Author: Kristof Lommers

Author: Kristof Lommers

Original translation: DAOctor@DAOrayaki.org

Original title: A Framework for DAO Token Valuation

In this article, we discuss a valuation framework for Decentralized Autonomous Organizations (DAOs). Although this paper is based on the theory of corporate finance, it introduces the concept of DAO native valuation. The valuation framework will enable the community to measure the DAOs performance in creating value for token stakeholders and help introduce more accountability to the development teams behind the DAO. It should be noted that the proposed DAO valuation framework is preliminary, as we are only learning about the characteristics of DAOs and how market participants value them.

Many protocols employ a dual company-DAO structure, where the company acts as the developer and operator of the DAOs underlying protocol. This article focuses on the valuation of the DAO token, which represents an independent valuation framework compared to the developers behind The DAO. We believe that the valuation of DAO tokens can be mainly carried out in two ways, namely the basic valuation method and the comparable analysis method. In the fundamental valuation approach, we try to value the DAO Token based on fundamentals, while in the comparable approach, we try to compare the DAO Token based on various metrics. Finally, we discuss various token-specific considerations that may be considered during the valuation process.

DAO Token Valuation

First, we need to define our pricing correctly. In this paper, we consider DAOs as organizations that (quasi) run autonomously on smart contracts and are governed by a community of stakeholders. A dual company-DAO structure exists for many protocols, where the company acts as the actual developer and operator of the underlying protocol delegated by the DAO. The companies behind the protocols are often created before the DAO and maintain ownership of the associated IP and assets. For example, Uniswap can be seen as a DAO with a governance token (UNI), where development is handled by the company Uniswap Labs. This article focuses on the valuation of the DAO token, which represents a separate valuation framework compared to the valuation framework used for the equity in the development company behind the DAO.

Web3 uses token economics for stakeholder and token incentive purposes to create proper decentralization and incentive alignment. Tokens are also used as a partial solution to the cold start problem, where token incentives are used to onboard users and reward appropriate user behavior. Fundamentally, a token’s value is expressed through community membership, the token’s utility within the ecosystem, and the governance rights that come with it. The value created by DAOs is generally not intended to distribute the generated value among token holders, but rather to provide utility and governance participation. In the absence of a legal debate involving securities — as this discussion is far from resolved — The DAO has been careful not to assign value directly to token holders, as this could lead to the token being classified as a security. The value created by the DAO can flow indirectly to the token holders through various channels - for example, one can value the value of staking, the interest of the community, membership and the overall growth of (parts of) the DAO. Depending on the circumstances, one could also incorporate direct value distribution into token holders, as some protocols do.

valuation method

First, there is no one-size-fits-all valuation method, and a DAO can cover many different concepts. For example, Hennekes (2022) categorizes DAOs into eight categories: Protocol DAOs, Grants DAOs, Charity DAOs, Social DAOs, Collections DAOs, Venture DAOs, Media DAOs, and Sub-DAOs.

Friend With Benefits DAO is a community-based effort that derives much of its value from social capital, while Orange DAO is a collective venture capital effort. Therefore, each DAO will require a valuation method specific to its category, and the importance of different factors will vary according to the DAO category. However, we can provide a general framework for considering valuations that can be broadly applied across different DAOs if appropriate class-specific adjustments are made.

We believe that the valuation of DAO tokens can be carried out in two main ways, namely, based on the basic valuation method or the comparable analysis method. In a fundamental valuation approach, one attempts to value the DAO token based on fundamentals related to the utility of holding the token and the expected growth in the tokens value. In the investment comparison method, one tries to compare DAO tokens based on various metrics. As the name implies, the fundamental valuation approach is more in line with trying to price tokens based on fundamentals, while the comparable analysis approach is a more market-aligned valuation approach that attempts to infer DAOs with comparable valuations from the market.

Fundamental Valuation Model

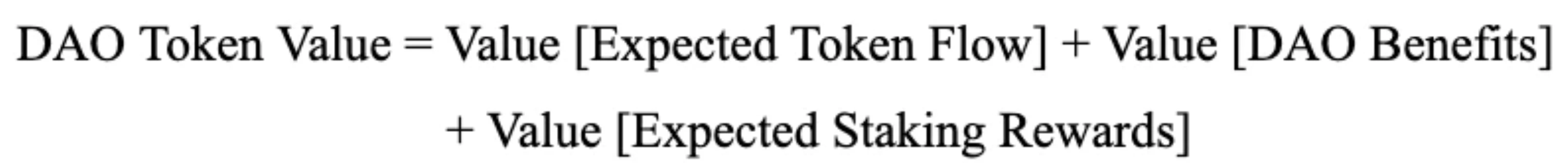

A fundamental valuation model for the DAO token can be considered in the following way

Valuation is both an art and a science, with many subcomponents requiring appropriate estimates and assumptions. In the following, we discuss the various subcomponents that play a role in the fundamental valuation of the DAO token.

A. Discount factor

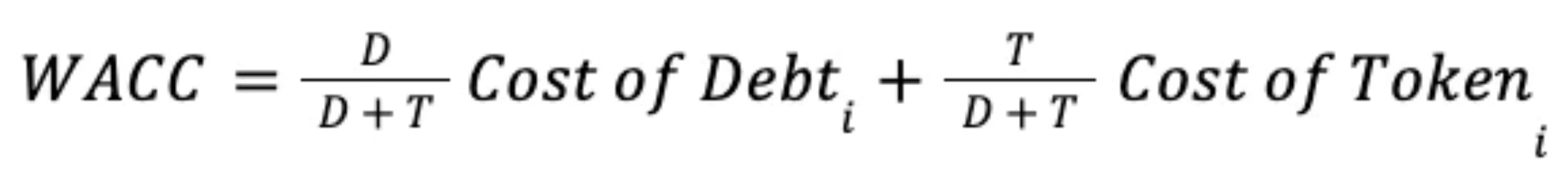

The discount rate can be estimated by the weighted average cost of capital (WACC), which is calculated based on the weighted average discount rates of its funding sources. These funding sources can include debt or equity (tokens). More specifically, WACC is calculated as follows:

Where D represents the debt value of DAO, and T represents the total value of DAO tokens.

For the cost of debt, we should simply take the value-weighted average of the rate at which the debt is charged. However, in most cases, there is no leverage in the DAO funding structure, which means that WACC is essentially equal to the token cost of capital.

We can estimate the cost of token capital by calculating the expected return within the framework of the DAO native factor model. The literature (eg, Liu and Tsyvinski, 2021) shows that the cryptocurrency market is an independent asset class with its own idiosyncratic movements and limited correlations with other macro asset classes. However, there is a relatively strong and increasing correlation with equities, and more specifically, the technology stock market. Especially DAO tokens, these tokens can be considered as stakeholders in the Web3 organization. We could borrow the concept of equity asset pricing, however, given the nature of this asset class, a DAO-native model approach would be required. Factor models have become popular in stock markets for estimating expected returns and estimating discount rates.

Previous research has shown that three-factor models capture a substantial portion of the systematic returns of cryptocurrencies. As shown in the principal component analysis of Botte and Nigro (2021), the first three factors account for about 70% of the co-movement, which is roughly consistent with the three-factor model for stocks. We’ve seen a shift in the crypto market, from token returns closely tied to Bitcoin to tokens that are increasingly decoupled from Bitcoin. Thus, there is a more idiosyncratic risk-reward in the crypto market, with DAO Token being more correlated to the DAO Token market segment and generally less correlated to the crypto market in the medium to long term.

For trading DAO tokens with sufficient history, we can use factor models to estimate expected returns. In the absence of transaction tokens (or too few data points), we can use a comparable set of DAO tokens and correct for relevant factors such as size and illiquidity. The factor models are built in two steps: first constructing the factor returns, and then performing a regression of the DAO tokens on the factor returns. Factor returns are estimated as returns on long-short portfolios that are rebalanced monthly and calculated on a value-weighted basis. However, Jiasun Li and Guanxi Yi (2020) find that the bullish factor in cryptocurrencies has greater significance. The greater significance of being long could be due to the relatively high cost of shorting cryptocurrencies, which creates less downward pressure. Standard practice in factor research is to value-weight portfolios, however, in cryptocurrencies, certain coins tend to have large dominance in terms of market capitalization, which would bias the value-weighting structure in favor of a small number of coins. Therefore, we recommend using a logarithmic value weighting scheme to confirm the market capitalization of the top coins, but not over-biasing the portfolio towards a few selected coins. Furthermore, factors should be estimated from data without survivor bias and including failed DAO projects.

We propose to use DAO Market, Ecosystem, Size, Value, Liquidity, and Momentum as factors in the DAO factor model. This represents the complementarity of the traditional 5-factor model with blockchain ecosystem factors. Market factors capture broad crypto market risk and are calculated as an average return across the DAO token universe. It should be emphasized that we exclusively use DAO markets and not general crypto markets. Ecosystem factors capture systemic correlations with the L1 ecosystem tokens (eg, Ethereum, Solana, Avalanche) on which the DAO is based. The DAO token is fundamentally tied to the ecosystem in which it exists. For example, a DAO on Ethereum relies on the Ethereum network to execute smart contracts and will have tokens within the ERC-20 framework. This ecosystem factor is calculated as an excess return relative to L1 ecosystem tokens (eg, ETH, SOL, AVAX). The size factor captures size risk and is calculated as the return for a portfolio that is long small DAO tokens and short large DAO tokens. Value factors in the traditional sense are difficult to define in DAOs. Value factors can be constructed from some of the metrics discussed in the comparison section of this article because these metrics represent measures of value based on financial and business variables. The liquidity factor captures liquidity risk and is calculated as the return of a portfolio that is long illiquid DAO Tokens and short illiquid DAO Tokens. Various liquidity measures are available, such as volume, bid-ask spread, or Amihuds illiquidity measure. Finally, the momentum factor captures momentum or trend exposure, calculating the return for a portfolio that is long the best performing DAO Tokens and short the worst performing DAO Tokens.

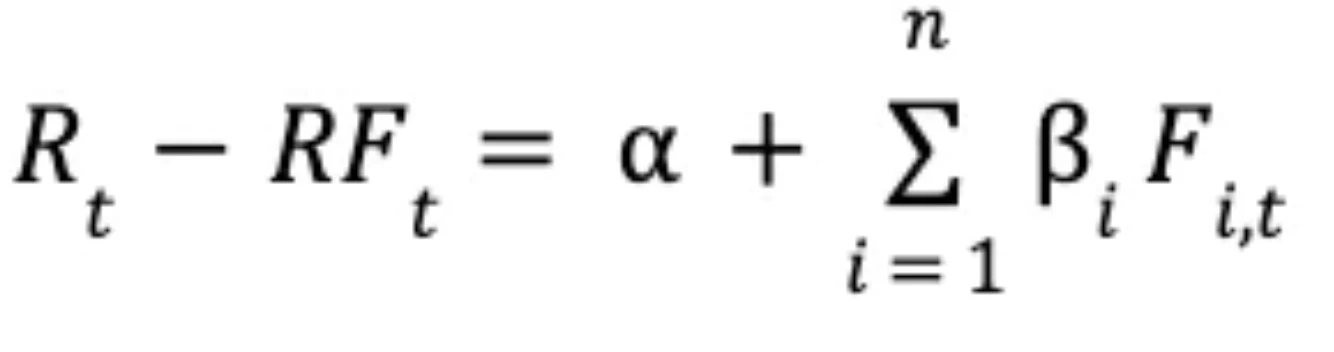

Finally, the regression of DAO tokens on factor returns is defined by

Among them, Rt represents the income of DAO tokens, RFt represents the risk-free rate or financing rate income, represents the alpha income of DAO tokens, i represents the exposure of DAO tokens to factor i, and Fi, t represents the income of factor i. The risk-free funding rate reflects the cost of liquidity. For example, liquidity in the Ethereum ecosystem is handled through ETH, where the staking return on ETH can be thought of as the base funding rate. The estimated beta coefficients can be used to calculate appropriate expected returns and discount rates.

B) Valuation of future token flows

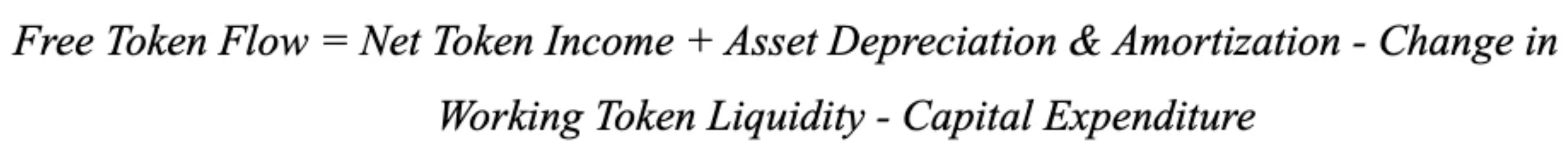

One of the most common underlying valuation models is the discounted cash flow (DCF) model, which is based on a discounted valuation of an entitys future (free) cash flows. Using a similar line of thought, one can think of a discounted token flow that can calculate the DAOs free cash flow. A DCF model uses three main components: cash flows, a discount rate, and assumptions about future expected cash flows (growth). In the case of a DAO, we can introduce the term Free Token Flow (FTF), which consists of the real token liquidity generated by the DAO, which can be calculated using net income, asset depreciation, work token liquidity changes, and system token payouts. calculate. More specifically, the free token flow can be calculated as:

Net income, asset depreciation, work token liquidity, and capital expenditures can be defined in traditional accounting and corporate finance practices. It should be noted that the field of DAO accounting is still young - cfr. Lommers, Ghanchi, Ngo, Song, and Xu (2022) discuss accounting for DAOs—and various methodological adjustments can be argued based on the properties of cryptographic accounting and DAOs.

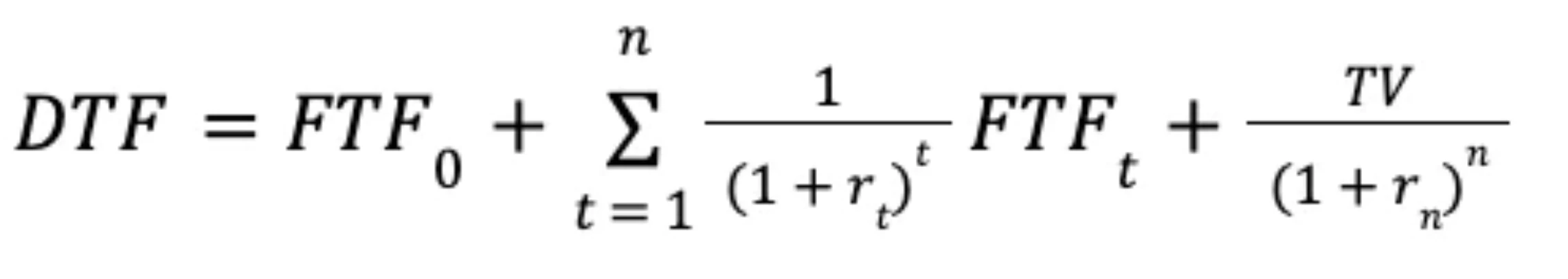

Discounted Token Flow (DTF) can be calculated as

Where FTFt represents the free token flow in year t, rt represents the discount factor in year t, and TV represents the future value.

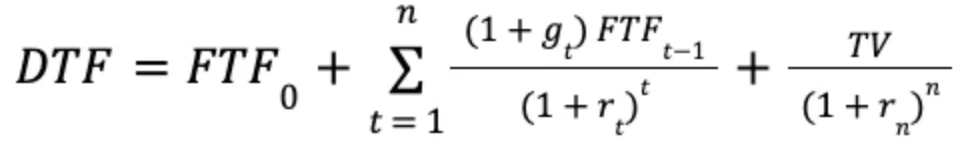

One can also assume that the DAO will grow as its segment grows and use that growth rate to estimate future free token flows. A recent McKinsey report (2016) supports the value of the discounted cash flow model for the valuation of technology start-ups. They recommend analyzing the expected long-term development of the segment the startup is targeting and working backwards from that. The DTF calculation becomes

Among them, FTFt represents the free token flow in t years, rt represents the discount rate in t years, gt represents the growth rate in t years, and TV represents the terminal value. A major assumption in the model will include future growth rates, but this can be dealt with through scenario analysis (e.g. continuation of growth rates, halving of growth rates, doubling of growth rates, etc.).

This token flow can be increased directly or indirectly to token holders. Such as repurchase and destruction mechanisms. Extend the value of token holders, direct distribution, etc.

C) Value of DAO Interest

Token ownership in a DAO can bring various benefits such as being part of a community, certain membership rights, governance rights, etc. As mentioned earlier, there is no one-size-fits-all approach in DAOs, and various DAOs can offer different benefits through the array of available options currently enabled by DAOs. For example, one benefit of most DAOs is that they are made up of community members. As Agarwal (2021) argues, communities are valuable in their own right, as they allow for the establishment of community-based collaborative initiatives, leveraging common resources, sharing knowledge and skills, and more. Governance rights are another common benefit of holding DAO tokens, reflecting the level of community participation in decision-making. To measure governance quality, Regner (2022) proposes various measures such as number of proposals, proposal threshold, proposal acceptance, voting participation, etc. Recently, there has been a lot of discussion in the community about whether governance rights have an impact on token value -- for example, Buterin (2022) believes that governance rights should not have an impact on token value --. We believe this can be determined on a case-by-case basis: whether value is distributed to token holders, how involved the community is in the operation of the DAO, etc.

There has been a recent discussion within the community about whether governance rights will affect token value - for example, Buterin (2022) argues that governance rights should not have an impact on token value. We believe this can be decided on a case-by-case basis: whether value is distributed to token holders, the degree of community involvement in the operation of the DAO, etc.

It should be noted that the benefits of a DAO may vary based on token holdings. For example, Mnema DAO divides the benefits provided into different tiers according to the number of tokens held, with the highest tier being more valuable than the lowest. In addition, being a large shareholder has certain strategic advantages in terms of governance, which can be said to be similar to the control premium in traditional corporate finance. Additionally, each token holder may value the DAOs earnings differently, so there is an element of discretion in this valuation process. However, one could try to estimate an approximate average of the benefits provided, which could be an avenue for future research.

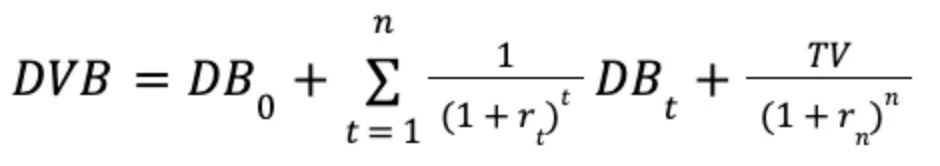

Finally, the discounted value of benefits (DVB) can be calculated as

Among them, DBt represents the value of DAOs income in year t, rt represents the discount factor in year t, and TV represents the future value of DAOs income in year t.

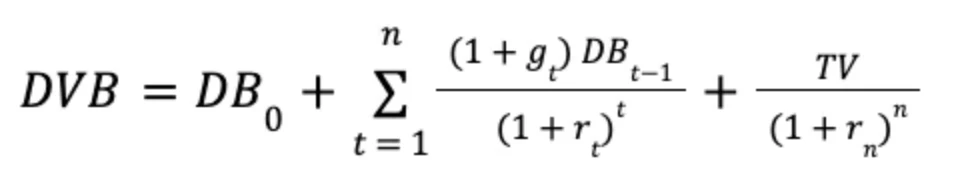

It is also possible to assume that the DAOs revenue will grow as the segment grows, and use this growth rate to estimate future revenue. In this case, the DVB calculation becomes

Among them, DBt represents the value of income in year t, rt represents the discount rate in year t, gt represents the growth rate in year t, and TV represents the final value of income. A major assumption in the model includes future growth rates, but this can be dealt with through scenario analysis (e.g. continuation of growth rates, halving of growth rates, doubling of growth rates, etc.).

D) Expected staking rewards

Most Web3 projects with native tokens allow token staking for blockchain consensus generation, token economics incentives, or protocol development, and these stakers are rewarded with tokens (Cong, He, Tang, 2022). In financial terms, think of this as generating passive income by locking up capital for a certain period of time. Thus, the expected staking reward discounted at an appropriate discount rate can be calculated. As mentioned earlier, ETH staking yield can be viewed as a cost of liquidity within the Ethereum ecosystem. Therefore, one could argue that the liquidity cost of a token in the Ethereum ecosystem is equal to the ETH staking yield plus an additional risk premium. The risks of staking mainly include the flexibility lost after the token is locked for a period of time: price fluctuations of the native token, project failure, and potential platform hacking (Royal, 2022). It should be noted that in order to motivate early users, staking revenue may be higher in the early stages. In these cases, staking yields can be significantly higher than risk-adjusted liquidity costs.

comparable analysis

Assuming that the value of the DAO token is linked to the value of the DAO, we can value the DAO as an entity using comparables for various relevant metrics. Comparable analysis uses ratios or metrics to determine valuation estimates. Whats more, it uses valuations based on similar competitors and is therefore a more market-aligned valuation method. Comparative analysis utilizes basic accounting and business information to calculate key metrics related to profitability, financial condition, user attractiveness, and more. We believe that DAO-native metrics need to be developed to assess organizations in this new paradigm.

Comparable DAOs can be defined in terms of category and size. If no comparable DAO is available in terms of the correct size and class, then you need to find the closest comparable. If comparable DAOs are found within a category but differ greatly in size, a size correction can be estimated. For example, the average valuation difference between large and small DAOs within a category can be estimated and used as a valuation correction. If possible, one should try to select different competitors and calculate a valuation range.

Standard comparability includes metrics such as revenue, profit, EBITDA and margin. There are many popular metrics used for Web2 companies, some of the most important metrics include monthly unique visitors, bounce rate, average order value, active users, customer conversion rate, churn rate, cost per visitor, and viral coefficient (Enterprise Finance Research Institute, 2022). These metrics can be used to compare companies and thereby value them relatively based on these metrics. In order to construct relevant comparability, it is necessary to distinguish DAOs from traditional (Web2) tech companies.

As stated by Hsu (2022), valuations in Web2 tend to focus on customer acquisition and user activity. We would argue that relevant factors in DAOs (and Web3 more broadly) include degree of decentralization, community engagement, protocol users, protocol development activity, integrations with other protocols, blockchain ecosystem metrics, and protocol revenue. Therefore, we can suggest the following metrics for Web3 valuation: unique protocol users and token holders, protocol fees collected, token holder participation in governance, protocol transaction volume, token transaction volume and velocity, community interaction ( e.g. Discord), financial spend and growth, protocol ecosystem growth, user acquisition costs in terms of token incentives (e.g. vampire attack) and user net present value (e.g. value received in tokens - value provided) . This list is by no means comprehensive and we hope to encourage the community to help expand this list of relevant Web3 metrics.

Comparable valuations are best performed by looking at different metrics that may be specific to the DAO type. For example, a DeFi protocol structured as a DAO requires different metrics than a social DAO. Total Value Locked (TVL) is considered to be one of the core indicators that people pay attention to when analyzing DeFi protocols. For example, Maker DAO (2021) presents total outstanding assets at risk, interest income correlation, net interest income, total outstanding DAI, DAI market share, DAI on-chain transaction volume, total interest income, and vaults opened. The relative overvaluation/underestimation of the DAO can be compared for each dimension, and a weighted average is performed according to the relative importance of the relevant dimension.

Other Token-Related Considerations in Valuation

Since token prices are a result of the balance between token supply and demand, it is important to consider token supply dynamics. Therefore, sustainable and sound token economics become part of the token valuation exercise. Protocol tokenomics should be composed in such a way that facilitates and optimally incentivizes the generation of production value. Since most cryptocurrencies in circulation represent utility tokens, one could argue that the token value should represent the utility of holding the token and describe the utility provided by the protocol ecosystem. Fundamentally, a sustainable tokenomics design will foster a stronger connection between token value and ecosystem utility. When comparing DAO tokens, one should correct for future token supply in order to make a proper side-by-side comparison. For example, an open token supply creates more uncertainty about future valuations than a fixed token supply.

Furthermore, as Samani (2017) argues. When valuing tokens, it is important to consider token velocity. Ecosystem growth does not necessarily mean price increases, as high-velocity tokens with no incentive to hold tokens appreciate less in price. Samani (2017) suggests some ways in which protocols can reduce speed, such as introducing profit-sharing mechanisms, building staking functionality, balancing burn and minting mechanisms, and gamification of incentives for holding.

Most DAO tokens are listed on decentralized exchanges, as listing on centralized exchanges can be a lengthy and expensive process. Especially for non-blue-chip tokens, liquidity can be low and transactions can have a large impact on price. This poses a significant risk to price fluctuations based on unusual trading activity. For example, if large holders sell their positions, this could have a significant negative impact on the token price. Related to this argument is the distribution of tokens, where the situation of large block holders can be considered to pose a significant risk. In this exercise, however, abstractions should be made about tokens held in protocol libraries, tokens in pool contracts, etc., as these tend to be more sticky or pooled for a specific purpose (e.g., token market making) Together. Additionally, early investors and development teams often have a vesting schedule in which tokens cannot be sold for a certain period of time. Vesting schedules have proven to be a consistent signal of token price movements, as investors tend to take advantage of opportunities to take profits. Therefore, valuations should take into account token vesting timelines, which could create significant downward pressure on prices in the short term. In addition, the liquidity of the treasury is also important. As Regner (2022) argues, DAOs tend to hold a large allocation of their own tokens in the treasury. For treasury business, liquidity is very important. If other tokens are illiquid, the Treasury will need to sell its own tokens, creating downward pressure on prices. Especially in the case of relatively illiquid small and mid-sized DAO tokens, treasury token sales can have a big impact on price.