12期数据破译币安Launchpool:BNB还是FDUSD?长短期策略如何选择?

原创 | Odaily星球日报

作者 | 南枳

近期的币安新币挖矿,仅可使用 BNB 和 FDUSD 进行参与,二者收益率有何差别?长短期持有策略二者孰优孰劣?Odaily星球日报将于本文解析过去 12 期数据,透视不同策略下的盈亏情况。

(Odaily 注:短期策略指在新币挖矿开始时购入 FDUSD/BNB,挖矿结束时卖出,净损益为挖矿收益扣除挖矿前后的价差;仅想查看最终结论的读者可直接阅读本文最后一节正文。)

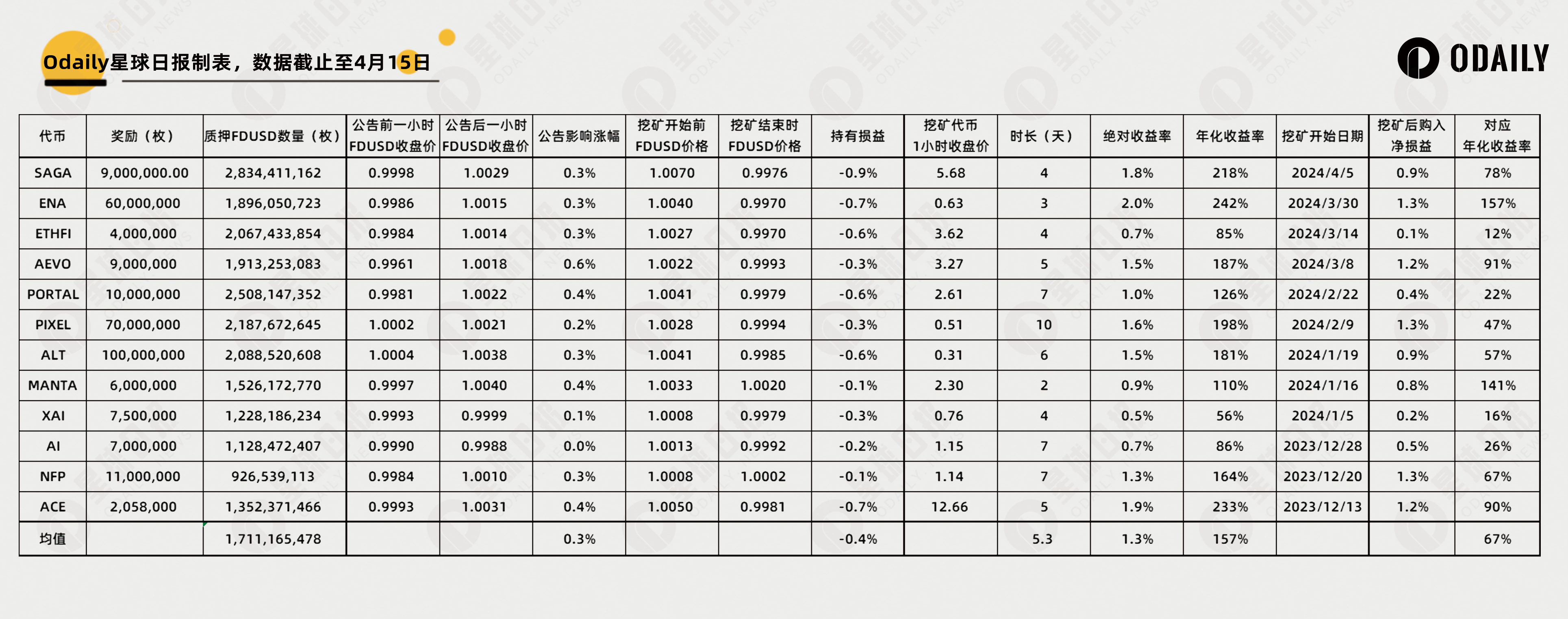

FDUSD 数据解析

下图为近十二期 FDUSD 相关数据,包括“币安公布新币挖矿”前后的价格变化,“新币挖矿活动”开始和结束时的价格变化,以及对应的收益率和短期策略收益。

Launchpool 发出后 FDUSD 上涨幅度较为一致,均值为 0.3% ;

而在挖矿开始到结束期间,FDUSD 跌幅差异较大,均值为-0.4% 。同时意味着 FDUSD 的折价率也较为稳定,长期价格差异不大;

同样地,每一期的年化收益率也相差较大,各期之间的相对大小与 BNB 矿池基本一致;

用持有损益叠加挖矿的绝对收益,短期策略下的绝对收益,然后再转为年化收益率,对应平均年化为 67% ,并且没有负值,即临时买入也有较高收益;

此外,在 SAGA 新币挖矿这一期,FDUSD 增发了超 11 亿美元,但收益率没有下降,能否维持还需要多期验证。

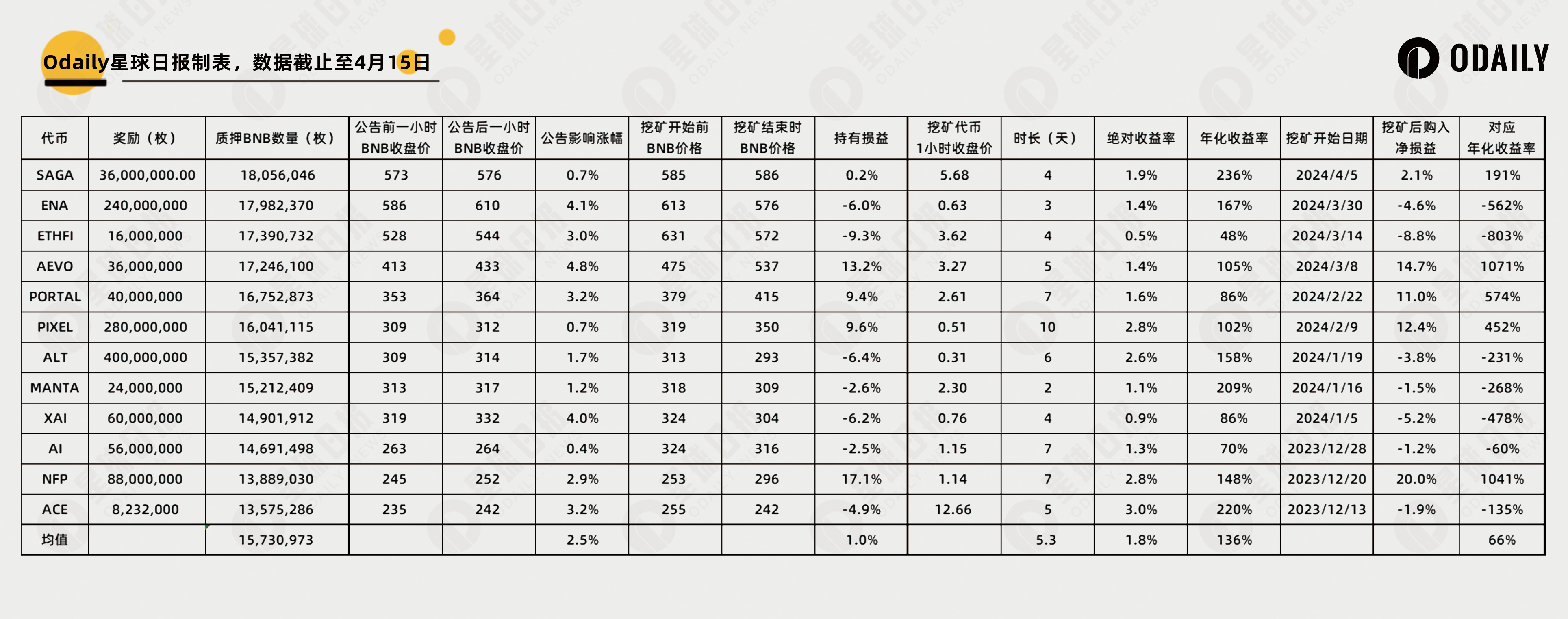

BNB 数据对比

将统计对象更换为 BNB 矿池,所有统计口径不变,具体数据如下表所示。

新币挖矿对 BNB 价格具有明显的提振作用,波动率更大;

相应地,挖矿前后的 BNB 价格波动也更大,并且大概率为负数, 12 期中仅有 4 期为显著的正数。意味着如果在挖矿前购入 BNB 持有到期,大概率需要承受一定价格跌幅;

BNB 的平均挖矿收益率为 136% ,在 FDUSD 增发前基本都低于 FDUSD 矿池(均值 157% );

BNB 的短期挖矿策略具有极大的波动性,平均年化收益与 FDUSD 相差无几,分别为 66% 和 67% ,但需要注意主要由 NFP 和 AEVO 两轮的 BNB 涨幅撑起(BNB 单价均上涨超 40 USDT)。

结论

如果我想临时买入,挖矿后退出,FDUSD 还是 BNB 好?

对于只想获取新币挖矿收益的用户,二者收益接近,但 FDUSD 更为稳定,并且对于中性策略的用户,无需套保 BNB,收益率实际上更高。

因此 FDUSD 为短期策略下的更优选择。

对于长期持有者,二者孰优孰劣?

以近 12 期数据而言,FDUSD 仅比 BNB 年化收益率高 15.4% 。意味着对于用户而言,如果认为 BNB 还能在当前的基础上上涨 15.4% ,则 BNB 优势更加明显。

不过以上结论是单纯持币视角,实际上还存在着抵押 FDUSD 借出 ETH 等资产,在空窗期进行链上挖矿活动,在挖矿期转回等操作,因此还需要根据用户的具体情况抉择。

挖矿空窗期有多久?

从 ACE 开始挖矿到 SAGA 结束,共计 118 天,而挖矿期共 64 天,空窗期共 54 天,因此平均每期之间的间隔仅 4.9 天。

那么在挖矿结束后抄底 BNB/FDUSD,公布后卖出,不参与挖矿策略的收益率有多少?

对于 BNB 而言,以上操作的绝对收益率为 2.44% ,高于挖矿的绝对收益 1.8% ,按照 4.9 天的空窗期计算,年化收益率为 181.7% 。但复用该策略需要考虑 BNB 高位下跌的风险;

对于 FDUSD 而言,该操作的收益率为 0.3% ,远低于挖矿收益的 1.3% 。