以太坊现货ETF获批再度推迟,这次多了只拦路虎

原创 | Odaily星球日报

作者 | Asher

3 月 13 日,以太坊顺利完成了坎昆升级,进入低交易费 L2 新时代。然而,以太坊的价格并没有出现独立的强势上涨,基本与其他主流币保持一致涨跌幅。对比“隔壁两位邻居”,社区中也戏称:“恭喜 SOL、BNB 完成坎昆升级”。

让“以太坊最大主义者”更为头秃的事还没完——今日凌晨,美 SEC 推迟批准 VanEck 以太坊现货 ETF,表示将在 5 月 23 日之前决定是否批准该 ETF。同时,有传言称,以太坊基金会接受某国家官方调查或是美 SEC 针对以太坊协同攻击的一部分。

在两个消息的共同影响下,以太坊价格短线跌破 3100 美元,最低触及 3055 美元,一小时最大跌幅超 5%。(Odaily星球日报注:ETH 目前已随今日大盘强势反弹,现报 3529 USDT。)

美 SEC 推迟 VANECK 以太坊现货 ETF

虽然,对本次以太坊现货 ETF 被推迟的结果,大部分人早有预期,但最终被推迟确定后还是对市场产生不小的影响,根据预测平台 Polymarket 的“民意”数据,截至 5 月 31 日,以太坊现货 ETF 获批的可能性继续下降,目前仅为 22% 。

那么,ETH 现货 ETF 是否还会进一步推迟甚至惨遭拒绝呢?Odaily星球日报特整理加密从业者以及 KOL 的看法,如下。

彭博 ETF 分析师 James Seyffart:

目前对以太坊现货 ETF 是否能短期通过产生担忧,美 SEC 没有就以太坊的特定问题与发行人进行互动,这与今年秋季比特币 ETF 的情况完全相反,VanEck、Ark/21 Shares 和 Grayscale 应该会在接下来的 12 天内延迟。并且,美 SEC 最终将在 2024 年 5 月 23 日拒绝以太坊 ETF 的现货申请。

彭博 ETF 分析师 Eric Balchunas:

以太坊现货 ETF 的批准机会继续减少,目前批准机会已从 70% 降至 25% 。尽管乐观情绪较低,SEC 只会推迟批准以太坊 ETF 的实施,而不会在 5 月 23 日批准;然而,仍然相信这将在长期的前景中发生。

Coinbase 首席法务官 Paul Grewal:

以太坊一直对加密货币领域至关重要,它是一种商品,而非证券,这也是 SEC 多年来一直采取的立场,SEC 没有充足理由拒绝以太坊 ETF 申请。

FOX Business 记者 Eleanor Terrett:

对 SEC 在 5 月 23 日前批准以太坊现货 ETF 的乐观情绪正在减弱。根据其与知情人士的谈话,最近几周的会议很大程度上是一边倒的,发行方和托管机构试图鼓动 SEC 工作人员来推动这一进程,但工作人员并没有(像他们在处理比特币现货 ETF 申请时那样)真正以有意义的方式参与进来。

加密 KOL DCinvestor:

虽然以太坊现货 ETF 的推迟使得 ETH 价格下跌,但很快就出现了强有力的反弹说明有机构正在购买。相信 5 月份以太坊现货 ETF 会获批,或将以太坊价格推高到 10, 000 美元。

加密 KOL Matthew Hyland:

以太坊现货 ETF 负面报道是完全可以预料的。华尔街的机构必须需要以太坊现货 ETF 的来购买以太坊,就像他们不能在没有比特币 ETF 的前提下购买比特币,获批只是时间问题。

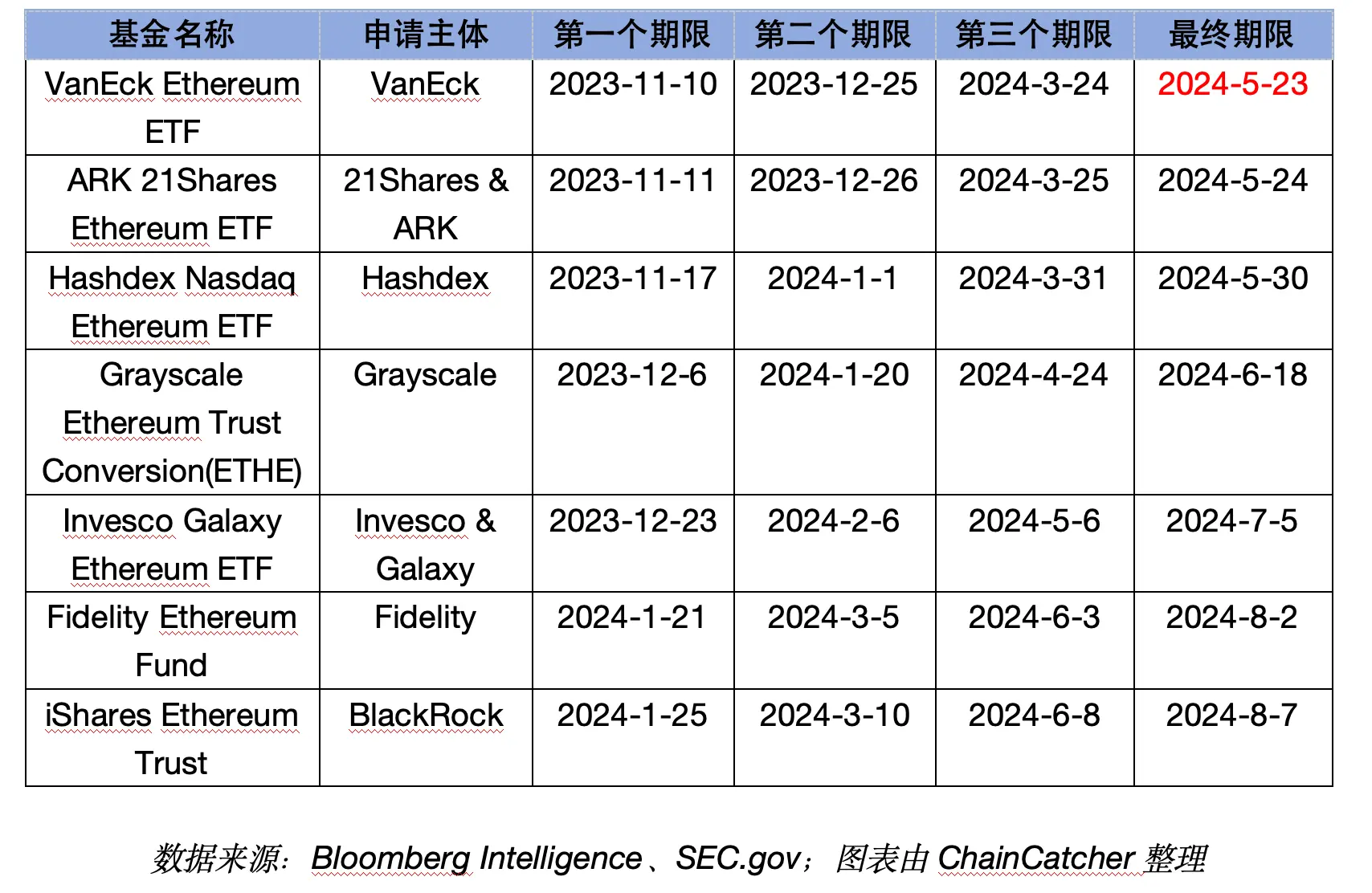

当前,有七家主体正在申请以太坊 ETF,分别是:BlackRock、Fidelity、Invesco&Galaxy、Grayscale、VanEck、 21 Shares &Ark 和 Hashdex,各基金在 SEC 的审批期限如下表所示, 5 月 23 日将是最早申请以太坊现货 ETF VanEck 的关键截止日期,其批准或否决也将直接影响其他 ETF 申请的决策结果。

总的来看,随着本次以太坊现货 ETF 的推迟,市场对其 5 月末前通过的预期大幅下降。虽说部分加密 KOL 仍认为 5 月会顺利通过,但相较于现货比特币 ETF,以坊的 PoS 机制、价格操纵以及证券化风险,这降低了现货以太坊 ETF 获批的可能性。或许,我们要提前做好以太坊 ETF 再次推迟的心理准备。

总的来看,随着本次以太坊现货 ETF 的推迟,市场对其 5 月末前通过的预期大幅下降。虽说部分加密 KOL 仍认为 5 月会顺利通过,但相较于现货比特币 ETF,以坊的 PoS 机制、价格操纵以及证券化风险,这降低了现货以太坊 ETF 获批的可能性。或许,我们要提前做好以太坊 ETF 再次推迟的心理准备。