Citi RWA Research Report: Money, Tokens and Games

Original title: "Money, Tokens, and Games》

Original title: "

Compilation of the original text: Will Awang

Original source:Original source:

Web3 Little LawThis 162-page research report by Citi comprehensively expounds the specific path for the blockchain and Web3 industry to achieve one billion users and tens of trillions of dollars in market size. What's more, this is not rhetoric, we may have achieved 20% of the progress bar! To achieve a market of tens of trillions of dollars, it is far from enough to rely on the nearly 1 trillion dollars of encrypted native market that has already been formed. Citigroup gave a broader dimension——Real World Assets Tokenization

. At present, the encrypted native market with a scale of nearly 1 trillion is already full of enthusiasm. Imagine how magnificent the market of tens of trillions of dollars will be!

1. Background

Disruptive technologies often change the way people do things, such as how people live, work, consume, invest, socialize, and so on. Blockchain and the related Web3 concept are both disruptive technologies, and for the past few years people have been talking about the potential of tokenization via blockchain as transformative, but we are not yet at scale The point of application. Unlike new energy vehicles or recent innovations such as ChatGPT or Metaverse, blockchain is a back-end infrastructure technology without a prominent consumer interface, so it is difficult to see how innovative it is at the surface.

In this report, we will explore some of the key drivers that will enable the blockchain and Web3 industry to have the next billion users and potentially bring economic activity in a multi-trillion dollar market that will impact our lives. , All aspects of work.

secondary title

1.1 Billions of Users

The number of billions of users will increase due to the daily applications of the blockchain industry, including currency, games, social media, etc. Successful applications of blockchain technology will have over a billion end users without even realizing they are using the technology.

Money: Some countries (with a total population of about 2 billion) may try central bank digital currency (CBDC) related to blockchain technology, especially the CBDC projects that some mainstream countries will adopt, such as the digital euro (EUR ), digital pound (GBP), digital rupee (INR), these projects will roughly cover 1/4 of the world's population and currency savings.

Social Media: Micropayments, including payments in Metaverse games, are likely to use blockchain technology. Additionally, large consumer brands are driving Web3 adoption. The field of art collection, film and television, and music entertainment will also enter the blockchain industry based on the characteristics of the blockchain (such as NFT), and many of them are supported by big brands such as Nike and Starbucks.

secondary title

1.2 Market size of tens of trillions (Trillions of Dollars)

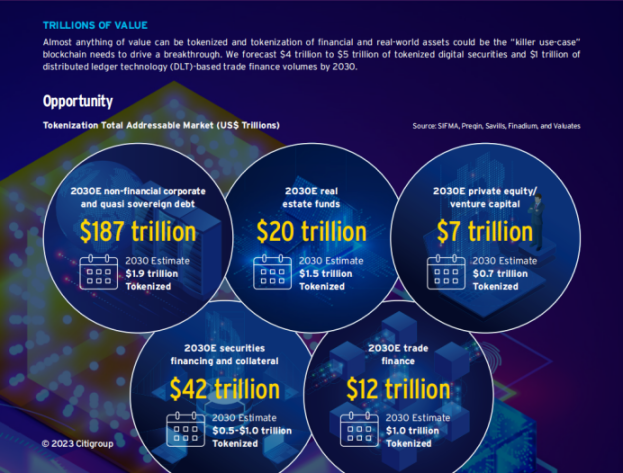

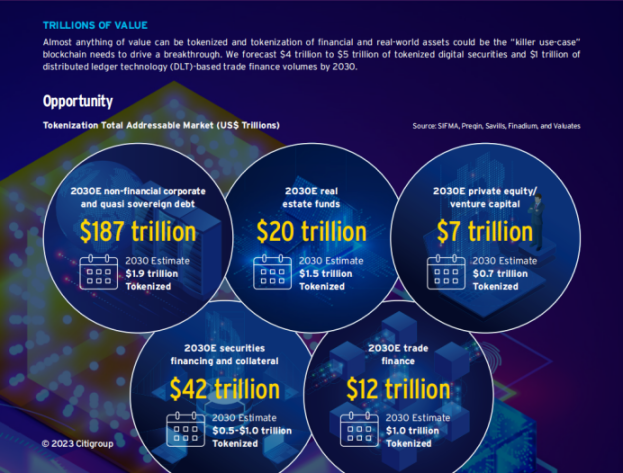

This could drive up to $1 trillion in asset tokenization in global trade finance by 2030. We expect private sector/unlisted companies such as securities and funds to drive up to $5 trillion in tokenized markets: non-financial corporate and quasi-sovereign debt markets; repo, securities financing and collateral markets; real estate, private equity (PE) ) and alternative asset markets such as venture capital (VC). Estimates from the financial industry for the total volume of tokenization are even higher.

secondary title

1.3 Technology and Legal Enablers

Bringing billions of users and tens of trillions of dollars of assets into the blockchain and Web3 industries requires comprehensive technical and legal improvements to support and maintain the entire ecosystem. These changes may include blockchain-based identity solutions (Decentralized Digital Identities), privacy solutions supported by zero-knowledge proofs (Zero-Knowledge Proofs), solutions to connect/provide real-world data off-chain (Oracle), cross- Chain technology solutions (Secure Bridges).

Of course, there is also a strong regulatory and legal framework that allows individuals and institutions to embrace this new technology. The next generation of legal smart contracts (Smart Legal Contract, SLC) is on the way, and SLC will provide a new operating model for global business and finance.

2. Web3, Tokenization, and Opportunities

As we explain in this report, the key drivers of blockchain and Web3 adoption will be Web2 consumer companies and established traditional financial institutions. We believe that Web3 will run side by side with Web2, and in some cases nested within it, like a Russian Matryoshka.

secondary title

2.1 Definition of Tokenization

Tokens are pieces of code on the blockchain that record information about the liabilities of the underlying asset, including its attributes or characteristics, status, transaction history, and ownership. After assets are tokenized, their ownership and value can be directly traded/transferred on the blockchain network. Asset tokenization can be divided into two categories:

A. Real World Assets: Represents highly illiquid, customized assets such as real estate, art and collectibles, agriculture, climate assets, and intangible assets (such as carbon credits and intellectual property). Real-world assets may also include those financial assets that are infrequently or easily traded, such as trade invoices, personal loans or mortgages, which are not generally defined as "securities".

In theory, almost any asset with monetary value can be tokenized. We believe that the best use cases for tokenization will be central bank digital currencies (CBDC) and private sector/non-listed company assets (Private Financial Assets), especially illiquid assets, as well as in-game assets.

secondary title

2.2 Opportunities for Tokenization

According to research by BCG and ADDX, the tokenization of global illiquid assets will generate a $16 trillion market (which will be close to 10% of global GDP in 2030), including a $3 trillion housing asset market, $4 trillion Listed/non-listed asset market, 1 trillion debt and investment fund market, 3 trillion alternative financial asset market, and 5 trillion other asset tokenization markets.

We believe that the private sector/private company market is more suitable for blockchain applications because of the liquidity, transparency, and fragmentation that come after tokenization. For public company securities across industries, tokenization will also provide benefits in areas such as efficiency, collateral usage, data usage and ESG tracking.

To achieve the above goals, the support of traditional financial institutions will be needed, whether it is in the tokenization of assets or the promotion of relevant legislation.

secondary title

2.3 Why is the tokenization of real world assets (RWA) needed?

RWA opens up a new paradigm for monetizing illiquid assets, which helps unlock liquidity while retaining fractional ownership of assets. For example, art collectors can tokenize their treasured collections. On the one hand, they can share ownership with lovers all over the world. On the other hand, they can also hand over their collections to museums for safekeeping and public display. In addition, tokenization can enable new financing methods for infrastructure assets such as roads, heavy machinery and public goods, and open up new direct decentralized financing channels for small companies and small and medium-sized enterprises (SMEs). Tokenization using blockchain technology can solve the traditional financing problems of the sector, such as lack of transparency, lack of liquidity and lack of democracy. Tokenization also helps to increase the efficiency of investors holding real assets on their balance sheets, as it provides liquidity to illiquid assets and simplifies the collateralization process.

A. Real estate (Real Estate): The traditional real estate market has been criticized for lack of transparency, difficulty in circulation and numerous intermediaries. A blockchain can be an excellent option to serve as a single, public source of information, providing data and coordination for all participants. Tokenization can also help lower minimum investment amounts and potentially reprice assets.

C. Unconventional Commodities: From gold to agricultural products, more and more commodities are brought to the blockchain. Agriculture: Platforms like Agrotoken use oracles and real-world proofs of grain reserves to create stablecoins backed by commodities like soybeans, corn, and wheat, offering new financing solutions. Climate finance projects: Blockchain can help with reliable records and transfer of carbon credits between suppliers and demanders, while also lowering the barriers to entry for carbon trading.

secondary title

2.4 Challenges of on-chaining real-world assets (RWA)

The main obstacle to the scale of digital assets lies in the fragmented legal and regulatory environment for digital assets in different jurisdictions, as well as inconsistent classification or classification standards around the world. Additionally, the tokenization of real-world assets may encounter other additional challenges:

Interoperability Issues: When tokens are based on multiple blockchains, or tokens need to interact with back-end systems outside the blockchain ecosystem, and between new architectures built on different chains, May cause interoperability issues.

Lack of Experienced Custodians: There are a limited number of professional third parties capable of safely custodying tokens and real-world assets.

Duplication and Unauthorized Tokenization: While information on the blockchain is publicly visible, there is a lack of oversight and standards of practice to curb duplication or unauthorized tokenization associated with real-world assets change.

Real-World Liquidity Risks: On-chain liquidity tends to be greater than real-world liquidity, likely due to market access with fragmented ownership.

Elevated Cyber Risk: More technology needs to be developed to achieve blockchain transparency without revealing actual information about borrowers and asset owners. The most widely used privacy solution today is Zero-Knowledge Proofs (ZKP). Cyber hacking on the blockchain will introduce additional risks associated with theft or loss of tokens.

Difficulty of Full Disintermediation: Internet of Things (IOT) technologies and oracle networks for valuation and status reporting of underlying real-world assets are still in their infancy and may take a while to reach commercialization at scale. Until then, many key steps, such as valuation, accounting and reporting, may still rely on human expertise and manual labor, just like traditional finance.

Blockchain-based currencies, games, and social products will have a major impact on consumers. In this chapter, we discuss how blockchain is revolutionizing these fields, why it is happening now, and how it has gained billions of users.

secondary title

3.1 Central Bank Digital Currencies (CBDC)

A CBDC is a digital currency denominated in a national currency unit issued by a central bank and represents a form of central bank liability. This is distinguished from other forms of digital payment instruments (eg, card payments, electronic money, credit transfers), which are liabilities of private institutions.

At present, more than 100 countries have conducted research, discussions, and experiments on CBDC, but only some small countries have adopted CBDC projects based on distributed ledger technology, and some large countries (with a total population of about 2 billion) may soon try to integrate with distributed ledger technology. Central bank digital currency (CBDC) related to ledger technology, such as digital euro (EUR), digital pound (GBP), digital rupee (INR), these projects will roughly cover 1/4 of the world's population and currency savings. However, due to policy and other reasons, a big country like China has adopted a CBDC project based on centralized ledger technology.

Beyond the individual use cases of CBDC, millions of businesses and importers/exporters will use bilateral or multilateral CBDC settlement arrangements developed between different countries. For example, a distributed Multi-CBDC project between China, Hong Kong, Thailand and the UAE, and is piloting different use cases, starting with cross-border foreign exchange (FX) trade settlement.

In addition, the increase of CBDC projects may bring many stablecoin projects to the table, because stablecoin projects can hold CBDC as their reserve, which is more stable and liquid than general money market instruments.

secondary title

3.2 Gaming

Games may be one of the biggest entrances for consumers to enter the blockchain and Web3 industries from the bottom up. In 2022, more than 1 million unique active wallets are connected to gaming Dapps every day. With the emergence of Web3 games, especially blockchain games from Asian studios in the next 1-2 years, it will lead the most active players (nearly 100 million "whales") to blockchain games. This could prompt mainstream game studios to incorporate blockchain and tokenization elements into their games.

Games account for the largest share of the entertainment industry, earning more than the movie and music industries combined. According to Newzoo, the gaming market is massive, with nearly 3.2 billion players by 2022. In 2022, 184 billion game revenue will be generated, of which Asian players account for half, North American players account for 26%, and European players account for 18%. Even if only a small percentage of gamers use blockchain-based games, this increase is enough to leverage the entire blockchain and Web3 ecosystem.

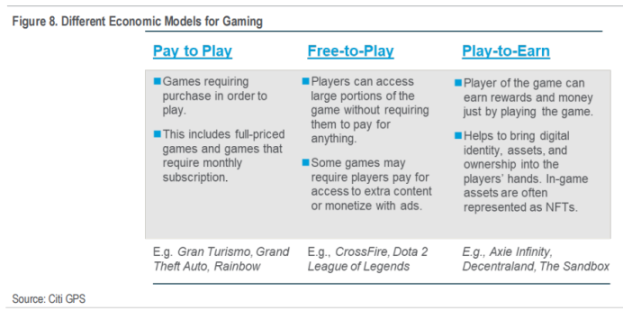

In our opinion, the gaming industry is inherently suitable for blockchain. Gamers are tech-savvy, and most already have a good understanding of digital ownership and digital assets. The emergence of Web3 and the rise of a new economic model (Play to Earn) aims to allow players to own their own in-game assets. These digital assets can range from digital currencies to in-game assets that have been tokenized.

Until now, blockchain-based games have typically been developed by crypto-natives who are more concerned with in-game token economics than making games fun and exciting. Hardcore gamers often criticize the superficial and simplistic gameplay in blockchain-based games. Some players also worry that NFTs and in-game tokens could become another tool to extract more money from players.

The next generation of game developers is already working hard to incorporate digital assets into fun games. This will help address the current concerns of the gaming community and increase adoption. For example, the recent Dookey Dash competition held by Yuga Labs provided the Bored Ape Yacht Club community with a fun gaming experience, attracted participants from all over the world, and proved the importance of NFTs in gaming.

Today, there are over 3 billion gamers worldwide, and by 2025 we may see close to 50-100 million people using games with Web3 or blockchain elements. Gamers in Asia may be the earliest adopters. However, the reality is that a small percentage of gamers account for the lion's share of game spending. In the next few years, we may see a major shift in transaction spending from off-chain to on-chain. The shift of heavy consumers to blockchain games may be an inflection point for the entire Web3 game ecosystem.

secondary title

3.3 Social media (Social)

Proponents of Web3 believe that a new system needs to be built that is completely decentralized. Blockchain-based social media can help with identity verification, account verification, and this process is completely open and transparent. The openly shared, immutable digital transaction ledger created by the blockchain can also help users improve transaction credibility and help build trust.

Companies like Aave are building decentralized social media platforms like Lens Protocol, where users can create profiles on-chain, follow others, create and collect content, ownership and control of which remains with the user hands (Social Capital), and users can also tokenize it. This is different from the Web2 era when user data is locked in a platform, monopolized by the platform and used for free.

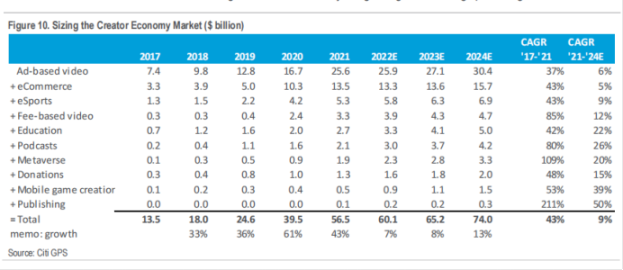

We believe that the current market size of the creator economy is 60 billion per year, and it is increasing at an annual growth rate of 9%. By 2024, the market size will reach 75 billion, and many subdivision tracks are growing at a double-digit rate. Blockchain-based social media platforms aim to put social media on-chain, offering the benefits of privacy protection, personal data ownership, and control over generated content. Most platforms also offer native tokens for the tokenization of content from creators. However, decentralized social media networks are still in their infancy, and the user experience is not as rich as traditional media.

secondary title

3.4 Art, NFTs, and The Metaverse (Art, NFTs, and The Metaverse)

Trust is the most important factor in the art world. Blockchain technology can help solve the trust conundrum without forcing anyone to trust an individual or institution. Tokenization of artwork helps to make this information accessible to all by cryptographically verifying that due diligence certificates are embedded in smart contracts and stored on-chain.

The art market is plagued by fraud, forgery and theft. Building a trustworthy registry of digital records can be difficult in the absence of any central authority. Using blockchain technology does not mean that traditional market participants cannot be trusted. Instead, it shows that they are more trustworthy, since all information will be recorded on an immutable ledger.

Blockchain technology can help artworks create immutable records such as ownership history, independent evaluation records, and ownership certification throughout the entire life cycle. These proof records, also known as asset tokens, can be legally bound and are digital representations of proof of ownership. We could see art owners and traditional galleries like Sotheby’s, Christie’s, and Phillips working with blockchain companies to create digital proofs that capture all the information associated with an artwork.

In addition, digital proof of artwork can also be wrapped in token assets, creating institutional-grade investment opportunities for high-value artwork and collectibles. Blockchain-based art funds can create an open and transparent environment for potential investors by providing artwork data, attribute performance, and update records. For example, Sygnum, a Swiss digital asset bank, tokenized Picasso’s Fillette au béret work itself according to the Swiss legal framework for digital assets, enabling individual/institutional investors to participate in the investment of Art Security Tokens of this work .

As an emerging art form, NFT will be highly sought after in 2021. Between March 2022 and February 2023, sales of art and collectibles totaled 3.8 million transactions worth $9.5 billion, according to Nonfungible.com. In the real world, artists cannot get a share of revenue from secondary sales, and NFT can be carefully designed to ensure that artists can obtain subsequent secondary sales royalties after the initial casting sale.

In addition to artworks, collectibles can also be chained in the form of NFT. In addition, based on the fact that NFT can serve as a proof of the authenticity of its corresponding physical assets, it creates trust, especially in the high-end collectibles market. For example, the BlockBar platform enables luxury brands to issue NFTs for their collections of wine and rare spirits. The main goal is to have exclusive wine and spirits bottles on the one hand, and to trade in the secondary market on the other hand, while physical wine bottles are stored in a secure, temperature-controlled warehouse.

4. Market size of tens of trillions (Trillions of Dollars)

secondary title

4.1 Tokenization of the securities market

While the industry is still in its early stages, based on our conversations with industry experts and insiders, we estimate that, assuming 1% corporate and quasi-sovereign bonds, 7.5% real estate funds, 10% private equity and venture capital funds, and 1% If trillions of dollars in securities financing and collateral activities are tokenized, the digital securities market size will reach 4 trillion to 5 trillion U.S. dollars. At the same time, it is accompanied by the tokenization of the trade finance market. By 2030, the scale of trade finance based on blockchain technology may reach 1 trillion US dollars, accounting for about 8% - 10% of the global trade finance scale.

secondary title

4.2 Why does the securities market need tokenization?

So why do securities market products such as stocks, bonds, and funds need to be tokenized? The traditional securities market has solved the problems of accessibility, high liquidity, openness and transparency for most products. And what drives private equity giants (such as KKR, Apollo, Hamilton Lane) to set up their encryption funds on digital asset exchanges such as Securitize, Provenance Blockchain, and ADDX? Why are some of the biggest asset managers like Franklin Templeton and Wisdom Tree trying to set up crypto mutual funds on public chains like Ethereum or Stellar?

The reasons may be: some financial assets may be restricted by traditional financial markets and rules, such as fixed income, private equity and other assets, and have liquidity like publicly traded securities, and it is relatively difficult to invest in these assets; , a phenomenon in the financial market is that financial institutions will pay a high premium for partial control of assets, which may be contrary to the wishes of investors, because these assets are more expensive, more complex, and more difficult to control; and the current financial market The infrastructure is fragmented, and the payment system, value discovery, market matching, and clearing and settlement systems are all different; many intermediaries in the financial system also create obstacles to the circulation of data.

What blockchain-based distributed ledger technology and tokenization solutions can provide is a brand-new technology stack that allows all stakeholders to work on a golden data source on the same and shared infrastructure. All related activities—no more costly reconciliations, risking settlement failures, waiting for faxed documents or “original documents” to be sent in the mail, or investment decisions limited by operational difficulty. The above is only the improvement of operational efficiency brought about by blockchain technology, not the final form of blockchain technology to transform the financial market.

In addition to the aforementioned financial blockchain-based advantages, different classes of assets can also be represented on the same blockchain, unlike today's traditional financial markets. Although cash tokens are conceptually and functionally different from bond tokens, they can be treated in a similar way on financial blockchains, and the nuances of each asset can be handled in smart contracts (such as fund tokens). limited holding period and limited screening of cash tokens). Smart contracts can then be programmed to automatically trigger cash token payments for company-specific actions or dividend deadlines. The use cases for tokenization are endless. But this requires a whole new blockchain infrastructure that supports programmability, verifiability and a trustless network.

secondary title

4.3 Benefits of Tokenization in the Securities Market

After tokenization, the direct benefits of liquid financial assets are concentrated in the efficiency of clearing, settlement, custody and asset services, while illiquid assets have wider upside and scalability.

Liquidity: High-value illiquid assets benefit from tokenization because tokenization allows asset ownership to be fragmented, which makes transactions, ownership transfers, and record updates easier, and can significantly improve high Liquidity of value illiquid assets. After high-value assets are fragmented through asset ownership, the minimum threshold for investment is lowered, and it can meet the customized needs of owners (only sell or mortgage a small part of high-value assets, and enjoy the appreciation/income of the rest).

Operational efficiency improvement (Distribution): The entire token distribution process (from creating tokens to transferring ownership) can be done openly and transparently on the chain (without any rent-seeking intermediary), theoretically speaking, anyone connected to the Internet can Open a wallet to own tokens. In addition, transactions built on the blockchain can achieve transactions and settlements at the same time (significant for cross-border foreign exchange transactions and real estate transactions), no matter who the counterparty is, and no transaction intermediary is required.

Enable Access: While potentially restricted by jurisdictional regulation, tokenization can help individuals gain access to certain assets that have traditionally been accessible only to institutional clients or top-tier investors. In addition, people in less developed parts of the world have limited access to banks and brokerage firms, which may also give them access to investment opportunities in securities and other real-world assets, benefiting from asset appreciation.

New user group (Wider Appeal): The group that accepts or advocates tokenization is often younger, more enthusiastic about technology, and has a diverse background. These user groups can become new target customers of traditional financial institutions.

Opportunities in Smaller Companies: In traditional financial markets, it is difficult for many assets to obtain financing. The tokenization of such assets, such as the equity of private companies of small and medium-sized enterprises, accounts receivable, etc., can open up new financing channels and investment channels.

Operational Efficiency: Smart contracts enable smoother, faster, and potentially cheaper issuance, trading, and post-trade processes, effectively reducing communication costs between issuers, investors, traders, and market infrastructure. In theory, this could also reduce transaction errors and transaction costs. The combination of smart contracts and other interoperable protocols can perform key functions together, and can be applied to application scenarios such as KYC/AML, margin calculation, and corporate behavior. Smart contracts can also improve the flexibility of corporate governance voting through automatic calculations and conditional payments. and improve the efficiency of communication between investors. Finally, blockchain-based infrastructure has the potential to provide shorter and more flexible netting, clearing and settlement cycles.

Composability: Tokenization of real-world assets and financial assets can enable product innovation in the financial industry by exchanging, mixing and combining with digital assets. Asset and wealth managers can create more diverse and flexible portfolios, including real-world assets, financial assets and digital assets accessed through a single digital wallet. The composability of tokenization models could also enable direct cash flow generation, replace new data-driven contracts, and improve investor treatment in traditional financial markets.

Trust Minimization and Transparency: Transactions of real-world assets, financial assets, and intangible assets (such as securities, artwork, real estate, and intellectual property) often rely on trust between buyers and sellers , and sometimes rely on trust between brokers and other third parties with legal, valuation and transactional expertise. Tokenized assets backed by smart contracts can automatically execute and record transactions and transfer ownership when preset conditions are met, thereby eliminating counterparty risk. The use of the Internet of Things (IoT) and Oracle Networks can also further reduce the need for manual reporting and managed asset valuations.

The tokenization of real-world assets, especially real estate, art, and collectibles, brings much-needed transparency and traceability to the provenance and valuation of assets. The blockchain can automatically update the ownership history of each transaction and record a time-stamped appraisal signature, providing clear evidence of the quality and authenticity of real-world assets. Appraisers’ historical verifications can be made visible on-chain, thus, price discovery for such assets becomes easier.

secondary title

4.4 Barriers to Tokenization in the Securities Market

If you want to achieve the final form of the financial blockchain mentioned above, an analogy based on the current situation is like changing the engine of an airplane when it is flying at an altitude of 30,000 feet. Additionally, the new engine required a complete rewiring while still being inter-compatible with the old system.

Before tokenization can have a meaningful impact on financial markets, the entire financial market and its workflow must first be digitized. This requires legal documents to appear digitally native (rather than via scans and PDFs) in ways such as smart contracts to enable composability with smart functions. Different jurisdictions are prioritizing making digital documents legally binding, which will pave the way for more tokenization projects. Switzerland, France, the United Kingdom, Singapore, the Philippines and other countries have embarked on the implementation of pilot trading projects related to tokenization.

However, a brand new technological innovation needs the test of time and the cost of replacing existing technologies, not to mention replacing the complex and huge traditional financial market. The blockchain industry also lacks an operational consensus standard, and it is not appropriate to use the existing blockchain infrastructure directly in the traditional financial system.

In any case, traditional financial institutions are still very keen on tokenization. In the traditional financial market, there are a large number of market participants and huge assets: the real estate market exceeds 300 trillion U.S. dollars, the securities market exceeds 250 trillion U.S. dollars, regulated public funds exceed 60 trillion U.S. dollars, and rapid growth private equity market. Even if the above 1% of the volume can be tokenized, the scale will reach trillions of dollars. Early adopters will benefit greatly.

secondary title

4.5 The practice of tokenization in the securities market

The securities we mentioned are tokenized in two ways:

A. Tokenization of securities: It refers to placing the underlying assets—traditional securities—into the tokenized infrastructure of the blockchain, and reissuing them in a tokenized manner. This is by far the most common and widespread method. Using distributed ledger technology to record the movement of securities can improve the efficiency of existing records, while also allowing asset ownership to be fragmented and collateralized.

B. Native Security Tokens: Refers to issuing new securities directly on the infrastructure of the blockchain and keeping them in wallets associated with distributed ledgers. While currently representative cases are limited due to regulatory constraints, this is likely to be the area of greatest impact in the long run. The issuance of native security tokens can not only enjoy the many benefits brought by blockchain finance, and is no longer limited by the traditional financial system, but also opens the door for new innovative product functions, such as ESG tracking and dynamic portfolio reallocation .

Tokenization can be used as an entrance for real-world assets to enter the Web3 blockchain ecosystem, which can enable an orderly transition of capital to the new Web3 ecosystem, thereby avoiding damage to the existing infrastructure. At present, various jurisdictions are actively exploring the tokenization process of securities, while the issuance of native security tokens is mainly concentrated in bonds.

Case 1: Digital Collateral Market

The collateral/securities lending market, or Repo Market, is a key segment of the securities market that can benefit immediately from tokenization. Despite the repo market's monthly trading volume exceeding $2 trillion, existing trade and post-trade processes in the market are still largely manual and inefficient, with significant risk.

Several new tokenization projects based on distributed ledger technology have emerged to target this large and inefficient market by creating digital mortgage records on the blockchain. Once digitized, these assets will enter a single, seamless pool of collateral assets and be able to leverage smart contract features such as automation and conditional settlement to dramatically improve operational efficiency.

Platforms such as the HQLAX platform, JP Morgan's Onyx repo platform, and Broadridge's DLT Repo are already processing billions in securities lending volume and have the potential to scale further. These platforms will bring considerable operational and capital savings to the industry. Given the current industry momentum, it seems likely that the digital collateral market will become the first large-scale use case for digital securities.

Case 2: Tokenization of Private Equity Funds

Historically, there has been a barrier to entry for retail investors investing in private market funds, a market limited to large institutional investors and ultra-high-net-worth individuals. Furthermore, a clear goal of the alternative asset market is to increase allocations to retail investors. This persistent underallocation is driven by high investment minimums, long holding periods, limited liquidity (including a lack of developed secondary markets), lack of means for value discovery, complex manual investment processes, and lack of investor education wait.

The challenges supporting this continued underallocation are high investment minimums; long holding periods; limited liquidity, including a lack of developed secondary markets; fragmented asset discovery options; complex manual investment processes; and lack of investor awareness and education etc.

While tokenization is still in its early stages, asset managers are testing the waters by launching tokenized versions of their popular funds.

Private markets investment firm Hamilton Lane has partnered with digital stock exchange ADDX to tokenize a share class of its most popular global private equity fund, lowering the minimum investment threshold from $125,000 or more to $10, 000 USD, which also gives investors the option to trade these tokenized assets on digital stock exchanges.

Alternative asset manager KKR has also tokenized its healthcare fund on the Avalanche blockchain through digital asset firm Securitize in late 2022. Meanwhile, private equity firm Apollo partnered with fintech firm Figure on investment management on the Provenance blockchain and launched a new tokenized fund.

5. Trade Finance

Trade finance is a set of technical or financial tools used to mitigate the risks inherent in international trade, ensuring payment to exporters and delivery of goods and services to importers. Trade finance is a huge market, worth about $8 trillion by 2022 and likely to grow to $12 trillion by 2030. The World Trade Organization (WTO) estimates that trade finance plays a key role in facilitating and supporting as much as 80%-90% of international trade. Changes in law and advances in technology could drive the tokenization of up to $1 trillion in assets in global trade finance by 2030.

One of the drivers of change in trade finance is upcoming legal reforms. Almost 80% of global trade is governed by UK law, which may soon begin to accept Electronic Transferable Records. The Model Law on Electronic Transferable Records (MLETR) was first introduced by the United Nations Commission on International Trade Law (UNCITRAL) in 2017 and applied by Bahrain, Singapore, Abu Dhabi and others in 2021. MLETR applies to electronic transferable records such as bills of exchange, bills of lading, bills of exchange, international guarantees, letters of credit, other receipts, etc. This is a potentially major change with far-reaching implications for the digitization of trade finance.

So far, in most countries, only paper documents are legally binding under common law. Once documents are legally binding in electronic form, they will greatly increase transmission speed and security, allow data reuse, and enable transactions to be automated through smart contracts. Digitizing trade documents is the first step towards using digital assets in trade finance. Digital transformation is expected to reduce the cost of global international trade by 80 percent and boost trade to $9 trillion, or about 10 percent of global GDP. Asian countries are also expected to benefit from legal reforms that could bring the combined benefits of paperless trade to Commonwealth countries to $1 trillion by 2026.

Another driver of change in trade finance is increased interoperability. Previously, banks and corporations deployed private closed networks, which amounted to some people texting, others WhatsApp, and another Telegram. But now, there's a growing awareness that networks need to communicate -- to have a network of networks.

The People's Bank of China, the Central Bank of the UAE, the Bank for International Settlements, the Bank of Thailand and the Hong Kong Monetary Authority (HKMA) have joined the mCBDC bridge to facilitate real-time, distributed ledger technology-based cross-border foreign exchange payments. International trade settlement was chosen as the first business use case to be piloted on mBridge. The mCBDC pilot, which consists of four participating jurisdictions directly on mBridge, differs in two ways: (1) Settlement of international payments occurs directly on the blockchain common platform, rather than in each country’s On the domestic payment system, and (2) the paying bank and the beneficiary bank conduct transactions directly with each other. The mCBDC pilot aims to demonstrate the capabilities of blockchain networks and central bank digital currencies to increase the speed and efficiency of cross-border payments while reducing costs and settlement risks.

After 2030, we will likely see wider adoption of blockchain in trade finance, where interoperability will enable tokenization to reach a higher percentage. Wider adoption will require simpler applications, basic functionality at low or no cost to use, and new liquidity providers to support trade finance.

6. Technology Enablers

So what needs to be improved at the technical level for the Web3 and blockchain ecology to achieve billions of users and a market size of tens of trillions of dollars?

secondary title

6.1 Decentralized Identity

The digital identity of Web3 refers to the unique, verifiable and decentralized identity representation of individuals or entities on the blockchain, which digitally proves "who I am". Web3 digital identity solutions are designed to provide individuals and entities with control over their data and the ability to use that data (e.g. transactions, interactions) in a secure and trusted manner.

We have developed from the simple email paradigm of Web1 digital identity to the only safer and more isolated form of digital identity in the Web2 era (such as Google, Apple, and Facebook all have their own independent account verification system, and users can only rent space on a separate platform) Read & Write, and pay data rent). Now, we are on the cusp of the Web3 era - decentralized on-chain self-sovereign identity. This allows users to have their own identities, thereby owning their own digital content and digital assets (Read & Write & Own).

Why do we need decentralized identity? Web3's decentralized identity can change the model of large platforms from mastering data to self-control, and use this decentralized identity system for the entire platform and network. At the same time, this is an effective way for the centralized platform to use its monopoly position to do evil (whether it uses user data for its own benefit, or it may cause data privacy leakage).

We believe that decentralized digital identities may be the key to interacting with Web3 worlds such as decentralized finance, decentralized social and open metaverses. A 2022 report by Cheqd estimates the potential market for decentralized digital identities to be around $550 billion. McKinsey estimates that in just the seven focus countries they analyzed, full coverage of decentralized digital identity systems could add between 3% and 13% to GDP by 2030.

secondary title

6.2 Zero-Knowledge Proofs

Zero-knowledge proof (ZKP), in simple terms, is a proof that separates knowledge (information required for verification) from verification, which can fully prove that one is the legal owner of certain rights and interests without disclosing relevant information Going out - that is, the "knowledge" to the outside world is "zero".

In cryptography, this "proof" process is usually done interactively, with the verifier asking the prover a series of questions, and the prover answering the questions. For example, these problems may involve "opening" the solution at a specific location to prove that the solution is correct, but this "proof" does not reveal all information about the entire secret solution, that is, the prover proves to the verifier that Make it believe that it knows or owns a certain message, but the proof process cannot reveal any information about the proven message to the verifier. After repeating enough times, there is a high probability that the prover knows the solution.

Privacy is a fundamental right and necessity of individuals and institutions. Banks and financial institutions may want to use blockchain for transactions, payments, and various processes, using the technology to increase efficiency in the middle and back office. However, on-chain data is public to anyone and everyone, and anyone can see a private transaction between two customers of the bank. ZKP solves the above privacy issues, and information such as payment amount, goods or services delivered, payment terms, etc. will not be publicly disclosed.

ZK-SNARKS technology addresses two main properties in blockchains: privacy and scalability. Privacy comes from ZKP, the prover is able to prove a statement to the verifier without revealing the secret. Scalability comes from SNARKS technology, where verification statements are orders of magnitude faster than the computations required to run proof statements.

secondary title

6.3 Oracles

Blockchains, by design, can only access and process data "on-chain". An Oracle can be thought of as an application programming interface (API) that helps connect the blockchain with the real world, linking on-chain and off-chain data. Oracles are at the heart of connecting blockchains to real-world data and information.

Oracles are a prerequisite for scaling blockchains, because without access to data on real-world assets, Web3 use cases will be limited to on-chain ecosystems. Oracle will create a hybrid smart contract (Hybrid Smart Contract), which consists of contract code on the chain and real-world data nodes off the chain.

Currently, we find that most of Oracle's work is done in the DeFi space. However, we are starting to see regulated financial institutions building many oracles for market and data pricing. As more and more assets are on-chain (e.g., bonds, stocks, real-world assets), Proofs of Reserves will be a necessity, and Oracles are expected to play a greater role in external financial market data.

secondary title

6.4 Cross-chain bridge (Secure Bridges)

The nature of the future blockchain is multi-chain, because different blockchains are being built and optimized for different use cases with different design ideas. This leads to the need for interoperability between chains and the emergence of potential solutions for cross-chain bridges.

A cross-chain bridge is a protocol or intermediary that enables users to transfer on-chain assets from one blockchain to another. The cross-chain bridge is suitable for a wide range of information communication, smart contract calls and other types of cross-chain communication. This is especially important in the context of the push for blockchain adoption in traditional financial markets, as information and data need to be transferred between different institutions or blockchain ecosystems.

One of the common use cases of cross-chain bridges is the Lock and Mint mode. In this mode, users can use the tokens of the A blockchain on the B blockchain. First, the user sends tokens from the A blockchain to the smart contract of the cross-chain bridge and locks them; then, the cross-chain bridge deploys a smart contract on the B blockchain, aiming to mint the same amount of tokens on the B blockchain Tokens, which are usually a "wrapped" version of the A blockchain token; finally, the B blockchain token is sent to the user's address, and the user can now spend, borrow, etc. on the B blockchain using the token.

Contracts are ubiquitous in everyday life, and each of them creates a legal relationship between two (or more) parties. We should pay attention to how to perform the contract, because the contract is closely related both in the business environment and in our personal life. Although the contract has matured, with the development of technology, the contract will be raised to a new level - legal smart contract (Smart Legal Contract, SLC), which will bring about improvements in automation, efficiency and security.

secondary title

7.1 Legal Smart Contract (SLC)

The concept of smart contract (Smart Contract) has been around for a long time. It is a set of commitments expressed in digital form, including agreements for parties to fulfill other commitments. A smart contract consists of a set of promises, a digital format, and an agreement. According to the Ethereum organization, a "smart contract" is simply a program running on the Ethereum blockchain, which is a collection of code (its function) and data (its state), located at a specific address on the Ethereum blockchain . The group further explains smart contracts as “computer programs stored on a blockchain that allow the transformation of traditional contracts into a digital parallel.”

For the purposes of our report, we make a distinction: legal smart contracts (SLCs) are a type of smart contract, but have distinct characteristics from smart contracts:

A. SLC may or may not use blockchain - this is in contrast to smart contracts built on blockchain.

B. SLCs aim (in form and structure) to create legally binding agreements that comply with the legal and regulatory requirements of their jurisdictions. Smart contracts rarely consider legal enforceability. As stated by the UK Law Commission, smart contracts can be used to define and fulfill obligations in legally binding contracts. The Commission explicitly defines an SLC as: "A legally binding contract in which some or all of the contractual obligations are defined and/or automatically performed by a computer program."

C. Since smart contracts lack legal enforcement, the code syntax used in smart contracts is the subject of agreement between the two parties - they have no legal enforcement as a fallback. In contrast, an SLC includes an agreement on the intent of both parties and how automation will be used to achieve that intent. This allows the court system to get involved in cases of disputes, improper execution, or computer code malfunctions.

E. While both smart contracts and SLCs can connect to and use external data sources (referred to as oracles when used for smart contracts), the legal enforceability of SLCs enhances their ability to use human assistance in their self-execution. Roles such as auditors, inspectors, or attorneys can use Oracles to assist with legal processing.

secondary title

7.2 Classification and characteristics of legal smart contracts

SLC can be divided into three categories, with different degrees of automation, applicable to different situations in practice: (1) The most widely used SLC is a natural language contract combined with code. It uses the code of a computer program to enforce contractual obligations (note: code does not define contractual obligations); (2) pure code contracts, in which both contract terms and execution are done by code, which is rare in practice; (3) hybrid contracts, Some of these terms are defined in code, and some contractual obligations are enforced by code.

Although SLC appears to be similar to smart contracts, SLC has the following characteristics:

A. Payment Identifiers (Payment Identifiers): SLC can create and embed International Bank Account Numbers (IBANs) or any other identifiers (such as blockchain "public keys" for "on-chain" payments) in the contract text, these The logo and its terms are managed exclusively by SLC. This means that payments to SLC (via IBAN) are processed quickly and accurately, with SLC verifying that payment requirements have been met. For example, an SLC-based corporate bond receives interest payments from borrowers and distributes the interest to each bondholder. Payment automation is created through Bank Integration Services, which creates a bridge between SLC and the global banking system.

B. Polls/Questions: SLC contains polls (or similar functionality). These polls ask the parties to the agreement (i.e., the signatory to the agreement or the service provider of the agreement) to answer questions about parts of the contract that cannot be digitized, often based on subjective assessments or requiring assistance from some form of outside activity. This is the part of SLC that requires human involvement.

This is important because many legal agreements contain terms that cannot be effectively implemented without human assistance. For example, a contract may require X number of audits per year before payment is sent. So a poll might ask: have X number of audits been done? This requires a human to answer this question, and based on the answer, the next phase of the contract can be executed.

C. The SLC Connects APIs (The SLC Connects APIs): This allows the SLC to use external data as part of its decision-making and is able to record the conditions that were fulfilled when the SLC was executed. It can also provide data about the SLC, such as its terms or its execution history or status, to external systems via an API. This is extremely important for businesses with a large portfolio of contracts on their books, where other techniques such as machine learning can be applied to help extract insights and make business decisions. These insights can include how contracts are being enforced, where contracts are failing, where there are disputes, where the business may have concentrated exposure to legal risk, and where failures are repeated, such as an SLC being breached multiple times.

According to the above characteristics of SLC, we can see that SLC does not necessarily need blockchain, which can be deployed on traditional cloud servers. As a result, the British Law Commission has adopted a relatively neutral attitude towards SLC, and organizations in the SLC field such as the Accord Project are not only targeting the deployment of the SLC protocol on the blockchain. However, compared with traditional agreements, blockchain-based SLC can bring many benefits, such as long-term independent storage in decentralized ledgers, open and transparent contracts (including performance conditions, execution degree, etc.), using encryption and decentralized The column technology improves the security level and effectively prevents any tampering, and the introduction of a consensus mechanism to resolve disputes.

secondary title

7.3 Application cases of SLC

While SCL is still in its early stages and varies from case to case, SLCs interoperate in that once certain conditions are met (in other words, once certain events are triggered), a specific process or task will is executed automatically. SLC relies on data to verify that conditions of terms have been met, including payment or transfer of title. SLCs can also be used to transfer funds into one’s wallet, and payments can be in fiat currency, digital assets, or CBDC.

A. Real estate (Real Estate and Proptech)

In the case of a property purchase, the SLC can be programmed to transfer money to the seller after legal title is obtained; or in a rental scenario, the SLC can be programmed so that the lease ends on a certain date unless you pay day X money; for those needing to purchase real estate with a loan, an SLC can eliminate the need for an intermediary and can be programmed to issue a mortgage as soon as all checks and documents are received.

SLCs can also be combined with the tokenization of real-world assets. In this case, tokenization enables the confirmation and transfer of digital ownership, with each token representing a fraction of ownership of the entire asset (similar to equity). The SLC can contain all the terms and conditions that need to be met to trigger an event to occur (eg, recording partial title and transferring title to the buyer upon payment and receipt of payment).

While tokens and tokenization have been a core use of smart contracts and DeFi, they are an interesting use case for SLCs, as the tokenization of traditional assets such as real estate requires the use of legally viable ownership structures. The underlying real estate may be owned by an SPV company that uses tokens to represent equity interest in the SPV, and a shareholder agreement for an SLC based on this legal structure will be set up and define the terms of purchase and ownership of the corresponding tokens, ensuring a new type of real estate ownership The form (token purchase) is harmonized with the legal framework of traditional real estate ownership forms (possession and transfer).

B. Escrow Payments

Associated with the case of using escrow funds to buy or sell property, a third party holds the money or property until certain terms in the contract are met. Transpact does this by automating the escrow payment process with SLC. The parties agree on the terms of the contract in natural language, the buyer pays Transpact, and once the SLC conditions are met, the funds are automatically released. If the conditions are not met, the funds will be returned to the buyer. The entire cycle is automated and self-running.

Escrow agreements based on SLC's programmable technology can also be used to facilitate complex vessel transactions. The SLC trusteeship agreement can pay the corresponding payment in stages according to the steps of the transaction. For example, in the ship purchase transaction, such as ship technical inspection conditions, signing of relevant agreements, on-site inspection, ownership transfer and other conditions are met, which can trigger part of the payment clause.

C. Insurance claims (Insurance)

SLC can be used to automatically pay out claims, and the SLC will clearly define what needs to happen in order to pay out (eg, flight needs to be delayed by more than X hours). To do this, the SLC connects to an airport database, keeps track of flight numbers and times (e.g. an oracle could be used to connect to an off-chain database such as a flight tracker, check how many hours a flight is delayed, and then transmit this information on-chain for use by the SLC) , and trigger the payout as soon as the flight delay reaches the level of the insurance policy.

The same logic applies to other types of insurance claims besides travel, as long as insurance payouts are required based on the specific event that occurred. However, not all types of insurance-related use cases can be fully automated. Some insurance claims require a physical inspection of an asset, such as a building, before payment is made. In these cases, SLC may rely on manual physical inspection.

D. Supply Chains

The reality that multiple participants in the supply chain rely heavily on paper documents makes the supply chain industry an ideal application scenario for SLC. Trade-related documents can be converted into SLCs to execute payments when specific events occur in the supply chain. In addition to payment execution (similar to the escrow example mentioned above), SLC can also be used to record events or messages when something happens, such as unforeseen events that may affect the contract.

E. Service Contract Breach (Managing Breaches in Service Level Agreements)

SLC can be applied to service agreement scenarios, such as cloud service providers providing technical services. The service provided is monitored from trusted sources and data about the service is collected and recorded to identify the negotiated service level. The trusted source must be linked to the SLC portion of the computer code, and if there is a breach of service level, the contract will be enforced.

F. Derivatives Agreements

The International Swaps and Derivatives Association (ISDA) has been working for years to promote digital standards that will eventually form the basis for the development of smart contracts in the derivatives industry. ISDA's work in developing common legal and documentation standards aims to reduce trading inefficiencies within the derivatives ecosystem and will provide the basis for the development and implementation of new technologies. Digitization of documents, and the processes and data that support them, enables the key commercial and operational terms of legal agreements to be more closely aligned with the operational and business processes they support, thereby increasing the automation of those processes.

ISDA also published legal guidance on the development of smart derivatives contracts for equity, foreign exchange, interest rate and credit derivatives. These documents provide an introduction to various derivative products for those who are designing and implementing technical solutions for these products. The documents emphasize that Which aspects of these contracts may present the best opportunities for automation in smart contracts.