Rewriting Ethereum's Scaling Logic: Monad's Parallelized "Parallel Universe"

I. Project Introduction

Recently, Coinbase announced the launch of its token public sale feature, with the first project being the highly anticipated Monad. Starting November 17th, 7.5 billion $MON tokens will be sold to the public at a price of $0.025 each, representing 7.5% of the total supply. This public sale round values the tokens at $2.5 billion, while Monad is priced at approximately $0.051 in the pre-market market on Binance, corresponding to a market capitalization of $5.1 billion.

Monad's high valuation is primarily due to its technological innovation and top-tier capital backing. In today's blockchain development, performance and compatibility have always been seemingly insurmountable obstacles. Ethereum laid the foundation for smart contracts but is plagued by low throughput and high transaction costs. Meanwhile, high-performance public chains that prioritize speed often sacrifice decentralization and ecosystem compatibility. Faced with this dilemma, Monad built a parallel architecture from scratch: through the MonadBFT consensus mechanism, asynchronous execution engine, and RaptorCast, it proves that high performance and full EVM compatibility can coexist. The practical significance of these technological breakthroughs lies in allowing developers to seamlessly migrate native Ethereum applications, while users experience near-real-time on-chain interactions within a familiar environment.

Technological innovation and product positioning have earned Monad recognition from top-tier investors. In 2024, it completed a $225 million funding round led by Paradigm, with participation from dozens of well-known institutions including Coinbase Ventures, Wintertermute, Amber, and GSR, building a solid ecosystem backing. Monad's high-performance and fully EVM-compatible design is propelling it towards a core role in next-generation decentralized application infrastructure. Its 10,000 TPS throughput, 1-second final confirmation, and average gas fees below 1 cent not only break Ethereum's performance ceiling but also provide viable underlying support for complex scenarios such as high-frequency trading, large-scale blockchain games, and real-time data interaction. With this architecture that balances speed and compatibility, Monad is poised to become one of the key underlying platforms supporting future Web3 ecosystem innovation.

II. Project Mechanism

Monad's design goals revolve around three points: making development easier, transactions faster, and the network more secure and decentralized.

● EVM Compatibility: Monad is fully compatible with EVM bytecode, meaning developers can directly migrate Ethereum contracts, tools, and DApps without needing to relearn languages like Move or Rust. Furthermore, it optimizes EVM execution efficiency, making instruction scheduling and state access during contract runtime much faster. Unlike Ethereum's linear execution, Monad employs an instruction-level parallel scheduling mechanism, allowing the same batch of transactions to run in parallel on a multi-core CPU architecture, fundamentally improving throughput.

● High Performance: Performance is Monad's core competitive advantage. Through its self-developed MonadBFT consensus mechanism, RaptorCast network protocol, asynchronous parallel execution, and just-in-time compilation optimization, Monad achieves a processing capacity of up to 10,000 TPS, with block generation time of only 0.5 seconds and confirmation within 1 second. Its transaction execution speed and stability are sufficient to support complex application scenarios such as high-frequency trading, on-chain games, and real-time AI interaction, while the average gas fee is less than 1 cent.

● Decentralization: Unlike many high-performance blockchains that rely on ultra-high-configuration nodes or centralized orderers, Monad achieves truly fair participation through a globally distributed validator network. Any node with ordinary hardware can join the validator layer, effectively preventing the concentration of computing power and the monopoly of governance rights.

III. Token Economy

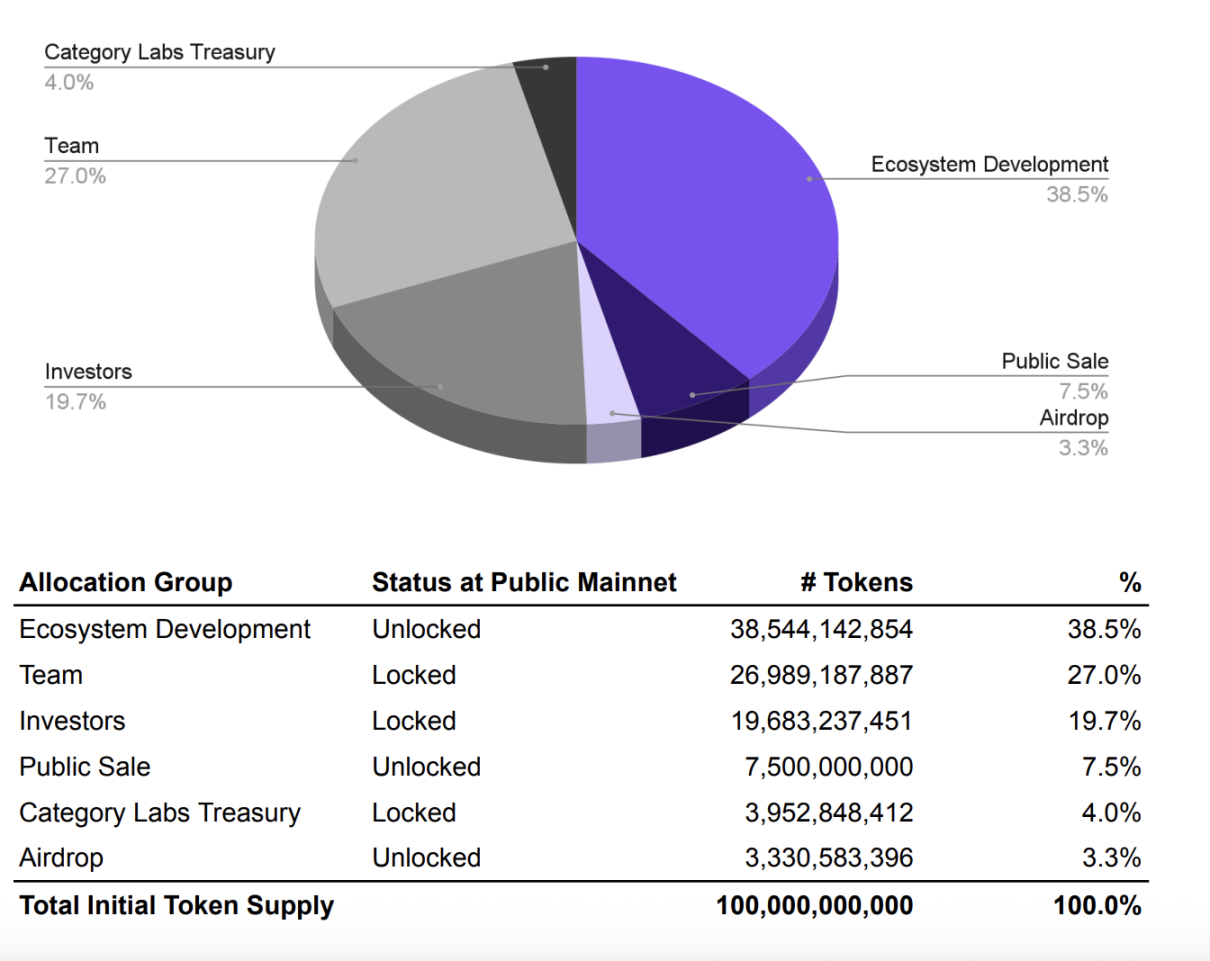

Monad's native token, MON, is the network's core asset, used to pay gas fees and for staking to maintain security. At mainnet launch, the total supply is 100 billion MON, of which approximately 10.8% (10.8 billion) will be unlocked and circulated upon launch, primarily distributed through a public sale (7.5%) and airdrop (3.3%). Approximately 38.5% (38.5 billion) is allocated to ecosystem development and managed long-term by the Monad Foundation; the remaining 50.6% (50.6 billion) belongs to the team, investors, and CategoryLabs, all locked for at least one year and gradually unlocked over four years. Specifically, the team receives 27% (27 billion MON), vesting one year after mainnet launch; investors hold 19.7% (19.7 billion MON), locked for one year and unlocked linearly monthly; and CategoryLabs receives 3.95% (3.95 billion MON) as future incentives, with the same unlocking rules. The Foundation plans to delegate 15-25 billion MON to validators for network security and ecosystem incentives.

MON employs a dynamic supply mechanism: approximately 25 MON are issued per block as staking rewards, with an annual inflation rate of about 2%; simultaneously, a portion of the transaction base fee will be burned, creating deflationary offsetting. It is expected that all locked tokens will be unlocked by Q4 of 2029 (the fourth anniversary of the mainnet launch).

IV. Market Performance and Ecosystem Projects

Kuru Exchange

Kuru is an on-chain order book DEX on Monad, integrating an AMM and connecting to all major liquidity sources. The project employs a dual architecture of account custody and a Lite mode, catering to both professional traders and novice users, and is one of the DEXs with the largest trading volume in the ecosystem. It supports Pro order book trading and Lite easy exchange. In 2025, it secured $11.6 million in Series A funding from Paradigm, Electric Capital, and other institutions.

aPriori

aPriori is Monad's native MEV infrastructure and liquidity staking protocol. Users can earn aprMON by staking MON, capturing staking rewards and network MEV earnings. The protocol is designed for Monad's parallel execution environment and incorporates a probabilistic MEVA model. By 2025, it had raised over $30 million in funding, making it one of the most funded DeFi projects in the ecosystem. Staking is already available on the testnet.

Castora

Castora is a decentralized P2P prediction market on Monad, similar in mechanism to Polymarket. Users pay an entry fee to participate in predictions, and the one whose prediction is closest to the snapshot price wins the prize pool. Currently, the ETH price prediction pool is open, with each bet of 10 USDC. If the prediction is correct, the user receives the entire pool's reward.

Kintsu

Kintsu is a liquidity staking protocol built on AlephZero and Monad, created by the former head of strategy at Pangolin. In 2025, it secured $4 million in funding from CastleIsland Ventures and other institutions, and will launch sMONADLST during the first week of the Monad mainnet launch. Its sTZERO platform on AlephZero is already live on the testnet, allowing users to stake TZERO to obtain liquidity staking tokens.

Modus

Modus is an on-chain prime broker on Monad, serving high-value DeFi users. The protocol integrates lending, Deltaneutral strategy treasury, and auction liquidation, returning profits typically taken by liquidators and arbitrageurs to LPs and protocol participants, thus improving capital efficiency.

V. Coinbase IPO Analysis

In terms of valuation, the market's pre-market valuation for Monad is currently close to $5 billion, while the valuation corresponding to the public offering is approximately $2.5 billion. Therefore, the token price after listing will most likely fall between $0.025 and $0.05. However, it should be emphasized that all tokens in circulation initially come from the public offering and airdrop, and both will be unlocked simultaneously upon listing. Coupled with the project's high market capitalization, it will inevitably face significant selling pressure in the short term, and the opening price may experience sharp fluctuations.

From the perspective of token economics and the current market environment, participating in the Coinbase public offering carries significant risks. Firstly, the full unlocking of both the public offering and airdropped tokens means that the opening price will immediately create a selling pressure window. At a price of $0.05, the initial potential selling pressure is approximately $540 million. Given the current weak overall market, whether there will be sufficient funds to absorb this pressure remains uncertain. Secondly, due to Coinbase's strong compliance requirements, the eligibility verification for non-US users is relatively strict. Whether overseas users can successfully pass KYC and whether they will face additional restrictions afterward is currently unknown. Regarding price expectations, if the opening price is $5 billion, the theoretical return for public offering participants in an optimistic scenario would be close to double. However, since October 11th, the altcoin market has generally been sluggish, and the initial performance of many recently listed tokens has been significantly weak. Therefore, participating in Monad's initial offering still carries a high risk of short-term losses and requires careful evaluation.

VI. Conclusion

Overall, Monad's core competitiveness lies in maintaining high performance while achieving full compatibility with the EVM, providing a viable infrastructure for complex applications such as high-frequency trading, blockchain games, and real-time interaction, and allowing developers and users to smoothly migrate within the familiar Ethereum ecosystem. However, in the current competitive landscape of public blockchains, technological capabilities have shifted from "determining the upper limit" to "determining the lower limit." What truly influences the ceiling of a public blockchain is the speed of ecosystem expansion and market positioning. Currently, the Monad ecosystem is still in its early stages, and no dominant project has yet emerged in any specific segment. However, the emergence of projects such as Kuru, aPriori, Castora, Kintsu, and Modus has initially formed a diversified ecosystem covering trading, liquidity staking, prediction markets, and institutional-grade DeFi tools, indicating significant future growth potential. Based on Monad's technological characteristics, DEX, blockchain games, and high-frequency trading projects within the ecosystem deserve continued attention.

Risk warning:

The information above is for reference only and should not be considered as advice to buy, sell, or hold any financial assets. All information is provided in good faith. However, we make no representations or warranties, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of such information.

All cryptocurrency investments (including financial products) are inherently highly speculative and carry a significant risk of loss. Past performance, hypothetical results, or simulated data are not indicative of future outcomes. The value of cryptocurrencies may rise or fall, and buying, selling, holding, or trading cryptocurrencies may involve significant risks. Before trading or holding cryptocurrencies, you should carefully assess whether such investments are suitable for you based on your investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

- 核心观点:Monad通过技术创新实现高性能与EVM兼容。

- 关键要素:

- 完全兼容EVM,支持无缝迁移。

- 10,000 TPS高吞吐,1秒确认。

- 获得Paradigm领投2.25亿美元融资。

- 市场影响:推动高频交易与复杂DApp发展。

- 时效性标注:中期影响。