Metis的排序器LSD计划,会掀起新一轮的造富机遇吗?

扩容一直都是区块链世界的主线任务。

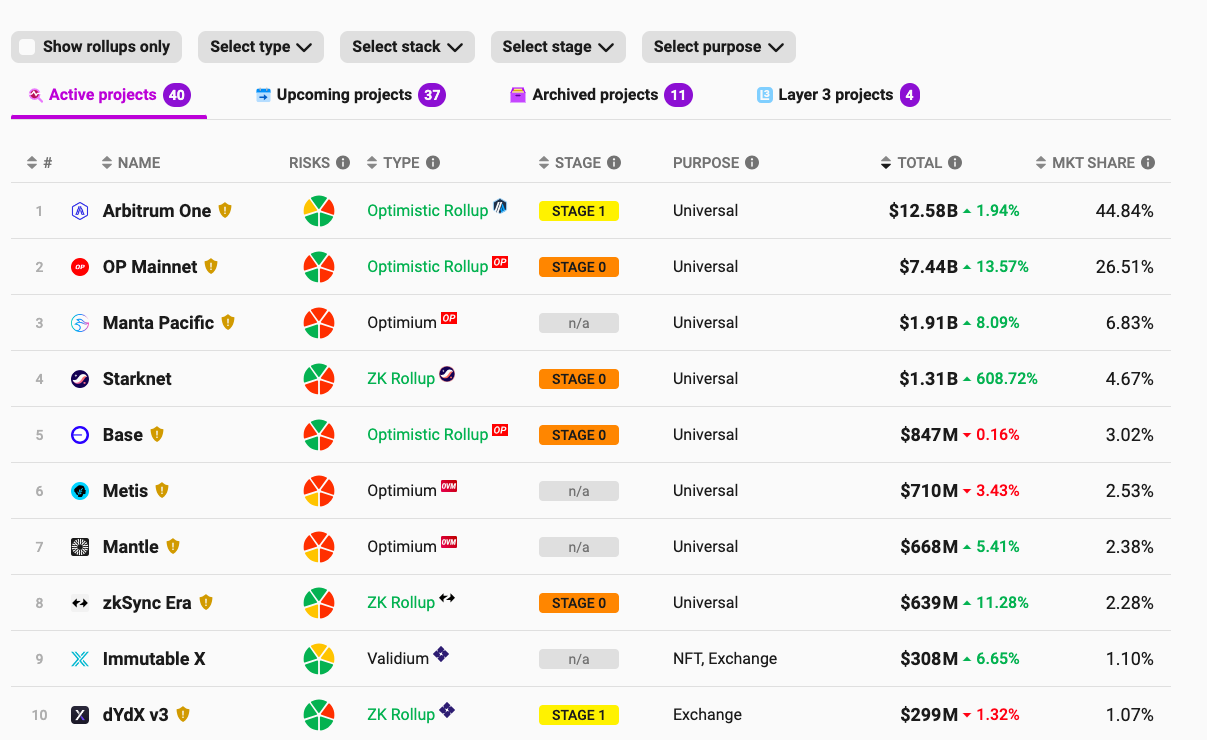

经历了多年的竞争与角逐,基于 Rollup 的 Layer 2 解决方案从诸多扩容路径中杀出重围,逐渐成为了市场的主流选择。L2BEAT 数据显示,当下正处于运行状态的 Layer 2 网络共有 40 条,待上线网络则有 37 条,资产锁定总额高达 280.7 亿美元。

虽然从主网启动的层面来看,各大 Layer 2 走进公众视野已有一定时间了,但从更绝对的技术意义上来讲,事实上当前所有 Layer 2 都尚未完成自己所预设的愿景。其中最核心的问题在于,除了本文的主角 Metis 之外,所有的主流 Layer 2 网络暂时都没有实现“排序器(sequencer)”的去中心化。

排序器之殇

排序器是 Rollup 链下部分的关键组件,其的职责是负责排序并压缩 Layer 2 的交易,然后再将交易批量打包并发送至 Layer 1 。

当前,绝大多数主流 Layer 2 网络的排序器都是由与开发团队相关的中心化实体负责运营,这里既存在着技术门槛问题,也存在着利益分配问题。

排序器从 Layer 2 交易中收取的费用是收入,将数据发回 Layer 1 所消耗的 gas 是成本,剩下的则将是排序器的利润,此外排序器还可通过扰乱交易顺序从而获得额外的 MEV 收益。这是一笔相当可观的收入,每个月多则数百万美元,少也有数十万美元,部分 Layer 2 会选择通过额外机制将该部分收入回馈给开发者社区,但也有部分项目尚未公开此项收入的分配细节。

虽然从逻辑上讲,由团队相关实体所运营的中心化排序器一般来说并不会在自己的网络上有什么作恶动机,但这种依赖于莫名信任的机制显然与区块链的理念并不相符,客观上也会削弱网络的抗风险能力及去中心化程度。

Metis 的征程与挑战

去年 12 月 18 日,Metis 正式推出 MetisEDF 发展计划,旨在拨付 460 万枚 METIS(当前价值约为 4 亿美元)用于社区的进一步增长,其中 300 万枚将作为“挖矿”激励分配给维护网络运转的去中心化排序器节点。

今年 1 月 16 日,Metis 在 Sepolia 测试网推出了关于去中心化排序器的第一季社区测试活动,在测试活动中,用户可通过探索各种 Dapp 来测试 Metis 的 POS 排序器池,同时也会获得对应测试积分奖励。最终,第一季的测试活动吸引到了 19.5 万余名贡献者参与,完成了超过 400 万笔交易,累积积分逾 5 亿。

2 月 5 日,Metis 再次启动了第二季社区测试活动,并宣布将在 2024 年晚些时候在主网正式启动去中心化排序器。

虽然看起来一切进展都很顺利,但 Metis 在实现排序器的真正“去中心化”道路上仍面临着一大挑战 —— 如何让更多用户参与到去中心化排序器的建设中来。

该挑战的核心问题在于,为了防范节点作恶,Metis 对于成为排序器节点设置了较高的门槛要求。若想要成为 Metis 的排序器节点,基础要求是质押 2 万枚 METIS,一旦被发现作恶,节点所质押的代币将会被罚没;此外,Metis 对于成为排序器节点还设置了较为严苛选举及白名单机制,这更是加大了普通用户成为排序器节点的难度。Metis 此项设计的本意是为了确保节点质量,维护网络稳定运行,但客观上却限制了用户通过成为排序器来帮助网络进一步去中心化的通道。

注:关于 Metis 去中心化排序器节点规则的详情,可参阅:《Metis:MEME 叙事中的 Layer 2 ,Layer 2 竞争中的最强黑马?》;《Metis:Layer 2 首个去中心化 Pos 排序器,尽显黑马之资》。

那么,这一挑战该如何解决呢?Metis 将目光转向了基于 METIS 的流动性质押协议(LSD)之上。

LSD,会是解决方案吗?

2 月 8 日,Metis 官方宣布推出 Liquid Stake Blitz 计划,该计划旨在将利用总额高达 460 万枚 METIS 的 MetisEDF 生态系统发展基金,加速 Metis 网络上的 LSD 协议和以 LSD 为重点的产品增长。

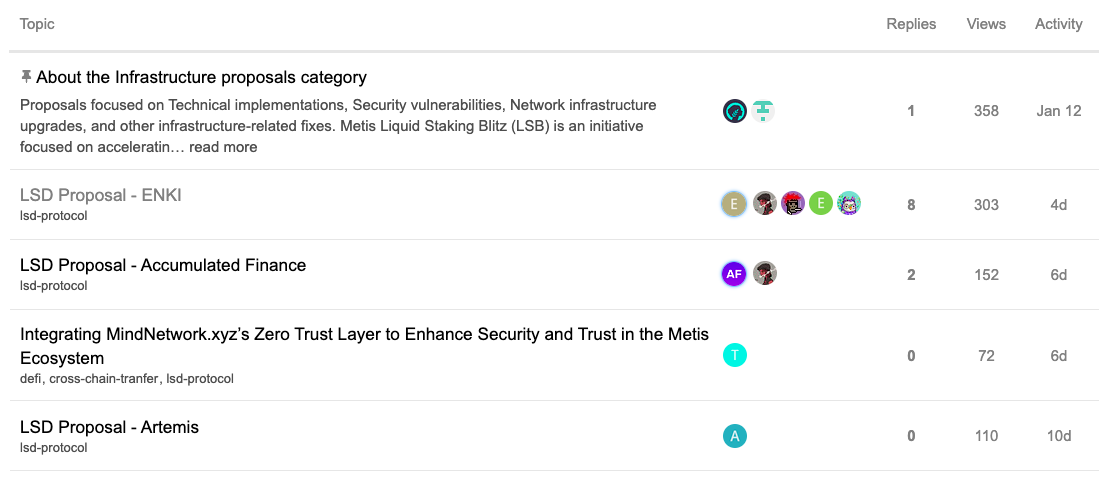

根据 Liquid Stake Blitz 计划,自 2 月 8 日起至 2 月底,Metis 生态的 LSD 协议将能够在 Metis 社区治理系统内发起提案,并在 3 月进入正式的投票环节。投票结束后,有限数量的获胜协议可赢得与去中心化排序器节点配对的权利(即白名单席位),进而获得稳定的节点参与资格。

Metis 治理系统显示,当前已有三家 LSD 协议在治理论坛内发起了申请提案,分别为 Enki、Accumulated Finance、Artemis。三家协议虽都支持基础的 METIS 流动性质押功能,但在机制设计以及附带服务上却有着一定的定位差异,Enki 通过衍生代币 eMETIS、质押代币 seMETIS 以及治理代币 ENKI,围绕该协议与 Metis 网络的共生构建了一个可持续的经济系统;Accumulated Finance 则比较侧重与 Curve 生态的集成,以解决衍生代币 stMETIS 的流动性问题;Artemis 则更强调单一衍生代币(artMETIS)模型,以简单用户操作,提供最简洁的排序器节点参与方案。

以最早提交提案的 Enki 为例,用户在使用 Enki 时,质押 METIS 之后会获得对应质押额度的流动性衍生代币 eMETIS,eMETIS 可以继续用于参与 Metis 网络之上的各种 DeFi 活动,而 Enki 则将利用用户质押的 METIS 去参与去中心化排序器的节点运营,并将所获取的排序器收益分配给所有通过 Enki 参与质押的用户。如此一来,大量无法触达 20000 METIS 门槛的用户可以“积少成多”,通过 Enki “众筹”获取一个稳定的节点席位,共同获取并分享排序器节点收益。

这一机制很像以太坊主网上的 LSD 协议 Lido,二者均可解决相应网络上的质押门槛问题,不同的是 Lido 底层所提供的是 Layer 1 层面上的 PoS 质押节点服务,而 ENKI 所提供的则是 Layer 2 层面上的排序器节点服务。

三层造富机遇

许多普通用户尚未意识到的是,Metis 启动 Liquid Stake Blitz 计划,很有可能会在该生态内打开新一轮的造富机会。基于我们的推测,随着 Enki、Accumulated Finance、Artemis 等 LSD 协议的相继落地,普通用户至少可获得三层较为明确的收益机会。

一是通过 Enki、Accumulated Finance、Artemis 等 LSD 参与质押,获取至少 20% 年化的稳定排序器收益。根据 Liquid Stake Blitz 的披露,Metis 会利用 MetisEDF 基金内的 METIS 储备,在第一年内向所有排序器节点提供保底的 20% “挖矿”收益。随着 ENKI 等协议破除了普通用户的参与障碍,持有小额 METIS 的用户未来亦可通过该渠道实现稳定生息。

二是 LSD 协议本身的空投奖励及代币激励。继续以 Enki 为例,该协议已于 2 月上旬启动了名为 Fantasy 的创世空投计划,将向社区用户空投 100 万个 ENKI(占供应量的 10% )作为奖励;此外,Enki 还宣布团队不会保留任何代币,占总供应量 90% 的其他 ENKI 代币将随着时间的推移以各种形式释放,这意味着 Enki 用户可通过将 eMETIS 再质押为 seMETIS,或是通过 METIS/eMETIS 的 LP 配对等各种各样的协议交互活动来继续获得 ENKI 收益。

注:ENKI 收益机会详情可参阅《读懂 Metis 上首个 LSD 协议 Enki:创世空投计划开启》。

三则是最为重要的一点 —— LSD 协议对于 METIS 本身效用及价值的放大。随着 Metis 将 METIS 的质押引入去中心化排序器的实现流程,METIS 的代币就已具备了其他 Layer 2 代币所不具有的实际效用及价值(其他 Layer 2 代币暂时基本只有治理效用)。

ENKI 等 LSD 解决方案的推进,则有望在 Metis 社区内进一步扩大该效用及价值,进行实现一个正向的增长飞轮:门槛降低,更多用户参与质押 —— 更多的 METIS 被锁定 —— METIS 供应削减,需求增长 —— 二级市场价格有望抬升 —— 质押收益提升 —— 吸引更多用户质押……当然了,这并不会是一个永久性的循环,但大概率会让 METIS 在一个更高的水平位上找到平衡,而在这一进程中,生态内的各方角色均会受益。

Layer 2 大势已至,Metis 独领风骚

自从选择发力推进去中心化排序器进程依赖,Metis 就以走上了与其他 Layer 2 截然不同的发展道路。也正是因为独特一选择,METIS 得以在 2023 年涨幅领跑诸多 Layer 2 代币,进而在身位上实现了多对个曾斩获巨额融资的 Layer 2 的反超。

展望未来,随着 LSD 解决方案的落地,Metis 社区集体参与去中心化排序器运行的积极性将会被大幅调动,这也有望进一步提高 Metis 生态的活力,助推该网络继续实现增速发展。