SignalPlus宏观分析(20240221):ETH突破3000美元,BTC现货ETF交易量创新高

作为逐步刺激经济计划的一部分,中国昨天下调抵押贷款利率, 5 年期贷款市场报价利率下调 25 个基点至 3.95% ,这是自去年 6 月以来的首次下调,也是自 2019 年以来最大降幅,然而,此举未能提振投资者情绪,沪深 300 指数收盘仅上涨 0.2% ,债券收益率也未能下探。市场仍然认为这些措施只是解决更大的结构性问题的一小步,房市需求低迷与其说是贷款成本的问题,不如说是供需不平衡和经济前景低迷的问题。

尽管日本和加拿大的 CPI 低于预期,且英国央行 Bailey 发表了鸽派立场(在降息之前不需要通胀回到目标水平),但 500 亿美元规模的投资等级企业债供给仍导致美债收益率曲线走陡。同时,Walmart 的财报显示,尽管交易量增长了 4.3% ,但平均消费者支出却下降了 0.3% ,暗示购买金额正在下降,这给通胀放缓的叙事带来了希望。

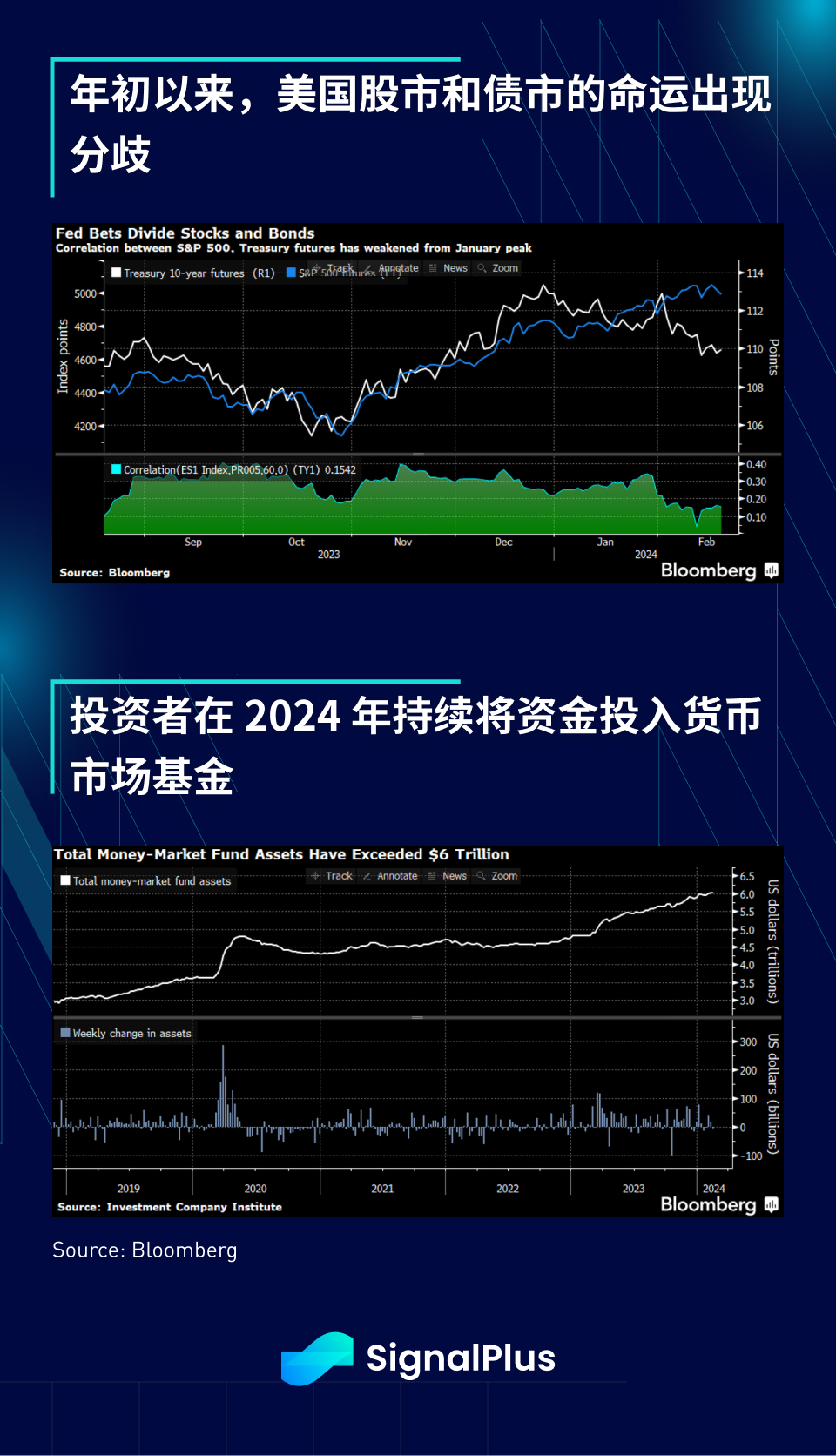

在股市方面,债券和股票之间的滚动相关性在 2 月持续减弱,股票价格保持在历史高点附近,债券则因降息预期在过去 6 周的调整(高利率维持更长时间)而受到打击。有趣的是,投资者继续大举投资货币市场基金,年初以来美国货币市场基金又新增 1, 280 亿美元的流入,资产总额目前已激增至 6 万亿美元,是加密货币总市值的 3 倍!

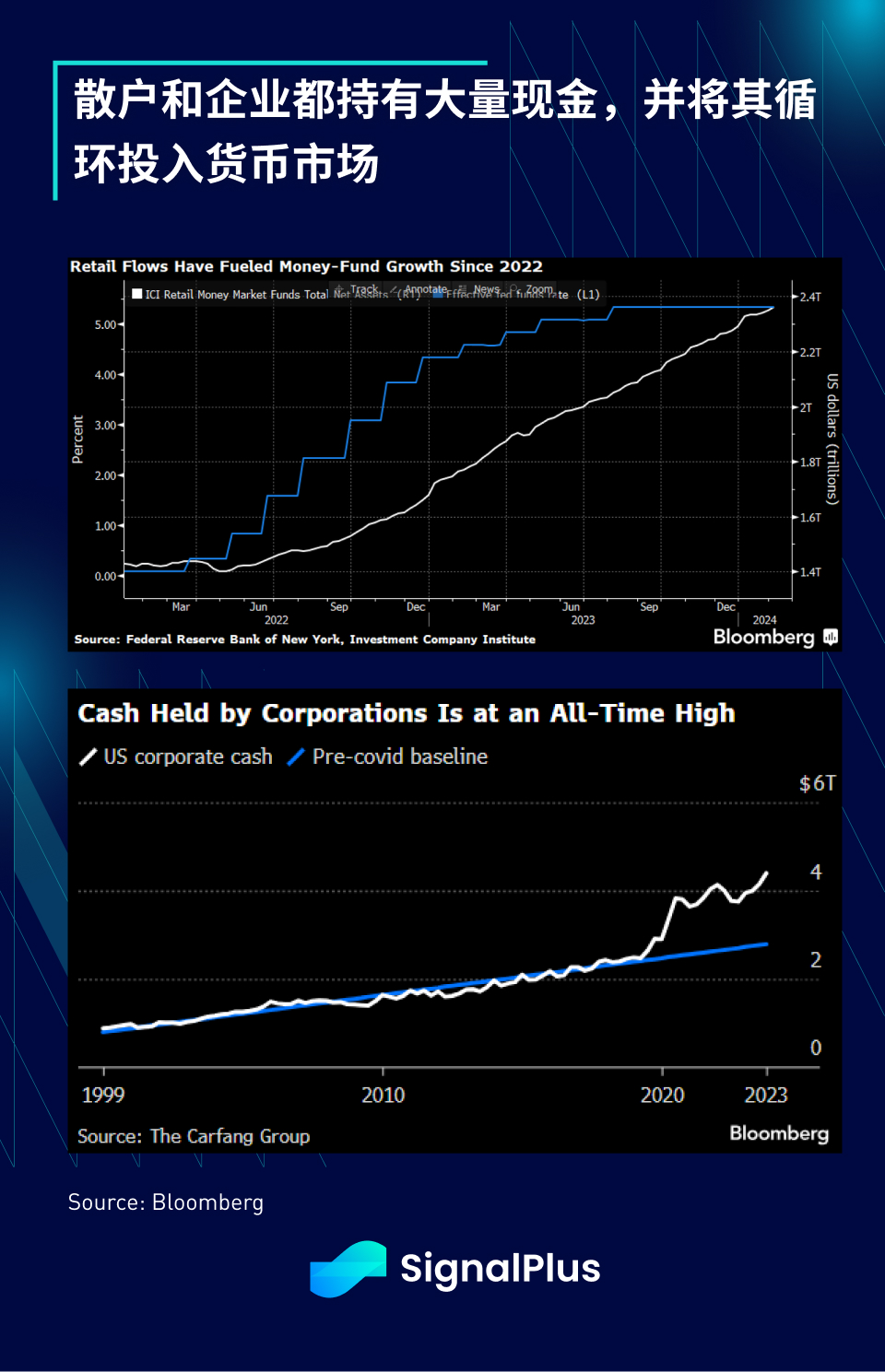

此外,不仅是一般家庭持有大量现金,企业也坐拥创纪录的 4.4 万亿美元现金,并将其投入至国库券;因此,在大量流动性的支持下,除非是进行短线操作,否则很难看跌风险资产和股票。

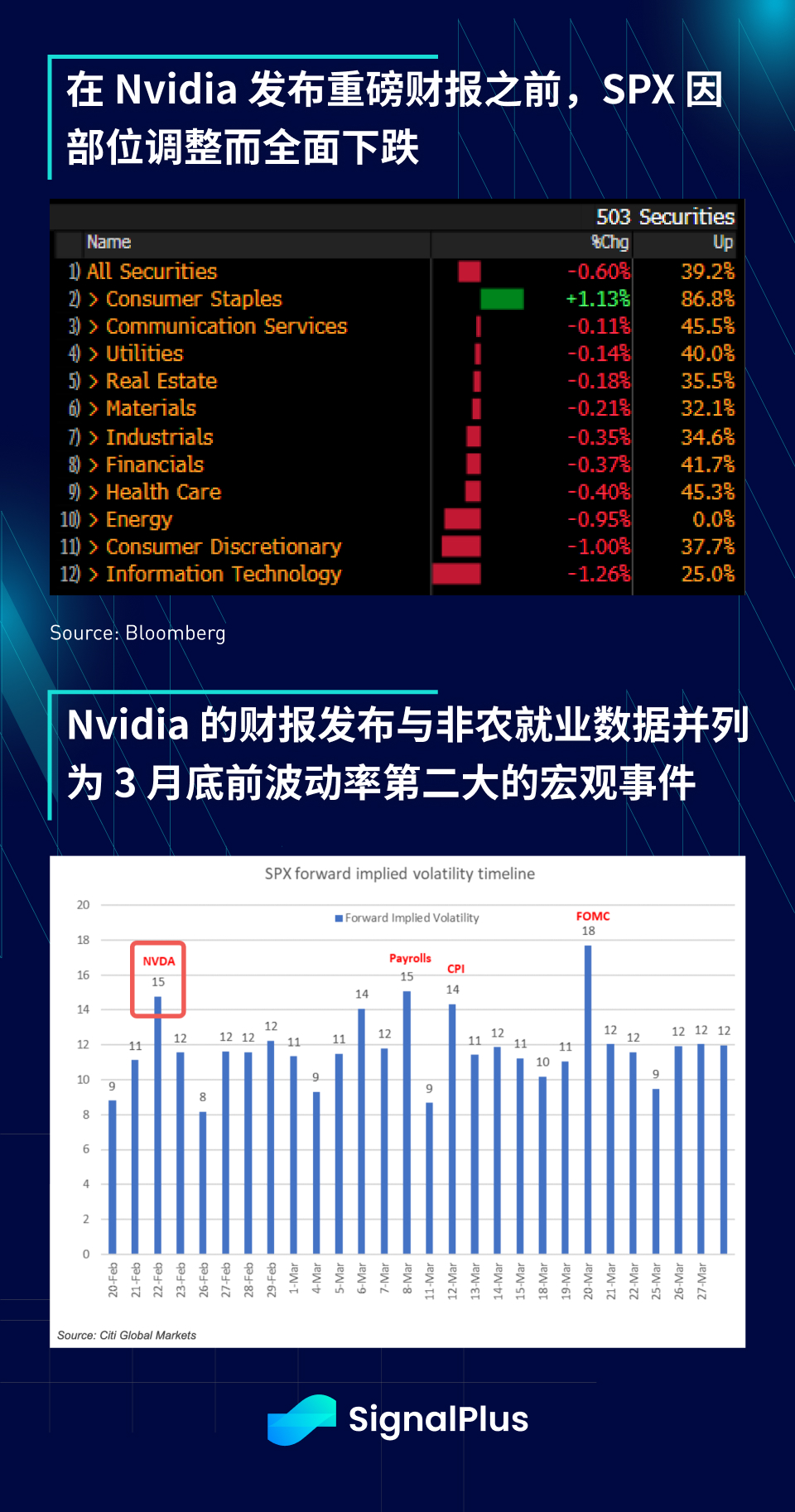

尽管如此,股市昨天确实经历了回调,在 Nvidia 财报公布前,SPX 出现了以科技股为首的全面下跌。

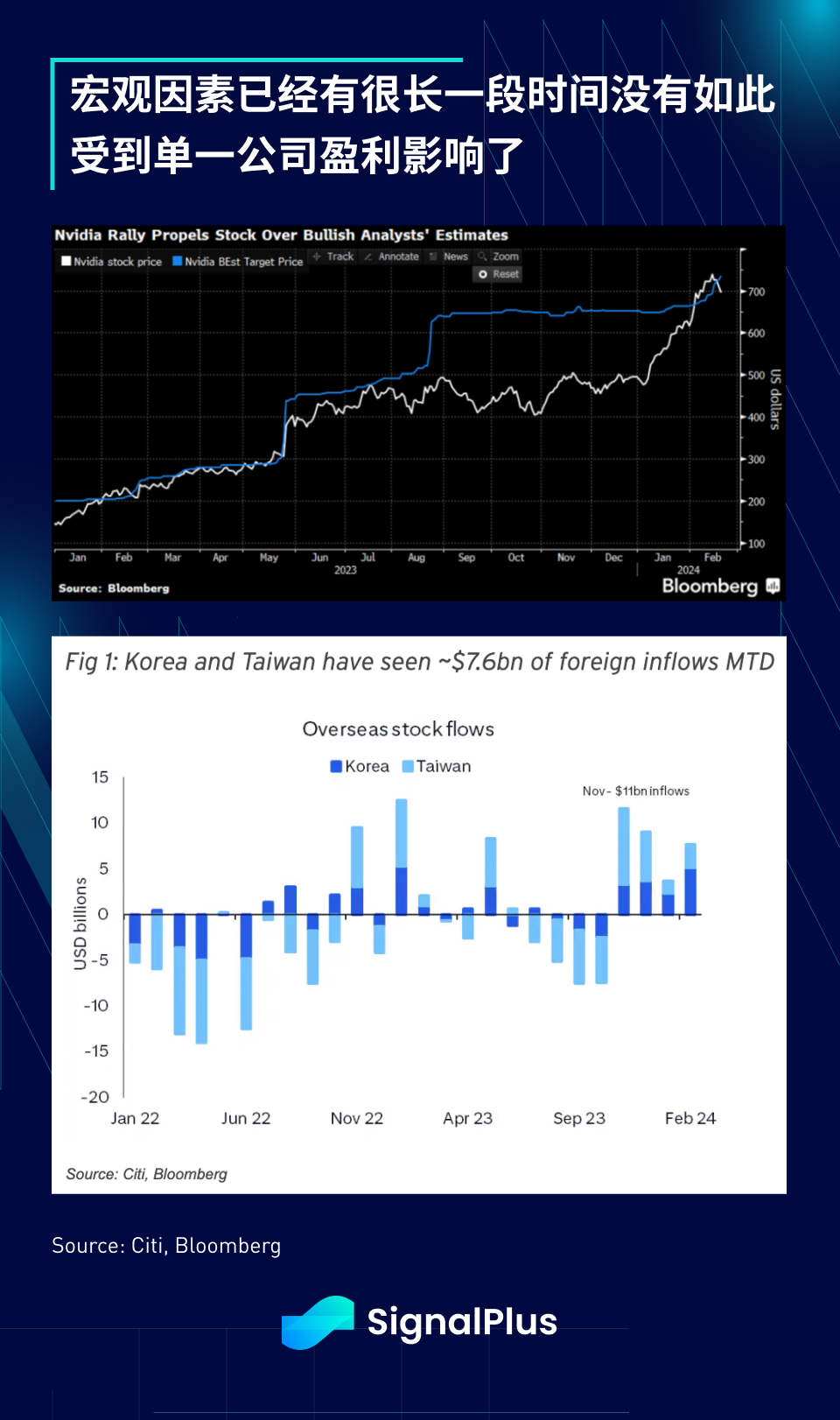

Nvidia 的财报被市场视为 3 月底前第二重要的宏观事件,仅次于 3 月的 FOMC 会议,并与即将发布的非农业就业报告并驾齐驱。此外,Nvidia 自身的期权隐含波动也高达 10.6% ,是 2012 年以来历史财报发布的最高区间,相当于每日市值的影响高达 +/- 1, 800 亿美元。AI 的 FOMO 效应显而易见,今年为止已有近 80 亿美元的外资流入韩国和台湾股市,因此,可以公平地说,这单一财报的影响力极为巨大。

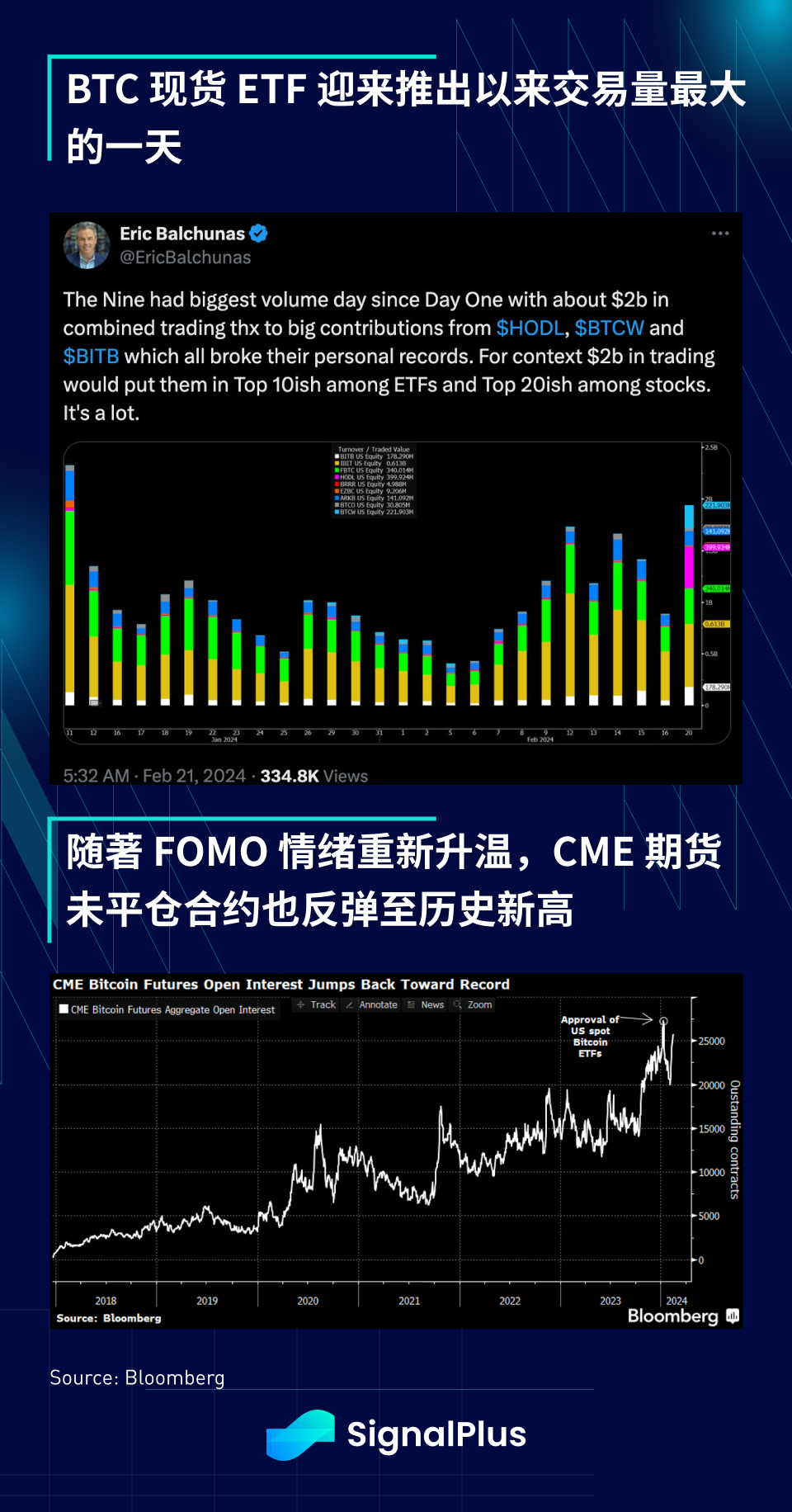

在加密货币方面,随著 ETH 突破 3, 000 美元,风险情绪持续升温。9 只新 ETF 创下推出以来最大单日交易量(20 亿美元),Bloomberg 的 ETF 分析师将这批 ETF 的总交易量列入美国市场 ETF 交易量的前 10 名,考虑到我们仍处于主流市场重新参与的早期阶段,这一成就尤为引人注目。在 1 月初遭遇 ETF 引发的下跌之后,CME 的期货未平仓量也反弹至接近历史最高水平。

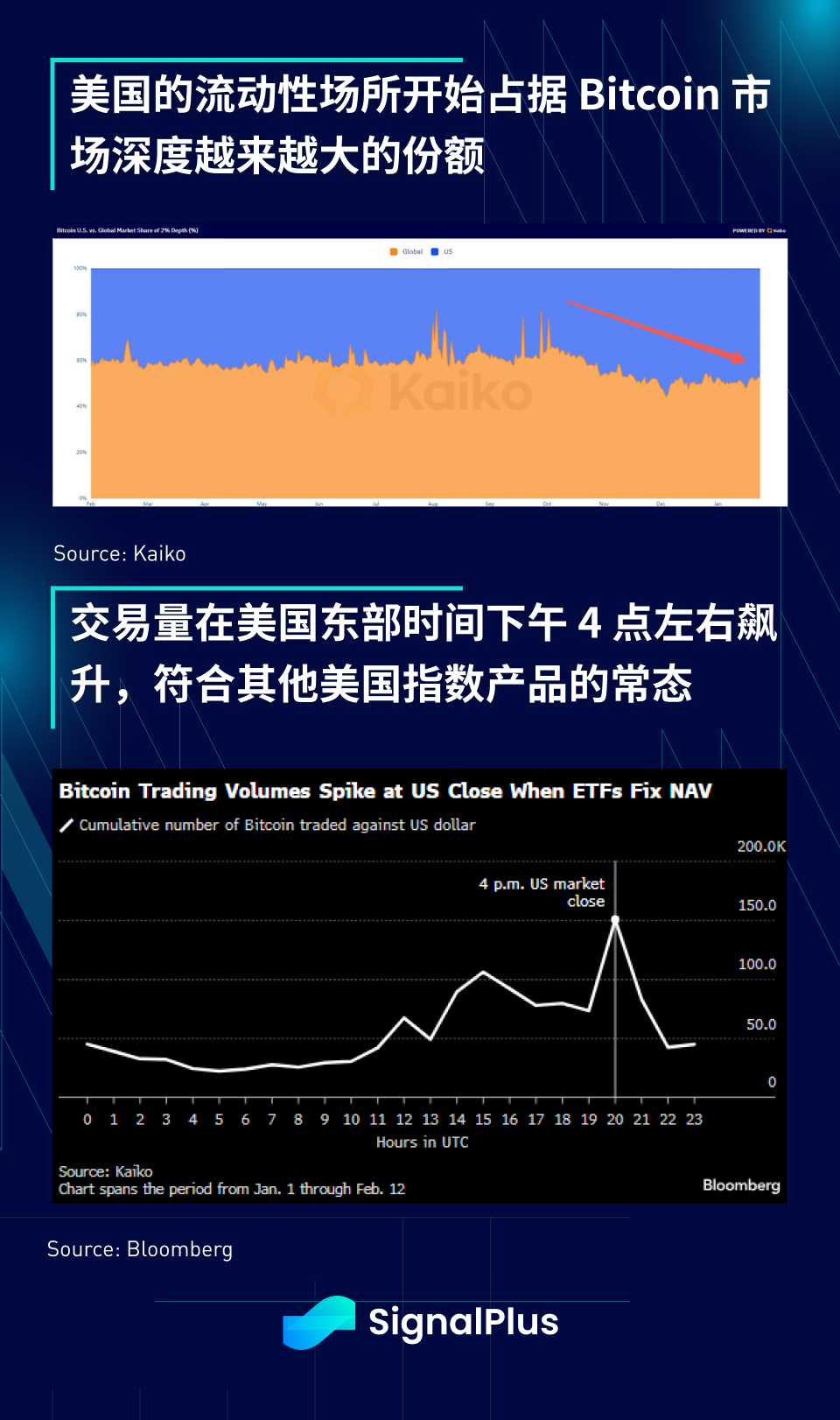

然而,我们之前提到过,在焦点转向 (TradFi) ETF 的同时,权力的平衡似乎也稍微转回西方。根据 Kaiko 的数据,美国交易场所在 Bitcoin 市场深度中的占比越来越大。此外,与我们在传统指数交易活动中看到的情况类似,交易量在 ETF 发行方记帐的 “EST 下午 4 点结算价” 期间激增,预计随著更多美国 ETF 产品的推出,这种行为将持续。随著虚拟资产未来进一步制度化,这种“权力更迭”的趋势值得我们持续关注。

您可在 ChatGPT 4.0 的 Plugin Store 搜索 SignalPlus ,获取实时加密资讯。如果想即时收到我们的更新,欢迎关注我们的推特账号@SignalPlus_Web3 ,或者加入我们的微信群(添加小助手微信:SignalPlus 123)、Telegram 群以及 Discord 社群,和更多朋友一起交流互动。

SignalPlus Official Website:https://www.signalplus.com