牛市补“弹药”进行时,两大稳定币30天内增发100亿美元

原文作者:Mary Liu,比推 BitpushNews

随着减半临近,比特币本周开局强劲,在周一早盘交易中飙升至 72, 000 美元以上,距离历史高点 73, 750 美元不到 3% 。 市场数据显示,在周末交易价格接近 69, 400 美元后,比特币多头在周一凌晨开始走高,突破 71, 000 美元的阻力位,在美国东部时间上午 8 点后不久触及 72, 780 美元的高点。 截至发稿时,比特币交易价格为 71, 845 美元, 24 小时涨幅 3.5% 。

周一上涨的其他代币包括以太坊(上涨 8% )、 meme 币 Dogwifhat (上涨 18% )和 Pepe (上涨 10% )。

Coinshares 周一发布的数据显示,上周数字资产投资产品录得 6.46 亿美元的资金流入。比特币相关的投资产品仍然是焦点,流入总额为 6.63 亿美元,而做空比特币的投资产品连续第三周流出总额为 950 万美元,表明看跌投资者略有投降。

Coinshares 研究主管 James Butterfill 表示:「今年迄今为止的资金流入达到历史最高水平 138 亿美元,目前远远超过 2021 年的 106 亿美元。」

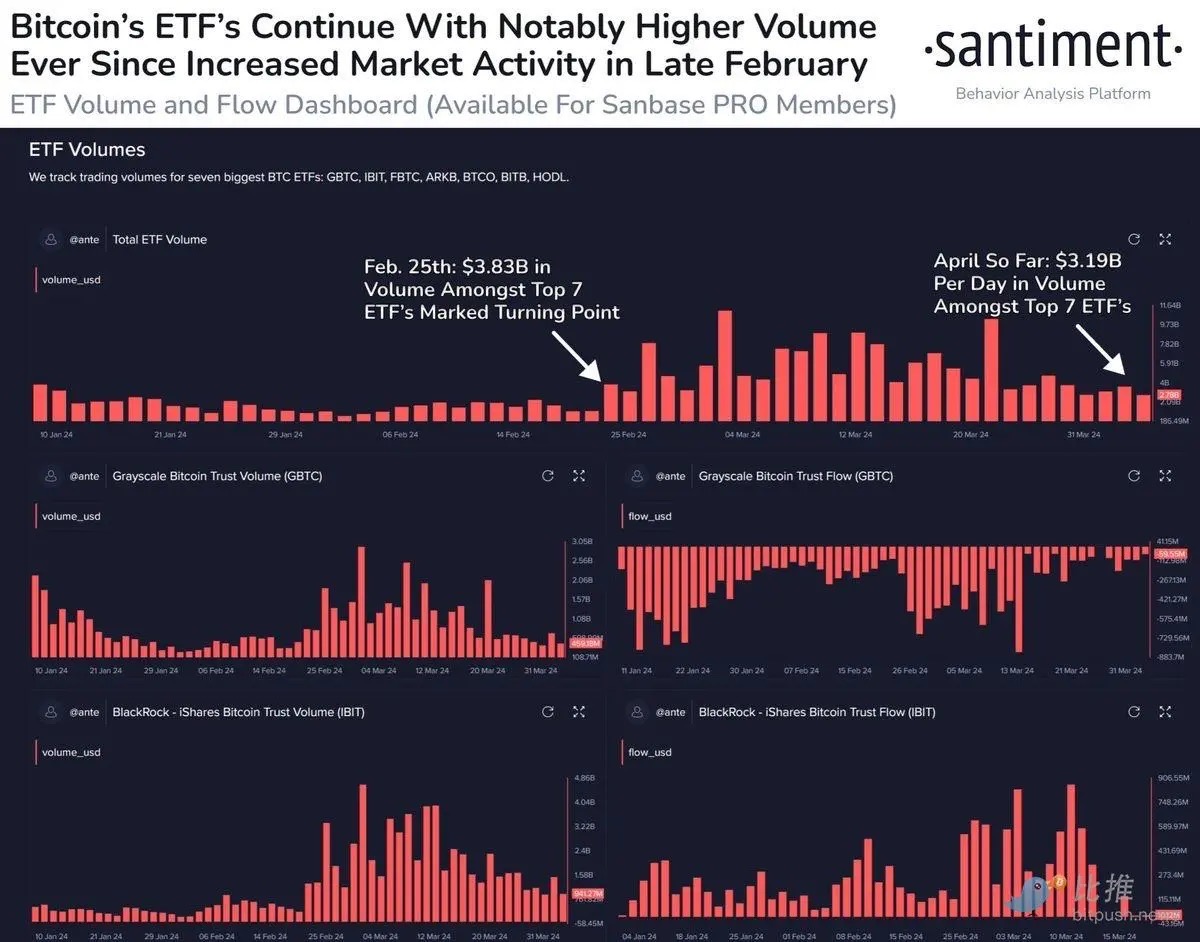

链上分析公司 Santiment 认为, ETF 交易活动仍保持在较活跃的水平。 该公司分析师称: 「比特币 ETF 交易量在 BTC 突破新高上涨四周后并未放缓。在 G BTC、 IBIT、F BTC、 ARKB、 BTC O、 BITB 和 HODL 中,交易者活动仍然明显高于 2 月底散户交易开始涌入后开始的转折点。」

他们补充道:「在 4 月 19 日减半之前,高活跃度应该会持续下去,但 ETF 交易量和链上交易量是否会在减半之后直接下降,将是个有趣的现象。」

稳定币活动表明多头正在为反弹做好准备

1 0x Research 研究主管 Markus Thielen 表示,虽然比特币价格自 3 月初以来一直横盘整理并盘整,但它可能很快就会恢复攀升。

分析师在周一的市场更新中表示:「自 1 月 25 日以来大幅看涨之后,我们在一个月前(3 月 8 日)变得谨慎,因为根据市场的技术设置,远期回报似乎不可预测,交易(加密货币)是关于风险回报,以及知道何时加大 / 小赌注,过去三十天确实是小赌注的时期。但这种情况很快就会改变。」

Thielen 指出: 「比特币上个月以对称三角形形态进行交易,根据一些历史分析, 75 %的三角形模式将看到(牛市的)延续模式和更高的价格。」

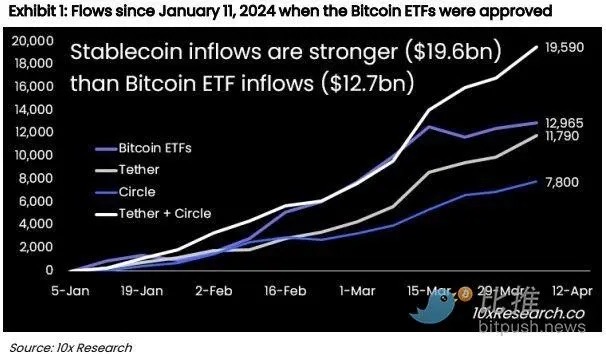

Thielen 表示,稳定币的交易量可以更好地预测未来的情况,而不仅仅是关注 ETF 流量或期货数据。

他说:「在过去 30 天里,我们看到 ETF 录得约 50 亿美元的净流入,而更值得关注的是, Tether 净流入了 69 亿美元, Circle 铸造了约 30 亿美元,总共有 100 亿美元的新资金通过稳定币进入。虽然比特币 ETF 的流量引起了媒体的关注,但与 ETF 相反,稳定币的铸造量是其两倍,而且可能只做多头。我们建议减少对比特币 ETF 流动的关注,稳定币发行商是需观察的对象,将推动这个市场走高。」

Thielen 总结道:「尽管我们表达了对 ETF 流量疲软的担忧,但接力棒已传递到稳定币上。 Tether 记录了 7 天 24 亿美元的铸币信号,这是自本轮牛市开始以来的最高记录之一,法定货币正在加速进入加密货币领域,随着对称三角形突破迫在眉睫,我们希望看涨。」

Thielen 的分析显示,根据目前的形态,三角线形态在 4 月 18 日「相遇」,如果是看涨突破,比特币可能会在未来几周内攀升至 80, 000 美元以上,在 69, 280 点买入并将止损设置在 65, 000 点似乎是「合适的」。

许多加密货币交易者预计,比特币减半事件将成为 2024 年的关键时刻,对加密货币市场产生重大影响。然而, Steno Research 的分析师预计,这将是一场「买谣言,卖新闻」的事件。 Steno Research 预计, BTC 的价值将在减半事件之前飙升。然而在减半后的前 90 天内,其价值可能「跌破减半时的价格」。

根据 Alternative 提供的数据,距离比特币减半仅剩 11 天,加密生态系统中的情绪仍处于「极度贪婪」领域。 目前加密货币整体市值为 2.69 万亿美元,比特币的主导率为 52.4% 。