Cobo Labs is the largest cryptocurrency custody platform in the Asia Pacific and the cryptocurrency research laboratory of Cobo, the most popular financial management service provider for institutions.

We focus on innovative projects, cutting-edge encrypted digital technology, global market compliance trends, market fundamentals and volatility factors; aiming to help market participants and cryptocurrency enthusiasts lower the cognitive threshold for entering the market.

Cobo Labs is the largest cryptocurrency custody platform in the Asia Pacific and the cryptocurrency research laboratory of Cobo, the most popular financial management service provider for institutions.

We focus on innovative projects, cutting-edge encrypted digital technology, global market compliance trends, market fundamentals and volatility factors; aiming to help market participants and cryptocurrency enthusiasts lower the cognitive threshold for entering the market.

Core content creators include:

- Co-founder and CEO of Shenyu (Mao Shixing) Cobo, co-founder of F2Pool

- Lily Zhuo Cobo COO, Former General Legal and Compliance Counsel of Well-Known US$40 Billion Fund

We also hope that lifelong iterative learners who have research spirit and scientific methodology in the field of encrypted digital currency can join us and export thinking insights and research views to the industry!

We also hope that lifelong iterative learners who have research spirit and scientific methodology in the field of encrypted digital currency can join us and export thinking insights and research views to the industry!

foreword

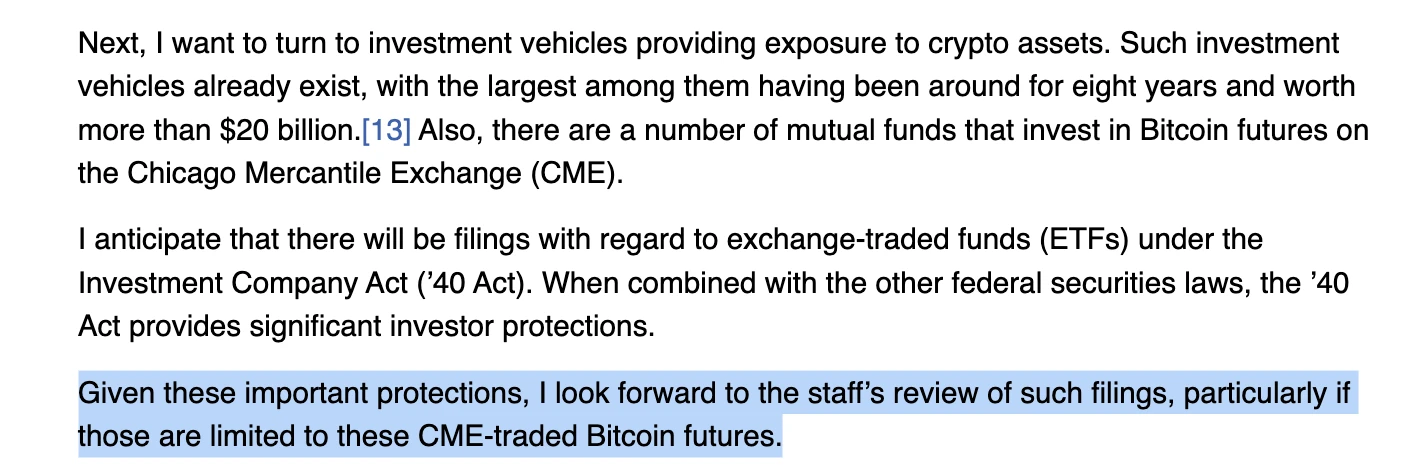

This is the third article of Cobo Labs."After 8 years of fighting with regulation, many fund managers believe that the market is expected to usher in the first tradable U.S. Bitcoin ETF this year. We can see some obvious signals from the speech of Gensler, Chairman of the US Securities Regulatory Commission, at the Aspen Forum in August (https://www.sec.gov/news/public-statement/gensler-aspen-security-forum-2021-08-03 ), he made it clear that “I would very much like my colleagues to review an ETF based on CME Bitcoin futures

, he gave an obvious signal to Wall Street, first of all, he wants to have a Bitcoin ETF, and secondly, a futures-based ETF, not a spot ETF. Regardless of whether this is the most correct choice, as far as the moment is concerned, we have seen a great improvement in supervision. The market’s confidence in this Bitcoin ETF is unprecedentedly high. Multiple sources said that many SEC individuals are also buying Bitcoin, looking forward to the arrival of the ETF.

image description

(Speech by Gensler, chairman of the US Securities Regulatory Commission)

Gold ETFs

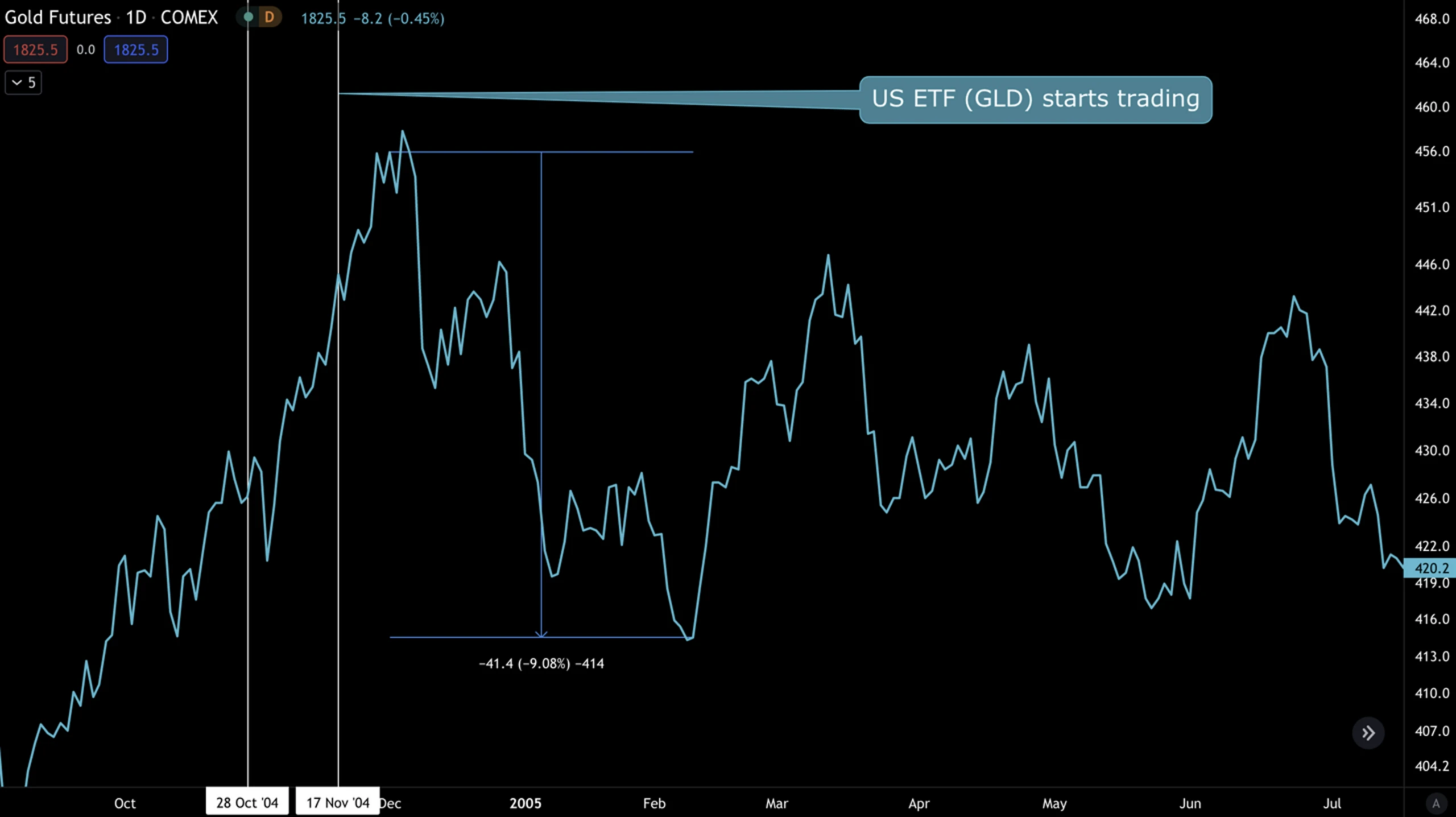

The chart below shows the history of gold ETFs. In 2003, Australia opened the worlds first ETF, and then Americas first gold ETF, GLD, was approved by the SEC in late October 2004 and started trading in November 2004.

image description

The following is the historical price chart of gold. The reason why we discuss the historical trend of gold ETF is to see whether Bitcoin will go out of a similar market.

When we zoom in on the K-line at that time, it will be more obvious: from the low point in 2001 to the passage in late 2014, before the ETF approval, the price of gold increased by 76%.

image description

This may give us a reference to buy ETFs before the approval of the United States, but what about the market after that? Do you need to sell the news?

Through the K-line below, we can see that in the next month after the ETF was passed, the market immediately fell by 9%, and then the market entered a sideways shock, and the effect of the ETF began to appear.

image description

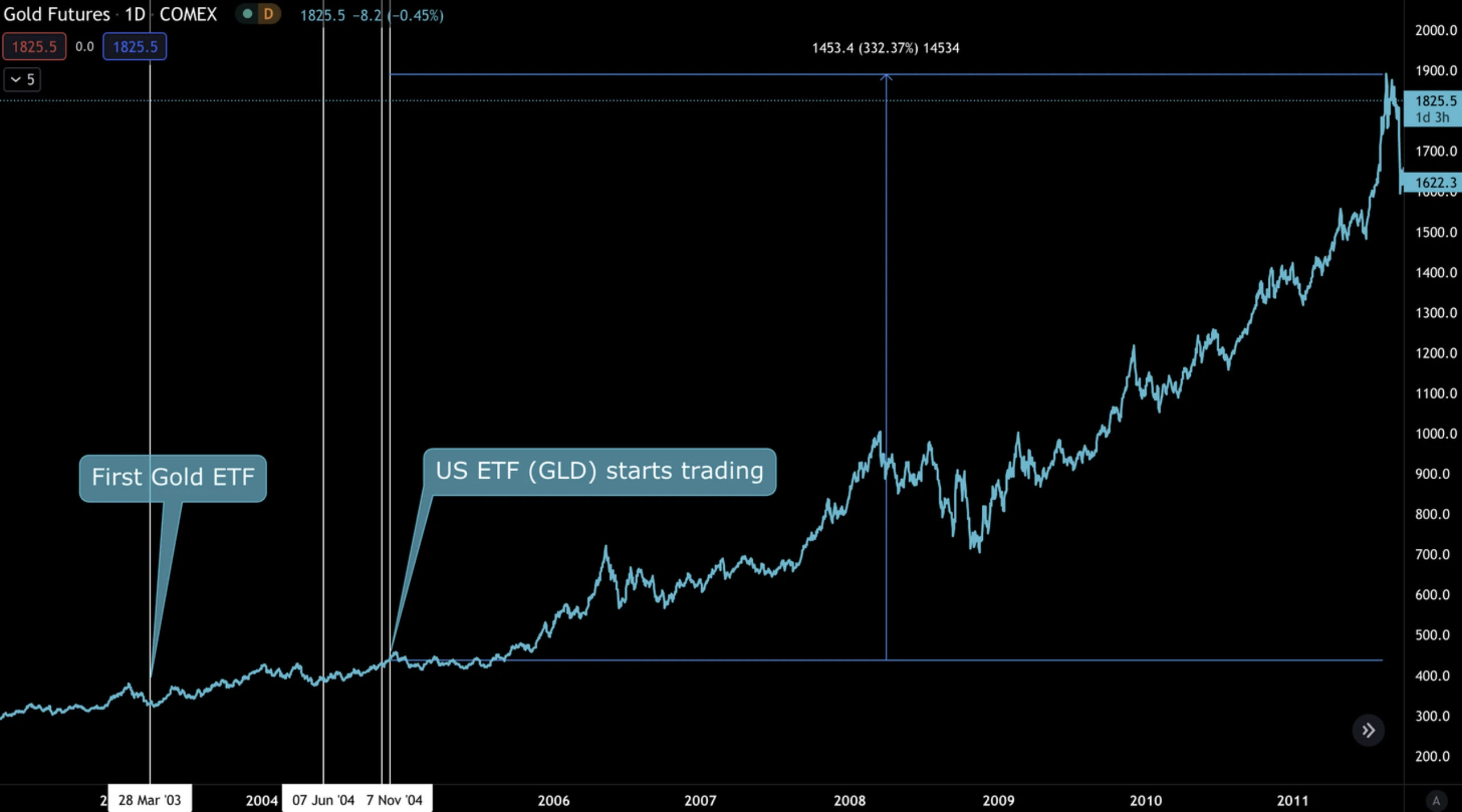

As more traders have easier access to precious metals, it also means that new trade participants can gain exposure to gold through ETFs without having to take custody of the metal, hire auditors, park it in a bank, etc. Sound familiar? ? As it became easier for new traders to buy this asset on the open market, what happened next was a matter of course.

image description

(After the adoption of the gold ETF, gold has come out of the crazy bull market in a few years)

Bitcoin ETFs

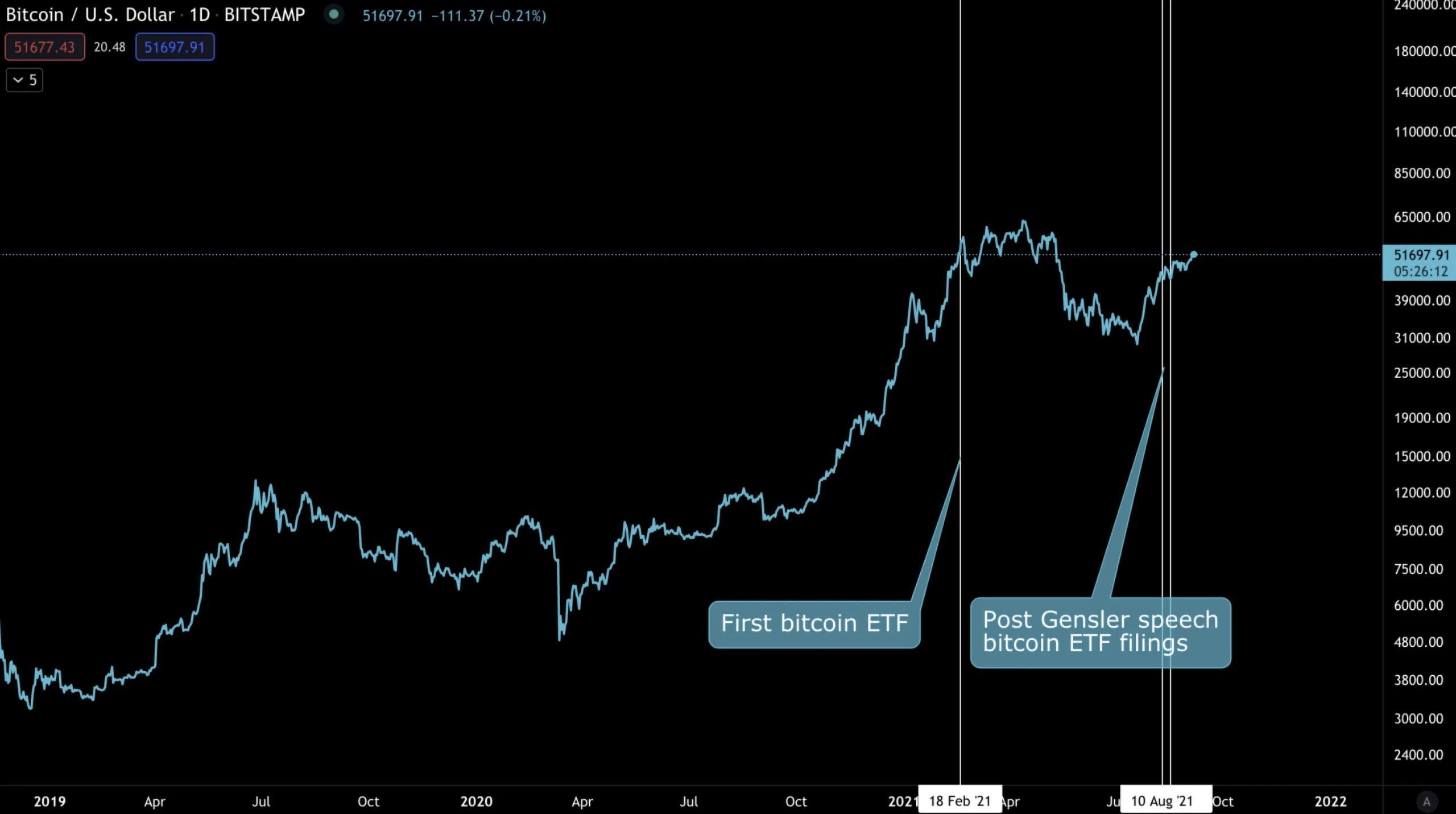

Now we look back at the history of Bitcoin. In February 2021, the worlds first Bitcoin ETF was passed in Canada. In August, we saw the friendly speech of the US SEC chairman on the Bitcoin ETF.

Generally, the average time from submission to approval of an ETF is 221 days, and the longest will not exceed 240 days. Therefore, we believe that the first ETF in the United States may be approved in March or April 2022, although many people think that it will be approved before Christmas this year. It can be seen to pass, but according to history, it may not be able to finally pass this year.

summary

text

summary

It is safe to say that the market will like Bitcoin ETFs, and it is very attractive to allocate funds to an asset class with low inflation and a limited amount. Keeping supply constant, more demand will only result in higher prices.

However, we cannot ignore that this is a CME futures-based ETF, which will necessarily have lower demand than a spot-based ETF. More downward pressure can be created by CME futures, which are paper contracts where traders can short more than 21 million bitcoins.

We are generally optimistic, but the biggest concern is that Wall Street will definitely create more products that lock up liquidity like Grayscale, making Bitcoin less circulating in the market, and transaction transfers do not occur on the Bitcoin network , if this trend continues, the interests of miners will be affected. If the transaction volume on the chain continues to shrink, will miners leave?

While we dont know how things will play out in the future, we dont need to worry about the next 4-5 years, especially if the ETF is passed next year, and the short-term impact will not be apparent.

More entities, individuals, funds, companies, etc. will have easier access to Bitcoin, and once this catalyst occurs, it will go higher in a few years, similar to what we have seen with gold. After the catalyst pushes the market to new highs, we can start the cybersecurity debate again. But for now, its UPONLY an opportunity, as long as its approved.

Risk Warning: All Cobo Labs articles cannot be used as investment advice or recommendations. Investment is risky. Investors should consider personal risk tolerance and make their own investment decisions carefully.