One article to understand the Intent-centric architecture that focuses on “intention” and only values results.

Original author: @YBBCapital Researcher @Ac_Core_

Preface

The cumbersome user experience of Web3 has become one of the reasons that hinders the large-scale adoption of blockchain. As Paradigm, a well-known venture capital firm of Web3, recently introduced the 10 potential trends that the organization focuses on in the field of encryption, it will be intention-centered. (Intent-Centric) Protocol and Infrastructure topped the list, and this concept instantly attracted the attention of the industry. This is a design philosophy that puts intention at the core around user needs. For example, I want to order a 30 yuan hamburger takeout is an intention. To complete this intention, the user needs to enter the name, phone number, and delivery address on the takeout platform and then place the order and pay. In the process, the merchant does not need to care about the 30 yuan paid. With the profits obtained and the profits distributed by the platform to the riders, I only need to wait for the burger to be delivered at home. This architectural form greatly simplifies the user experience threshold, allowing each user to only express their intentions, hand over the intermediate process to various other protocols, and wait for the final result. Note: This article is not for project publicity and is suitable for public readers. The content is for analysis and reference only.

Intent-Centric design principles

Background:

In the Web3 world, trading is the core function. No matter DeFi, GameFi, NFT or even any track, basic transactions are inseparable. But the reality is that the decentralized nature of the blockchain determines that different chains are independent islands. We need to find bridges between different islands to link them to complete asset exchange. Although centralized exchanges provide a convenient user asset trading experience, users still need to authorize their wallets one by one to access countless Dapp applications one by one. In order to lower the experience threshold of decentralized applications, the Intent-Centric concept came into being.

Although the prototype of intent was not born recently, this conceptual storm was triggered by Paradigm, so we borrow their definition for reference: Intent is a set of signed declarative constraints that allows users to create transactions to Third-party outsourcing without giving up full control of the counterparty”. In reality, signatures are driven by the user’s voluntary intentions, but is it really possible to hand over assets to a third-party for outsourcing processing in order to lower the user threshold? Below is a discussion of what is involved in achieving Intent-Centric’s vision.

What is intention:

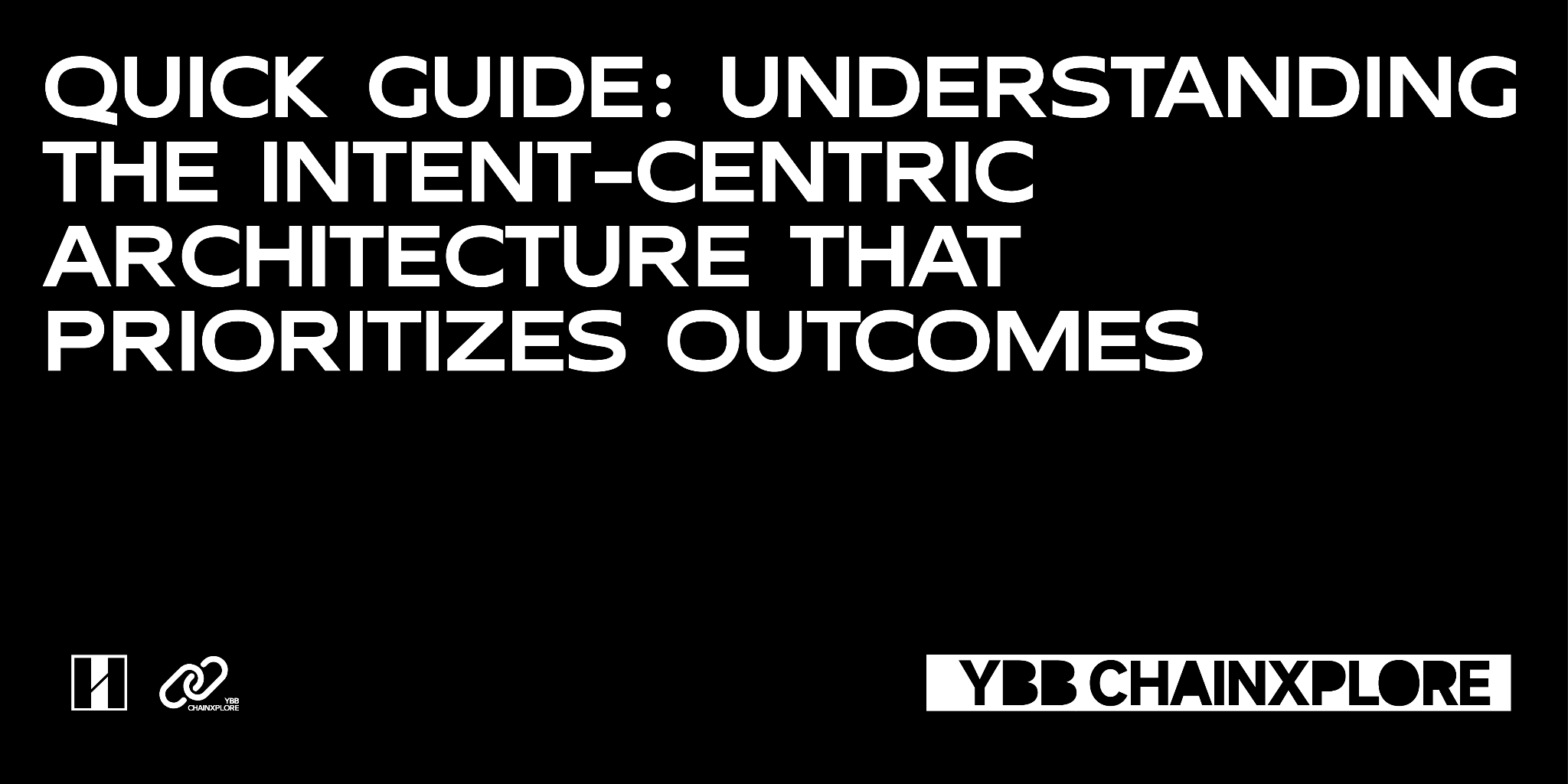

Intent-Centric can be understood as intention-centered. Paradigm expressed its explanation of the concept of intention in the article Intent-Based Architectures and Their Risks published on June 1, 2023. In the users regular transaction process, the transaction signature allows the verifier to perform verification according to a specific calculation path, and the gas fee in the process is used to motivate the verifier to complete the calculation. However, the intention is not to specifically refer to a certain calculation path, and any path can complete the final result under certain constraints. In actual operation, by signing and sharing intentions, users actually allow the recipient to choose the transaction execution path on their behalf (as shown below). In order to distinguish it from transactions, we define intentions as information signatures, which allow execution from a given starting state. State transition to retrieve multiple paths to reach the final state result [1].

Image source: Intent-Based Architectures and Their Risks – Paradgim

As shown in the figure above, a clear execution path needs to be specified when submitting a transaction, such as Token exchange on Uniswap, but when submitting an intention, the execution path is determined by the matching results. For users, they only need to put forward their own intentions, and the rest is completed by Intent-Centrics related protocols/applications, that is, matching the execution path. The execution operation is briefly described as the Solver (solver) is responsible for matching the execution path that meets the intention, and finally waits for the final Just execute it and get the result.

In short: transaction = I specify the execution method to do this; intention = I only want the result but do not pay attention to the process of realization.

The intentions of different preferences can be matched in complex ways, and achieving this requires counterparty discovery and solver solution.

Bob,the Intent Solver

Source: ETH Global

Bob the Solver (transliteration: Bob Solver, hereafter collectively referred to as the solver but not specifically Bob Solver) is an intent-based trading infrastructure. Its main purpose is to simplify the operation process, lower the users participation threshold, and integrate participation. The essence of wallets and decentralized applications is to create and execute users outsourced transactions. Their implementation mainly consists of two parts:

The solver that creates transactions: It consists of an AI chatbot + intent classification + transaction optimization. It is responsible for realizing the optimal execution path of user intentions and sending it to the AA wallet. The solver is equipped with a machine learning (ML) model for user analysis. Classification of intentions;

Abstract account wallet for executing transactions: The AA wallet system using the EIP-4337 standard is composed of a bundler (Bundler) and a payment contract (Paymaster). It is integrated with the solver to simplify the transaction process.

Intent layer and solver

Is it possible to build a separate intent layer and have solvers compete to solve it? Although it is achievable in theory, the reality is that it is very difficult to implement. When talking about this, we need to focus on Anoma and SUAVE (see details below) to solve the core MEV problem. In order to achieve Intent-Centrics vision and goals, transactions are packaged to a third party for processing. What features are needed to safely complete asset transfers?

1. Trustworthy

To achieve the characteristics of a trustworthy and decentralized blockchain, it may not be enough to assume the existence of a simple intent network that fails to honor user and solver guarantees of intent. Because after the user expresses his intention, Sovler will calculate the specific costs required for each execution path, and Sovler will also be constrained by the adjustments set by the user. The user needs to know that each execution path is trustworthy;

2. Privacy

The solver provides users with an optimal execution path. The complex nature of the solution will inevitably lead to hackers stealing assets or obtaining user information. At the same time, in most cases, the users on-chain activity information will be exposed to observers. To ensure The security of user information requires encrypting or hiding at least some important information, but it is very difficult to privatize computable information on the blockchain;

3. Expression of intention

Intention is an abstract concept. There seems to be a similar problem in the way users express their intentions to the blockchain and the way users ask questions to AI. How should I explain it so that I can understand what I want to express? For example, if some express some implicit intentions, whether the solver will incur more gas costs when selecting the execution path? An efficient and accurate resolver is the key to realizing the intention;

4. Keep intent consistent with MEV

Here we take SUAVEs independent blockchain that solves the practical problems of EVM as an example. When it handles Ethereums intentions, it requires cross-chain settlement, such as the great success of MEV decentralized solutions such as MEV-Geth and MEV-Boost that have been launched. , meeting the needs of cross-chain MEV with a more fair and transparent transaction processing mechanism;

5. Resist censorship

According to Paradigms explanation, it is not difficult to find that there is a core problem. A parser with AI functions should not exist alone. If a single parser is attacked or deactivated, it will cause the entire system to shut down, and whether the parser can There are problems such as execution refusal and incorrect execution. These problems may be solved by Anoma below;

6. Competitiveness of solvers

Different users will have different intentions, and the solver will also contain multiple transaction categories, such as exchange, cross-chain, staking, etc. There will be no competition between single solvers, because only when settling on the chain, the solver Only fees can be charged. Is it possible to reasonably redistribute the solvers responsible for different transaction categories or optimize the solver algorithm to maintain competition among solvers, so that every valid address is eligible to become a solver to successfully participate in the Mempool? ), thereby improving the quality of transaction execution;

7. Intention memory pool

Paradigm proposes three new memory pool (Mempool) solutions:

a. Permissionless Intentpools: An open design allows anyone to submit intentions to the memory pool and provides executors with permissionless access;

b. Permissioned Intentpools: Permission is required to submit and execute user intentions, allowing users to pass their intentions to a trusted third party to execute on behalf of the user;

c. Hybrid Solutions: Combining the characteristics of the above two memory pools, aiming to achieve a balance between openness and controllability.

Elements required to achieve the intent

Account Abstraction (AA)

Brief review: Ethereum has two account types: EOA externally owned accounts and CA contract accounts. The difference is that the former can initiate transactions, while the latter cannot initiate transactions but can host Solidity code. Most of the accounts we use now are EOA accounts. In addition, there are multi-signature smart contract accounts (SCW) such as Gonsis Safe. The contract account just mentioned cannot initiate transactions, so EOA needs to be used to activate SCW. In this way, EOA can only be responsible for signing transactions, and the smart contract can be executed. Arbitrary logic can develop countless new application scenarios while enhancing asset security.

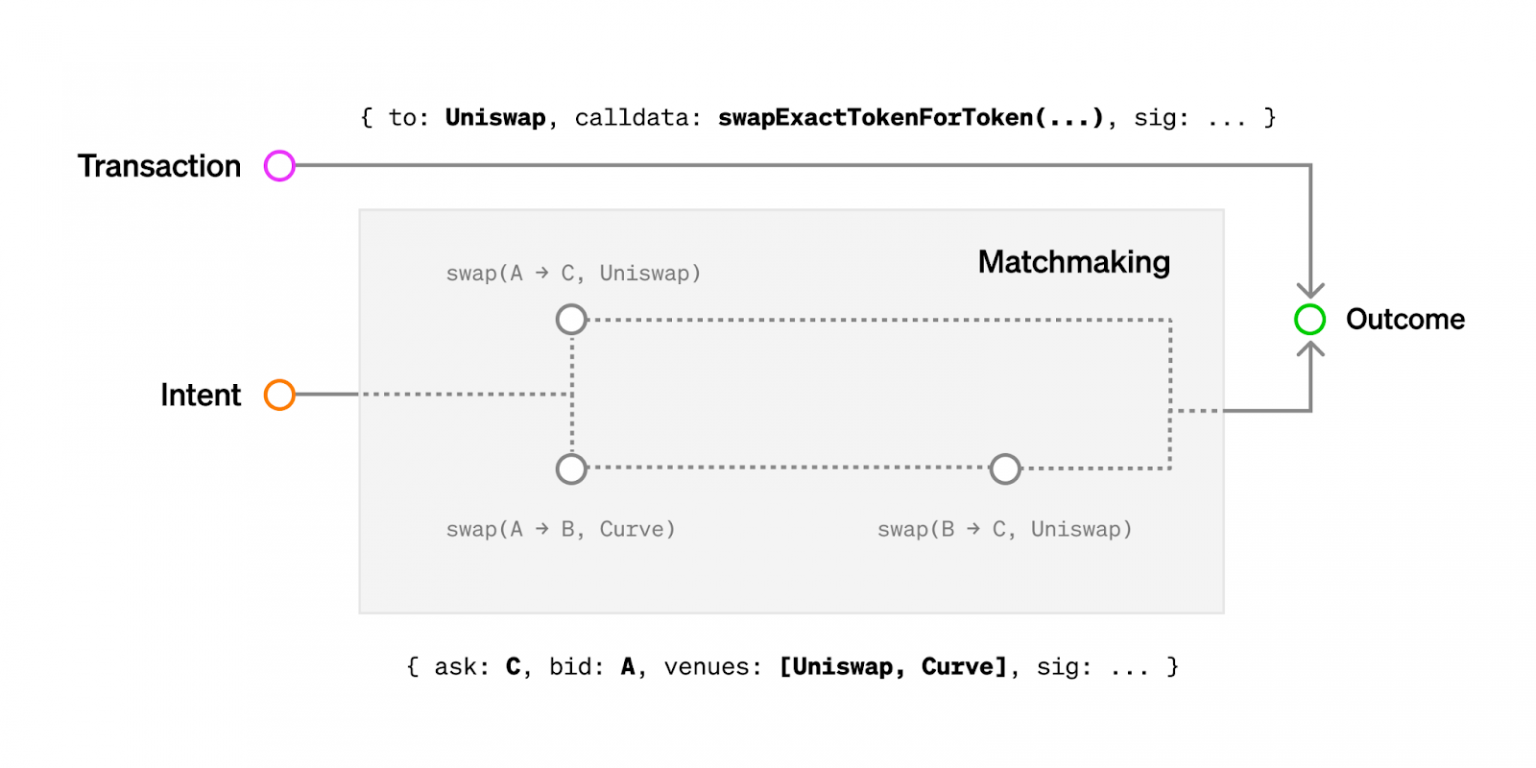

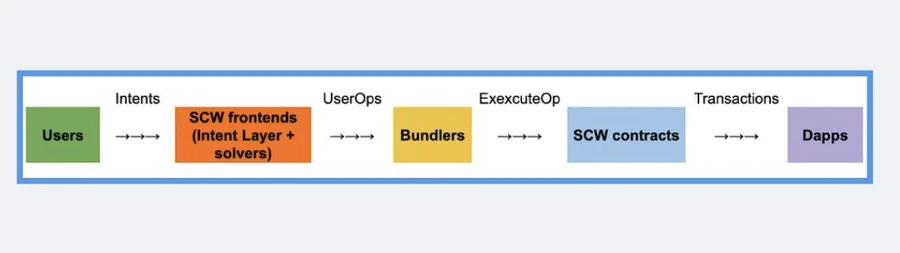

The implementation of the intent layer requires account abstraction (the reason is explained in the SUAVE section below). EIP-4337 consists of user operation (UserOperation), bundler (Bundler), entry contract (EntryPoint), contract factory (Wallet Factory), and payment contract (Paymaster). ), Signature Aggregator (Signature Aggregator) consists of six parts. The brief operation process is as follows:

Initiating a user operation means executing the transaction content;

The operation is sent to the P2P UserOperation Mempool and the bundler bundles and packages the executed signature, Gas fee and other user operation transaction content and submits it to the chain (actually including multiple situations will not be expanded here) ;

The bundler packages the content and sends it to the entry contract for processing. It can also optionally use a signature aggregator to check whether it is legal;

The entrance contract pre-sends the transaction to the wallet contract or payment contract;

The payment contract can be expanded into multiple types according to the business logic of the project party. For the sake of brief description, we will not expand it here [2].

Source: ReadON Investment Research Group

Smart contract wallets are undoubtedly the largest players in account abstraction. Currently, the main competing forces are the multi-signature wallet Gnosis Safe and the Candide smart contract wallet that focuses on building fully compatible with EIP-4337. Through the analysis of the above figure, it is not difficult to find that account abstraction uses bundler + payment contract to achieve the narrow sense suitable for developers intention, while Paradigm uses Solver + AI to achieve the broad meaning suitable for mass users intention. It is perfect to put the two concepts of abstraction and intention in the same understanding of the track. They both have a magical concept of chaos with a hint of order.

Programmability of intentions

According to Researcher@tme l0 211, the programmability of intention can be summarized as: if the intention is not programmable, the program cannot be executed, automation is impossible, and intelligence is out of the question. How to understand that intention is a man-made expression of thoughts, which itself is abstract and contains emotional factors, and what is accepted is a string of cold codes and algorithms. For example, my intention is to make money, how can codes and algorithms help me find that intention? Execution path? Intent-Centric is not a new concept, but is based on the existing simplified intent design. For this purpose, existing Intent-Centric projects and concepts have been sorted out.

Known representative projects:

UniswapX :off-Chain extension intent

CowSwap :off-Chain extension intent

1inch : Fusion order matching off-Chain + multi-DEXAggregator

Solv Protocol :The new ERC 3525 standard implements complex financial intent

Unibot :Centralized server background preset parameters, rules and other automated intents

Opensea :Off-chain signature + on-chain contract combination completed

Known representational concepts:

ERC 3525 standard: Proposed by Solv Protcocol, it aims to provide a semi-qualitative asset standard that can describe digital assets in a more structured manner and meet the needs of various application scenarios;

Abstract Account Account abstraction: Provides a set of standardized account management interfaces to abstract the underlying implementation complexity of different types of accounts, eliminating gas, social recovery, etc.;

MPC Wallet: Use private key sharding technology to divide the private key into multiple parts and store them on multiple independent nodes. When conducting operations such as transactions, these nodes jointly calculate and generate signatures through a secure multi-party calculation protocol without the need to reconstruct the complete private key.

In summary, the representative projects or concepts mentioned above all provide users with a more simplified experience through a series of more complex instructions.If the above content is divided, it can be divided into four categories:

Centralized intent:

Based on centralized resource matching platforms, such as Unibot and other robot trading, CEX trading, Friend.tech, etc.;

Structured intent:

Based on smart contract or agent contract combination, on-chain + off-chain preprocessing combination, new ERC standard and other preset parameters adapted to EVM virtual machine execution;

Distributed intent:

A new executable user complex intention market built based on a new blockchain architecture such as Solver+Executor that does not need to be distributed;

Intelligent intent:

Based on AIGC as the carrier of input+outcome, AI through DeFi global training programs the users complex intentions and executes the output.

Image source: Researcher@tmel0211

MEV

Maximal Extractable Value (MEV) means that miners can obtain additional income rewards by adding, deleting, and rearranging transactions, and can complete DEX arbitrage, front-running transactions (Fornt-Running), and trailing transactions (Back-Running). ), Liquidation, Snipping bots, Time-bandit attack, Sandwich and other behaviors, which harm the rights and interests of users who normally use DeFi. To expand, transactions on Ethereum are sorted by miners based on Gas. High Gas will be packaged first, and low Gas will be processed slowly. Transactions will first be submitted to the Mempool memory pool [3], waiting to be included in the block. In , validators pull transactions from the mempool and add them to the next block at build time. Since the mempool is public, searchers have the opportunity to pay validators to order transactions in a specific way, by sorting them from users. Extract value, so there is MEV miner value. To realize the users intention, the transaction needs to be handed over to a third-party outsourced processing, so the MEV generated by the transaction in the Intent-Centric architecture is also one of the issues that needs to be focused on.

The most intuitive impact of MEV: while hurting the entire network, competition also makes the market more efficient.

The uneven distribution of capital (large households have more ETH chips) may lead to the centralization of validators (larger pledge pools obtain higher MEV returns) and reduce the security of the overall network, even if it has already produced certain effects. Mitigation means, but the centralization risk brought by the block construction rights cannot be completely eliminated at present;

In order to increase the possibility of transactions being packaged, MEVs competing searchers gain priority by bidding for Gas, which will cause the public memory pool to become network congested due to searchers high Gas fee transactions, but at the same time DEX arbitrage and loan liquidation It can also help the DeFi market reach equilibrium faster to maintain market stability.

MEV is an unavoidable and important topic that has been explored in this industry for many years. How to alleviate the disadvantages brought by MEV is also constantly being explored. This article will explain in the next chapter Universal Solutions to Realize Intentions. According to EigenPhi data as of September 15, 2023, there is still a large profit space for the profit level of MEV on the chain. After the merger of Ethereum, the profit of block producers using only Flashbots has exceeded 200,000 ETH, so this is a piece of A very huge profit distribution pie.

Image source: EigenPhi | MEV Data

Cross-chain, sequencer and oracle

Intent-Centric is a huge system architecture. According to Paradigms explanation, the content of Intent-Centric will involve the entire blockchain field, and huge asset transfers between various Layer 1 and different Layer 2 must be passed to Intended to facilitate processing. Nowadays, the development of the industry has brought us to a multi-chain era. Each chain is an island, but there are different bridges between the islands, so cross-chains and sequencers are also necessary to meet the purpose. of bridging.

Based on the current prosperity of the Ethereum Layer 2 ecosystem, the four currently recognized mainstream kings: Arbitrum, Optimism, zkSync, and Starkware, each show their strength to tell their own Layer 3, and OPstack and ZKstack correspond to the narrative. The common problem currently faced by Layer 2 is the centralized sorter problem. Although we are currently actively looking for feasible solutions, the reality is that there is a huge cake hidden here. Taking OPstack as an example, we can simply regard its profit model as renting a shop. To understand, Layer 2s profit = Layer 2s Gas income + MEV income - Layer 1s Gas expenditure. Layer 2 and Layer 1 tolls are essential if the intended purpose is to be achieved.

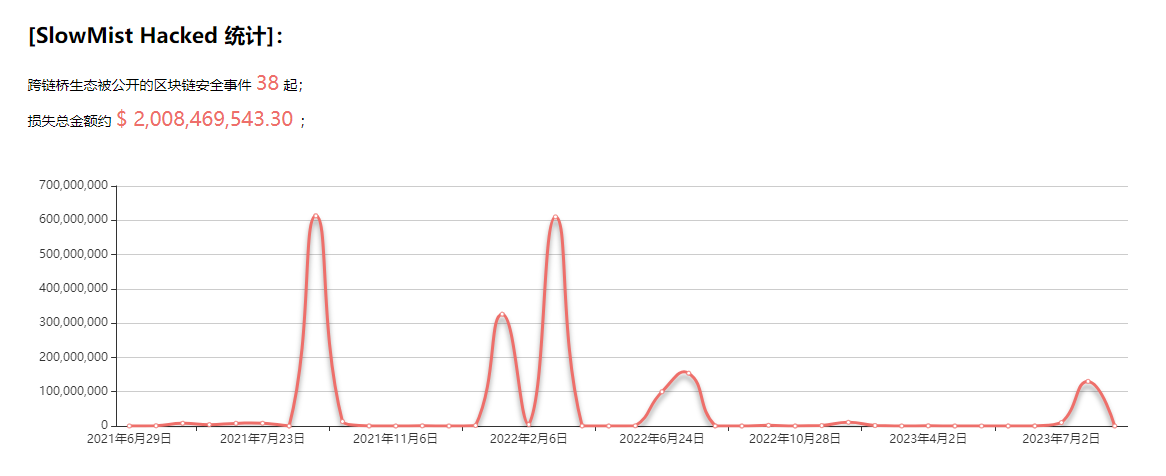

The topic comes to cross-chain bridges. The current prosperity of Layer 2 has made us early realize the considerable profits of sequencers, but the profits of cross-chains cannot be underestimated. Cross-chains are an indispensable bridge to open up the islands of different chains. As an infrastructure First, in the current bear market environment, in addition to meeting the cross-chain needs of normal trading users, the cross-chain demand generated by the Lu Mao Partys expectations for airdrops is still an actual market demand. The ever-prosperous Dapps applications will also gradually erode profits from convenient centralized exchanges. But a noteworthy issue is the security of cross-chain bridges. According to official data from hacked.slowmist, in the two years from June 29, 21 to September 16, 23, a total of 100,000 cross-chain bridge ecology incidents were disclosed. There were 38 security incidents, with cumulative financial damage reaching US$2 billion. To sum up, the gas fees involved in realizing the intention are inevitable, but this article will not discuss the security of the sequencer and cross-chain for the time being, although this is an issue worthy of our focus.

Image source: hacked.slowmist

The topic comes to Oracle. From a macro perspective, the strong financial attributes of blockchain make it a system environment that pursues certainty. Even though the narrative of RWA has been talked about for many years, the reality is that blockchain cannot obtain off-chain Real-world data can only obtain data within the chain, because the virtual machine (VM) cannot allow smart contracts to have network calls (Network Call), so the operation of smart contracts must have consistent results, so to the outside world, blockchain data It is also closed.

Let’s zoom in and come to a micro perspective. Oracles are an important factor in the DeFi world. Although the security of different protocols is usually inherited by the underlying smart contract network, its normal operation still needs to rely on oracles. If a protocol If the oracle is attacked or destroyed, the entire protocol will be manipulated. Today’s DeFi prefers to define itself as “Primitives” and hopes that more teams will build products or combination protocols based on them. However, the new DeFi contracts derived during this iterative process have to bear the burden of larger The ecosystem will upgrade its own operating logic, which also brings some external dependencies and creates unpredictable related risks.

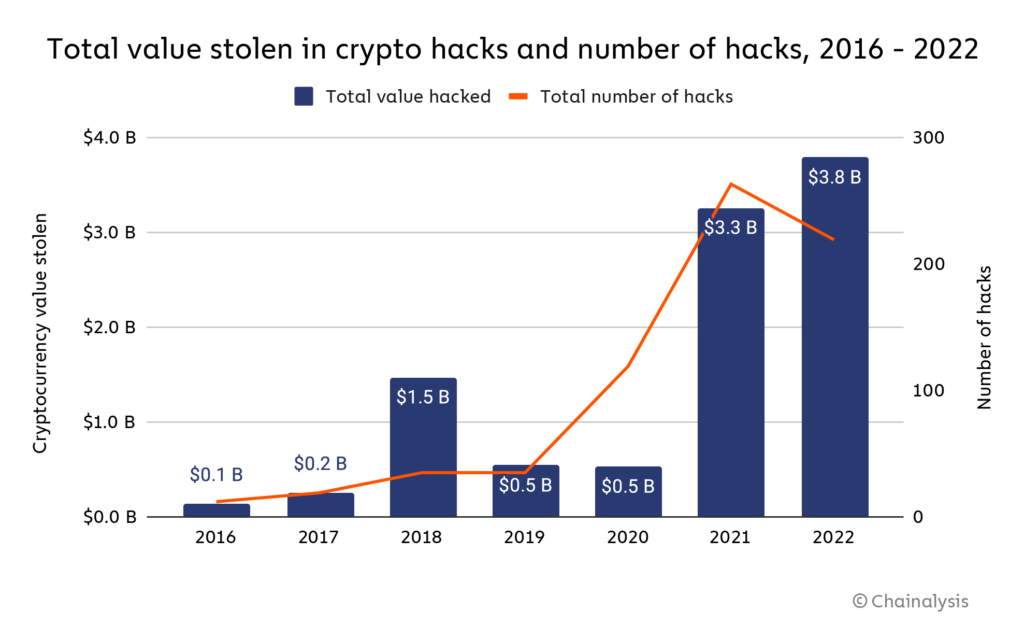

After several years of development, the DeFi field has also suffered a cumulative theft of billions of dollars. For example, in March this year, the Euler Finance lending protocol was hacked, with losses as high as US$200 million. It allows users to post collateral and borrow money. Its problem occurs in a specific function and there is no security check on it, allowing users to break the basic invariant of the lending market (such as the basic invariant in UniSwap: tokenBalanceX * tokenBalanceY == k). Derivatives protocols that also rely on oracles for pricing lack internal price discovery mechanisms and are susceptible to price lags and no updates, thus severely limiting their scale and user experience. This also explains why trader Avraham Eisenberg was able to successfully attack Mango Markets and siphoned off $116 million from the cryptocurrency trading platform.

To sum up, the dark laws of the blockchain forest are generally full of unknown risks, and there is still a long way to go to realize the vision of the Intent-Centric architecture.

Source: Chainalysis

Aggregators and Gas

The direct purpose of the emergence of aggregators is to save users the trouble of finding the best trading paths and income strategies, including many aggregator types, such as: trading aggregators, information aggregators, income aggregators, liquidity aggregators, asset management aggregator. The Intent-Centric architecture requires a certain degree of centralization. Various aggregators may facilitate the execution path of the parser in the process of finding intent and provide a certain degree of reference answer.

Gas is an indispensable toll fee for executing various transactions. How to optimize Gas fee is also one of the common topics in the industry. Currently, it is generally focused on optimizing the product side, account abstract wallet, and DeFi protocol. Will it be possible in the future? Let’s wait and see how the aggregator, account abstraction, and DeFi protocol can be combined to optimize Gas from a new product perspective.

Wallet authorization

The first step in Dapps interaction: wallet authorization, let us return to the transaction itself. The purpose of the Intent-Centric architecture is to simplify transactions and reduce the user threshold. However, each transaction in the intention will involve countless authorization signatures. How to solve the authorization problem safely and conveniently is also an issue that needs to be considered. Perhaps account abstraction and dappOS below V2 is a good solution.

Universal solution to achieve your intent

Anoma

Source: Anoma official

Introduction:

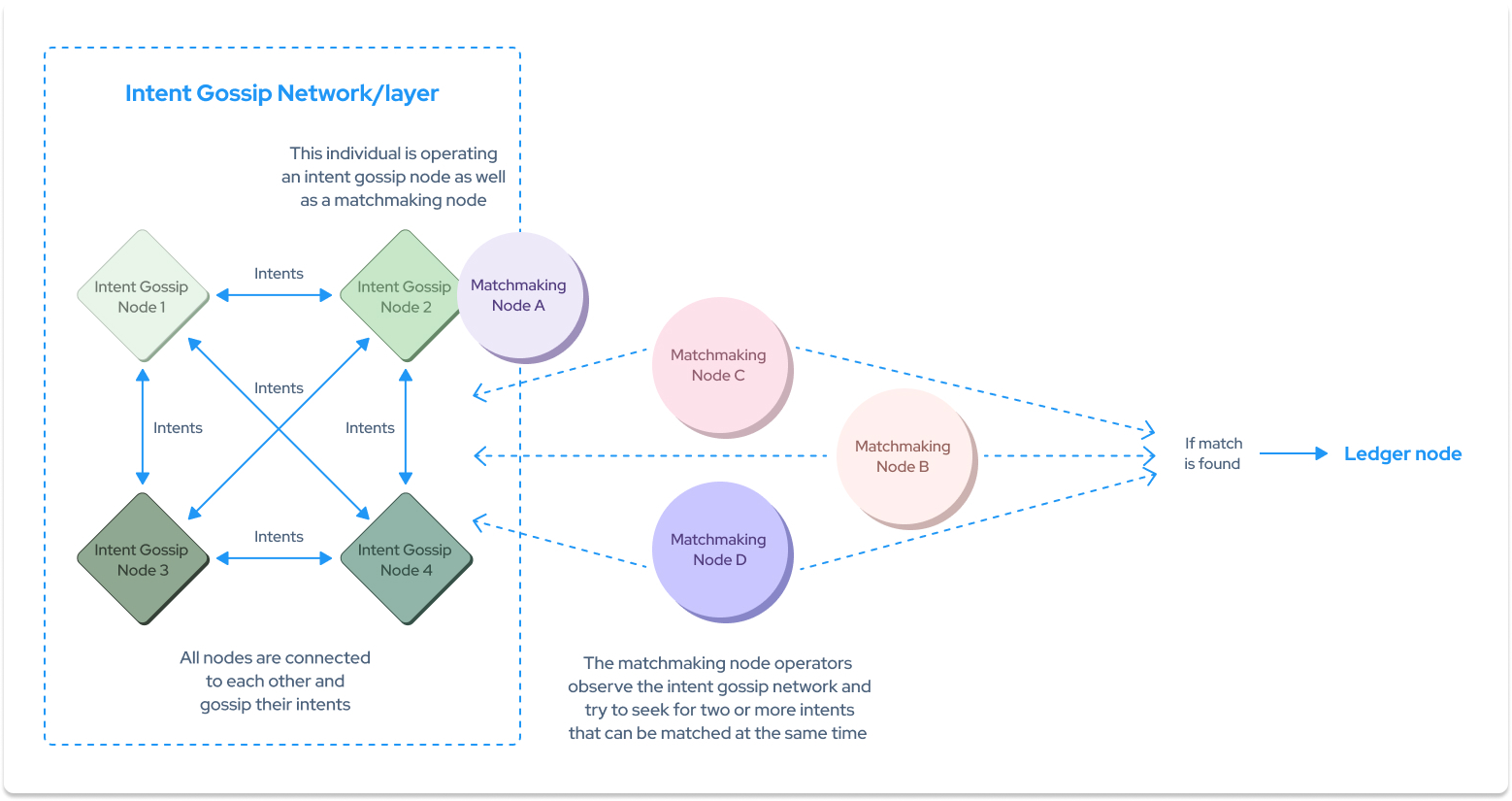

According to a Coindesk report on May 31, 23, Anoma Foundation has successfully completed a cumulative investment of US$25 million from 14 capitals including CMCC Global and Electric Capital. The projects white paper published in August 22 has already proposed the intent architecture: Intent Gossip Layer. The intent propagation layer (Gossip here is temporarily translated as propagation, and some translations are interpreted as gossip) is used to propagate intentions, discover counterparties, and match execution. path. It is designed as the default verification path, and all its propagation (Gossip) information is signed by the sender node, thus forming a signature chain that can be traced back to the initiator. This feature is effective in resisting censorship and DoS attacks (denial of service attacks, It is a method used to destroy legitimate users access to target network or website resources) is particularly important, so when it comes to the implementation of Intent-Centric, Anoma is indispensable.

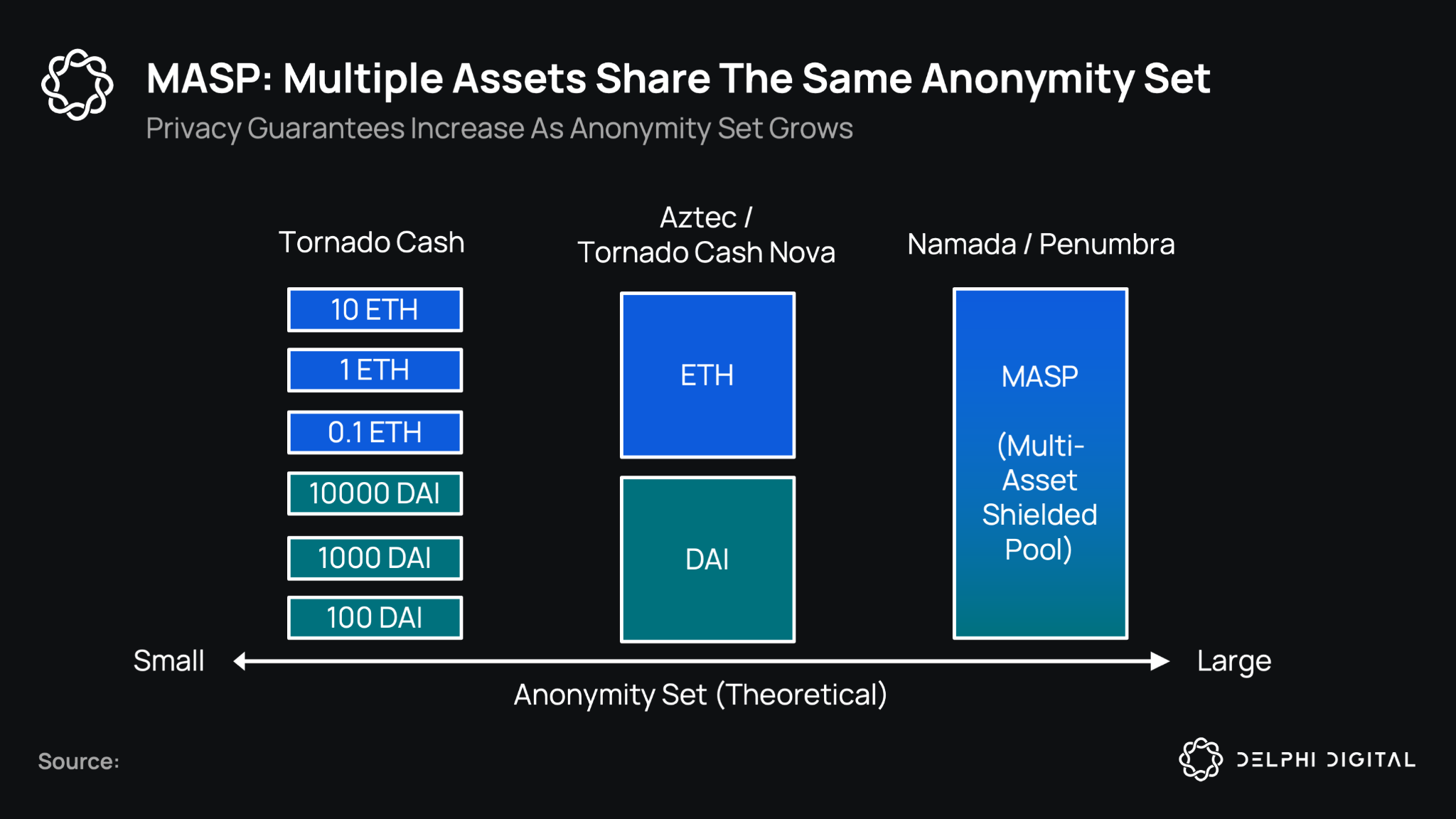

Anoma was initially developed based on Tendermint and used a Byzantine Fault Tolerance (BFT) consensus mechanism, and then moved to another PoS proof-of-stake consensus mechanism Typhon developed by Heliax to allow consensus division between independent chains. The project team has successively developed Taiga (a private state transition framework integrated into the intent propagation layer Intent Gossip Layer and matching layer), Typhon (a cross-chain atomic transaction consensus mechanism), MASP (multi-asset shielded pool), Vamp-IR ( Arithmetic circuit language), Juvix (smart contract programming language) and other technologies promote experiments in cryptography and distributed systems.

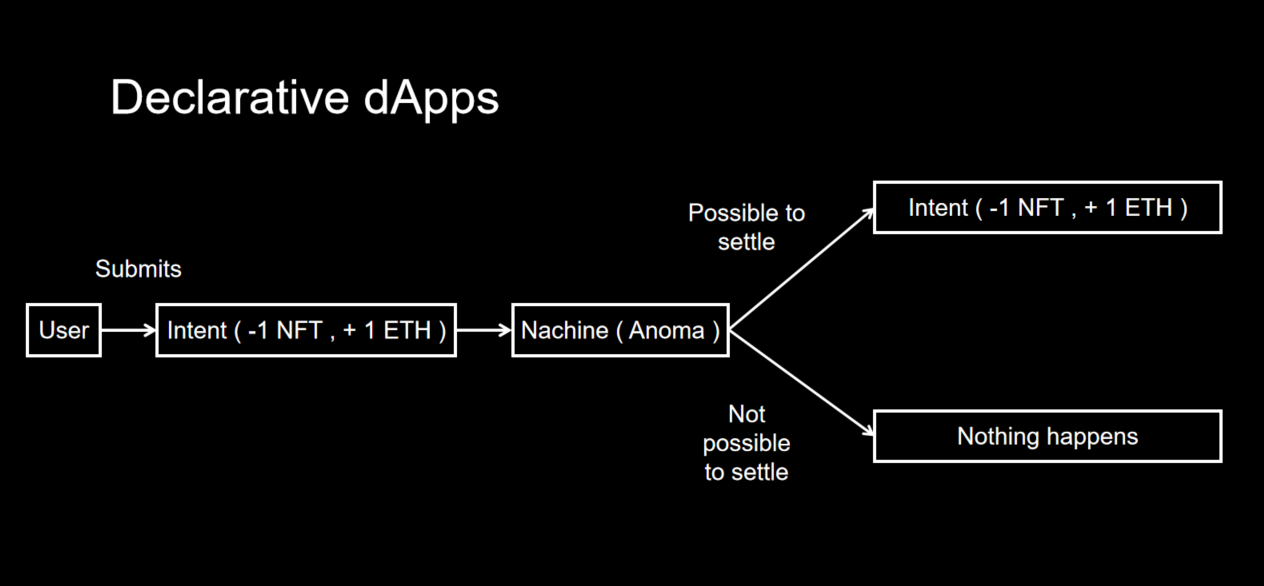

Continuing from the above paragraph Programmability of Intents, to realize the architectural vision of Intent-Centric, programmable algorithm structure and discovery of counterparties are indispensable functions, which need to be built on the basis of multi-interaction and multi-applications. Above, Anoma, a unified architecture for full-stack decentralized applications, is introduced here to jointly build an example of decentralized applications.

Source: Anoma

Design architecture and its innovation points:

1. Privacy payment

In order to protect user privacy and prevent others from retroactively collecting data, the sender, receiver, amount and asset denomination are all encrypted, and the transfer of funds is guaranteed through zero-knowledge proof zk-SNARKs. Its unique feature is that it allows all assets to share the same Shielded Pools (MASP) provide composable asset protection to increase user anonymity sets, rather than shielding each asset individually. The more participants, the more assets and the more frequent transfers, which greatly increases the degree of anonymity of asset transfer data;

Image source: Delphi Digital - Delphi Creative

2.Barter transaction

The barter exchange scheme has been repeatedly emphasized in this project, the core idea of which comes from ancient barter. To put it simply, it is bartering, which does not require a medium of exchange and does not involve cash receipts and payments. The participants must have at least a double coincidence for the transaction to be successful. One is that both parties happen to have the items that the other party wants, and the other is that the transaction is transferred by both parties. convenient. This helps users pass to the node operators of the intent propagation layer and run matching node operators that check whether these intentions are compatible, in order to create and match the relevant transactions, and send the corresponding execution transaction ledger. Anoma implements a digital barter program that facilitates the exchange of goods, services, or digital representations of value;

3. Intent matching system

In the Ethereum EVM, transactions do not enforce a future state but instead authorize a specific execution path, whereas Anoma includes a matching system that allows users to broadcast transaction intentions using gossip. Simply speaking, Anoma consists of two main parts: the distributed ledger and the intent matching system. They complement each other and can also run independently. By using Intent Gossip to run nodes, Token exchange solvers and RPC servers that request new intents, and transfer transactions from Matching intentions are submitted to the distributed ledger, helping users automatically discover counterparties;

4.Multiple chain support

Anoma uses the Cosmos ecosystems cross-chain communication IBC protocol for inter-blockchain communication. IBC uses relays to realize data transmission between different blockchains, aiming to become a multi-chain privacy layer. Although currently relays are typically run by node operators, anyone with the ability can run them and earn fees in the process;

5. Fractal scaling expansion plan

Anoma uses a fractal solution to address blockchain’s scalability issues, allowing users to create local instances to meet additional transaction needs. Fractal refers to dividing Anoma into different application chains to handle different tasks, so that each Anoma application chain can be highly customized to achieve scale and cope with user growth (similar to supporting the IBC protocol for expansion purposes). In the future, it will Security will be improved by IVInterchain Security, IVMesh Security, and IVInterchain Alliance projects.

SUAVE

Introduction:

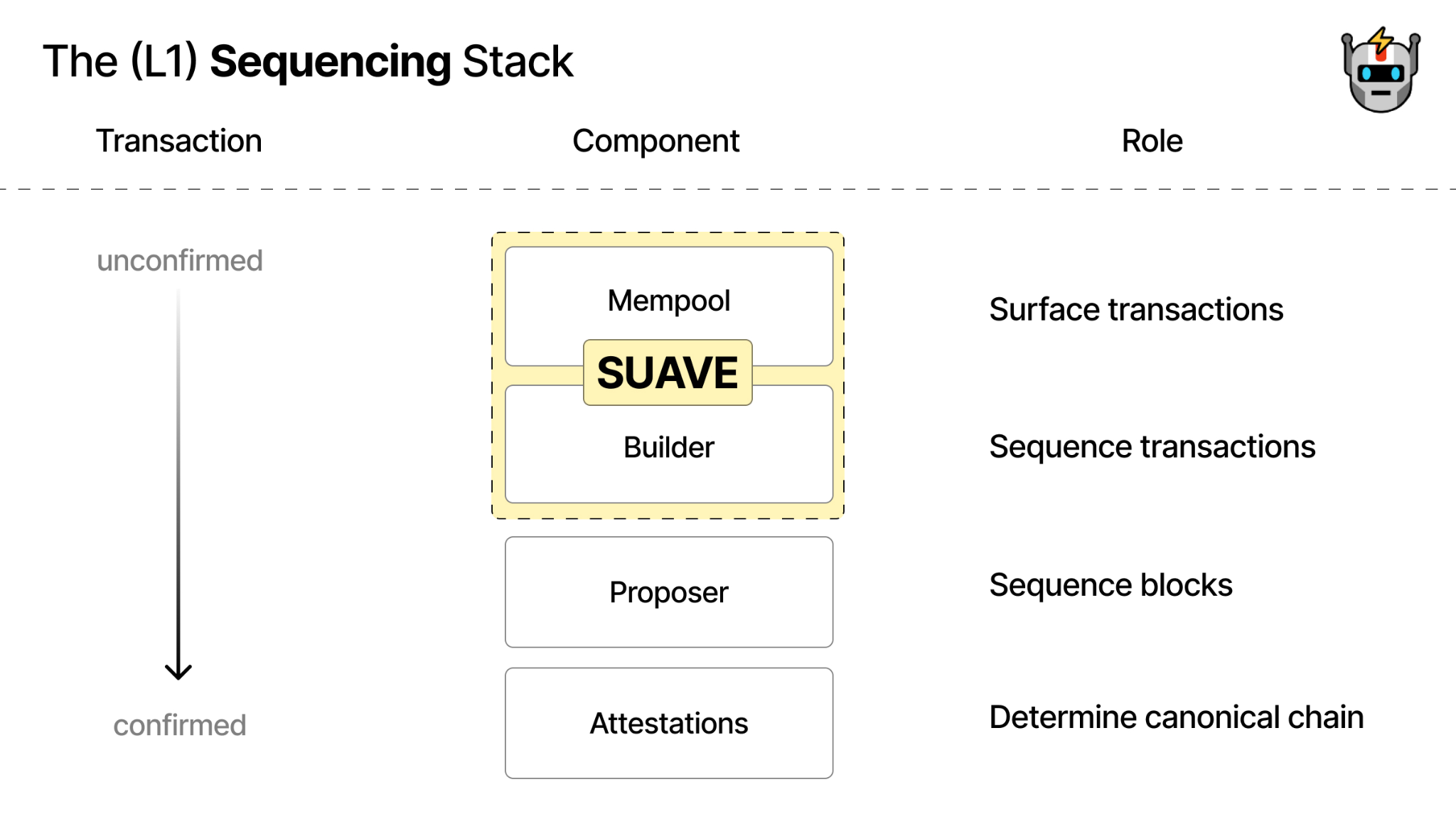

According to news on July 25, 2023, Ethereum infrastructure service Flashbots completed a $60 million Series B financing at a valuation of $1 billion to develop the SUAVE platform. SUAVE (Single Unified Auction for Value Expression) separates the memory pool and block generation from the existing blockchain to form an independent blockchain network (ordering layer) and provides a highly specialized plug-and-play alternative [ 4 ], infrastructure designed to address MEV-related challenges.

Although SUAVE is a new blockchain, it is not a general-purpose smart contract platform that can compete with Ethereum or any other participating chain. If Anoma is like building an intent-centric blockchain, SUAVE is about building an intent-centric infrastructure.

Image source: SUAVE in the blockchain stack

SUAVE has three goals:

Illuminating the Dark Forest: Exposing unfair events in the current opaque MEV ecosystem to every user, quantifying their impact and breaking down information barriers between participants;

Democratic mining: realize the integration between miners and retrievers in an open way, promote competition between parties in the most restrictive way and open it to all miners for free to prevent MEV integration and centralization;

Benefit distribution: Give MEV to the people who created it - Ethereum users.

According to SUAVEs intended solution, cross-chain settlement is required when processing transactions from the outside (Ethereum for example). It can be used to try to solve various risks in EVM, such as MEV-Geth and MEV-Boost that have been launched. The huge success of decentralized solutions. However, it should be noted that users will deposit funds into SUAVE in the process of realizing their intentions, and in the process of unlocking funds when their needs are resolved, the smart contracts on SUAVE need to involve oracles for asset verification, so to a certain extent SUAVE will also be exposed to all the risks of todays cross-chain bridges.

From SCW and AA to SUAVE and Intent-centric:

Review the Account Abstraction AA section above, and then think about the main functions brought by account abstraction: private key retrieval, gas-free payment, multi-signature authorization, multiple transfers in one transaction, rate restrictions, etc. In general Account abstraction perfectly combines the advantages of regular accounts (EOA) and smart contract accounts (CA).

SUAVEs vision is to become a common ordering layer between various different chains (including cross-chain transactions and MEV), so if the user intends to involve cross-chain asset transfer, Account Abstraction (AA) and multi-signature smart contracts such as Gonsis Safe Account (SCW) combines the advantages of both parties and combines it with SUAVEs EVM solution, which may be a better solution in theory at present.

CoWSwap

Image source: CoW Protocol

Introduction:

If you want to select the project closest to the Intent-Centric architecture, CoWSwap will definitely be on the list. The difference between its protocol and other protocols is that user transactions only need to send out a signature order, entrust the execution of the transaction to the solver network, and complete the transaction in this network (without specifying the execution path). At the same time, the off-chain signature order will be processed due to The solver is executed after matching (similar to but different from the Bob Solver above). Due to the batch bundling rights of the solver, the gas cost in the process will be borne by the solver. There is no need to pay for transaction failure.

CoWSwap Hooks:

Does talking about Hooks remind us of Uniswap V4? However, the actual functions of the two are completely different. CoW Hooks connect transactions, bridging, staking, deposits, etc. together, and can be executed before/after order execution and perform transaction sequencing in the form of a single transaction.

The main function:

Pre-hooks can be used for orders"set up"condition. For example, executing the code required to verify on-chain signatures, or setting up the required approvals via EIP-2612 permissions;

Post-hooks are executed after the exchange has occurred and the receiving address has received the funds. Post-pegs provide immediate access to funds, including through staking, providing liquidity, bridging tokens to L2, etc.

DeFi example of CoW Hooks:

Repay debt and pledge: Set the pre-peg operation to repay the debt and close the position, then use CoW Swap to exchange assets, and finally use the post-peg operation to deposit the new assets into the staking vault;

Create LP position: you can use only pre-pegged transactions or only post-pegged transactions;

JIT (just in time) smart orders: Program the Safe smart contract wallet through the composable CoW framework (ERC-1271) to perform customized smart contract approval and exchange;

NFT: NFT can be sold or purchased in the CoW Hooks feature;

Cross-chain: Assets can be sent to the bridge contract through Cow Hooks to complete cross-chain transactions;

Airdrop: You can use CoW Hooks to sell airdrops without using ETH as gas;

Unlocking and re-staking: If you are a validator who has pledged 32 Ethereum, you can unbind to receive rewards, or you can re-stake the assets on other chains through CoW Hooks;

Automatically increase LP positions: Suppose you become a liquidity provider of the EUR-USDC pool on the Gnosis chain to obtain GNO Token rewards. You can use CoW Hooks to automatically convert your GNO to EUR - USDC at a 50/50 ratio through CoW Swap, allowing the asset to automatically increase the LP position.

dappOS V2

After discussing the intent layer and related infrastructure layers, let’s discuss the dappOS V2 protocol, which is known as the “new wave of intent layer”. On July 21, 2023, dappOS V2, with a valuation of up to US$50 million, completed a seed round of financing co-led by IDG Capital and Sequoia Capital (China). At the same time, it also attracted the attention of other major VC institutions and Binance .

dappOS V2 is an intent protocol that references dappOS accounts and the dappOS network designed to simplify user interactions with dApps to a CeFi-level user experience. At the same time, the Chain Abstraction technology eliminates the fragmentation obstacles caused by multiple chains (chain abstraction is similar to post-account abstraction).

Image source: Intent-Centric A Narrative worth keeping an eye

Whether for intent or transaction purposes, the users focus is always the total amount of the fund account, not the individual asset balances between different chains. According to the understanding of dappOS V2, there should be a unified account wallet to achieve the vision of one signature completes everything and the design concept of one-click multiple TXN (Transaction Record-Transaction) is introduced to provide users with Remove obstacles before completing TXN and achieve users intent-driven transaction goals.

For example, it can be used to realize interaction with GMX between different chains of Arbitrum and Avalanch without assets, so as to achieve the basic transaction rules that will center on intention in DeFi in the future. Therefore, implementing intent-centered concepts requires chain abstraction, account abstraction, and more protocol abstractions. But here is a question that needs to be considered: Assuming that all kinds of abstractions are realized, will the interaction rules of masturbating users and the airdrop rules of various projects change accordingly?

summary:

Intent is still full of risks and challenges during its execution. It relies on intermediaries or specific executors, so there is a risk of concentration of power and monopoly, which affects the trust issue of the entire middleware. Secondly, the security and privacy related risks caused by handing over transactions to third parties for execution are also worth considering. Whether Intent application developers can achieve a balance between security, privacy and convenience is also worth looking forward to.

The concept of intent has relatively mature applications in the Web2 field, such as taxi-hailing software, ticketing software, and map navigation. However, the success of these applications is based on the sound infrastructure of Web2. If mature applications need to appear in the Web3 field, Application scenarios still need to wait for the industry to continue to mature. Intent-Centric is a grand concept that will involve all aspects of blockchain. It is also one of the best ways to combine blockchain with AI. However, whether it can be implemented and developed still requires our continued attention.

Interpretative literature and reference articles

【 1 】https://www.paradigm.xyz/2023/06/intents

【 3 】https://www.alchemy.com/overviews/what-is-a-mempool

【4】https://writings.flashbots.net/the-future-of-mev-is-suave/#iv-suave-in-the-blockchain-stack

【6】https://news.marsbit.co/ 20230818082351362551 .html

【 8 】https://research.web3 caff.com/zh/archives/11091? login=success&ref= 416