Why does the US SEC, which clearly classifies more than ten tokens as securities, continue to evade ETH?

Original source: CryptoSlate

Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

The U.S. Securities and Exchange Commission (SEC) recently shocked the crypto industry by filing a lawsuit against Binance.

Binance faces 13 different charges, the more important ones that can have a long-term adverse impact on Binance include: mixing customer assets with its own assets, allowing US customers to use Binance Globe, using virtual transactions to deliberately drive up Binance.US platform Trading volume.

indictmentindictmentto respondto respond

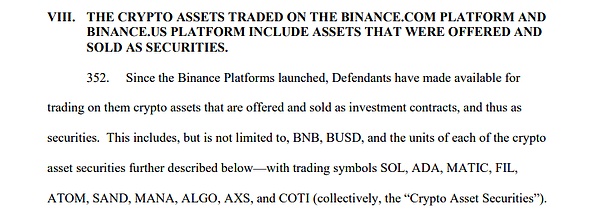

Notably, the SEC clearly articulates in the lawsuit that it considers many tokens listed on Binance to be “unregistered securities,” including but not limited to Solana (SOL), Cardano (ADA), Polygon (MATIC), Coti (COTI), Algorand (ALGO), Filecoin (FIL), Cosmos (ATOM), Sandbox (SAND), Axie Infinity (AXS), Decentraland (MANA).

secondary title

From cryptocurrencies to "crypto-securities"

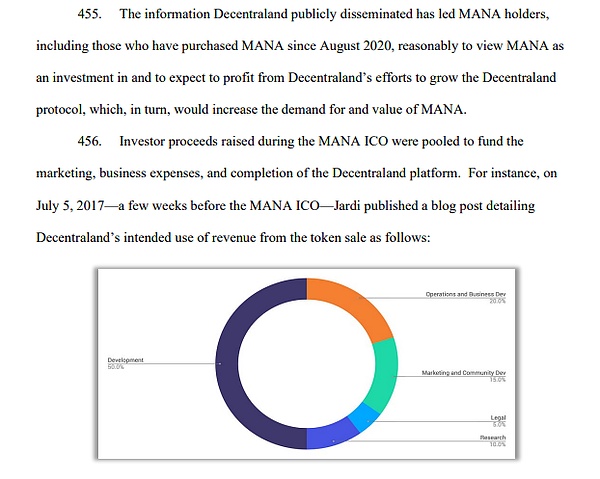

The SEC's argument for designating the above-mentioned tokens as "crypto-asset securities" is in Section VIII of the indictment (pp. 85-123), analyzing each project in turn, and it is clear that they share a similar pattern: ICOs (ICO) process, vesting of tokens, distribution of the core team and facilitating profit generation by owning these tokens.

However, Ethereum, which also has the above-mentioned model, is not among them. SEC Chairman Gensler has been coy about whether ethereum and its pegged coins, such as WETH, are securities. ETH is often held as an investment, suggesting it could be classified as a security, but it is also widely used as a medium of exchange across protocols on a daily basis, allowing it to function more like cash.

Gensler has previously said that "any cryptocurrency other than bitcoin" in the crypto market could be considered a security, but he declined to specify ethereum. When asked "is ethereum a security," Gensler typically doesn't answer.

secondary title

Is ETH a security in the eyes of the SEC?

This may be an issue of debate within the US government.

Ethereum may fall under the jurisdiction of the U.S. Commodity Futures Trading Commission (CFTC), which has considered BTC, ETH, and USDT to be commodities rather than securities. Not only are the two categories distinct from each other, but this overlap could create a regulatory tug-of-war, so Gensler is trying to avoid infighting within the government by taking a more public stance on ethereum.

Encrypted media Protos once published an analysis that Gensler's avoidance of Ethereum may be the result of SEC's inaction after the infamous "The DAO Hacking Incident", which caused the Ethereum network to fork and disrupt the entire ecosystem. The system was at risk and many investors were in dire straits at the time. However, the SEC did nothing at the time, opting for silence and inaction. Now Gensler finds himself in the awkward position of making up for his predecessor's oversight. Now that the Ethereum ecosystem has spent years restoring credibility, retroactively declaring it an unregistered security now would have disastrous consequences for investors.

In other words, protecting investors in this situation means protecting them from protectors.

Another possible reason for Gensler’s reluctance to categorize ethereum explicitly: he may not know.

Cryptocurrencies and the blockchain technology behind them are innovative and novel. They represent a fundamental shift in the way we understand finance and asset ownership, and in the development of ecosystems like Ethereum, they introduce many entirely new use cases.

Any new thing will be inconvenient to classify, and this is what Ethereum does - it is sufficiently "decentralized" and conforms to the "concept" of securities (investors, profit promises), which is the core of being difficult to be regulated.

This regulatory ambiguity poses complex challenges for Ethereum, as the progress of the crypto industry depends on clear legal definitions for Layer-1 tokens (such as Ethereum) that simultaneously serve as everyday tokens within their respective ecosystems. A medium of transaction and an investment vehicle. Regulatory ambiguity poses significant obstacles, stifling potential, hindering mainstream adoption, and fueling uncertainty in a crypto industry teeming with growth and innovation.

secondary title

Crypto Industry Needs Meaningful Regulatory Progress

Currently, the path to comprehensive cryptocurrency regulation is blocked by two significant obstacles that must be urgently addressed to promote the responsible development of the industry.

First, the US SEC must establish a formal position on Ethereum. Given the SEC’s inaction when it had the opportunity to restrict Ethereum, it has inadvertently created a situation that has investors in a regulatory bind. The SEC, as investor protector, has a duty to provide some form of regulatory guidance—even if temporary—as a starting point. The lack of clear regulation is not only inconvenient, but also lacks the necessary protections for the growing number of participants in the crypto market.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.