YBB Capital: Stuck in dire straits, but staying stable and not stopping innovation

Original Author: Solaire, YBB Capital

Introduction

Stablecoins have always been a crucial part of the crypto world, occupying around 8.6% (approximately $124.5 billion) of the total market capitalization of the blockchain. Centralized stablecoins collateralized by the US dollar and US Treasury bonds, such as USDT and USDC, have always dominated the market. However, centralized stablecoins are always subject to central control. For example, Tether has the ability to freeze any address containing USDT, and their security is guaranteed by centralized entities. This clearly goes against the original intention of blockchain existence. In the exploration of decentralized stablecoins, two major branches have emerged: over-collateralized stablecoins and algorithmic stablecoins. Although over-collateralized stablecoins can maintain stability in highly volatile crypto markets due to their high collateralization ratio, their capital efficiency is low due to the minimum collateralization ratio of 1.5-2. On the other hand, the market for algorithmic stablecoins has always been the harshest. Although they have the highest capital efficiency, their model of near-zero collateralization always leads to their demise. After the failure of LUNA, this track has disappeared for a long time. However, the author always believes that there should be a decentralized stablecoin without over-collateralization in the crypto world. This article will explore the history of algorithmic stablecoins and some new ideas.

What are algorithmic stablecoins?

Generally, algorithmic stablecoins are stablecoins that do not require any reserves or collateral and fully adjust their supply and circulation through algorithms. This algorithm controls the supply and demand of the currency, aiming to peg the price of the stablecoin to a reference currency, usually the US dollar. In general, when the price rises, the algorithm will issue more coins, and when the price falls, it will buy back more coins from the market. This mechanism is similar to seigniorage, which is the way central banks adjust the supply and value of a currency by issuing or destroying money. For some algorithmic stablecoins, their functionality can be modified based on community suggestions, and this modification is achieved through decentralized governance. This way, the power of seigniorage is handed over to the users of the currency, rather than the central bank.

In short, algorithmic stablecoins differ from common stablecoins like USDT and USDC in terms of decentralization. They do not require reserves and are independent. As algorithmic stablecoins are based on the intrinsic relationship between mathematics, monetary economics, and technology, they introduce a possibly more advanced stablecoin model than centralized stablecoins.

A Brief History of Algorithmic Stablecoins

The early attempts that influenced later algorithmic stablecoins can be traced back to 2014 when economist Robert Sams proposed a model called "Seigniorage Shares." This model maintains price stability by automatically adjusting the money supply. This concept was partly inspired by modern central bank monetary policy. Next, BitShares attempted to adopt a hybrid model that primarily relied on asset collateral but also included elements of algorithmic adjustments. This can be seen as an important step in the development of algorithmic stablecoins, although it wasn't a pure algorithmic stablecoin itself.

In 2017, a project called Basis (formerly Basecoin) gained widespread attention. The project aimed to maintain the value of stablecoins through a complex three-token system. However, due to incompatibility with U.S. securities laws, the project was ultimately forced to shut down at the end of 2018.

In 2019, Ampleforth introduced a new model called "elastic supply," which adjusts not only the issuance of new tokens but also the quantity of existing tokens in users' wallets to achieve price stability. Around the same time, Terra also released its stablecoin, which used a composite model including taxation, algorithmic adjustments, and asset collateral through its native token minting. Of course, this token is also widely known as LUNA, which came later.

Terra LUNA

LUNA is not only the most representative project in the algorithmic stablecoin space but also one of the most notorious projects in the crypto world. Its history is like a flashbulb, shining brightly for a moment and then disappearing. Today, the re-exploration of LUNA is just a lesson from history, seeking insights for the future.

LUNA Historical K-line (Data source from CoinGecko)

Terra is a blockchain built on Cosmos SDK and Tendermint consensus, originally aimed at solving the payment problem in e-commerce with cryptocurrency. However, traditional cryptocurrencies are too volatile to be used like fiat currencies, and centralized stablecoins like USDT have regional and centralization issues. So Terra wants to create a rich and decentralized stablecoin portfolio, such as Korean won, Thai baht, and US dollar.

To achieve this goal, Terra needs to introduce a universal minting mechanism. Soon, on a certain day in April 2019, a minting method was proposed by Terra's two co-founders, Do Kwon and Daniel Shin, in Terra Money's whitepaper. It involves minting stablecoins of various countries using LUNA (Terra's native token). Let me briefly explain this method using UST (Terra's US dollar stablecoin) as an example.

· First, UST is pegged to the US dollar at a 1:1 ratio;

· If UST exceeds the pegged price, you can convert 1 US dollar worth of LUNA into 1 UST, at which point UST is worth more than 1 US dollar, and you can profit by selling it;

· Conversely, if UST is below the pegged price, you can always exchange 1 UST for 1 US dollar worth of LUNA.

This model has been questioned since its introduction. From the birth of LUNA to its demise, various well-known figures in the cryptocurrency community have been warning that LUNA is nothing but a Ponzi scheme. Yet, despite all that, many people continue to enter this dangerous territory. So why is that?

Seigniorage

To understand a Ponzinomics scheme, you first need to understand the motive behind designing this scheme, which is the widespread adoption of UST to increase the price of LUNA and a crucial point of interest - seigniorage.

Seigniorage is an economic concept that describes the income a government generates by issuing currency. Specifically, this term is commonly used to refer to the difference between the face value of the currency and its production cost. For example, if it costs 50 cents to produce a $1 coin, then the seigniorage is 50 cents.

In the crypto world, all three types of stablecoins have seigniorage. Stablecoins backed by fiat currencies generally charge a seigniorage fee of approximately 0.1% during the minting and burning process. Overcollateralized stablecoins derive their income from transaction fees and interest paid by holders. As for algorithmic stablecoins, they have the highest seigniorage rate. By introducing a mechanism that involves volatility-linked tokens, stablecoins can convert all the funds entering the system into seigniorage, creating something out of nothing. This mechanism significantly reduces the startup cost, to some extent, and improves the anchoring speed but also comes with inherent vulnerability.

Anchor Protocol

LUNA is a miracle in the history of algorithmic stablecoins. Prior algorithmic stablecoin projects either failed in a very short period or never managed to grow significantly. LUNA not only secured the third position in the stablecoin sector but also positioned itself as one of the few companies bridging the payment sector.

Before Terra's collapse, it had actually established an excellent financial ecosystem, along with two payment systems built on the Terra protocol: CHAI and MemaPay. CHAI had even seamlessly integrated with local payment channels in South Korea and collaborated with numerous enterprises, including NIKE Korea and Philips. Within Terra's financial ecosystem, there were also active protocols for stocks, insurance, asset fractionalization, and more. In fact, Terra has already achieved great success in bringing the advantages of blockchain into the real world.

Unfortunately, all this prosperity was built on Do Kwon's scam, rather than steadily advancing various use cases for UST. Do Kwon pressed the acceleration button with Anchor Protocol, accelerating the success of Terra but also hastening its demise.

Anchor Protocol is a decentralized bank within the Terra ecosystem that offers a very attractive savings product, a 20% APY non-loss UST deposit service (the initial design was 3% APY, but Do Kwon insisted on 20%). In a world where banks cannot even provide a one percent interest rate, UST has a 20% APY. As a result, Do Kwon discovered the mysterious button for massive UST minting and stable dumping.

To maintain this scheme, Do Kwon went mad in the later stages of Terra, refinancing and buying BTC to support UST's annualized rate (there was a proposal to reduce the annualized rate to 4% at the time, but Do Kwon knew that massive selling pressure was more terrifying) and UST's stability. However, the truth can't be hidden forever. On the night when UST migrated from the Curve 3 Pool to the DAI killing 4 Pool, when UST liquidity was at its lowest, a meticulously planned short attack directly caused UST to decouple. Even BTC, as a second-layer shield, couldn't protect UST's fixed exchange rate and instead fed the short attackers. From that point on, the giant empire of Terra collapsed in an instant.

Parallel Universes

If there were parallel universes, Do Kwon did not press that button out of self-interest, or on the night of the UST migration, there was no attack. Could Terra avoid the fate of death in the end? The answer is no. In the parallel universe where UST was not attacked, UST would still die due to a Parsonian death, and even without the Parson, UST would die due to forced pegging. Pegging to another currency itself is extremely difficult, and even without a short attack, many uncontrollable events would crush this fragility.

Schwarzschild Radius

The Schwarzschild radius is a physical parameter of celestial bodies that refers to the point at which any object collapses into a black hole if its radius is smaller than the Schwarzschild radius.

In fact, this principle applies not only to celestial bodies, but also to algorithmic stablecoins like LUNA, and even centralized stablecoins based on the "gold standard." As LUNA and UST are twins, each of them is the Schwarzschild radius of the other. Once UST decouples or if LUNA faces liquidity issues while the minting mechanism continues to operate normally, they will eventually collapse rapidly into a "black hole".

Centralized stablecoins backed by the US dollar or US Treasury bonds can be considered as the security of centralized entities. This centralization issue involves the stablecoins themselves as well as banks and custodians. Although we all understand that both USDT and USDC have been around for many years and have survived countless FUD incidents, their history is still relatively short compared to the crypto world. No one can guarantee that any centralized institution in the world is too big to fail. After all, even Lehman Brothers went bankrupt. Once there is a situation of losing collateral or being unable to convert back to the US dollar (USDC almost faced this crisis in March this year), they will also be instantly drained like a "black hole".

Looking back at the history of real-world currencies, these mechanisms have actually collapsed into black holes before. For example, the collapse of the gold standard was due to imbalanced gold reserves during wartime and excessive issuance of banknotes by central banks, where the gold reserves could not match the total amount of banknotes issued. The general public had no idea how much gold reserves the banks actually had. It was only when a run occurred that people realized their banknotes were worthless, and excessive printing of banknotes became a legalized practice (modern fiat currency system). Another situation is when a currency is pegged to another currency, such as the indirect pegging of the British pound to the German mark. Britain briefly participated in the European Exchange Rate Mechanism (ERM), a semi-fixed exchange rate system among multiple currencies. In the ERM, the exchange rates of participating countries' currencies fluctuated within a relatively narrow range, with the German mark often serving as an "anchor" currency. This can be seen as an indirect pegging. However, due to various factors (including the rise in interest rates caused by German reunification and the need for the UK to lower interest rates to stimulate exports under domestic economic pressures), maintaining a fixed exchange rate within the ERM became increasingly unsustainable for Britain.

The infamous Black Wednesday event in history happened at this moment. Soros discovered the vulnerability of this system and, together with some long-term speculative funds and multinational companies, sold weak European currencies in the market, forcing these countries to spend enormous amounts to stabilize their currency values.

On September 15, 1992, Soros decided to heavily short the British pound, and the pound fell all the way to 2.8 against the German mark. At this point, the pound was already on the verge of exiting the ERM system. On the 16th, even though the British Chancellor of the Exchequer raised the country's interest rate to 15% within a day, the effect was minimal. In this battle to defend the pound, the British government used $26.9 billion in foreign exchange reserves, and the central bank repurchased £2 billion every hour, but still could not keep the exchange rate above the minimum of 2.778. It ended in a disastrous defeat and forced Britain to exit the ERM system. Soros, on the other hand, made nearly $1 billion in profit from this battle and gained fame. The method of shorting LUNA is almost identical to this.

Credit Money

The modern monetary system is built on the credit of centralized governments. The money in our hands is a debt of banks or governments, and national debt is a debt of debt. Modern money is essentially "credit money". The continuous issuance of government debt will only devalue the currency and accelerate the cycle of inflation. This monetary system may be the largest Ponzi scheme in human history, but when it comes to "money," most people do not think of anything other than fiat currency. This is because people have accepted this Schelling point, which is long enough to sustain a scam and is considered "real". If we want to establish a stablecoin on the blockchain, we may have to accept a certain degree of Ponzi existence.

Changes in the purchasing power of the US dollar (source: Tencent News)

Reflection

So, my personal views on how to establish a currency on the blockchain are as follows:

· Low volatility but allowing for fluctuations, with sufficient liquidity;

· Not forcibly pegged to any fiat currency;

· Allocation based on tracking supply and demand indicators;

· Accept a certain degree of Ponzi existence, making this currency a Schelling point.

· Sufficient application scenarios to connect real-world payments.

Floating Stablecoin, f(x) Protocol

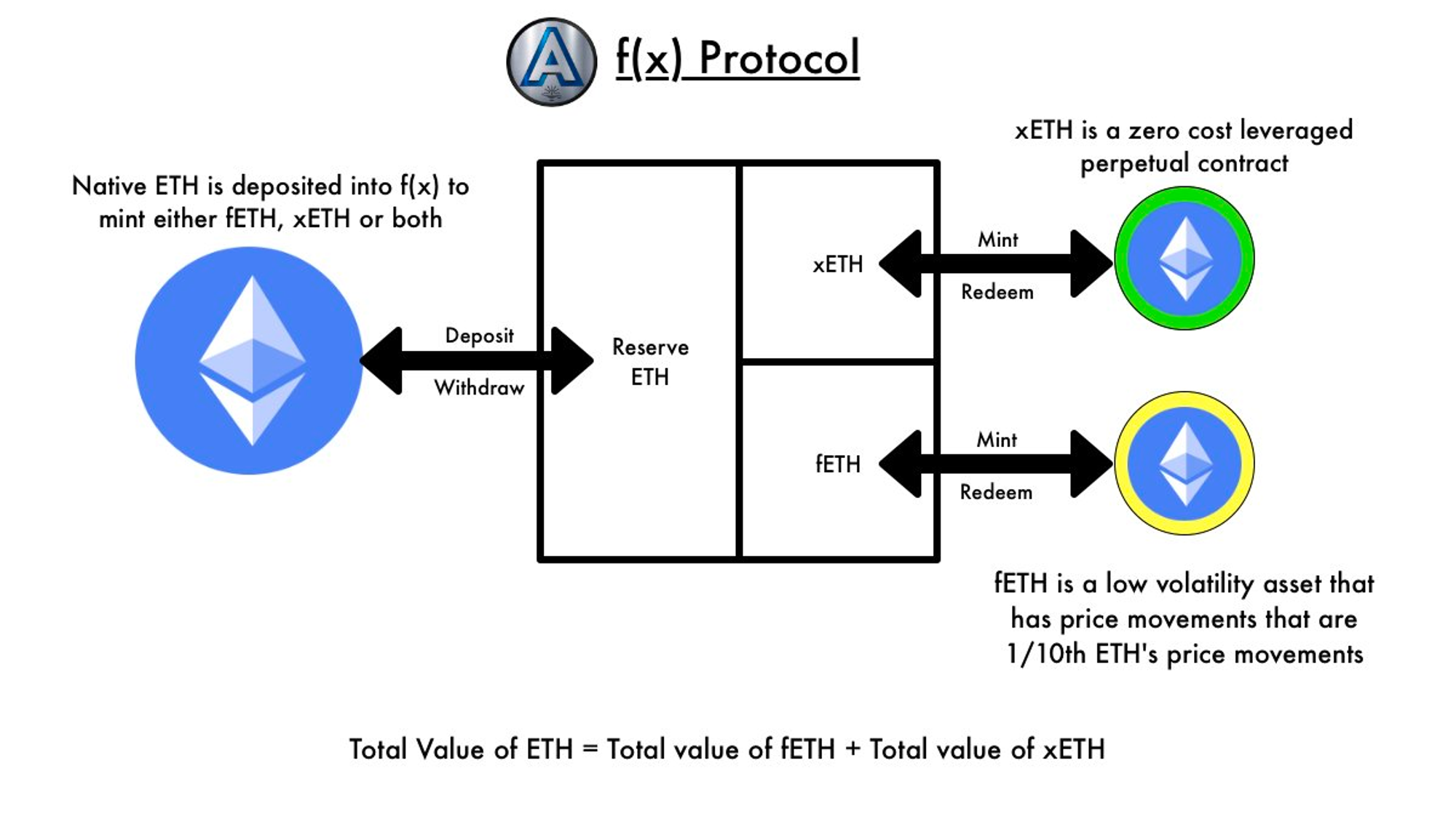

f(x) is an ETH leveraged protocol designed to meet the cryptocurrency industry's demand for stable assets while reducing centralization risks and capital efficiency issues. The f(x) protocol introduces a new concept called "floating stablecoin" or fETH. fETH is not pegged to a fixed value but gains or loses a small portion of the native Ethereum (ETH) price fluctuations. Additionally, a complementary asset called xETH is created, which acts as a zero-cost leveraged long ETH position. xETH absorbs most of the ETH price volatility, stabilizing the value of fETH.

Image source: f(x) official X

· fETH: a low volatility ETH asset, with a price that fluctuates at 1/10th of the native ETH price (β coefficient of 0.1). For example, if today's ETH price is $1650, the minted fETH would also be $1650. If tomorrow the ETH price drops to $1485, the fETH price would still be maintained at $1633.5, and vice versa. It can be simplified as 90% stablecoin + 10% ETH;

· xETH: a zero-cost leveraged long ETH position designed to absorb ETH volatility and stabilize the fETH price (i.e., β > 1). These xETH tokens can be traded in DeFi (supported by the demand for long ETH positions).

The β coefficient can be adjusted in this mechanism.

β

In finance, Beta is an indicator used to measure the relative volatility of assets or investment portfolios compared to the overall market. It is a key parameter in the Capital Asset Pricing Model (CAPM) used to estimate the expected return and risk of assets.

Calculation Method

Beta is calculated through regression analysis, typically by comparing the returns of individual assets to the returns of the overall market (often represented by market indices such as the S&P 500). Mathematically, Beta is the slope in the regression equation:

Asset Return = α + β × Market Return

Here, α is the intercept term representing the expected return of the asset in a risk-free scenario, and β is the slope representing the sensitivity of the asset to market returns.

Explanation

· β = 1: The volatility of the asset is consistent with the market's volatility;

· β > 1: The asset is more volatile relative to the market, meaning it may experience larger changes when the market goes up or down;

· β < 1: The asset is relatively stable compared to the market, with lower volatility;

· β = 0: There is no correlation between the asset's return and the market's return, typically seen in risk-free assets like government bonds;

· β < 0: The asset's return is negatively correlated to the market's return, providing a hedge during market downturns.

Working Principle

The f(x) protocol accepts only ETH as collateral and supports tokens with low and/or high volatility (β) backed by that collateral. Providing ETH allows users to mint fETH and/or xETH tokens, with quantities based on the price of ETH and the current Net Asset Value (NAV) of each token. Conversely, users can redeem the NAV ETH of fETH or xETH from the reserve at any time.

The NAV of fETH and xETH changes with the price of ETH, so at any time, the total value of all fETH tokens plus the total value of all xETH tokens is equal to the total value of ETH reserves. In this way, each fETH and xETH token has its NAV support and can be exchanged at any time. Mathematically, the invariant holds at any time:

Where neth is the quantity of ETH collateral, peth is the ETH USD price, nf is the total supply of ETH, pf is the ETH NAV, nx is the total supply of xETH, and px is the xETH NAV.

The protocol limits the volatility of fETH by adjusting its NAV based on changes in ETH price, so that the 10% return on ETH (for βf= 0.1) is reflected in the fETH price. The protocol also adjusts the xETH NAV to exceed the return on ETH, in order to satisfy the invariant f(x) (equation 1). In this way, xETH provides leveraged ETH returns (tokenized, with zero financing cost) while fETH exhibits low volatility, and both remain trustworthy and decentralized.

Risk Model

In fact, under this concept, fETH relies on the existence of xETH. If the demand for xETH is not large enough, the β coefficient of fETH cannot be maintained, or if the volatility is too high, it cannot be maintained. Therefore, the protocol introduces a CR formula to calculate the health level of the entire system.

CR is the total collateral value divided by fETH's total NAV, and four risk levels have been set based on the percentage.

If the system's CR drops to a level where it faces the risk of maintaining βf= 0.1, the risk management system of the system will initiate four progressively stronger modes to guide the system back towards overcollateralization. Each mode sets a CR threshold, and when it falls below that threshold, additional measures are activated to help maintain the stability of the entire system. As long as the CR is below its specified level, the incentives, fees, and controls described by each mode will remain in effect, so for example, if level 3 is active, it means that level 1 and level 2 are also active. They automatically restore when CR rises above the respective levels.

· Level 1 - Stability Mode: When CR value is below 130%, the system enters stability mode. In this mode, fETH minting is disabled and redemption fees are set to zero. Redemption fees for xETH increase, and xETH miners receive additional rewards from fETH holders in the form of small stability fees;

· Level 2 - User Rebalance Mode: When CR value is below 120%, the system enters user rebalance mode. In this mode, users can earn rewards by exchanging fETH for ETH, and the remaining fETH holders pay stability fees similar to the stability mode. This allows users to earn slightly more than fETH's NAV during redemption. In this mode, redemption fees for fETH are set to zero;

· Level 3 - Agreement Balance Mode: When CR value is below 114%, the system enters an agreement balance mode again. This mode is similar to Level 2, with the difference being that the agreement itself can use reserve funds for rebalancing. This mode is unlikely to be triggered because the rebalancing action of Level 2 is profitable and user response is faster than the agreement. However, it creates an additional layer of protection. In this mode, the agreement purchases ETH from the market using ETH in the fETH reserves, and then burns fETH from the AMM. With this mechanism, the NAV of fETH only decreases by the rebalancing stability fee the agreement gains in this situation;

· Level 4 ——Recapitalization: In the most extreme cases, the agreement has the ability to issue governance tokens and raise ETH for capital restructuring through the minting of xETH or the purchase and redemption of fETH.

Conclusion

The f(x) Protocol proposes an interesting idea of creating a stablecoin by controlling volatility. However, there are still some obvious drawbacks, as fETH can only exist in relatively stable market conditions and with a sufficiently high adoption of xETH. Nevertheless, this is indeed a very innovative idea. It is inevitable that blockchain will fail to establish a system similar to modern fiat currency under the premise of decentralization (it must be centralized to have a chance of success). Therefore, we need to focus on having enough use cases and low volatility with liquidity. Personally, I believe some meme tokens (such as Dogecoin) have the potential to develop use cases, and there are also other attempts being made besides f(x). For something in its nascent stage, patience and tolerance should be exercised.

References

1. f(x) Whitepaper

2. Terra Money: Stability and Adoption

3. The Decentralization of Currency

4. The Lord of the Algorithmic Stablecoins: After LUNA, There Won't Be Another UST

5. Unveiling LUNA: Why I Believe Attempts at Algorithmic Stablecoins Are Doomed to Fail