SignalPlus宏观分析(20240223):AI持续爆发,美国经济数据表现强劲

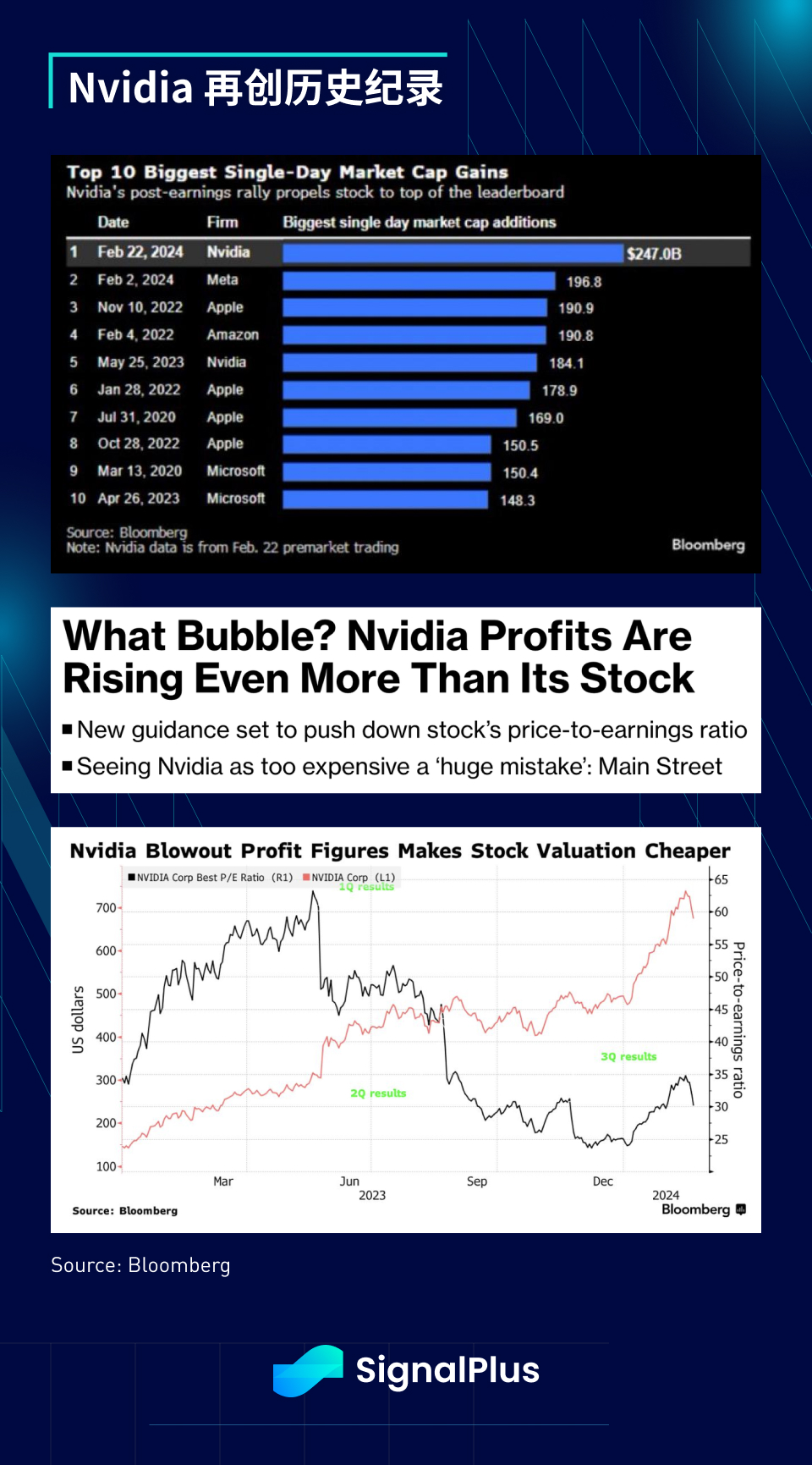

ตามที่คาดไว้ ตลาดความเสี่ยงพุ่งสูงขึ้นโดยผลประกอบการที่ระเบิดได้ของ Nvidia ทำให้ตลาดหุ้นขึ้นสู่ระดับสูงสุดใหม่ มูลค่าตลาดของ AI ยักษ์ใหญ่เพิ่มขึ้น 247 พันล้านดอลลาร์เมื่อวานนี้ สร้างสถิติสำหรับมูลค่าหลักทรัพย์ตามราคาตลาดที่เพิ่มขึ้นสูงสุดในวันเดียว ซึ่งแซงหน้า Meta ก่อนหน้านี้ ในเดือนนี้ แตะถึง 197 พันล้านดอลลาร์ก่อนหน้านี้ นอกจากนี้ นักวิเคราะห์กระแสหลักและสื่อได้เริ่มปกป้องการดำเนินการในอดีตของหุ้น โดยอ้างว่าการเติบโตของ EPS ได้นำไปสู่การบีบอัดตัวคูณ (P/E ล่วงหน้าคือ เท่านั้น 35x)

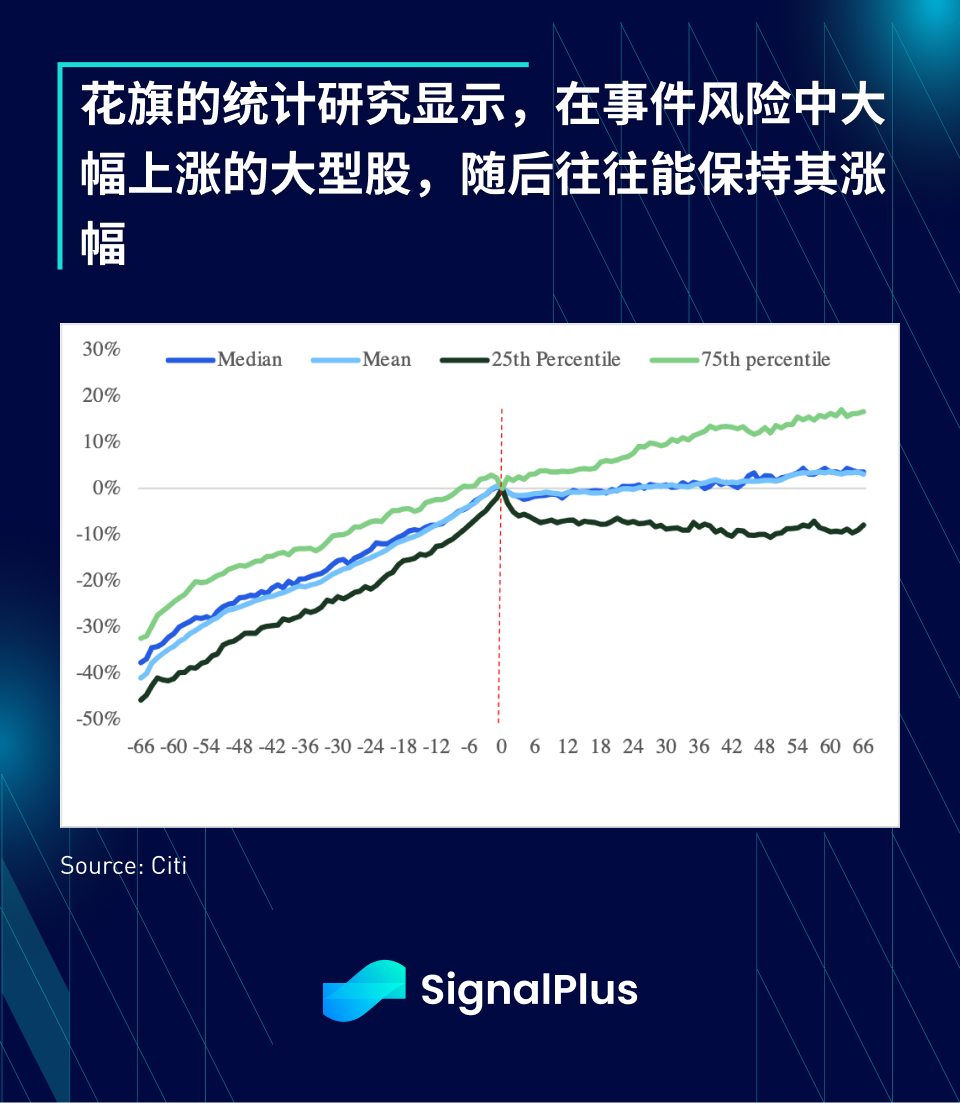

นอกจากนี้ ผลการศึกษาทางสถิติชี้ว่า “ฟองสบู่” AI ในปัจจุบันยังอยู่ในช่วงเริ่มต้นและยังมีโอกาสเติบโตได้อีก โดยวิเคราะห์หุ้นขนาดใหญ่กว่า 1,000 หุ้น ที่ปรับตัวขึ้นกว่า 35% ใน 3 เดือน ตลอด 30 ปีที่ผ่านมา ผลการวิจัยพบว่าผลตอบแทนยังคงเป็นบวกเล็กน้อยในไตรมาสหน้าโดยไม่มีการถอยกลับอย่างมีนัยสำคัญ ซึ่งเป็นลางดีสำหรับความเสี่ยงในปัจจุบันหากประวัติศาสตร์ซ้ำรอยในระยะเวลาอันใกล้

เมื่อวานนี้ ดัชนี SPX เพิ่มขึ้น 2% กำไรค่อนข้างกว้างและแข็งแกร่ง ยกเว้นสาธารณูปโภค เพิ่มขึ้นทุกภาคส่วน โดยหุ้นเทคโนโลยีเพิ่มขึ้นมากถึง 4.4% ไม่น่าแปลกใจเลยที่ต้นทุนการป้องกันความเสี่ยงด้านลบลดลงสู่ระดับต่ำสุดในรอบหลายปี เนื่องจากนักลงทุนไม่มีเหตุผลที่จะต้องกังวลในระยะสั้น

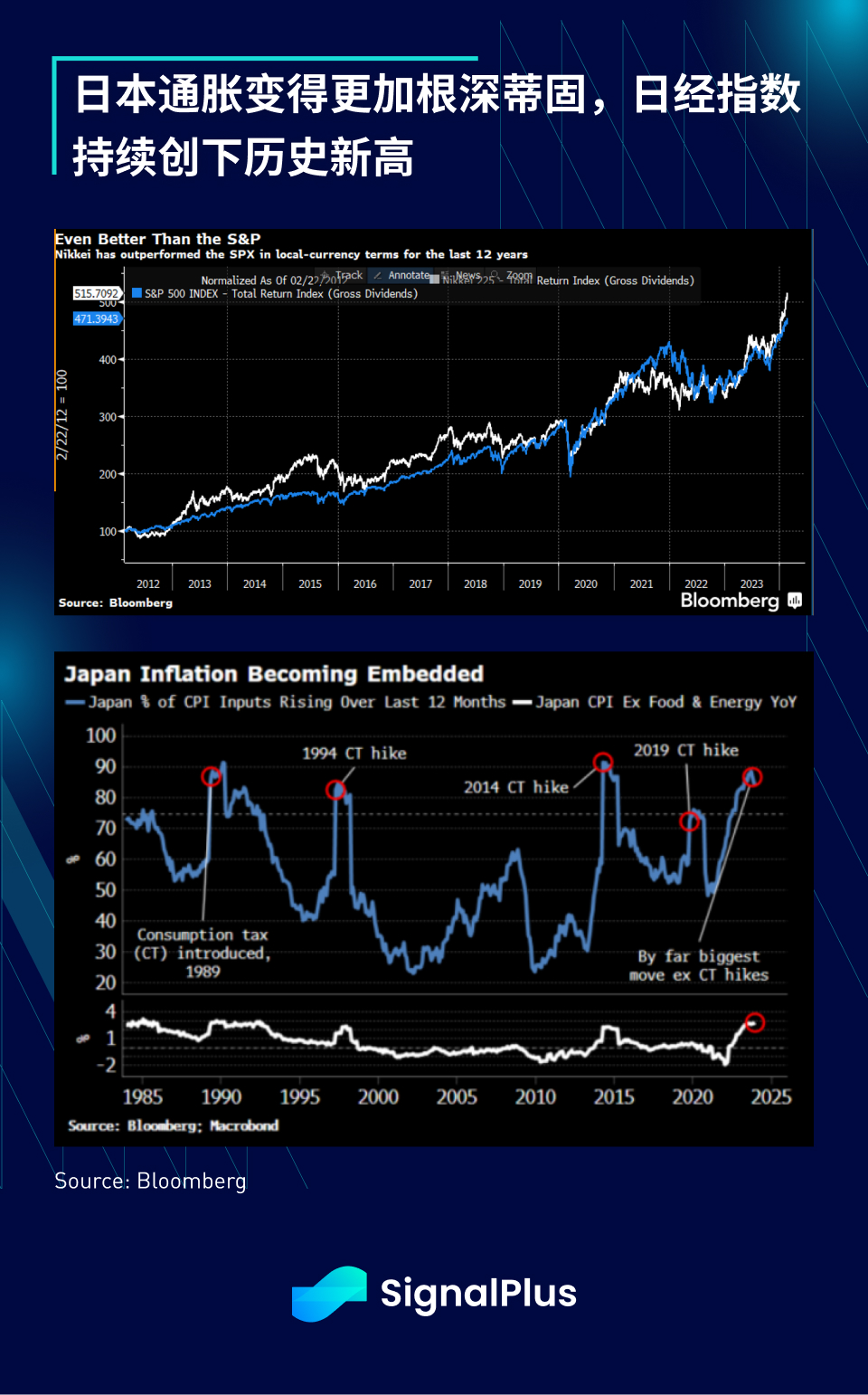

การขึ้นอย่างแข็งแกร่งนี้ไม่ได้จำกัดอยู่แค่ในสหรัฐฯ เท่านั้น โดย Nikkei ยังแตะระดับสูงสุดตลอดกาลและทำได้ดีกว่า SPX (ในรูปสกุลเงินท้องถิ่น) ในช่วง 10 ปีที่ผ่านมา เกือบ 90% ของหมวดหมู่องค์ประกอบ CPI ของญี่ปุ่นเพิ่มขึ้น อัตราเงินเฟ้อของญี่ปุ่นเริ่มที่จะยึดที่มั่นมากขึ้น และเงินทุนยังคงหลั่งไหลเข้าสู่ตลาดหุ้นและอสังหาริมทรัพย์

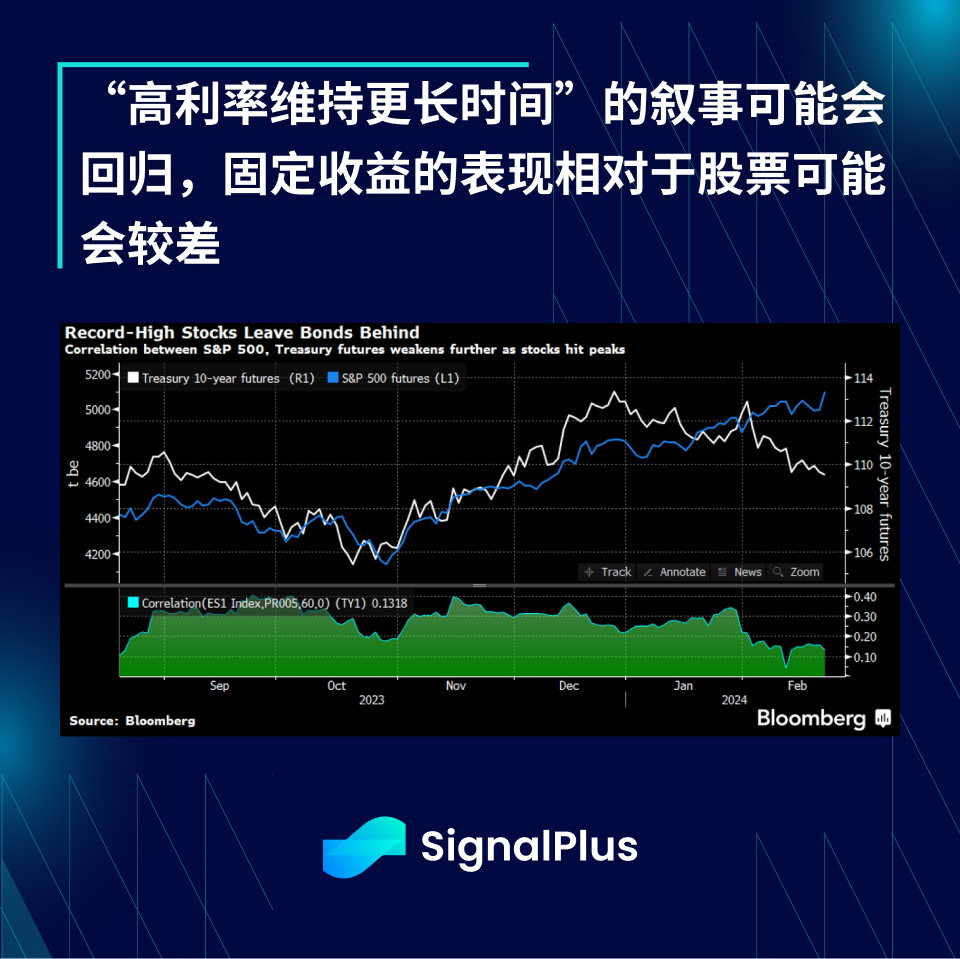

เศรษฐกิจสหรัฐฯ ยังคงอยู่ในสภาพที่ดี (การขอรับสวัสดิการว่างงานเบื้องต้นและ PMI ที่ประกาศเมื่อวานนี้ยังคงแข็งแกร่ง) สถานการณ์ทางการเงินผ่อนคลายลงอย่างมาก บริษัทจดทะเบียนขนาดใหญ่ในสหรัฐฯ ยังคงทำเงินได้ และ AI กำเนิดได้นำผลกระทบด้านความมั่งคั่งอย่างมีนัยสำคัญและการปรับปรุงประสิทธิภาพการผลิตในอนาคต ความคาดหวังว่าเฟดจะถูกบังคับให้ใช้จุดยืนแบบประหัตประหารมากขึ้นหรือไม่? หรือเราได้เข้าสู่ยุค “ความอุดมสมบูรณ์อย่างไม่มีเหตุผล” (Greenspan 1996) ซึ่งตลาดหุ้น “ยืนอยู่บนที่สูงชั่วนิรันดร์” (Fisher 1929)? ไม่ว่าในกรณีใด การเล่าเรื่อง อัตราที่สูงขึ้นในระยะยาว ควรกลับมาอีกครั้ง โดยความสัมพันธ์ระหว่างหุ้นและพันธบัตรมีแนวโน้มที่จะยังคงแยกออกจากกันในระยะสั้น

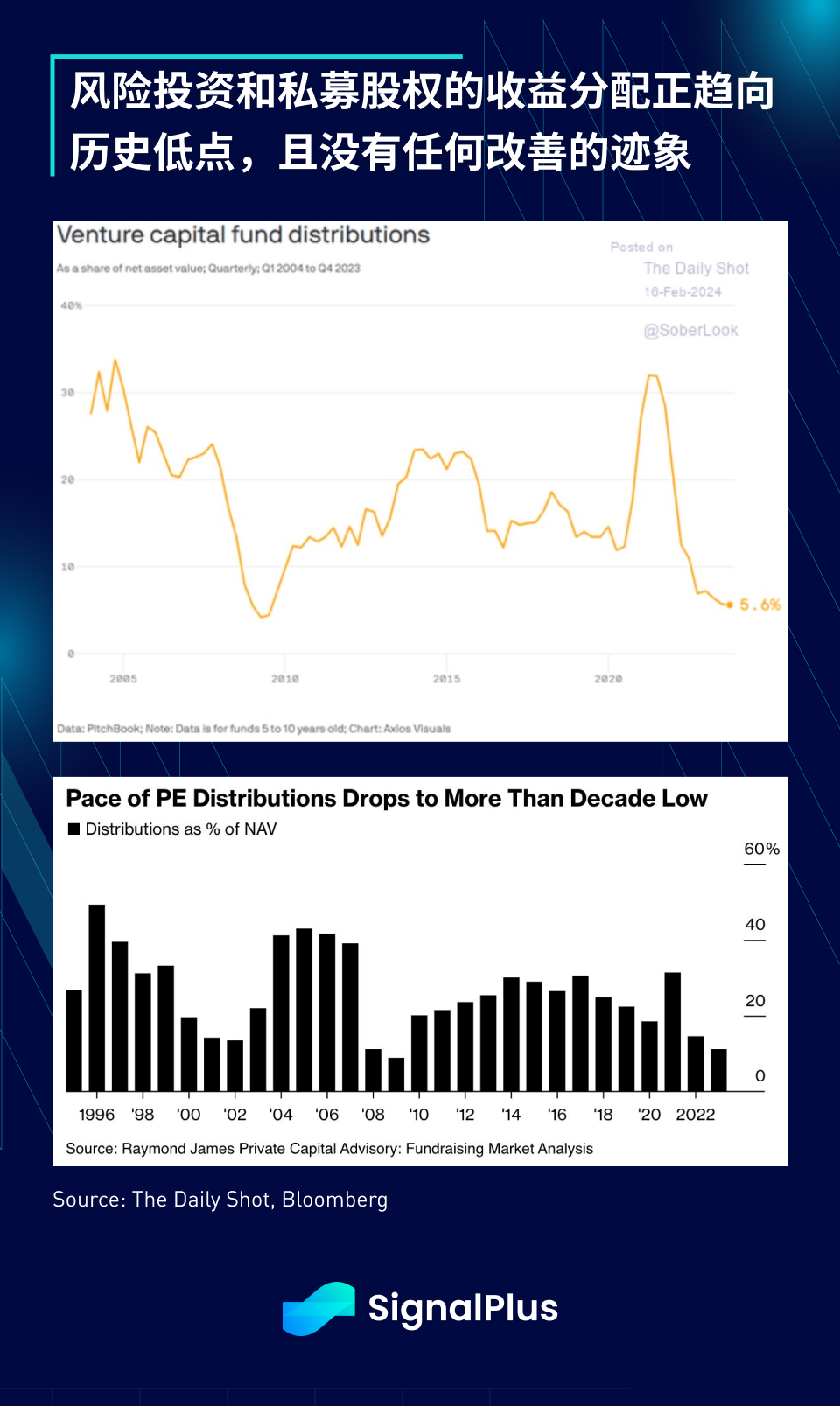

น่าเสียดายที่กระแสน้ำที่เพิ่มขึ้นทำให้เรือทุกลำต้องยกขึ้น และเนื่องจากต้นทุนทางการเงินเพิ่มขึ้นและการจัดสรรทุนกระจุกตัวอยู่ใน AI นักลงทุนจึงไม่สนใจที่จะลงทุนใหม่น้อยลง และเงินทุนร่วมลงทุนที่มีสภาพคล่องน้อยลงและภาคการลงทุนภาคเอกชนก็ได้รับผลกระทบ นักลงทุนในปัจจุบันให้ความสำคัญกับเงินสดมากขึ้น การไหลและสภาพคล่อง ด้านการลงทุนในหุ้นนอกตลาดอาจยังคงหันไปสู่ตลาดรองที่มีโครงสร้างและโครงสร้างกองทุนต่อเนื่อง ตลาดและวัฏจักรมีการพัฒนา และเราก็ต้องทำเช่นกัน

คุณสามารถค้นหา SignalPlus ได้ใน Plugin Store ของ ChatGPT 4.0 เพื่อรับข้อมูลการเข้ารหัสแบบเรียลไทม์ หากคุณต้องการรับข้อมูลอัปเดตของเราทันที โปรดติดตามบัญชี Twitter ของเรา @SignalPlus_Web3 หรือเข้าร่วมกลุ่ม WeChat ของเรา (เพิ่มผู้ช่วย WeChat: SignalPlus 123) กลุ่ม Telegram และชุมชน Discord เพื่อสื่อสารและโต้ตอบกับเพื่อน ๆ มากขึ้น

SignalPlus Official Website:https://www.signalplus.com