SignalPlus宏观分析特别版:Asymmetric

经过连续 3 个通胀数据超出预期后,周三公布的 CPI 数据大致符合预期,这一结果足以刺激风险市场再来一轮大规模反弹。盘点市场表现:

SPX 指数再创新高

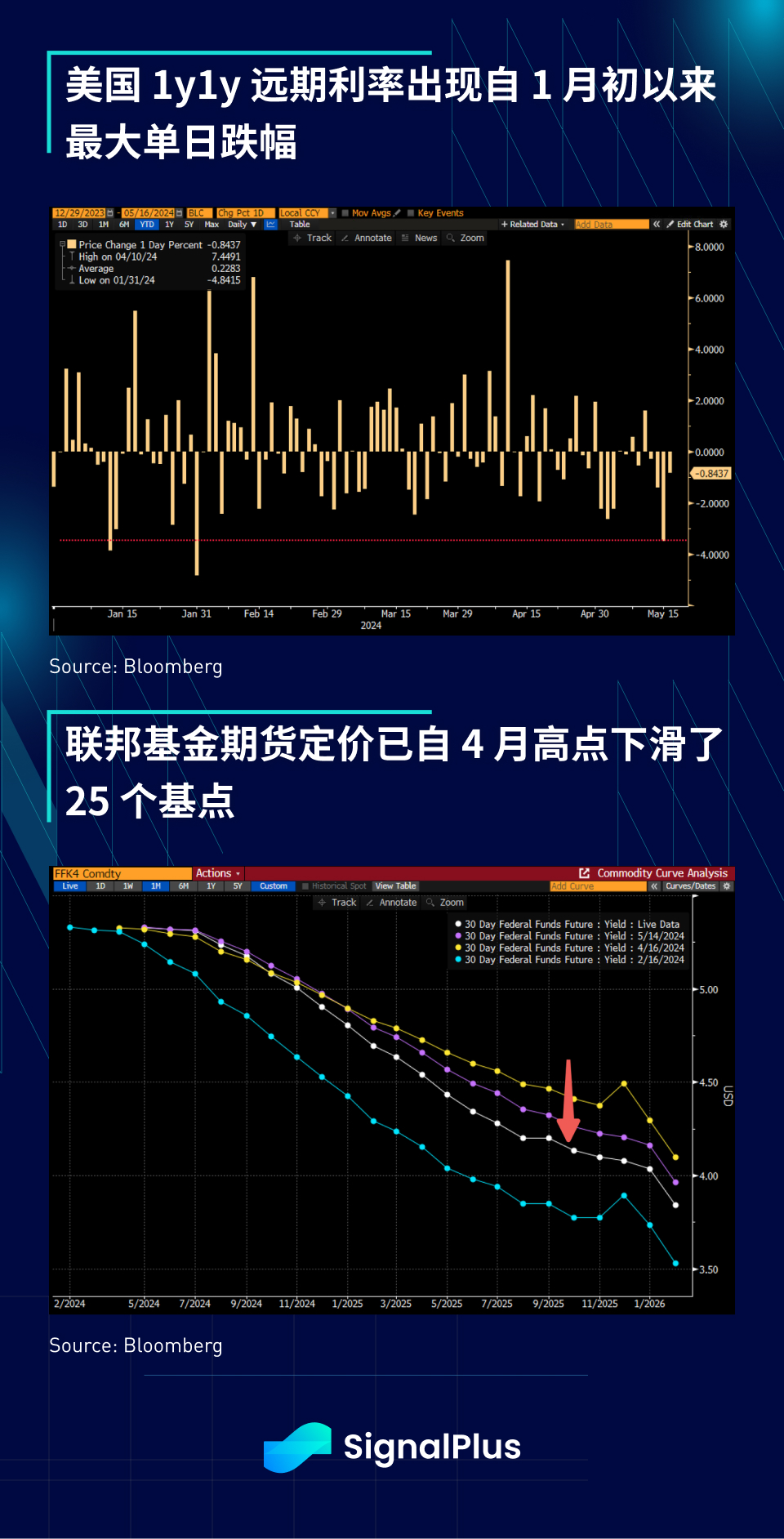

美国 1 y 1 y 远期利率出现自 1 月初以来最大单日跌幅

2025 年联邦基金期货定价从 4 月高点下跌了 25 个基点(相当于一次降息)

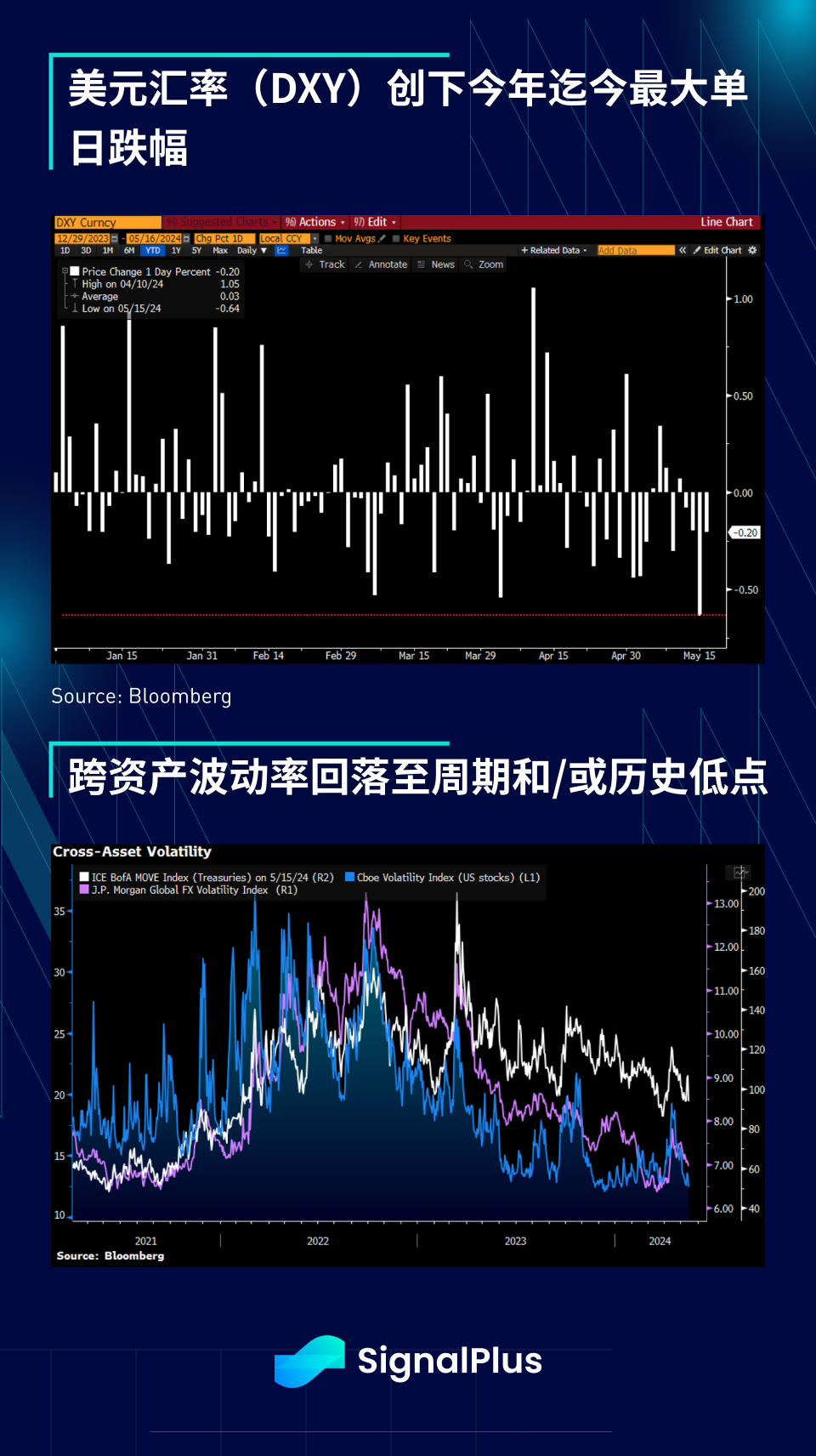

美元指数 DXY 创下今年迄今最大单日跌幅

跨资产波动率(外汇、股票、利率)回落至中期和/或历史低点

美联储是否会尽快降息呢? 6 月联邦基金期货显示降息的可能性仅 5% ,而 7 月也只有 30% ,即使是 9 月,降息的可能性也只不过是 64% 左右,那么大家在兴奋什么呢?

美联储是否会尽快降息呢? 6 月联邦基金期货显示降息的可能性仅 5% ,而 7 月也只有 30% ,即使是 9 月,降息的可能性也只不过是 64% 左右,那么大家在兴奋什么呢?

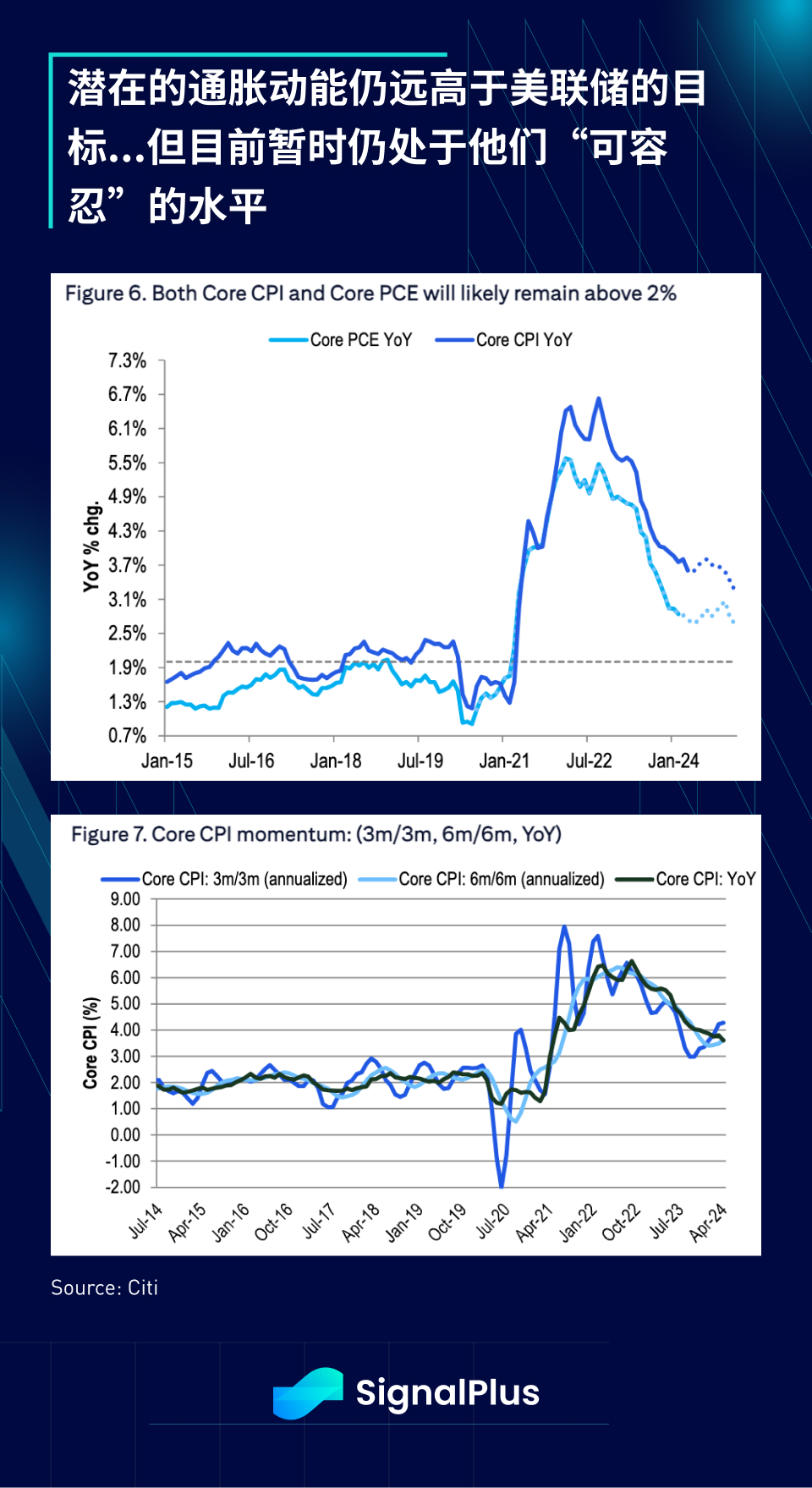

正如我们先前所提的,美联储已经转向一个完全不平衡的立场,只要通胀不再重新加速,即使通胀压力持续,也可以被容忍,而就业市场任何疲软的迹象都将被视为政策放松的驱动力。因此,虽然整体通胀和核心通胀仍分别高于美联储 3.6% 和 3.4% 的目标值,但市场担心的是价格重新加速,而这个情况在上个月并未出现,这符合美联储重新回到“观察宽松时机”的主题,因为“就业市场放缓”和“虽然高但可容忍的通胀”这两项内容正在被逐一确认。

回到 CPI 数据本身, 4 月核心 CPI 环比上涨 0.29% ,在连续 3 个月超出预期后,这次数据结果仅略低于市场预期,疲软主要来自于商品价格的下降以及住房价格和业主等价租金的可控增长。不包括住房在内的核心服务通胀则环比上涨 0.42% ,大致符合预期。

在 CPI/PPI 公布后,华尔街预计 4 月核心 PCE 将环比增长 0.24% 左右,朝着 2% 的年化水平和美联储的舒适区间迈进,交易员对于下半年通胀将继续回落仍深具信心。

另一方面, 4 月零售销售数据大幅疲软,不同支出类别均普遍走软。零售销售环比持平,低于普遍预期的环比增长 0.4% - 0.5% ,控制组支出环比下降 0.3% ,前值也被下修。一般商品甚至非店铺销售都出现自 2023 年第一季以来的最大降幅。

零售销售数据不及预期,延续了近期一系列疲软的消费者数据,包括信用卡和汽车贷款拖欠率上升、累积的超额储蓄耗尽以及就业市场的恶化。虽然现在断言经济大幅放缓还为时过早,但我们似乎已经接近经济增长的转折点,高利率是否终于开始侵蚀美国经济?

一如往常,市场乐于忽略任何经济放缓风险,暂时只关注美联储的宽松政策。提醒一下,虽然市场非常具有前瞻性,并擅长将所有可用信息纳入定价,但请注意,市场也没有那么前瞻。短暂享受当前的派对吧!

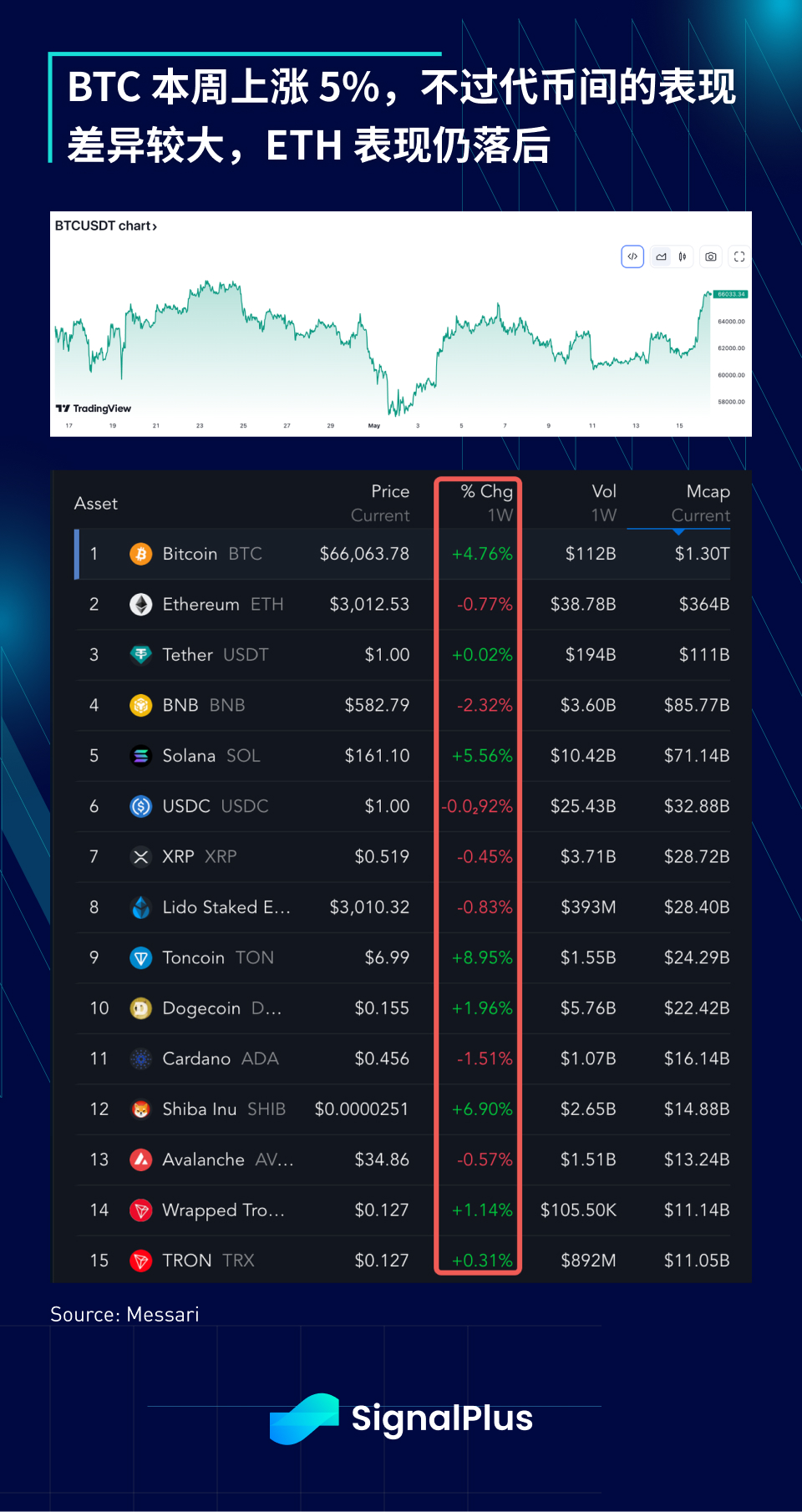

在加密货币方面,BTC 价格继续受到整体股票情绪的影响,价格突破了本月高点,回升至 4 月的峰值 6.7 万美元左右。ETF 资金流入也十分良好,昨天 CPI 公布后新增 3 亿美元资金流入,甚至 GBTC 也出现净流入。然而,各个代币的表现差异仍然很大,ETH 和部分前 20 大代币仍在努力收复跌幅,市场的涨幅越来越集中于一小部分的代币(BTC、SOL、TON、DOGE),而不是整体市场的上涨。

预计这种情况将持续下去,关注重点仍将会是 TradFi 资金流入的主要受益者 BTC(13 F 文件显示,一些大型对冲基金的 BTC ETF 敞口不断增加),且原生代币或 degen 代币的 FOMO 现象在这一周期会相对较少。祝各位好运!

您可在 ChatGPT 4.0 的 Plugin Store 搜索 SignalPlus ,获取实时加密资讯。如果想即时收到我们的更新,欢迎关注我们的推特账号@SignalPlus_Web3 ,或者加入我们的微信群(添加小助手微信:SignalPlus 123)、Telegram 群以及 Discord 社群,和更多朋友一起交流互动。SignalPlus Official Website:https://www.signalplus.com