Restaking持续升温,七个维度解析九大协议特点与选择依据

原创 | Odaily星球日报

作者 | 南枳

上周,加密再质押服务提供商 EigenLayer 宣布完成 1 亿美元融资,a16z 参投。而 Binance Labs 也宣布参投了两个 Restaking 协议 Puffer Finance 和 Renzo。另一方面,二月初据链上分析师监测,孙宇晨的三个地址已投入 271, 328 枚 stETH 参与 ReStaking,当前价值达 8.8 亿美元。

Restaking 热度愈发高涨。

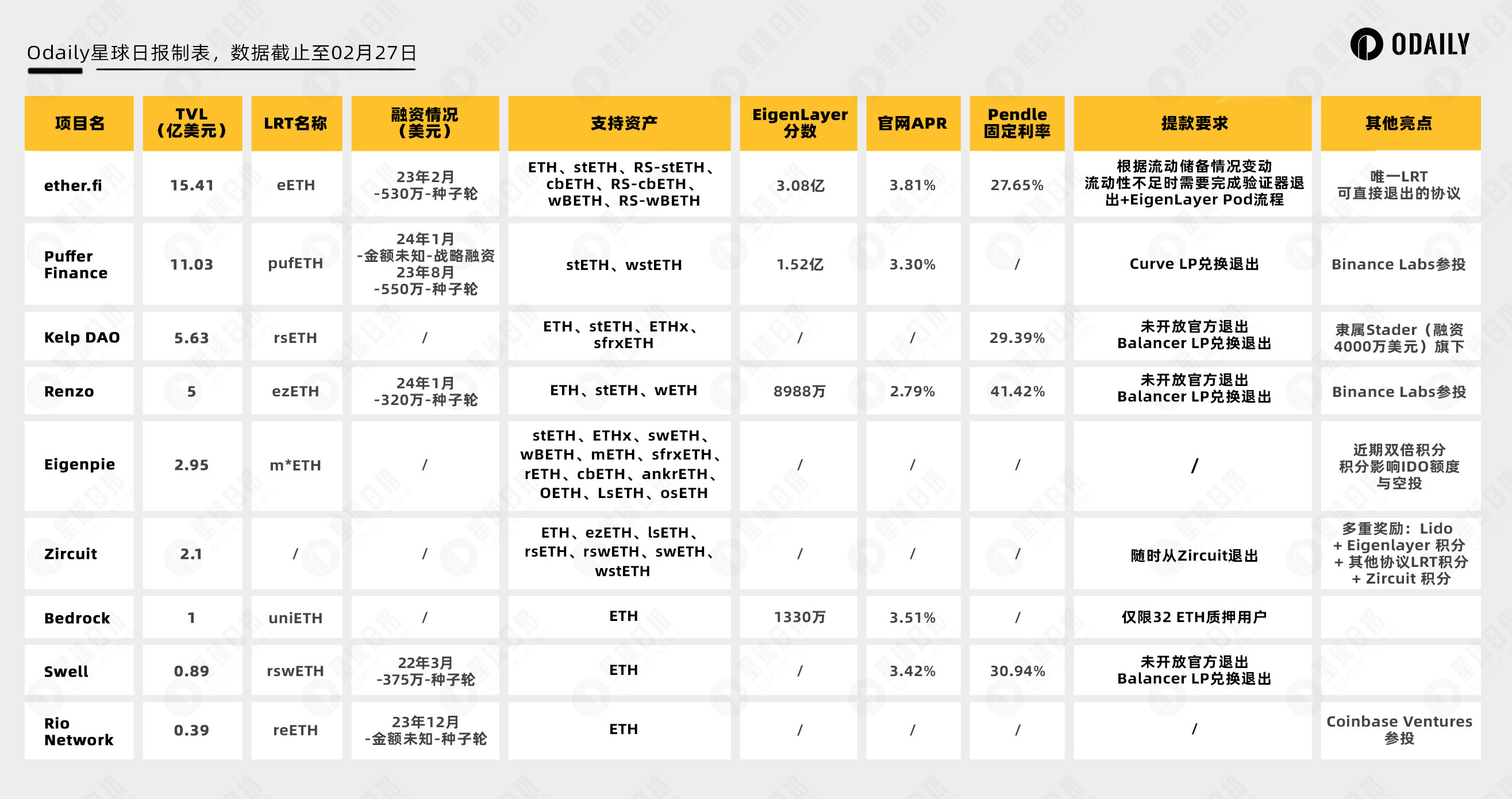

Odaily星球日报将于本文汇总各主流 Restaking 协议,多维度比较其差异和亮点,下图为以 TVL 降序的协议列表。

协议对比

融资

融资方面,目前已公开宣布融资情况的协议尚不多,时间集中于 23 年年末和 24 年年初(Swell 的融资主要面向当时的 LSD 业务),金额均为百万美元。

另一方面,各协议的参投机构重叠度不高,TVL 第一的 ether.fi 领投机构为North Island Ventures和Chapter One,Puffer Finance 领投机构为Lemniscap和Faction等。其中影响最大的融资事件为 Binance Labs 宣布参投 Puffer Finance 和 Renzo,市场认为这一消息预示着代币有着较高的上线币安交易所的可能,随着参投新闻的披露, TVL 随着快速上升。

Pendle 固定利率

Pendle 将生息类代币封装成 SY(标准收益代币),SY 再被拆分为本金和收益两个组成部分,分别为 PT(本金代币)和 YT(收益代币)。持有 PT 代币的用户,能够在到期后兑换等额本金,而期间所有的利率归 YT 所有。PT 当前价格与到期价格的差值即为固定收益。

Pendle 为 LRT 推出了专有导航界面如下图所示,各协议的到期固定收益约在 30% ~ 40% 的区间内,到期日分别为 120 天和 57 天。值得注意的是,只持有 PT 意味只获得固定收益,放弃了积分和质押收益。

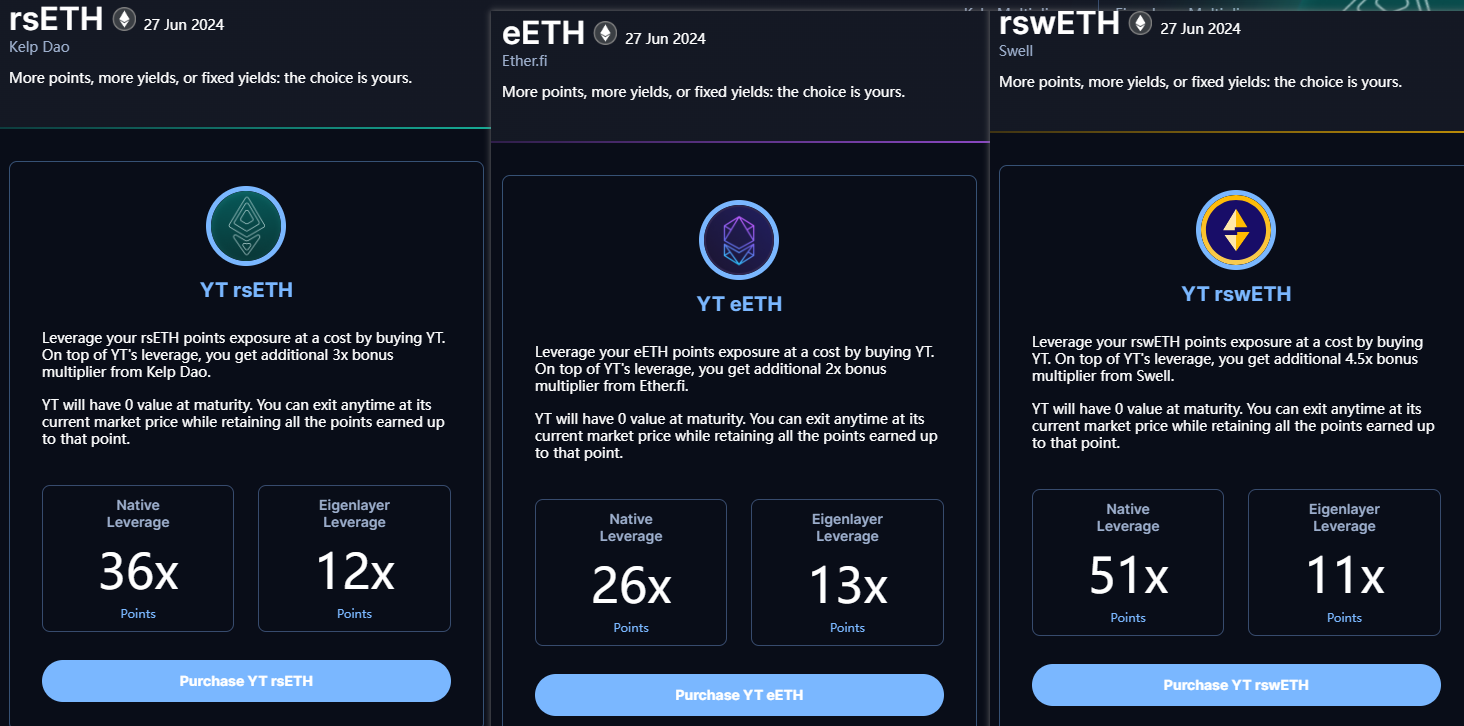

而购入 YT 则相当于使用了杠杆获取 EigenLayer 积分和项目积分,Odaily星球日报对部分 YT 产品截图如下,几个协议的 YT 相当于以十倍杠杆获取 EigenLayer 积分,并附有不同倍数的杠杆积分。

EigenLayer 积分

目前仅有四个协议公布了 EigenLayer 积分,其中最多的为 ether.fi 的 3.08 亿分,最少的为 Bedrock 的 1330 万分。

此外,根据积分交易市场 Whales Market 数据显示,当前 EigenLayer 的积分地板价约为 0.15 USDT/分,对于 ether.fi 的质押者相当于共计持有了 4620 万美元的积分资产,占 TVL 约 3% 。读者同理可计算已披露的其他协议的 EigenLayer 积分价值,或者按照 TVL 换算其他协议的积分资产。

此外 Whales Market 还上线了 ether.fi 的项目积分,当前市场深度较差,若基于地板价 0.00074/Point 计算,当前协议的 Loyalty Points 为 221 亿,约等于 1642 万美元。其他协议积分暂无可参考的公开价格。

资产退出

当前大部分的 Restaking 协议暂未实现提款逻辑,只能通过各类 DEX 以资产兑换的形式退出,存在一定磨损。而 ether.fi 为唯一能直接退出的协议,并且 ether.fi 还准备了流动性储备资金,以满足用户的即刻提款需求。

但同时 ether.fi 也遇到了“偷分”的质疑,社群用户指出,以其他协议的 TVL 和 EigenLayer 积分为基础,ether.fi 实际获得的积分显著小于换算应得的分数。ether.fi 对此回应,积分相对较少的原因是因为存入的时间差,以及为用户即刻提款准备的资金池所导致,以将全部 EigenLayer 积分转移给用户。

结论

各个 Restaking 协议具备不同的特点,用户可根据自身需求选择:

对于流动性要求高的用户,可选择在 ether.fi 质押,以获得随时退出参与其他协议的机会;

对于追求稳定收益的用户,可以选择购入 Renzo 的 PT。

对于风险偏好中等的用户,可选择 Puffer,因其具备较高的上线币安预期且大户较多,如孙宇晨为 Puffer 排名第一的质押者。

此外还有 Zircuit、Eigenpie 等奖励类型丰富的协议,适用于希望提高资金利用效率,平衡收益预期的用户。