Why are all the top projects betting on "participation in financialization"?

On the eve of TGE, OpenSea clearly stated that historical contribution to trading activity will be an important indicator for measuring airdrop weight, and similar stories are constantly unfolding in Web3. From the buzz surrounding infoFi to behavioral incentives on task platforms, the concept of behavioral financialization is reshaping the way value is distributed through reliable behavioral mapping mechanisms and incentive systems.

"Participatory financialization" represents a deeper evolution: how to retain users and make them more valuable. Every instance of user participation is no longer a one-off event, but rather becomes long-term value that can be accumulated, valued, and redeemed. It transforms "participation → value → re-participation" into a growth flywheel, thereby completely reshaping the logic of user retention.

01. The Shift: From "Speculative Growth" to "Participatory Financialization"

Over the past five years, we have experienced: narrative-driven, airdrop-driven, emotion-driven, and now the hottest trend: attention-driven.

Behind the narrative of the battle for attention provided by infoFi, we find that, driven by the attention economy and on-chain verifiability, user behavior has for the first time acquired a “measurable price,” and participation itself is becoming a measurable and settleable asset.

We've previously discussed how the full spectrum of finance enabled by Web3 expands the expression of value beyond "assets" to encompass the sum of information, attention, emotion, and trust. This is precisely the core proposition of the "Internet of Value": everything that can be perceived, disseminated, and traded can be financialized.

In BTCFi, AI, InfoFi, social protocols, L2, DEX, and even RWA, every top project is doing the same thing—creating user engagement behavior into user paths, focusing more on the value inherent in retention and continuous contribution.

Whether you are a BTCFi user participating in Aura Mining, a contributor feeding data to the AI Agent, a governance participant on the Optimism Superchain, an active trader in the Solana ecosystem, or a content node in a social protocol, every interaction will become part of your future benefits.

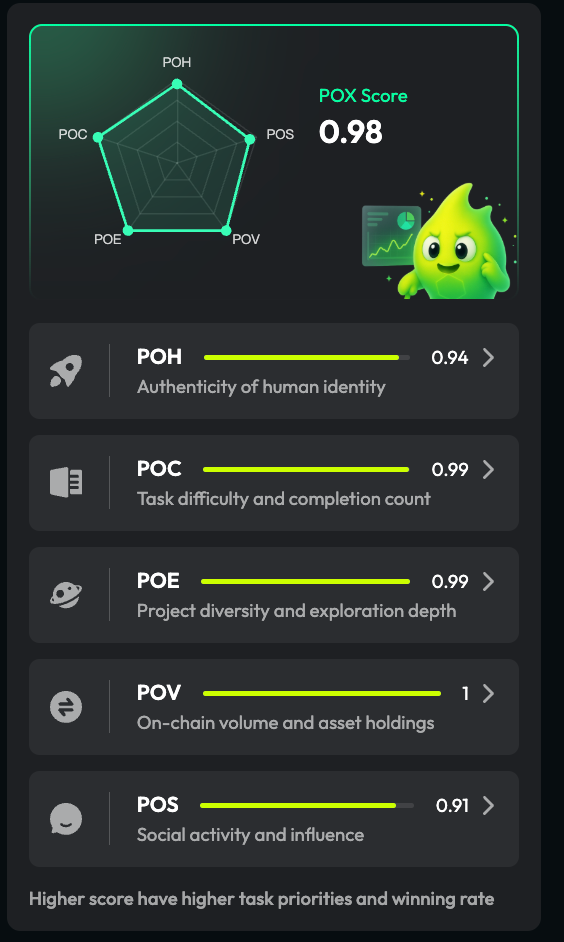

Participation in financialization is not an abstract concept; it is being instrumentalized by growth products. TaskOn's recently launched POX Score is a representative attempt to analyze user behavior and retention in the growth field. The higher the POX score, the greater the chance of earning rewards. By incentivizing users to improve their POX scores based on future expectations, it points users to the path to high rewards and motivates them to work harder. This is a precise user retention system—a positive growth flywheel.

02. Why does participation become an "asset"?

Does this sound a bit like the project team using PUA tactics to get users to work for free? In fact, participating in financialization is more like value-added content attached to the "X-to-Earn model". From users contributing to the project → obtaining benefits, to users continuously contributing to the project ecosystem → points system/on-chain footprint → ecosystem co-construction and sharing, it has changed from a single incentive to a deep binding of value and incentive.

Below, we'll break down some of the most popular sectors to see how to achieve "participation in financialization".

A. BTCFi: Participation = Yield Rights

BTCFi, represented by BounceBit, SatoshiVM, Babylon Protocol, and Pendle, is directly linking "participation" with "right to profit":

- Staking → Yield Stream

- On-chain contribution → Allocation Priority

- Governance participation → The value expression of decision-making power

The essence of BTCFi is to use BTC as the "underlying yield engine" so that every on-chain participation of users can be mapped to "future yield distribution rights".

B. AI × Web3: Participation = Data Dividend

Companies like Bittensor, FLock.io, Aethir, and ChainGPT have come to view "participating in training/providing data" as an asset.

- Data contribution = Data Credits

- Interaction with the AI Agent = a measurable "engagement curve"

- Continued participation in training nodes = long-term benefits and privileges.

AI's "participation equals value" is even more thorough than InfoFi's.

C. Layer2 & Airdrop Banking: Participation = Discounted Value of Future Airdrops

In top-tier L2 libraries such as Arbitrum, Base, zkSync, Linea, Starknet, and Mantle, users no longer focus solely on the benefits of a single action, but rather view the "participation path" as an expected form of accumulative future benefits.

Every Bridge, Swap, Delegate, and vote becomes a "discount signal" for potential future benefits.

D. DEX/Trading: Participation = Fee Discount + Rebate + Level

Trading platforms such as Hyperliquid, Jupiter, Raydium, and Uniswap are all assetizing trading activities.

- XP / points represent potential future airdrops.

- Level determines fees, priority, maker/taker rewards, etc.

- Activity level determines subsequent rewards

Transactions are no longer just actions, but rather "the accumulation of future equity".

E. SocialFi: Participation = Relationship Assets

For example, Farcaster, Lens, Friend.tech, Fantasy:

- Content interaction becomes a form of "identity and credit".

- On-chain relationship chains possess asset-like attributes

- Scenario participation gives accounts social capital

F. Growth Platform: Infrastructure for Validation and Incentive Layers in Financialization

Growth platforms like TaskOn are reshaping the value of user data, transforming it into a traceable, verifiable, and incentivized asset for participation.

- Accumulated assets: Points / EXP / Level / Milestone

- Redeemable benefits: WL, qualification, Allocation, lottery probability, extra rewards for transactions

- Can display identity: Leaderboard, contribution level, public identity

- Compounding Cycle: Level → Benefits → More Participation → Higher Levels

This can drive short-term growth while also building long-term relationships. It establishes ownership over user behavior, becomes an entry point for behavioral assets, and constructs a long-term incentive system.

03. How to promote "participation in financialization"?

In the entire Web3 growth paradigm, how can we transform participation behavior → rights confirmation → quantification → settlement → ultimately into quantifiable long-term value?

Whether it's BTCFi, DEX, AI×Web3, InfoFi, or more traditional trading and governance activities, a complete user engagement cycle typically includes three things:

- Action occurs.

- Behavioral verification (Proof)

- Incentive (Value Realization)

By guiding users at the interaction layer and automating the verification layer, participation becomes executable, traceable, incentivized, and reciprocal. At the incentive layer, user behavior value is anchored through systems such as points and NFTs, giving users clear goals for the long-term path.

Myriad, a Web3 prediction market protocol incubated by Decrypt's parent company, allows users to earn Points through tasks such as daily check-ins and content sharing to participate in prediction markets. High scores and high win rates will get you onto the leaderboard, and this prestige may translate into community recognition or special rewards in the future.

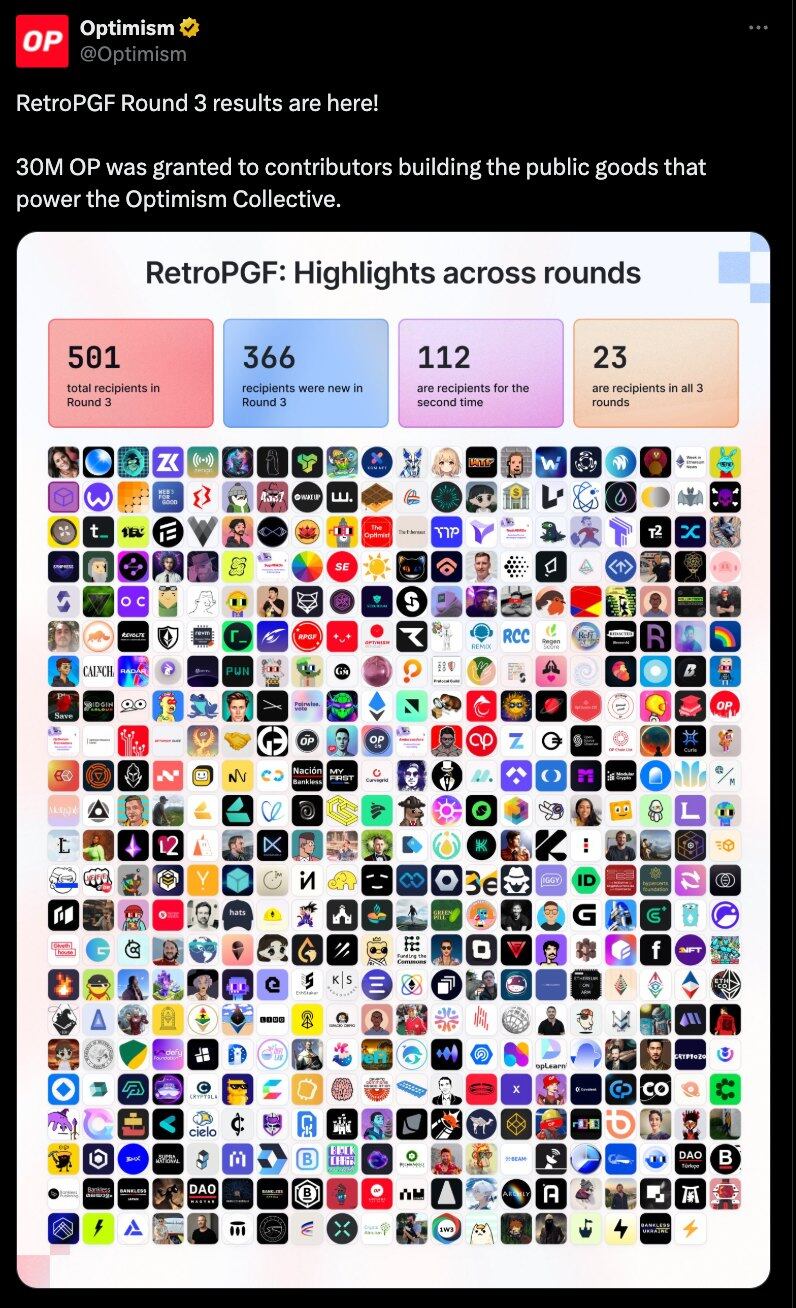

1. Optimism RetroPGF: Participation = Retrospectable Long-Term Value

Optimism's RetroPGF is the first to upgrade "participation" from an immediate action into a traceable, quantifiable, and settleable long-term asset. Contributors' actions are stored in a public contribution graph, which is then reviewed in the future to reassess past contributions, tracing them back to actual OP governance, incentives, and funding allocation.

RetroPGF's core logic is: Participation path = Publicly contributed assets = Future realizable value

- Participation is not an instant reward, but rather something that is systematically accumulated.

- The contribution curve will be quantified, reviewed, and recorded;

- Future returns depend on the quality and impact of past participation;

- The value of projects, communities, and individuals is reflected in the long term, rather than driven by short-term behavior.

Optimism makes "participation" a quantifiable, governable, and sustainable asset, enabling participants to obtain real long-term value through institutional design.

2. TaskOn: Gamification Design of User Retention System

On the growth platform TaskOn, in the dual growth of projects and users, their growth tools include: intelligent, results-oriented Quest setup templates and intelligent verification tools, which enable users to "know what to do" and "follow the path," and make user behavior "real, credible, and measurable."

And at the end of the campaign, TaskOn's incentive system began to have a retention effect:

- Points / EXP: Provides immediate incentives

- Level: Long-term growth mechanism

- Milestone: Achievements at a Stage

- Benefits Shop: Points Redemption Benefits

- Leaderboard: Amplifying the Value of Participant Identity

TaskOn serves as the infrastructure for the transition from "participation behavior" to "assetization." It can be seen as a standardized implementation of participation-based financialization in the field of user growth.

Meanwhile, TaskOn launched a brand-new POX rating system that cross-rates user identity and participation behavior across five dimensions:

- Proof of Human Nature (POH): A signal of trustworthiness, such as wallet/social binding and KYC.

- POC (Proof of Contribution): The frequency, quality, and consistency of task completion.

- POE (Proof of Exploration): The breadth and depth of exploration of new chains, functions, and events.

- POV (Proof of Value): On-chain asset size and transaction activity.

- POS (Proof of Social Relationship): Genuine interactions on X/Discord/Telegram.

Through multi-dimensional cross-validation, the authenticity of participation and anti-witness capabilities have been significantly improved, and a clear growth path has been provided for users: improve rating → unlock more features/rewards.

4. Conclusion: Participation itself is an asset.

Participation in financialization is not a small narrative, but a grand trend of Web3 moving from "short-term activities" to "long-term value systems".

Different tracks require different behaviors, but all tracks need a complete participation cycle of "trigger-validate-incentive". Web3 projects need to start from their own product characteristics and use tools that can validate, grow, and retain users to connect this cycle so that behaviors can be executed, validated, and incentivized.

Financial participation is not merely a tool or trend, but a process of restructuring the Web3 value system. It transforms participation into an asset, paths into value, and retention into a core driver of growth. All future Web3 products will require a complete participation cycle of "trigger-validation-incentive."

This will become the true growth paradigm for Web3 in the future.

- 核心观点:Web3正将用户参与行为金融化。

- 关键要素:

- 用户行为可计量为资产价值。

- 参与形成可累积的长期权益。

- 构建"参与-价值-再参与"增长飞轮。

- 市场影响:重塑价值分配与用户留存逻辑。

- 时效性标注:长期影响