简析DeFi借贷协议利率的6种决定模式

原文作者:David Ma

原文编译:Luffy,Foresight News

在第 1 部分中,我对 Web3 中的借贷协议进行分类。快速回顾一下,借贷协议是一套规则,用于管理借款人如何暂时借用贷方的资产并承诺偿还这些资产。这协议将定义如何向借款人征收利息,以及如何构建抵押来保护贷方。本系列的第 1 部分探讨了利息期限相关的主题:活期与定期、贷款滚动和永续等,并在该框架内对一些协议进行了分类。

在这篇文章中,我将继续讨论各种借贷协议如何确定利率的。

利率

利率是借款人向贷款人额外支付的的费用。为了便于比较,利率通常以年化格式报价,用年化百分比率 (APR) 或收益率 (APY) 表示。两者之间的区别在于,APR 假设不进行复利,而 APY 则假设进行复利。例如,APR 为 10% ,半年复利将导致 APY 为 10.25% 。

两者的关系以下面公式表示:

APY = ( 1 + APR / k)^k — 1 ,其中 k 是每年复利的次数。

在 Web3 中,大多数贷款都是连续复利的(k 值较大),因为大多数贷款都是活期贷款。因此,他们以 APY 报价来告诉贷方用户,假设利率保持不变,他们一年会赚多少钱。对于定期贷款,更常见的是以 APR 报价。

顺便说一句,如果 2020 年风格的简陋流动性挖矿卷土重来,请警惕 APY 掠夺性报价,因为这些机会都不会持续很长的时间,复利的结果难以实现。用 APR 在心中进行计算要可靠得多。对于固定奖励池,TVL 加倍意味着奖励减半。

现在,阐述完定义后,我们可以讨论利率定价了。

定价方式

定价是计算借款人和贷款人相互支付多少利率的机制。虽然并不详尽,但本文将介绍其中一些机制:

订单簿定价:最灵活且由市场驱动,但需要权衡用户体验

基于利用率的定价:这种模型在 DeFi 中找到了产品市场契合度,但效率并非 100% ,并且在极端情况下表现不佳

拍卖:定价良好,贷款效率高,但需要用户提前计划,二级市场碎片化,以及存在其他小摩擦。

Ajna 利用率模型:对经典利用率模型的一种改造,适合在无预言机协议中使用

Tazz 永续贷款融资模型:一种新的 p2p ool 贷款原语,可以让市场定价利率,从而使抵押品完全模块化。

手动定价:治理主导的定价。

订单簿定价

最常见的资产定价方式是让市场通过订单簿自行调整。让借款人和贷款人发布限价订单,规定各自愿意借入或贷出的金额和利率。当订单匹配时,促成交易。

然而,订单簿也有缺点:

不熟练的用户不知道如何为他们定价。这些用户只是想在不支付巨额成本的情况下进行交易。

下达限价单就像一个免费期权。市场流动性越差,出块时间越慢,期权就越有价值。换句话说,理论上的真实价格在订单未被执行的情况下变动得越多,这些限价订单本身包含的期权价值就越大。

订单簿的良好运营需要积极的管理。你需要取消过时的限价订单,需要与其他参与者一起玩竞价战游戏。

它需要大量的交易。

这就是为什么订单簿在链上仍然不受欢迎的原因。相反,AMM、询价和拍卖都更适合区块链产品。

在借贷方面,订单簿面临着更大的挑战:

订单簿交易创建点对点贷款匹配,违约风险是不可替代的。

持续发放定期贷款会产生彼此不能完全互换的头寸。相反,Pendle 和 Notional 等协议选择在特定日期固定期限发放贷款。可用贷款的期限是 37 天、 159 天等,这未免很奇怪。

短期贷款创造了更多交易。你可以自动化滚动,但如何为下一笔贷款定价?

所有这些都导致了市场的割裂,或者至少是复杂的交易体验。也就是说,像 Blur 和 Arcade.xyz 这样的 NFT 借贷平台仍然依赖于类似订单簿的用户体验。它们都想出了可以减轻糟糕的用户体验的功能。

Blur 融合了一种永续贷款的形式,以消除期限维度的困扰。

Blur 和 Arcade 都有「collection offers」,贷方将整个 NFT 集合视为可替代的,集合中的任何 NFT 都可以用作抵押品。

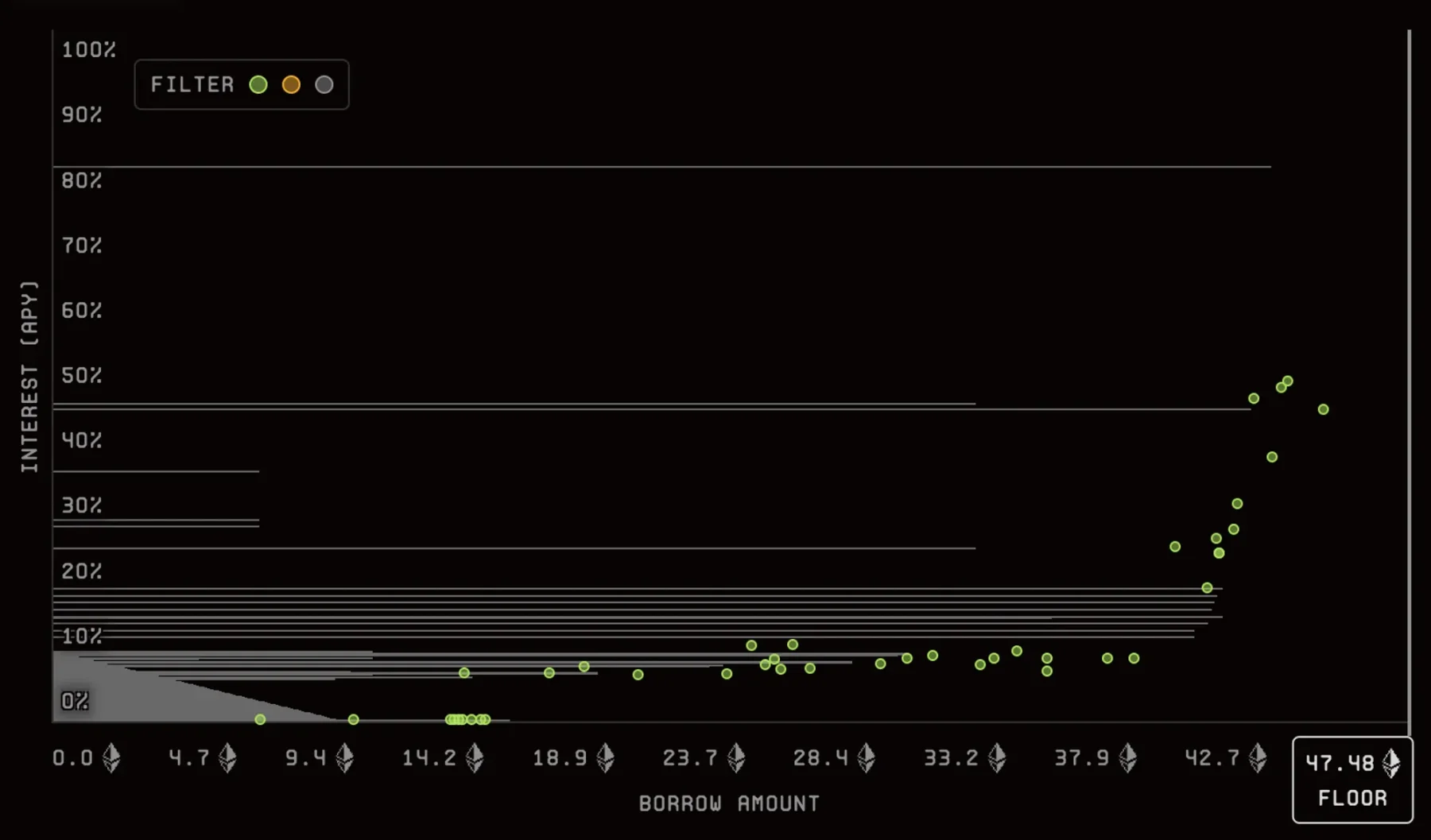

有没有想过如何解读 Blur 的收藏品借贷图表?我在这里写了一个帖子。

Arcade 的 P2P 贷款匹配和 collection offers

AMM 是订单簿的一个子类别。如果一个协议可以将足够多的人聚集到可替代代币的借贷市场中,那么 AMM 是一个不错的选择。利率比代币具有更好的均值回归能力,因此使用 AMM 获得 LP 利率比 LP 代币更安全。这就是 Pendle、Notional 和 Tazz 的工作原理。

回顾一下,虽然订单簿可以很好地处理简单的资产,但借贷订单簿有太多的维度需要考虑,并且需要巧妙的方法来降低用户体验的复杂性。

基于利用率的定价

给定借贷资产池的利用率是指借出资产总额与可借资产总额的比率。

基于利用率的定价将利率定义为利用率的某种递增函数。

第一个也是最大的链上借贷平台 Aave 就采用了这种方法。它仍然是流动性和可替代资产最流行的利率定价方式。

请注意,Aave 并不是从这个设计开始的。 EthLend(Aave 品牌重塑前的名称) 2018 年白皮书概述了 p2p 定期订单簿,基于利用率的模型是他们 2020 年白皮书中介绍的。这种对金融原语的彻底重新思考(Uniswap AMM 是另一个例子)是 DeFi 的乐趣之一。

Aave 的借款利率

由于白皮书中没有对此进行解释,因此我对这种方法背后的动机的猜测非常简单。考虑经济学模型——当利率高时,愿意借钱的人更少,而愿意放贷的人更多。 「最佳」利率是指愿意借款的人数与贷方的数量完全匹配,且利用率为 100% 。

当利率太低时,愿意借款的人比贷款人多。利用率将达到 100% ,但它并没有告诉我们目前处于模型的哪个位置。此外,贷方无法退出贷款。

当利率太高时,大量贷款供应就会闲置。 APY 利差(1- 利用率)随着利率的增加而增加。这还是在平台收取费用之前。

由于不可观察的借贷曲线随市场条件而变化,因此面临的挑战是保持利率接近最优利率,同时为贷方退出保留一定的缓冲。

上述 Aave 的「interest rate mode」有点用词不当。数学爱好者喜欢将其称为 PID 控制器,但只是部分自动化。首先,Aave 选择目标利用率(例如 90% )和纠缠曲线。如果利用率经常超过 90% ,Aave 的治理将使利率曲线变得陡峭,试图将利用率推低。如果利用率太低,则反之亦然。

有时,市场会遇到特殊情况,PID 控制器反应太慢。例如,在 2022 年 9 月的以太坊合并期间,合并前的 ETH 将被分叉为 PoS ETH 和 PoW ETH。 PoW ETH 被市场认为价值约为 PoS ETH 的 2% 。市场参与者看到了这一点,并希望在钱包中保留尽可能多的合并前的 ETH。一种方法是将稳定币作为抵押品并借入 ETH。只要借款期限内的累计利息低于 2% ,这就是有利可图的交易。在不到 1 周的时间内赚取 2% 意味着可以支付超过 100% 的 APR。 Aave 的利率上限为 100% 。不用说,在合并之前的几天里,Aave、Compound、Euler、Inverse 和每个 PID 控制器借贷协议的 ETH 利用率都达到了极限。如果我没记错的话,Inverse 没有设定利率上限,APR 最终达到了 1000% 。

关于基于利用率的定价最后需要注意的是,它与点对点结构自然契合,因此是活期贷款。因此,我们经常看到这些属性自然结合。

总而言之,好处在于正常市场条件下的用户体验:随时借、随时走。但当利用率达到 100% (如以太坊合并期间)时,贷方就陷入了无追索权的境地。其他缺点是 10% 的贷款缓冲资产导致资本效率低下,以及无法提供定期贷款。

拍卖

拍卖是一种经过时间考验的新债发行方式(一级市场发行)。美国国债是全球流动性最强的政府证券,它利用拍卖来为新债务定价。在借贷协议中,借款人和贷款人向定期举行的拍卖提交秘密报价,找到市场清算利率,并向清算利率的参与者发行新债务。

Term Finance 是一个相对较新的协议,就是受到这种机制的启发。他们的拍卖实施细节值得一读。

拍卖可以有效地匹配贷款人和借款人。与订单簿不同,订单簿需要锁定资本来下达等待执行的订单,或者基于利用率模型的贷款池需要为贷方提款提供缓冲,因此没有任何资本处于闲置状态。唯一的非生产性时期是资产在拍卖期间被锁定的时期。

拍卖还产生高质量的定价,因为市场参与者聚集到一个谢林点来汇总他们的信息。

不利的一面是,拍卖需要一些预先计划,而且不那么用户友好。对于美国国债来说这是一个不错的选择,但在加密货币领域,定期贷款市场的参与度还不够高。另一个挑战是市场的碎片化,加密货币有很多类似但不可替代的资产。这将是一个更难启动的产品,但我希望有一天,Term Finance 能够在以太坊的全力支持下发行以太坊国库券。

Ajna 的利用率模型

Ajna 是少数不依赖于预言机的借贷协议之一。对 Ajna 如何实现这一目标的完整阐述超出了本文的范围。相反,其利率设计方式的值得讨论。

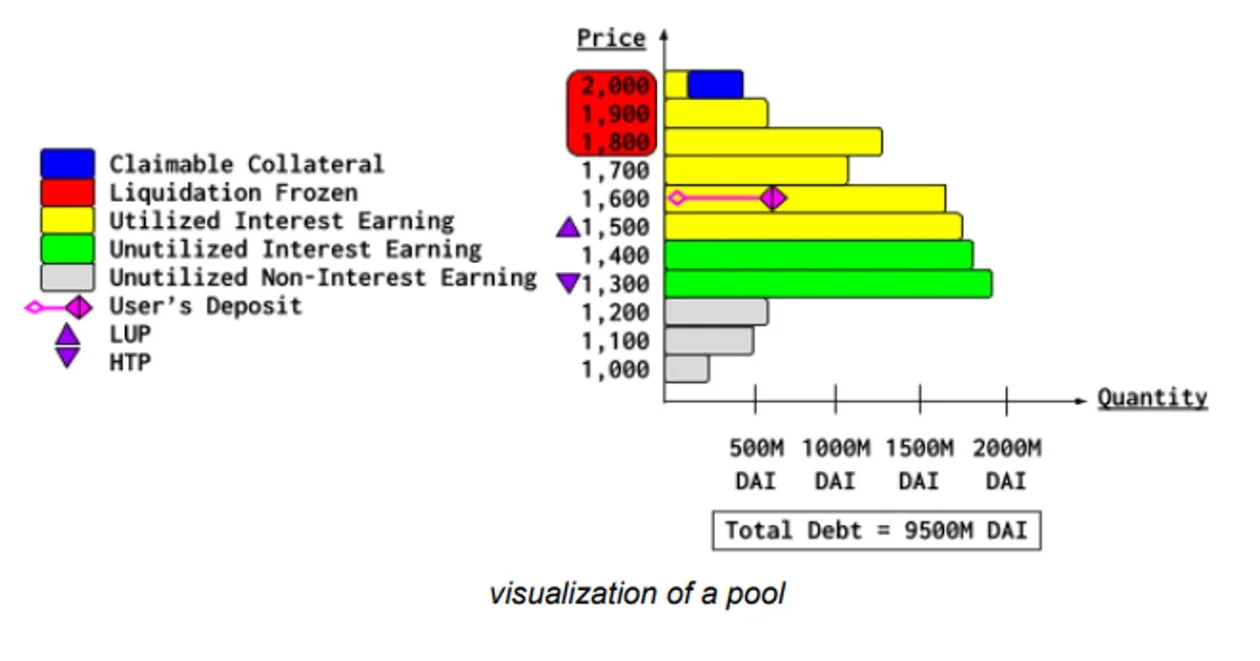

贷方首先选择他们愿意借出代币(例如 USDC)的抵押品(例如 ETH)估值。借款人从最高估值向下匹配。贷款风险最高(贷款与抵押品比率最高)的借款人设定「最高门槛价格」(HTP),估值较低的贷款人不会获得利息。

https://www.ajna.finance/pdf/Ajna_ELI5.pdf

贷方不想将估值定得太高,因为他们可能会因违约而蒙受损失。贷方也不想将估值定得太低,因为他们无法获得任何利息。

利率由利用率函数决定,但这里的计算仅考虑将抵押品估值设置为高于 HTP 的贷方。利率从 10% 开始,每 12 小时乘以或除以 1.1 ,具体取决于利用率与「目标利用率」的比较情况。

主要优点是,尽管采用点对池设计,但该机制不需要任何预言机即可运行。另一方面,贷方需要不断监控其估值。与其他基于利用率的利率定价机制一样,APR 也会受到未使利用的借款的影响。

尽管借款人和贷款人可以随时离开(活期),但 Ajna 的最低贷款周期为 1 周。由于 Ajna 进入市场的时间还不够长,所以现在了解这种机制的全部优缺点还为时过早。

真正的无需许可和不可变的协议很少见,因为它们很难正确执行。但当它们确实发生时,它们就成为可组合性的基石。我真心希望 Ajna 能够成为借贷界的 Uniswap。

Tazz 的永久贷款融资模式

Tazz 是即将推出的借贷协议,它引入了新的利率定价原语。同样,该机制的完整描述超出了本文的范围。

与 Aave 类似,Tazz 债务以零息永续贷款开始。债务代币(Aave 术语中的 AToken)可以在任何 DEX 上进行交易。除了协议破产之外,Aave 的 Atoken 与实际代币交易价格几乎总是接近 1: 1 ,而 Tazz 的债务代币(ZToken)则由市场定价。 ZToken 的价格决定了名义债务累积的利率(即资金)。如果名义债务继续增加,抵押参数将触发清算。

持续资金支付与 k ( 1 – ZToken 相对于代币价格的 TWAP) 成正比。k 越低,债务期限越长,越容易受到利率风险的影响。

请注意,在这种机制中,抵押与协议的其余部分完全模块化。你可以设置无抵押品、NFT 抵押品、LP 代币、非流动性代币、锁定代币、基于预言机的抵押品定价或一次性定价的资产池。这并不重要,因为市场可以为承担风险所需的利率定价。

值得注意的是,这使得:

点对点借贷

100% 贷款利用率,因此利差较低

合并流动性

任何抵押品类型

一个潜在的缺点是它需要监控资金池价格(但少于 Ajna)。如果不切实际的价格持续太久,就会导致不切实际的利率。 ZToken 的流动性市场将使借款人和贷款人都不必过于密切监控。

手动 / 治理定价

鉴于 GHO 脱锚,这种模式值得一提。有一些债务抵押头寸(CDP)稳定币。 Maker 的 DAI 规模最大,Liquity 的 LUSD、Lybra 的 eUSD、Prisma 的 mkUSD 等紧随其后。

尽管 CDP 看起来不像贷款,但其实不然。借款人用 ETH(Maker v1)、LST(Prisma、Lybra)或其他资产进行抵押。借款人铸造一个 CDP,协议预言机按照 1: 1 的价格计算美元价值。 CDP 可以在公开市场上出售,从而借款人「借入」另一种资产,贷方收到 CDP。该贷款是永久性的,并且价值可能不会固定在 1 美元。借款人向协议支付利率,贷款人可以从协议接收另一个利率(例如 Dai 储蓄利率)。有时,有一个称为「稳定模块」的保护基金,以避免 CDP 脱钩。

手动定价的缺点是它受到治理流程、冗长的辩论、社区治理参与度低等的影响,因此反应很慢。好处是,人类流程比可能出现极端情况的代码更难被操纵。

GHO 自创建以来一直下跌

Aave 的 GHO 是一个具有手动利率的 CDP。目前 GHO 的借款利率为 3% (低于国库券和 Dai 的 5% ),他们在 Aave 上的贷款(储蓄)利率为 0% 。因此,愿意借钱的人太多,愿意放贷的人太少,导致 GHO 价格下降。

Aave 治理论坛上的争论已经持续了数月。争论的本质归结为是钉住汇率还是保持稳定的利率(因此利率是可变的)。在 GHO 获得更多市场主导地位之前,GHO 无法两者兼得。

结论

在本文中,我们介绍了贷款协议中利率定价的各种方式。当然还有很多方法,但本系列的目标是建立一个分类法。到目前为止,我们已经将利息期限和利息定价视为可以对协议进行分析和分类的两个主要视角。在下一篇文章中,我将讨论抵押。