LD Capital宏观周报(2.19):比特币ETF成最大资金吸引者,市值占比超黄金,NV剑指2万亿,CB财报隐忧

이번 주에는 다음과 같은 이유로 비트코인 거래 시장과 ETF의 최신 개발에 중점을 둡니다.

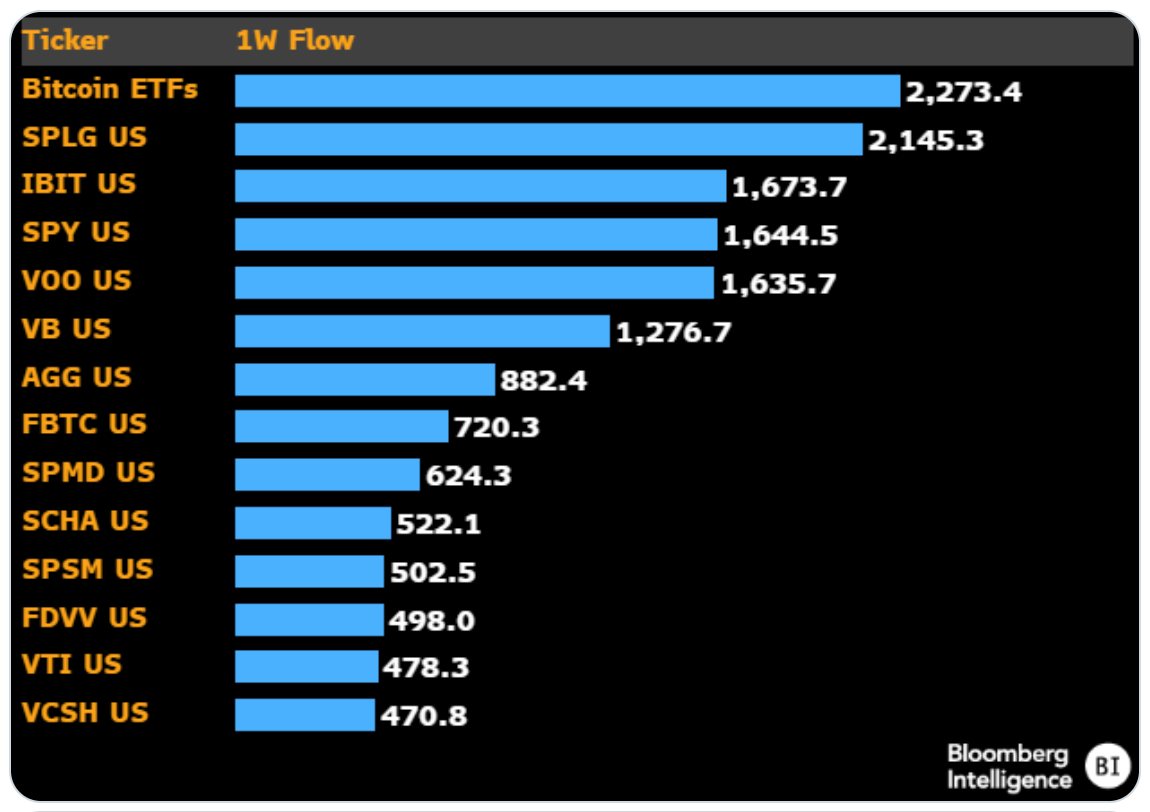

비트코인 ETF는 지난 주 유입액 + 22억 7천만 달러 기준 세계 최대 거래소 상품이 되었습니다.

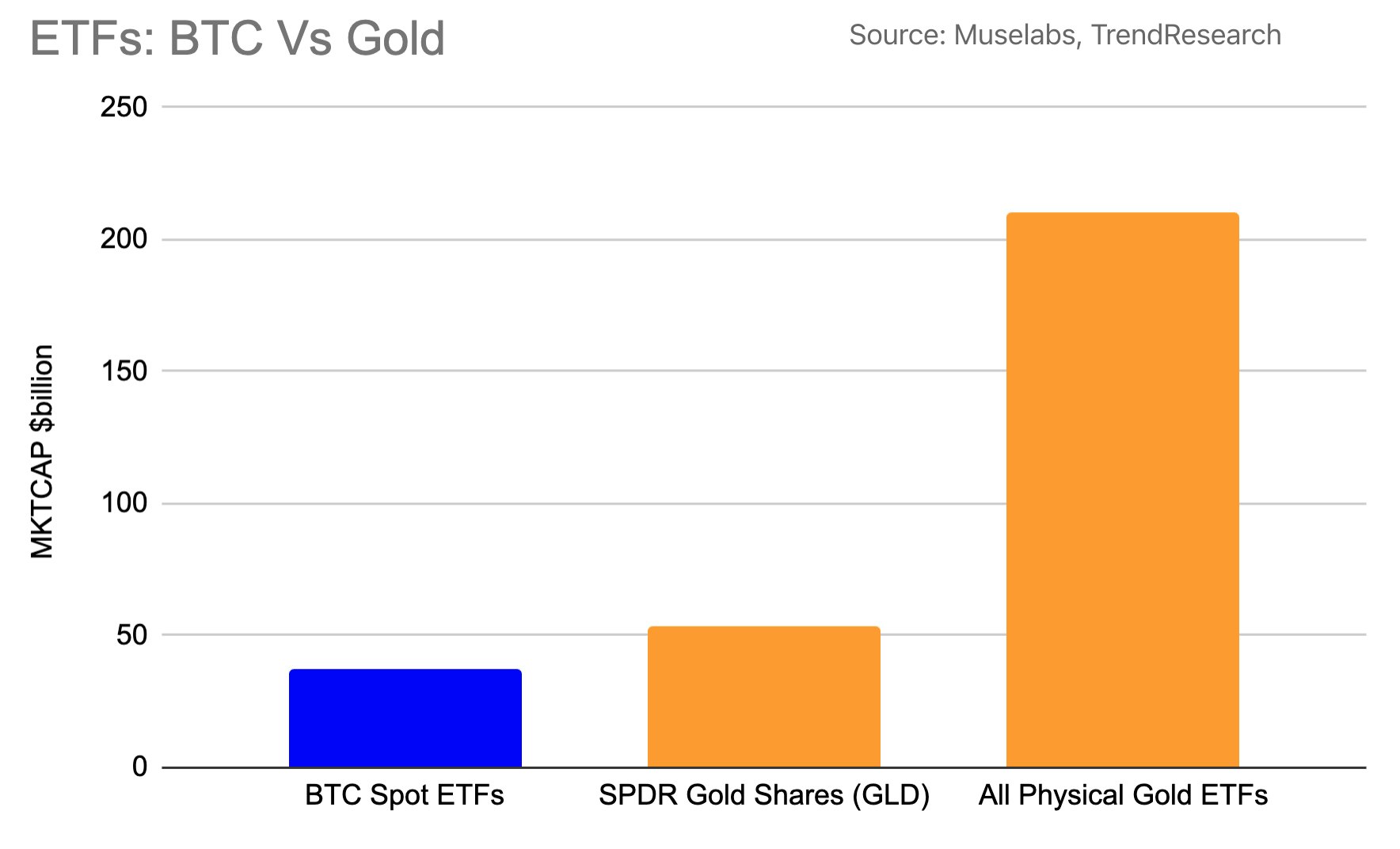

총 시가총액은 GLD의 69%에 달합니다.

계약 시장 OI는 사상 최고치에 가깝습니다.

암호화폐 개념 주식 급등, 네트워크 난이도가 새로운 수준에 도달

이러한 현상은 월스트리트에서 암호화폐, 특히 비트코인의 중요성이 커지고 있음을 나타냅니다.

또한 다음과 같은 몇 가지 뜨거운 주제에 대해서도 논의할 것입니다.

반감기가 다가오고 있는데, 가격이 지난번처럼 새로운 최고점에 도달할 수 있을까요?

전체 시가총액 기준으로 보면 비트코인 ETF가 금보다 크다. ETF 유입은 끝났는가?

아직도 ETH ETF에 대한 과대광고의 여지가 있습니까?

제네시스 매각에 대해 걱정할 필요가 있습니까?

코인베이스의 실적 악화에 대한 우려는 무엇입니까?

AI 붐을 타고 있는 암호화폐는?

현재 시장의 가장 큰 역풍인 인플레이션과 AI 붐이 투자자의 신뢰를 다시 시험하게 될까요?

AI 리더인 엔비디아의 가치 평가에 여전히 성장 여지가 있습니까?

선물/계약 OI가 사상 최고치에 근접

비트코인 선물 미결제약정(OI)은 220억 달러를 넘어 2021년 11월 BTC 가격이 65,000달러로 정점을 찍은 이후 최고치를 기록했습니다. 당시 계약 OI는 230억 달러까지 높았습니다. 새로운 자금이 시장에 유입되어 현재 가격 방향을 뒷받침하는 것으로 나타났습니다. 이러한 추세는 당분간 지속될 수 있음

이 중 CME의 BTC 선물계약 포지션은 ETF 도입 이후 급락(63B~44B)했다가 빠르게 사상 최고치를 기록했는데, 이는 월스트리트 투자자들이 시장에 진입하거나 기존 투자자들이 늘어나고 있음을 의미한다. 포지션, 그리고 랠리에 따른 OI 상승은 더 많은 투자자들이 더 높은 가격에 계약을 매수할 의향이 있기 때문에 시장의 강세 정서를 더욱 확증해 줍니다.

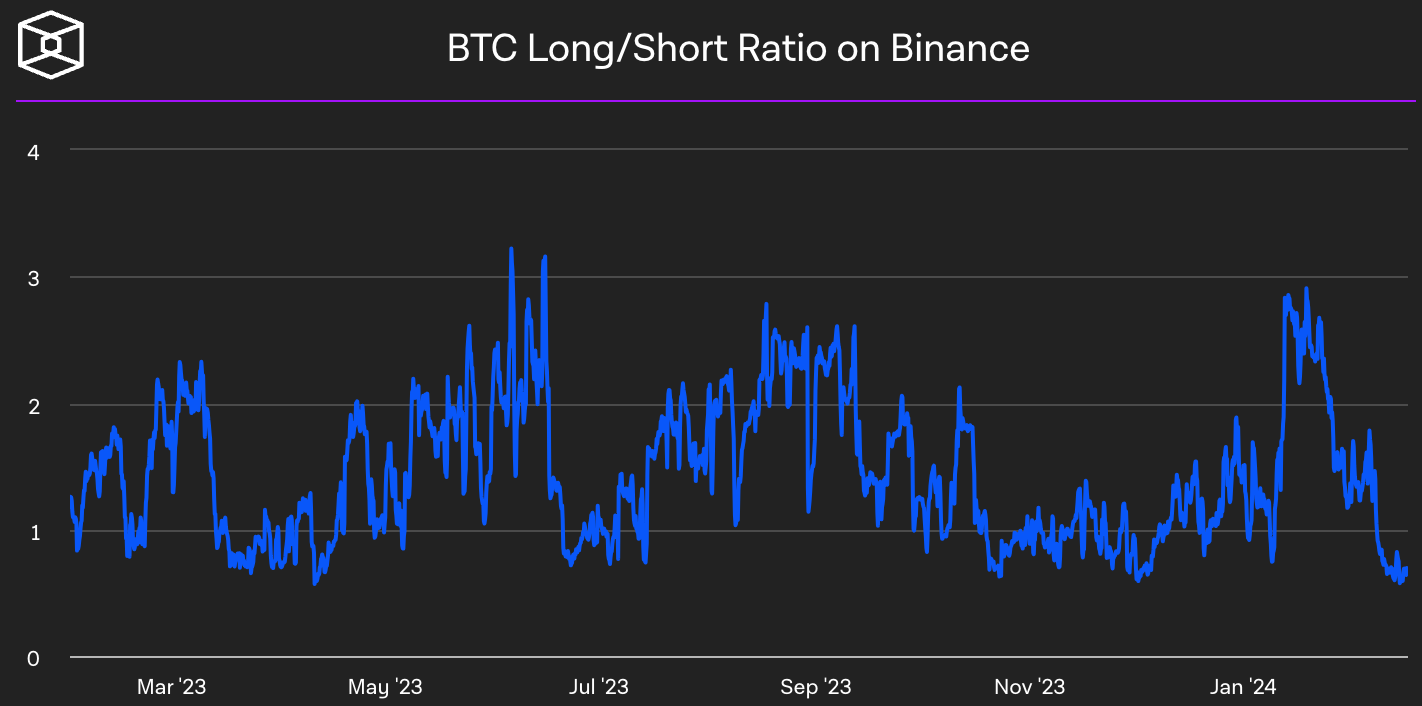

바이낸스 선물의 롱숏 비율은 사상 최저 수준입니다.

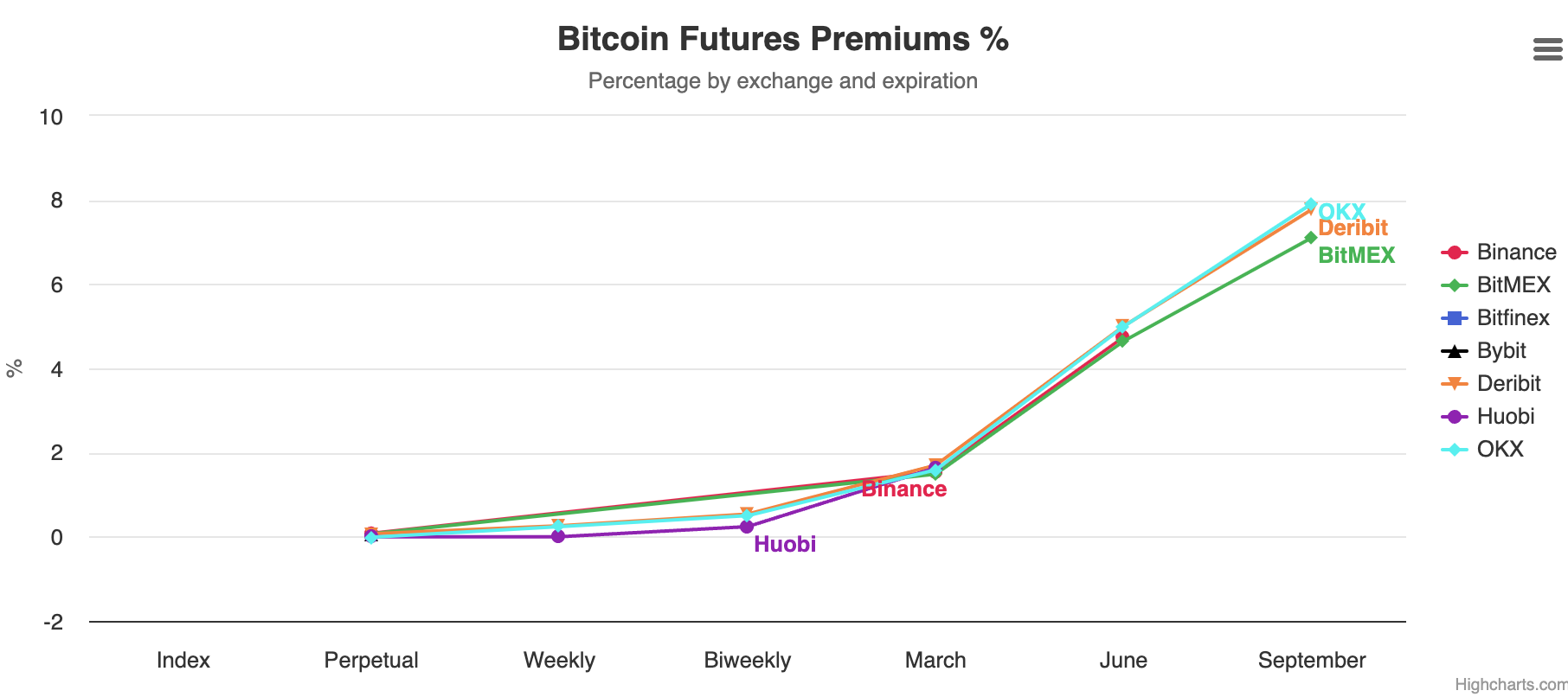

배송 계약 프리미엄은 정상 범위 내에서 유지됩니다.

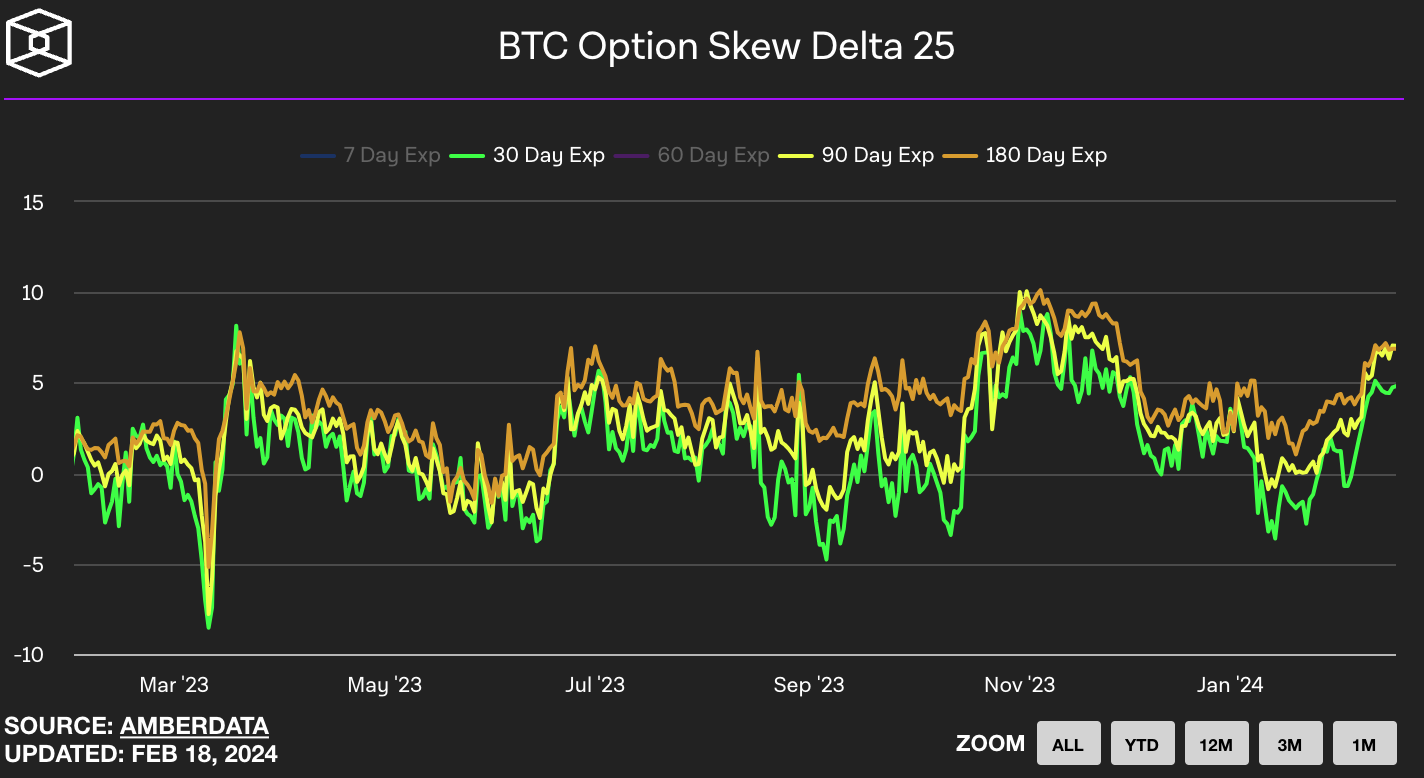

BTC 25 델타 옵션 스큐는 양의 왜곡을 갖고 있어 콜옵션이 풋옵션보다 더 비싸거나(또는 수요가 더 높음) 긍정적인 정도가 극단적이지는 않습니다. 30일 콜옵션은 90일 풋옵션보다 내재 변동성이 4.8% 더 높고, 180일 약 7% 포인트 더 높음:

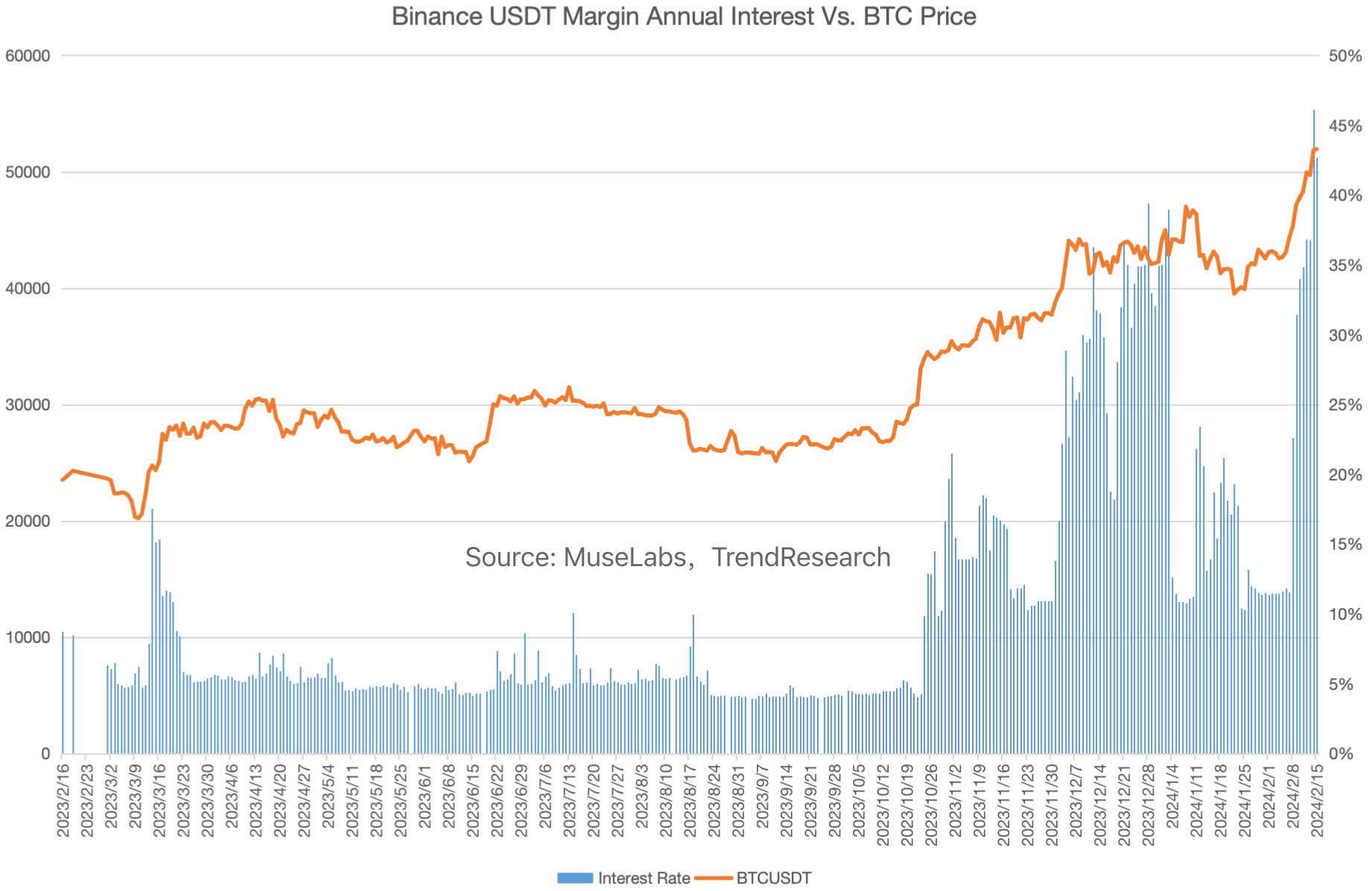

최근 바이낸스의 USDT 파이낸싱 비율은 매우 드물게 45%를 넘어섰으며, 이는 레버리지 매수에 대한 열정이 크다는 것을 보여줍니다. 지난해 11월부터 파이낸싱 금리가 꽤 높았으나 지난 1년간의 이력을 볼 때 이 지표와 BTC 가격 사이에는 뚜렷한 역전 관계가 없는 것으로 보인다.

현물 유입은 미국 주식 상위권에 진입

비트코인 현물 ETF는 2월 12일부터 2월 16일까지 22억 7천만 달러(44,865.4 BTC) 이상의 순 유입을 기록하며 지난 주 동안 강력한 성과를 거두었습니다. 이는 상장 이후 전체 유입의 거의 절반에 해당합니다.

동시에 BTC ETF는 지난 주 순유입에서 모든 미국 ETF 상품 중 1위를 차지했습니다(물론 이는 ETF 그룹 대 단일 테마 ETF입니다). $IBIT만으로도 52억 달러를 유치하여 BlackRock의 총 417개 ETF 순 ETF 흐름의 50%를 차지합니다.

거래상품의 시장가치가 금을 따라잡는다

계약 시장과 현물 시장 모두에 대한 미결제약정이 동시에 증가하여 암호화폐 시장에 유동성과 변동성이 추가되었습니다. 일반적으로 가격과 OI가 동시에 급격히 상승하는 경우 이는 시장이 과열되었음을 의미할 수 있습니다. 이러한 현상은 대부분 가격 상승을 이끄는 투기적 매수를 동반하며, 투자 심리가 극단적인 낙관론에 도달하면 부정적인 뉴스나 사건으로 인해 시장이 급락할 수 있습니다. 하지만 요점은 이제 BTC가 새로 출시된 ETF에서 강력한 유입이 이루어지고 전체 보유량이 더 높은 수준으로 상승하는 것이 합리적이라는 것입니다.역사를 완전히 수평적으로 비교하여 과열 여부를 판단할 수는 없습니다.

2024년 현재까지 14개 주요 금 ETF의 유출액은 24억 달러에 달했습니다. ARK의 Cathie Wood는 비트코인에 대한 금의 대체가 진행 중이라고 믿습니다. 그러나 우리는 미국 주식의 FOMO 정서가 현재 금 투자에서 자금을 끌어들이는 또 다른 힘일 수 있다는 점을 무시할 수 없습니다.

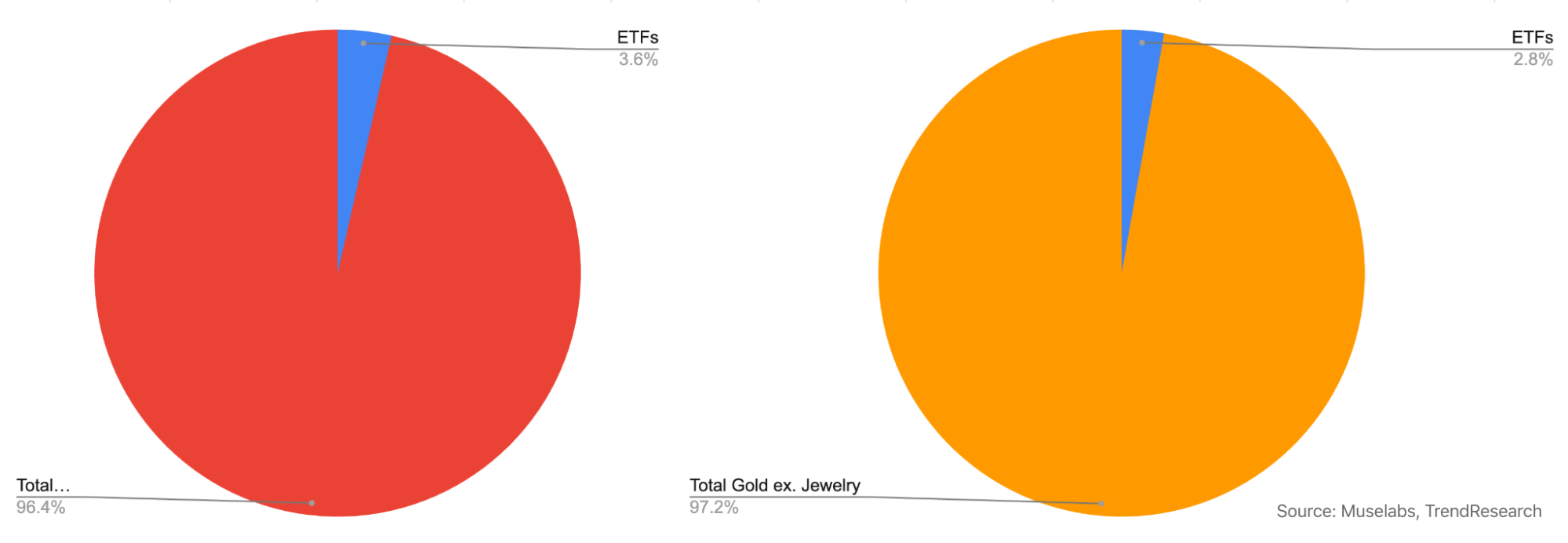

현재 비트코인 현물 ETF의 시가총액은 370억 달러, 금은 2100억 달러로 17.6%를 차지하며, 가장 크고 유동성이 높은 $GLD만 보면 540억 달러로 69%를 차지한다. 비트코인이 금을 따라잡는 것은 놀라운 일입니다.

BTC ETF는 비트코인 시가총액의 약 3.7%를 차지합니다. 이에 비해 금 ETF는 표면 금(보석 제외) 전체 시가총액의 2.8%에 해당합니다. BTC ETF는 이 지표에서 가장 큰 경쟁사를 능가했지만 이것이 과열의 신호입니까? 이 결론만으로는 도출될 수 없습니다.

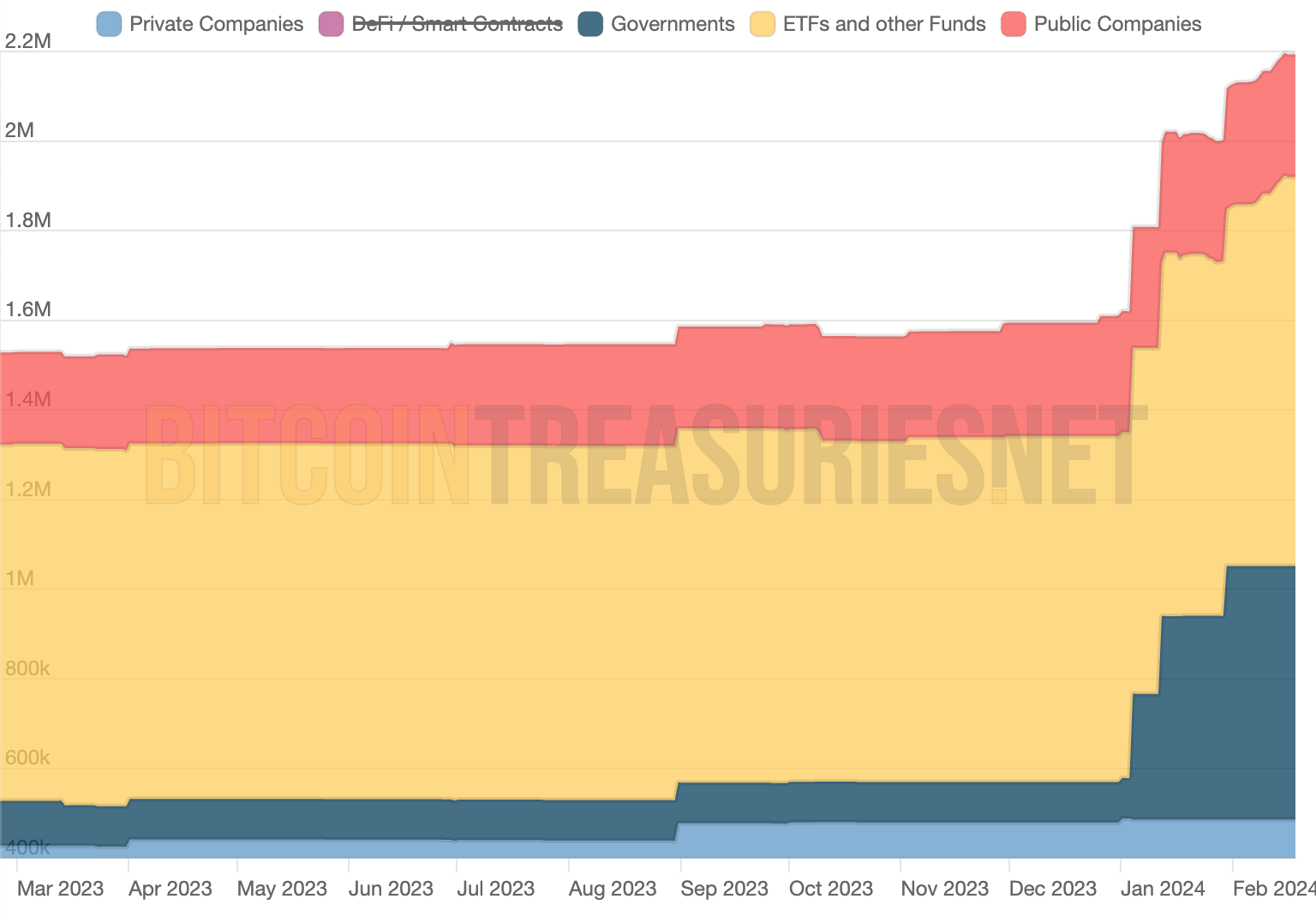

반면, 현재 기업, 정부, 펀드가 보유하고 있는 BTC의 총량은 220만개에 육박하고, 그 가치가 미화 1,100억 달러가 넘으며, 이는 BTC 총 계획 발행량의 10%를 초과하며, 채굴된 BTC의 11%, 미사용 BTC까지 포함하면 공개된 자료에 따르면 이 비율은 더 높아야 하는데, 미국 주식의 전체 기관 보유 비율이 70~80%에 달하는 것과 비교하면 이 비율은 더 높아야 한다. , 아직 성장할 여지가 많습니다.

일일 평균 순 유입량 3700 BTC

관심 있는 친구들은 ETF의 일일 순 흐름과 BTC의 일일 생산량을 비교 차트로 만드는 것이 좋습니다. 현재 일일 생산량은 약 1,000개이며, 4월 말 반감기 후에는 약 500개에 불과합니다. 순유입이 생산량보다 크면 시장에 부정적인 영향을 미칠 수 있습니다.신뢰도가 높아집니다.

지금까지 비트코인 ETF는 상장 이후 약 96,000 BTC의 순유입을 기록했으며, 26거래일 동안 일일 평균 3,700 BTC가 유입되었습니다.

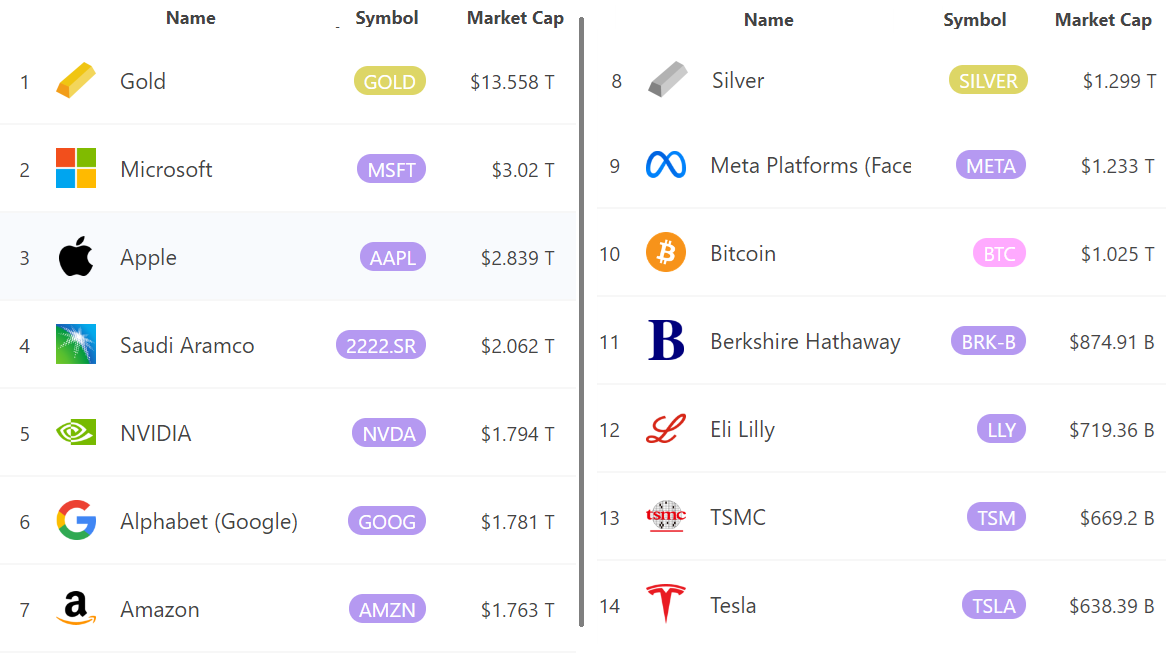

비트코인의 현재 가치는 1조 달러로 워렌 버핏의 버크셔 해서웨이(시가총액 8,750억 달러)보다 앞서 세계 10대 거래 가능 자산에 속합니다.

암호화폐 개념 주식

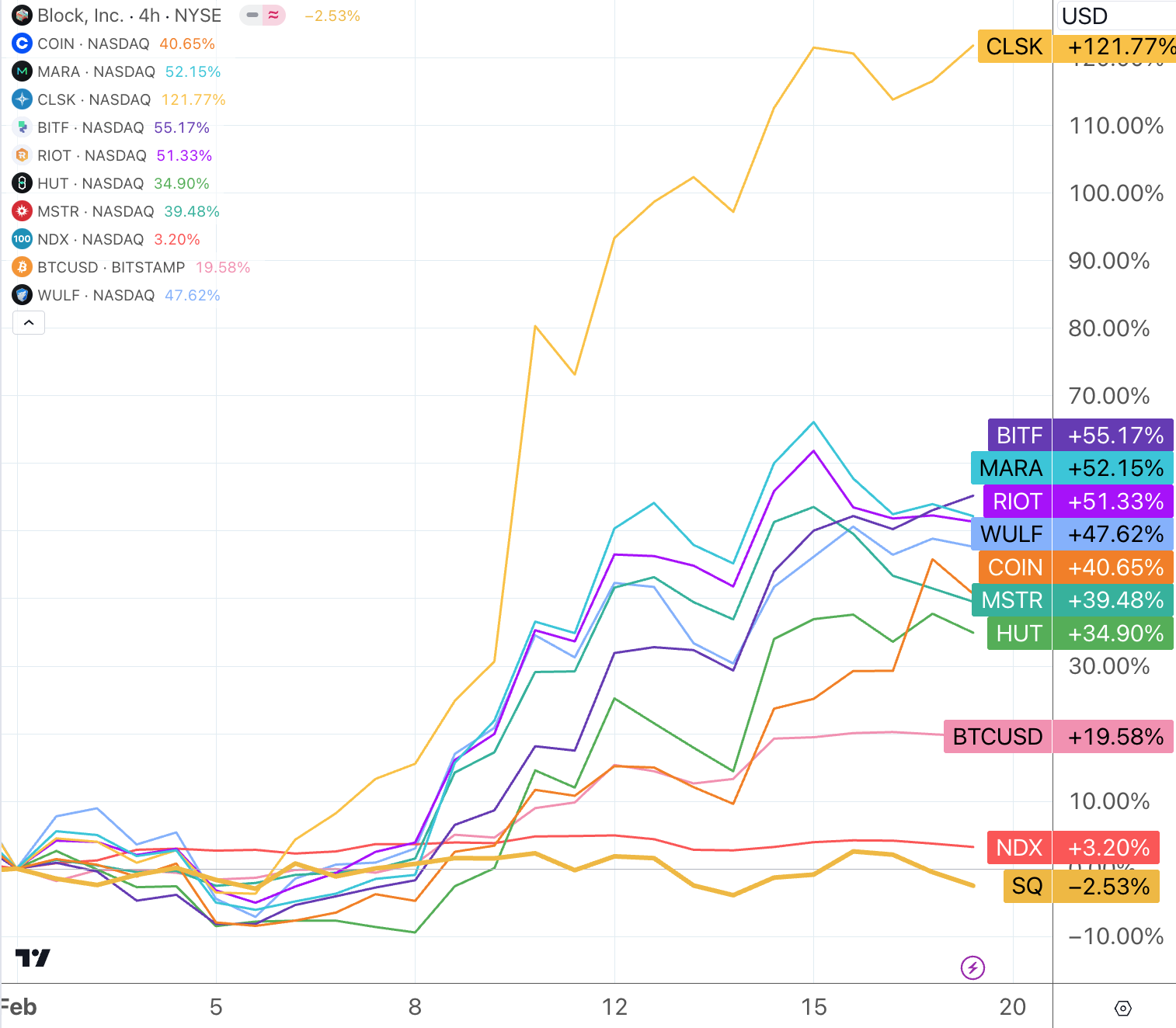

암호화폐 개념 주식은 2월부터 급등했으며, 특히 BTC 채굴 회사의 이익은 비트코인 자체의 이익을 훨씬 초과했습니다. 이 가운데 $CLSK는 지난 주 미국 조지아주 샌더스빌 공장에서 첫 100MW 확장 프로젝트의 가동을 완료했다고 발표했습니다. 이번 성과로 클린스파크의 컴퓨팅 파워는 40% 증가해 14 EH/s를 넘어 현재 미국 상장사 중 3위를 기록했으며, 예상을 뛰어넘는 1분기 재무보고서와 맞물려 $CLSK는 암호화폐 주식 중 가장 눈길을 끄는 기업이 됐다. :

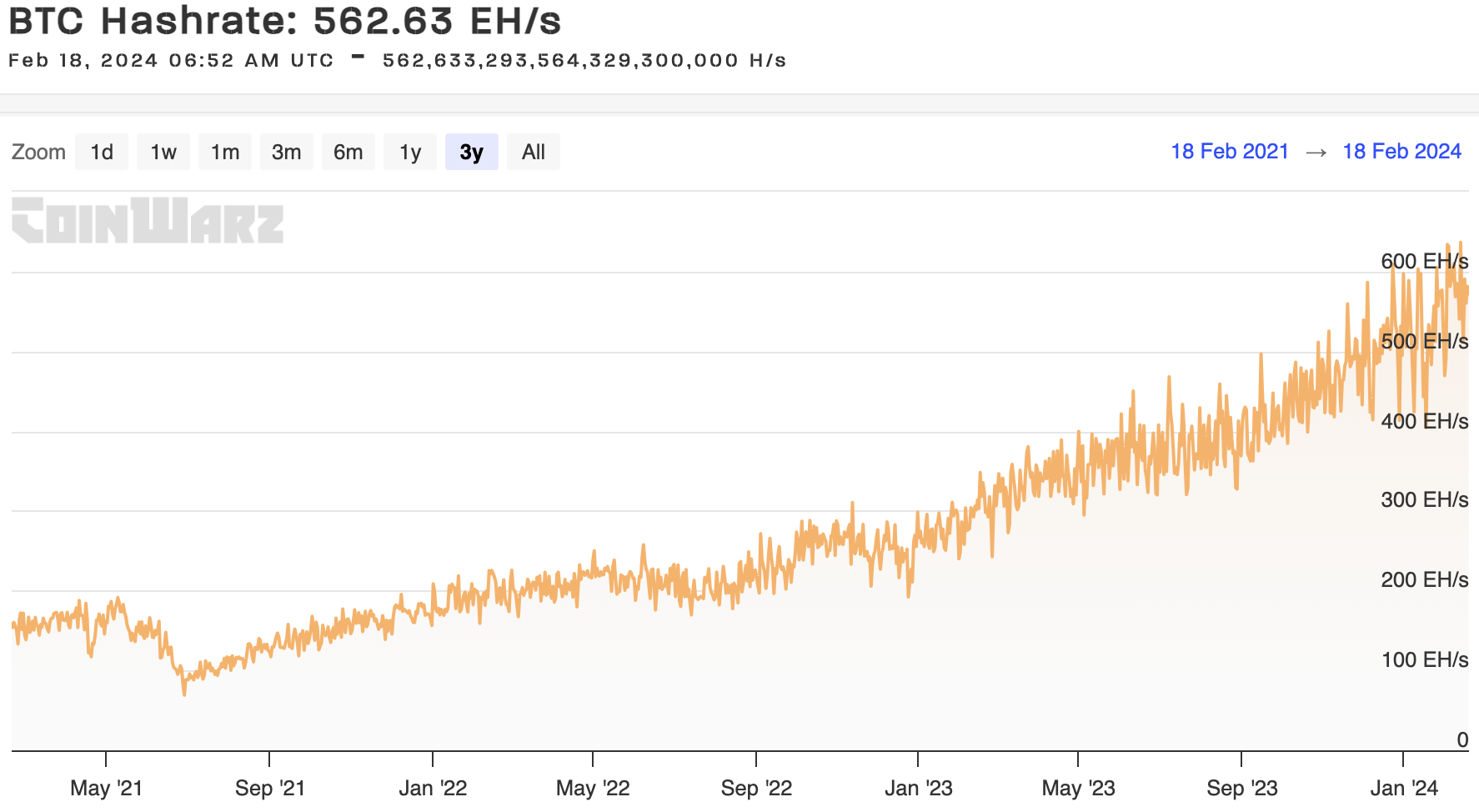

비트코인 네트워크의 총 컴퓨팅 성능은 지난 3년 동안 260% 증가했습니다.

COINBASE, 최초로 수익성 달성

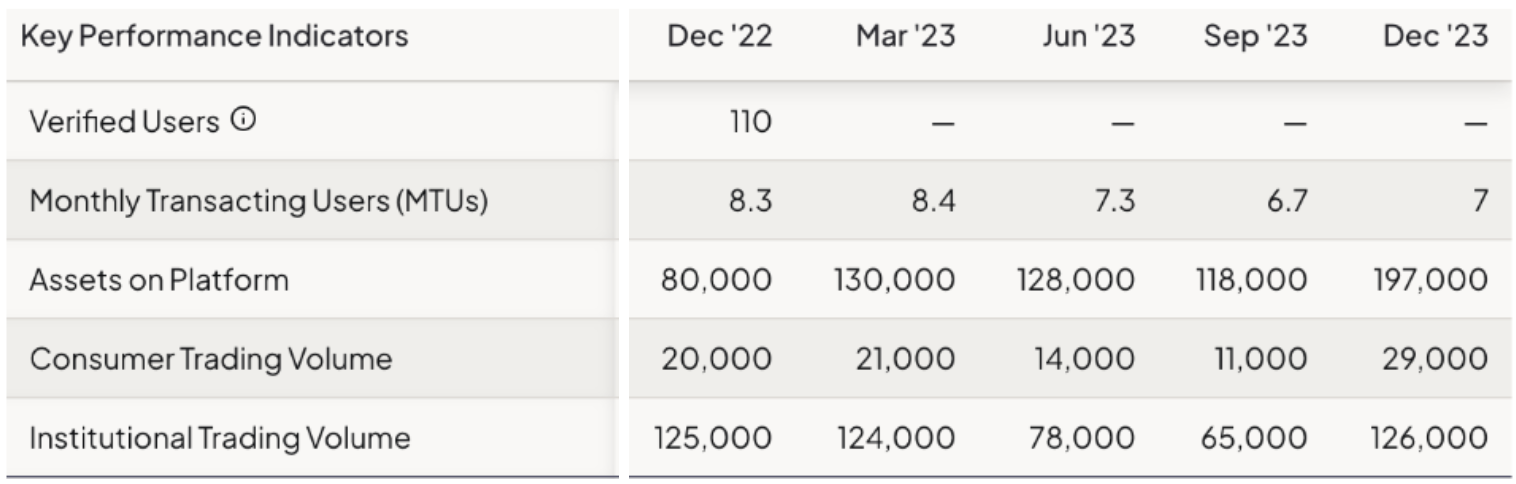

암호화폐 개념주 관련 가장 주목되는 점은 지난주 코인베이스(COINBASE)의 4분기 재무보고서다.미국 유일의 디지털화폐 거래 플랫폼 주식으로 상장 후 2년 만에 분기별 흑자를 달성했다. 매출은 미화 9억 5천만 달러로 시장 컨센서스 기대치를 초과했습니다. 4분기 이익은 2억7천300만 달러로 지난해 같은 기간에는 5억5천700만 달러의 손실을 기록했다. 예상치 못한 분기별 수익은 주당 1.04달러로, 주당 1센트 손실에 대한 분석가들의 예상을 크게 뛰어넘었습니다.

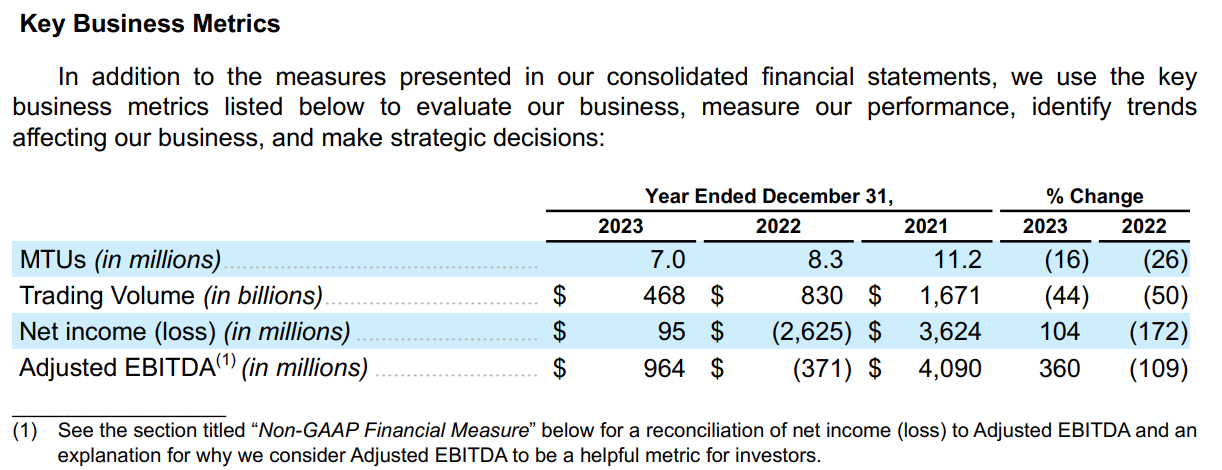

좋아보임에도 불구하고 코인베이스의 총 거래 수익은 시장이 강세장에서 반등함에 따라 여전히 전년 대비 44% 감소했습니다. 2024년 거래량은 4,680억 달러로 2022년 8,300억 달러, 2021년 1조 6,710억 달러에서 계속해서 급격한 감소를 보였습니다. .

그러나 낮은 거래량에도 불구하고 회사의 다른 자산, 특히 고객 암호화폐 자산의 보관은 +155% 증가한 1,926억 달러를 기록했고 구독 및 서비스 수익은 78% 증가한 14억 달러를 기록했으며 총 운영 비용은 26억 달러 줄었습니다. 거래 수익 감소를 상쇄하여 순이익 9,500만 달러를 달성했습니다.

구독 및 서비스 수익을 자세히 살펴보면 약간 오해의 소지가 있습니다. 해당 수익의 대부분(8억 7천만 달러)이 스테이블코인이나 예금에 대한 이자 소득에서 나오며, 이는 주로 전반적인 경제 환경의 이자율 상승으로 인해 발생합니다. 회사의 통제.

또 다른 하나는 활성 거래자 수의 감소입니다. MTU(월별 거래 사용자): 28일 롤링 기간 내에 최소 한 번 이상 거래를 한 사용자를 말합니다. MTU는 2023년 평균 700만 개로 2022년 830만 개, 2021년 1,120만 개에서 순차적으로 감소했습니다. 거래량과 OI 측면에서 암호화폐 시장의 활동이 3분기와 4분기에 크게 증가했지만 활성 사용자는 감소하기까지 했기 때문에 이는 이상합니다.

또한 Coinbase에 따르면 약 5,200만 명의 미국인이 암호화폐를 소유하고 있습니다.

2024년 코인베이스는 올해 1분기 분기 매출이 처음으로 10억 달러를 초과할 것으로 예상하지만 비용도 증가할 것으로 예상된다.

코인베이스 주가는 나중에 180달러로 9% 상승했지만, 2021년 데뷔 이후 여전히 시가 381달러보다 훨씬 낮습니다.

거래비용이 낮은 비트코인 ETF 출시에 맞춰 코인베이스는 플랫폼 거래수수료를 낮출 것으로 예상됐으나, 활성 거래자 수의 급격한 감소로 볼 때 코인베이스는 압박을 받을 것으로 보이지만 현재까지는 그렇지 않은 것으로 보인다. CFO QA에 따르면 그들은 여전히 현물 ETF가 코인베이스 플랫폼에서 더 많은 암호화폐 노출을 찾는 더 많은 투자자를 유도할 수 있다고 믿고 있으므로 가격 경쟁 경로를 택할 생각은 없습니다.

동시에, 코인베이스의 새로운 해외 파생상품 거래소가 많은 거래를 유치하고 11월에 자격을 갖춘 미국 소매 거래자를 위한 파생상품 상품을 출시했다는 점에 주목하는 것이 중요합니다. 이는 중요한 발전입니다. 파생상품 시장이 현물 시장을 훨씬 능가한다는 점을 고려하면 코인베이스는 이 분야에서 엄청난 성장 잠재력을 갖고 있다고 생각합니다.

월스트리트 분석가들 사이의 합의는 매수 쪽으로 기울고 있으며, 중간 합의 목표는 165달러이고 목표 범위는 최저 60달러에서 최고 250달러입니다. 이러한 높은 분산 목표 범위는 $COIN의 미래 가치가 매우 불확실하고 투기적인 특성을 가지고 있음을 강조합니다.

위협을 절반으로 줄인다

4월 BTC 생산량이 절반으로 줄어들면 비트코인 채굴자들에게 위협이 될 것입니다. 비트코인 발행량이 블록당 6.25BTC에서 3.125BTC로 감소함에 따라 비트코인의 인플레이션율은 연간 1.7%에서 0.85%로 떨어지며, 디플레이션의 한계영향도 점점 작아져 이론적으로 가격을 뒷받침하는 효과는 그리 좋지 않을 것입니다. 이전과.

블록 보상으로 인한 채굴자의 수입은 사실상 절반으로 줄어들지만 지불금은 증가해야 합니다.

그러나 채굴자들 역시 주식과 채권 발행을 통한 자금 조달, 암호화폐 보유고 판매 등 금융 전략을 통해 블록 보상 감소를 준비하고 있는데, 이 전략은 반감기 이후 비트코인 네트워크의 안정성과 보안을 유지하는 데 매우 중요하다. 또한 비트코인 블록체인(Inscription 및 L2 등)의 혁신으로 인해 채굴자의 수수료 수입이 증가했으며 이전처럼 블록 보상에 의존하지 않으므로 네트워크의 컴퓨팅 성능이 잠시 후에도 여전히 이전 반등 패턴을 반복할 수 있을 것으로 기대합니다. 감소.

하지만 지난 반감기 이후 급등은 뉴크라운 전염병 이후 글로벌 재정+통화 정책을 동반했기 때문에 가격 예측이 더 어렵다.

2020년 반감기를 되돌아보면 블록 보상이 6.25 BTC로 줄어들었고 비트코인의 해시율은 2주 만에 30% 하락했고 가격은 9,000달러 근처에서 거의 변하지 않았습니다. 그러나 시스템은 빠르게 적응하여 불과 7주 만에 사상 최고 해시율을 달성하며 기록을 경신했습니다. 가격이 거의 65,000이라는 사상 최고치에 도달하는 데 불과 8개월이 걸렸습니다.

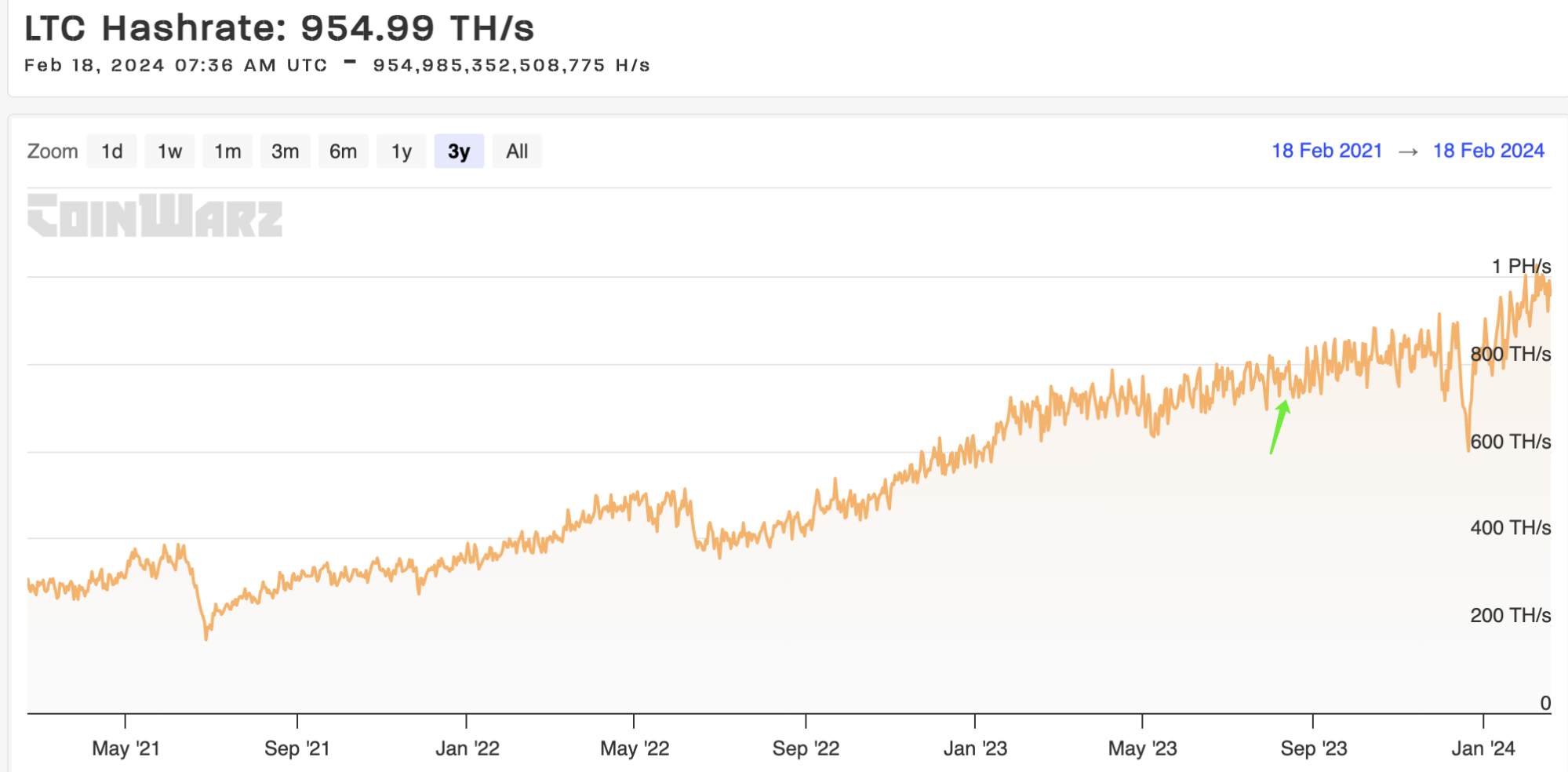

지난해 8월 사전 반감기를 진행했던 LTC의 가격은 반감기 전 한때 80달러 안팎에서 115달러까지 올랐으나 곧 반감기 이후 56달러까지 떨어졌다. 최근 강세장에도 불구하고 70달러까지 반등할 수 있습니다.

그러나 LTC 네트워크의 컴퓨팅 성능은 반감기의 영향을 거의 받지 않았으며 8월 이후 30% 이상 증가했습니다.

ETH ETF가 점차 주목을 받고 있습니다.

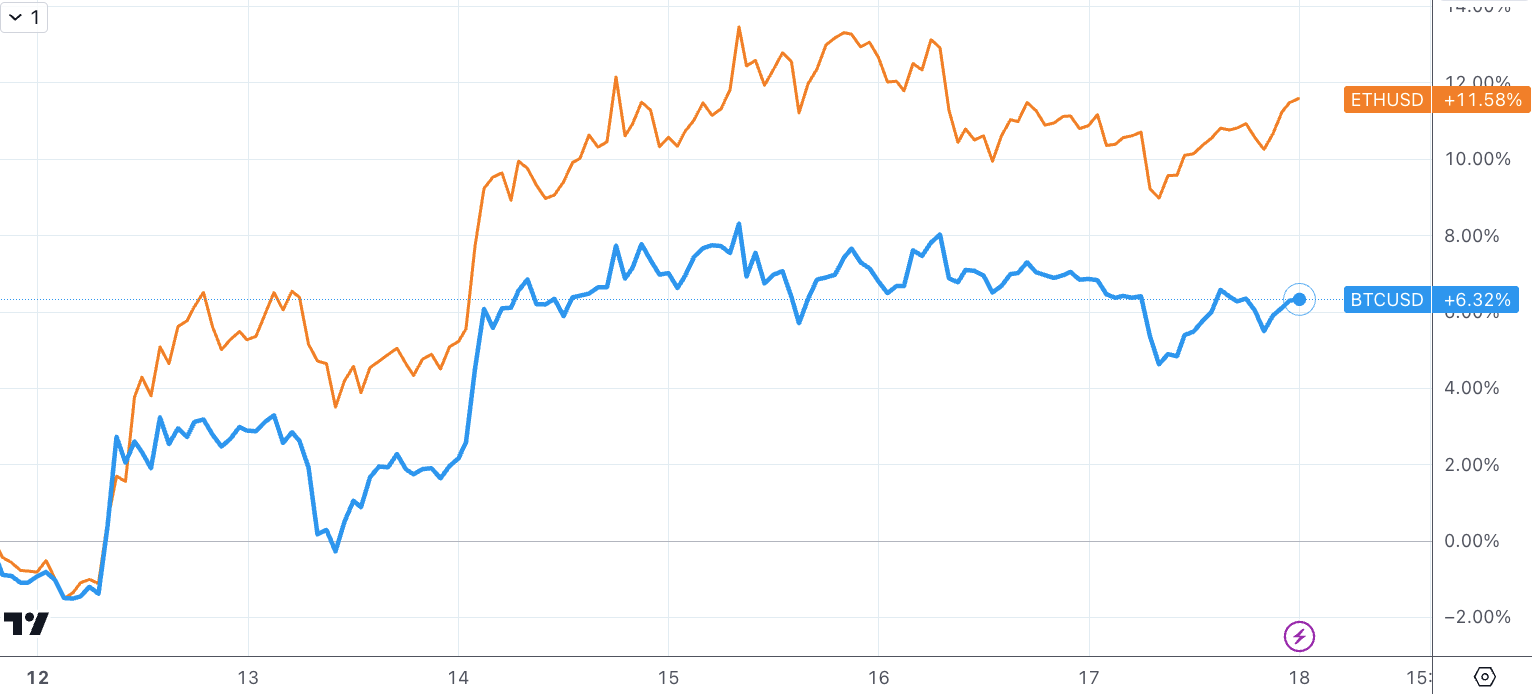

지난 주 ETH는 2,800달러를 돌파하고 11.6% 증가해 BTC의 6.3%를 훨씬 뛰어넘는 21개월 최고치를 경신했습니다. 소셜 미디어 정서에 따르면 BTC 현물 ETF의 긍정적인 효과가 투자자들을 다시 시장에 집중시켰습니다. ETH 현물 ETF가 곧 통과될 가능성이 있습니다. 지난 주 VanEck와 ARK/21 Shares는 현물 Ethereum ETF 제출을 위해 업데이트된 신청서를 제출했습니다.

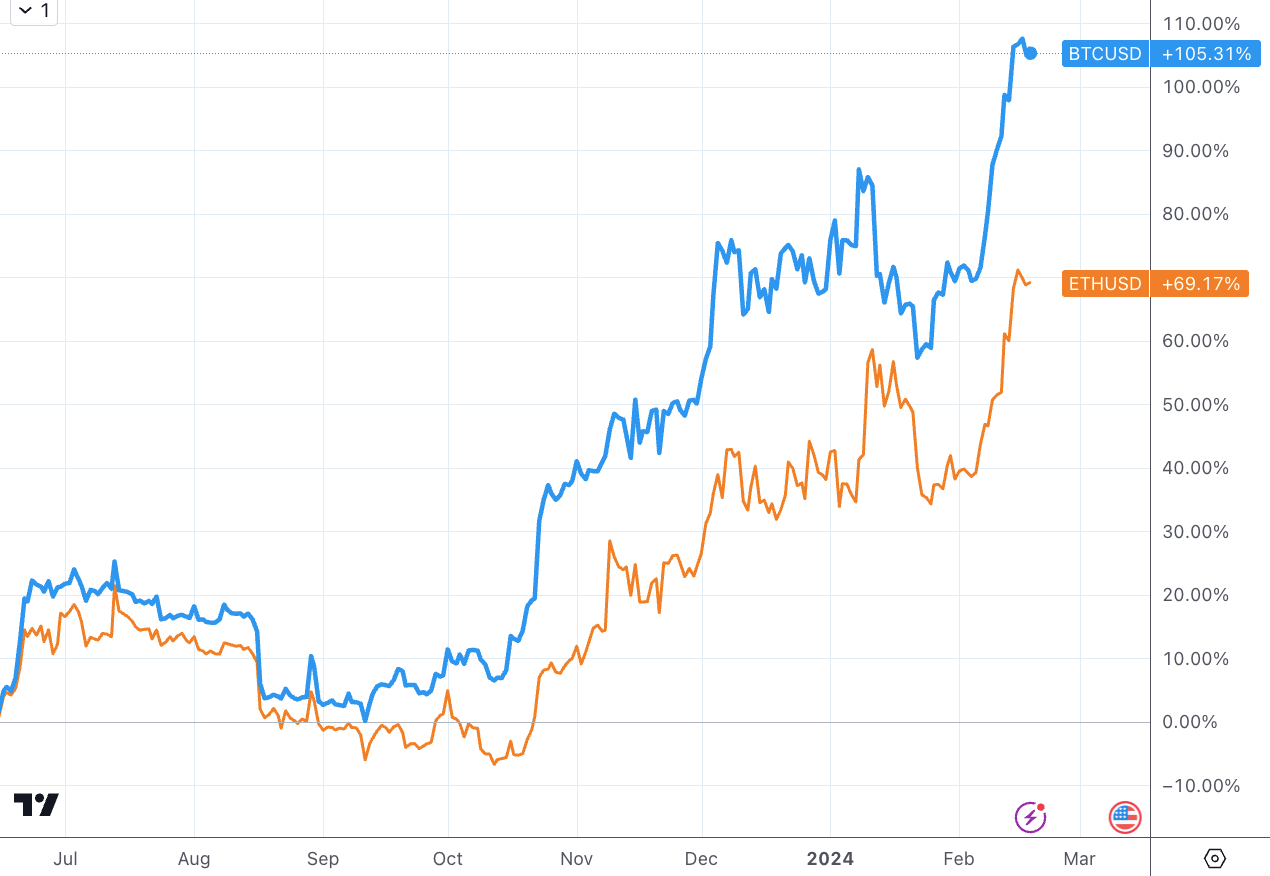

블랙록이 지난해 6월 BTC 현물 ETF 적용을 제안한 이후 BTC는 100% 반등한 반면, ETH는 같은 기간 70% 반등에 그쳤다.이론적으로 시장가치가 낮고 사용량이 많은 ETH의 가격은 시나리오는 더 탄력적이어야 하므로 ETH 가격은 현물 ETF가 발행될 수 있다면 강세장 가격 성과는 BTC보다 좋아야 합니다. 또한, 규제 대상 이더리움 제품은 토큰 약속 시 최대 5% APY를 제공할 수 있는데, 이는 수익이 없는 BTC ETF 제품에 비해 매력적일 것입니다.

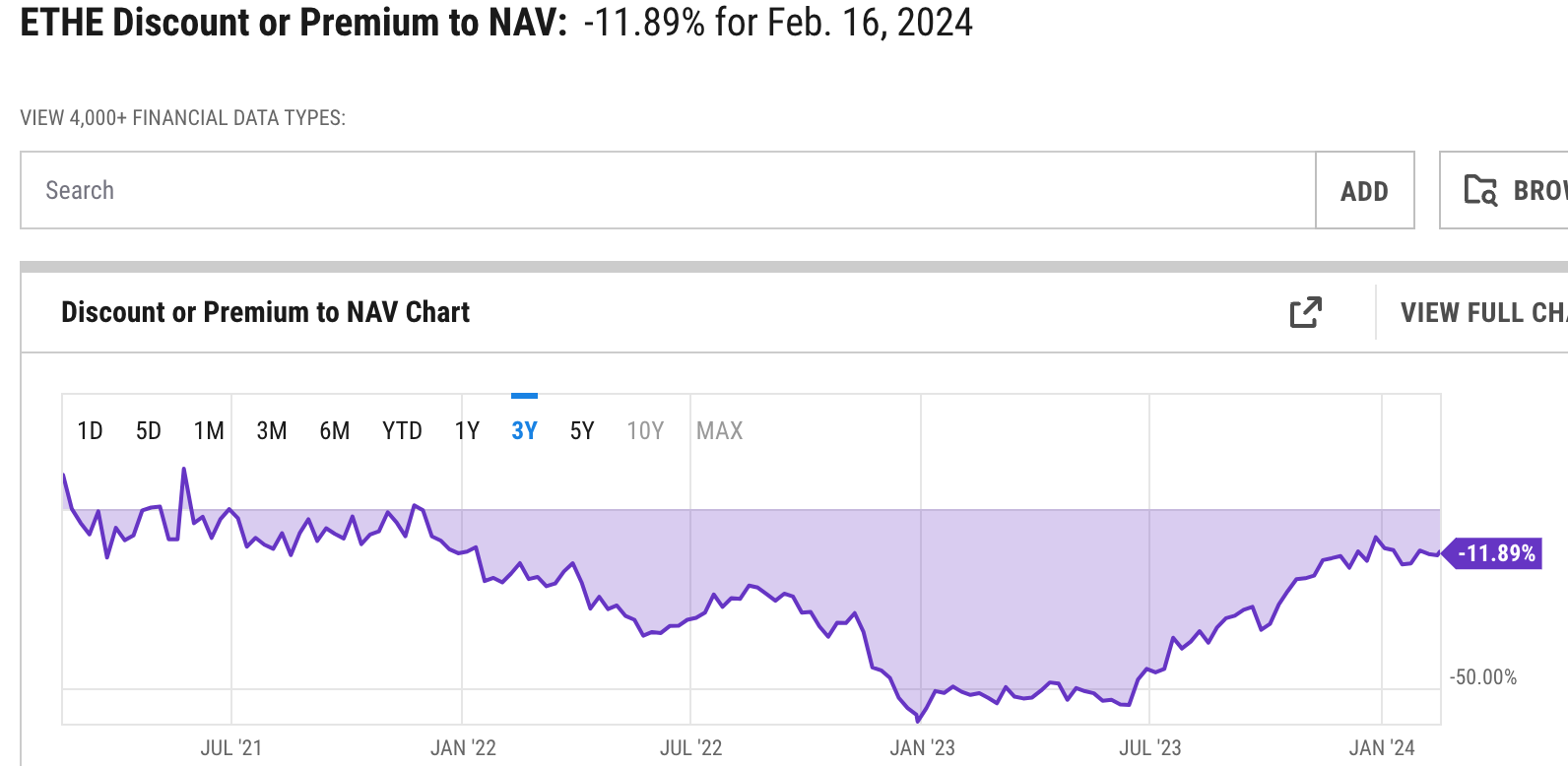

폐쇄형 펀드 ETHE의 비중은 지난 6개월 동안 크게 감소했으며 작년 보고서에서는 관련 기회를 반복해서 제시했습니다.50% 할인된 가격으로 ETH 구매: 기회인가 함정인가? 그레이스케일 트러스트 심층분석》,Grayscale Trust에 대한 심층적 해석 | 왜 이더리움을 반값에 구입할 수 있나요? (둘). 그레이스케일 이더리움 트러스트의 관리수수료는 연간 순자산가치(NAV)의 2.5%이며, 다른 리스크를 고려하지 않는다면 오늘의 할인은 포지션 보유에 따른 기회비용의 할인으로 이해될 수 있다. 따라서 유통시장 할인율을 기준으로

포지션 보유 기회비용 + 10년 미국 국채 수익률 + 2.5% 관리 수수료, 그러면: (1-Y)^T= 1+X

사용 가능: T=ln( 1+X)/ln( 1-Y)

그렇다면 현재 11.89%의 할인은 여전히 -2.6년 안에 패리티를 회복할 것이라는 기대에 해당하며 이는 여전히 너무 길다.올해 BTC 현물 ETF 통과의 맥락에서 우리는 ETH 통과에 대한 어떤 저항도 볼 수 없다. 따라서 ETHE를 구매하고 ETH를 영구적으로 매도한다면 계약 전략은 적은 할인으로 돈을 버는 것 외에도 특정 플러스 펀딩 요율을 청구할 수도 있습니다.

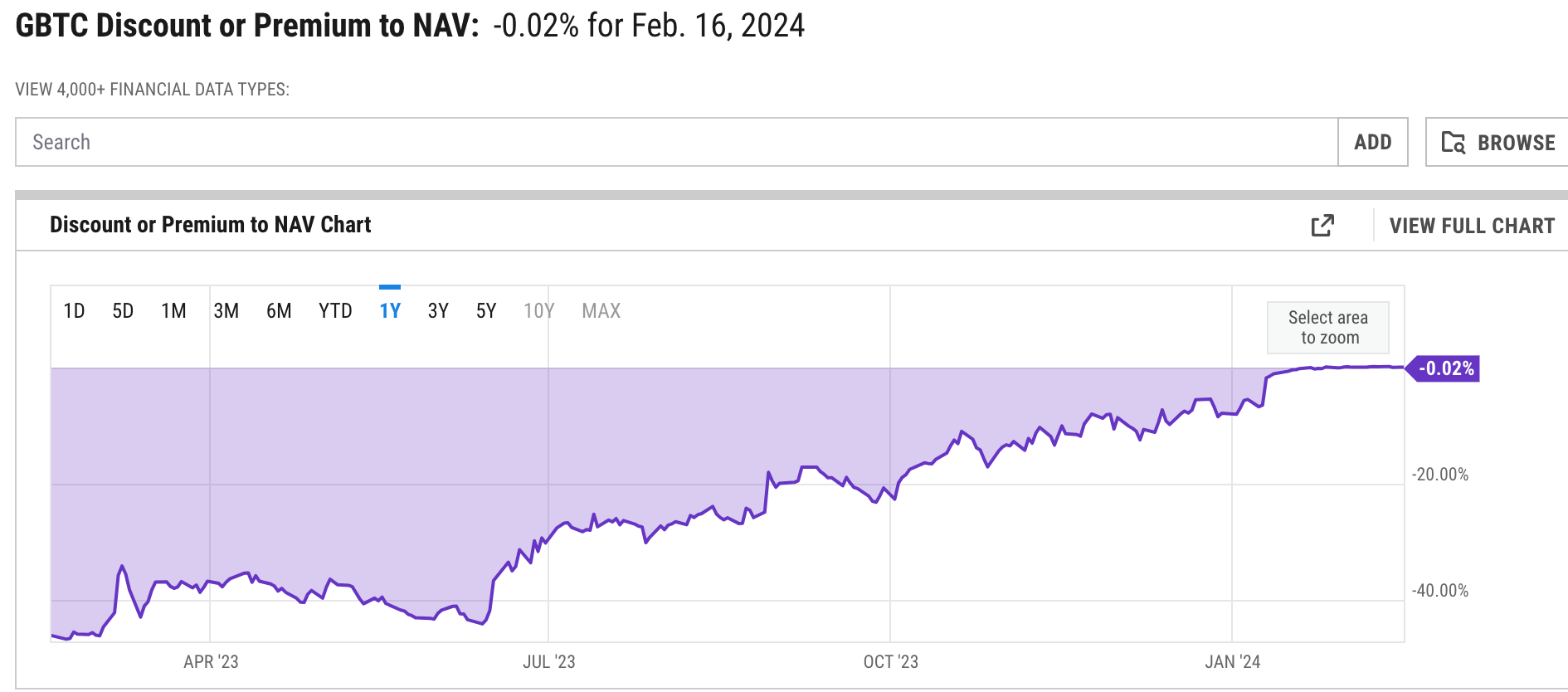

ETF를 통한 GBTC 이 할인은 전주에 6.x%로 축소되었습니다.

제네시스, 잠재적 13억 달러 화재 매각

2월 14일, 파산 판사는 채권자 상환 노력의 일환으로 Genesis에게 약 13억 달러 상당의 GBTC를 청산할 수 있는 권한을 부여했습니다. 파산 계획 규정에 따라 제네시스는 채권자를 대신해 GBTC 주식을 기초 비트코인 자산으로 전환하거나, 해당 주식을 직접 매도해 현금을 배분할 수 있으므로, 이 자금 중 얼마만큼이 궁극적으로 암호화폐 생태계에서 유출될지는 불분명합니다. 사용자는 여전히 암호화폐로 상환받을 것이며, GBTC를 현금으로 청산한 후 암호화폐 현물을 다시 매입하므로 시장에 미치는 영향은 제한적일 것입니다. 그렇지 않으면 일정한 영향이 있을 것입니다.

법원 소식이 발표된 후 시장은 크게 당황하지 않았으며 BTCUSD는 여전히 $50,000 이상으로 변동했습니다.

AI와 암호화폐

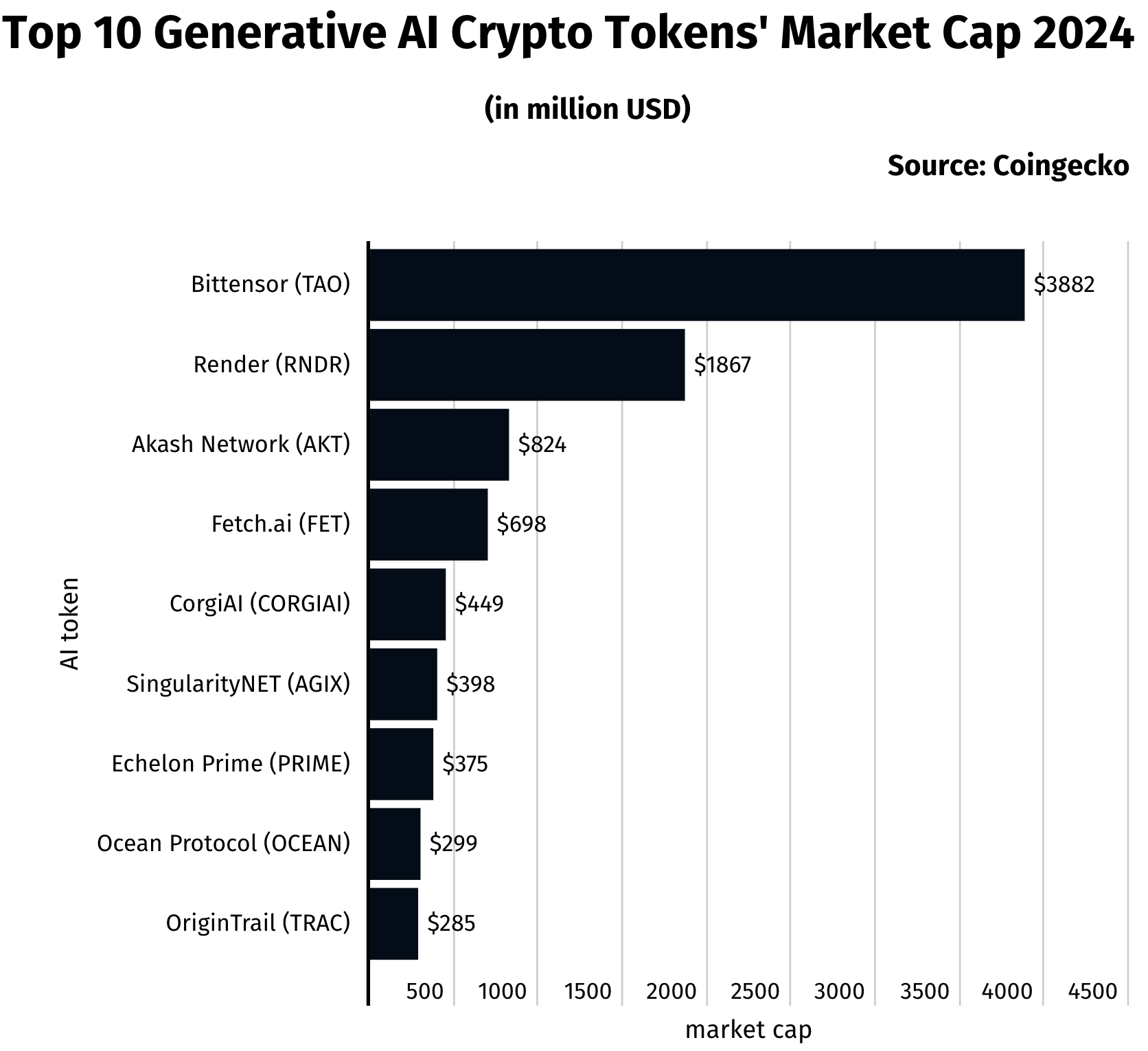

Stocklytics의 최근 보고서에 따르면 인공지능(AI) 관련 암호화폐의 전체 시가총액은 120억 달러를 넘어섰습니다.

시가총액이 가장 높은 AI 관련 암호화폐는 TAO(Bittensor)로 38억8000만 달러에 이르렀고, 5개월 만에 가격이 11배나 올랐다. Bittensor(TAO)는 인공 지능 및 기계 학습 분야의 알고리즘 제공자와 사용자를 위한 마켓플레이스 역할을 하는 분산형 기계 학습 프로토콜입니다. 채굴자는 처리 능력과 기계 학습 모델을 네트워크에 기여하여 알고리즘을 제공합니다. 솔루션에 대한 입력으로 ML 알고리즘이 필요한 클라이언트는 해당 알고리즘에 액세스하기 위해 프로토콜의 기본 암호화 토큰인 TAO를 지불해야 합니다.

2위 RNDR(렌더링)의 시가총액은 그 절반도 안 되는 18억 7천만 달러입니다. RNDR은 애니메이션 및 렌더링 작업 비용을 지불하는 데 사용할 수 있습니다.

3위 Akash Network의 AKT의 시가총액은 8억 달러가 조금 넘습니다.

나머지 6개 암호화폐 중 Fetch.ai의 FET는 시가총액이 5억 달러가 넘고 나머지 5개는 4억 5천만 달러에서 2억 8천만 달러에 이릅니다.

위 목록의 암호화폐 중 RNDR, FET, AGIX만 바이낸스 거래소에 상장되어 있고, 시가총액이 가장 큰 TAO는 OKX에도 상장되어 있지 않습니다.

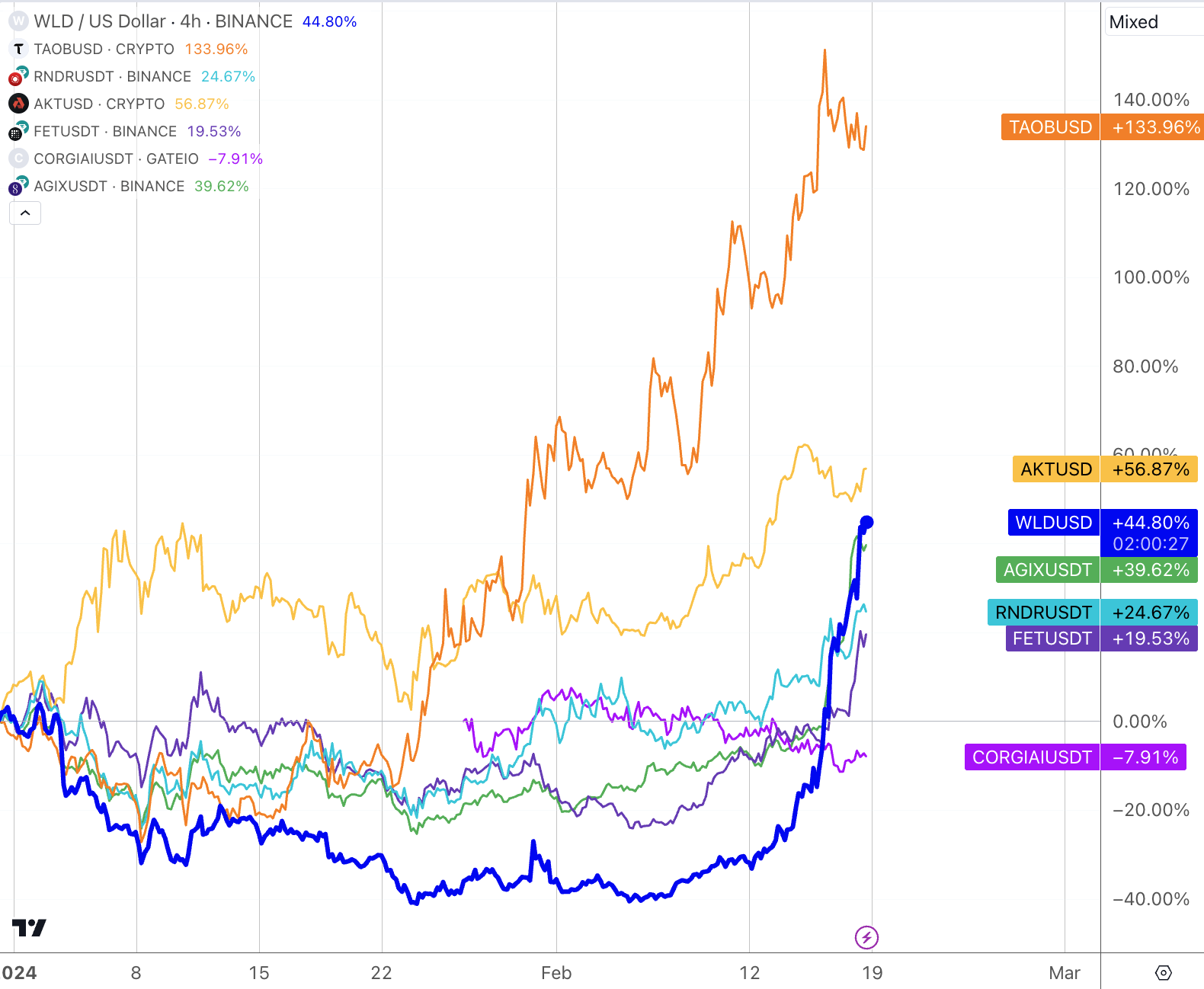

그러나 우리는 AI 개념의 디지털화폐에는 WorldCoin($WLD)도 포함되어야 한다고 믿습니다. 업계에서는 OpenAI나 Sam 자신이 큰 뉴스가 나올 때마다 WLD는 변함없이 추세를 따를 것입니다. 예를 들어, 지난 주 OpenAI는 Sora라는 텍스트-비디오 AI 모델을 출시하여 전 세계를 놀라게 했고, 이후 WLD는 50% 이상 급등했습니다. Sam은 인공지능이 많이 등장하는 미래 세계에서는 WLD의 중요한 임무 중 하나인 인간이 누구인지 이해하는 것이 점점 더 중요해질 것이라고 믿습니다.

2024년 주요 AI 개념 암호화폐 동향:

가장 큰 역풍: 인플레이션과 AI 붐

보이저(Voyager), 제네시스(Genesis), FTX, 리플(Ripple), 바이낸스(Binance) 등 관련 파산이나 규제소송을 포함해 지난해 대부분의 정책 및 고레버리지 리스크가 해소됐기 때문에 이번 반등의 기반은 비교적 건전하다. 그러나 문제는 2021년 이전 마지막 강세장이 저금리를 기반으로 했다는 점인데, 당시 미국 채권수익률은 0.5% 미만이었고, 이중 재정 및 통화부양책과 맞물려 투자자들은 수익률이 높은 위험자산을 찾게 됐다는 점이다. 암호화폐의 거의 모든 자산과 재화, 서비스 가격이 오르고 있습니다. 미국 CPI는 한때 8%를 넘어섰습니다. 그 전에는 연준이 금리 인상 절차에 착수해 적극적으로 가격 거품을 깨뜨렸습니다. BTC는 8개월 전에 정점을 찍었습니다. 인플레이션보다

차트: 미국 CPI 및 BTC 가격

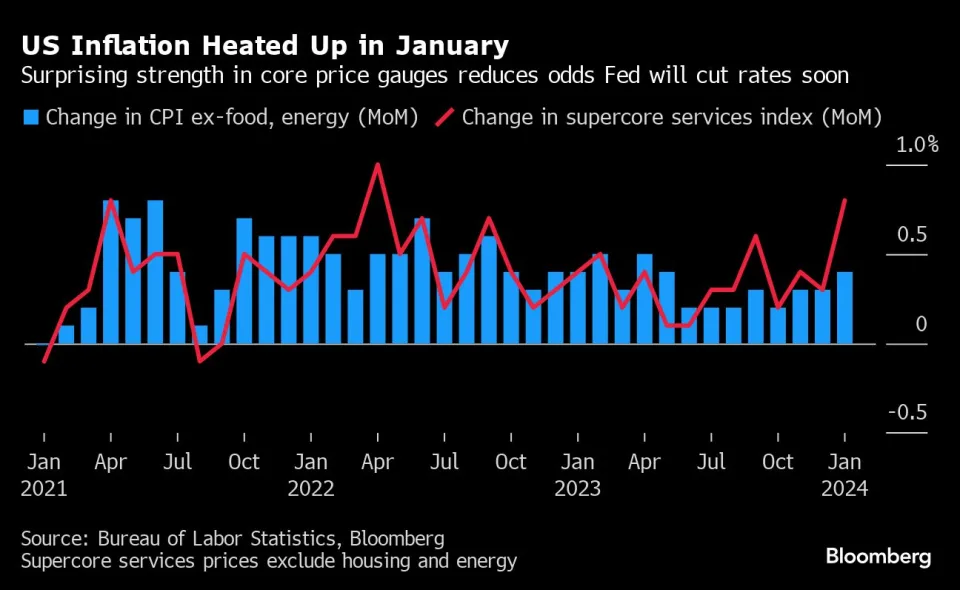

지난 주 미국이 발표한 두 가지 주요 인플레이션 지표인 CPI와 PPI가 모두 전반적으로 기대치를 초과하면서 서비스 인플레이션이 다시 불붙고 주택 가격도 기대 이상으로 반등하는 등 미국 내 인플레이션 압력이 지속되고 있음을 나타냅니다. 최근 낙관적인 경제 지표와 함께 연준의 금리 인하 기대감이 계속해서 뒤로 밀려났습니다.

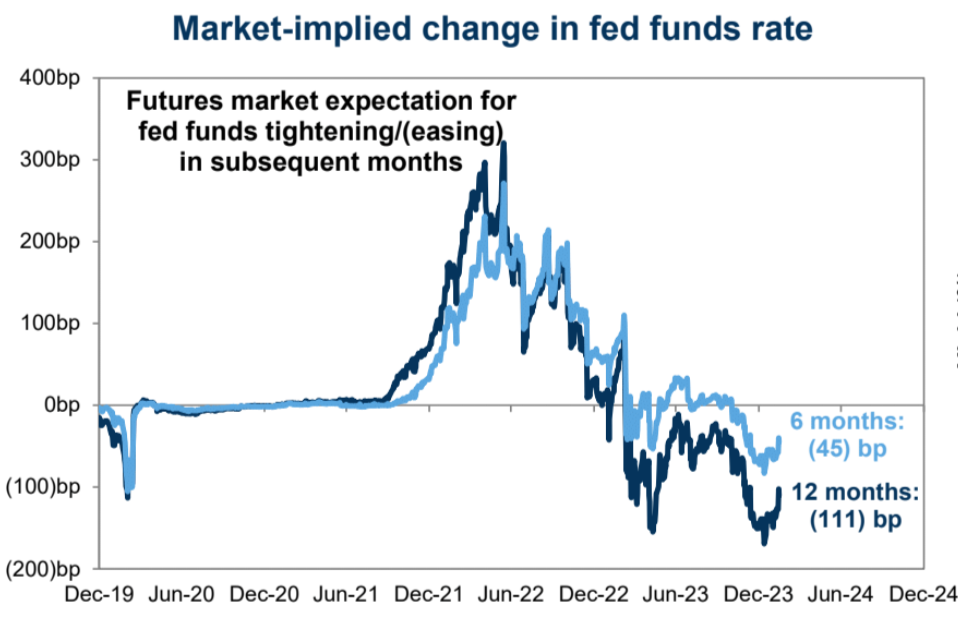

금리파생상품시장은 금리인상 둔화세를 한 달 넘게 재조정해 왔지만, 주식시장과 암호화폐시장은 이에 아무런 반응도 하지 않고 있다. 금리시장은 진전이 있지만, 언젠가 시장의 열기가 고갈될 때 투자자들이 이 문제를 다시는 볼 수 없다는 의미는 아니며, 이는 여전히 위험자산이 지속적으로 상승하는 데 가장 큰 역풍입니다.

지난 금요일 예상을 뛰어넘는 두 가지 가격 데이터 이후 연초를 시작했던 미국 증시의 모멘텀은 마침내 잦아들었지만 그럼에도 불구하고 시장의 하락세는 여전히 제한적이었습니다. 최고 기록. 예상되는 금리 인하 시기가 3월에서 6월로 연기된 상황도 투자자들을 크게 불안하게 만들지는 않을 것으로 보인다. 현재 시장의 관심은 AI 선두주자 엔비디아가 다음 주 발표할 결과에 쏠려 있는데, 이는 이러한 과대광고 열풍이 계속될 수 있을지 직접적으로 결정짓는다.

지난 보고서에서는 주당 순이익(EPS)이 3.39달러, 매출이 161억 1천만 달러로 예측되었습니다. 그 결과, 11월 말에 발표된 결과는 주당 순이익이 4.02달러, 매출이 181억 2천만 달러로 예상을 크게 웃돌았습니다. 매우 강력한 수치를 제공했음에도 불구하고 NV 주가는 이후 잠시 하락세를 보이며 최고치(500 – 455)에서 10% 하락했습니다.

이번에는 주당순이익이 4.57달러, 매출이 203억6천만달러로 예상되는 등 시장 기대치가 훨씬 높아졌다.그때까지 데이터가 다시 기대치를 뛰어넘더라도 시장이 잠시 휴식을 취할지는 불확실하다. 그러나 이는 장기적인 낙관론에 영향을 미치지 않을 것입니다. 지난 몇 주 동안의 실적 시즌 동안 Meta, Google, Microsoft 등 주요 고객이 새롭게 정의한 인공 지능 전략을 내놓았습니다. 컴퓨팅 칩에 대한 수요는 줄어들 가능성이 낮습니다. 기업들은 인공지능에 대한 향후 지출이 수백억 달러에 달할 것으로 예상하고 있습니다.

새해가 시작된 지 한 달여 만에 NV 주가는 50% 상승했으며 현재 시가총액은 1조 7천억 달러가 넘습니다. 실적 발표를 앞두고 주가가 하늘 높이 평가되는 가운데, 모든 좋은 소식이 가격에 반영되어 있다고 생각하기 쉬우며, 사소한 문제라도 주가가 폭락할 수 있습니다. 그러나 실제로 NV의 과거 P/E 비율은 95배에 달하지만 12개월 선행 P/E 비율은 35배에 불과합니다. 이는 SP 500이 20배, META가 23배이기 때문에 과언이 아닙니다. , AMD는 47배, Tesla는 65배, ARM은 95배입니다.

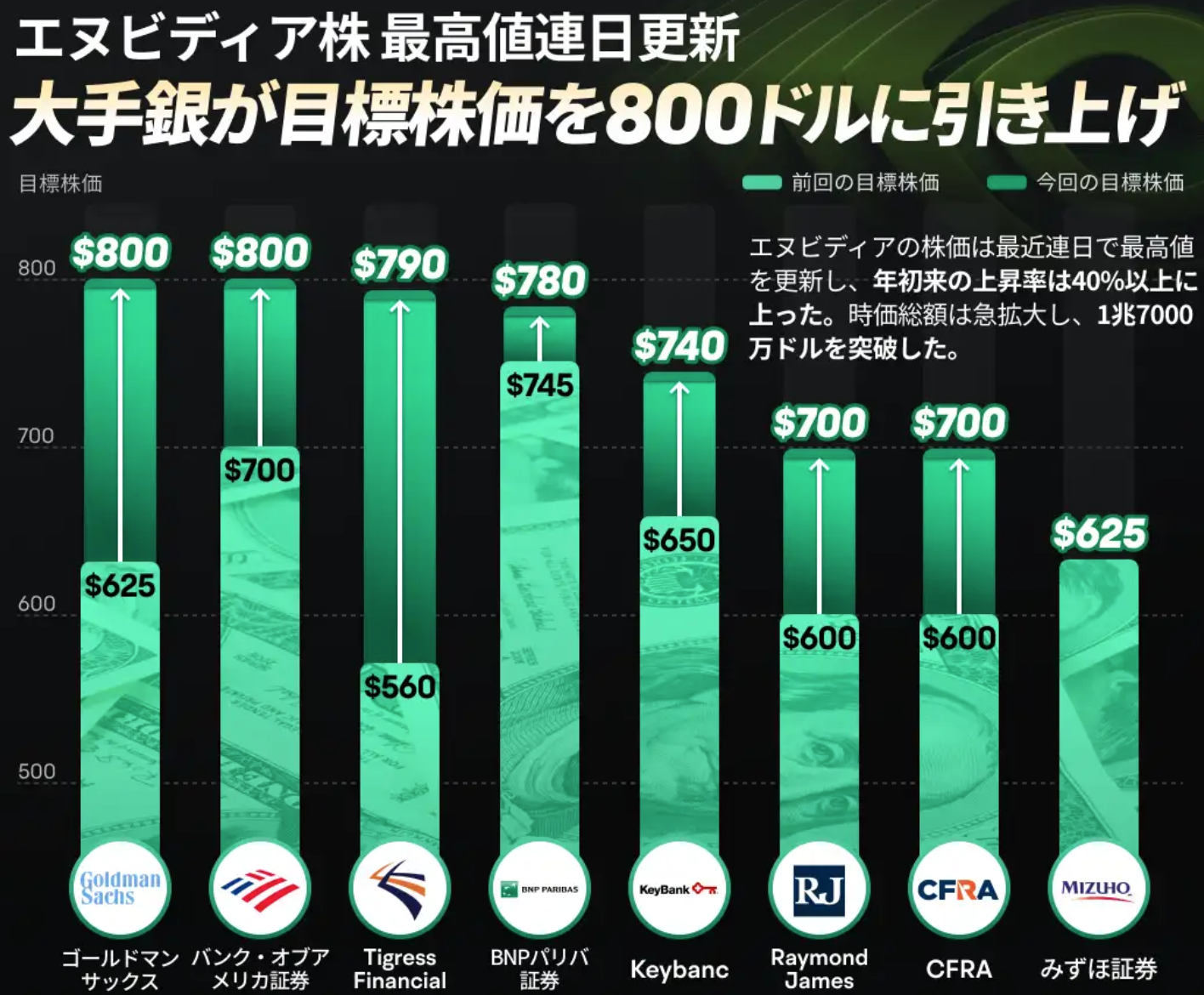

골드만삭스, 뱅크오브아메리카(Bank of America) 등 기관들은 최근 엔비디아의 목표주가를 상향 조정했는데, 새로운 목표가인 800달러가 채택된다면 가치평가액이 2조달러를 넘어설 것이라는 뜻이다.

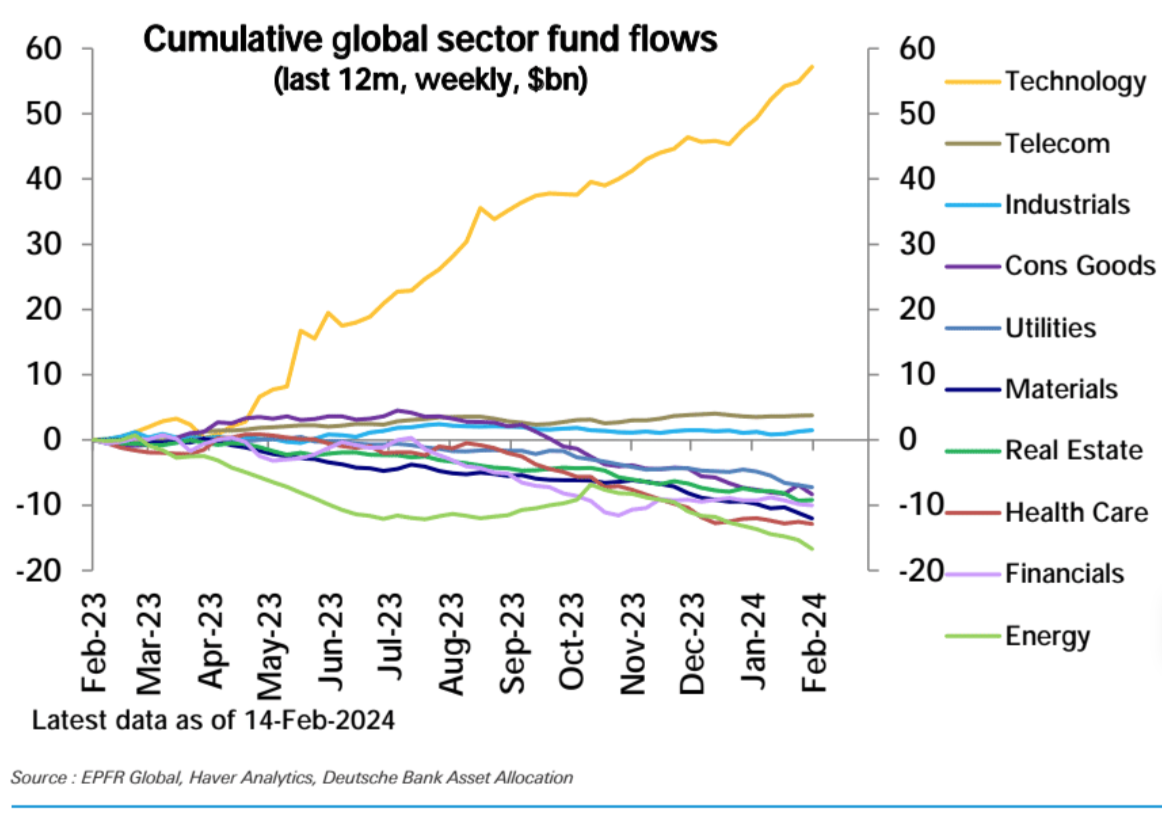

주식시장의 돈과 감정

주간 자금 흐름: 주식 160억 달러(미국 110억 달러, 중국 30억 달러), 채권 116억 달러, 금 유출 6억 달러, 현금 유출 184억 달러(8주 만에 최대 유출)

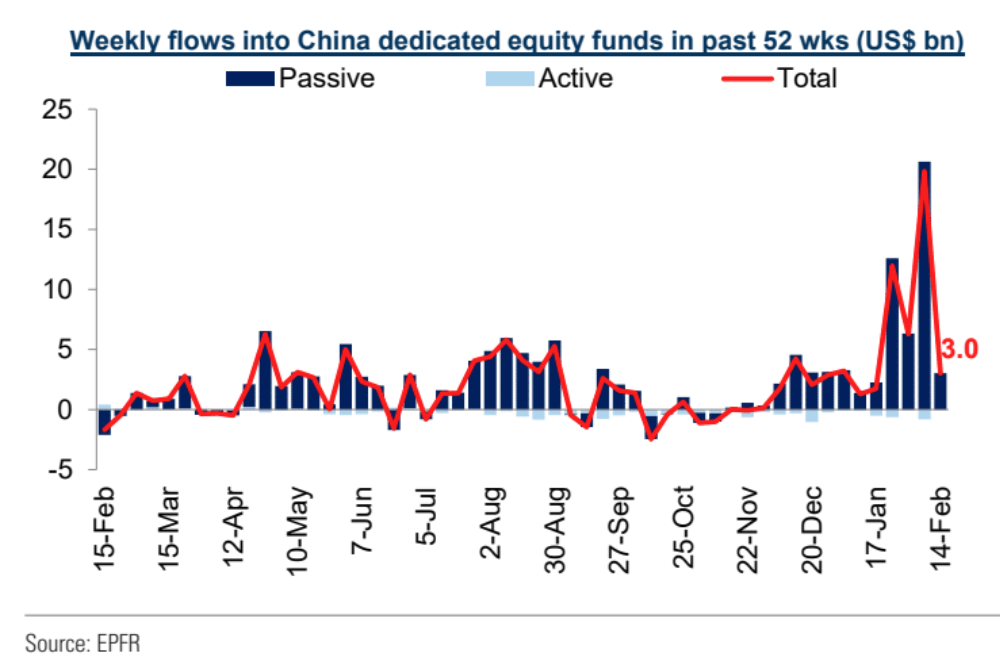

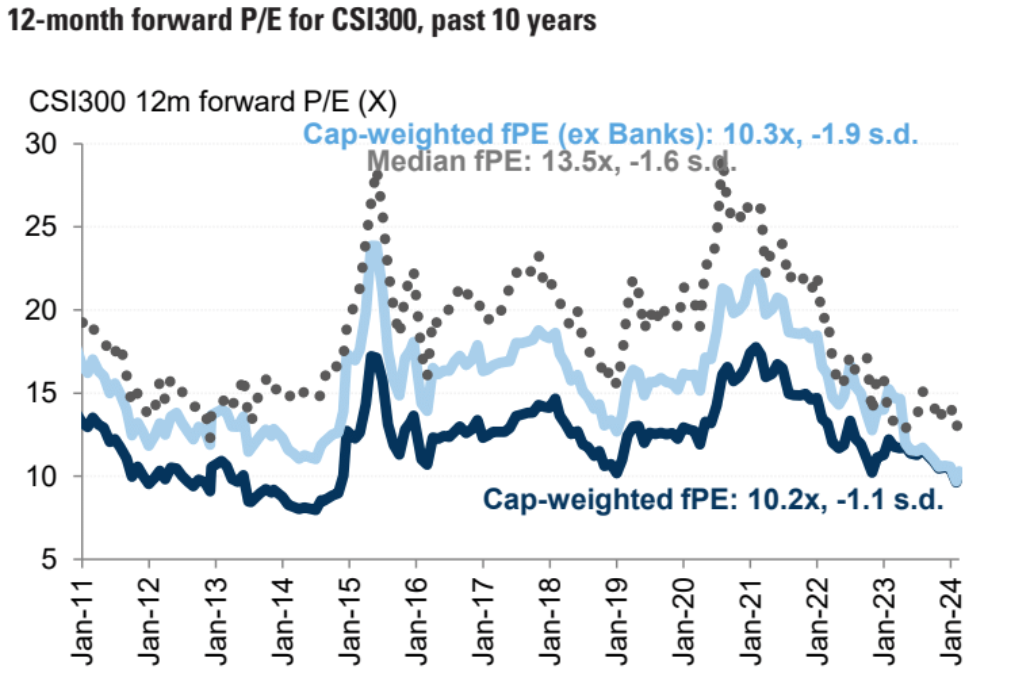

국가대표팀 매수가 시장을 뒷받침하고 있는 것으로 의심된다.EPFR이 최근 4주간 추적한 중국 주식자금 순유입액은 440억달러다.물론 지난주 춘절 연휴로 인해 데이터 값에는 유입액도 포함된다. 2월 8~9일이며 단일 주 데이터가 과소평가될 수 있습니다.

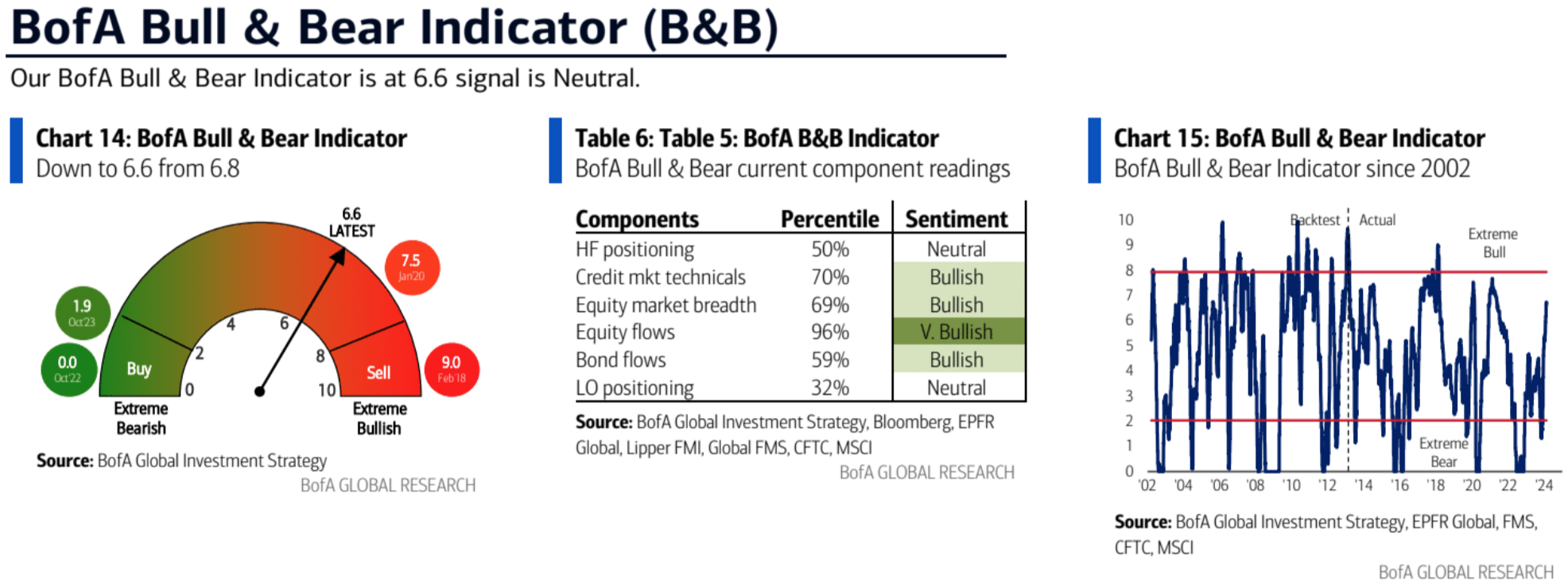

Bank of America Bull and Bear 지표는 중립 수준인 6.8에서 6.6으로 떨어졌습니다.

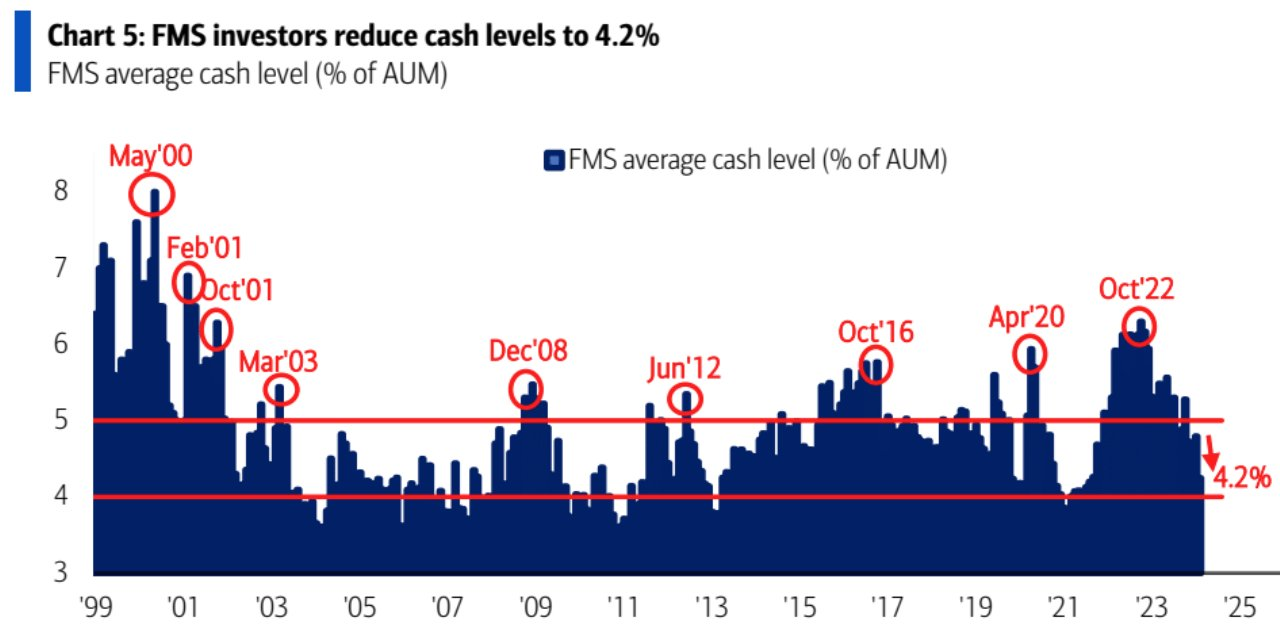

지난 2월 Bank of America가 조사한 펀드매니저 포트폴리오의 현금 수준은 4.2%로 떨어졌습니다. 현금이 4.0%에 도달하거나 그 이하로 떨어지면 Bank of America의 매도 신호가 트리거됩니다.

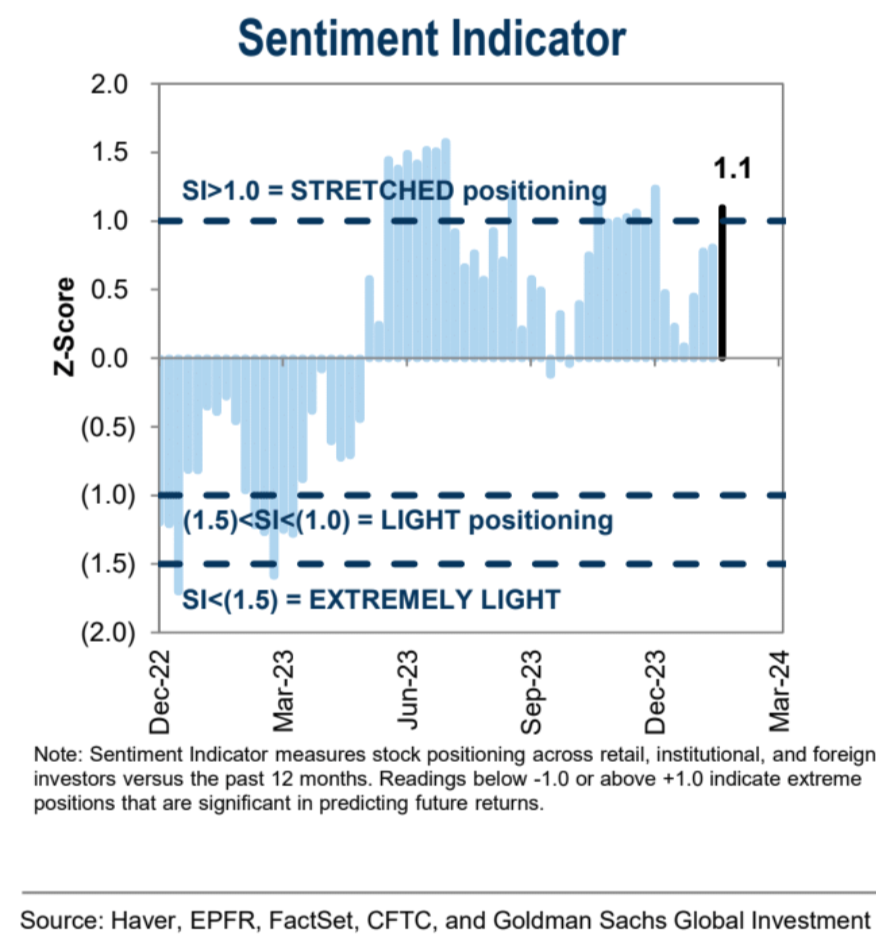

골드만삭스의 제도적 정서 지표가 올해 처음으로 과열에 돌입했습니다.

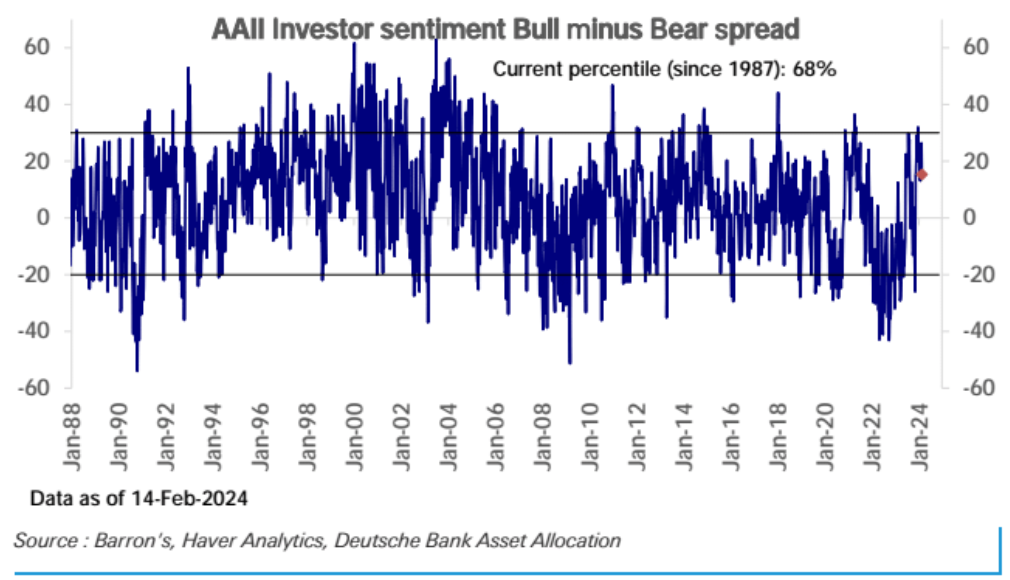

AAII 투자자 설문조사에 따르면 롱-숏 갭은 87~68 백분위수로 급격하게 감소했는데, 이는 주로 숏 포지션 비율의 증가로 인한 것입니다.

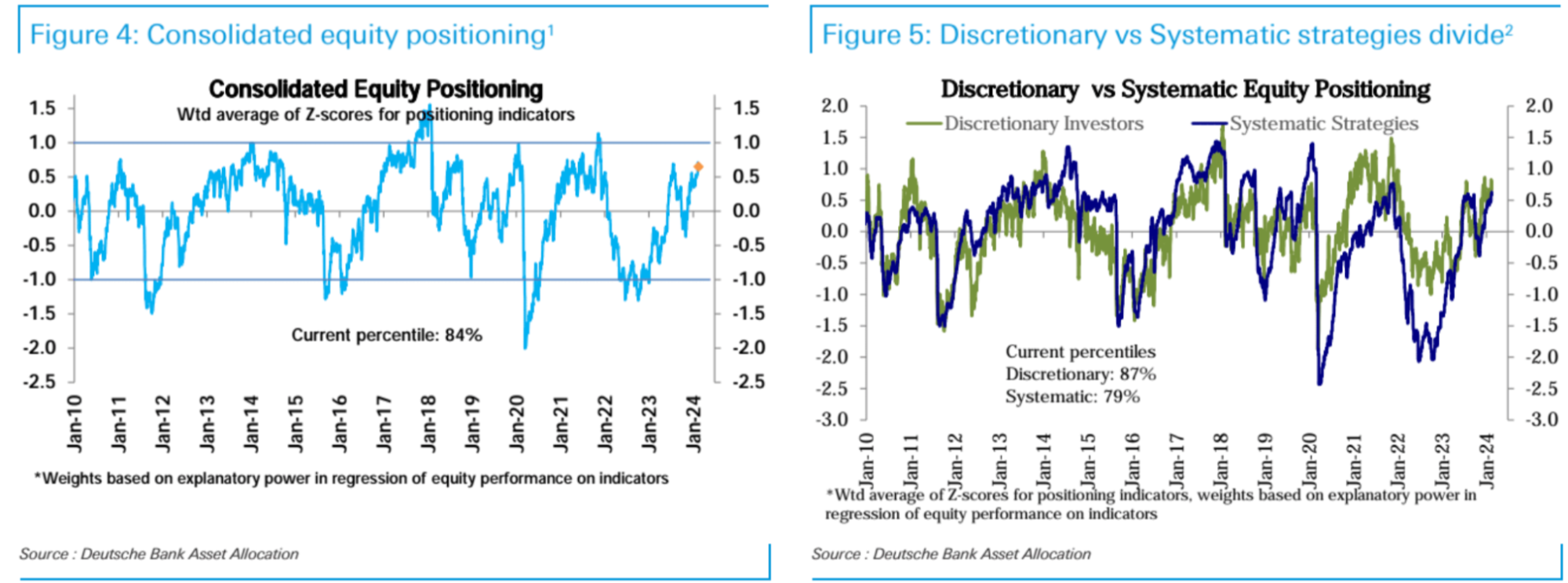

전체 주식 포지셔닝에 대한 도이체방크 수준의 척도는 하락하여 6개월 최고치에서 약간 후퇴하여 현재 84번째 백분위수에 머물고 있습니다. 이 중 독립투자자의 포지션은 하락세(88~87백분위수)를 보인 반면, 체계적 전략 포지션은 소폭 상승(78~79백분위수)을 이어갔다.

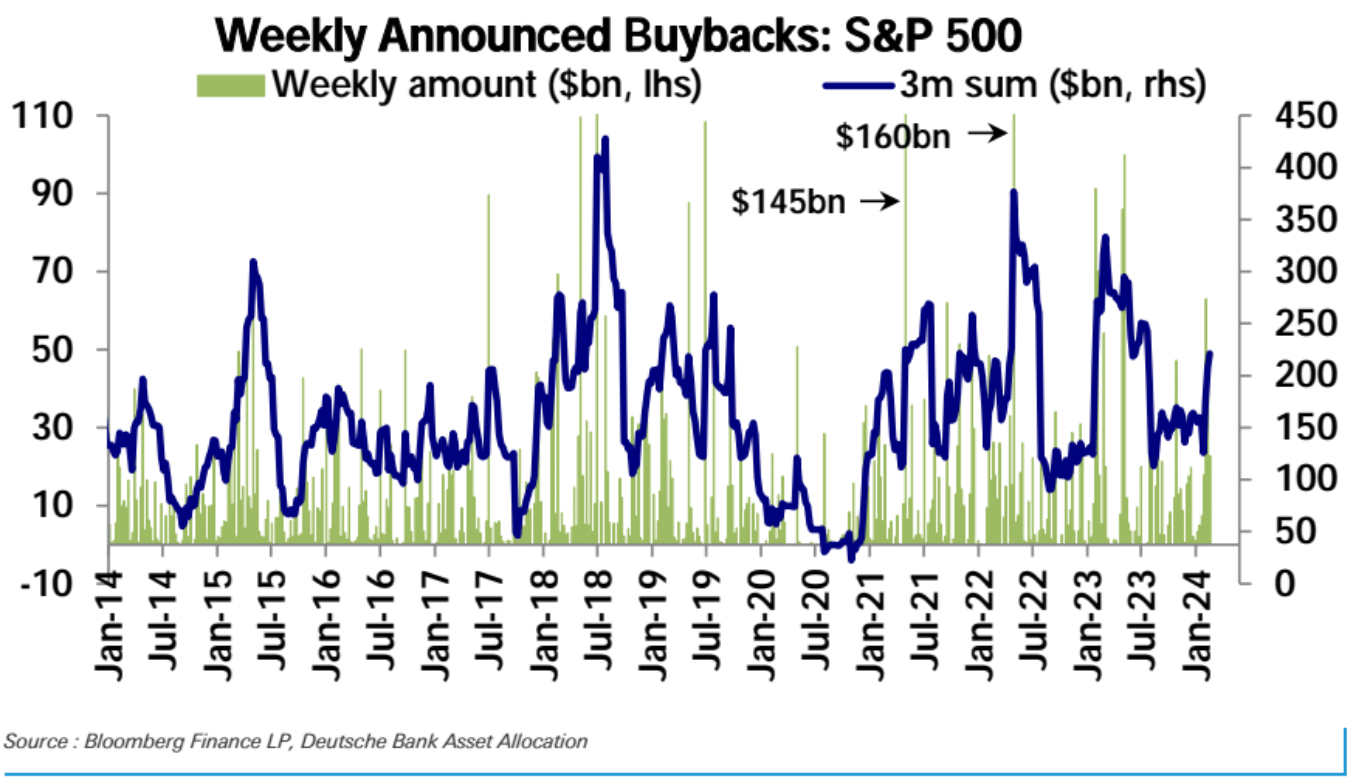

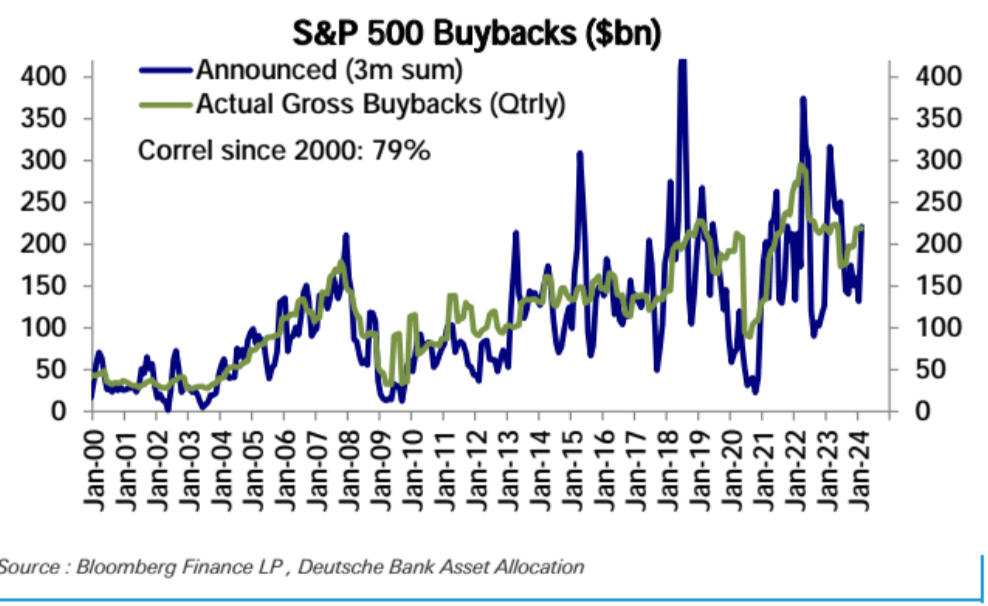

이번 실적 시즌 동안 자사주 매입 발표가 계속 증가하고 있습니다.