行情低迷时,盘点三种不依赖市场趋势的盈利模式

原文作者:The DeFi Investor

原文编译:Yuliya,PANews

尽管近期加密货币市场表现低迷,但市场依然存在着不依赖于代币价格上涨的盈利机会。事实上,除了传统的交易者和投资者之外,还有许多参与者通过其他途径在这个领域获得了可观收益。本文将从技术与策略层面,深入分析三种不依赖市场趋势的盈利模式。

1.空投与收益农场

当前 DeFi 生态中,以 BTC、ETH、SOL 等头部资产为核心的流动性挖矿与空投机制日趋完善。以 Pendle 协议为例,其智能合约支持稳定币资产锁定获取 19% 的固定年化收益率(APY),以及 BTC 资产 12% 的固定年化回报。通过优化策略组合与资金利用效率,专业操作者可实现 50-80% 的稳定币年化收益。

2.高 FDV 新币做空套利

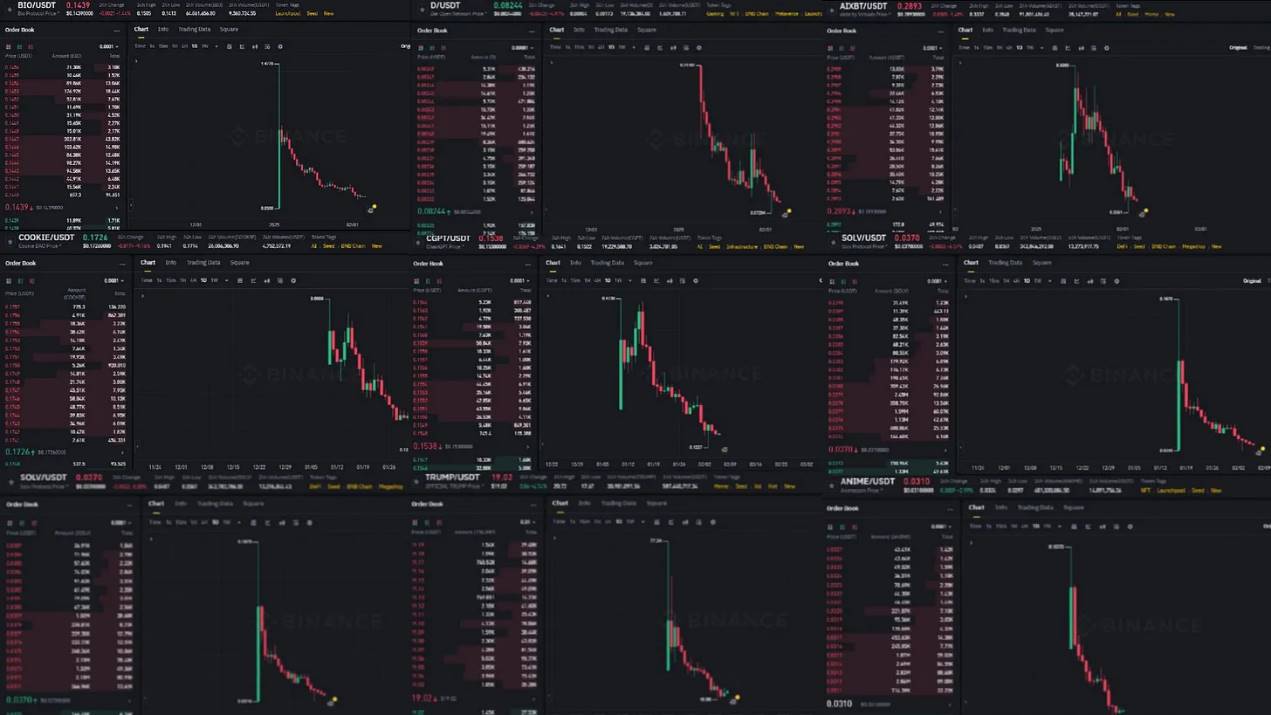

币安近期上架的新代币

通过对币安交易所新上线代币的技术分析表明,绝大部分代币在 TGE 后呈现明显下行趋势。这一市场现象主要源于两个核心因素:

代币分散化严重:链上数据显示,每日都有数万个代币被发行

估值体系失衡:项目方倾向于通过高估值模式实现早期投资者套现

正如市场常言:「混乱之中往往蕴含机遇」。这种市场非效率性为专业交易者提供了显著的做空机会。以 Hyperliquid 为代表的衍生品交易平台,通过快速上线新币永续合约的方式,为做空策略提供了有效的交易渠道。但需要特别注意的是,考虑到新发行代币的高波动性特征,建议采用低杠杆策略以优化风险收益比,并通过小规模试验积累策略经验。

3.资金费率套利(Delta 中性策略)

在永续合约市场的定价机制中,资金费率作为多空双方的周期性结算机制,为套利者提供了显著的获利空间。

当资金费率为正时,多头方向需要向空头方向支付费用;

当资金费率为负时,则空头支付多头。

专业交易者可通过构建 Delta 中性组合来捕获资金费率差价。具体操作层面,当观察到显著正向资金费率时,可同时建立 1000 美元的 BTC 现货多头与 1000 美元的合约空头仓位(可通过 Coinglass 平台监控资金费率),通过市场中性策略获取稳定收益。

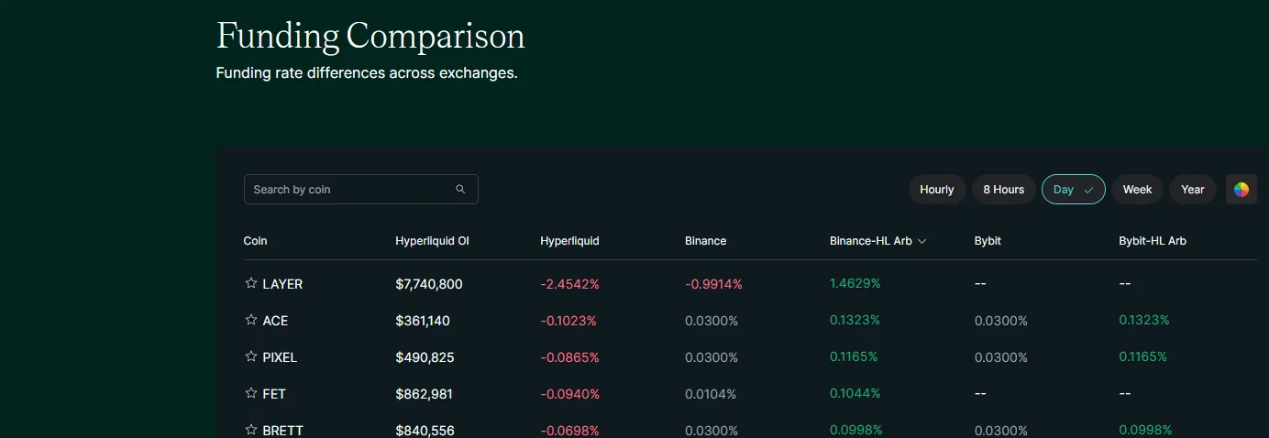

目前,Ethena 与 Resolv 等协议已开发自动化资金费率套利系统,为用户提供被动收益。然而,通过手动操作多品种套利策略,尽管较为耗时,但仍可能获得更高收益。投资者可以使用 Hyperliquid 平台的「Funding Comparison」功能板块寻找套利机会。

总结

即使在市场下行期间,加密货币领域仍然存在众多机会。与普遍认知相反,加密市场仍然存在较多无效现象,这为套利者提供了丰富的获利空间。建议每个参与者都应该找到自己擅长且能够盈利的特定领域,并不断精进,争取成为该领域的专家。