Review the operation of "Brother Sun" in the crisis, and sort out the escape guide for 5 stablecoins decoupling

What should you do when your stablecoin is at risk of decoupling? What is the logic behind the seemingly useless operation of Sun Ge exchanging USDC for DAI?

Decentralized stable currency

Decentralized stable currency

secondary title

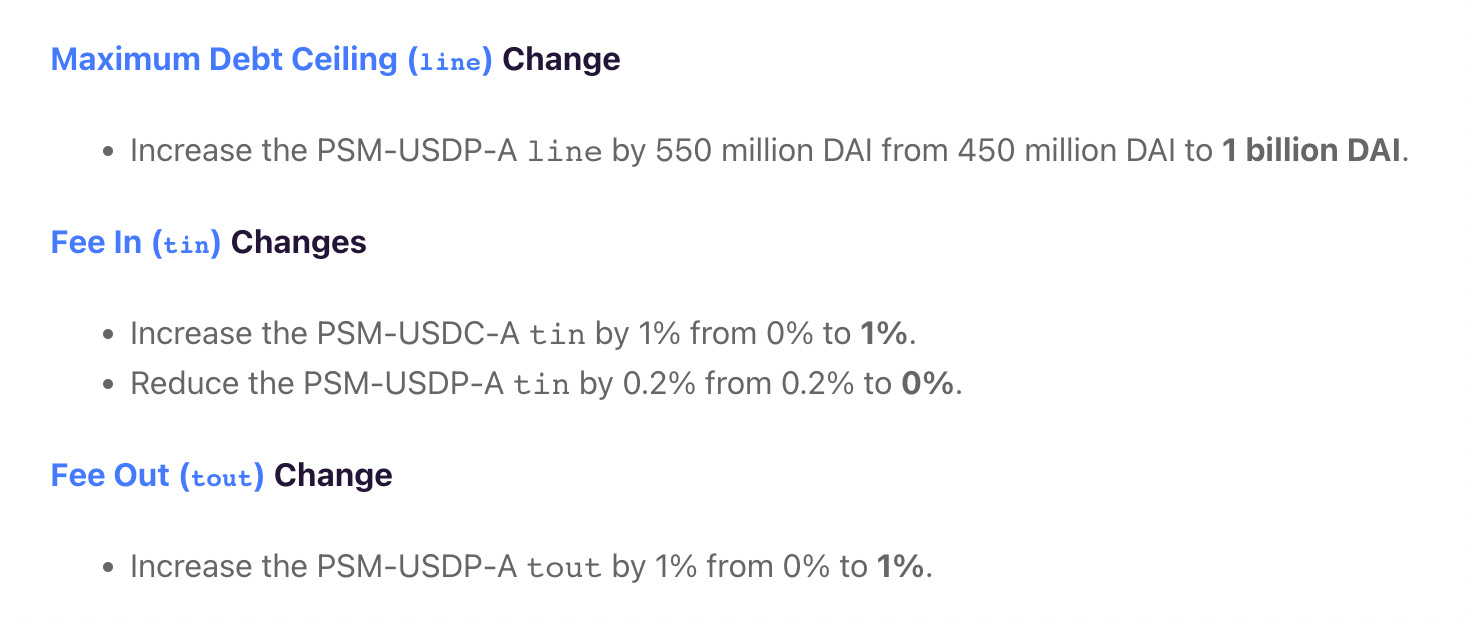

A. PSMBy supporting direct exchange with other stable currencies to link, such as DAI supports 1: 1 exchange USDC/USDP

So since it's all 1: 1 exchange, why did Brother Sun exchange USDC for DAI? Actually it's good

There is an upper limit for the PSM quota. Once the upper limit is reached, it becomes a one-way conversion, that is, only DAI → USDC, not USDC → DAI, and the one-way conversion becomes DAI>= USDC

If in the end USDC can only be exchanged back to US dollars at a price of 0.98, makerDAO may eat up this part of the debt for re-peg

If the situation worsens and the market collapses, triggering large-scale repayment and liquidation of borrowers, then it is necessary to buy back DAI to repay the debt, thereby pushing up the price of DAI

secondary title

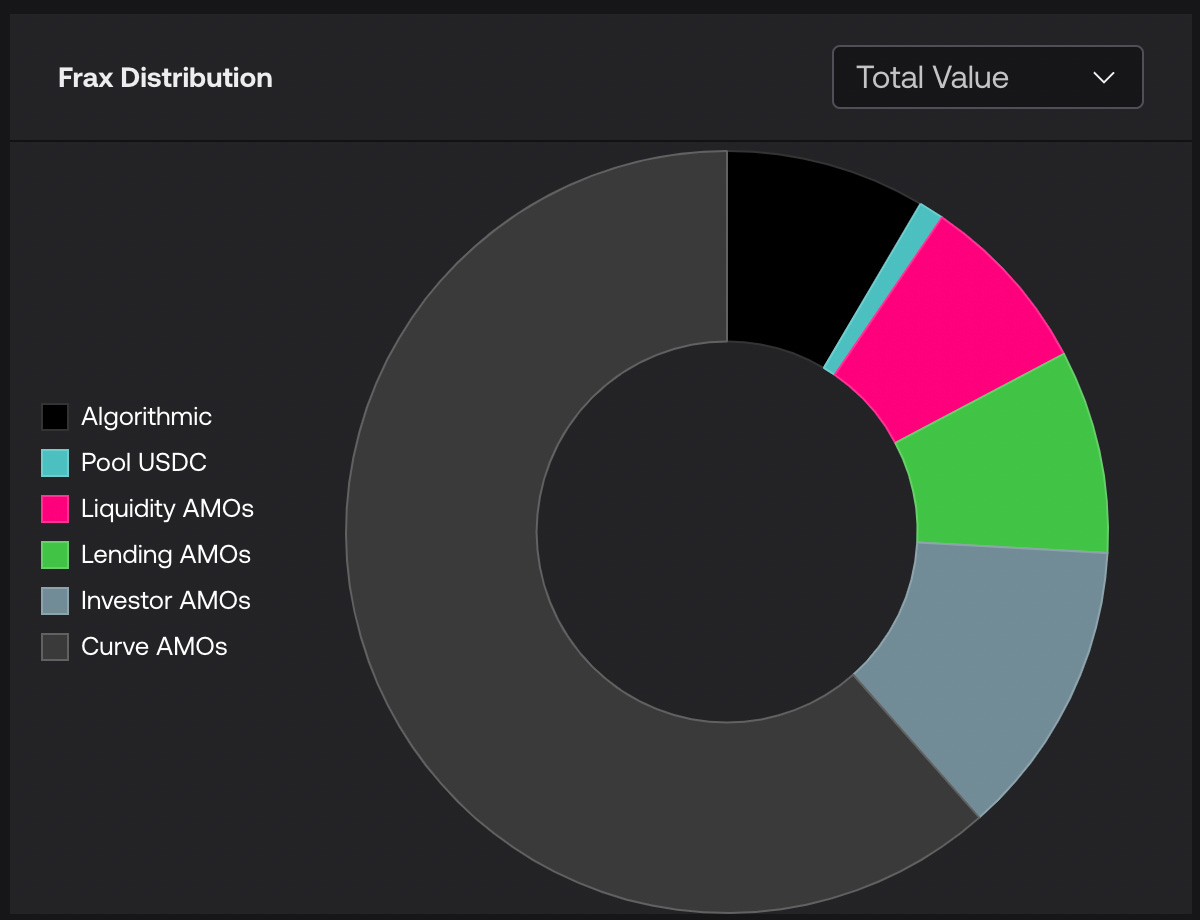

B. AMO:Open market price intervention, such as FRAX/ crvUSD, etc.

For example, most of the underlying assets of FRAX are Curve AMO, namely Curve FRAX/USDC LP and other assets. When FRAX < 1, take out FRAX from the FRAX/USDC pool, that is, buy FRAX in disguise to support the currency price; when FRAX > 1, issue additional FRAX injections, and sell FRAX in disguise to suppress the currency price.

Why is FRAX also de-peg this time? Because in the final analysis, we still rely on external assets to peg USDC de-peg, so how can FRAX/USDC as a reserve support it. So FRAX is fine when UST has an accident, but if there is a problem with the USDC/USDT/DAI underlying AMO, then FRAX will inevitably be affected.

secondary title

C. Debt/Collateral Pricing Exchange:Two-way conversion of Luna/UST, one-way conversion of LUSD→ETH

LUSD is an over-collateralized stablecoin, and the collateral only supports ETH, which is a pure word.

LUSD has never been significantly < 1 for a long time since its release, but frequently » 1 , why is this? Because it stipulates that 1 LUSD can be exchanged for ETH as collateral after paying a certain rate at a price of $1. Yes, it is very similar to UST exchanging $1 for Luna, but ETH cannot directly exchange $1 for LUSD. In this way, when LUSD < $ 1* (1-fee rate%), there is a very definite arbitrage space, and the collateral is pure ETH, the risk is relatively low, and the borrower does not expect the price to drop further, so start arbitrage in time Convenient peg live.

As for why it is often greater than 1, this is because when the price of ETH falls, many are forced to buy back LUSD to repay the debt and push up the price. You can say that at this time someone lends LUSD and sells it for arbitrage, but when will the price of LUSD go down? There is no fixed time for this profit to fall into the pocket, and the risk of liquidation in a bear market is high, so it naturally becomes a long-term premium situation. What is the upper limit? Since the limit mortgage rate of LUSD is 110%, 100 LUSD can be borrowed with ETH worth $110. If LUSD>$1.1, then a certain instant arbitrage opportunity will appear, so the upper limit is $1.1.

secondary title

D. Random hook:Simply put, there is hook logic but not strong

For example, MIM and other over-collateralized stablecoins without PSM, the principle is that when the price is lower than $1, the borrower can buy MIM cheaply to repay the loan and then withdraw the pledge to realize arbitrage.

Yes, the truth is correct, but what if the borrower thinks that your currency will continue to fall or will not rise for the time being? Since MIM collateral supports many complex products, such as Curve LP / GLP, etc., the risk is greater, and the lack of confidence in a bear market will naturally lead to a long-term decoupling state.

first level title

Centralized stable currency

Centralized stablecoins rely on U.S. dollar reserve assets to link to the U.S. dollar, so the analysis should start from the reserve assets. The security of reserve assets from high to low is: treasury bonds = reverse repurchase of treasury bonds > cash (bank deposits) > low-quality assets (commercial paper/corporate bonds, etc.). In addition, bonds have the concept of maturity time. Simply put, the shorter the maturity time, the better the liquidity.

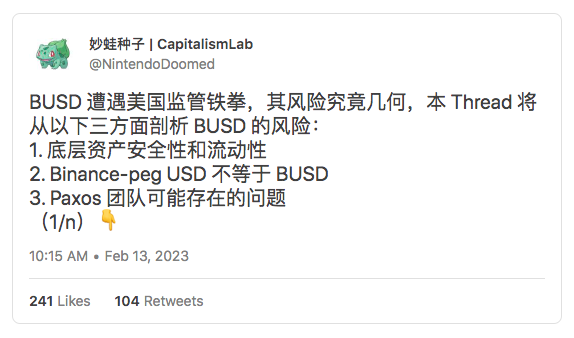

According to the analysis of the underlying assets of BUSD/USDC/USDT in the two tweets below, it can be seen that BUSD > USDC > USDT in terms of comprehensive security and liquidity. However, USDT also has the benefits of proven and "opaque", while BUSD has become a thorn in the side of US regulators.

In addition, there are USDP/GUSD, etc., which are relatively small, and the principle is the same. This time, after they declared that they have no exposure to Silicon Valley Bank, the risk is naturally smaller. However, it must be noted that large-scale bank problems will inevitably affect the centralized stable currency. No problem this time does not mean no problem next time.

image description

image description

secondary titlehttps://twitter.com/NintendoDoomed/status/1625076182550208512? s= 20

Currency holding + short hedging

Buying 1 ETH spot and then shorting the contract by 1 ETH looks good but the problem is:

You need to trust this exchange. A lot of the exchange’s assets are in stablecoins. UXD on Solana used to hold sol and empty sol on perp dex Mango. As a result, Mango was hacked unfortunately...

If you are short on the ETH/USDT trading pair, then in essence you are holding USDT, and if you are short on ETH/BUSD, you are holding BUSD, which eventually turns back.

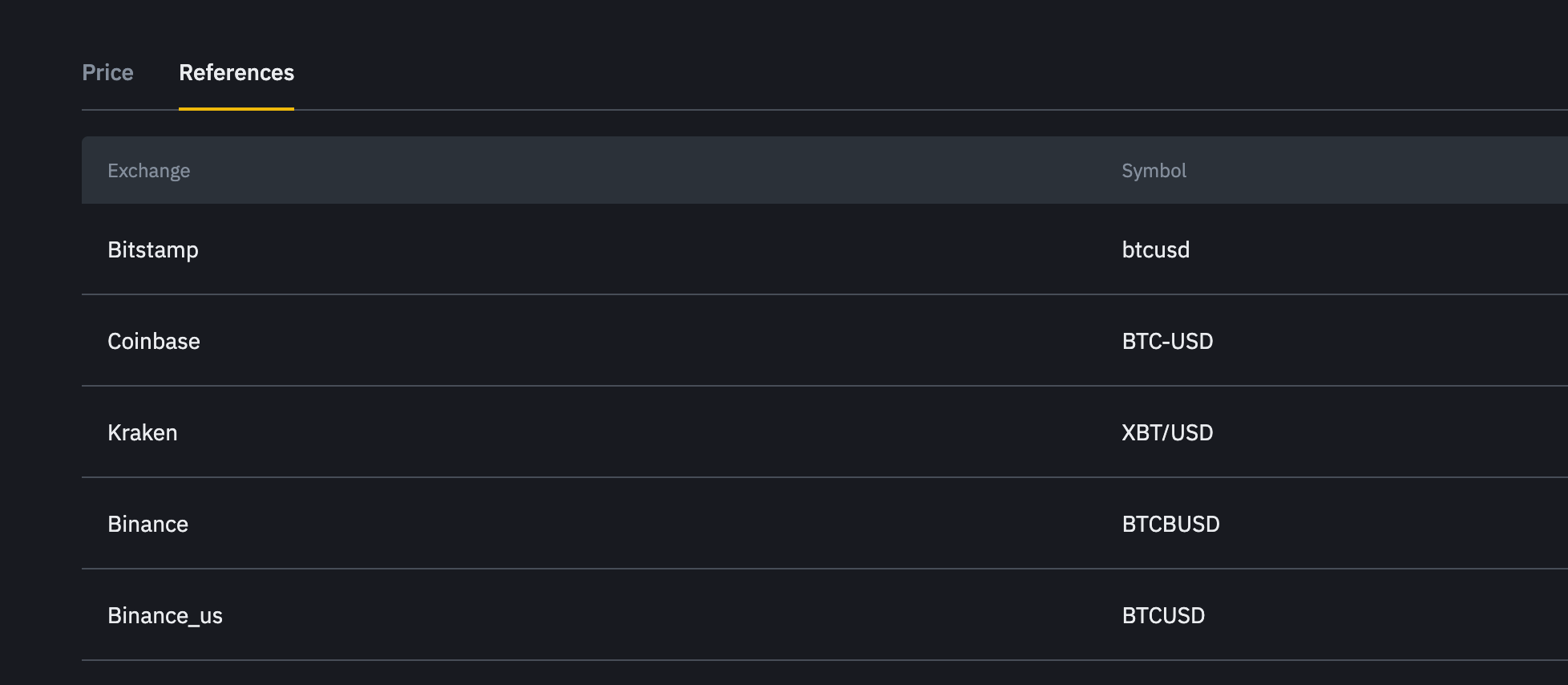

However, if it is a currency-based contract, such as Binance’s Index, which takes prices from real USD trading pairs, it seems to be a feasible solution.

Summarize

Summarize

From the schemes listed above in this article, you can find the most suitable escape path based on your own situation, but any indirect holding of US dollars in the currency circle is a solution that bears additional risks, and the safest way to hold US dollar assets It must be buying U.S. bonds. For the correct posture, please refer to the tweet.