproot Assets

Taproot Assets:

On October 18, 2023, Lightning Labs released the UTXO-based Taproot Assets mainnet Alpha version. With the completion of the mainnet version, the Bitcoin Lightning Network will become an upright multi-chain asset network, mainly for institutions and asset issuance, and can Create instant, low-fee, high-volume transaction application protocols via the Lightning Network.

Against the backdrop of El Salvador declaring Bitcoin as legal tender in 2021, the Lightning community has experienced explosive growth, with users around the world enjoying instant settlement, low fees, and peer-to-peer Bitcoin transactions without financial intermediaries. Lightning Labs continues to offer users the ability to add stablecoins to their applications using Bitcoin infrastructure. In addition, developers are also trying to use real-world assets such as gold, U.S. Treasury bonds, corporate bonds, etc. for programmatic coupon payments. There are two key factors in Taproot Assets: Lightning Network and Taproot.

Image source: Lightning Labs official website

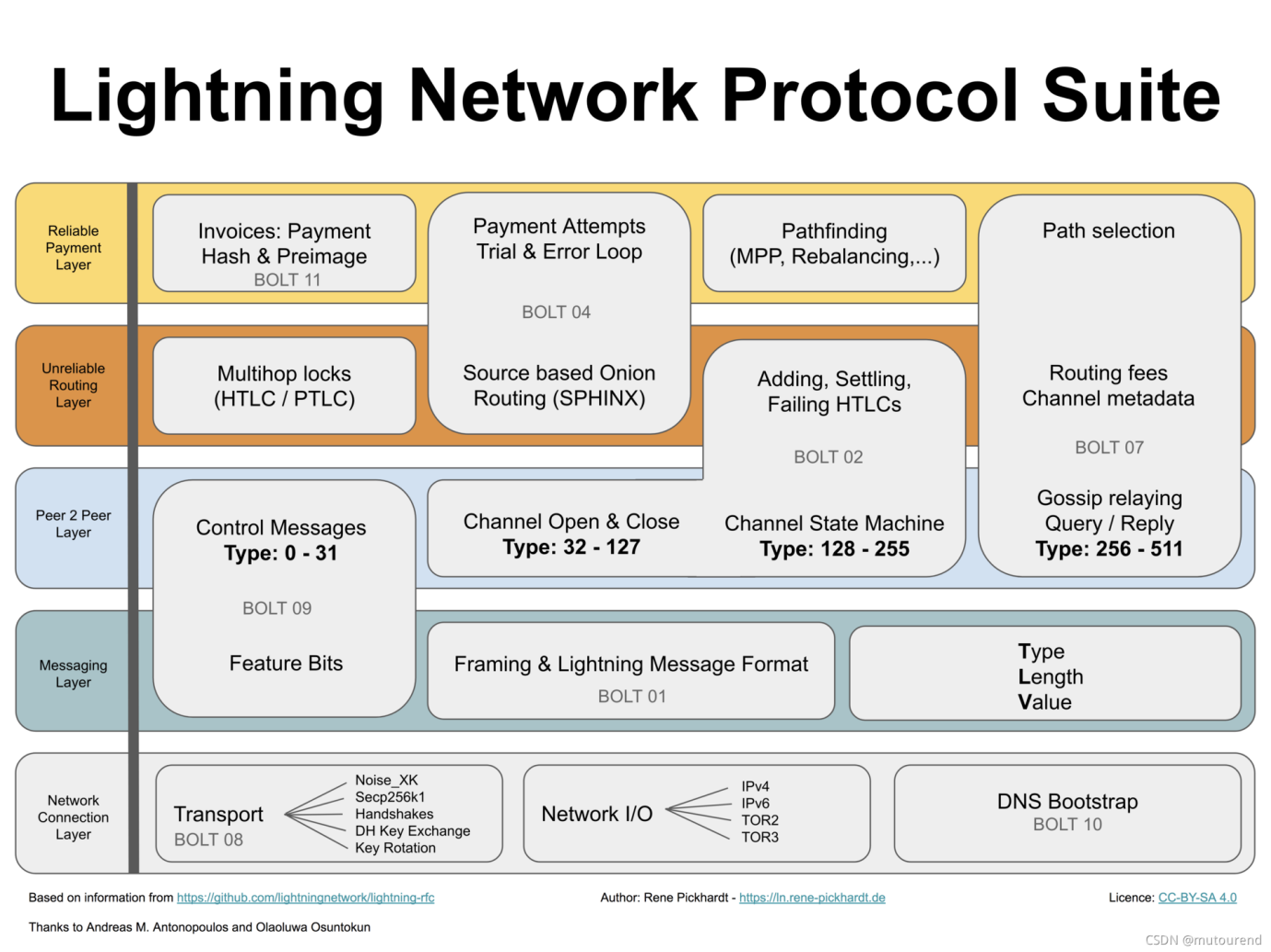

Lightning Network:

Currently, the Bitcoin transaction speed limit in the Bitcoin system is set to one confirmation every 10 minutes, and the number of transactions that can be processed per confirmation is 2,500. This number is determined by discussions between the Bitcoin community and developers. The main purpose of setting a speed limit is to protect the decentralization and security of the Bitcoin system, thus abandoning scalability to a certain extent.

Lightning Network was first proposed by Joseph Poon and Thaddeus Dryja in February 2015 and released in March 2018. It is a Layer 2 expansion solution for Bitcoin. It allows relevant participants to create smart contracts off-chain, mainly solving the problems of Bitcoins scalability and high handling fees, allowing transactions to charge almost no fees.

The core idea of the Lightning Network is very simple: it allows all participants to deposit funds into a common off-chain wallet address (smart contract), and then send the funds to another participant on the same contract as soon as the payment is completed, with only the final The transaction results are only confirmed on the chain. The Lightning Network is a major upgrade to the Bitcoin protocol, but it also brings a new problem, namely the liquidity of fund recipients among participants.

Image source: CSDN@mutourend

Taproot

The core reason for Bitcoins innovation is due to the Segregated Witness (SegWit) upgrade in 2017 and the Taproot upgrade in 2021. SegWit helped by introducing a block field to save proof data, that is, the signature and public key of Bitcoin transactions. Expanding Bitcoins throughput, but potential vulnerabilities force developers to limit the size of this data, and the Taproot upgrade has two main obvious changes: MAST+Schnorr signatures, which solves these security issues and allows the deletion of old SegWit limitations [5].

Core functional points of Taproot Assets:

1. Issuance of stable currency: Paypal, the worlds largest payment application, has issued its own US dollar stable currency PYUSD after becoming a very popular payment channel. The essence is to expand from the payment channel to the value transmission carrier itself. Taproot Assets also has the same goal, which is to provide users with stable coins in a borderless financial world by leveraging the value of Bitcoin itself. For example, it can be used to create a new stable currency taUSD, and a single Bitcoin transaction can be used to transfer BTC and taUSD. Enter the Lightning Network channel to perform DeFi operations, which is also the core of Taproot Assets running on the Lightning Network;

2. Multiple Universe Mode: Universes are repositories that hold all the information needed to initialize the Taproot Asset wallet and synchronize the state of a specific Taproot Asset. Therefore, even if the publishers server crashes, the legal validity of the assets can be verified through multiple universe servers without over-reliance on data stored off-chain by third parties;

3. Asset issuance and redemption API: Similar to corporate bonds, proofs of these destruction transactions can be uploaded to the chain, allowing each user to trade various assets on Bitcoin as easily as investing in stocks and bonds in the real world. , in order to map it to the issuance of real-world assets, thereby unfolding the imagination of the RWA track. Mint multiple sets of assets at different times to maintain fungibility, and the asset destruction API facilitates redemption by asset issuers;

4. Asynchronous reception function: Provide developers with tools to add Uniform Resource Identifiers (URI) to on-chain addresses;

5. Scalability: The new function build-loadtest command allows developers to stress test the software. Perhaps Lightning is not the final expansion solution for Bitcoin, but direct integration with Lightning Network completes fast transactions in a borderless financial world. There is a very broad space for imagination in providing users with stablecoin support.

RGB protocol:

RGB is the LNP/BP Standard Association (Lightning Network Protocol/Bitcoin Protocol: Bitcoin Protocol/Lightning Network Protocol). The association is a non-profit organization that oversees the development of all layers of Bitcoin, covering the Bitcoin Protocol, Lightning Network Protocol and RGB Wait for smart contracts. The RGB protocol is suitable for scalable and private Bitcoin and Lightning Network smart contract systems. Its purpose is to run complex smart contracts on UTXO and introduce it into the Bitcoin ecosystem. The official description is: A scalable and confidential smart contract protocol suite for Bitcoin and the Lightning Network that can be used to issue and transfer assets and rights more generally. The protocol is based on the concepts of client verification and one-time sealing proposed by Peter Todd in 2016, and runs on Bitcoin’s second layer, or off-chain, client verification and smart contract system. Understanding the RGB protocol requires understanding the following four key elements:

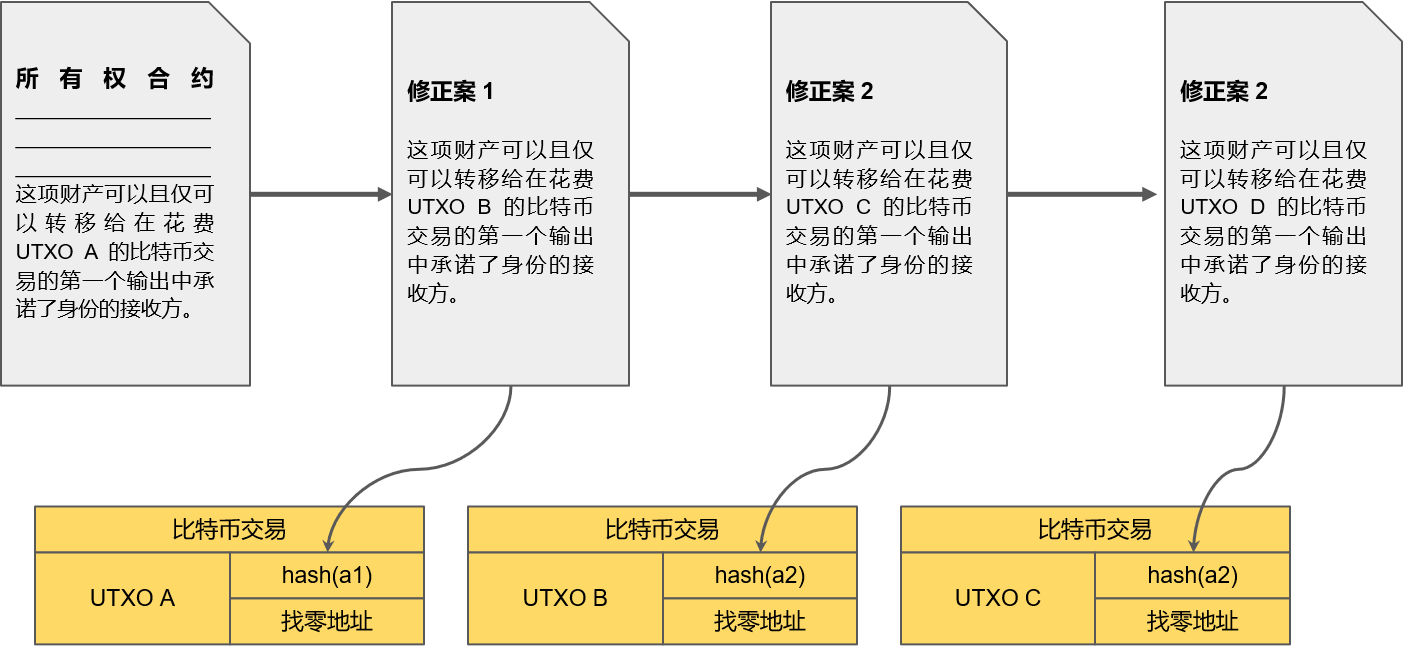

Single-use-seals:

To put it simply, it is as literal as it sounds. It is to add a layer of disposable sealing strip to the object that needs to be protected so that it can only have two states: open and closed. This ensures that the content is only used once to prevent double spending. Compared with Ethereum accounts, there are only wallet addresses in the Bitcoin network, in which the Unspent Transaction Output (UTXO) can be used as a seal.

Therefore, before understanding one-time sealing, you need to understand what UTXO is. It is a ledger model that generates input (Input) and output (Output) in every transaction. The output of a transfer transaction is the recipient’s Bitcoin address and transfer The amount, and these outputs are stored in the UTXO collection to record unspent transaction outputs. At the same time, an input points to an output of the previous block, so these transactions can be traced, so here are the Bitcoin transactions The output can be used as a disposable sealing strip.

According to the explanation of RGB official documentation, a UTXO can be regarded as a seal: when it is created, the seal is locked; when it is spent, the seal is opened. According to Bitcoin’s consensus rules, an output can only be spent once. Therefore, if we use it as a seal, then the incentives to ensure that the Bitcoin consensus rules are enforced will also ensure that such a seal can only be opened once [2];

Image source: RGB Docs Chinese official

Bitcoin’s promise of client-side verification and finality:

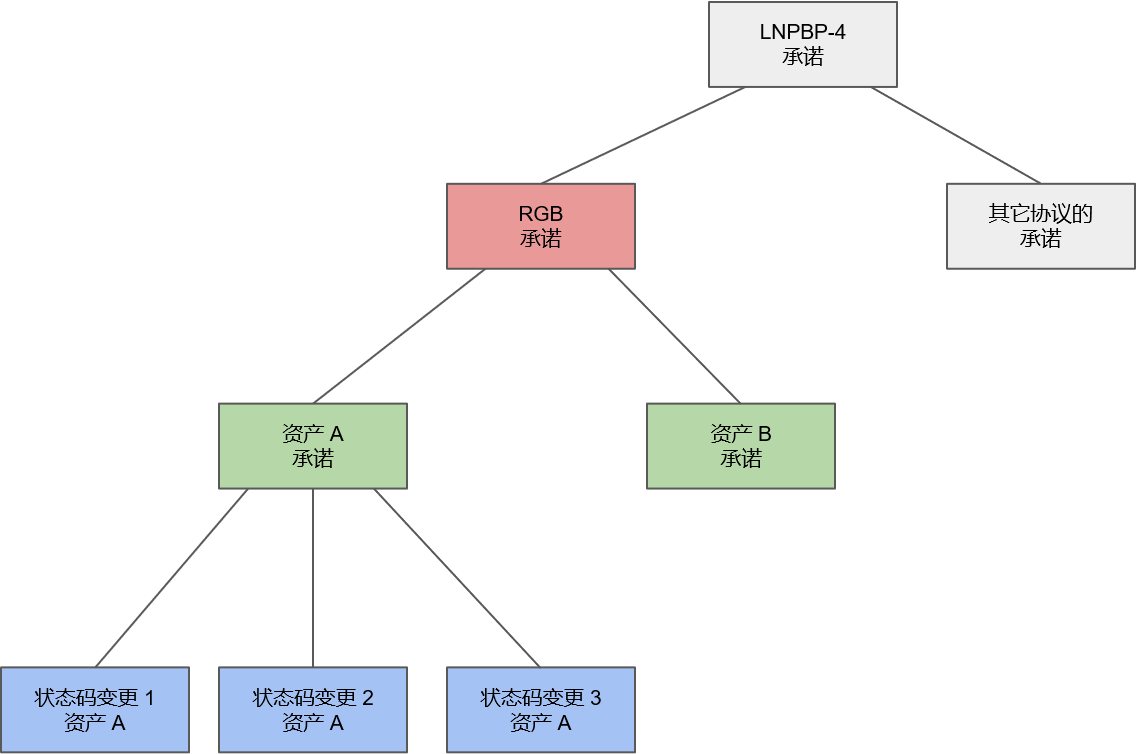

Client verification is a paradigm proposed by Peter Todd in 2016. In Bitcoins PoW consensus, state verification does not require global execution by all parties participating in the decentralized protocol but requires verification of all aspects of specific conversions. Convert it into a short deterministic Bitcoin commitment by using cryptographic hash functions, etc. This commitment requires some kind of Proof-of-Publication and has three proofs: receipt proof, non-publication proof, and membership proof. main feature. All in all, OpenTimeStamps can be considered the first protocol in this field, and RGB is the second protocol. Other protocols can also exploit and use these themes and form a client verification protocol series for these protocols [3].

RGB leverages the Bitcoin blockchain to prevent the double-spend problem by committing to an RGB state transition and spending the UTXO currently holding the rights to be transferred in a specific Bitcoin transaction. In this way, multiple state transitions can be committed to a single Bitcoin transaction and each state transition can only be committed to one Bitcoin transaction (otherwise there will be a double-spending problem);

Image source: RGB Docs Chinese official

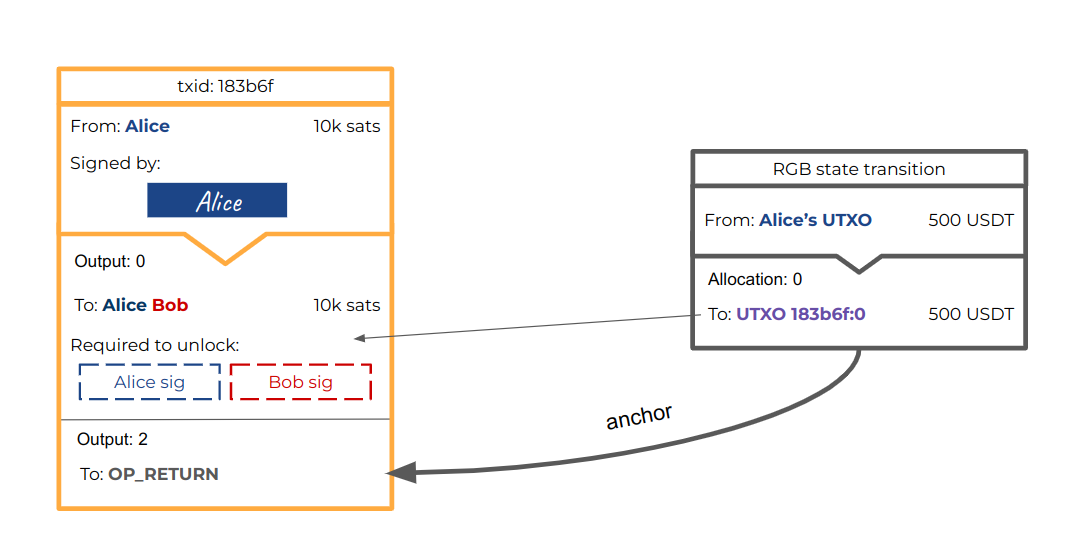

Lightning Network Compatibility:

When a state transition is committed to a Bitcoin transaction in the RGB website, such a transaction does not need to be settled immediately on the blockchain, as it can become part of a Lightning Network payment channel and then derive security from it , and at the same time, it uses the payment channel of the Lightning Network to bring a lot of digital asset circulation to RGB;

Image source: RGB Docs Chinese official

Updates for RGB v 0.10 version:

According to Waterdrip Capital’s interpretation, its upgrade changes are mainly reflected in its flexibility and security upgrades, and the following summary is listed:

Source: Waterdrip Capital

The concept of RGB was proposed as early as 2016, but after several years of development, it has still not received widespread attention and application. The main reason may be due to the relatively limited functions of early versions and the high learning threshold of developers. With the development of RGB With the arrival of v 0.1, we can look forward to whether RGB can bring us more room for imagination in the future.

Bitcoin sidechains Stacks, Liquid, RSK, Drivechain

In 2016, Blockstream proposed pegged sidechains as a possible way to scale Bitcoin. Sidechains often refer to trust-minimized blockchains that allow payments to be made with foreign crypto-assets (an asset native to another blockchain). The most meaningful benefits that can be achieved through sidechains are user asset issuance, stateful smart contracts to support DeFi solutions, commitment chain expansion, faster settlement finalization, and greater privacy.

Stacks:

Image source: Stacks Chinese official

Basic working principle:

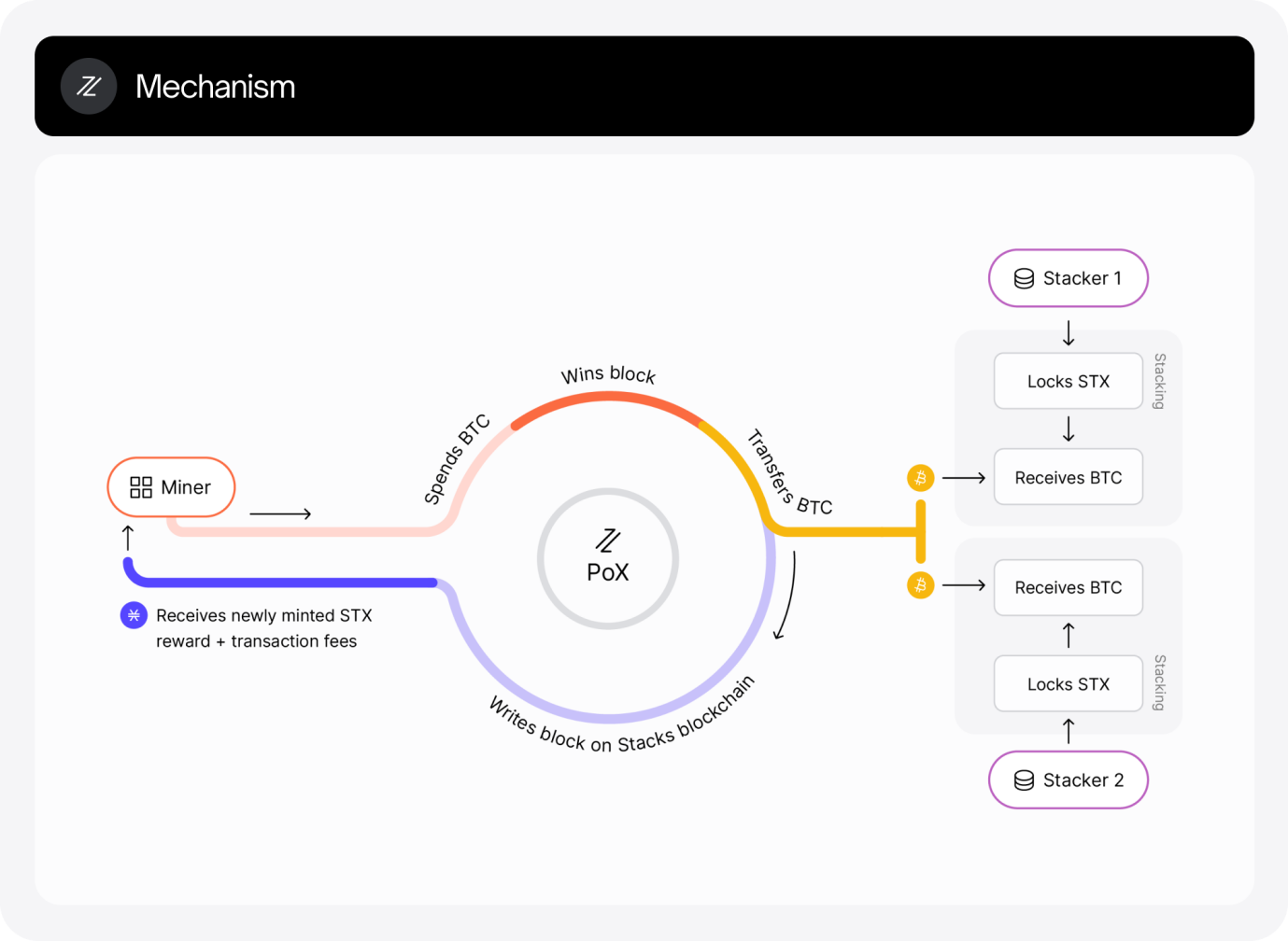

First, let’s introduce Stacks. Although it does not directly call itself a side chain, whether it can be included in a side chain is still controversial. It aims to use its unique “Proof of Transfer” consensus mechanism Proof of Transfer (PoX). Linking itself to the Bitcoin chain enables high decentralization and scalability without adding additional environmental impact.

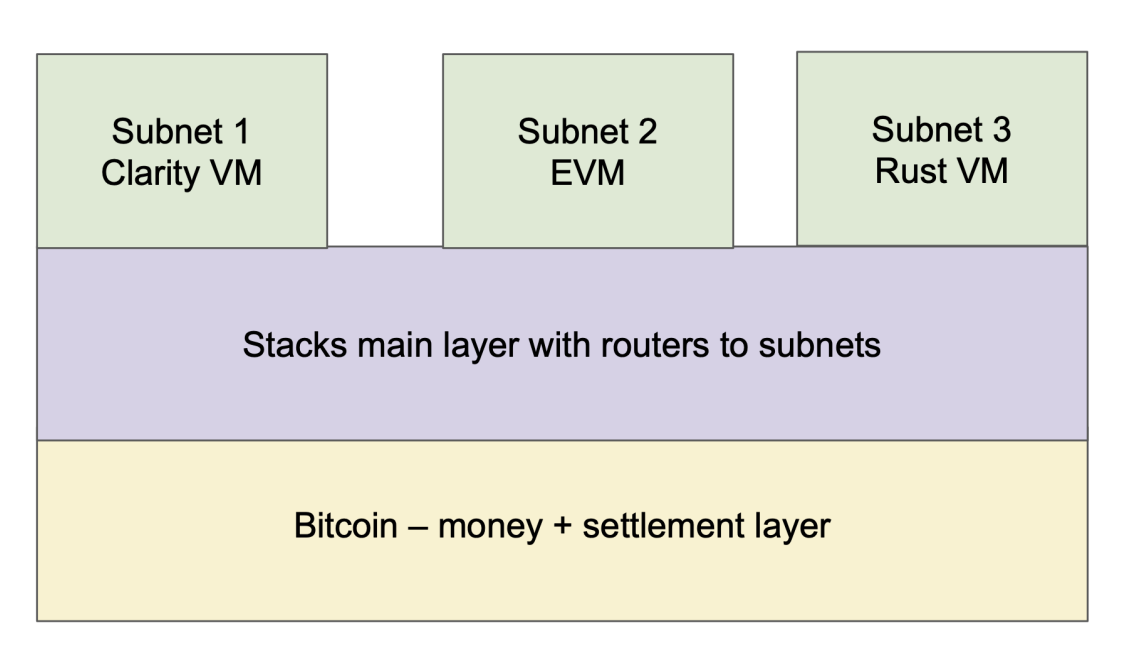

Stacks is an open source Bitcoin second-layer blockchain that introduces smart contracts and decentralized applications to Bitcoin. Stacks was originally named Blockstack, and its basic work began as early as 2013. Stacks’ technical architecture includes a core layer and a subnet. Developers and users can choose between the two. The difference is that the mainnet is highly decentralized but has low throughput, while the subnet is less decentralized but has higher throughput. high.

Image source: Stacks white paper

The Stacks core layer interacts with the Bitcoin layer based on the PoX mechanism. PoX is a staking system similar to PoS, a variant of Proof of Burn (PoB), which gives Stacks miners a pass"combustion"The right to mine blocks as part of its token (native asset or other cryptocurrency). pass"combustion", Stacks miners can mine more blocks and earn BTC rewards by helping to secure the network. Their interaction process is as follows:

Proof of transfer in Stacks requires miners to send bitcoins to other Stacks network participants (on the Bitcoin network, not at burnt addresses). Since Stacks can read the Bitcoin network state, it can verify these Bitcoin transactions. The Stacks protocol will then randomly select the winning miner for the block and reward them with Stacks’ native token STX.

There is also no need to modify its base layer protocol when Stacks interacts with Bitcoin, as Stacks transactions are bundled together and Bitcoin simply acts as the final settlement layer for Stacks and is subsequently sent to Bitcoin for verification and confirmation. The history of Stacks blocks will be forever recorded on the Bitcoin blockchain.

Image source: Stacks white paper

Clarity smart contract:

Stacks uses a tool called"Clarity"[4] creates smart contracts using a coding language designed specifically for Stacks to optimize for predictability and security, while Clarity is intentionally designed to be Turing-incomplete, thus avoiding Turing complexity. Its smart contract code is public and directly accessible on the chain, allowing developers to test the code before running any smart contract, meaning developers can build decentralized applications that benefit from the security and stability of Bitcoin, Also adding new functions and features. What can we innovate in Stacks with the support of Clarity and what are the advantages and disadvantages?

What can be done:

1. Build decentralized applications on Bitcoin and migrate the DeFi sector;

2. Native assets can be created on Stacks.

Advantage:

1. Security: It integrates the powerful security attributes of Bitcoin and has strong security and attack resistance;

2. Interoperability: The first-layer smart contract can communicate with other blockchains;

3. Scalability: The PoX consensus mechanism leverages Bitcoin to achieve faster transaction determination and higher scalability.

Disadvantages:

1. Its unique design architecture has certain learning costs and thresholds for developers. It is also particularly important whether it can attract more developers from the Ethereum ecosystem and the MOVE ecosystem before it reaches its potential;

2. Whether the regulatory uncertainty brought about by its STX mining and Stacking will affect the development and operation of the second-tier network is also worth considering.

Liquid:

Source: LBTC official

The topic comes to Liquid. It is not only a Bitcoin side chain, but also an exchange settlement network that can connect cryptocurrency exchanges and institutions around the world. Its core functions include: fast settlement, strong privacy, Digital asset issuance and pegging to Bitcoin, enabling faster Bitcoin transactions and digital asset issuance, allowing members to tokenize fiat currencies, securities and even other cryptocurrencies.

What Liquid shares with RSK is that both rely on consortium multi-signatures to lock the Bitcoins issued in the side chain as the native currency of the side chain, but the actual peg design is still quite different. Both sidechains currently have 15 functional authorities in operation, with Liquid requiring 11 signatures to issue bitcoins and RSK requiring 8. Liquid seems to prioritize security over usability, while RSK prioritizes usability over security.

Overall Liquid is a sidechain platform designed to provide shared liquidity to exchanges, focusing on protocol simplicity, security, and privacy.

RSK:

Source: Mt Pelerin Official

RSK is also a side chain whose native token is RBTC, aiming to become the cornerstone of financial inclusion and focusing on decentralized finance (DeFi). RSK is a stateful smart contract platform secured by Bitcoin miners that increases the value of the Bitcoin ecosystem by expanding the use of the Bitcoin currency. Decentralized applications can be written using the Solidity compiler and Web3 standard library, enabling Ethereum compatibility. In addition, it can expand Bitcoin payments through more on-chain space and off-chain transactions provided by the RIF Lumino payment channel network.

RSK aims to address a broader set of use cases, improves openness and programmability by adopting a stateful VM, is compatible with Ethereum to port Ethereum dApps and tools to RSK, and Liquid is focused on being an extremely efficient Tool of.

Drivechain

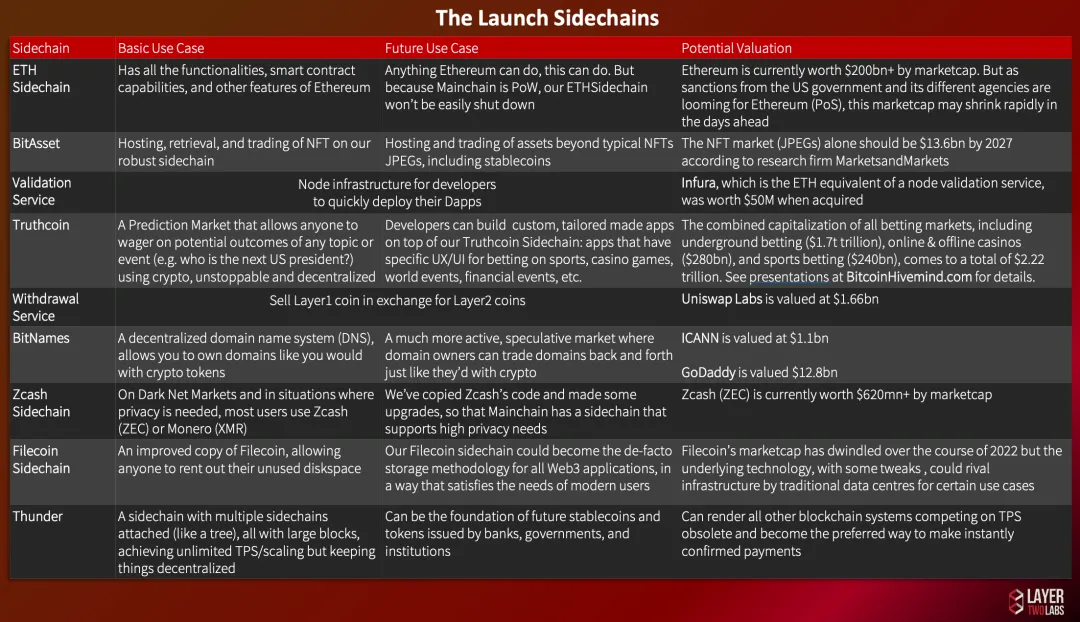

Drivechain is a Bitcoin open sidechain protocol that can customize different types of sidechains according to different needs. BIP-300/301 proposes to allow developers to add features to the Bitcoin world without actually modifying the Bitcoin core code. and functionality” concept. By creating a Bitcoin Sidechain that is secured by Bitcoin miners, various scalable use cases of Layer 2 can be implemented in the Sidechain on the premise of using Bitcoin as the Layer 1 guarantee of security. It should be noted that BIP-300 Hashrate Escrows compresses 3-6 months of transaction data into 32 bytes through Container UTXOs, and BIP-301 Blind Merged Mining Like RSK, the security of the network is maintained through federated mining.

Use sidechains to create blockchain applications that meet the needs of your own application scenarios, and drivechain treats sidechains as the second layer to complete expansion, thereby avoiding the 1 MB block size limit of Bitcoin. There are currently 7 Sidechains based on BIP-300 that are in progress and continue to attract more Bitcoin communities and enthusiasts to join, respectively (only examples are given for brief description, see [6] for details):

EVM side chain: EthSide

Digital assets/colored coins/NFT side chain: BitAssets

High transaction throughput sidechain: Thunder Network

Prediction market sidechain: Hivemind

Privacy sidechain: zSide

Distributed DNS side chain: BitNames

Storage side chain: Filecoin

Image source:LayerTwo Labs Asia Community

Ordinals protocol and BRC-20:

UniSat Wallet is a popular Chrome plug-in wallet in the Bitcoin ecosystem that helps users store, mint, and transfer BRC-20 tokens. The Bitcoin ecosystem services provided include buying and selling BTC, NFT, domain names, etc.

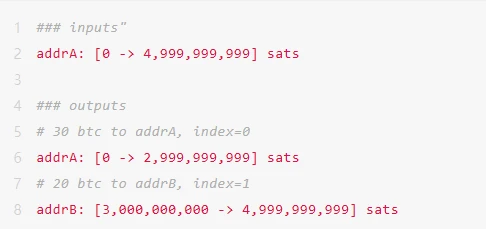

Briefly describe the origin of BRC-20

As explained above, the calculation method of the UTXO part will produce countless inputs and outputs (changes in balance increase or decrease) for each transaction, because each Bitcoin is composed of the smallest unit: 100 million Satoshis (1 BTC = 10^8), and each of these sats has a unique identifier and is indivisible, so that each satoshi is given a specific meaning based on the ordinal of the sat in Bitcoin. For example, 50 BTC can be expressed in the network as: 4, 999, 999, 999 sats.

Picture source: Fourteen Jun

Although the Ordinals protocol and the self-proclaimed BRC-20 have the characteristics of being overly centralized and lacking a verification mechanism, it is undeniable that the hot market has brought more attention to the Bitcoin ecosystem and the second layer, which to a certain extent will The publics attention has once again been drawn back to Bitcoin.

summary:

Bitcoin abandoned the scalability attribute at the beginning of its design in order to greatly enhance the decentralization and security of its own network. Regarding related expansion issues, Bitcoin, as the most successful network in the blockchain, brings absolute The crushing security also brings huge room for imagination to many geek developers.

Therefore, supporters of the Bitcoin ecosystem are roughly divided into conservatives and radicals. Conservatives believe that Bitcoin must maintain its pure currency nature and be used only as a store of value. It is pure digital gold and does not require other forms of gold. Scalability: Radicals believe that Bitcoin needs to be expanded in order to embrace more original ecological applications and maximize the transaction attributes of Bitcoin, which is conducive to the long-term development of Bitcoin. Perhaps we can leave this important question to the future, and time will tell us the answer.

Explanatory literature:

【 1 】https://twitter.com/tmel0 211/status/1715627595004543032

【 2 】https://docs.rgb.info/v/zh/she-ji

【3】https://blackpaper.rgb.tech/consensus-layer/3.-client-side-validation

【5】https://www.odaily.news/post/5169725

【6】https://layertwolabsasia.medium.com/seven-sidechains-overview-538e76352e6c

Reference article:

(1)https://www.weiyangx.com/139964.htm

(2)https://research.web3 caff.com/zh/archives/11414? ref= 0&ref= 416

(3)https://blog.rootstock.io/zh-hans/noticia/the-cutting-edge-of-sidechains-liquid-and-rsk/