一文读懂LBP:如何在公平的IDO中买到合理的筹码?

原文作者:加密狗

上周,老牌炼油龙头 MOBOX 出品的新游戏 Dragonverse Neo 启动游戏代币 $MDBL 的公平发射,在比特币原生二层 Merlin Chain,采用 LBP 的方式发射。

LBP 作为一种 IDO 策略,以公平和高效的价格发现为优势,在加密世界中得到广泛采用并经久不衰。但对于这种机制,许多投资者拿不准如何参与,甚至在过程中踩坑。本文将用通俗易懂的语言介绍 LBP 的价格机制,并分享更合理的参与策略。阅读完本文,你自然会对以下问题拥有答案:

为什么说 LBP 是更公平、对社区更有利的 IDO 方式?

LBP 过程中的代币价格受哪些因素影响?

为什么你会被挂在山顶,而别人却能买到更便宜的筹码?

到底该在什么时候入场,如何购买最合适?

LBP: 为公平而生

LBP 全称 Liquidity Bootstrapping Pool (流动性引导池),是一种去中心化代币发行方式,起源于 Balancer 提出的 weighted pool,后得到广泛采用。它的诞生旨在解决一个核心问题:

如何以相对公平的价格,把代币分配到社区成员手中?

如果一个代币在 Uniswap 上发售,当代币池子加好的瞬间,就开始有成百上千的机器人开始抢跑购买,价格瞬间飙升,且越来越高,真正的项目参与者跑不过机器人;若根据资金权重分配代币,小资金的用户几乎没有公平购买的机会。

LBP 在这种情况下应运而生,它结合了荷兰式拍卖(价格由高至低)和英式拍卖(价格由低到高),让代币在发射过程中,用市场需求调节价格,如果购买者众多,价格上涨;如果无人购买,价格下降。这种策略在很大程度上解决了 IDO 的公平问题:

抢先购买不一定能买到价格最低的筹码,从而避免抢跑 —— 在购买时间上实现公平。

不限制购买量,防止大户和机器人吸筹 —— 让持仓分布更加广泛。

发射过程中价格可升可降,鼓励理性价位建仓 —— 形成高效的价格发现。

为什么 LBP 中价格可升可降?

理解 LBP 的价格模型,首先需明白一个概念:权重。在 LBP 流动性池中,存在两种代币:一种是项目的发行代币,另一种是具有相对稳定价值的代币(如 USDC)。"权重"就代表了两种代币在池子中的价值比率。

权重会在 LBP 过程中随着时间从高到低变化,且只与时间有关。

以 Mask Network 发行的 MASK 为例,其 LBP 开始时,MASK 价值占流动性池总值的 95% ,剩下的 5% 是 USDC。随着时间流逝,这个比率会逐渐变化,直到结束,MASK 的价值占比降为 40% ,USDC 占比增为 60% 。权重变化的参数是由 MASK Network 预设好的。

由此可以得出 MASK 的价格公式:

MASK 价格= (MASK 权重 / USDC 权重) * (USDC 数量 / MASK 数量)

从价格公式可以看出:

随着时间流逝,公式左边的 (MASK 权重/USDC 权重) 逐渐下降,从 95: 5 降到 40: 60 ;

随着购买量增多,公式右边的 (USDC 数量/MASK 数量)逐渐上升,池子里的 MASK 越来越少

因此,代币价格受到 “时间权重” 和“交易行为” 的双重影响,并且可升可降。LBP 的过程可以体现市场经济中的自发性机制,通过交易活动使价格趋于合理,反映市场中真实的供需关系,是一个良好的价格发现过程。

LBP 的优势与考验

对用户的好处

无论资金量大小,均能买入筹码。

更大概率以合理价格买到筹码,无需抢跑竞争。

对用户的考验

考验入场时机,心急可能被套在山顶吹风,犹豫不决可能错过最佳上车时机。

考验看项目的眼光,需要考察团队是否有长期发展的实力和计划。

对项目方的优势

由于一开始主流资产在池子里占比小,项目方可以用较少的资产提供流动性,会有更小的启动压力。

对项目方的考验

考验长期建设能力:如果代币在后续的产品和生态中无实际应用,或没有有持续的利好信息,那么采用 LBP 的发射方式便无多大意义。

LBP 策略:如何买到最合理的筹码

前期调研:心理价位决定入场时机

因为很难预测其短期价格波动,LBP 本质是个估值游戏。给项目一个估值,用估值除以 Token 总量,就可得到心理预期价位。如果 LBP 期间任何一个时刻,当前价格低于你的心理价位,都是较为合适的入场时机。

在 LBP 前可以对于项目的以下几个方面进行调研:

市值估算:是否在天花板高、热度高的赛道?业务是纯画饼还是具备清晰的产品路线图?

项目团队:投资背景,过往声誉,团队实力

经济模型:代币的经济模型,在生态中的后续应用

根据市场热度和初始 FDV,可能出现的几种价格走势

回顾 LBP 的价格公式:

Token 价格= (Token 权重 / USD 权重) * (USD 数量 / Token 数量)

结合价格公式与过往案例,我们总结出不同市场热度 + 初始 FDV 下,可能出现的几种价格走势,以得出相应的 LBP 购买策略:

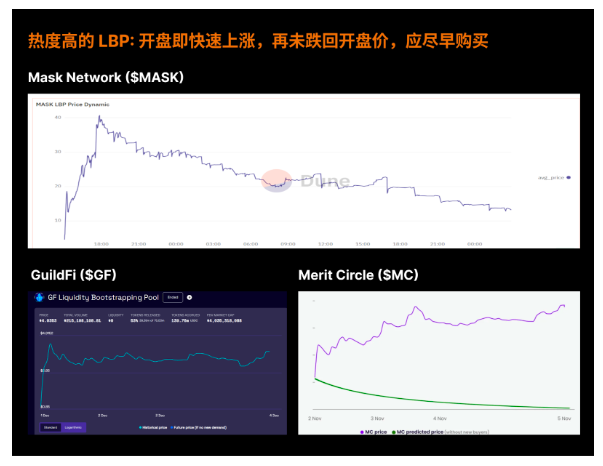

1. 初始 FDV 低,参与热度极高:越早参与越好

如果代币初始定价低,市场参与热度极高,那么往往价格会在开盘后迅速上涨,且在之后回落,但大概率全程不会再低于初始发行价。

以 $MASK 为例,LBP 一开始的定价是 $ 3.9 ,结束时价格是 $ 13.28 ,全程 $MASK 均价为 $ 20.94 。其他著名的 LBP 案例也是如此:Merit Circle 的 $MC,GuildFi 的 $GF,开盘时价格最低,一开盘即快速上涨,且再也没有跌回开始时的价格,

如果一个项目热度高,且你认为其初始 FDV 所代表的市值被低估,那么参与策略是越早越好。

2. 有一定热度,但不算 FOMO:中期进入,不建议拖到最后

许多人会被 LBP 的预期价格曲线所迷惑,认为到后面价格一定会降下去,等待可以换来更便宜的筹码。但是,越到后期,权重变化对价格的影响越小,当购买行为导致价格上涨,越不容易随时间跌回低价。如果所有人都等到快结束再购买,则会导致价格以较大的幅度形成一个 U 形回涨。

在真实的 LBP 中,这种情况也时常发生:以 $TUNA 和 $DEAI 为例,均是在开始时价格下降了一段时间,在中期的价格最低。因此这种情况下,建议在价格/市值到达合适心理预期的时候购买。

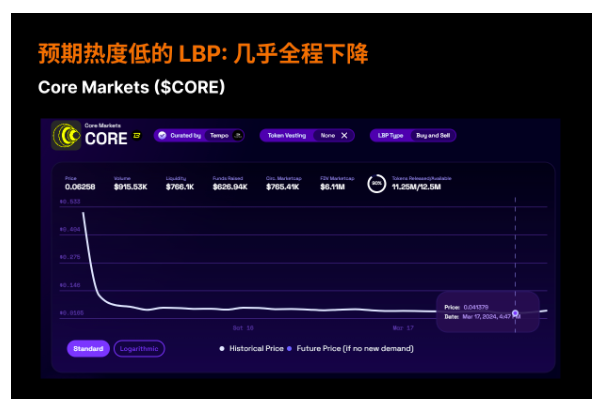

3. 预期热度低的 LBP

对于参与者较少的 LBP, 价格公式中的右半部分 (USD 数量 / Token 数量) 影响很小,价格主要受到 (Token 权重 / USD 权重) 的影响。理论上来说,如果没有任何购买,则在结束时购买价格最低。不过在真实环境中,没有任何购买的假设不完全成立,为了避免在最后时刻价格被拉起,可以选择在临近结束前一段时间购买。

总结

综上所有分析,可得到最通用的 LBP 策略:

在价格低于你的估值的任意时机,将总额度分为多次买入。

对于热度高、开盘价低的项目,开盘后立即入场就不亏,但不建议像传统 IDO 那样一开盘就投入大量资金。

对于大部分情况,不建议为了更便宜的筹码拖到后期。越到后期权重越低,少量购买就可能引起价格上涨。大部分过往 LBP 的最低点都在中期,建议在合适价格区间入场。