BitMEX推出多资产保证金功能:让衍生品交易更便捷

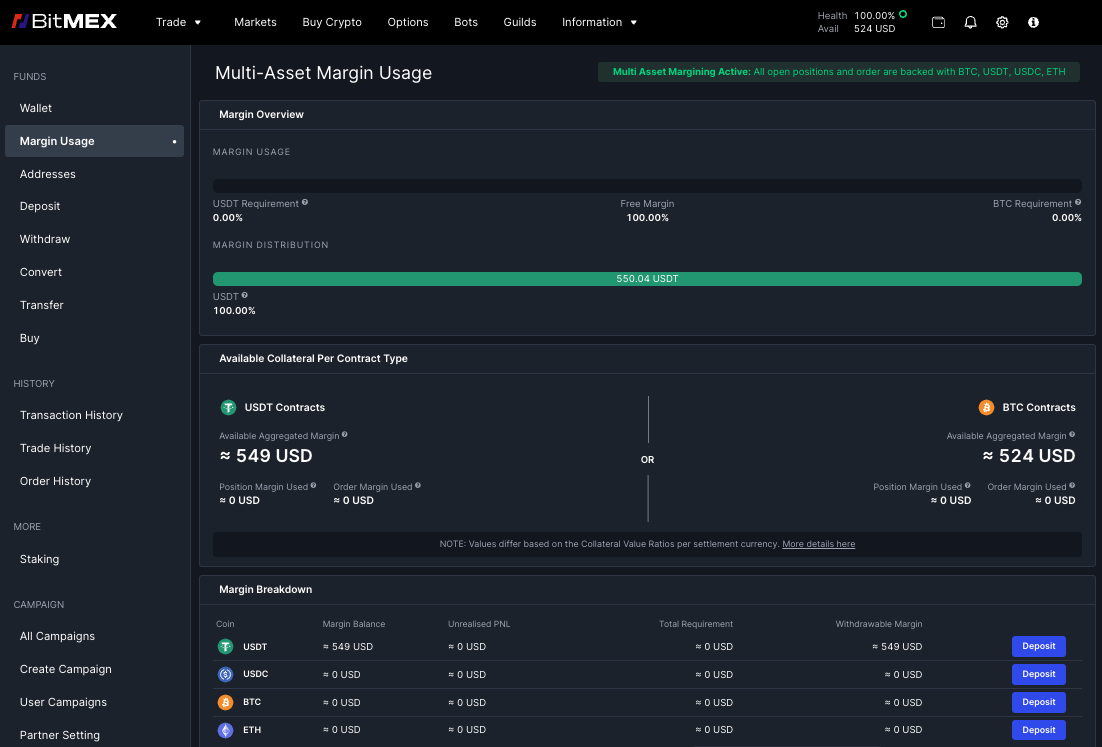

作为加密衍生品交易领域的先行者,BitMEX 正式推出全新的“多资产保证金功能”。这项革命性功能允许用户使用多种资产作为保证金,包括 USDT、USDC、ETH 和 XBT(比特币),用以交易衍生品合约,无需繁琐的资产转换或钱包转账。该功能旨在简化交易流程、提升灵活性并提高资金使用效率,未来将支持更多资产类别。

通过多资产保证金功能,用户可以使用与合约结算货币不同的资产开仓或持仓,不仅节省了资产转换时间,还能同时持有多种资产,从而轻松参与多样化市场机会。

不同于其他交易所的繁杂要求,BitMEX 致力于打造无缝的交易体验。用户只需存入自己喜欢的资产,就能直接开始交易,无需在多个钱包间频繁转移资金。

BitMEX 首席执行官 Stephan Lutz 表示:“多资产保证金功能的推出是我们简化用户交易流程和提升资金效率的重要一步。这一功能不仅免除了繁琐的资产转换和钱包操作,还为用户开启了优化资金利用的新机遇,使他们能够更加轻松地参与加密衍生品市场。展望 2025 年及未来十年,我们将继续致力于构建更高效、更友好的加密交易生态系统。”

多资产保证金功能如何运作?

BitMEX 的多资产保证金系统会根据用户的仓位需求,将资金自动分配到最适合的位置,从而提升资金使用效率。用户只需在账户设置中启用该功能,并可随时在“钱包”页面查看可用保证金。

启用步骤如下:

1. 进入交易界面左侧的下单区域

2. 点击下单表单左上角的“单一资产”按钮

3. 在弹窗中选择“多资产保证金”

4. 按钮名称会变为“多资产”,即可开始使用所选保证金资产进行交易

如需了解更多关于 BitMEX 多资产保证金功能的信息,请访问 FAQ 页面 或 BitMEX 官方博客。

关于 BitMEX

BitMEX 是加密衍生品交易所的行业先锋,为专业交易者提供低延迟、高深度的加密原生流动性以及卓越的可靠性。

自成立以来,BitMEX 在面对黑客攻击或入侵时,从未丢失过用户的任何加密资产,确保用户能够安心交易。此外,我们始终致力于提供帮助用户盈利的产品与工具。

BitMEX 也是全球首批公开链上储备证明(Proof of Reserves)和负债证明(Proof of Liabilities)数据的交易所之一,并持续每周两次更新这些数据,确保用户资金安全无忧。

更多信息,请访问 BitMEX 官方博客或 www.bitmex.com,并关注我们的 Telegram、 Twitter 及其他社区平台。媒体联系请发送邮件至 press@bitmex.com。