Compare three SocialFi products from multiple angles: friend.tech, Stars Arena, TOMO

Original author: Biteye core contributor Louis Wang

Original editor: Biteye core contributor Crush

The Socialfi craze driven by Friend.Tech has swept through various public chains. Basically, imitation disks have been produced on every chain, and they have also generated good popularity, such as Stars Arena on Avalanche and TOMO on Linea. This article will compare FT with these two imitation disks in terms of product experience, data, etc.

01 Friend.Tech

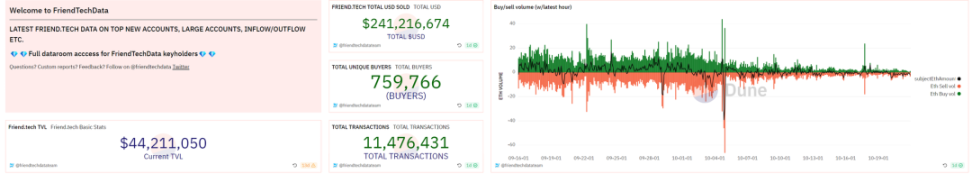

As the pioneer of this wave of Socialfi craze, he has brought a new narrative to the encryption market while firmly occupying the leading position. Launched three months ago, the cumulative users exceed 75k and the TVL exceeds $44M.

(Source:https://dune.com/friendtechdatateam/friendtechdata)

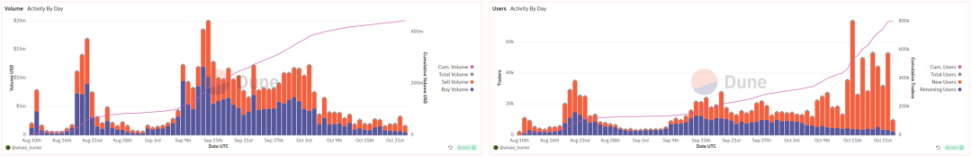

Although many keys are already quite expensive due to too steep pricing curves, and transaction volume has dropped significantly compared to the previous two weeks, what is interesting is that new users continue to grow, with daily growth even reaching new highs, and there are still many new users pouring in.

(Source:https://dune.com/whale_hunter/friend.tech-ultimate-analytics)

At the same time, although there have been recent cases of SIM SWAP leading to the theft of FT user funds, the negative news does not seem to have a major impact on FT.

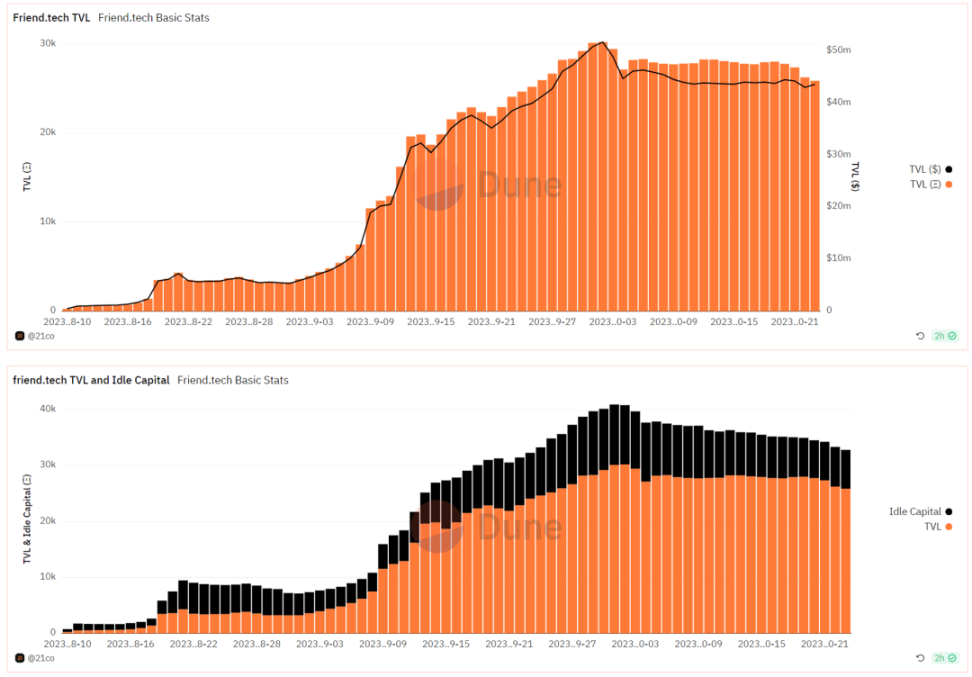

Profitable funds did not leave the market quickly, and a large amount of idle funds stayed in Friend.Tech. Therefore, TVL did not decline significantly due to trading volume or potential risks.

(Source:https://dune.com/21co/friendtech-analysis)

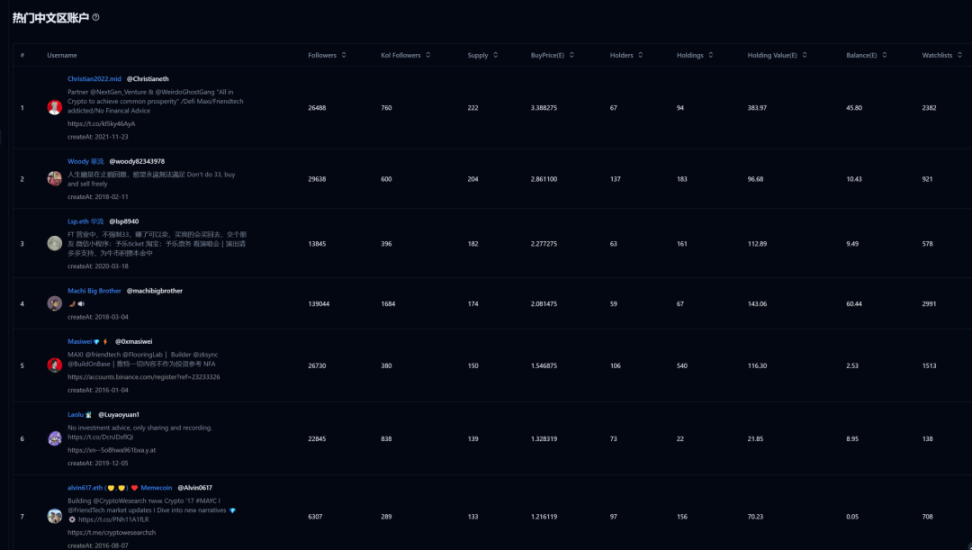

Regarding the popular Chinese accounts on FT, you can refer to the bulletin board:

https://www.cryptohunt.ai/zh-CN/friendtech/topcn

02 Stars Arena

Stars Arena is a FT product on Avalanche. The gameplay is similar to FT. You can enter the other partys private chat room by purchasing a ticket.

One obvious functional difference is that SA does things more like Twitter. Content can be published and presented in the form of information flow, and user operations are more diverse.

In addition to room chat, you can also like, forward, comment and even reward tweets. The social elements are richer than FT, and it is even a bit like Farcaster with private chat and group functions.

(Source:https://www.techflowpost.com/article/detail_14130.html)

SA was first launched on the PC side. On the mobile side, you need to add a web page to the desktop like FT. The registration and recharge process is similar to that of FT. Use Avalanche C-chain to recharge AVAX as the transaction currency. The overall experience is much smoother than FT. In terms of fission, use invitation links. , there is a commission mechanism to encourage dissemination.

The economic model also takes 10% of the transaction commission, but the distribution ratio is different from FT. SA allocates 7% of the profit to the homeowner, 2% belongs to the platform, and the other 1% is used for rebate rewards, which means that when the transaction volume is the same, the homeowner The income in SA will be higher than that in FT.

SA has a positive guiding role in increasing daily activity for Avalanche. It has received strong support from Avalanche officials and founders, and they have all settled in SA. SAs TVL peaked at over $2.5M, with nearly 25k users.

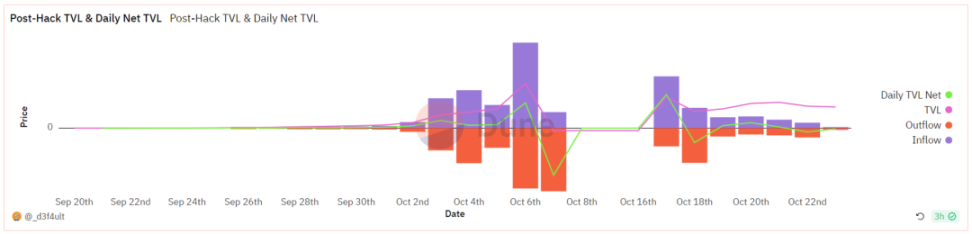

Unfortunately, the good times did not last long. On October 7, SAs contract was attacked by a hacker replay attack, stealing all users assets in the contract, worth about $2.9M in AVAX.

In the end, SA recovered 90% of the stolen assets. The contract has now passed the audit and the product was re-launched on the 17th. After going online, users need to migrate their wallets within the App to trade assets they previously owned.

(Source:https://dune.com/_d3f4ult/starsarena)

Obviously, the stolen contract caused huge damage to users confidence. The assets recovered to $2.9M, and 1/3 of the funds flowed out that day. TVL has been falling all the way, and currently remains at $1.2M.

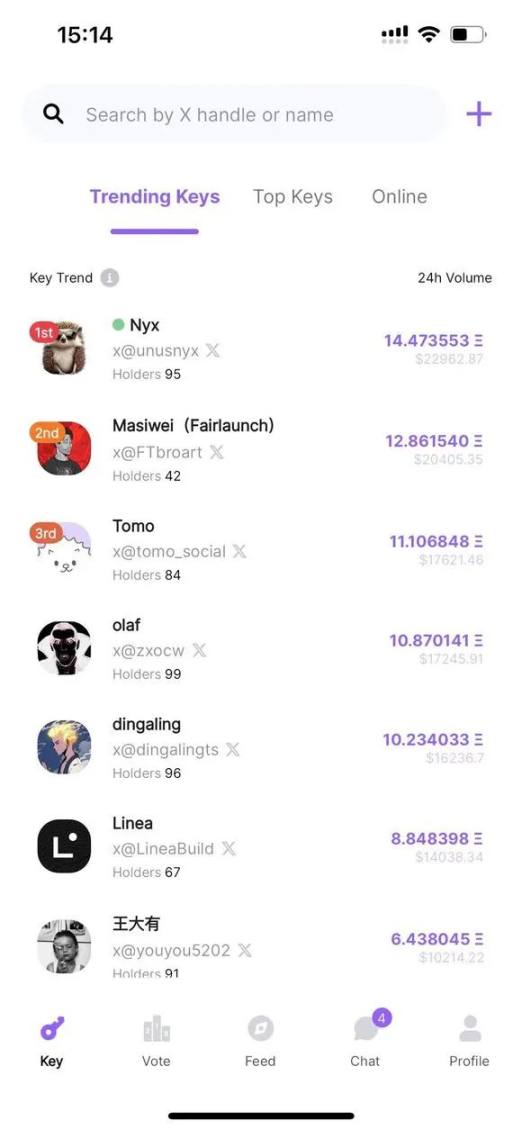

03 TOMO

Users are more positive about the imitation disks on the new L2. Those who missed FT do not want to miss the imitation disks again. There is also the expectation of adding interactive airdrops on the new public chain, potentially eating two fish.

TOMO is an FT imitation disk on Linea. Unlike FT, it is not a web page that needs to be added to the home screen, but an App that needs to be downloaded from the App Store.

The entire registration process is very similar to FT. You need to bind Twitter and recharge. You can recharge from the main network or Linea.

Although the current wallet in the App supports withdrawals, it cannot export the private key because it uses the ERC-4337 standard account abstraction wallet. This is 4337s first attempt in SocialFi.

The product function is also similar. You can enter the private chat room by purchasing a Key. Different from FT, in addition to Key, there is another asset, Vote, that is, those Twitter users who have not yet opened a TOMO account.

Users can purchase futures on their keys, and once they open a TOMO account, the Vote can be converted into Keys.

In the economic model, votes and keys follow the same rules, that is, 5% of the purchase and sale will be given to the platform and 5% to the homeowner, which is consistent with FT.

For those who have not moved in yet, but have already been traded to generate fees, the transaction fee will be accumulated in the unopened room and become a fee to be collected. If the owner does not move in within six months, the fee will be distributed to the votes. holder.

The pricing curve that TOMO follows is key price= x^ 2/43370. The price curve is smoother than FT, which means that for the same number of key holders, the price of TOMO will be about 37% of FT, which is more conducive to small retail consumption and is equivalent to The capacity of the chat room has been expanded.

This is a very interesting micro-innovation. There are a large number of robots on FT that are watching KOLs who have just opened accounts, called Snipers, trying to buy the keys of these KOLs at low prices as early as possible to make profits.

TOMO eliminates the advantages of robots in this regard by futuresizing Keys that have not opened accounts.

In terms of eliminating the influence of robots, TOMO allows users to purchase multiple Keys at one time on the application front-end.

On FT, users can only purchase one Key at a time in the application, and there is no quantity limit on the contract. Some users will use robots to purchase multiple Keys at once, which is fast and cheap (buying them one by one will increase the purchase cost if someone inserts them), which will actually affect the experience of ordinary users.

With these two small adjustments, there is not much room for robots to play on TOMO, so the user experience is relatively pure.

Similar to FriendTech, TOMO also has points. Currently, the information is only related to inviting friends, and it is likely to be linked to Lineas points in the future.

TOMO has deep participation from the founders of Polychain, Ankr, and Galex. Linea has also officially settled in, with sufficient brand endorsement. At the same time, Linea is a public chain that has a high probability of airdrops, so it is suitable for early participation.

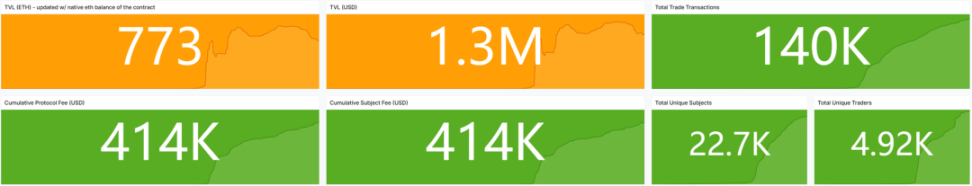

At present, TOMOs TVL has reached $1.3M, which is 40 times lower than the leading FriendTechs TVL of $44M. There is enough room for imagination. However, most of the people active on TOMO are KOLs from the Chinese-speaking area, and KOLs from the English-speaking area are more involved. Few, and the user growth rate has stagnated.

TOMO has earned $414k through handling fees, with a total of 4.9k users.

(Source:https://app.sentio.xyz/sentio/tomo/dashboards/mfqtRDSI)

04 Summary

This article analyzes and compares the current situation of FT and the two most competitive imitation disc products, as shown in the figure below.

Compared with FT, SA has much expanded social functions, higher creator bounties and smooth experience, which are very exciting. Unfortunately, the middle road collapsed and the contract was stolen, which has a huge impact on users confidence, even if it is now back online. , TVL also plummeted;

TOMO is more like an upgraded version of FT, with smoother operation and presented in the form of an App. At the same time, it pays great attention to solving the negative impact of robots in FT.

Through functional design, unfair competition among robots is eliminated as much as possible, and the design is more mature and ingenious.

If there are no security issues, it will be a very strong competitor of FT, but it currently lacks more participation from KOLs outside the Chinese-speaking area.

Compared with the excellent performance of imitation disks, FT is at a disadvantage in terms of product experience and the update speed is not fast enough. It is likely to become a point of criticism soon. However, its influence as a pioneer, the depth of TVL’s capital pool, and a large number of high-quality The early participation, investment, and even empowerment of users and KOLs, as well as the sunk costs of earning points, have become its deepest moat.

At present, only FT has announced the financing situation, and the other projects are all riding on the expectations given by FT. The next wave of acceleration requires more financing and airdrop information as catalysts.

This wave of SocialFi boom driven by FT is one of the few hot spots in the bear market. As a new type of social trading asset, Key may be the next ERC20 and is worth participating in and looking forward to.