Original | Odaily Planet Daily ( @OdailyChina )

By Wenser ( @wenser 2010 )

This afternoon, crypto influencer Crypto Fearless revealed that the Plasma team and the Blast team have some overlap in personnel, and the entire team has virtually no experience running payment or stablecoin projects. Plasma's current model is virtually identical to Blast's (i.e., finding a hot market, launching a model to attract deposits, and then issuing tokens to close the deal). After founder Pacman fell out with the original Blast team members, other key members launched Plasma. The news caused quite a stir in the market.

Meanwhile, Plasma officially announced the launch of Plasma One, a stablecoin-native financial application, last night. This application supports stablecoin payments and offers the possibility of earning over 10% returns and approximately 4% in cashback. Future plans include expansion into over 150 countries and regions. Backed by PayPal founder Peter Thiel's Founders Fund and Tether CEO Paolo Ardoino's Bitfinex, Plasma's ambition to establish a crypto bank is clear.

As Plasma has officially announced that it will hold its TGE on September 25, Odaily Planet Daily will analyze the project's related actions in this article for readers' reference.

Plasma's Ambition: From Stablecoin Blockchain to Crypto Bank

As a stablecoin project that has recently been able to compete with the "king-level project" Trump family crypto project WLFI, Plasma's previous multiple rounds of public offerings on multiple platforms have received great attention and extremely enthusiastic participation from the market.

Through multiple rounds of public fundraising, Plasma has raked in nearly $2.5 billion (fundraising + TVL)

- On June 9, Plasma 's $500 million public offering was sold out in minutes;

- On June 12, Plasma ’s newly added $500 million public offering deposit quota was fully filled at 9:00 am that day, taking only half an hour.

- From July 17 to 28, Plasma launched the XPL token public sale , with subscriptions exceeding US$373 million and oversubscription exceeding 7 times.

- On August 20, the first batch of 250 million USDT quotas for Binance's Plasma term product were quickly sold out. Due to enthusiastic market demand, Binance subsequently announced that it would increase the total subscription limit for Plasma term products to 1 billion USDT, and added an additional 250 million USDT quota on August 22, which was again quickly sold out within 5 minutes. Finally, Binance once again increased the per-user limit for subscribing to Plasma USDT locked products to 50,000 USDT. On August 29 , this "grand Plasma savings event" came to an end in a lively atmosphere.

- At the end of August, the stablecoin protocol USD.AI announced a partnership with Plasma and would open new deposit limits for USDT; on September 4, USD.AI announced that the deposit limit would be increased from US$110 million to US$160 million.

- On September 16th, Plasma and Maple announced the launch of a $200 million syrupUSDT pre-deposit pool, providing initial liquidity and offering exclusive XPL rewards to participants. The pre-deposit pool will officially open at 9:00 PM (Beijing time) on the same day, with a two-month lockup period and a minimum deposit of $125,000. Supported assets include syrupUSDT, USDT, and USDC, and participation is permissionless and open to all users.

In this way, Plasma, which raised $24 million in financing , became the biggest winner in the recent "money saving track". The quick-acting Plasma team did not hesitate, but quickly announced the TGE-related news to the hungry market.

On September 18, Plasma announced that it plans to hold TGE on September 25, and the mainnet test version will be launched together with the native token XPL. XPL will become the eighth largest stablecoin blockchain. It is expected that $2 billion worth of stablecoins will be put into use on the first day of launch. The funds will be deployed in more than 100 DeFi partner platforms, including Aave, Ethena, Fluid, Euler, etc.

Yet, amidst the intense anticipation, the market received not precise details about the coin launch, but rather a stablecoin-native financial application called Plasma One. Furthermore, Plasma even boasted in a lengthy article : "Plasma One aims to give everyone, everywhere permissionless access to the US dollar and the financial system it unlocks. Open access will be rolled out in phases so we can quickly iterate, release new features, and scale to billions of people. With Plasma One, we will bring the world on-chain. This will be the first new bank built for a truly global financial system."

Plasma's ambition to build the world's first crypto bank with global reach has been revealed since then.

Plasma One: A one-stop stablecoin native financial application and a prototype of a crypto bank where “money never sleeps”

In the previous article "Gemini is once again "choked" by JPMorgan Chase, and the founder angrily accuses the bank of launching "financial persecution 2.0" , we systematically sorted out the many constraints that traditional investment banks have on crypto projects. JPMorgan Chase even used bank data to "choke" Gemini and other crypto exchanges.

When will the cryptocurrency industry finally have a truly market-leading crypto bank? This is a question on the minds of many crypto practitioners, and now, Plasma is ready to provide its own answer to this question – the Plasma One, which is shaped like an American Express card.

“Faster, cheaper, better”

Plasma One: 10%+ Return, 4% Cashback, Keep Your Stablecoins Sleepless

According to the Plasma One official website, the main advantages of this application are:

- "Stablecoin Yu'e Bao" : Supports stablecoin balance payments while earning 10%+ yield;

- Cash Back : Users can earn up to 4% cash back on Plasma One card purchases (physical or virtual).

- Global Coverage : Supports over 150 million merchants in over 150 countries and regions worldwide;

- “Zero-fee transfers” : USDT can be sent to individuals and businesses for free;

- “Register and use” : You can receive a virtual consumption card by registering and activating it in a few minutes (instead of the days it takes for traditional banks to open a card).

Furthermore, Plasma officials stated that Plasma One's initial target market is urban centers in countries like Turkey, Argentina, and the UAE, where demand for US dollars is high. The stablecoin will greatly facilitate daily payments, business transactions, and cross-border trade. Even if users don't use it for transactions, the savings potential alone is undoubtedly enough to attract significant interest. With the backing of PayPal and Tether, Plasma's launch of PayFi is a natural progression.

Plasma One application channel: https://one.plasma.to/

“Stablecoins never sleep”, they can earn you income while you sleep

Plasma's personnel reserve war: Absorbing FTX's global payment director, growth, product, capital, security, DeFi, design, and legal are all complete

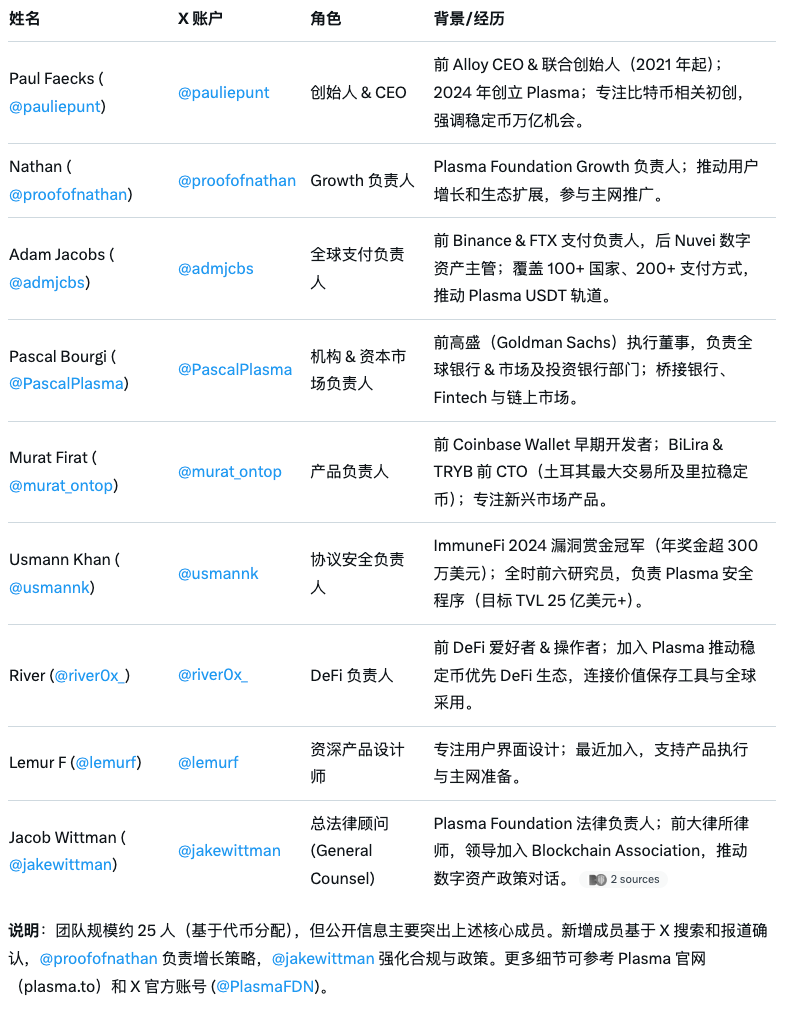

In addition to products, Plasma also made sufficient preparations in terms of personnel on the eve of the launch of the mainnet.

Earlier this month, Plasma officially announced the addition of three senior executives: Murat Firart as Head of Product, Adam Jacobs as Head of Global Payments (formerly Head of Global Payments at FTX), and Usmann Khan as Head of Protocol Security.

Based on existing public information, the main members of the Plasma team are as follows (Odaily Planet Daily combined with Grok):

Plasma Team Information at a Glance

It has to be said that despite market rumors that part of the Plasma team came from the now-defunct Blast team, judging from the member list, this group of people can still be considered experienced in the cryptocurrency industry and have their own strengths.

Conclusion: XPL will become the touchstone of Plasma's "public chain + application + token" flywheel

As of the time of writing, the pre-market price of XPL was temporarily reported at $0.82, and the 24-hour trading volume on the Hyperliquid platform exceeded $93.6 million. At present, the release of Plasma One has significantly boosted market confidence, but this is not the ultimate test.

Whether XPL can continue to rise in the end still depends on the performance of the Plasma public chain mainnet release. Based on the existing information, perhaps the goal of 1 XPL = 1 USDT is not too far away.

- 核心观点:Plasma团队推出稳定币金融应用,剑指全球加密银行。

- 关键要素:

- Plasma One提供10%收益和4%返现。

- 项目融资及TVL总额近25亿美元。

- 团队吸收FTX前支付主管等人才。

- 市场影响:可能推动稳定币支付和收益产品竞争。

- 时效性标注:短期影响。