When the Ethereum team officially announced the launch of the Swarm project, perhaps everyone in the circle felt that another king-level project was coming. As the genius creator of Ethereum, Vitalik Buterin and his team have devoted all their efforts to building and shouldering the responsibility of "world computer hard drive"Swarm with this important task has attracted everyone's attention since its birth, and many people are expecting that maybe it will be the next rocket to fly to the moon.

besides attractinglots of eyeballs,alsoAccompanied by chaos。

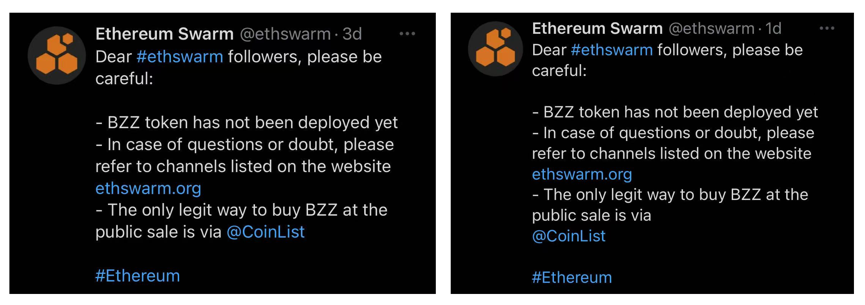

The Swarm official announcement will beMainnet soft launch on June 13(soft launch) andOn June 14, the public sale of its token BZZ began on CoinListAfterwards, the official issued two consecutive tweets with the same content, which read:

Dear Swarm fans, please note:

- BZZ tokens are not deployed yet.

- If you have any questions or concerns, please consult the relevant channels on the official website ethswarm.org.

- Currently the only way to buy BZZ on the public platform is on CoinList.

In Swarm's official soft launch related announcement, there is also a passage like this:

Please be careful of scams. Currently, exchanges, projects or individuals claiming to provide BZZ tokens are not affiliated with the Swarm Foundation, and the Swarm Foundation does not recognize such activities before the mainnet goes live. The Swarm Foundation has not yet approached any exchanges regarding the listing of BZZ. Private buyers are not allowed to stake tokens before mainnet launch.

From this series of scam warnings and risk reminders, it is not difficult to see that,Swarm-related scams on the market have disturbed the project team, so that they have to remind users over and over again, don't be deceived. Sosecondary title?

BZZ Token Sale Scam

As the official reminder, BZZ has not been officially distributed at present, only CoinList can openly make an appointment to buy BZZ,At this stage, all exchanges or individuals who claim to sell BZZ imply a great risk, and the possibility of being a scam is very high.

For example, some scammers will claim that they have the private placement quota of BZZ, and after the distribution of BZZ on the main network, they will put the BZZ purchased by the buyer into their wallets, etc.

In this case, some users cannot judge the authenticity of the information provided by the other party, especially in the field of cryptocurrency trading, due to its unique encryption properties,Once the money is put into the other party's wallet in advance as required, the possibility of recovery is basically zero,lost heavily.

In addition, since Swarm is currently developingTestnet Million Token Airdrop EventIn this activity, mining can get checks, and the checks can be exchanged for official airdropped BZZ when the main network is officially launched, and some individuals or mines will start selling checks through this activity. It must be noted that there are also great risks in this type of sale.

Risk point one: It is impossible to determine whether the counterparty actually holds a valid check. This situation is similar to a token sale scam. Once the money is put into the other party's wallet in advance, it cannot be recovered.

Risk point two: Only valid checks can be exchanged for BZZ. The so-called valid check refers to the check generated by interacting with 35 randomly determined queen bee nodes. These 35 queen bee nodes are completely randomly determined. No one (including the Swarm team) can predict which nodes will become Queen bee node. At present, the number of nodes in Swarm's entire network is in tens of thousands, and only 35 queen bee nodes are selected from them. It is conceivable that the proportion of valid checks will not be too high.

Risk point threesecondary title

BZZ mining project risk

Since the Swarm project is a project of the Ethereum team and was born as one of the three pillars of Web3.0 - "storage", its prospects are quite attractive, so many users who are optimistic about its long-term value have set their sights on On the mining project of Swarm. When there is potential demand, there will be a market, soVarious Swarm physical node pre-sales, mining pools, mining machine sales and other projects have begun to emerge.

At present, Swarm officials have not disclosed its specific mining mechanism, but judging from the known information, its mechanism may be close to Filecoin, that is, mining requires “staking”.

I still remember that when Filecoin was about to go online, there was a similar situation. Under the premise of not knowing the mining mechanism, people invest in related mining projects just because they are optimistic about this project. The results can be imagined.Due to a series of problems such as failure to immediately adapt to this new mining mechanism and lack of collateral required for mining, some investors suffered heavy losses.

Before the official announcement of Swarm's mining mechanism, all related mining projects should be treated with caution. "Blue Shell Cloud Storage"In order not to expose users to relevant risks, we decided not to launch related mining projects before Swarm's mining mechanism is officially disclosed. However, "Blue Shell Cloud Storage" has actively deployed a large number of Swarm test network nodes and miner,Once the main network is officially launched, the Swarm mining project can be seamlessly startedsecondary title

BZZ Futures Spot Spread

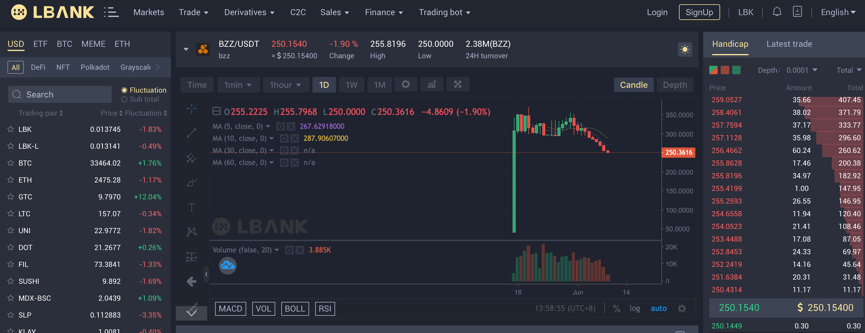

At present, BZZ futures are generally traded on exchanges, and from the data displayed on the LBank trading platform,BZZ futures has risen to around 250U。

butComparing the official sale of Swarm on CoinList, which priced each BZZ at $1.92, we can see that the current price of BZZ futures is very high.Although this also means that users are extremely optimistic about its value, it must also be considered that there is a possibility of excessive speculation. When BZZ is officially distributed on the mainnet, the BZZ futures market may usher in a sharp drop (Statement: Blue Shell Cloud Storage does not make BZZ value predictions, and here is only a possible situationsecondary title

The Pit of BZZ Check Collection

In the current Swarm test network mining, users need to receive the check (cashout) in advance, and the process of receiving the check needs to consume Ethereum Goerli test coins. The test currency is mainly from the faucet: https://faucet.goerli.mudit.blog/

There are some pitfalls in BZZ check collection, users need to pay more attention:

Pit No. 1: The faucet that issues test coins often fails to issue coins.

Pit No. 2: The coins issued are relatively small, and each account can receive 36 coins every 9 days.

Pit No.3: The early team of the testnet did not encourage everyone to actively receive the check, thinking that users only need to wait for the mainnet to get it before the launch, and the official Discord group has always encouraged everyone not to receive it in advance. Therefore, many users have been waiting for the mainnet to go online, and there is a backlog and they have not received the check. Now that the launch date of the mainnet is approaching, a large number of users collect checks in a centralized manner, and Geth is required to collect checks, so the network will definitely be very congested.

Pit No. 4: The gas price of the Goerli test network has been rising, so more Geth will be consumed.

Pit No. 5: Many miners have an error {message: cannot cash cheque, code:500} when receiving (cashout) checks. One possible reason for this error is that the recent check collection concentration, the gas price of the Goerli test network has soared, and the Geth of the mining machine node It is not enough to pay the handling fee for receiving the check. In this case, recharge the Geth test currency and receive it again.

Finally, "Blue Shell Cloud Storage" once again reminds everyone that no matter how high-level the project is, there will inevitably be some risks.All investments come with risks, while paying close attention to Swarm-related developments, users must treat it with caution and invest rationally.