一周融资速递 | 39家项目获投,已披露融资总额约2.15亿美元(1.22-1.28)

经 Odaily星球日报不完全统计, 1 月 22 日-1 月 28 日公布的海内外区块链融资事件共 39 起,较上周数据(16 起)大幅上升,已披露融资总额约为 2 亿美元,较上周数据(2.15 亿美元)有所下降。

上周,获投金额最多的项目为数字银行 Sygnum (超 4000 万美元);以太坊 Layer 2 开发商 Polymer Labs 也紧随其后(2300 万美元)。

以下为具体融资事件(注: 1. 依照已公布金额大小排序;2. 不含基金募资及并购事件;3. *为部分业务涉及区块链的“传统”领域公司):

数字银行 Sygnum 完成超 4000 万美元战略融资,最新估值已达 9 亿美元

1 月 25 日,数字银行 Sygnum 宣布已在一轮中期战略融资中获得了超过 4000 万美元的资金,本轮融资由总部位于米兰的资产管理公司 Azimut Holding 领投。该公司透露,在最新一轮融资中,其估值已达 9 亿美元。

以太坊 Layer 2 开发商 Polymer Labs 完成 2300 万美元 A 轮融资

1 月 23 日,以太坊 Layer 2 开发商 Polymer Labs 完成 2300 万美元 A 轮融资,Blockchain Capital、Maven 11 和 Distributed Global 领投,Coinbase Ventures、Placeholder、Digital Money Group、North Island Ventures 和 Figment Capital 等参投,新资金将推动 Polymer Labs 确保连接所有区块链的互操作层在整个生态系统中保持中立、开放、模块化和无需许可。

Ingonyama 完成 2100 万美元种子轮融资,IOSG Ventures 等领投

1 月 23 日,专注于加速和普及零知识证明技术的创新公司 Ingonyama 完成 2100 万美元种子轮融资,IOSG Ventures、Geometry 和 Walden Catalyst Ventures 领投。IOSG Ventures 致力于支持在 ZK 技术创新和应用开发上有突破性进展的项目,将与 Ingonyama 达成长期合作伙伴关系,专注更广泛的 ZK 技术发展。Ingonyama 目前专注于通过产品 ICICLE 提高零知识证明(ZKP)的能力。

CryptoSafe 以 9500 万美元估值完成 2000 万美元融资,VentureX Capital 等参投

1 月 25 日,专注于提高加密货币市场资本效率的区块链项目 CryptoSafe 宣布已经以 9500 万美元估值完成 2000 万美元融资,据悉这笔交易在今年 1 月 1 日完成,直到目前才被公开披露,VentureX Capital、NexTech Ventures 和 Blockchain Innovations Fund 等数家投资基金参投,新资金将用于提升其技术基础设施和能力,未来还将进行一些收购交易。

以太坊历史数据协议 Axiom 完成 2000 万美元 A 轮融资

1 月 25 日,以太坊历史数据协议 Axiom 完成 2000 万美元 A 轮融资,Paradigm Crypto 和 Standard Crypto 领投。Axiom 是一种新型协议,使用零知识证明来访问以太坊链上历史数据,新资金将用于发展团队以及开发他们的平台。

AI 驱动的品牌保护平台 Doppel 完成 1400 万美元 A 轮融资,a16z领投

1 月 24 日,据官方消息,由 AI 驱动的品牌保护平台 Doppel 宣布完成 1400 万美元 A 轮融资,a16z领投,Strategic Cyber Ventures、Okta 副主席兼联合创始人 Frederic Kerrest、Datadog 首席信息安全官 Emilio Escobar、Capital One 首席技术风险官兼执行副总裁 Andy Ozment、Chainguard 总裁 Ryan Carlson、Material Security 联合创始人兼董事长 Ryan Noon、 Octant 联合创始人 Ramsey Homsany、OpenAI 研究科学家 Prafulla Dhariwal 等新投资者、以及 South Park Commons、SVAngel、Gokul Rajaram、Sabrina Hahn 现有投资者参投。

区块链证券投资平台 Dinari 于 2023 年Q4完成 1000 万美元种子轮融资

1 月 24 日,区块链证券投资平台 Dinari 在 X 平台宣布于 2023 年Q4完成 1000 万美元种子轮融资, 500 Global、Coinbase 前首席技术官 Balaji Srinivasan、Alchemy、Version One Ventures、Sancus Ventures 等参投。

据悉,Dinari 在 Arbitrum One 上推出了 1: 1 支持的美国股票、ETF 等 RWA 产品,今天新增 10 多个;此外还在扩大 dShare 产品,在 Arbitrum 上提供新的加密主题资产。

Web3游戏基础设施服务提供商 3 thix 完成 850 万美元融资,Sonic Boom Ventures 参投

1 月 24 日,总部位于德克萨斯州奥斯汀的Web3游戏基础设施服务提供商 3 thix 宣布完成 850 万美元融资,括视频游戏商务公司 Xsolla 创始人 Shurick Agapitov 的家族办公室 Hand of Midas 和 Algorand 联合创始人兼前首席执行官 Steve Kokinos 的家族办公室 Sonic Boom Ventures 参投。

去中心化网络 Masa Network 完成 540 万美元种子轮融资

1 月 23 日,去中心化网络 Masa Network 宣布完成 540 万美元种子轮融资,由 Solana 基金会的 LilyLiu 和前 Polychain 的 Joe Eagan 共同创立的风险投资公司 Anagram 领投,Avalanche Blizzard Fund、Digital Money Group 和 Golden Tree 等参投,新资金将用于在 Avalanche 上建立一个专注于用户个人数据的去中心化网络。

Web3原生数据湖开发公司 Hyperline 完成 520 万美元种子轮融资,Slow Ventures 领投

1 月 27 日,Web3原生数据湖开发公司 Hyperline 宣布完成 520 万美元种子轮融资,Slow Ventures 领投,South Park Commons、Script Capital、Canonical Crypto、Picus Capital、Volt Capital、Mischief 和 Maelstrom 参投,该公司主要为构建 AI 产品和分析应用程序的Web3开发人员构建共享存储和计算引擎,以支持数据应用和服务功能。

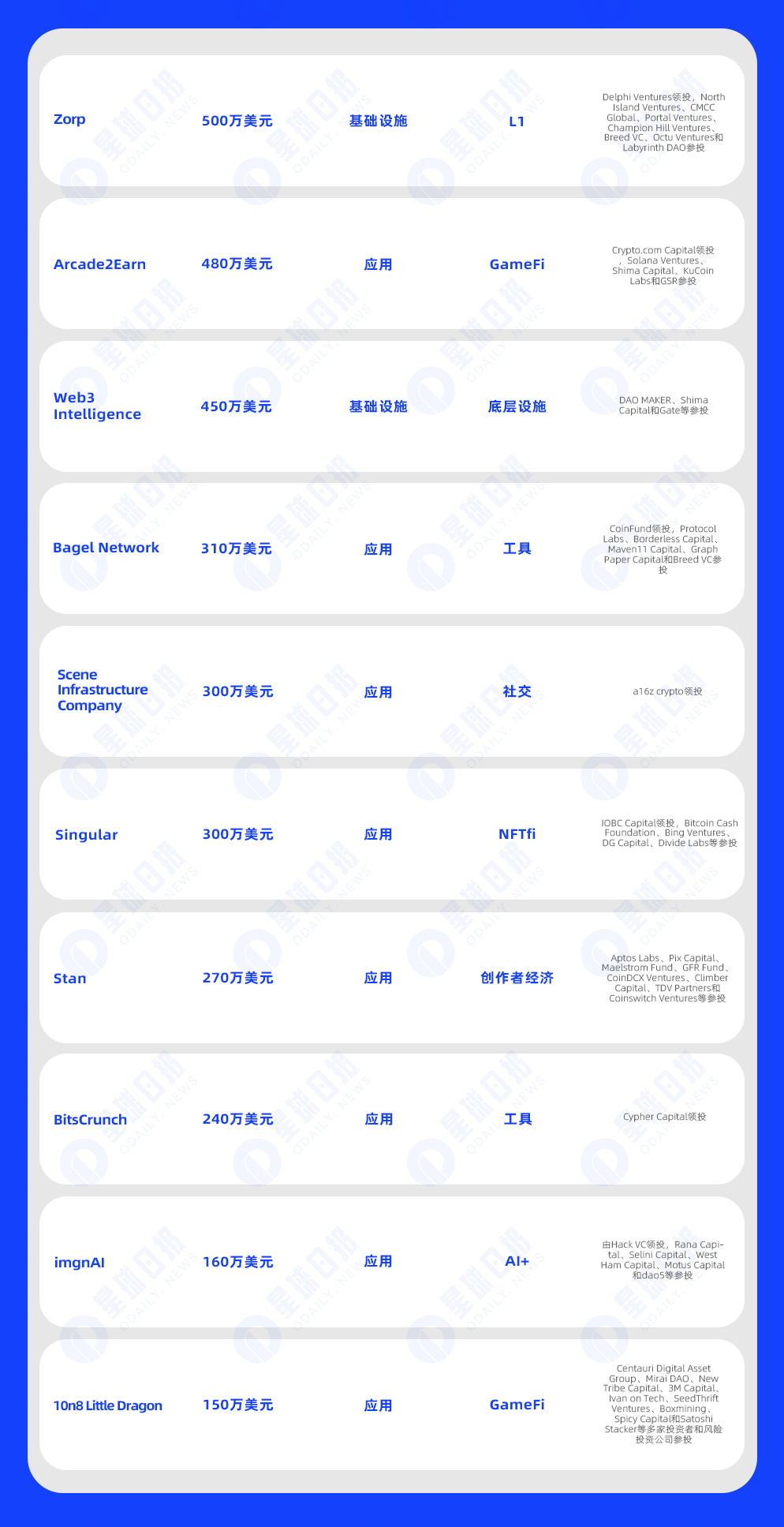

ZK 开发公司 Zorp 完成 500 万美元种子轮融资,Delphi Ventures 领投

1 月 24 日,据官方消息,ZK-L1网络 Nockchain 开发公司 Zorp 宣布完成 500 万美元种子轮融资,Delphi Ventures 领投,North Island Ventures、CMCC Global、Portal Ventures、Champion Hill Ventures、Breed VC、Octu Ventures 和 Labyrinth DAO 参投。

P2E游戏平台 Arcade 2 Earn 融资 480 万美元,Crypto.com Capital 领投、Solana Ventures 等参投

1 月 24 日,P2E游戏平台 Arcade 2 Earn 完成 480 万美元融资,Crypto.com Capital 领投,Solana Ventures、Shima Capital、KuCoin Labs 和 GSR 参投。

Web3 Intelligence 完成 450 万美元私募轮融资,Shima Capital 等参投

1 月 25 日,Web3投资应用程序 Dopamine 开发商Web3 Intelligence 完成 450 万美元私募轮融资,DAO MAKER、Shima Capital 和 Gate 等参投。Web3 Intelligence 主要向机构提供反洗钱信息,以向其客户提供与传统金融相同的合规标准。

据悉,该公司即将发行 DOPE 实用型代币,持有 DOPE 的机构将可以访问Web3 Intelligence 的反洗钱 (AML) 基础设施,该基础设施支持丢Web3钱包的合规性进行评分,并以 NFT 的形式将评分结果封装在区块链上。

去中心化数据平台 Bagel Network 完成 310 万美元的种子前融资,CoinFund 领投

1 月 23 日,去中心化数据平台 Bagel Network 宣布完成 310 万美元的种子前融资,CoinFund 领投,Protocol Labs、Borderless Capital、Maven 11 Capital、Graph Paper Capital 和 Breed VC 参投。Bagel Network 计划通过创建一个市场来解决数据垄断问题,该市场允许数据科学家和 AI 工程师以成本效益高且保护隐私的方式交换和授权可验证的数据集。

Scene Infrastructure Company 完成 300 万美元种子轮融资,a16z crypto 领投

1 月 24 日,社交网络 Friends With Benefits(FWB)宣布其软件开发公司 Scene Infrastructure Company 完成 300 万美元种子轮融资,a16z crypto 领投,该公司由 Dapper Labs 的 DAO 长期贡献者和前 DAO 产品负责人 Jose Mejia 以及 Zora 联合创始人 Ethan Daya 领导,FWB 也将会成为其测试用例来探索代币和社交网络应用。

NFT 跨链借贷协议 Singular 完成 300 万美元种子轮融资,IOBC Capital 领投

1 月 23 日,NFT 跨链借贷协议 Singular 宣布完成 300 万美元种子轮融资,IOBC Capital 领投,Bitcoin Cash Foundation、Bing Ventures、DG Capital、Divide Labs 等参投。Singular 表示,接下来的几个月将专注于优化产品以增强用户体验,此外还计划引入各类 NFT 资产,提供更好的流动性支持。

Web3电竞粉丝参与平台 Stan 融资 270 万美元,Aptos Labs 等参投

1 月 24 日,Web3电竞粉丝参与平台 Stan 完成 270 万美元融资,Aptos Labs、Pix Capital、Maelstrom Fund、GFR Fund、CoinDCX Ventures、Climber Capital、TDV Partners 和 Coinswitch Ventures 等参投。

Stan 帮助用户购买收藏品,并通过聊天和音频房间以及其平台上的专属社区与受欢迎的电竞人物(无论是选手还是 KOL)互动。其中一些收藏品是Web3项目,如 NFT。

德国 NFT 和链上数据分析平台 BitsCrunch 完成 240 万美元融资

1 月 24 日,德国 NFT 和链上数据分析平台 BitsCrunch 宣布完成 240 万美元融资, Cypher Capital 领投,同时还获得了 Coinbase Ventures、Animoca Brands、Chainlink、Crypto.com Capital、Morningstar Ventures、Shima Capital 的支持。BitsCrunch 是一个人工智能驱动的去中心 NFT 数据平台,使开发人员能够构建可靠的 NFT 应用程序 (dApp),并且还提供 NFT 和多链数字资产进行数据分析服务。

加密 AI 平台 imgnAI 完成 160 万美元种子轮融资,由 Hack VC 领投

1 月 27 日,加密 AI 平台 imgnAI 宣布完成由 Hack VC 领投的 160 万美元种子融资,Rana Capital、Selini Capital、West Ham Capital、Motus Capital 和 dao 5 等参投,但具体估值未公开。

据悉,公司的图像生成机器人平台于 2022 年底推出,其网站上的 imgnAI 加密代币用于解锁高级功能,并将图像直接铸造为 NFT。

游戏化比特币加速器 10 n 8 Little Dragon 完成 150 万美元融资,Spicy Capital 等多家风险投资公司参投

1 月 26 日,游戏化比特币加速器 10 n 8 Little Dragon 宣布完成 150 万美元融资,Centauri Digital Asset Group、Mirai DAO、New Tribe Capital、 3 M Capital、Ivan on Tech、SeedThrift Ventures、Boxmining、Spicy Capital 和 Satoshi Stacker 等多家投资者和风险投资公司参投。10 n 8 Little Dragon 创建目标是加速亚太地区项目,推动更多用户在不同的矿池和游戏中进行质押、玩游戏并赚取收益,未来还将开发基于 Unity 的元宇宙游戏。

Web3安全公司 KEKKAI 完成 150 万美元种子轮融资,Bixin Ventures 等参投

1 月 23 日,据官方消息,Web3安全公司 KEKKAI 完成 150 万美元种子轮融资,Decima Fund、Bixin Ventures、Sora Ventures、Plug and Play、FlickShot、Mask Network、Stratified Capital、MZ Web3 Fund、Presto Labs、GoPlus Security 和 Dora Ventures 等参投。

跨链借贷协议 Synonym Finance 完成 150 万美元种子轮融资

1 月 24 日,跨链借贷协议 Synonym 宣布完成 150 万美元种子轮融资,Bordless 领投,Robot Venture、Big Brain Holdings、Wormhole 跨链生态基金等参投,新资金将用于 Synonym 扩展到新的生态系统,并为 DeFi 专业人士提供加密资产跨链借贷服务。

Spellborne 的开发商 Mon Studios 宣布完成 135 万美元战略融资

1 月 26 日,MMORPG 游戏 Spellborne 的开发商 Mon Studios 宣布完成 135 万美元战略融资,本轮融资的投资者包括 32-Bit Ventures、Momentum 6、Yunt Capital、D 64 Ventures、County Capital 以及来自 Animoca Brands、YGG、Faze Clan、Immutable、Tatsumeeko 等公司的创始人和高管,资金将用于继续开发 Spellborne。

Bitflow Labs 完成 130 万美元 Pre-Seed 轮融资,Portal Ventures 领投

1 月 25 日,旨在 解决整个比特币生态系统流动性断裂问题的去中心化交易所 Bitflow Labs 宣布已完成 130 万美元的 Pre-Seed 融资,Portal Ventures 领投,Bitcoin Frontier Fund、 Bitcoin Startup Lab、Big Brain Holdings、Newman Capital、Genblock Capital、Tykhe Block Ventures 等参投。Bitflow 平台支持交易 BTC、稳定币、BRC 20、以及 Stacks 代币等,只在推动比特币生态发展。

去中心化算法交易 Algotech 在预售轮融资中已募集 110 万美元

1 月 25 日,去中心化算法交易平台 Algotech 在预售轮融资已募集 110 万美元,该平台旨在利用算法和区块链技术确保交易透明度、不变性和安全性,减少手动交易复杂度。

非托管 Telegram 交易机器人 Bitbot 私募轮融资触及 30 万美元

1 月 24 日,非托管 Telegram 交易机器人 Bitbot 在预售启动后 72 小时内,私募轮融资已触及 30 万美元。

数字资产数据公司 CCData 获 VanEck 和 MarketVector Index 战略轮投资

1 月 22 日,数字资产数据公司 CCData 官方宣布已获得 VanEck 和 MarketVector Index 战略轮投资,但具体融资金额暂未披露。该公司目前主要聚合全球交易所的实时加密数据源,提供全面、准确的数字资产数据、参考汇率和指数,其数据解决方案已被 MSCI、Pantera、Ripple、BitGo、Metamask、Coinbase 和 21 Shares 等传统金融和数字资产领域机构所采用,并与 Refinitiv、SIX Digital 等平台建立了战略分销合作伙伴关系。

Algorand 生态预言机项目 Gora Network 完成战略轮融资

1 月 23 日,Algorand Ventures 宣布战略投资 Algorand 生态预言机项目 Gora Network,该项目旨在为区块链应用程序提供安全、可靠和真实的离线数据,新资金将用于推动 Gora 的发展,包括业务拓展、基础设施扩展、产品套件扩充、生态系统培育,以及研究和发展。

合作型人寿保险 DAO 服务提供商 Takadao 完成战略轮融资,Cardano 生态基金 Adaverse 参投

1 月 23 日,合作型人寿保险 DAO 服务提供商 Takadao 宣布完成一笔战略轮融资,Cardano 生态系统加速器和种子基金 Adaverse 参投,具体融资金额暂未披露,Takadao 推出的合作型人寿保险 DAO“Takasure”能够实现去中心化储蓄和收益生成,允许成员之间重新分配利润,同时利用区块链技术的金融解决方案可以提高透明度并降低成本。

EDX Markets 完成 B 轮融资,红杉资本与 Pantera Capital 领投

1 月 23 日,由 Citadel Securities 和 Fidelity Digital Assets 支持的加密货币交易所 EDX Markets 宣布完成 B 轮融资,红杉资本与 Pantera Capital 领投,Citadel Securities、Virtu Financial 等参投,但该交易所拒绝透露本轮融资的具体金额。

据悉 EDX Markets 正在新加坡建立一家交易所,并在获得投资者的额外融资后扩展到提供现货和永续期货。

数字资产托管机构 BDACS 完成种子轮融资,Avalanche 旗下 Blizzard Fund 参投

1 月 24 日,韩国数字资产托管机构 BDACS 完成种子轮融资,Avalanche 旗下 Blizzard Fund 参投,具体融资金额暂未披露。

据悉,BDACS 将为 Avalanche 提供 AVAX 和 BTC.b 作为机构托管资产,并为 Avalanche P-Chain 提供质押支持。

DeFi 永续协议聚合器 Cadence Protocol 完成种子轮融资,CSP DAO 等参投

1 月 24 日,据官方消息,DeFi 永续协议聚合器 Cadence Protocol 宣布完成种子轮融资,Dewhales Capital、CSP DAO、FourMoons Investment Group、Code 4 Arena/Canto/Slingshot 创始人 Scott Lewis、Zellic 联创 Stephan Tong 以及 Marin Ventures 的 Ryon Nixon 等战略天使投资人参投,具体融资金额暂未披露。

新融资将用于在 Canto 链上发布永续协议,通过集成 RWA、合约担保收入(CSR)和流动质押衍生品(LSD)提升资本效率。

OKX Ventures 领投去中心化 Layer 2 跨链协议 Orbiter Finance

1 月 24 日,据官方消息,OKX Ventures 宣布领投去中心化的 Layer 2 跨链协议 Orbiter Finance。过去两年,Orbiter 已处理超 1200 万笔交易,总金额达 78 亿美元,累计用户超 300 万。

BitGo 完成新一轮战略融资,运钞车生产商 Brink's 参投

1 月 24 日,BitGo 完成新一轮战略融资,运钞车生产商 Brink's 参投,此次投资的财务细节并未披露,与 BitGo 的合作并不是 Brink 第一次涉足数字资产领域,该公司早在 2022 年就开始与瑞士加密货币托管服务提供商 Metaco 进行了合作。

去中心化物理网络 Meson Network 以 10 亿美元估值完成战略融资,Presto Labs 领投

1 月 25 日,去中心化物理网络 Meson Network 于 X 宣布,其以 10 亿美元估值完成了由 Presto Labs 领投的新一轮战略融资,具体融资金额未披露。

据悉,Meson Network 专注于 DePIN+AI,旨在打造一个由人授权的去中心化物理网络,Meson 网络“DePIN”节点采用用户友好技术开发,可容纳各种硬件,如个人笔记本电脑,服务器,物联网设备等等。

BSquared Network 完成种子轮融资,OKX Ventures 等参投

1 月 25 日,比特币二层网络 BSquared Network 宣布成功完成种子轮融资,投资方包括 OKX Ventures、HashKey Capital、IDG Capital、Kucoin Ventures、ABCDE、Waterdrip Capital、OGs FUND 和 Antalpha Group。

多链 DEX 聚合器 Arken Finance 完成战略轮融资,Arche Fund 参投

1 月 27 日,多链 DEX 聚合器及一站式交易门户 Arken Finance 宣布完成战略轮融资,Arche Fund 参投并与之达成战略合作伙伴关系,但具体融资金额暂未披露。

Kepple Africa Ventures 战略投资 INTMAX 开发公司 Ryodan Systems AG

1 月 27 日,投资机构 Kepple Africa Ventures 宣布投资 Ryodan Systems AG。此外,双方达成战略合作,以加速 INTMAX 生态向非洲市场拓展。

据悉,Ryodan Systems AG 是以太坊 Layer 2 项目 INTMAX Stateless zkRollup 和加密货币钱包 INTMAX Wallet 的开发公司。

bitSmiley 完成第一轮代币融资,OKX Ventures 与 ABCDE 领投

1 月 28 日,比特币 DeFi 生态项目 bitSmiley 完成第一轮代币融资,OKX Ventures 与 ABCDE 领投,CMS Holdings、Foresight Ventures、LK Venture、Silvermine Capital 以及来自 Delphi Digital 和 Particle Network 的相关人士参投。