Grayscale เปิดตัวกองทุนรายได้แบบไดนามิก GDIF และโทเค็นระบบนิเวศของ Cosmos กลายเป็นผู้ชนะที่ยิ่งใหญ่

ต้นฉบับ - โอเดลี่

ผู้เขียน-สามีอย่างไร

บรรณาธิการ | ฉิน เสี่ยวเฟิง

หลังจากประสบความสำเร็จในการแปลง Bitcoin Trust ให้เป็น Bitcoin Spot ETF แล้ว Grayscale ก็ไม่หยุดนิ่ง เมื่อวันที่ 5 มีนาคม Grayscale ได้ประกาศเปิดตัว Crypto Dynamic Income Fund (GDIF) อีกครั้ง โดยนำรูปแบบกองทุนที่เกิดขึ้นใหม่มาสู่การเงินแบบดั้งเดิมอีกครั้ง และบูรณาการ Web3 และ Web2 ต่อไป

ตามเอกสารอย่างเป็นทางการ GDIF เป็นกองทุนที่มีการจัดการอย่างแข็งขันกองทุนแรกของ Grayscale โดยจะใช้รายได้จากการจำนำของพอร์ตสินทรัพย์หลายโทเค็นเพื่อให้นักลงทุนมีเครื่องมือที่คุ้นเคยเพียงเครื่องมือเดียวในการเข้าร่วมในคำมั่นสัญญาหลายสินทรัพย์และรับรายได้จากแบบจำลองกองทุน Grayscale จะ กระจายรายได้ (เป็นดอลลาร์สหรัฐ) ให้กับนักลงทุน “GDIF ถูกสร้างขึ้นเพื่อให้นักลงทุนสามารถเข้าถึงรางวัล PoS ได้โดยไม่ต้องเผชิญกับความท้าทายในการดำเนินงานของการลงทุน PoS โดยตรง ในเวลาเดียวกันนักลงทุนมีโอกาสที่จะถือพอร์ตโฟลิโอที่ประกอบด้วยสินทรัพย์ crypto หลายรายการผ่านการลงทุนเพียงครั้งเดียว”

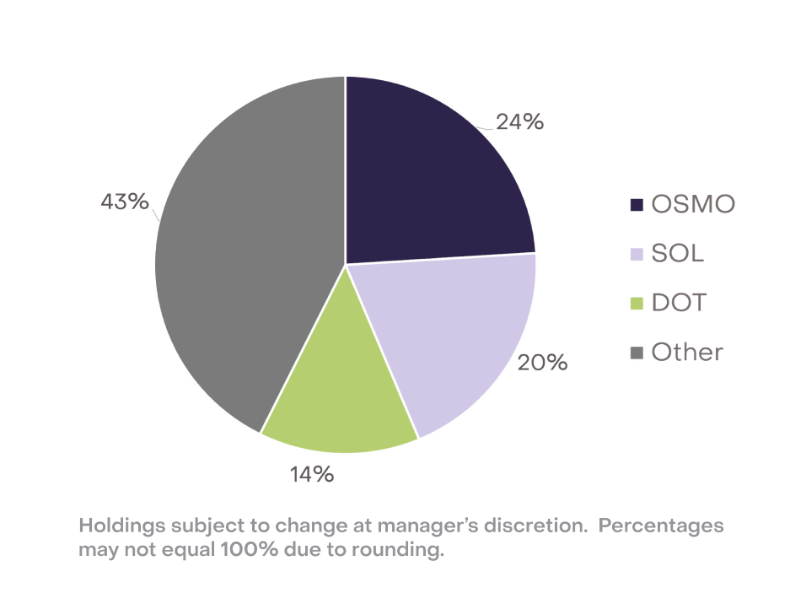

ปัจจุบันพอร์ตโฟลิโอ Grayscale GDIF มีสินทรัพย์เข้ารหัส 9 รายการ:Aptos (APT), Celestia (TIA), Coinbase Staked Ethereum (CBETH), Cosmos (ATOM), Near (NEAR), Osmosis (OSMO), Polkadot (DOT), Sei Network (SEI) และ Solana (SOL). รูปด้านล่างแสดงสัดส่วนสินทรัพย์ปัจจุบันของกองทุน GDIF ในจำนวนนี้ OSMO คิดเป็น 24% SOL คิดเป็น 20% DOT คิดเป็น 14% และส่วนที่เหลือคิดเป็น 43%

เกณฑ์ของ Grayscale ในการเลือกสินทรัพย์ที่กล่าวถึงข้างต้นมาจากการใช้ปัจจัยเชิงคุณภาพและเชิงปริมาณเพื่อประเมินผลตอบแทนของสินทรัพย์ดิจิทัล ซึ่งสะท้อนให้เห็นโดยเฉพาะในด้านต่างๆ เช่น รางวัลจากการปักหลัก มูลค่าตลาด และสภาพคล่อง อย่างไรก็ตาม เมื่อพิจารณาจากองค์ประกอบของโทเค็นข้างต้น ส่วนใหญ่เป็นโครงการที่มีประสิทธิภาพโดดเด่นในรอบตลาดกระทิงครั้งล่าสุด (Polkadot, Near, Cosmos, Solana, Osmosis) และโครงการดาวจำนวนไม่มากที่มีประสิทธิภาพโดดเด่นในรอบนี้ (เซเลสเทีย แอปทอส ฯลฯ).

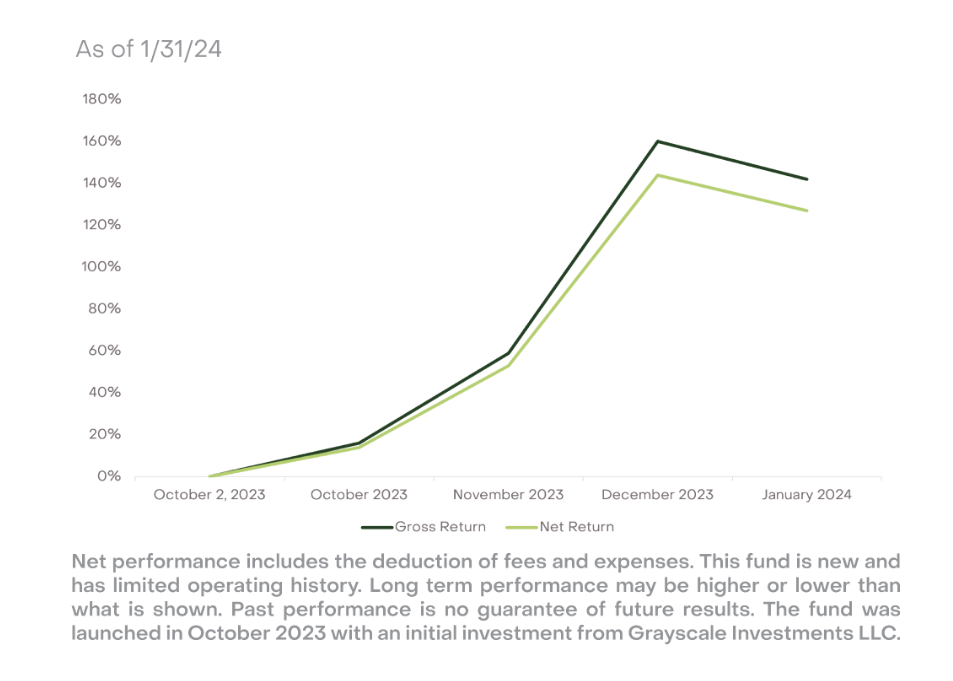

ดังที่คุณเห็นจากแผนภูมิด้านล่าง กองทุนเปิดตัวในเดือนตุลาคม 2566 Grayscale ใช้กองทุนภายในเพื่อจัดหาทุนเริ่มต้นสำหรับกองทุนในระยะเริ่มต้น อัตรากำไรขั้นต้นสูงสุดของกองทุนในปัจจุบันอยู่ที่ประมาณ 160% และหลังจากหักค่าใช้จ่ายที่เกี่ยวข้องแล้ว อัตรากำไรสุทธิจะอยู่ที่ 140%

อย่างไรก็ตาม กองทุนนี้ไม่ได้เปิดให้บุคคลภายนอกเข้าชมได้อย่างสมบูรณ์ และนักลงทุนก็มีเกณฑ์การลงทุนที่แน่นอน ตามเว็บไซต์อย่างเป็นทางการของ Grayscale ลูกค้าการลงทุนที่มีคุณสมบัติเหมาะสม หมายความว่าขนาดการจัดการสินทรัพย์ของนักลงทุนจะต้องมีมากกว่า 1.1 ล้านเหรียญสหรัฐ หรือสินทรัพย์สุทธิจะต้องมากกว่า 2.2 ล้านเหรียญสหรัฐ

ระบบนิเวศของจักรวาลอาจกลายเป็นผู้ชนะที่ยิ่งใหญ่ที่สุด

ข้อมูลข้างต้นอธิบายองค์ประกอบสินทรัพย์ของกองทุน GDIF โครงการที่เกี่ยวข้องกับ Cosmos มีสี่ประเภท ได้แก่ Celestia, Sei Network, Cosmos และ Osmosis

(1)Osmosis(OSMO)

Osmosis ใช้เทคโนโลยีข้ามสายโซ่ IBC ของ Cosmos สำหรับการทำธุรกรรมสินทรัพย์ข้ามสายโซ่ ช่วยให้ LP ได้รับผลตอบแทน APR ที่สูงขึ้นผ่านกลไกการจำนำที่หลากหลาย นอกจากนี้ Osmosis ยังให้บริการธุรกรรมข้ามสายโซ่ระหว่างระบบนิเวศ Cosmos และระบบนิเวศ Ethereum และได้ร่วมมือกับ Axelar เพื่อขยายไปยังระบบนิเวศอื่น ๆ ปัจจุบัน ตามข้อมูลของ DefiLlama Osmosis อยู่ในอันดับที่ 10 ใน TVL ในภาค DEX ของเครือข่ายทั้งหมด โดยมี TVL รวม 228 ล้านเหรียญสหรัฐ

Osmosis คิดเป็นสัดส่วนมากถึง 24% ของสินทรัพย์ใน Grayscale Fund สาเหตุหลักมาจาก Osmosis มีผลตอบแทนจากการปักหลักใน DEX ที่สูงกว่า ประการที่สอง ในฐานะ DEX แบบ cross-chain ที่ใหญ่ที่สุดในระบบนิเวศ Cosmos ช่วงการแผ่รังสีของมันค่อนข้างกว้างซึ่งเอื้อต่อ ทางเลือกในการดำเนินงาน

(2)Sei Network(SEI)

Sei Network คือ DeFi L1 ที่สร้างขึ้นบน Cosmos ซึ่งเป็นเหมือนจุดศูนย์กลางระหว่างเครือข่ายสาธารณะและเครือข่ายแอปพลิเคชัน ในฐานะ L1 ตัวแรกในระบบนิเวศ Cosmos ที่รองรับการจองคำสั่งซื้อ Sei Network มีเป้าหมายที่จะกลายเป็นเครือข่ายความเร็วสูงที่อุทิศให้กับธุรกรรมเพื่อช่วยให้การแลกเปลี่ยนแบบกระจายอำนาจทำงานได้ดีขึ้น

(3)Cosmos(ATOM)

Cosmos เป็นโครงการที่เป็นตัวแทนในช่วงแรกๆ ของการเชื่อมต่อโครงข่ายแบบหลายเครือข่าย และ Cosmos SDK ได้กลายเป็นโมเดลที่ต้องการสำหรับการสร้างเครือข่ายสาธารณะและแอปพลิเคชันใหม่ๆ มากมาย แม้ว่าเมื่อปีที่แล้วจะประสบกับความวุ่นวายทางแยกเนื่องจากปัญหารายได้จากการปักหลัก โดยทั่วไปแล้ว จะไม่ได้รับผลกระทบ ขนาดทางนิเวศน์ของ Cosmos นั้นเล็กกว่าระบบนิเวศของ Ethereum เท่านั้น และผู้ใช้จำนวนมากก็ต้องการสิทธิ์ในการปักหลักโทเค็น

(4)Celestia(TIA)

ในฐานะโปรเจ็กต์ตัวแทนของบล็อกเชนแบบโมดูลาร์ที่เน้นไปที่ความพร้อมใช้งานของข้อมูล Celestia จึงถูกสร้างขึ้นผ่าน Cosmos SDK สมาชิกในทีมส่วนใหญ่ที่ Celestia มาจาก Cosmos นับตั้งแต่เปิดตัวเมื่อปีที่แล้ว โทเค็น TIA ได้เพิ่มขึ้นมากกว่า 10 เท่า

จากการแนะนำข้างต้น พบว่าระบบนิเวศของ Cosmos นั้นดีกว่าเครือข่ายสาธารณะอื่น ๆ มากในแง่ของเทคโนโลยีพื้นฐานและการพัฒนาระบบนิเวศ (รองจาก Ethereum เท่านั้น) และสามารถให้ช่องทางในการสร้างรายได้มากขึ้น ในทางตรงกันข้าม Ethereum แม้ว่าจะมีโครงการระดับสองหลายโครงการ แต่ก็มีโครงการน้อยกว่าที่จะได้รับผลประโยชน์จากการปักหลัก ด้วยเหตุนี้ Grayscale Dynamic Income Fund จึงมีสัดส่วนสินทรัพย์ที่เกี่ยวข้องกับ Cosmos ค่อนข้างสูง

บางทีอาจได้รับผลกระทบจาก Grayscale GDIF โทเค็นของ Cosmos, Sei Network และ Osmosis โดยทั่วไปเพิ่มขึ้นประมาณ 10% ใน 24 ชั่วโมงที่ผ่านมา: ปัจจุบัน ATOM ซื้อขายที่ 13.7 USDT โดยเพิ่มขึ้น 24H ที่ 10.34%; SEI ปัจจุบันซื้อขายที่ 0.81 USDT โดยเพิ่มขึ้น 24H ที่ 11.8% ปัจจุบัน OSMO ซื้อขายที่ 0.81 USDT โดยเพิ่มขึ้น 24H ที่ 11.8% เสนอราคาที่ 1.75 USDT โดยเพิ่มขึ้น 24H ที่ 9.72%

สรุป

Grayscale เปิดตัวกองทุนใหม่ GDIF โดยค่อยๆ เปลี่ยนตัวเองจากการรับความผันผวนของ crypto อย่างอดทนเป็นการเข้าร่วมอย่างแข็งขันในการรับรายได้พื้นเมืองของ crypto สำหรับ Grayscale การเคลื่อนไหวนี้คือการสำรวจแหล่งที่มาของรายได้จากสินทรัพย์ crypto เพิ่มเติม และค่อยๆ นำไปใช้กับการเงินแบบดั้งเดิม ซึ่งเพิ่มขึ้น ประสิทธิภาพการบริหารจัดการกองทุน ความหลากหลาย

สำหรับตลาด crypto โครงการสินทรัพย์ crypto ทั้งเก้าโครงการที่รวมอยู่อาจค่อยๆ ย้ายเข้าสู่ตลาดกระแสหลัก เนื่องจาก Grayscale มีส่วนร่วมในการวางเดิมพัน เมื่อเปรียบเทียบกับ Trust ที่เปิดตัวก่อนหน้านี้โดย Grayscale Bitcoin Trust ก็ประสบความสำเร็จในการเปิดตัวในรูปแบบของ Spot ETF และ Ethereum Trust ที่ตามมาอาจเดินตามรอย Bitcoin หากไม่รวม BTC และ ETH สินทรัพย์ crypto ที่เหลือยังคงค่อนข้างไม่คุ้นเคยกับการเงินแบบดั้งเดิมขนาดใหญ่ และยังต้องการการส่งเสริมบริษัทจัดการสินทรัพย์กระแสหลัก เช่น Grayscale เพื่อช่วยให้ตลาด crypto กลายเป็นกระแสหลักโดยเร็วที่สุด

คำถามอีกข้อหนึ่งก็คือ การเปิดตัวกองทุนของ Grayscale เพื่อให้บริการจำนำจะกระตุ้นให้เกิดความกังวลด้านกฎระเบียบหรือไม่?

ในเดือนกุมภาพันธ์ พ.ศ. 2566 Kraken ถูกฟ้องโดยสำนักงาน ก.ล.ต. ของสหรัฐอเมริกาในการให้บริการ Stake การเข้ารหัสลับ ในที่สุดก็ได้จ่ายค่าปรับ 30 ล้านดอลลาร์สหรัฐและระงับบริการ Stake ในท้องถิ่นของสหรัฐอเมริกา ในที่สุด Kraken ก็ก่อตั้งบริษัทสาขาอิสระในต่างประเทศเพื่อให้บริการ Stake สำหรับลูกค้าที่ไม่ได้อยู่ในสหรัฐอเมริกา บังเอิญในเดือนกรกฎาคมปีที่แล้ว Coinbase ถูกหลายรัฐในสหรัฐอเมริกาฟ้องร้องในข้อหาละเมิดกฎหมายหลักทรัพย์ปี 1933 ในการให้บริการวางเดิมพัน ขณะนี้ Grayscale ได้เปิดตัวบริการเดิมพันอย่างเปิดเผยเพื่อท้าทาย SEC ความกดดันด้านกฎระเบียบอาจเกิดขึ้นในไม่ช้า (ท้ายที่สุด Grayscale และ SEC มีข้อพิพาทลึกซึ้ง และพวกเขาจะชนะหรือแพ้ในศาล)

แต่ในแง่ดี วิธีการของ Grayscale อาจทำให้การควบคุมดูแลไม่สามารถเริ่มต้นได้ ท้ายที่สุดแล้ว บริการรับจำนำที่จัดทำโดย Coinbase และ Kraken ในฐานะการแลกเปลี่ยนนั้นเป็นบริการจำนำที่มีการจัดการอย่างเต็มรูปแบบ นั่นคือ ผู้ใช้ฝากโทเค็นที่เกี่ยวข้องลงในที่อยู่กระเป๋าเงินเย็นของ Coinbase และ Kraken และพวกเขาดำเนินการบริการจำนำของห่วงโซ่เป้าหมายในนามของพวกเขา และคีย์ที่เกี่ยวข้องจะได้รับการควบคุมในมือแลกเปลี่ยน

สิ่งที่ Grayscale มอบให้คือกองทุน นักลงทุนซื้อกองทุนในสกุลเงินดอลลาร์สหรัฐและสุดท้ายก็จ่ายเงินที่ได้รับเป็นดอลลาร์สหรัฐซึ่งไม่เกี่ยวข้องกับการโอนสิทธิ์ของสกุลเงินดิจิทัล ดูเหมือนว่าระดับสีเทาจงใจหลีกเลี่ยงการกำกับดูแลและมองหาพื้นที่สีเทาตามกฎหมาย แต่ก็ยังไม่ชัดเจนว่าจะสามารถทำเช่นนั้นได้ในที่สุดหรือไม่