SignalPlus波动率专栏(20231206):多头再度发起猛攻,BTC期权交易量创近期新高

昨日(5 Dec)美国 ISM 服务业指数因商业活动的增加而得到回暖,录得稍高于预期的 52.7 ,另一份 JOLTS 职位空缺数据录得 8.733 M,远低于预期的 9.3 M,为 2021 年 3 月以来最低,凸显了美国劳动力市场降温的迹象,美债收益率受此影响继续下跌,十年期收益率跌破 4.2% ,现报 4.19% ,对利率政策更为敏感的两年期收益率先跌后涨,现报 4.614% 。美股交投平淡,标普和道指分别收跌 0.06% 和 0.22% ,纳指收涨 0.3% 。

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

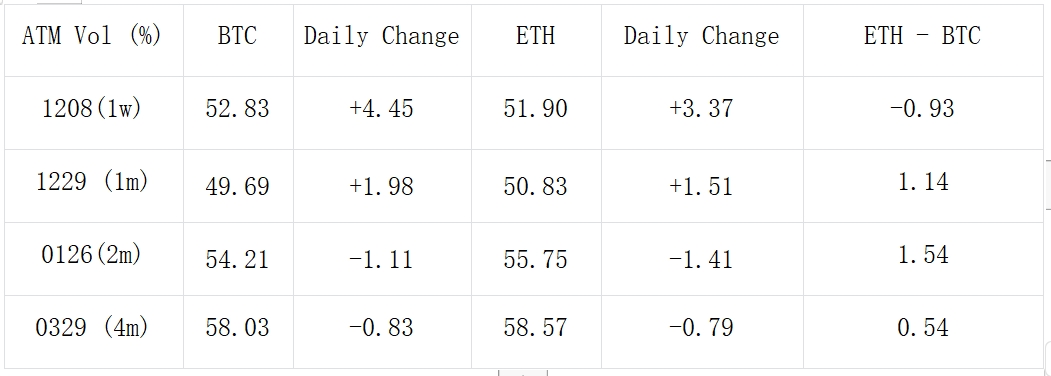

数字货币方面,BTC 多头在经过一天的调整后再度向更高点发起挑战,一夜之间价格再涨 5% ,收报 43619 美元,ETH 弱势联动,收涨于 2267.3 (+ 2.92% )。实际波动的上涨再度拉动了前端 IV 的上扬, 29 DEC 23 仍以局部低点的角色成为曲面斜率走平的分割点。此轮上涨行情在某种程度上可以被解读为对 1 月 SEC 批准 BTC SPOT ETF 审核的正面预期的下注,BTC 期权成交量受此提振创下近期新高,其大宗上再度出现了以 26 Jan 24 42000 vs 50000 Long Call Spread 为代表的看涨策略,中短期内也不乏一些以 Sell Call Spread 形式出现的滚仓操作,一同表达了对后市上行空间的展望。除此之外,BTC/ETH 两币种在中短期内还有不少买入 Put Spread 策略,实现了下行场景下对仓位的保护。

Source: Deribit (截至 5 DEC 16: 00 UTC+ 8)

Source: SignalPlus

Source: Deribit Block Trade

Source: Deribit Block Trade

您可在 ChatGPT 4.0 的 Plugin Store 搜索 SignalPlus ,获取实时加密资讯。如果想即时收到我们的更新,欢迎关注我们的推特账号@SignalPlus_Web3 ,或者加入我们的微信群(添加小助手微信:xdengalin)、Telegram 群以及 Discord 社群,和更多朋友一起交流互动。

SignalPlus Official Website:https://www.signalplus.com