Original author: Sun Yujie, Senior Lawyer at Shanghai Mankun Law Firm

Recently, an old friend who has been in the cryptocurrency industry for many years consulted Mankun Law Firm because he was scammed out of 50,000 Tether (USDT) on a certain exchange.

The situation was that he sold his Tether (USDT) on a well-known overseas cryptocurrency derivatives trading platform, and the buyer claimed to have a Hong Kong account and could only pay in Hong Kong dollars, requiring my friend to provide a Hong Kong bank account. So, without thinking too much, my friend sent his Hong Kong bank account to the buyer. After a while, he received a notification of a deposit in Hong Kong dollars.

Upon seeing the notification, my friend thought that the money had been deposited and without hesitation, he transferred his Tether (USDT) to the address provided by the buyer. However, after a while, my friend found that the deposited Hong Kong dollars had been withdrawn. It was at this point that my friend realized he had been scammed.

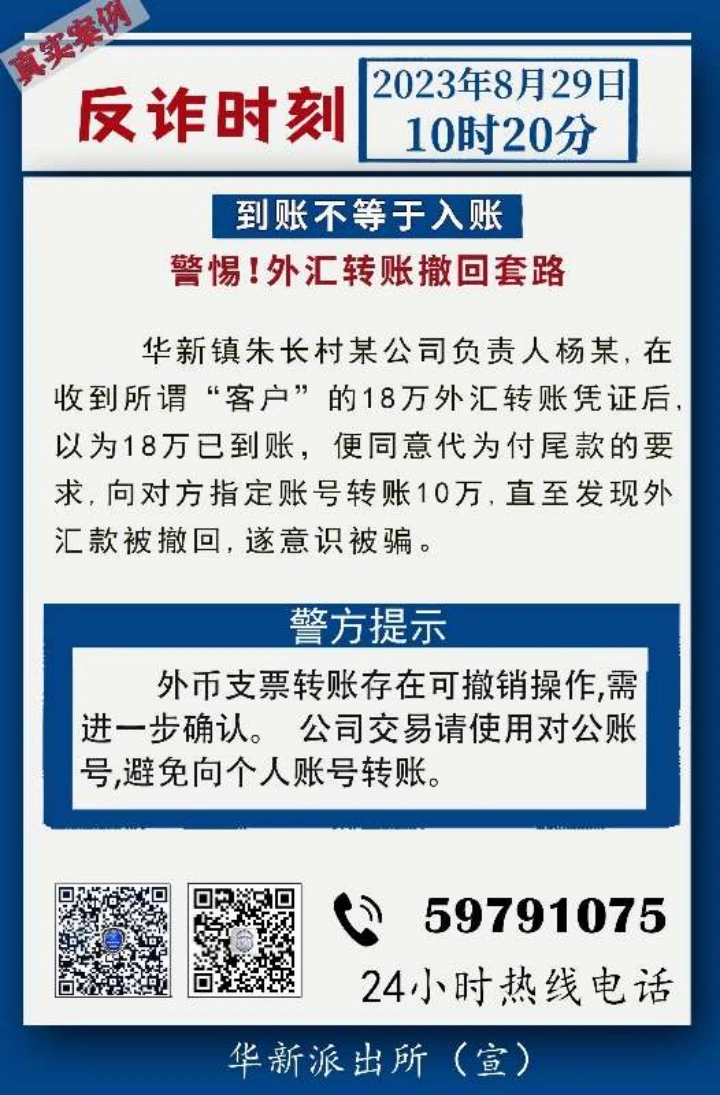

Similar scams are actually quite common. A recent case announced by the Shanghai Huaxin Police Station showed that a company executive named Yang, after receiving a foreign exchange transfer voucher of 180,000 yuan from a so-called "client," thought that the money had been deposited and agreed to pay the remaining amount on behalf of the other party, transferring 100,000 yuan to the designated account. It was not until later that he discovered the foreign exchange payment had been withdrawn and realized he had been deceived.

01 What are common tactics used in check fraud schemes?

In Hong Kong, interbank transfers in Hong Kong dollars can be made using checks. A check is a document issued by the drawer, entrusting a bank or other financial institution authorized to handle check deposits to unconditionally pay a specified amount to the payee or holder of the check when presented.

However, the deposit of a check in Hong Kong does not necessarily mean that the funds have been received. There is a 24-hour reconciliation period between the deposit and the actual availability of the funds. During this 24-hour period, the recipient will receive two separate bank SMS notifications: the first notification indicates that the funds have been deposited, but these funds are only "displayed as a number in the recipient's account" (also known as "on-hold funds"), and are not yet actually owned. The second notification, received the next day (24 hours after the first deposit message), is a reminder that the funds have become available, and at this point, the funds can be used.

The emphasis is that according to the operational characteristics of the Hong Kong financial system, the payer can revoke the remittance at any time during the period from the time of credit to the time of receipt. Even if the payer does not revoke the check, the check may not be credited due to insufficient funds, inconsistent signatures, or other factors that do not meet the cashing conditions of the bank (also known as "bounced check").

In the cases published by the police and the incidents encountered by friends, the swindlers use the unfamiliarity of everyone, especially mainland friends, with the operation of the Hong Kong check system to commit fraud.

There are three popular fraud methods for overseas payment by check in the past two years: using the time difference to revoke after issuing the check, bouncing the check (insufficient funds, etc.), and defrauding the payment difference.

1. Revocation after issuance of the check. As in the above scam, swindlers use the time difference to first make the other party mistakenly believe that they have received the transfer, but it actually has not arrived in their account. After the other party pays the virtual currency, they quickly withdraw it.

2. Bouncing the check as an empty check. When the check is credited, most banks have a freezing period (retrieval period), which can last up to six months. If the check bounces after this period, not only the money has to be returned, but also a handling fee has to be paid. This type of scam is more common in foreign trade transactions.

3. Defrauding the payment difference. This method is even worse than the first two scams. When issuing the check, the swindlers intentionally overpay, and when the payee mistakenly believes that they have received the money, the swindlers will kindly ask them to refund the difference, claiming that they accidentally overpaid.

02 Checks Targeting Virtual Currency Transactions

The learning ability and diligence of swindlers are not inferior to any new talents in the workplace. In the new round of scams, the swindlers not only target physical enterprises but also set their sights on the emerging virtual currency market.

In this scenario, swindlers usually disguise themselves as buyers and have simple communication with virtual currency sellers automatically matched by the platform to gain initial trust. Because the check payment scam needs to be completed in a local account in Hong Kong, they will then require the seller to provide a local Hong Kong account. Then they take advantage of the loophole that many, especially mainland friends, are unaware of regarding the operation of the Hong Kong check's 24-hour reconciliation system. They credit the "exchanged check" for the transaction amount into the Hong Kong account provided by the seller. After the seller receives the first credit notification, the swindlers urgently urge the seller to transfer the virtual currency to their designated address. Once they receive the virtual currency, they use various excuses such as inconsistent signatures or incorrect amounts to revoke the payment using the check transfer.

Therefore, although the above scams may seem like old tricks from years ago, they are still "quite fruitful" in emerging formats. At the same time, the swindlers protect themselves very well and are usually not Hong Kong residents, making it extremely difficult to recover the money after being swindled.

03 Tips from Lawyer Man Kun

The healthy and orderly development of the market relies on legal protection, and at the same time, we also need to raise our awareness of prevention.

1. Be vigilant in daily life. Listen and observe more, familiarize yourself with common scams, and remain cautious during transactions. For example, follow our lawyer Mankun's WeChat public account to learn various tricks used in the cryptocurrency circle.

2. Pay attention to buyer information. When trading cryptocurrencies on overseas exchanges, pay attention to the seller's historical transaction order quantity, past buyer reviews, platform certifications, and prefer cash settlement methods. Make sure to confirm receipt of funds before releasing the coins. If the buyer insists on using check remittance, extend the transaction time until the check is truly cashed, and base it on the actual available amount in the bank.

3. Contact customer service to freeze the account and report to the police in a timely manner. If unfortunately encountering such scams, do not panic. Contact the exchange's customer service personnel as soon as possible, organize relevant documentary materials, and apply to connect with the other party's trading account. If the amount of funds defrauded is large, you can also seek assistance from a lawyer to report to the public security authorities.

Special statement:

This article is an original piece by Shanghai Mankun Law Firm, representing the views of the author alone and does not constitute legal consultation or advice on specific matters. For permission to reprint this article, please contact Mankun Law Firm staff: MankunLawFirm