$HGP上线KuCoin,首个链上沙漏协议未来看涨的催化剂有哪些?

今日,KuCoin 交易所正式公布 ERC 404 A 项目 Hourglass Protocol 代币$HGP 即将上所。作为一个新兴 ERC 404 A 项目,Hourglass Protocol 凭借其创新的 ERC 404 A 标准和沙漏冷却机制的优势逐渐受到市场认可。最近一周,$HGP 在 Uniswap 上的表现令人瞩目,涨幅达到 20 倍。本文将带你分析低市值的 Hourglass Protocol 是如何取得高涨幅,并解读其即将到来的百倍催化剂。

一、创新解决 NFT 流动性难题:图币互换开启全新玩法

重启 NFT 碎片化时代

Pandora 采用一种介于 ERC 20 和 ERC 721 之间的试验性的代币标准 - ERC 404 ,支持用户在 Uniswap、Opensea 等平台进行交易。ERC 404 代币标准的出现,为 NFT 碎片化提供了技术支持,使得用户可以通过持有一定量的代币而非完整的 NFT,更加灵活地参与 NFT 投资。在本质上让 FT 和 NFT 拥有共生关系,以此来解决 NFT 流动性差的难题。

Hourglass Protocol:升级 ERC 404 A

Hourglass Protocol 是第一个部署在以太坊上的链上沙漏协议,其混合了 ERC 404 A、ERC 20、ERC 721 实施和原生流动性,通过将游戏中沙漏紧张推动进展的想法延伸到了潜在解决 NFTs 面临的流动性问题。在数字资产标准领域,ERC 404 A 是 ERC 404 的升级版本,通过实现更小的资产单位交易来降低用户交易成本。

全新加入了沙漏冷却机制,用户在币图转换之间增加了时间约束,类似于游戏里面的道具或技能的冷却时间,随着沙漏的计时结束,币图转换才能完成。沙漏协议允许用户在指定的时间段内限制与沙漏资产相关的某些操作或交易。这些时间段可以在用户希望防止资产过度波动或操纵的情况下发挥作用。它提供了一种机制来确保稳定性并促进更受控制的交易环境。

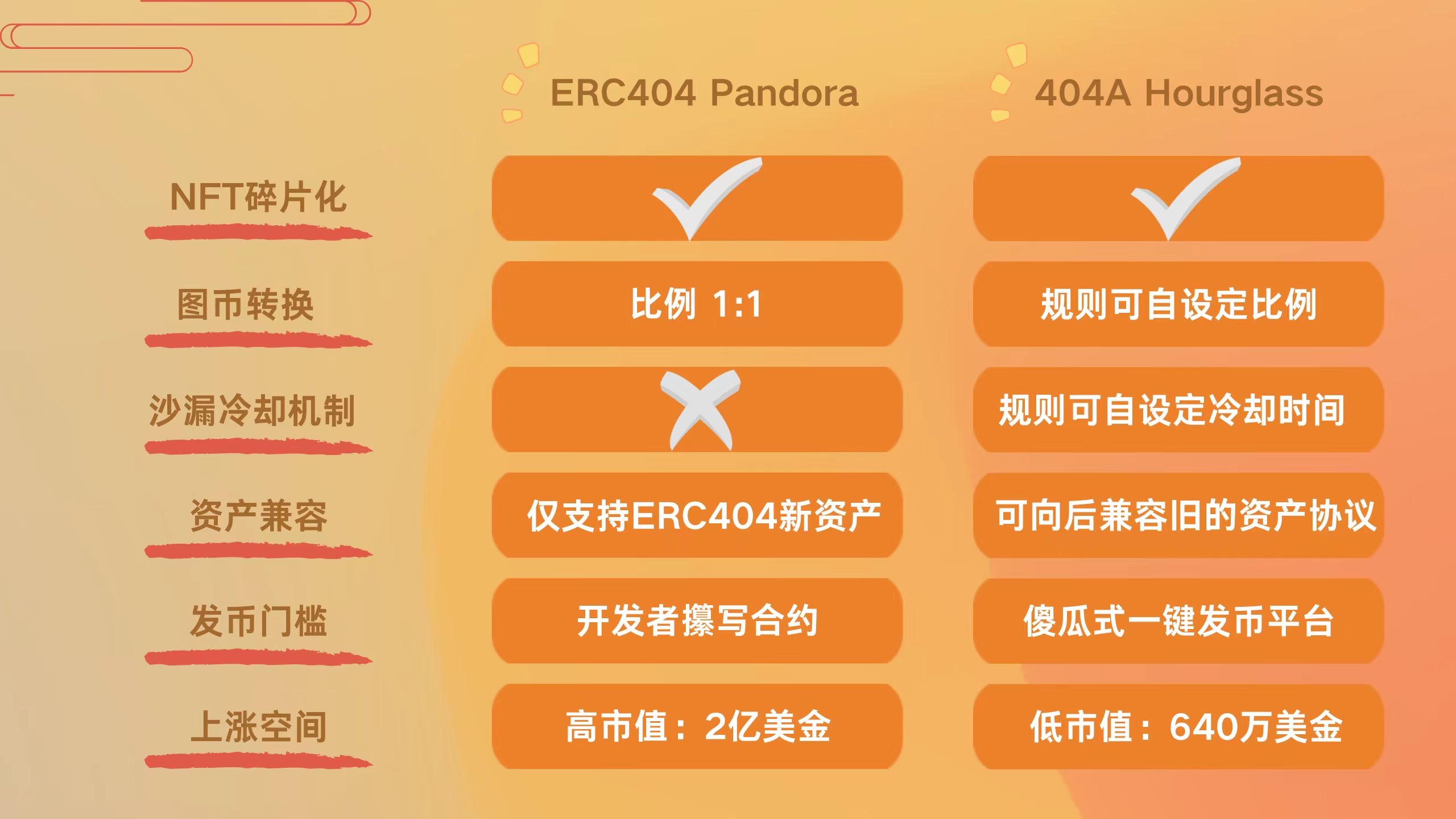

ERC 404 与 ERC 404 A 的对比

ERC 404 和 ERC 404 A 作为数字资产标准的代表,各具特色,分别为数字资产的发展带来了新的契机和可能性。

与 ERC 404 相比,Hourglass Protocol 的 ERC 404 A 在保证 ERC 404 新资产上线的基础上做到向前兼容老资产协议,使得已有的 ERC 20 和 ERC 721 资产也能参与其沙漏协议,并结合了例如设置冷却时间,图币二象性资产兑换比例等功能,为其协议的使用领域开拓更多场景。

二、ERC 404 A 标准:为数字资产带来灵活性与稳定性

技术升级

相较于 ERC 404 标准,Hourglass Protocol 的 ERC 404 A 标准在技术层面进一步推动了发展和变革。ERC 404 A 标准的最大优势之一是其向前兼容老资产协议,这意味着已有的 ERC 20 和 ERC 721 资产不需要进行繁琐的迁移或转换,便可以直接参与 Hourglass Protocol 的沙漏协议。这一特性为用户和项目方提供了极大的便利和灵活性,同时也减少了迁移过程中的风险和不确定。

在 Hourglass Protocol 的 ERC 404 A 标准下,用户还可以根据自身需求自由设定图币转化比例,自定义冷却时间,根据自己的需求和偏好设定资产的交易周期,实现资产的增值和稳定。

产品升级

即将上线的 Hourglass Protocol 更新旨在将其打造为一个功能更为强大、种类更为丰富的数字资产交易平台。借助 ERC 404 A 标准,用户可以质押 HGP 代币,享受一键发币的便捷,轻松实现代币同步发布。此外,为了提供全面的链上生态体验,Hourglass Protocol 不仅与 ETH 兼容,同时也将扩展支持包括 BSC、Arbitrum、Polygon 在内的所有 EVM 兼容链,以满足更多用户的需求。

机制变革

Hourglass Protocol 引入了一种创新的方式 - 沙漏冷却机制,为用户在数字资产交易方面提供了更加多样化和功能丰富的选项。该机制通过设定时间限制来管理资产转换,使用户能够在指定的时间段内对其资产执行的操作或者交易施加限制。这一措施旨在降低资产的过度波动风险或预防操纵行为,从而让交易过程更加稳定,同时赋予用户更大的灵活性和决策缓冲时间。

三、拓展应用空间:GameFi、DeFi 生态发展带来更多机遇

Hourglass Protocol 不仅仅是一个数字资产交易平台,它在游戏和其他Web3行业中也有广泛的应用前景。在游戏领域,Hourglass Protocol 的沙漏机制可以与游戏中的道具冷却机制完美融合。通过 Hourglass Protocol,游戏开发者可以设计更具创意和策略性的游戏玩法,利用沙漏机制控制游戏内部资产的供给和需求,从而实现游戏内部经济的稳定和发展。此外,Hourglass Protocol 还可以与其他游戏元素相结合,如 NFT 收藏品、游戏内交易市场等,为游戏玩家提供更多样化的游戏体验和投资机会。

除了游戏领域,Hourglass Protocol 在其他Web3行业中也有着广泛的应用前景。例如,在 DeFi 领域,Hourglass Protocol 的沙漏机制可以用于稳定资产价格和提高流动性,为用户提供更安全和高效的交易环境。在 SocialFi 领域,Hourglass Protocol 可以用于创建社区代币、奖励机制等,促进社区参与和共识达成。在 AI 领域,Hourglass Protocol 的智能合约技术可以用于数据交换、信任建立等,推动 AI 应用的发展和应用场景的拓展。

四、交易数据对比

PANDORA 币目前的价格稳定在$ 24, 263 美元,而 Hourglass Protocol 代币$HGP 总量为 800 ,不存在增发可能性,当前价格稳定在$ 8, 141 美元,曾一度突破 1 万美元的高点。

作为代表 ERC 404 A 协议的 Hourglass Protocol,其上线仅一周便实现了 10 倍的币价涨幅,展现出巨大的发展潜力。相比之下,Pandora 在目前阶段的市值相对较高,而 Hourglass Protocol 在市场上的表现还处于初级阶段,为投资者提供了更低的准入门槛和更大的增长空间。

结语

Hourglass Protocol 将作为图币二象性新星,引领数字资产行业的未来发展。先进的技术和功能,以及广阔的应用前景,让它成为数字资产领域的领先者和创新者。

随着 KuCoin 交易所上线 $HGP 为其增加流动性和其项目整体发展的推进,预计 Hourglass Protocol 将通过其生态系统及各种产品套件捕获大量的流动性,使$HGP 持有者从中长期受益,短期内或有望突破 1 亿美金市值。