比特币新高1分钟,闪崩回调1万美元,牛还在吗?

原创 | Odaily星球日报

作者 | 南枳

昨日 23 时,BTC 短线突破 69000 USDT,最高一度触及 69080 USDT,突破了曾于 2021 年 11 月创下的前高 69040.1 USDT。

OKX 行情显示,BTC 仅突破了前高不足 1 分钟,而后加密市场整体出现了一波迅猛的下跌行情,凌晨 3 时 55 分,BTC 一度下跌至 59000 USDT,ETH 最低跌至 3179 USDT。截至发文时跌幅有所收回,BTC 现报 63300 USDT, 24 H 跌幅为 7.8% ,ETH 现报 3524 USDT, 24 H 跌幅为 3.5% 。

CoinGecko 数据显示,加密货币总市值下跌至 2.47 万亿, 24 H 跌幅 5.9% 。Alternative 数据显示,加密用户交易热情较之昨日显著下降,今日恐慌与贪婪指数为 75 ,等级为“贪婪”,而昨日的贪婪指数为 90 ,等级为”极度贪婪“,创 2021 年 2 月以来新高。

衍生品交易方面,Coinglass 数据显示,过去 24 小时全网爆仓 11.54 亿美元,其中多单爆仓 8.88 亿美元,空单爆仓 2.66 亿美元;BTC 爆仓 3.23 亿美元,ETH 爆仓 2.08 亿美元。币安 BTC 合约未平仓头寸为 66.6 亿美元, 24 H 降幅 10.9% ,去杠杆明显。

下跌力量——早期获利者获利了结

为何触及新高后又迅猛回调?或与早期获利者的获利了结有关:

CryptoQuant 数据显示,在比特币创新高开始暴跌之前,一个年龄超 10 年的地址将 1000 枚比特币转移到了 Coinbase,经 CryptoQuant 分析该地址与矿工相关。

CryptoQuant 分析师 Bradley Park 在接受采访时表示:“交易所订单数据显示,每 100 美元的价格区间有 5-10 枚比特币的流动性, 1000 枚比特币的抛售极有可能引发价格大幅下跌。尤其再像周二这样的时间节点,交易员正在等待做空比特币。”

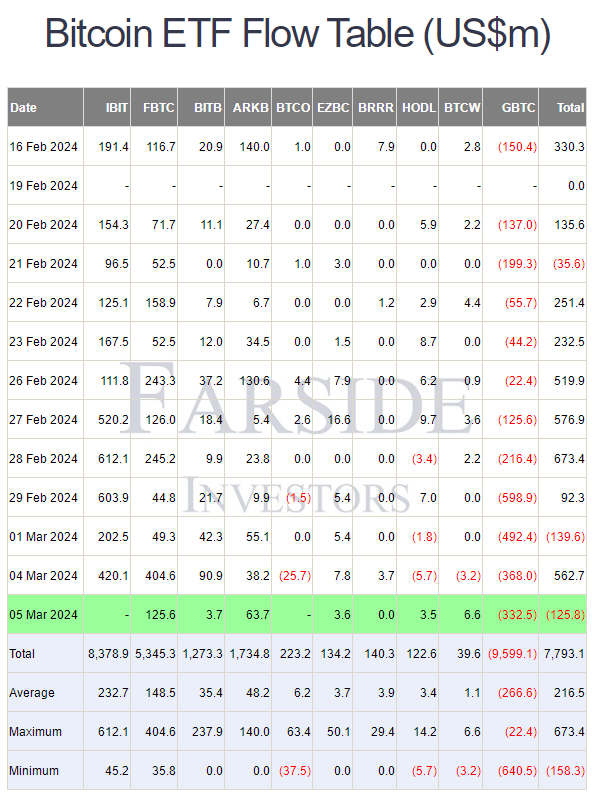

ETF 市场交易热情仍在显著上升,昨日比特币现货 ETF 日交易量达 100 亿美元,刷新单日交易量记录。Farside Investors 数据显示,GBTC 昨日流出 3.325 亿美元,目前还有三只 ETF 净流动数据未披露,已披露部分昨日净流出 1.258 亿美元,构成了市场的回调压力,最终是否净流出取决于 IBIT 是否还在像前几个交易日仍在大幅买入。

费率回归健康值

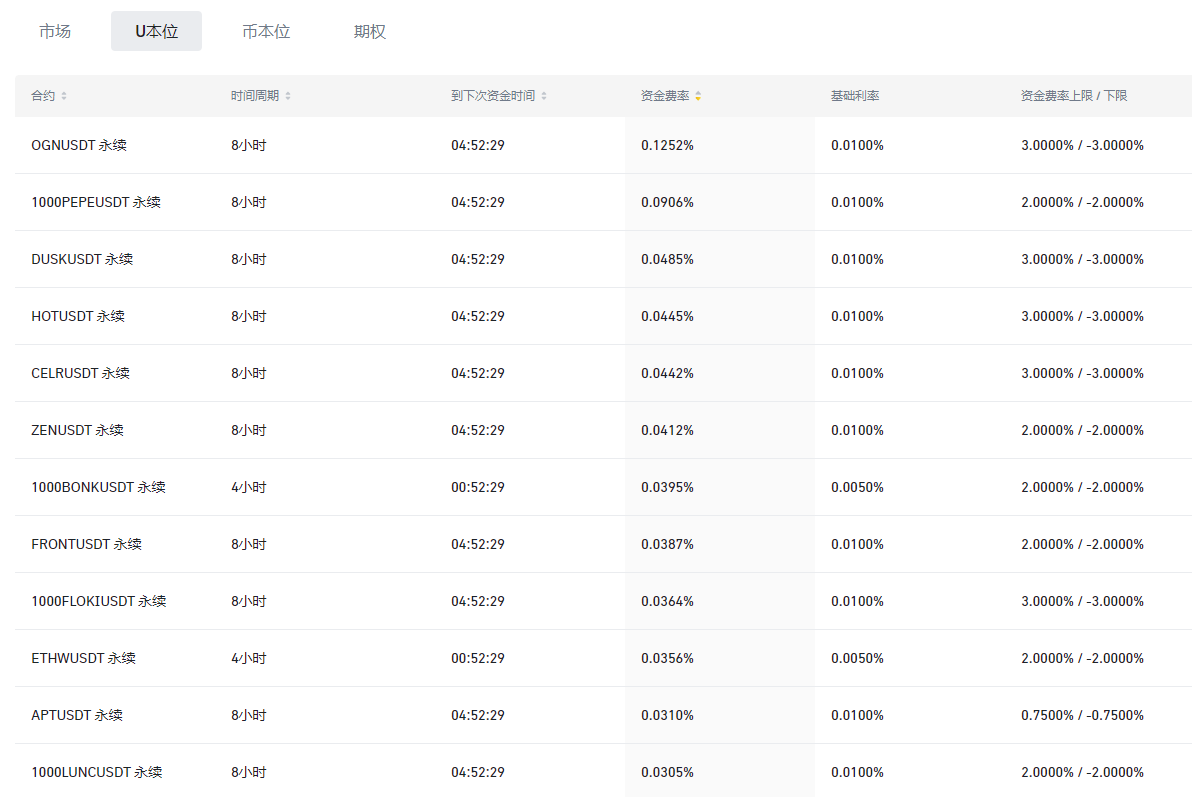

在比特币到达 6.9 万美元的新高前,许多的山寨币费率高达 0.2% ~ 0.4% ,并且部分币种间隔 4 小时进行收取,BTC 在 3 月 1 日至 5 日期间,平均费率也高达 0.06% ,展现了市场的高杠杆和狂热情绪。

而在下跌后,费率已一定程度上恢复理性,当前仅有一个 OGNUSDT 永续合约的费率超 0.1% , 12 个币种合约费率超 0.03% ,BTC 的费率也已恢复到 0.0207% 。

Greeks.Live 研究员 Adam 在 X 平台发文表示:“比特币在冲击历史新高成功后,转而开启万点暴跌,一度跌破 60000 美元。以期货基差为代表的衍生品数据全面熄火,牛市 Fomo 情绪高峰时闪崩。期权方面,万点暴跌背景下,各主要期限期权 IV 反而小幅下降,超短期期权都在下降,这与以往行情明显不同。”

哪些币种未受影响?

币安涨幅榜显示,目前仅有 10 个代币今日涨幅大于 1% ,主要为小市值币种,分别为:

SYN(28.7% )、ERN(16.2% )、WIF(12.6% )、JST(8.2% )、STRK(5.8% )、AR(5.4% )、FIS(4% )、LSK(3.3% )、CELR(2% )、BICO(2% )。

牛还在吗?

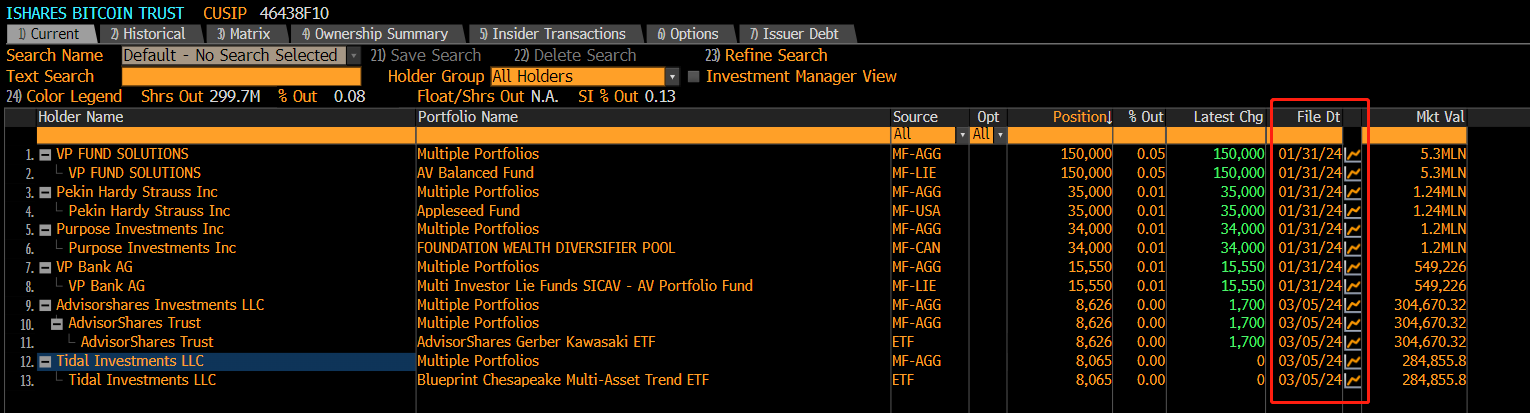

据 LD Research 人员@kanazawa0x0 披露,已有一系列基金配置了贝莱德所发行的 IBIT,持仓最大的德国的 AV Balanced Fund 配置权重已高达 5% ,虽然规模还不到 1000 万美元,但这只是刚刚开始,尤其是被动策略的 ETF 配置的时候具备不参考价格的特性。

而各巨头也在持续进行以太坊的现货 ETF 申请,今日美 SEC 推迟对富达以太坊现货 ETF 申请做出决议,昨日推迟对贝莱德现货以太坊 ETF 作出决议,但也或将像比特币现货 ETF 带来持续性的预期想象空间和获批后的资金流入力量。

多头杠杆在昨日的暴跌后基本清理干净,传统市场的资金也还在持续流入,减半、BTC L2等各重大事件在即,牛市可能刚刚开始。