Original Author: Drew Van der Werff, Alex Matthews

Original Translation: Block unicorn

Summary:

History has shown that derivatives can strengthen the spot market and provide additional tools for stakeholders in the supply chain to manage their business. Similarly, Ethereum's spot gas market could also benefit from the derivatives market.

With the development of Ethereum gas derivatives, we have the opportunity to develop a suite of products that provide a better user and developer experience (for example, users and developers can expect or rely on a fixed gas price without worrying about price fluctuations) and improve the efficiency of Ethereum block space price discovery. In addition, in most markets, the trading volume of derivatives far exceeds that of spot, providing significant opportunities in a vast design space.

When designing these products, regulatory/legal, market, and protocol-specific considerations need to be taken into account. Additionally, the sophistication of market participants must increase to support active trading of these products.

While it is difficult to predict when this market will develop, some favorable conditions are emerging, such as concentration of gas buyers (i.e., due to developments in L2/account abstractions), increase in products for hedging (e.g., staking products), and increased sophistication of various stakeholders in the trading supply chain (e.g., through infrastructure improvements).

Throughout history, there have been numerous examples of commodity markets experiencing increased volatility due to external events. While factors outside the market help reduce the risk for commodity producers and consumers (e.g., globalization has brought more efficient shipping/transportation and connectivity), derivatives can serve as a broader price discovery tool. Additionally, derivatives can be used to better manage commodity-dependent businesses (e.g., oil companies, precious metals, agricultural products). Similar opportunities exist in the Ethereum block space, where the development of derivatives in the block space can provide stakeholders with better user experiences, more tools to manage their businesses, and increased efficiency in price discovery. Below, we provide an overview of the current state of the Ethereum block space, historical analogies from traditional markets, and attempt to show key considerations for developing a derivatives market in the block space based on other people's research.

Introduction to Ethereum Block Space

Ethereum's business model revolves around selling block space. Block space is utilized by various participants to interact with smart contracts that power applications, support additional infrastructure layers, or complete transactions directly. However, like most resources, the supply of block space is limited. To determine who or what can consume these supplies, Ethereum introduces Gas (the transaction fee paid on the blockchain network, known as Gas). Gas is utilized by parties to specify how much they are willing to pay for including their transaction.

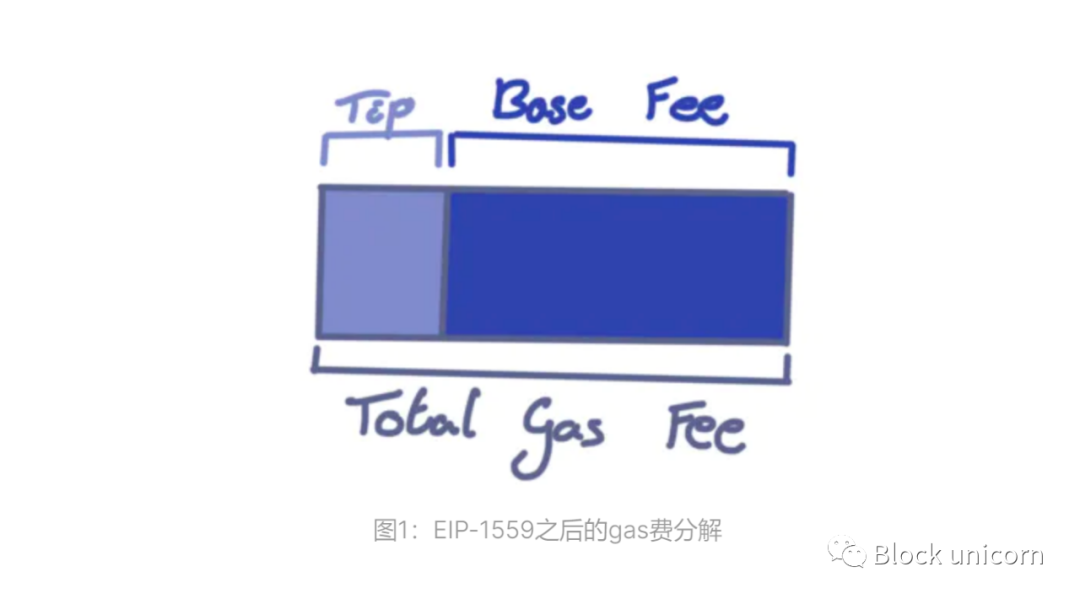

Gas and its usage in Ethereum have evolved, and the recent significant changes occurred in August 2021. With the London hard fork and the implementation of EIP-1559, Ethereum's fee market transitioned to one consisting of a base fee burned and a tip given to validators. After this change, the market now has a protocol-driven base fee serving as the reference rate and ensuring a minimum cost for including transactions in a block.

In September 2022, "The Merge" happened! Although subtle, this also changed some dynamics related to any potential derivative markets. After the merge, validators responsible for proposing the final confirmed new blocks are known two epochs in advance, giving the market approximately 12 minutes to know who will be stacking the next block (which can have interesting implications for potential physical delivery markets).

Finally, in the short term, the community may introduce a new cost market related to data storage. Called EIP-4844, this market will be Ethereum's first multidimensional cost market, separating data storage from execution. The impact of this and other roadmap projects will be discussed in the following text.

What can we learn from other commodity markets

To begin understanding the potential design and market structure of the block space derivatives market, as well as its potential impact on the spot market, we surveyed traditional markets and observed various attributes. Here are several key characteristics we identified in the most comparable markets:

Non-tradable underlying: In its current form, Ethereum Gas is not directly tradable; we are looking for markets based on non-tradable underlying indices.

Cash vs. spot: Given the different dynamics between actual delivery of block space and cash settlement at expiration, we are looking for derivative markets that settle in cash at expiration while spot markets involve actual delivery.

Stakeholders: Significant activity and speculation should be driven by the actual use of commodities/goods.

Market microstructure: The position of a transaction in a block can have a major impact or greatly alter the price buyers are willing to pay. Therefore, we are looking for markets with similar microstructural dynamics driven by quality/geographical location/other indicators.

We found that, based on these factors, the most relevant markets are oil and VIX (volatility index, where higher index values indicate higher volatility and stronger panic). More details are discussed below, but it is important to note that both of these markets have already been widely used by various stakeholders to achieve a range of objectives (i.e., better management of their business, hedging, observation, etc.).

Oil

Until the 1980s, the oil market was essentially dominated by a small number of market participants, primarily oil-exporting countries. By the late 1980s, a healthy spot market had developed, gradually replacing fixed-term pricing contracts. However, even with this development, there was still an issue - this market required physical delivery. Given the complexity of delivering oil, these markets continued to be dominated by a few long-term partners rather than being open to broader participation.

With the continued maturity of these markets, benchmarks such as West Texas Intermediate (WTI) crude oil have been developed to track the overall situation of spot prices from certain regions. This allows the market and other stakeholders to support and exchange oil in a standardized way (for example, you don't need to understand the subtle differences in regions or markets to trade oil). Through this development, not only are more participants able to have an understanding of prices, which increases the depth of market liquidity, but derivative products can now be developed on this index (most cash-settled products are based on the index). As a result, more stakeholders can participate in price discovery, which can be said to improve efficiency and provide stronger tools for producers and consumers to manage their business. Currently, the trading volume of WTI and Brent futures contracts on ICE and NYMEX exchanges can reach billions of barrels per day, while global oil demand is around 100 million barrels per day; futures trading volume is more than 25 times the daily oil consumption.

Volatility Index / VIX

VIX market originated from the financial economics research in the late 1980s to early 1990s, proposing a set of volatility index that can serve as underlying assets for futures and options trading. The role of the volatility index is similar to market indices, where traders can speculate on a group of stocks or, in the case of VIX, speculate on the underlying volatility of a broader market. This allows participants to speculate on future market uncertainties and hedge against increased volatility in market downturns, which may cause losses to investors' equity portfolios. However, unlike equity indices, VIX itself cannot be traded. Thus, only derivative products based on cash settlement of VIX can be traded. Nonetheless, since its launch in 2004, the average daily trading volume of VIX futures market has grown from around 460 contracts to approximately 210,000 contracts in 2022. This market structure is similar to the current Gas market. The underlying Gas cannot be traded, but it serves as an observable and quantifiable attribute of the Ethereum block space market. Therefore, creating a standardized Gas reference price is necessary for cash settlement of futures/options/swap/ETPs. Fortunately, since EIP-1559, this task has become easier as it serves as a reliable oracle about block space congestion.

Factors to consider in product design

Although we can extract information from historical analogies to demonstrate the potential impact of the derivatives market on the stability of the Ethereum block space market, the Ethereum block space has unique characteristics that will also determine the design of the reference benchmark and derivative products. We believe the following should be the primary considerations for anyone committed to developing markets/products. The following sections will discuss:

Market structure: This section covers considerations about block space/Gas market participants, whether price makers can effectively hedge, integration of potential buyers, reference rate design, regulations, and various other matters.

Protocol/Roadmap: This section covers considerations about the complex spot Gas market, differences in block space, other matters, and potential roadmap considerations for future projects.

Cash and Physical Settlement: Defines cash and physical settlement and discusses the design potential for block space in physical settlement.

1. Market Structure

Block Space/Gas Market Participants: In such a market, there are price takers and price makers:

Price takers need to interact with the market to manage risks in their business. In the case of the oil market, these include both oil producers and participants in the subsequent supply chain involved in refining or commercial use of oil. Similarly, in the Gas derivatives market, there are validators providing block space, followed by applications/users requiring block space. These participants may want to ensure fixed income for block space in advance, while applications/wallets may want to ensure predictable fixed costs for their future block space needs.

These participants ultimately want to avoid exposure to dynamic price changes in the spot market, but there are two opposing aspects:

Bearish: One party commits to sell block space in the future at a price agreed upon now, which faces the risk of preselling future block space at a too low price.

Bullish: One party commits to buy block space in the future at a fixed price agreed upon currently, which faces the risk of paying too high a price for future block space.

Price makers are market participants who speculate and bear pricing risks. In traditional markets, these roles are played by market makers at banks, asset management companies, high-frequency trading entities, etc. These participants are crucial for creating more liquid and efficient markets. In the Gas market, we see this role being played by digital asset market makers, investment companies, and, in the long run, validators themselves. However, there is currently a lack of price makers in the market, primarily due to the absence of a sufficiently liquid spot market for hedging block space risks.

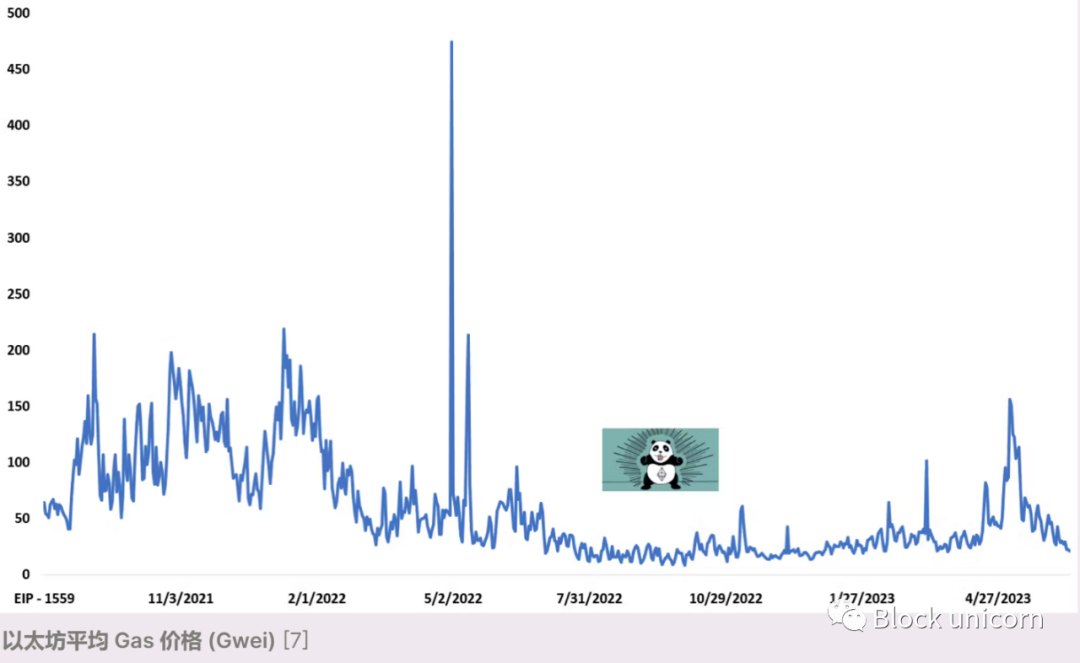

Price makers are unable to hedge effectively: The auction mechanism driving the base fee for block space can be manipulated (especially in the short term), and tips can be unlimited. As shown in the graph below, the average Gas price has high volatility, and if observed block by block, the volatility would be even greater.

These factors bring significant risks to price setters as they expose themselves to unlimited variable costs of block space. Some issues can be smoothed out by using time-based indicators (reducing the impact of single cost increases on reference rates) or other investment products that limit loss/profit. However, these methods have trade-offs, they may not meet the needs of sellers/buyers and often reduce the hedging effect of derivatives for longs/shorts. Given this, we expect validators, block builders, and searchers to play the role of shorting the market at the beginning, as they have the ability to naturally supply or access physical block space, the ability to optimize and utilize block space supply, and experience in managing block space risk.

Buyer concentration: With the development of L2 and the possibility of most users accessing block space through rollup rather than L1, we expect buyer concentration in L1 block space to shift towards L2 operators/people completing L2 transactions on L1. Outside of L2, we expect further concentration of block space buyers to shift towards infrastructure and actors that allow users to not directly purchase block space, such as block builders/AA (account abstraction)/MPC (technologies for decentralized private key storage) + middleware. Designing products for these stakeholders, rather than individual consumers with broad goals and demands, should help narrow product design.

Reference rate design: If the product is cash-settled, the reference rate is an important design feature of a thriving market, and this design needs to balance longs

2. Protocol/Roadmap

Complex spot Gas market: As part of EIP-4844, Ethereum has, for the first time in its history, introduced a multi-dimensional fee market that creates two prices for Ethereum block space - one for data and one for execution. These two spot markets will use independent but similar pricing/auction mechanisms. However, due to the different consumption of data block space and execution block space, there may be price differences between these two markets. Therefore, anyone designing block space derivatives may need to consider this and may provide interesting hedging/trading opportunities for buyers/speculators and risk managers between these two markets based on the development of the spot market after EIP-4844. Additionally, while still early, community researchers have mentioned the possibility of further fee market fragmentation, which would create additional microstructures.

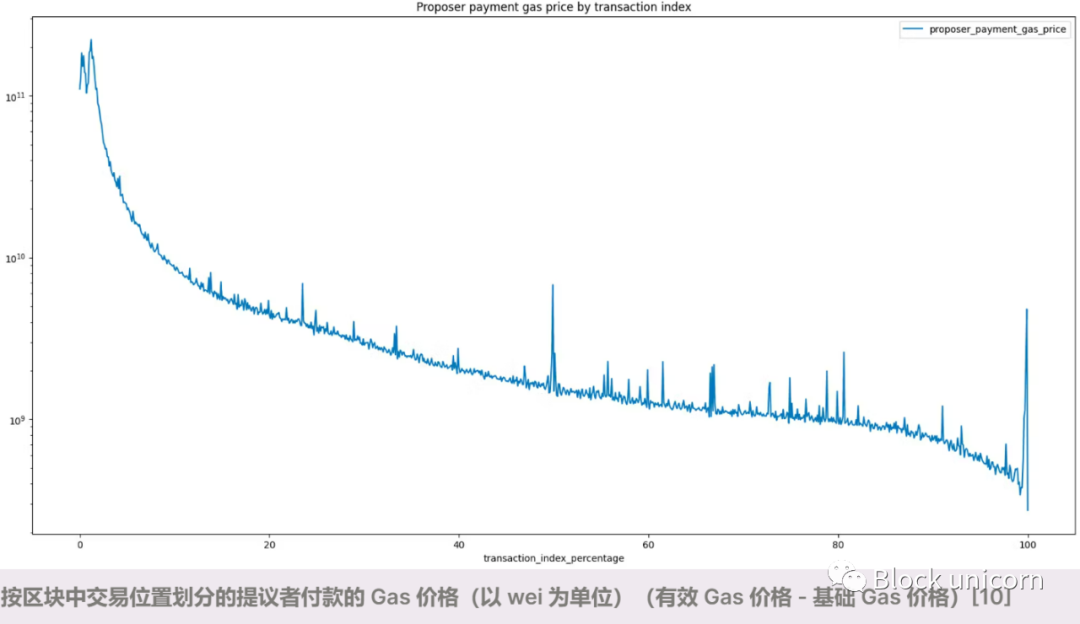

Diversity of block space: Not all block space is homogeneous. For example, there are congested blocks, which encompass block space that users can include by just paying the fee. Then there is competition, where users pay fees to indicate a desire to be included in the block in a certain order. Considering the behavior of consumers in each microstructure, derivatives may need to consider these dynamics or be designed for these specific participants. Although it is difficult to estimate, we looked at the quantity and quality of resources to understand where historical user preferences have been and help identify recent and long-term opportunities.

In the figure above, we can see that some users are willing to pay exponentially higher prices for block space in the block header and footer (i.e., competition), but most users only pay for inclusion (i.e., congestion). A leading researcher at the Ethereum Foundation recently speculated that a significant number of users prioritize congestion over competition. While there may currently be a market related to competition, based on the aforementioned and other MEV-related dynamics, we expect that the largest block space derivatives market will focus on congestion in the long term.

Considerations for various other matters: In addition to the above, there are other factors to consider that may impact the derivatives market. These include forks and probabilistic finality, confirmation rates (low confirmation rates lead to congestion and slow block processing), and potential scrutiny by block builders and/or validators.

Further developments: While it may still be several years away, there will be further dynamics that impact block space and any derivative products. Apart from EIP-4844, we believe the most relevant and closely watched changes are MEV-Burn, changes to validator caps/stake economics in any form, finality of individual transactions, and ePBS (Block unicorn note: short-lived block space proof of time. This is a new consensus algorithm designed to improve block propagation efficiency and security while considering network latency and broadcast costs. In ePBS mode, validators no longer generate blocks solely based on their stake, but based on their status and performance in the network. This can make block generation and propagation fairer, effectively preventing network attacks).

Block unicorn note: MEV-Burn is just one part of Ethereum's roadmap to directly address MEV. The solution redistributes MEV back to ETH holders by burning the value extracted by MEV participants, effectively reallocating value to ETH holders, making the assets scarcer, and reducing selling pressure on block validators.

3. Cash Settlement vs. Physical Delivery

Gas derivatives can choose between "cash" settlement or settlement through "physical delivery." More details are provided below, but generally, cash-settled products cannot fully replicate deliverable spot markets as they offer synthetic exposure to the commodity usually based on reference rates. Therefore, the presence of derivatives mechanisms for physical delivery settlement is crucial. It ensures that the broader block space derivatives market accurately reflects the conditions of the deliverable spot market.

Physical Delivery: Compared to the cash market, physical delivery in Ethereum block space (actually any commodity market) is more complex. When derivatives expire, both parties must physically settle the goods. For transactions between validators and applications, this means that validators need to provide block space to the buyer. Below, we discuss several possible ways of physically delivering block space:

Block Builders Provide This Service: As mentioned in previous articles, due to economies of scale and technical requirements for full-fragmentation, block building is likely to continue to be dominated by a small number of participants who are well positioned in these markets. Block builders are obviously the natural buyer/seller of block space (after all, they are in the business of managing/optimizing block space) and can also provide physical delivery services of block space to applications/consumers of block space.

Validator Coordination/Middleware: Besides block builders, validators are also major stakeholders in the physical delivery market for block space. This will be driven by a desire of validators to help manage revenue fluctuation in their current validation business and allow for the development of new markets where validators can sell future block space for a premium.

Issues Regarding Block Space Derivatives

We recognize that there have been various attempts at hash rate derivatives around the Bitcoin network. These markets have grown to some extent but are still relatively limited. While these markets may be ahead of their time, the market structure friction around hash rate derivatives does not exist in the potential Ethereum block space market—most importantly a broader range of natural market participants increase the possibility for liquidity, bilateral market growth. However, we also acknowledge that it is still too early. After all, the trading volume of futures for a more mature Ethereum market is still dwarfed by the trading volume of derivatives in traditional commodity markets. Additionally, for this market to flourish, roles like block builders, validators, and applications need to become more proficient, competition between these participants needs to be sharpened to the point where teams use these products to gain competitive advantage over each other or to offer a unique product that relies heavily on managing future block space.

Despite this timing in our minds, we believe block space futures could have a unique impact on Ethereum, helping stakeholders better address Gas and block space-related issues. We hope this post will inspire a wave of relevant discussions, developer musings, hackathon projects, and innovations that emerge over the next decade.