The fundamental reason for the current stagnation of the NFT market is due to a lack of reflection.

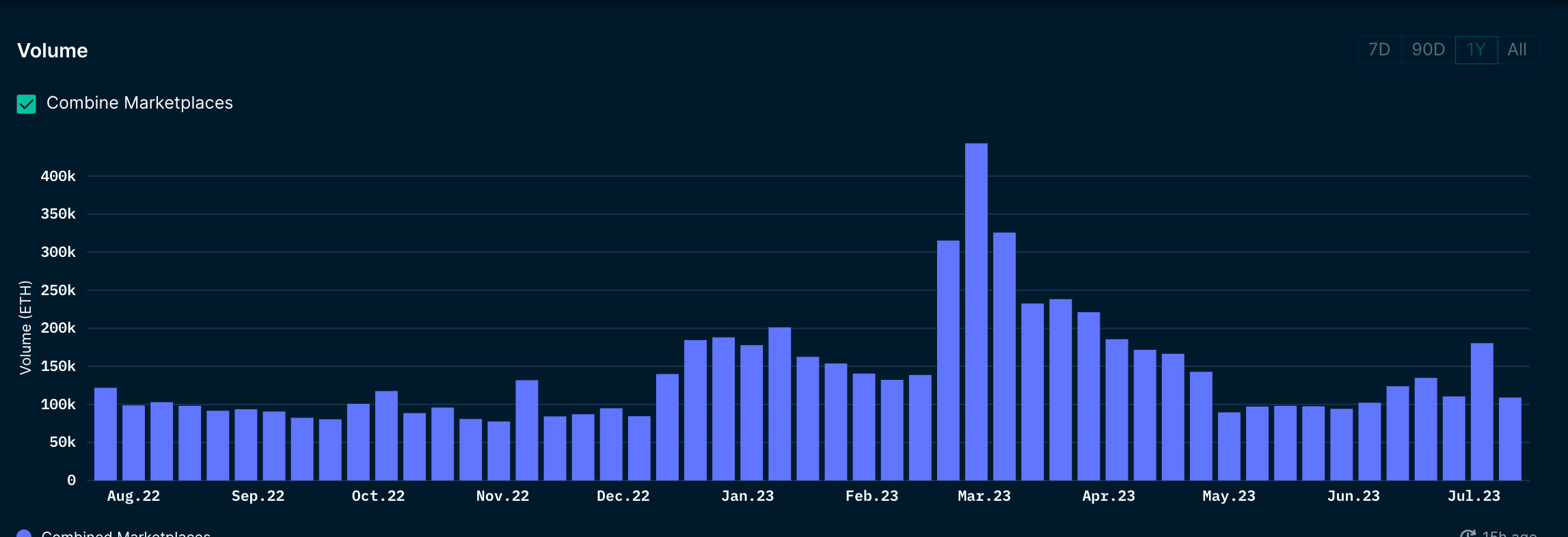

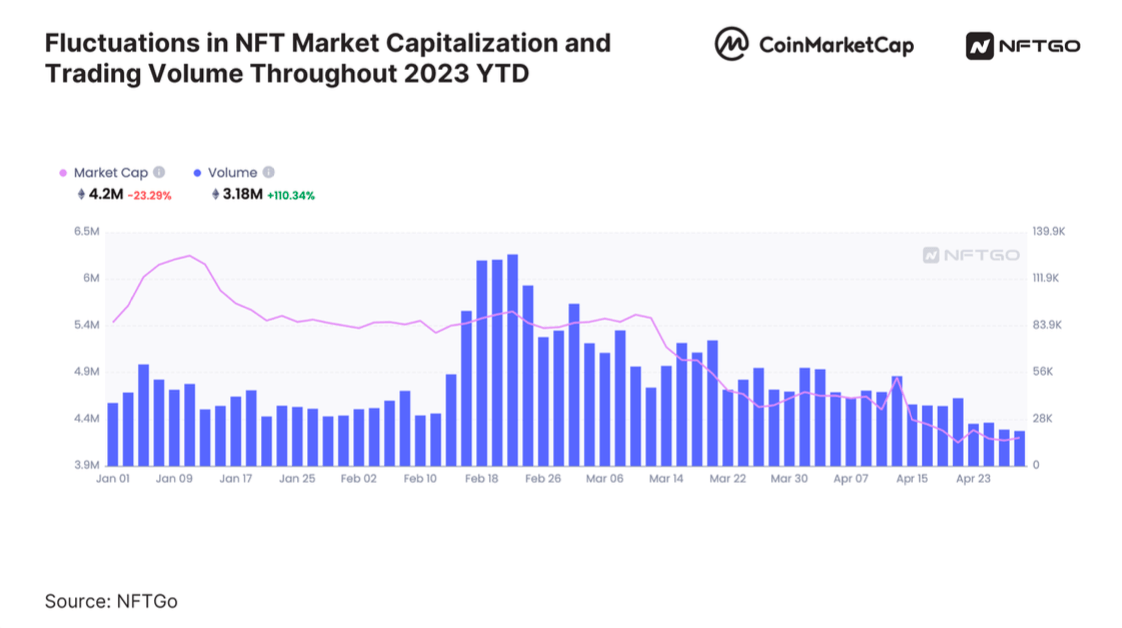

In the previous article "Data reveals whether the growth of the NFT market in 2023 is driven by new funds or old capital", we mentioned that thanks to the successful airdrop incentive campaign by Blur, the NFT market experienced a brief boom at the beginning of 2023, especially between February and May, with a 60% increase in funds invested in the NFT market compared to the previous period. However, the latest data shows that after reaching its peak in February and March 2023, the NFT trading volume has started to decline, indicating that NFTs have entered a bear market once again.

Some people point out that the growth of the NFT market usually lags behind the growth of cryptocurrencies by one to two quarters, so with the recent growth of cryptocurrencies, NFTs may soon flourish again. However, we believe that the recent bear market is not only influenced by the cyclical industry downturn but more importantly, it is caused by fundamental issues that have directly led to the stagnation of the NFT market.

In this article, we will first present the specific performance of the recent bear market in the NFT market using data, and then analyze the main reasons that hinder the growth of the NFT market.

Data from various dimensions reveals the contraction of the NFT market

/h2>1. Trading volume, sales, and the number of active wallets are all showing a declining trend.

It is worth emphasizing that, apart from the weekly trading volume being roughly the same as during the bear market in 2022, the number of transactions and the number of active wallets have significantly decreased compared to 2022. In other words, the trading activity and the number of participants in the NFT market are at the lowest levels in the past year.

2. Continuous sharp decline in the value of Blue-Chip NFT series

Nansen provides the Blue-Chip-10 and NFT-500 indexes to measure the total market value of blue-chip/top NFT series, reflecting the overall performance of the NFT market. Both indexes have been consistently declining since April this year, and the combined market value of blue-chip/top NFT has evaporated by 70-80% compared to its peak in February.

Blue-Chip-10 Index

NFT-500 Index

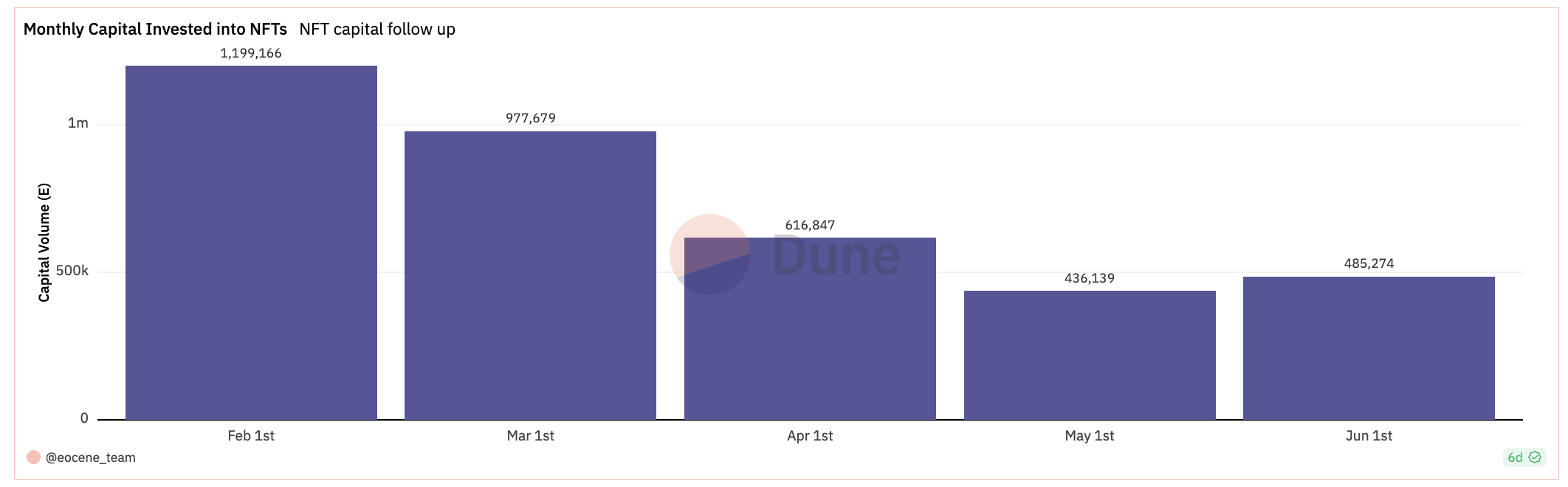

3. Investment in the NFT market decreased by 20%-40% per month

We calculated the monthly investment in the NFT market from February to June 2023 based on the method described in our previous article "Is the growth of the NFT market in 2023 driven by new funds or the recycling of old funds?". The data shows that the investment in the NFT market has been significantly decreasing every month compared to the previous month (except for a small increase from May to June). The funding level in June is only 40% of that in February.

Monthly Investment in the NFT Market

The above indicators reflect a decrease in NFT market participants, a decrease in trading activity, a contraction in investment, and a decline in prices. These dimensions collectively indicate that the NFT market is facing stagnation or even contraction.

Three Main Reasons for the Sluggish NFT Market

1. The "Bid for Airdrop" mechanism used to stimulate demand-side liquidity is fundamentally flawed.

Blur launched an Airdrop incentive mechanism at the end of 2022, mainly rewarding loyal users who list and bid on Blur. In the early stages of the mechanism, many experienced NFT players believed that this would be a strategy that could effectively drive NFT liquidity, and the market in the early stages confirmed this view - during the beginning of Blur Season 1 to Season 2, market liquidity and trading volume showed significant improvements.

The total market value of NFT has dropped significantly as Blur season 2 progresses

2. Most project teams lack market value management experience

The incentive mechanism of Blur not only attracts those who want to earn Blur tokens, but also attracts a lot of malicious arbitrage funds.

An example of "malicious arbitrage" in the Blur airdrop activity: an arbitrageur first purchases a large number of tokens of an NFT series at a lower floor price, and then lists these tokens at a higher price, thereby driving up the floor price. At the same time, they will place "fake" buy orders on Blur that are close to their listed price, while other players (aka miners) who want to earn points will place orders in the 2nd and 3rd positions to reduce the probability of "unfortunately" receiving the NFT. Since these miners do not know that the top bidders are actually the ones listing for sale, and the ones listing for sale can choose the bidders who take over their NFTs, the arbitrageur will sell a large number of his NFTs to these miners when the bid pool in the 2nd and 3rd positions is deep enough.

However, two years have passed, and the roadmaps of many NFT projects have become empty promises, failing to deliver on their promises and bring real value to the holders. Although some project teams are doing things, the value they bring to holders, such as T-shirts, dolls, and organizing some IRL meetups, does not match the high prices of the NFT series, and they also lack innovation.

These reasons have resulted in a lack of real intrinsic value in most NFT projects, leading to fewer and fewer users investing in and holding NFTs for the long term, ultimately turning the NFT market into a "speculator's market."

Revitalizing the NFT Market

Based on a thorough investigation into the reasons for the NFT market contraction, we have put forward some ideas for revitalizing the NFT market.

Firstly, we should strive to build a truly valuable NFT ecosystem. This means that NFT project teams should continue to bring real value to holders, thereby achieving the sustainable development of NFTs. At the same time, the significant price drops of many NFT series during this bear market may not necessarily be a bad thing, as "the big waves wash away the sand" can cleanse low-quality and non-performing projects, while encouraging other project teams to do tangible work and improve innovation. Meanwhile, those series that genuinely strive to create value for NFT holders and the entire NFT ecosystem, even though their prices may be temporarily affected by the Blur mining mechanism, we believe they can still persevere. For example, despite the heavy blows that Moonbirds has suffered from malicious short selling, I personally still have great hope for the PROOF team because they have consistently created value through high-quality content.

Secondly, the project team should recognize the importance of market value management. After the incident related to the Blur airdrop activity, the market value management of NFT projects has become prominent. To avoid repeating the same mistake, the project team should prepare enough tokens in advance and have control over funds and relevant knowledge, so that they can take timely action and protect the project's market value when faced with malicious manipulation of NFT prices.

Lastly, let's address the issue of liquidity. First of all, we already have products to improve liquidity, such as the pro-trader trading platform of Blur, as well as other liquidity improvement products like NFT fractionalization protocol and NFT lending protocol. However, the main reason for the current poor liquidity is that most projects lack real value, resulting in low market demand. Therefore, we believe that the key to creating real liquidity lies in the project team no longer focusing on short-term gains at the expense of long-term value, and instead, focusing on real value creation to stimulate genuine market demand and attract value investment.

Although the recent stagnation in the NFT market is disappointing, once we identify the root problems, we can dedicate ourselves to finding solutions. We still have a long way to go to fully realize the true value and potential of NFTs.

About the Authors

This research analysis report is co-authored by Helena L. and Zixu H. from Eocene Research. Follow us on Twitter to stay updated on more of our NFT analysis and research.