坎昆升级完成,LRT赛道催化以太坊生态?

随着坎昆升级的完成,以太坊及其相关生态代币价格在近期表现亮眼。同时,模块化概念项目和以太坊 Layer 2 项目陆续推出主网,进一步推动了当前市场对以太坊生态的看好。流动性再质押(Liquid Restaking)叙事也因 EigenLayer 项目的爆火而开始吸引资本的关注。

但,从 ETH -> LST → LRT 是以太坊生态催化剂还是如大多人说的套娃?

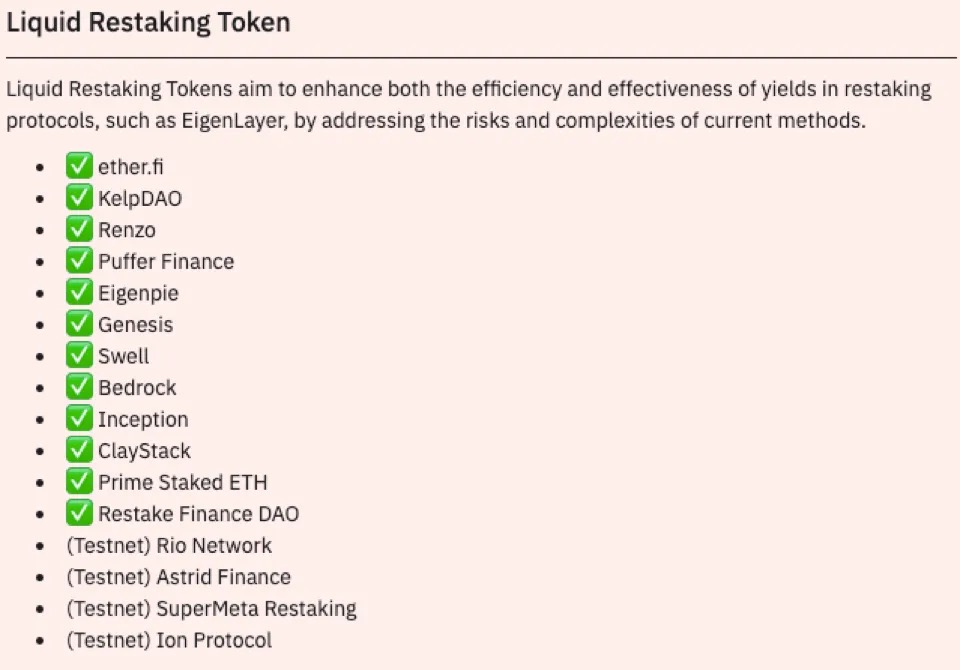

本研报围绕 LRT 赛道生态情况,对 LRT 赛道的现状、机遇与未来做了详细阐述。目前,很多 LRT 协议并没有发行代币,项目同质化较严重。但比较看好的是 KelpDAO、Puffer Finance、Ion Protocol,这三类协议有明显区别于其他 LRT 协议的发展路线。LRT 赛道的未来仍是一个增长迅猛的利基市场。火币研究院预测未来只有少数头部项目跑出来。

这篇演讲撰写于 HTX Ventures 旗下的 Research 团队。HTX Ventures 是火币 HTX 的全球投资部门,整合投资、孵化和研究以识别全球最优秀和最有前景的团队。

LRT 赛道背景

由于坎昆升级的临近,以太坊及其相关生态代币价格在近期表现亮眼。同时,模块化概念项目和以太坊 Layer 2 项目陆续推出主网,进一步推动了当前市场对以太坊生态的看好。

流动性质押项目在以太坊生态中占据了很大份额,而另一个叙事 — — 再质押(re-staking),随着 EigenLayer 项目的爆火而开始吸引资本的关注。

“再质押”概念最早是在 2023 年 6 月由 Eigenlayer 提出。它允许用户将已经质押的以太坊或流动性质押代币(LST)进行再质押,以此对各种以太坊上的去中心化服务提供额外的安全保障,并为自己赚取额外的奖励。基于 Eigenlayer 提供的再质押服务,流动性再质押代币(LRT)相关项目应运而生。

LRT 是套娃吗?看看 LRT 的演化路径

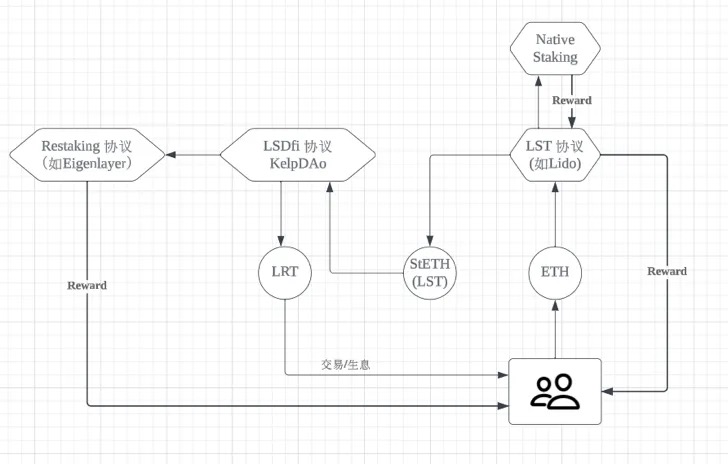

LRT 流动性再质押代币,是指将 LST 进行质押后得到的一个“再质押凭证”。

那么,

这个再质押凭证 LRT 是如何诞生的呢?

从 ETH -> LST → LRT 是如大多人说的是套娃吗?

这就需要追溯一下 LRT 的演化路径。

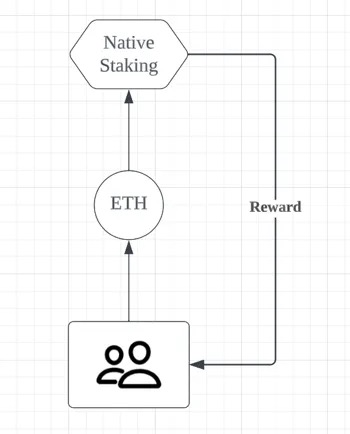

Phase 1 :以太坊原生质押

以太坊升级转 PoS 机制后,为了维护以太坊网络的安全性,矿工的身份也转变为验证者,负责存储数据、处理交易以及向区块链添加新区块,并获得奖励。成为验证者,需要在以太坊上质押至少32 个 ETH 和一台全年无休连接到互联网的专用计算机。

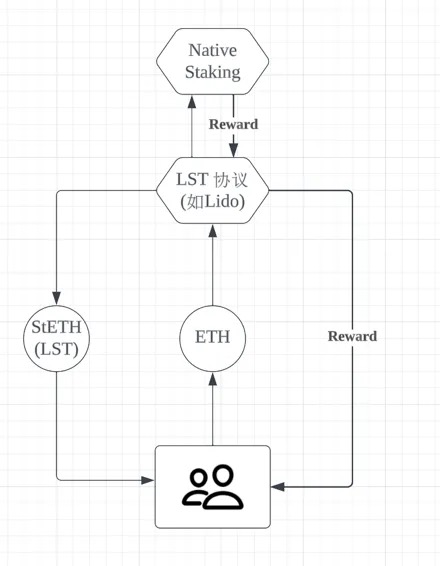

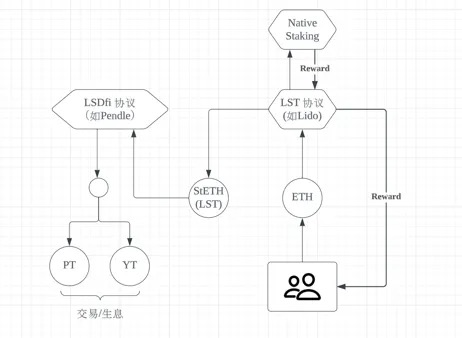

Phase 2: LST 协议的诞生

由于官方质押要求最少 32 个 ETH,而且相当长一段时间不能提款,在此背景下,质押平台应运而生,它们主要解决 2 个问题:

降低门槛:比如 Lido 可以质押任意数量的 ETH 并且没有技术门槛

释放流动性:比如在 Lido 质押 ETH 可以获取 stETH,stETH 可以参与 Defi 或者近似等价的兑换 ETH

通俗来讲,就是“拼团”。

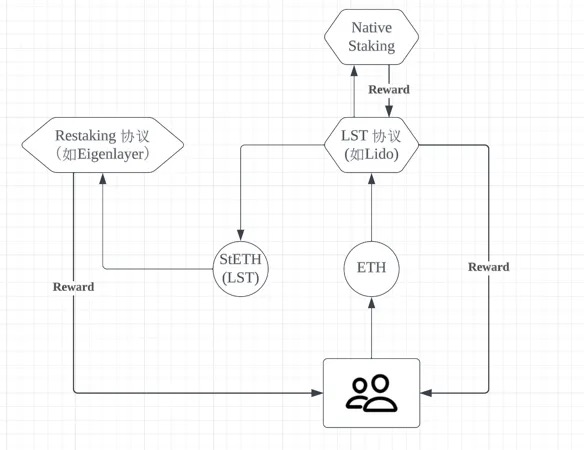

Phase 3: Restaking 协议的诞生

随着以太坊生态的发展,大家发现,流动性质押代币资产(LST)可以质押在其他网络和区块链,以获得更多收益,同时仍有助于提高新网络的安全性和去中心化的行为。

其中最具代表性的项目就是 Eigenlayer,其再质押背后的逻辑主要分两块。一是对 ETH 内的生态系统共享安全性,二是用户有更高收益的诉求。

再质押能与侧链和中间件(DA Layer/桥/预言机等)间的安全性共享,从而进一步维护以太坊的网络安全。安全共享就是允许区块链通过共享另一个区块链的验证节点的价值,来增强自身区块链的安全性。

从用户侧来看,则是质押找收益,再质押要找更多收益。

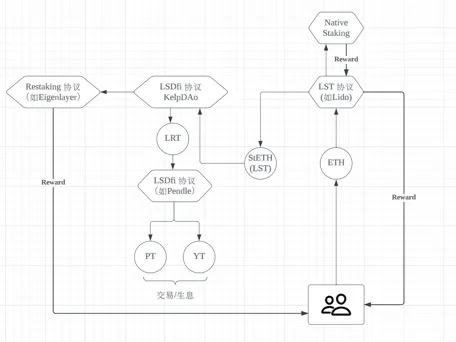

Phase 4 : LRT 的诞生

有了 Restaking 协议之后,大家发现,可以将 LST 进行再质押生息,但是 LST 代币放进去质押以后,似乎流动性就锁死了。这个时候,就有项目发现了机会,他们帮助用户将 LST 资产放入 Restaking 协议进行再质押获得一份收益,同时,他们给用户发放了一个“再质押凭证”,用户可以用这个“再质押凭证”去做更多的金融操作,例如抵押和借贷等,以解决再质押中流动性锁死的局面。这里的“再质押凭证” 就是 LRT。

Phase 5 : Pendle 协议加持 LRT 的爆发

当用户得到了 LRT 之后,想要进行一系列的金融操作,那么这些 LRT 该去哪里,该做些什么金融操作呢?这个时候 Pendle 提供了一个非常精巧的方案。

Pendle 是一个去中心化利率交易市场,提供 PT(Principal Token,本金代币)和 YT(Yield Token,收益代币)的交易。

随着收益型美元和最近的流动性再质押代币(LRT)的出现,收益型代币的种类逐渐扩展,Pendle 得以不断迭代并支持这些加密货币的收益交易。Pendle 的 LRT 市场尤为成功,因为它们本质上允许用户预售或布局长期空投机会(包括 EigenLayer)。这些市场已迅速成为 Pendle 上最大的市场,并且遥遥领先:

通过对 LRT 的定制整合,Pendle 允许 Principal Token 锁定基础 ETH 收益、EigenLayer 空投以及与发行 LRT 的 Restaking 协议相关的任何空投。这为 Principal Token 购买者创造了每年 30% 以上的收益率。

另一方面,由于 LRT 集成到 Pendle 中的方式,Yield Token 允许某种形式的“杠杆化积分流动质押(leveraged point farming)”。通过 Pendle 中的交换功能,我们可以将 1 eETH 交换为 9.6 YT eETH,这将累积 EigenLayer 和 Ether.fi 积分,就像持有 9.6 eETH 一样。

事实上,对于 eETH,Yield Token 购买者还能获得 Ether.fi 的 2 倍积分,这实际上是“杠杆化博取空投的质押(leveraged airdrop farming)”。

利用 Pendle,用户可以锁定以 ETH 计价的空投收益(基于市场对 EigenLayer 和 LRT 协议的空投预期)和杠杆化的流动性挖矿。由于今年可能会围绕 AVS 向 LRT 持有者空投的猜测,Pendle 很可能继续主导这一市场细分。从这个意义上说,$PENDLE 为 LRT 和 EigenLayer 垂直领域的成功提供了很好的风险敞口。

小结:

上文阐述了 LRT 的是如何诞生的过程,那么,

从 ETH -> LST → LRT 是如大多人说的是套娃吗?

这个问题的答案是需要分情况讨论的,

如果说在单个 DeFi 生态内,质押 LST 产生了再质押凭证,然后再把该凭证质押,然后以锁住流动性之名发个治理代币,让二级市场炒作反哺 Restaking 的预期价值,这是套娃。因为让下一级流入资金反哺上一级资产,透支的是市场对一个 Token 的预期,并没有真正的价值增长发生。

那么看看以 Eigenlayer + Pendle 为核心的经典再质押模式,

通过 Eigenlayer,

用户将 LSD 重复质押到 EigenLayer。

重复质押的资产会被提供给 AVS(Actively Validated Services,主动验证服务) 用作保护。

AVS 为应用链提供验证服务。

应用链支付服务费用。费用将被分为三部分,分别作为质押奖励、服务收益以及协议收入分配给质押者、AVS 和 EigenLayer。

通过 Pendle,

用户可以锁定以 ETH 计价的空投收益(基于市场对 EigenLayer 和 LRT 协议的空投预期)

杠杆化的流动性挖矿

LRT 作为生息资产就有了极佳的应用场景

这个模式的本质是为了共享以太坊的安全性,并且通过这个机制共享安全性的项目需要为该服务支付费用,正向的资金进入了生态,这个就绝对不是套娃,而是非常合理的经济模型。

简单来说,这一轮 LRT 叙事启动的核心动力,有以下两个关键条件

LRT 底层资产的生息能力

LRT 的应用场景

其一,LRT 的底层资产的生息能力由 Eigenlayer 提供,包括 Eigenlayer 的空投及其实用性服务收入,下文还会对 Eigenlayer 进行详细介绍

其二,LRT 应用场景 Pendle 给了很好的范例

那么在下文,我们会重点针对 Restaking 最核心项目 Eigenlayer 进行介绍,并对其他 LRT 项目进行盘点梳理。

LRT 赛道生态情况(重点介绍)

EigenLayer-再质押中间件

EigenLayer 简介

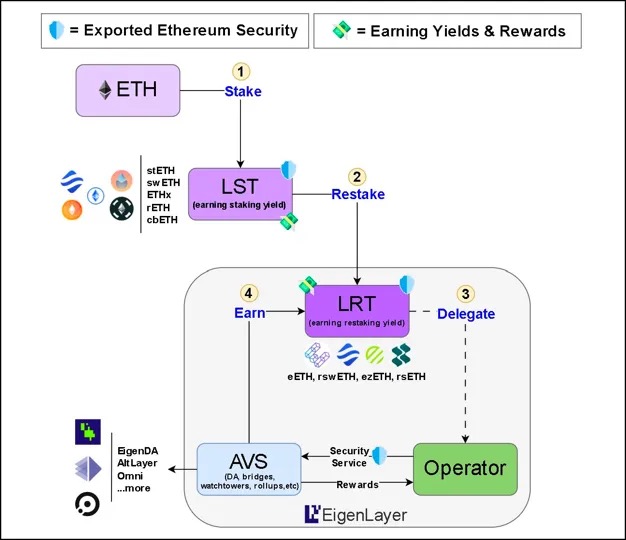

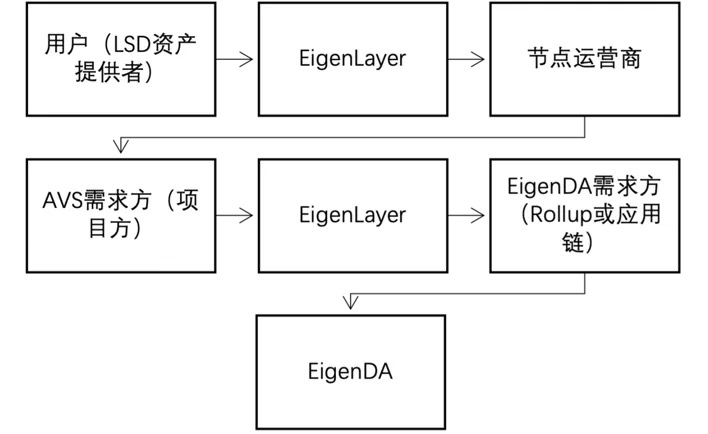

EigenLayer 是一个以太坊的再质押集合,是一套在以太坊上的智能合约中间件,允许共识层以太币(ETH)的质押者选择验证在以太坊生态系统之上构建的新软件模块。

EigenLayer 通过提供经济权益平台来允许任何权益持有者为任何 PoS 网络做出贡献,通过降低成本和复杂性,EigenLayer 有效地为 L2 挖掘 Cosmos 堆栈中的表达性创新铺平了道路。使用 EigenLayer 的协议正在从以太坊现有的质押者那里“租赁”其经济安全性,这种重复利用 ETH 为多个应用提供安全性。

总结来说就是:EigenLayer 通过一套智能合约让再质押者去参与验证不同的网络和服务,为第三方协议节省成本同时享受以太坊安全性,为再质押者提供多重收益以及灵活性。

产品机制

对于中间件项目来说,EigenLayer 可以帮助他们进行网络快速冷启动,即便之后自己发行代币,也可以切换到由自己代币驱动的模式。EigenLayer 就像一个安全服务提供商。对于 DeFi 来说,可以基于 EigenLayer 构建各种衍生品。

EigenLayer 在整个 LST/LRT 中的产品逻辑

用户通过 EigenLayer 流程图

详解 EigenLayer AVS

EigenLayer 中另一个重要的新概念就是 AVS(主动验证服务)。

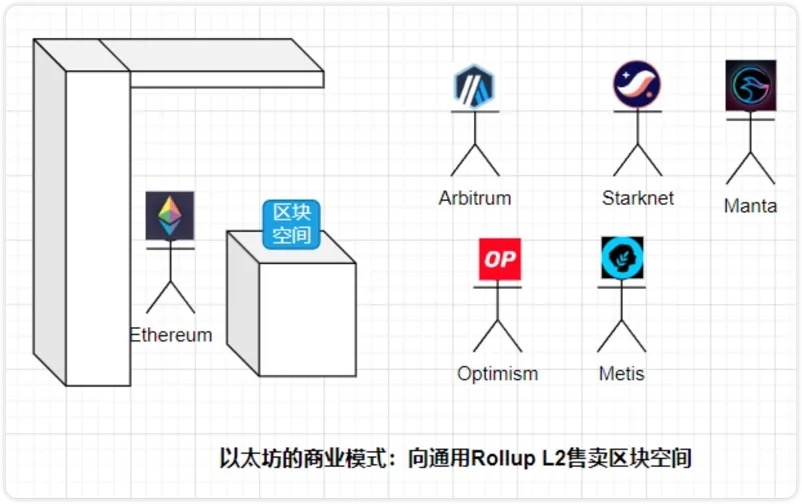

Restaking 好理解,AVS 理解起来有点复杂。要理解 EigenLayer 的 AVS,需要首先理解以太坊的商业模式。如果从商业视角观察以太坊主网与以太坊生态 Rollup L2们的关系,以太坊当下的商业模式,是向通用 Rollup L2们出售区块空间。

图片来源:Twitter 0x Ning 0x

通用 Rollup L2们,通过支付 GAS,将L2的状态数据和交易,打包到它们在以太坊主网部署的智能合约验证可用性,再以 calldata 的形式保存在以太坊主网,最后由以太坊共识层将这些状态数据和交易排序和包含在区块内。这一过程的本质,是以太坊在主动验证 Rollup L2状态数据的一致性。

而 EigenLayer 的 AVS,只是将这一具体过程的抽象为一个新的概念 — AVS

我们再来看 EigenLayer 的商业模式。它通过 ReStaking 的方式将以太坊 PoS 共识的经济安全性抽象封装成一个丐版(低佩型号),这样共识安全变弱了,但费用也变便宜了。

因为是丐版 AVS,所以它的目标市场群体,不是对共识安全要求非常高的通用 Rollup L2,而是各种 Dapp Rollup、预言机网络、跨链桥、MPC 多重签名网络、可信执行环境等等这些对共识安全需求较低的项目。这不正好 PFT(Product Market Fit)吗?

图片来源:Twitter 0x Ning 0x

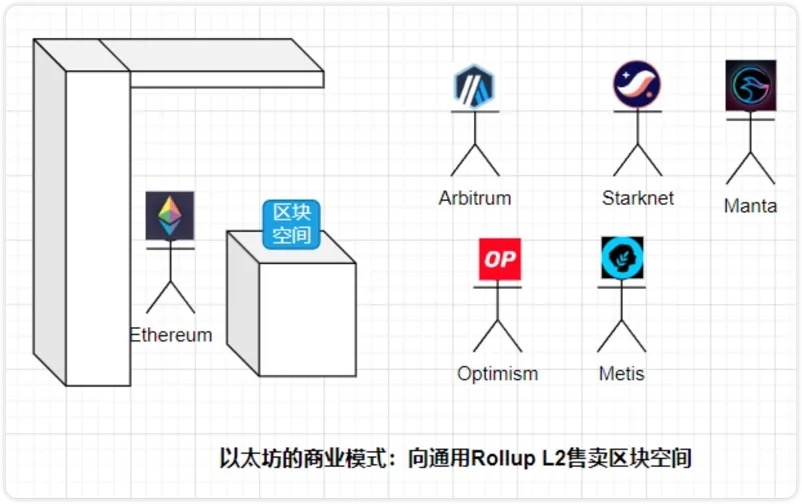

AVS 主动验证服务商项目

目前被 EigenLayer 收纳的 AVS 大约有 13 家左右,更多的 AVS 服务商正通过 EigenLayer 的 Dev 文档加入 AVS。这些项目与 RaaS 概念高度绑定,大部分服务于 Rollup 项目的安全性、扩展性、互操作性和去中心化,也有延伸至 Cosmos 生态系统。

其中我们熟悉的有 EigenDA, AltLayer, Near 等 ,下面我们列示一下 AVS 相关项目的特点。

Ethos:Ethos 主要是将以太坊的经济安全性和流动性桥接到 Cosmos。Cosmos Consumer 链通常是将仓位原生质押代币来保障网络安全,尽管 ATOM 质押提供了一部分的跨链安全(ICS),但 Ethos 正将以太坊的经济安全性和流动性与 Cosmos 联系起来。Ethos 的灵感来源于 Mesh Security(允许在一条链上使用另一条链的质押代币),从而在不需要额外节点的情况下提高经济安全性。这种结构的好处在于,ETHOS 很可能会收到合作伙伴链的代币空投(和收入)。与此同时,ETHOS 代币本身也将空投给 Eigenlayer 上的 ETH 再质押者。

AltLayer :与 Eigenlayer 合作推出的新项目 Restaked rollup, 特点是引入了三种 AVS: 1)快速最终性;2)去中心化排序;3)去中心化验证。ALT 的代币经济学非常巧妙,因为需要将 ALT 与再质押的 ETH 同时质押以保护这三个 AVS。

Espresso : Espresso 是专注于去中心化 Layer 2 的排序器。AltLayer 实际上集成了 Espresso,因此开发者在 AltLayer 堆栈上部署时可以选择使用 AltLayer 的去中心化验证解决方案和使用 Espresso Sequencer。

Omni 旨在整合以太坊的所有 Rollups。Omni 引入了一个「统一的全局状态层」,通过 EigenLayer 的再质押进行保护。该状态层将应用程序的跨域管理集成在了一起。

Hyperlane 的目标是连接所有的 Layer 1 和 Layer 2 。使用 Hyperlane,开发人员可以构建链间应用程序,Hyperlane Permissionless Interoperability 允许 Rollups 可以自己连接到 Hyperlane,而无需麻烦的治理审批等。

Blockless 采用了一种网络中立的应用程序(nnApp),允许用户在使用应用程序的同时运行一个节点,为网络贡献资源。Blockless 将为基于 EigenLayer 的应用程序提供网络,以最大限度地减少意外罚没。

其他值得关注的 AVS 项目:

Lagrange:LayerZero、Omni 和 Hyperlane 的另一个竞争对手,其跨链基础设施可在所有主要区块链上创建通用状态证明;

Drosera:用于遏制漏洞的「事件响应协议」,当黑客攻击发生时,Drosera 的 Trap 会检测到它并采取行动减少漏洞;

Witness Chain(见证链):使用再质押功能进行 Proof of Diligence,确保 Rollups 安全,以及 Proof of Location 以建立物理节点去中心化。

EigenLayer 产品特点小结

EigenLayer 的产品特点可以总结为以下几点:

EigenLayer 是一个「超级连接器」,同时连接 Staking、基础设施中间件和 DeFi 三大板块。

EigenLayer 在以太坊再质押中推演着桥梁的角色, 是以太坊加密经济安全的外延。EigenLayer 的市场需求和供给非常坚固。

EigenDA 是以太坊 Rollup-centric Roadmap 下扩容解决方案 Danksharding 的先行探索版本。简单来说就是“分片存储的青春版”

EigenLayer 生态相关项目

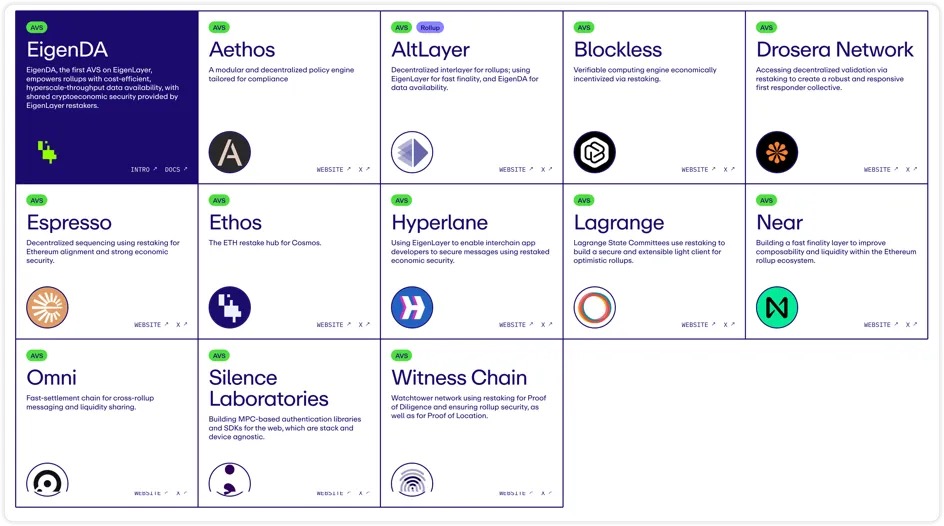

以太坊 LRT 项目梳理

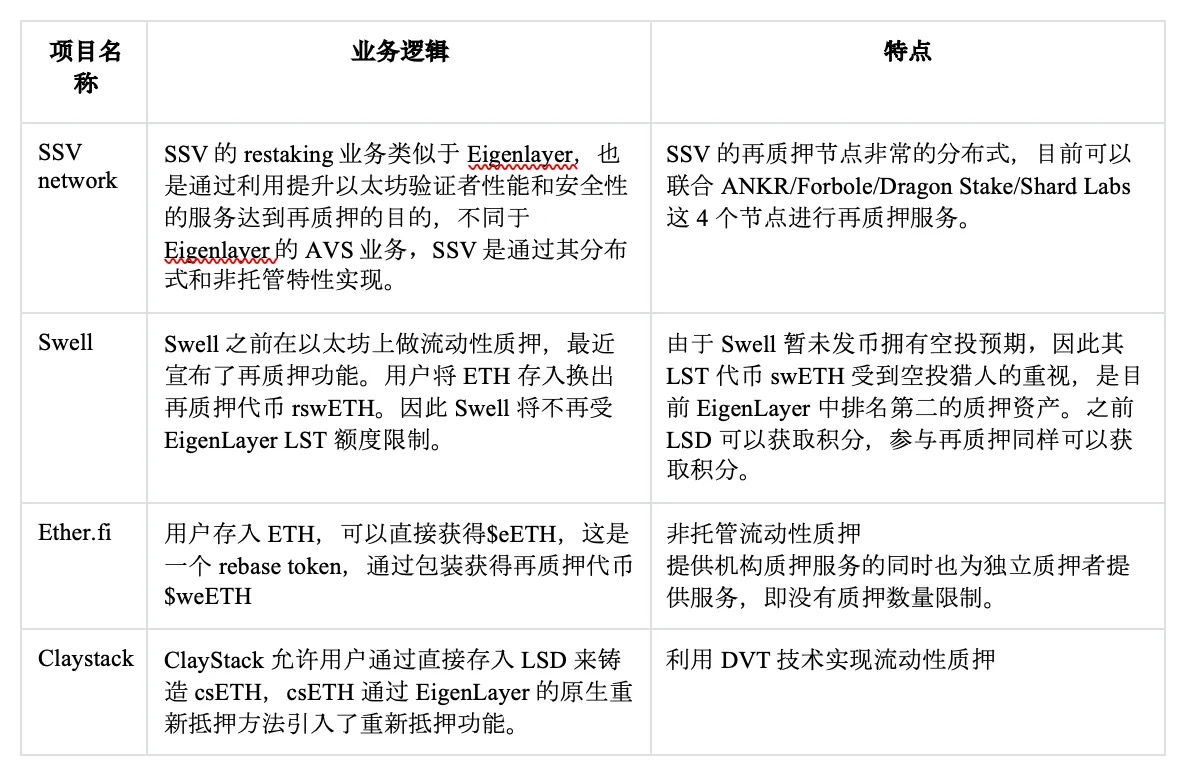

以太坊上的 LRT 协议数目前大概有 15 个, 9 个已经上线, 6 个还在测试网。LRT 协议大部分还是依托于 Eigenlayer 获取 restaking 收益,主要分为 3 大类:

Liquid-LSD Restaking:将用户质押的 LST 统一管理放入 Eigenlayer 等外部 Restaking 协议,用户则得到抵押凭证代币 Liquid Restaking Token (LRT) (这类协议有 KelpDAO、Restake Finance、Renzo)。这类协议同质化严重,技术和创新性有限。

Liquid Native Restaking:原生流动再质押指的是例如 etherf.fi 或 Puffer Finance 这类型提供小额 ETH 节点服务的项目,将节点内的 ETH 提供给 EigenLayer 再质押。

协议在 Eigenlayer 协议的基础上进行优化,同样提供安全和验证服务,同时开展 LRT 业务(这类协议有 SSV),这类协议的发展主要取决于协议本身与 Eigenlayer 形成竞争关系,需要寻找突破点去吸引节点。

大部分 LRT 协议在机制创新上会从 3 点出发:

比 Eigenlayer 提供更强的安全性;

Eigenlayer 存在分配策略问题:随着 AVS 数量的增加,再质押者需要主动选择和管理对运营商的分配策略,这将会极其复杂。LRT 协议会为用户提供分配策略的最佳方案。

EigenLayer 的 LST 存款有数额上线,原生 ETH 存款暂未设限,但大多数用户很难获得,因为其要求用户拥有 32 枚 ETH 并运行与 EigenLayer 集成的 Ethereum 节点来运行 EigenPods。而在部分 LRT 协议上,这个限制会被取消。

具体项目及情况如下:

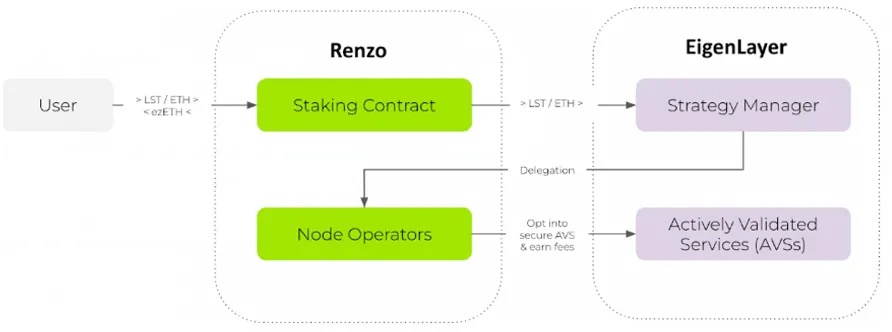

Renzo

Renzo 在 Eigenlayer 上进行了优化,其抽象了最终端用户 Restaking 的复杂流程,再质押者不必担心运营商和奖励策略的主动选择和管理。帮助用户构建投资组合,以投入到更大收益的 AVS 分配策略中。其次,在 Renzo 中存入代币是没有额度上限的,这也成为了 Renzo TVL 暴涨的主要因素之一。

融资情况: 1 月宣布完成 320 万美元种子轮融资,Maven 11 领投,SevenX Ventures、IOSG Ventures、OKX Ventures 等参投。

业务逻辑:

用户质押 ETH 或 LST 到 Renzo 协议,用户获得等价值的$ezETH;

Renzo 将 LST 质押到 Eigenlayer 的 AVS 节点上,但 Renzo 会调整质押在节点的 LST 权重,以获得最佳的收益。

现状:尚未发行代币,$ezETH 属于其 LRT 代币,由于其获得再质押收益,因此价格会比 ETH 高,目前已铸造 217, 817 个,TVL $ 777.7 m。在手续费问题上,会根据再质押收益情况进行适当收费。社群情况,目前 twi 粉丝数 51.7 K。

KelpDAO

KelpDAO 是 Stader Labs 扶持的 LRT 项目,业务模式与 Renzo 大同小异。与 Renzo 不同的是 rsETH 的 withdrawal 方式,Renzo 需要 7 天以上,而 KelpDao 提供了 AMM 流动性池,随时可以 redeem $rsETH。

业务逻辑:

将 stETH 等 LST 存入 Kelp 协议中,能够换取 rsETH 代币,Node Delegator 合约将 LST 质押到 Eigenlayer 的 Strategy Manager contract 中。

KelpDAO 与 EigenLayer 联动,用户再质押既能获取 EigenLayer 积分,也能套出流动性使用 LRT 去生息,同时享有 LST 的生息收益。

现状:尚未发行代币,TVL $ 718.76 m,整体表现好于 Restaking Finance。协议不收取任何费用也算是 KelpDAO 目前的一大优势。社群数据上,twi 粉丝数 23.6 K,互动较少。

Restake Finance ($RSTK)

RSTK 是 EigenLayer 上的第一个模块化流动性再质押协议,做的是帮助用户把 LST 投放在 Eigenlayer 项目上。整个业务逻辑并没有创新或竞争力。代币经济模型上并没有太多新意。代币价格表现上由于 restaking 概念和 Eigenlayer 项目的热度在一段时间内有大幅上涨,但最近表现不佳。

业务逻辑

用户将流动性质押生成的 LST 存入 Restake Finance;

项目帮助用户的 LST 存入 EigenLayer,并允许用户生成 reaked ETH(rstETH)作为再质押凭证;

用户拿着 rstETH 再去各种 DeFi 中赚取收益,同时也会获取 EigenLayer 奖励的积分(考虑到 EigenLayer 还没发币)

代币功能

治理

质押,获得协议收入的分红

现状:TVL 达到$ 15.5 m,共有 4, 090 个 rstETH 流通,唯一地址数 2500 个以上,用户数超过 750 。社群数据方面,twi 粉丝数 12.8 k,互动较少。

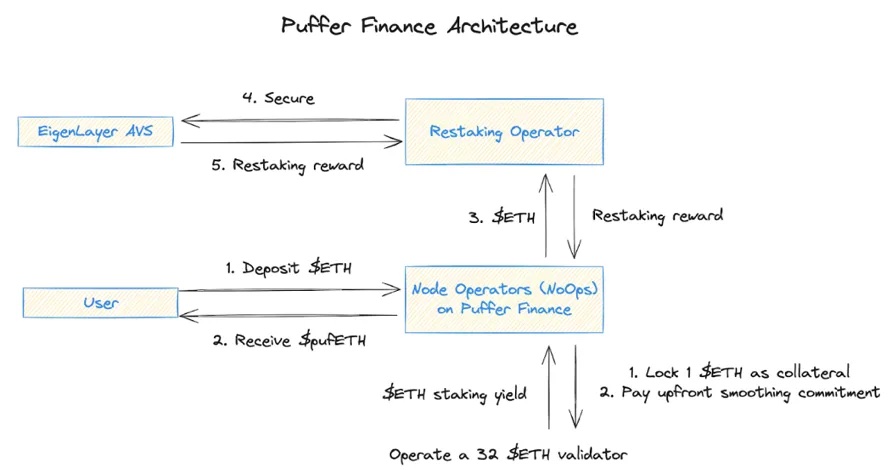

Puffer Finance

由于 Binance Labs 的投资,Puffer 近期热度较高。Puffer Finance 是一种反罚没的流动性质押协议,同样是属于 Liquid Native Restaking 的类型的产品。Puffer Finance 曾获得 Jump Crypto 领投的种子轮融资,总计获得了 615 万美元融资。Puffer 还将开发 Layer 2 网络。

优势:

Eigenlayer 对再质押节点的要求是 32 个 ETH,而 Puffer 的再质押功能降低了门槛到 2 个 ETH,试图吸引小型节点们。

安全性,secure-signer & RAVe(远程证明验证 remote attestation verification on chain)

业务逻辑:

用户质押$ETH 获得$pufETH,Puffer 的 Node Operators 将$ETH 分为两部分,一部分质押给以太坊验证者,另一部分参与 Eigenlayer 的再质押。

现状:已开发质押功能,共铸造 365, 432 个 pufETH,TVL 达到$ 1.40 b。社群情况,是目前 LRT 协议中 twi 粉丝数最多的项目, 213.7 K。

流动性质押+再质押服务

这类项目原本在流动性质押赛道中已经占有一席之地,再转做再质押赛道,优势在于: 1.协议内本身就有质押大量 ETH,可以直接转换成再质押代币;2. 用户群体锁定,用户也无需再去寻找 LRT 协议。目前 Swell 和 Ether.fi 在 Eignlayer 网络上已经成为 LRT 项目中的佼佼者,根据存款量就已经占据了领先位置。

其他 LRT 协议

总结

目前,很多 LRT 协议并没有发行代币,项目同质化较严重。但比较看好的是 KelpDAO、Puffer Finance、Ion Protocol,这三类协议有明显区别于其他 LRT 协议的发展路线。

根据部分 LRT 协议发行的 token 排行,其中 ether.fi 的数量最大,其次是 Puffer Finance 和 Renzo。

从实际利益出发,LRT 更像一种为流动性创造的投机杠杆。杠杆的意思是指,原始资产还是只有一份,但是通过代币的映射和权益的锁定,可以通过原始的 ETH 不断上杠杆套娃,出现多份衍生品凭证。

这些衍生品凭证在顺风局中极大的盘活了流动性,更有利于市场投机行为

但是,发布衍生品的各个协议因为流动性而互相连接,持有 A 可以借出 B,借出 B 可以盘活 C。一旦 A 协议本身出了问题且体量较大,造成的风险也是连环的。

LRT 赛道未来预测

整体上,LRT 赛道是一个增长迅猛的利基市场。LST 赛道能提供 5% 左右的稳定收入,这在熊市阶段确实有一定的吸引力。而 LRT 赛道的收益如何,还是要看 Eigenlayer 这类提供再质押服务项目的能力,而最终的收益才能吸引用户是否能够给予 LRT 赛道持续的关注和资金沉淀。LRT 赛道还是早期阶段,但是项目同质化严重,赛道承载资金有限,预测未来只有少数头部项目跑出来。

风险:

罚款风险:由于恶意活动,失去质押的 ETH 的风险增加。

集中化风险:如果太多质押者转移到 EigenLayer 或其他协议,可能会对以太坊造成系统性风险。

合约风险:各协议的智能合约可能存在风险。

多层次风险叠加:这是再质押的关键问题,它将原本已经存在的质押风险与额外的风险相结合,形成了多层次的风险。

未来机会:

LRT 与其他 DeFi 协议的多重组合,比如借贷。

安全性提升: 利用 DVT 技术可以帮助降低节点运行风险,比如 SSV 和 Obel;

多链扩展:在多个 Layer 2 或者 PoS 链中发展 LRT 协议,比如 @RenzoProtocol 和@Stake_Stone;

— — — — — — — — — — -

关于我们

这篇演讲撰写于 HTX Ventures 旗下的 Research 团队。HTX Ventures 是火币 HTX 的全球投资部门,整合投资、孵化和研究以识别全球最优秀和最有前景的团队。作为区块链十年行业的先驱,HTX Ventures 推动行业内的尖端科技和新兴商业模式发展, 为合作项目提供全方位的支持,包括融资、资源和战略咨询,以建立长期区块链生态。目前,HTX Ventures 已支持跨越多个区块链赛道的 200 多个项目,其中部分优质项目已上线火币交易。同时,HTX Ventures 是最活跃的基金中基金(FOF)投资者之一,携手 IVC、Shima、Animoca 等全球顶尖区块链基金共同建设区块链生态。

参考文献:

SevenX Ventures:LRT 流动性再质押的格局与机会

https://foresightnews.pro/article/detail/51837

再质押代币(LRT)叙事重燃:在无尽的流动性套娃中,寻找高潜力项目机会

https://www.techflowpost.com/article/detail_15548.html

Liquid staking landscape

https://docs.google.com/document/d/1gtVgo9n2JbnZR-HFYbnsJ9nmPUGt4SYUdPXZdNHeQBY/edit

Pendle 暴涨背后:博空投,上杠杆, EigenLayer 再质押叙事中的赢家

https://www.techflowpost.com/article/detail_16101.html

Restaking 赛道大盘点,「质押年」不容错过的项目知多少?

https://s.foresightnews.xyz/article/detail/52874

再质押市场的春风将至?盘点再质押赛道潜力项目

https://www.odaily.news/post/5192591

关于 LRT 的解读: https://twitter.com/0x Ning 0x

关于 LRT 的解读(HaoTian):https://twitter.com/tmel0 211

免责声明

1. HTX Ventures 与本报告中所涉及的专案或其他第三方不存在任何影响报告客观性、独立性、公正性的关联关系。

2. 本报告所引用的资料及数据均来自合规管道,资料及数据的出处皆被 HTX Ventures 认为可靠,且已对其真实性、准确性及完整性进行了必要的核查,但 HTX Ventures 不对其真实性、准确性或完整性做出任何保证。

3. 报告的内容仅供参考,报告中的结论和观点不构成相关数字资产的任何投资建议。 HTX Ventures 不对因使用本报告内容而导致的损失承担任何责任,除非法律法规有明确规定。 读者不应仅依据本报告作出投资决策,也不应依据本报告丧失独立判断的能力。

4. 本报告所载资料、意见及推测仅反映研究人员于定稿本报告当日的判断,未来基于行业变化和数据资讯的更新,存在观点与判断更新的可能性。

5. 本报告版权仅为 HTX Ventures 所有,如需引用本报告内容,请注明出处。 如需大幅引用请事先告知,并在允许的范围内使用。 在任何情况下不得对本 报告进行任何有悖原意的引用、删节和修改。