SignalPlus波动率专栏(20240402):看涨势头暂时消退

上周五美联储主席鲍威尔在 PCE 数据公布后发表演讲,一改之前的鸽派表态,向市场表露出当前形势下并不急于降息的观点,在这之后,昨日(1 APR)美国 3 月 ISM 制造业指数录得 50.3 ,超出预期,为 2022 年来首次扩张,致使市场对美联储 6 月降息的预期再度减弱(期货市场将此概率定价降至 50/50),美债收益率大幅上行,两年期/十年期分别触及 4.70% 和 4.35% ,鸽派叙事持续面临挑战。

Source: SignalPlus, Economic Calendar;本周将公布美国非农就业指数,每小时工资等数据

Source: SignalPlus & TradingView

Source: Coinglass

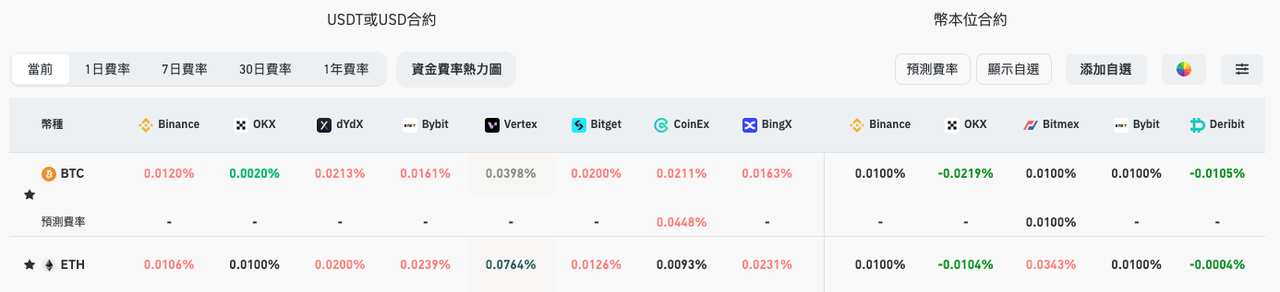

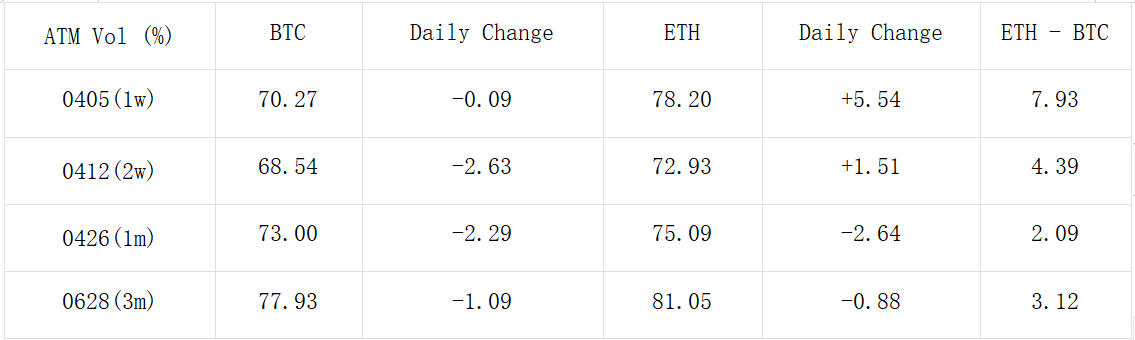

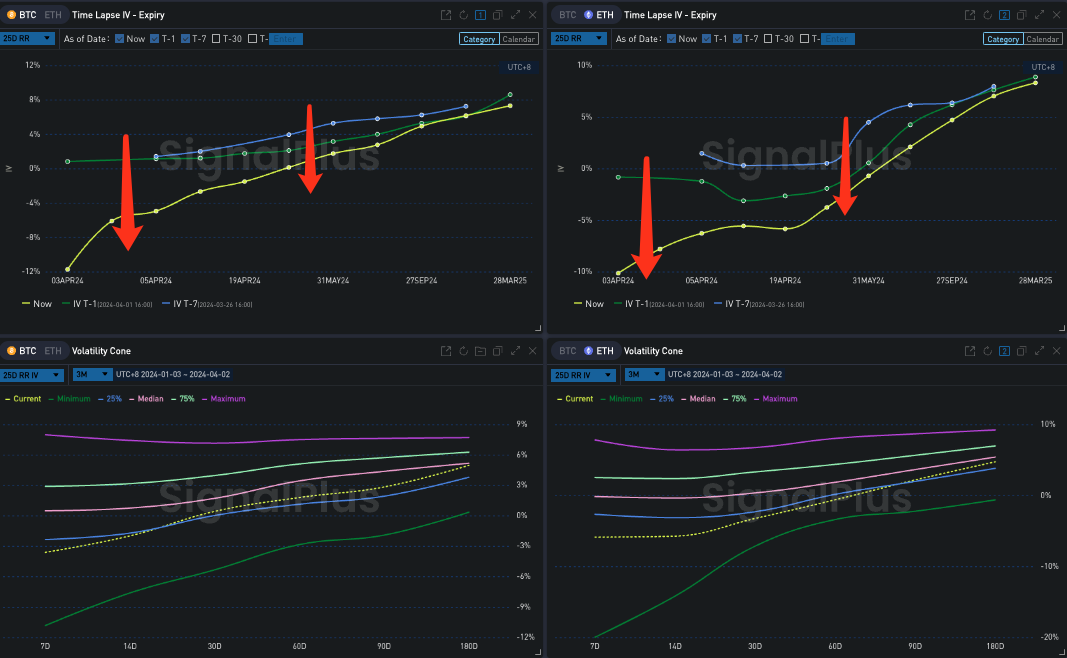

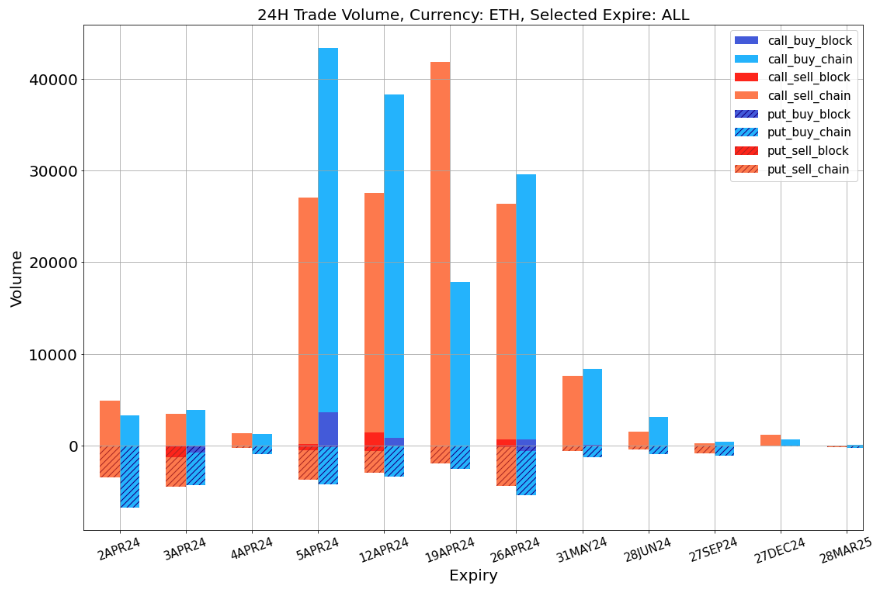

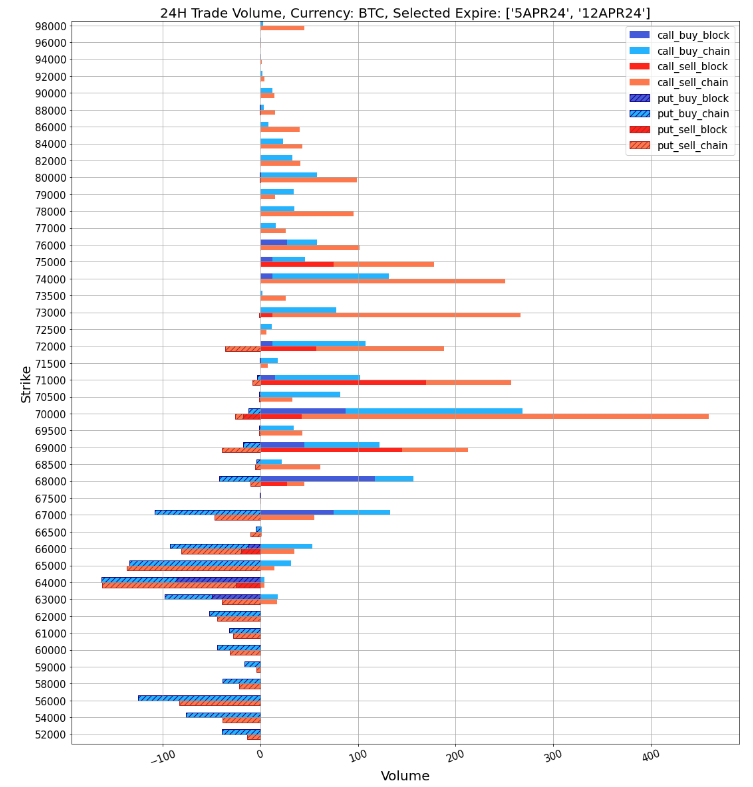

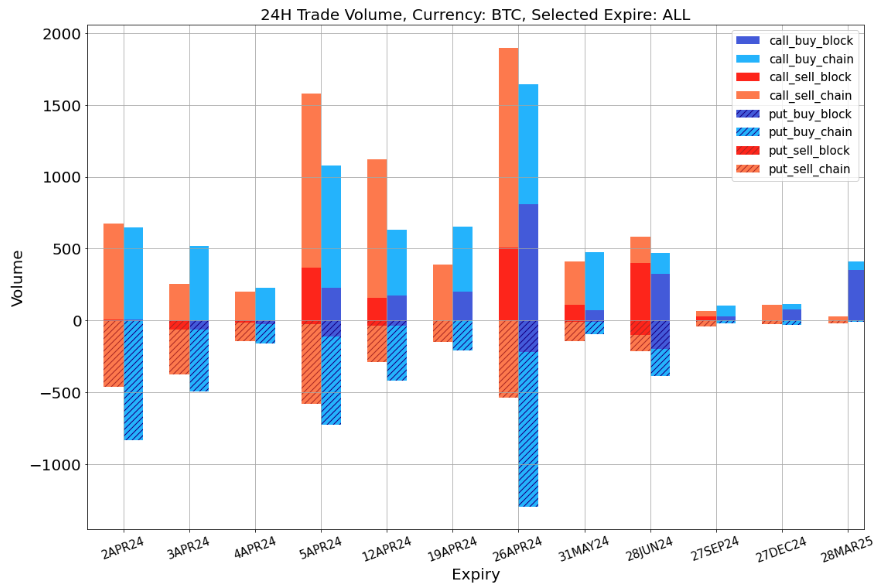

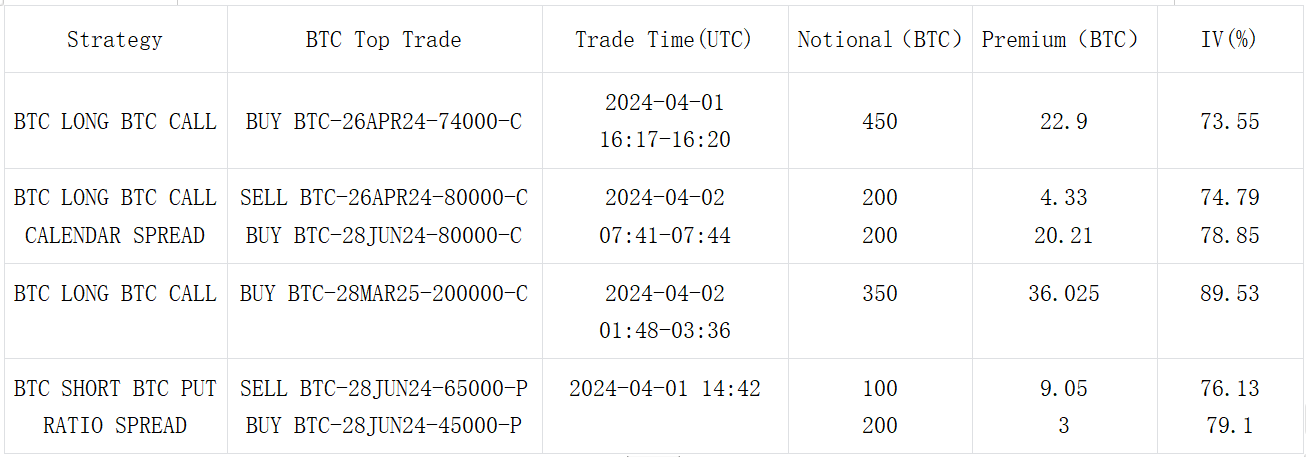

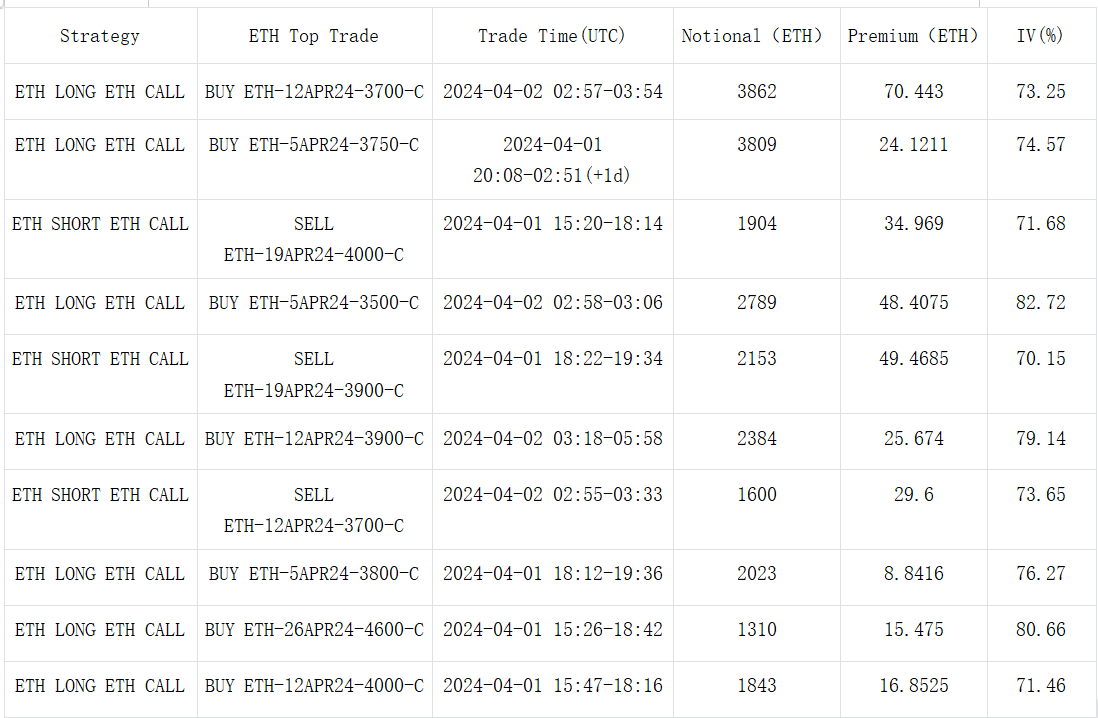

数字货币方面,BTC 在亚盘时段下跌至 66000 美元,打破了近日在 70000 附近的横盘行情,但各大交易所的资金费率仍在一边倒的多头持仓下维持在较高的水平,有分析指出,此轮价格调整或是由于期货多头清算和止损行为引起。加密货币上涨的势头似乎开始减弱,期权盘口的 Vol Skew 也处在历史低点(25 dRR 大约处在过去三个月的 25% 分位数)。从交易上看,过去一日看涨期权交易量显著压过看跌期权,ETH 的 P/C Ratio 甚至达到了接近 0.2 的极低点,形成类似 Sell Call Spread 的 Flow,BTC 短期内的卖压更为强势,看涨多头分布向远端发生转移。

Source: Deribit (截至 2 APR 16: 00 UTC+ 8)

Source: SignalPlus, ATM Vol

Source: SignalPlus, Vol Skew

Data Source: Deribit,ETH 交易分布,P/C Ratio 达到接近 0.2 的极低点

Data Source: Deribit,BTC 交易分布,短期内卖压强势

Source: Deribit Block Trade

Source: Deribit Block Trade

您可在 ChatGPT 4.0 的 Plugin Store 搜索 SignalPlus ,获取实时加密资讯。如果想即时收到我们的更新,欢迎关注我们的推特账号@SignalPlus_Web3 ,或者加入我们的微信群(添加小助手微信:xdengalin)、Telegram 群以及 Discord 社群,和更多朋友一起交流互动。

SignalPlus Official Website:https://www.signalplus.com