Gryphsis 加密货币周报: Binance被罚43亿美金,CEO赵长鹏离职,BTC现货ETF通过预期上涨

亲爱的读者,欢迎阅读 Gryphsis 学院的周度加密货币摘要。我们为您带来关键的市场趋势、新兴协议的深度洞察,以及全新的行业动态,所有这些都旨在提升您对加密货币和Web3的专业知识。 祝您阅读愉快!关注我们的 Twitter 和 Medium获取更深入的研究和洞见。

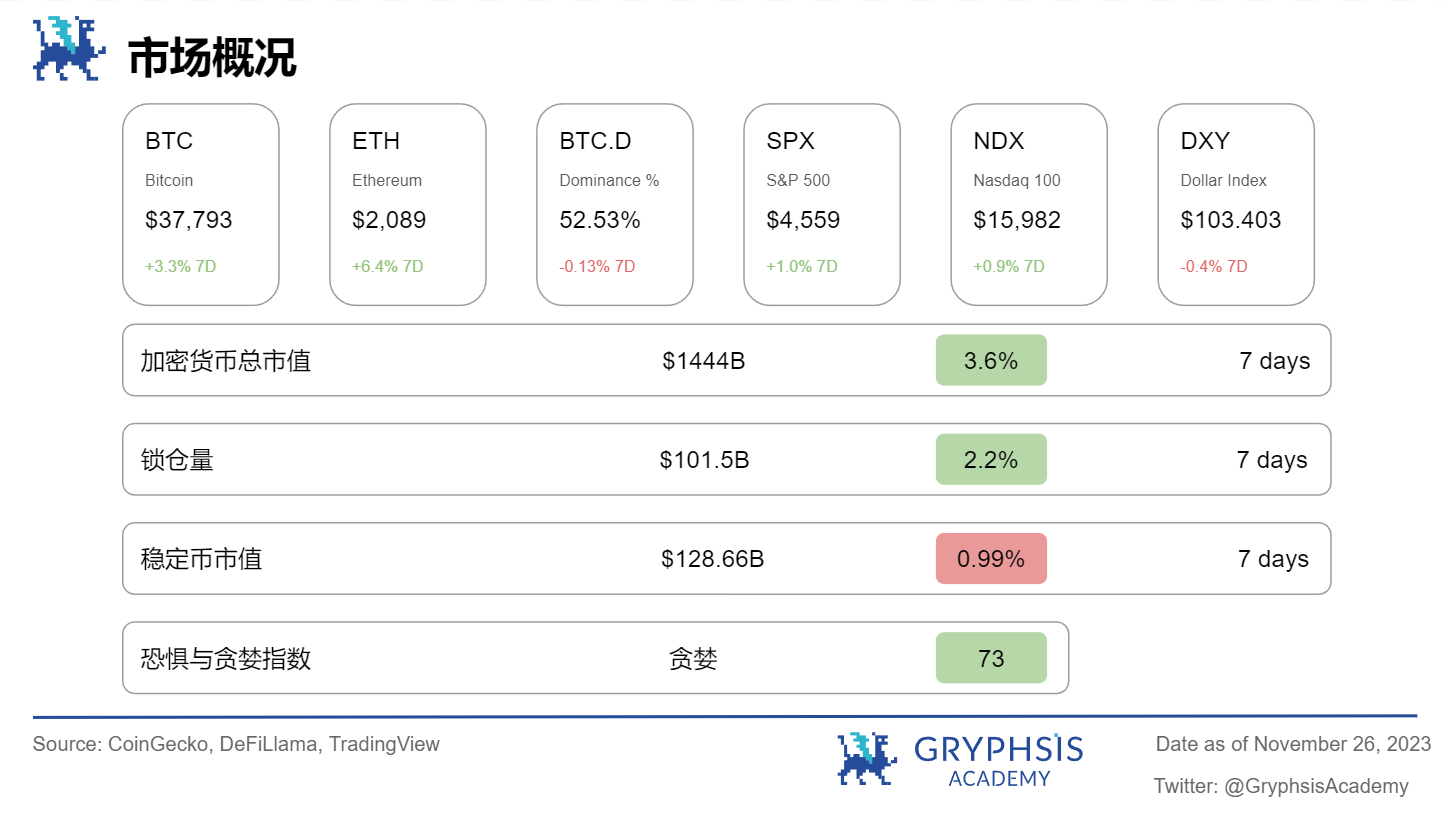

市场和行业快照:

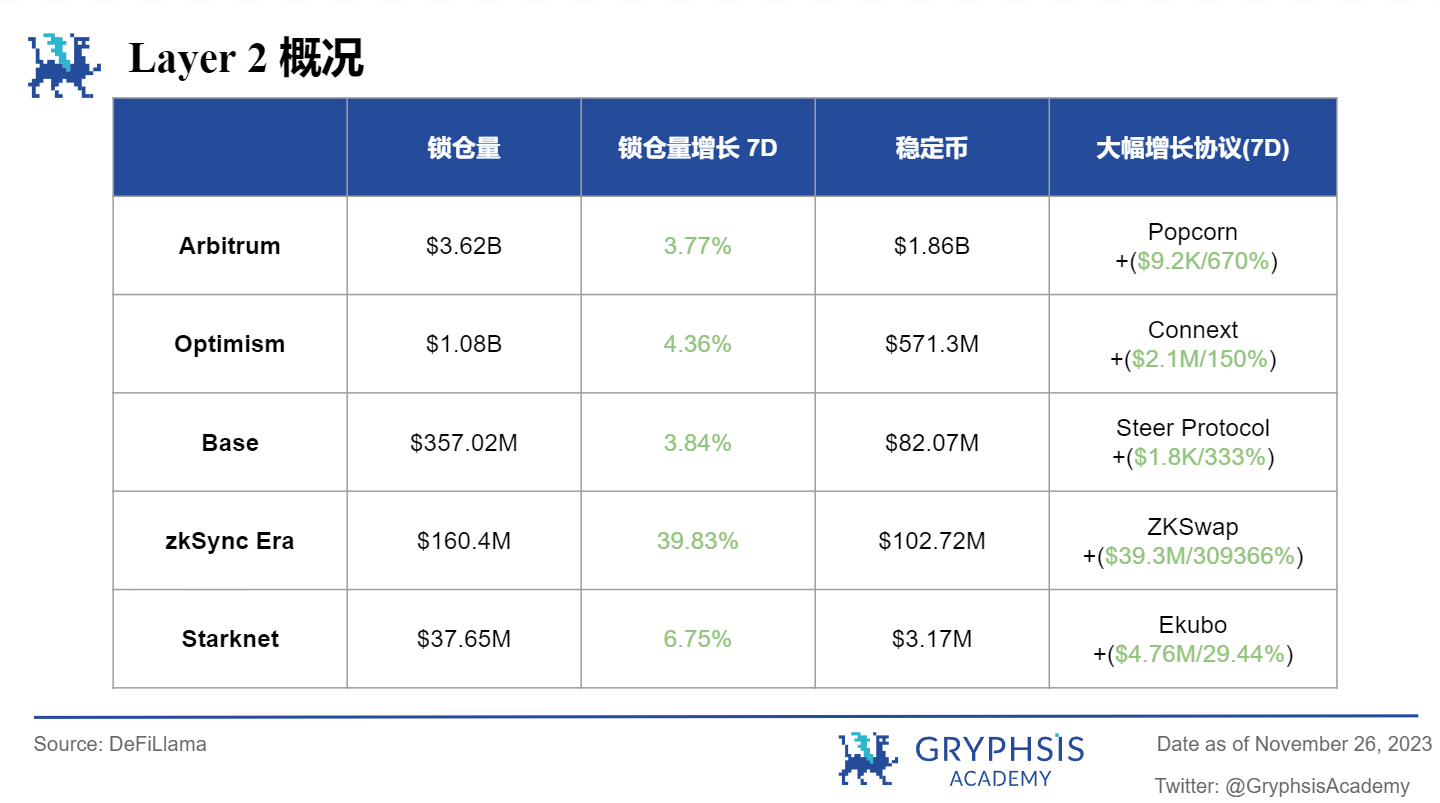

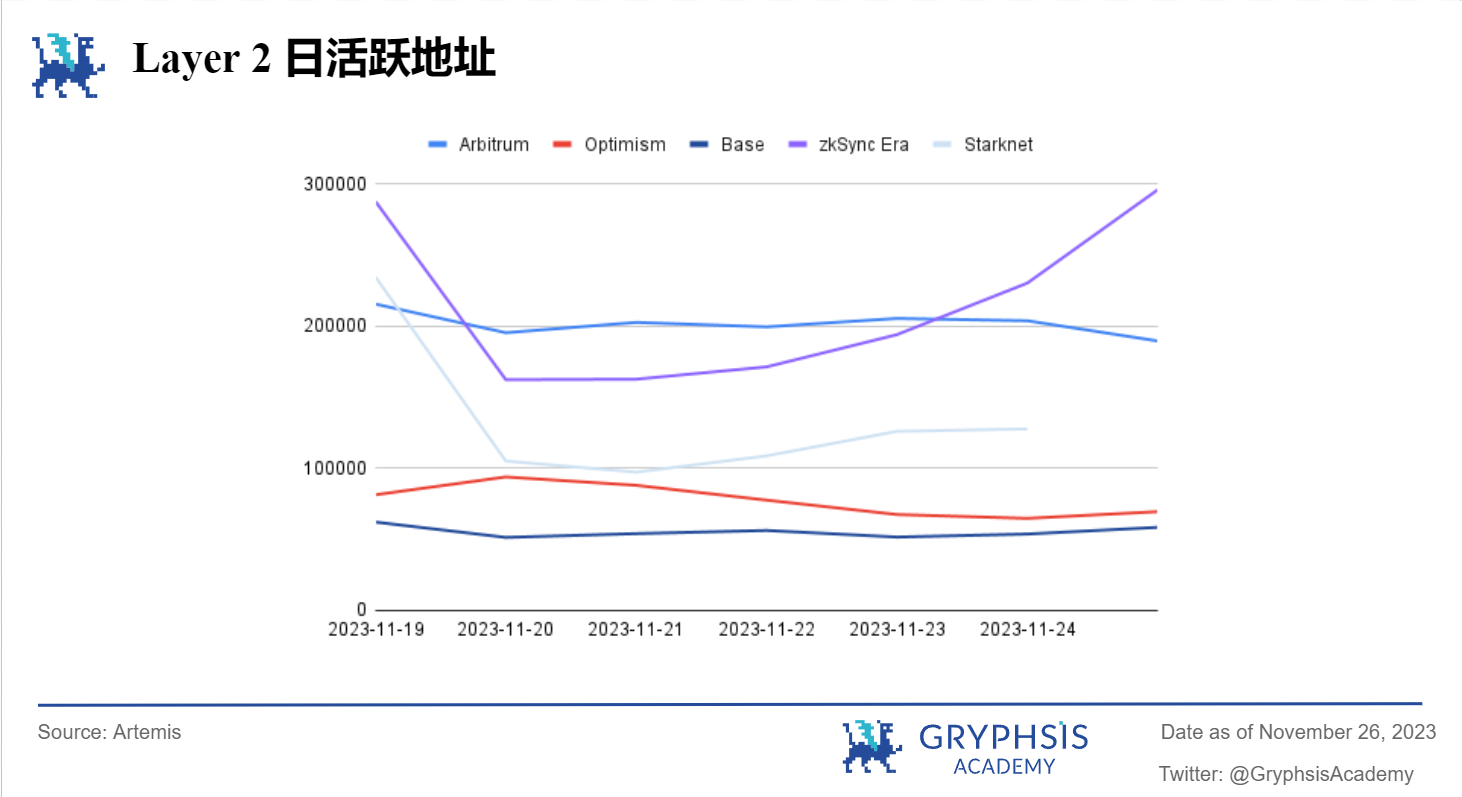

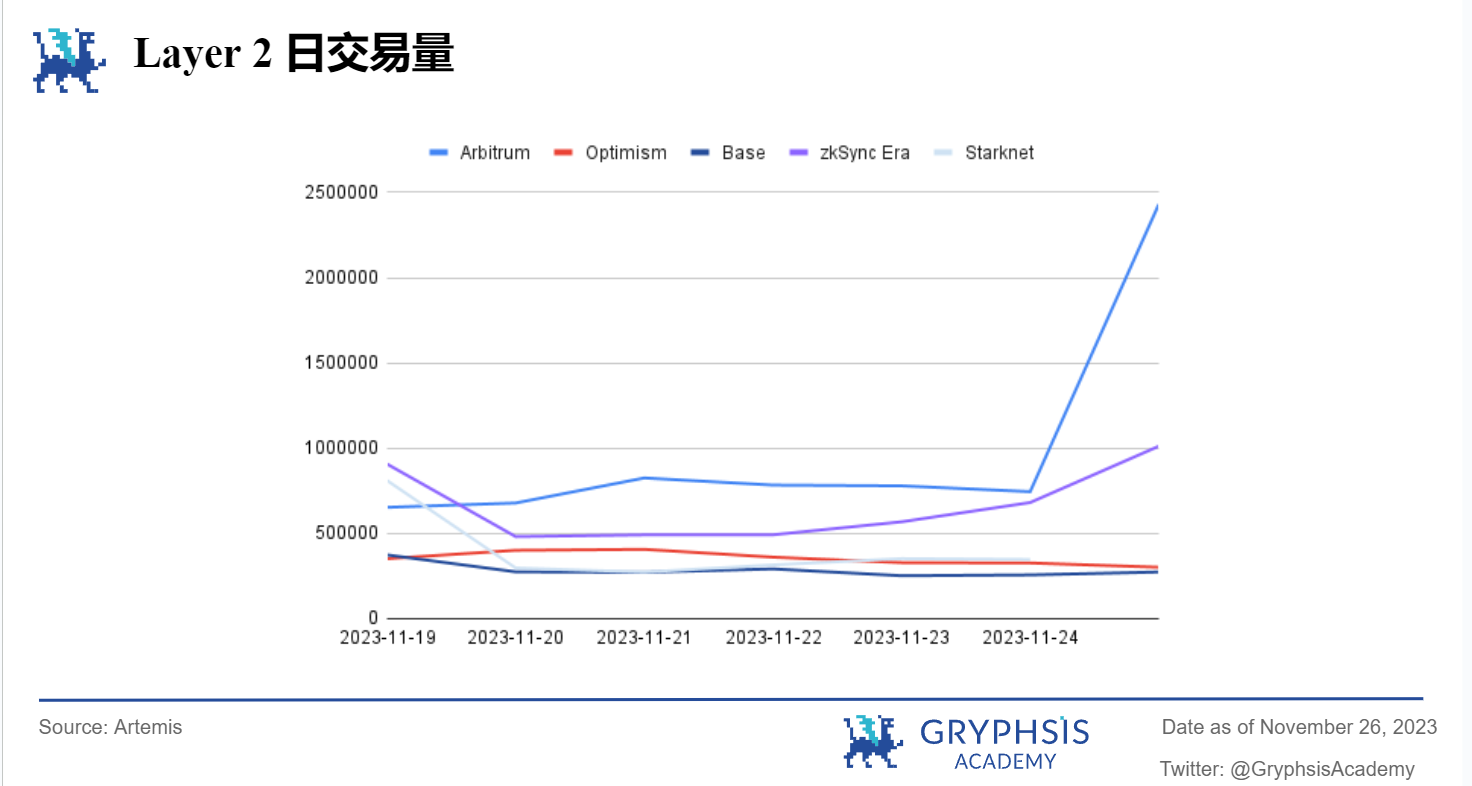

Layer 2 Overview:

上周,Layer 2 整体均呈正增长,其中 Optimism 本周突破了 1 B 的 TVL。zkSync Era 增长最为明显,为 39.83% 。像 ZKSwap、Steer Protocol 和 Popcorn 这些协议展示出了值得注意的 TVL 增长比例。

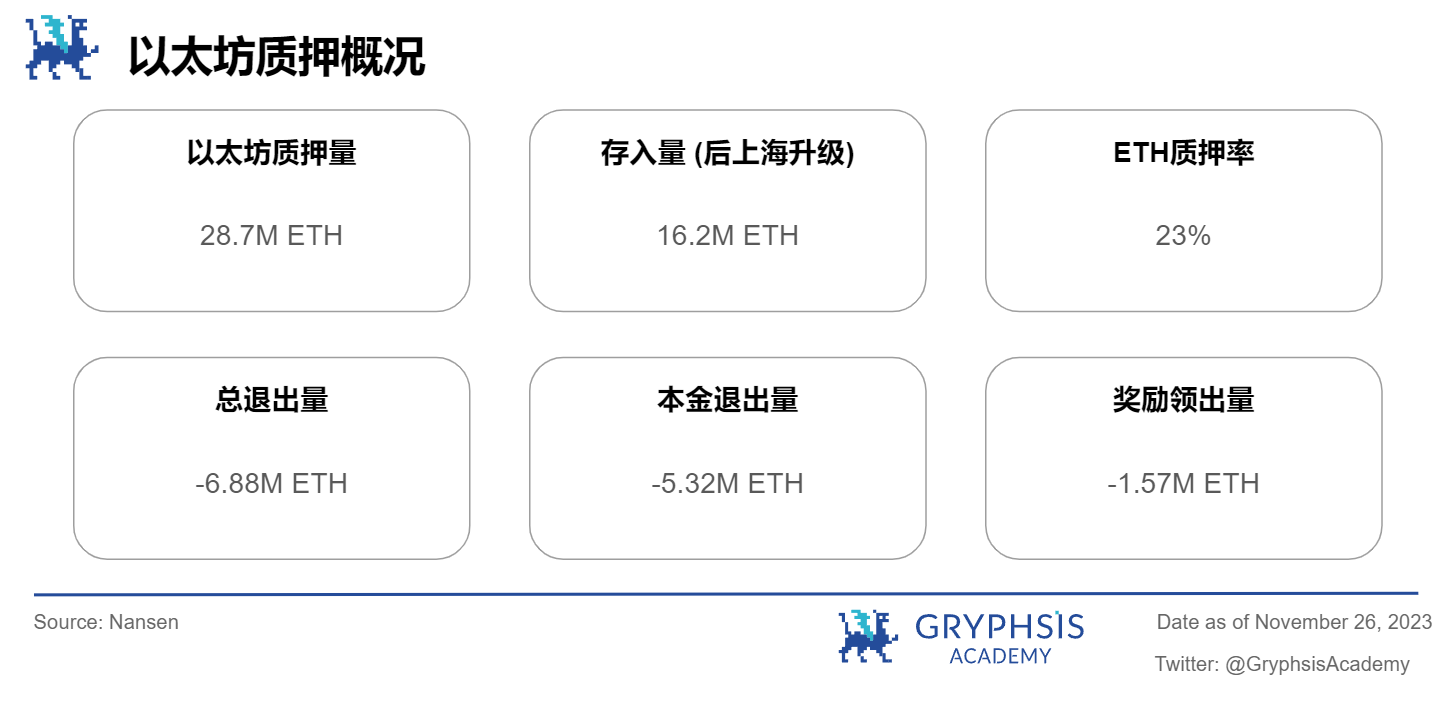

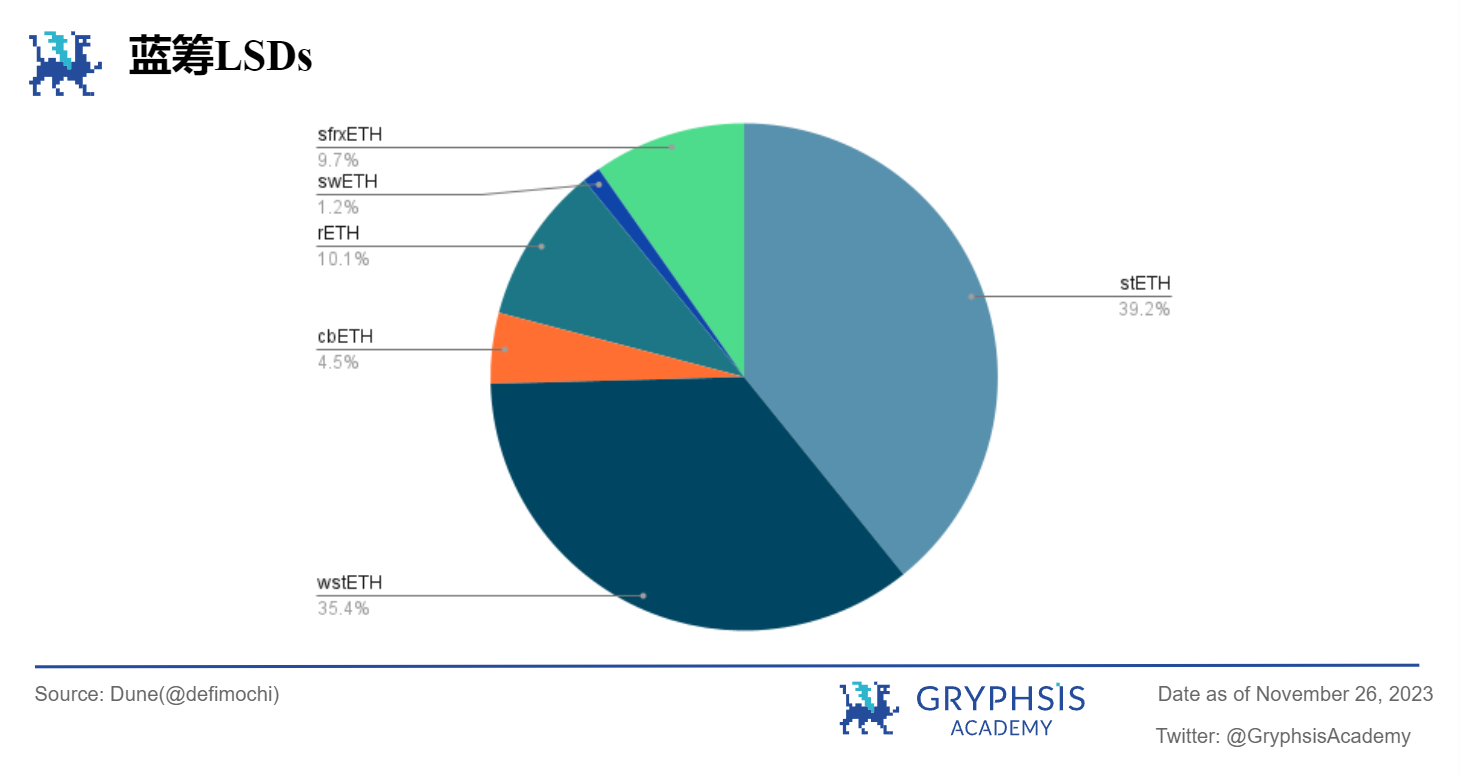

LSD Sector Overview:

在 LSD 领域,以太坊质押保持细微增长,但质押率略有下降,但是幅度不大。就市场份额而言,s 所有蓝筹 LSD 均呈现增长态势,其中 swETH 在本周增长明显,为 16.01% 。

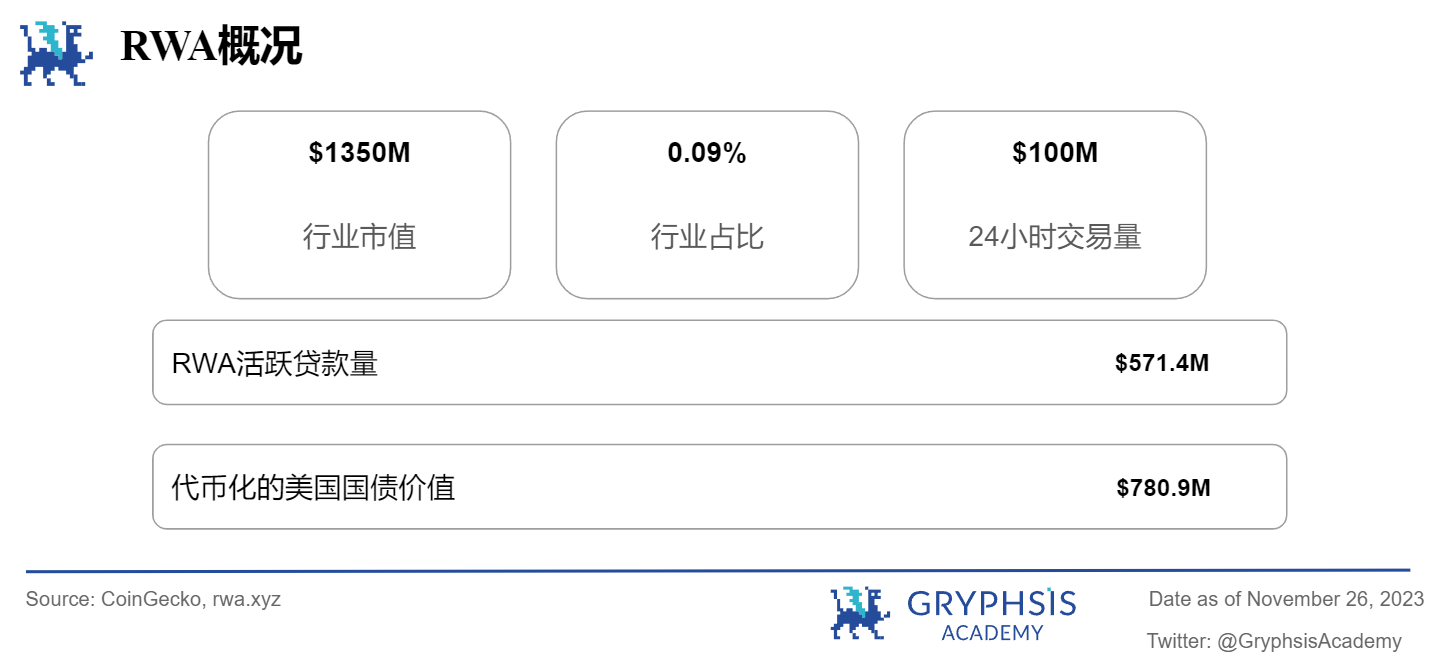

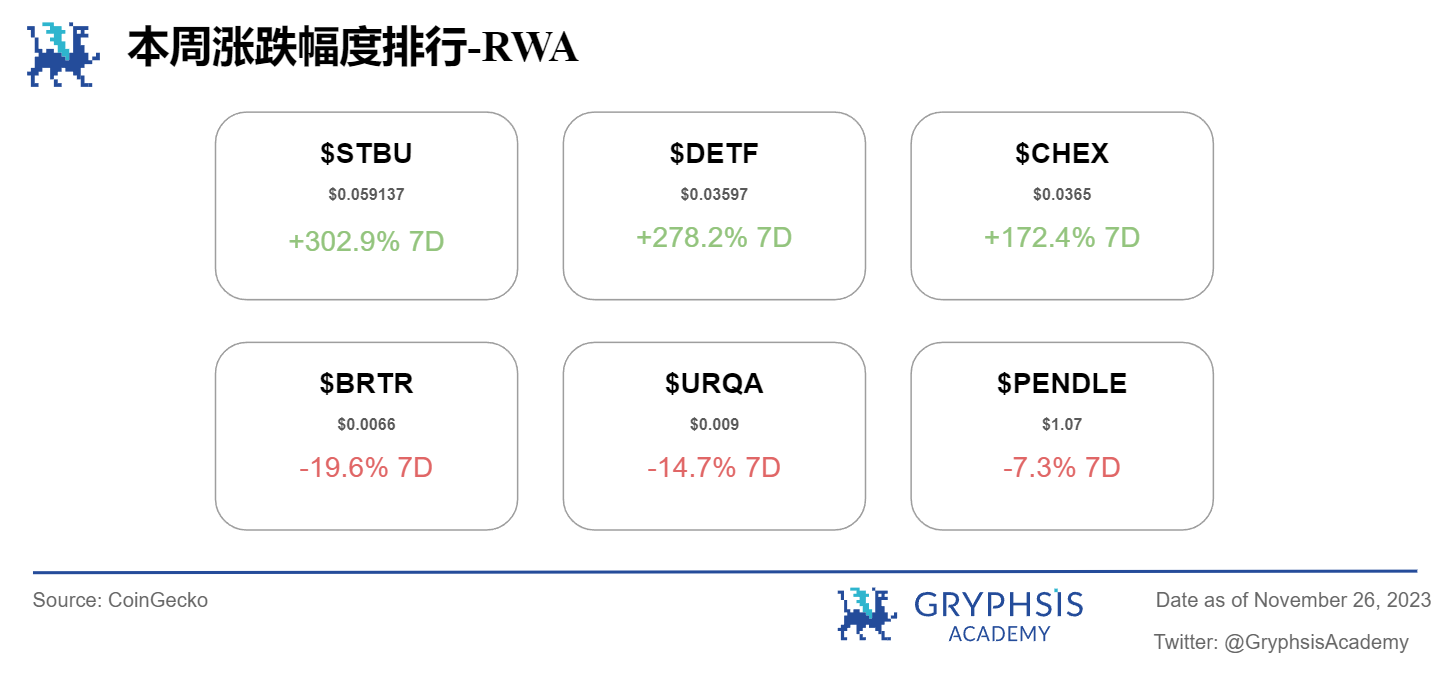

RWA Sector Overview:

上周,世界真实资产的总市值上涨 21.07% ,行业占比上涨 0.013% 。此外 RWA 活跃私人信贷值和代币化国库均有所细微增长。值得注意的增长代币包括 $STBU、$DETF 和 $CHEX。像 $BRTR、$URQA 和 $PENDLE 这样的代币经历了较大的亏损。

Main Topics

宏观概述:

US Stock V.S. Crypto

本周大事件:

Binance Fined $ 4.3 Billion, CEO Resigns, BTC Spot ETF Expected to Rise.

每周协议推荐:

Seneca

每周 VC 投资聚焦

AI 21 Labs($ 155 M)

Blast($ 20 M)

Privy($ 18 M)

推特 Alpha:

Aaron.D on weekly governance

Michael Rinko on Consumer Fraud

Teng Yan on Blast and Blur

Joseph A.C. LIoyd ON Shrapnel

@0x Tindorr on Gamefi narrative

宏观概述

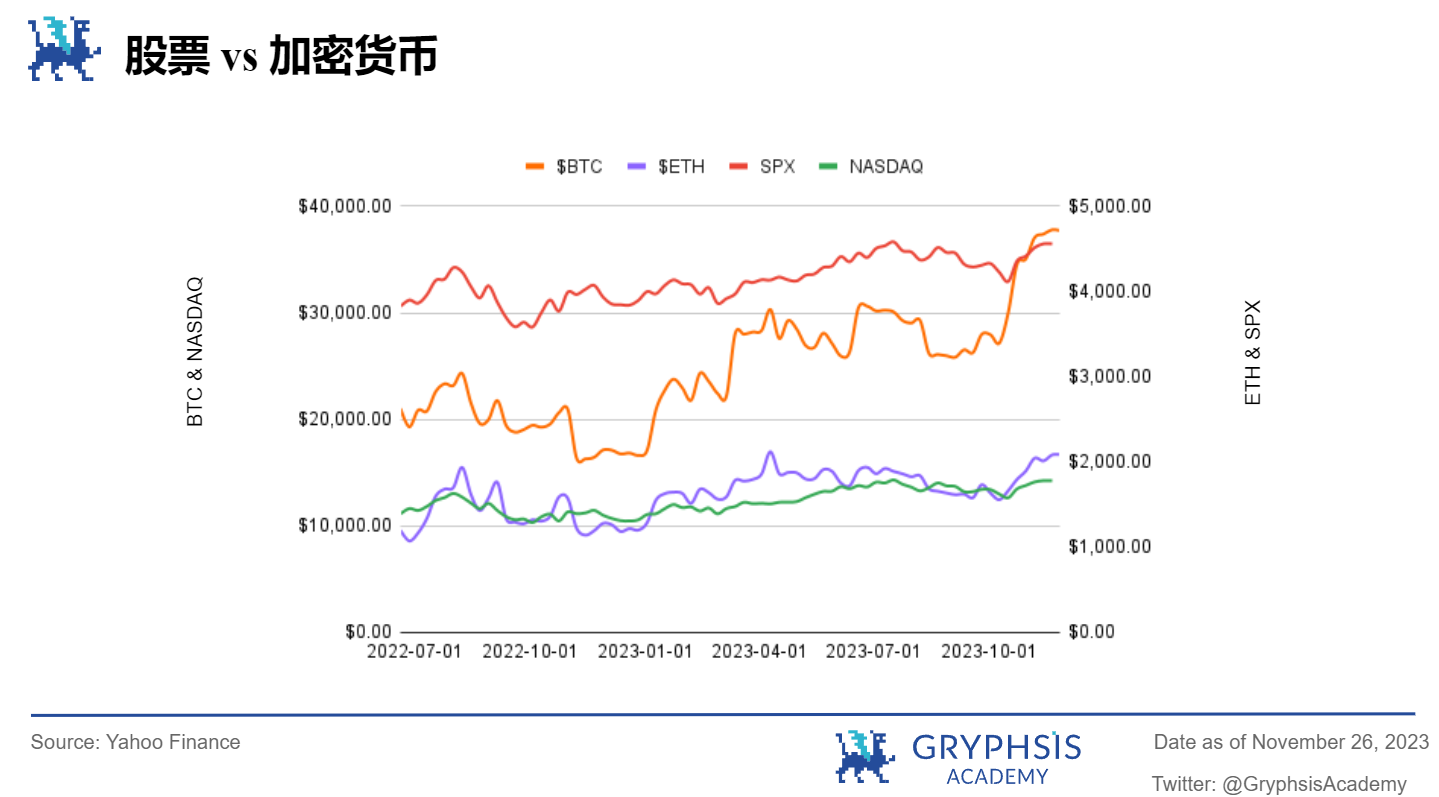

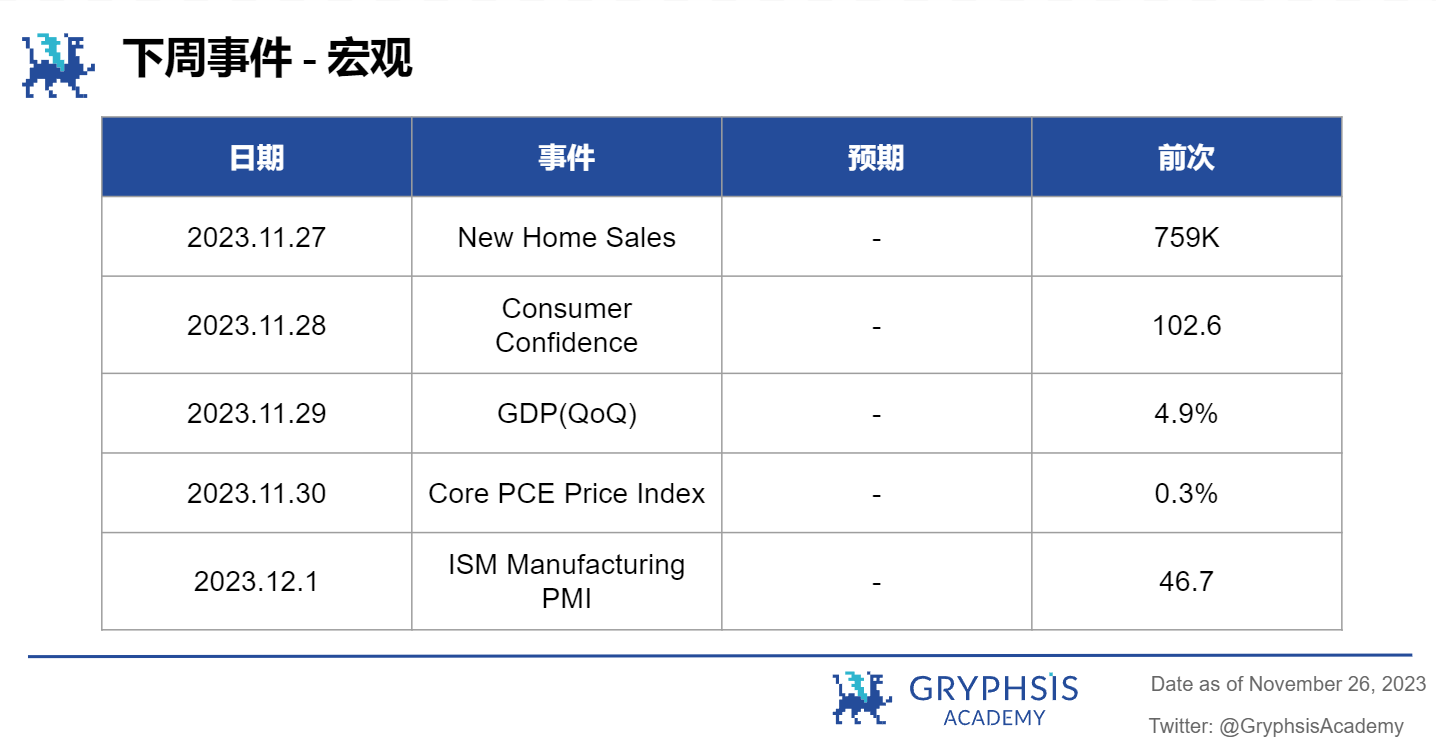

本周,股市和加密市场均呈增长趋势,加密领域上涨更为明显。标普 500 和纳斯达克分别上涨 1.19% , 1.14% , $BTC 和 $ETH 分别上涨 3.3% , 6.4% 。在未来一周,要关注消费者信息,PCE 物价指数,ISM 制造业指数等重大事件。

本周大事件

Binance 被罚 43 亿美金,CEO 赵长鹏(CZ)离职,BTC 现货 ETF 通过预期上涨

11 月 22 日全球最大的加密货币交易所币安因违反制裁和货币传输法而被刑事起诉,并同意支付 43 亿美元以解决这些指控,这是美国从企业被告中获得的“最大罚款”之一。创始人赵长鹏“CZ”在西雅图认罪,同意支付 5000 万美元罚款,并辞去 CEO 职务。前阿布扎比监管机构负责人、后来担任币安区域市场负责人的 Richard Teng 将接任 CEO。

币安因未能维护适当的反洗钱计划、经营未经许可的货币传输业务和违反制裁法而被指控。币安的罚款将被计入其欠商品期货交易委员会的金额中,并与美国财政部和商品期货交易委员会达成和解。

根据认罪协议,币安需要任命一个独立的合规监察员为期三年,并向美国政府报告其合规努力,同时支付罚款。赵长鹏被禁止在未来三年内参与币安的经营或管理,但此禁令将在监察员任命三年后结束。

https://www.coindesk.com/policy/2023/11/21/binance-to-settle-charges-with-us-doj-source/

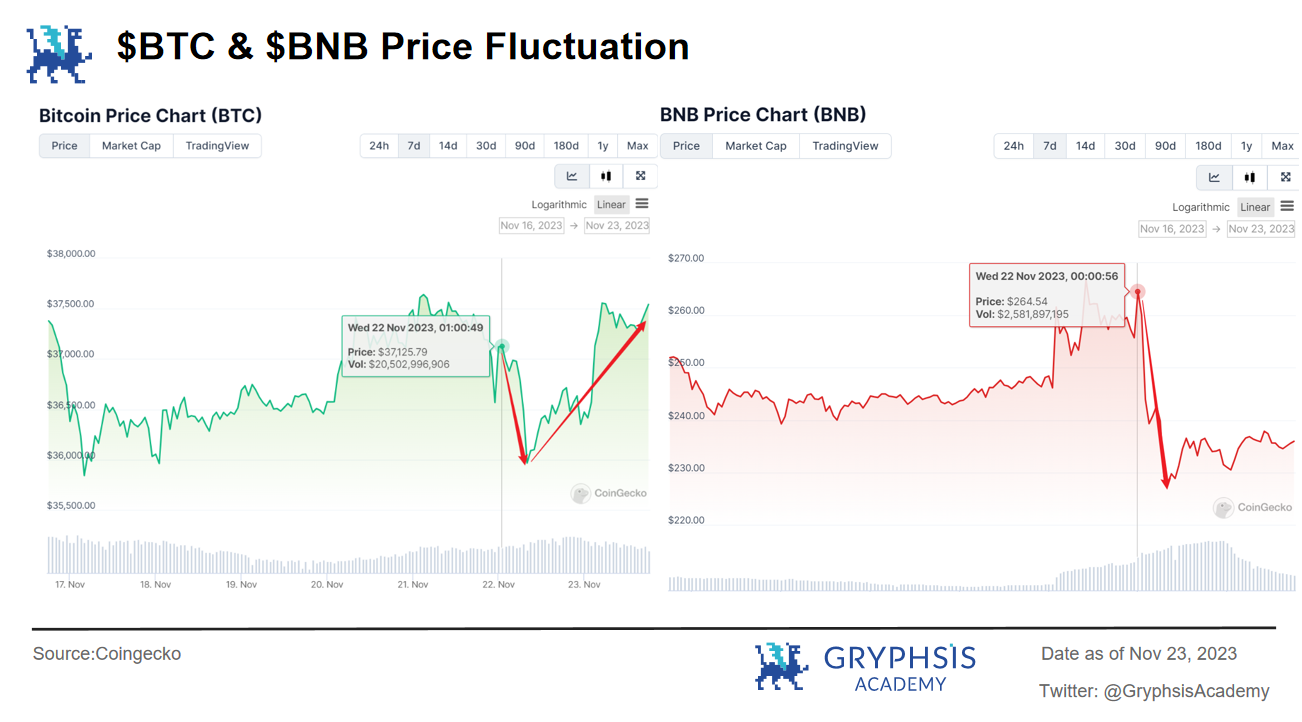

此消息一出,$BNB 价格当日从 264.54 跌到 227.95 ,跌幅为 113.8% 。且根据 The.Block 报道,币安 24 小时流出总量超过了 10 亿美元,但过去 7 天的净流出总额为 7.03 亿美金,相比之下币安此次事件对其的消极影响较大。

不仅如此,BTC 在 22 号当天也下跌明显。主要原因是现货比特币 ETF 的批准乐观兴奋情绪逐渐消退,取而代之的是美国监管机构持续打击的现实。美国司法部宣布将于今天下午晚些时候公布“重大加密货币执法行动”,导致比特币(BTC)下跌超过 2% ,至 36, 400 美元。

但也有一些观察人士指出,Binance 的和解协议实质上可能为美国证券交易委员会(SEC)最终批准一只现货比特币 ETF 扫清了障碍。他们表示,Binance 的中性化和 CZ 的退出,可能缓解了该机构对海外操纵比特币价格的担忧。

但也有一些观察人士指出,Binance 的和解协议实质上可能为美国证券交易委员会(SEC)最终批准一只现货比特币 ETF 扫清了障碍。他们表示,Binance 的中性化和 CZ 的退出,可能缓解了该机构对海外操纵比特币价格的担忧。

加密服务提供商 Matrixport 写道: “有了这份认罪协议,对现货比特币 ETF 的期望可能已经上升到 100% ,因为业界将被迫遵守 TradFi 公司必须遵守的规则。”

每周协议推荐

欢迎来到我们的每周协议环节——在这里,我们会重点关注在加密空间掀起波澜的协议。本周,我们选择了 Seneca,一个针对有收益的资产的全链 CDP 协议。

Seneca 发布于今年 3 月份,已由 Sherlock 完成审计。目前支持 Arbitrum 链,生态有三种代币,原生代币$SEN,$senUSD 抵押稳定币,以及$sSEN 作为治理代币且享有协议收入,仍处于测试网阶段。

Seneca 发布于今年 3 月份,已由 Sherlock 完成审计。目前支持 Arbitrum 链,生态有三种代币,原生代币$SEN,$senUSD 抵押稳定币,以及$sSEN 作为治理代币且享有协议收入,仍处于测试网阶段。

1.$SEN:最大供应量为 100 M,可以通过质押$SEN 获得$sSEN

2.$sSEN:可被转化成$SEN,持有者可以享受协议收入费用和治理权。

3.$senUSD:作为 CDP 稳定币,价格通过动态调整以达到$ 1

1)如果小于$ 1 ,开立 CDP 的用户可以从市场中低价买 senUSD,从而偿还债务

2)如果大于$ 1 ,用户可以开立 CDP 借出 senUSD,然后在市场高价卖出,等价格下降后再买回

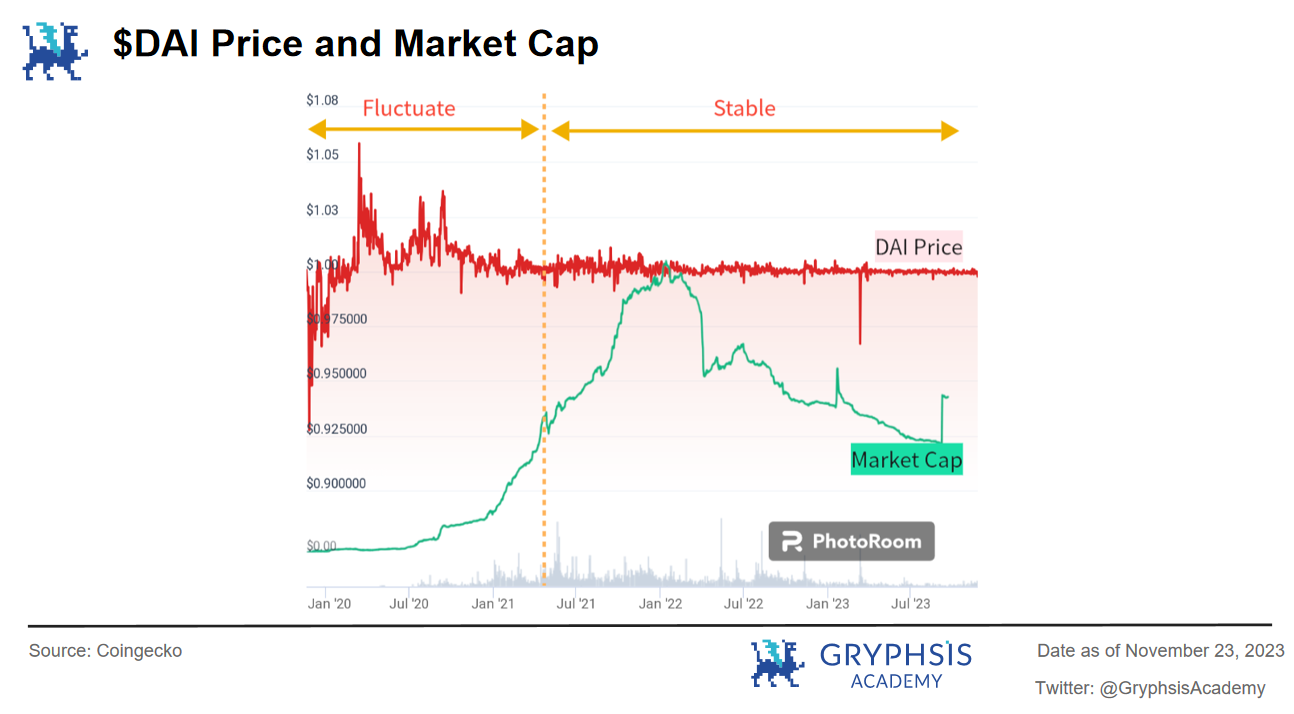

总的来说,senUSD 是通过用户自行套利,通过市场的自我调节来达到 senUSD 和 USD 宽松锚定。

不过由于是测试网阶段,目前用户可以通过质押 WETH,从而借出 senUSD,且现在咱无法实现 senUSD 套利。官方正鼓励用户质押$SEN,获得$WETH 奖励。此外也积极的增加抵押品种类包括$ARB, $wstETH, $rETH,但暂未全部上线。

协议具有以下几个特点:

1. 隔离负债和杠杆:债务相对于抵押品来说是独立的,意味着每一个 CDP 之间都不会相互影响。

2. 利润再分配:sSEN 持有者有权享受协议的 Trading Tax(WETH 计价),借款费用,利息,清算费用组成的收入。

总体来说,Seneca 的机制类似于 MakerDAO 的仿盘,在初期的时候仍有盈利空间。只不过想要构建 omnichain 的 CDP 平台,当下整个体系搭建的较为缓慢,仍需要时间。

我们的洞察

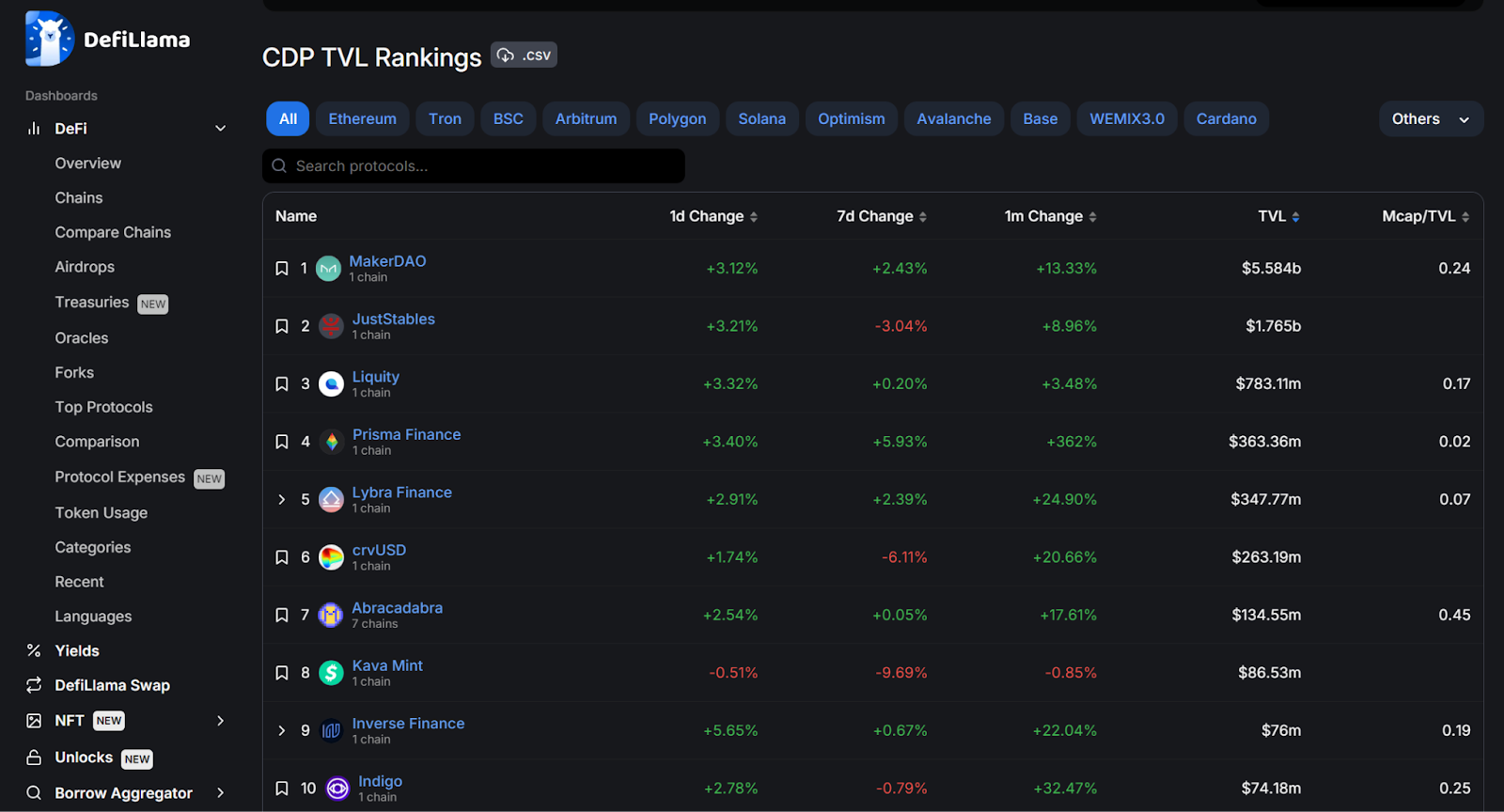

CDP(Collateralized Debt Positions)抵押债仓,Maker DAO 为其首发行人,目前在整个 Defi 赛道中位列前 5 ,共有$ 9.9 2B的 TVL。整个 CDP 赛道中,以 MakerDAO, JustStables, Liquidity 为前三头部协议。

CDP 的一般路径为,用户通过抵押自己的资产,从而换取(超额)抵押稳定币。CDP 会将资产锁定,直到用户偿还稳定币之后才可以拿回抵押资产。当抵押物价值低于清算值是,CDP 会被清算,被强制平仓。

CDP 的一般路径为,用户通过抵押自己的资产,从而换取(超额)抵押稳定币。CDP 会将资产锁定,直到用户偿还稳定币之后才可以拿回抵押资产。当抵押物价值低于清算值是,CDP 会被清算,被强制平仓。

仅以和 Lending 不同的是,CDP 借出的软锚定稳定币在初期阶段在池子深度较浅的情况下存在明显的套利机会,容易被操控。Lending 借出的币种虽不是稳定币,但其大部分流动性深厚,尽管有所波动,但市值量大,操控成本高。

就 Seneca 而言,其机制和阶段发展现状存在潜在的套利机会。不过其最为重要的 senUSD,当下可供抵押的标的只局限于 WETH,且 senUSD 暂没有其他的 DEX 可供交易。所以,这个用户驱动的绝佳标的暂时还未正式开放,但是可以保持关注,先参与早期的 SEN 的激励活动。

目前唯一支持的是 Camelot DEX,允许 SEN-ETH 的 Swap 和 LP(APR 281% ),官方也针对$SEN 的质押提供 WETH 奖励(APR 177% )。且后续官方会给 SEN/senUSD 池的 LP 基于两部分的激励,一块是 Bribe,还有每 Epoch 给的额外$SEN 排放,最早期的 Epoch 每天排放 90268 个$SEN。

综合而言,可以对 Seneca 保持关注,且当下的 APR 数据较为理想可以提前参与,等待 senUSD 上线后进行套利。

每周 VC 投资聚焦

欢迎来到我们的每周投资聚焦,我们在这里为你揭示加密空间中最重大的风险投资动态。每周,我们将重点关注获得最多融资的协议。

AI 21 Labs

AI 21 Labs 成功完成了 1.55 亿美元的 C 轮融资,使该公司的融资总额达到 2.83 亿美元,估值为 14 亿美元。投资者包括 Walden Catalyst、Pitango、SCB 1 0X、b 2 venture、Samsung Next、Google 和 NVIDIA。该公司旨在为企业带来可靠的生成式 AI,为企业提供基于其领先的 LLMs 和神经符号系统的创新自然语言解决方案。

https://x.com/AI21Labs/status/1697211212616843727?s=20

Blast

以太坊二层扩容方案 Blast 已经在早期访问阶段上线,其创始团队是 NFT 市场 Blur 的原班人马。由 Paradigm 和 Standard Crypto 等公司投资 2000 万美元。Blast 声称为以太坊和稳定币提供原生的二层收益生成,已经吸引了超过 3000 万美元的资产。

https://x.com/Blast_L2/status/1726747087906464024? s= 20

Privy

Privy,一个旨在安全地收集数据的开发者工具平台,已经完成了由 Paradigm 领导的 1800 万美元的 A 轮融资。其他参与者包括 Sequoia Capital、Archetype Ventures 和 BlueYard Capital。该项目将利用新的资金来扩大团队,并继续构建其库,以便开发人员可以创建引人入胜的链上应用程序,供任何人使用。

https://x.com/privy_io/status/1726967584472576157?s=20

协议事件

Binance saw $ 1 billion in net outflows

PancakeSwap proposes veCAKE launch to boost governance influence and liquidity

Ethereum Layer 2 Kinto migrates to the Arbitrum ecosystem

Blast goes live in early access after $ 20 million raise

KyberSwap offers 10% bounty to hacker following $ 47 million exploit

行业更新

SEC recently met with Grayscale for spot bitcoin ETF listing

Altcoins lead market retrace ahead of release of Fed minutes

Paradigm leads $ 18 million Series A raise for web3 infrastructure startup Privy

Wintermute Asia executes first options block trade through CME Group

SEC files new lawsuit against Kraken for allegedly operating online trading platform without registering

推特 Alpha

在加密推特中蕴含了许多 Alpha,但在数千条推特线程中导航可能很困难。每周,我们都会花费几个小时进行研究,精选出充满洞见的线程,并为您策划每周的精选列表。让我们深入了解吧!

https://members.delphidigital.io/feed/having-a-blast-with-blur?&utm_source=link&utm_medium=portal

https://x.com/0x Tindorr/status/1728438340708704398? s= 20

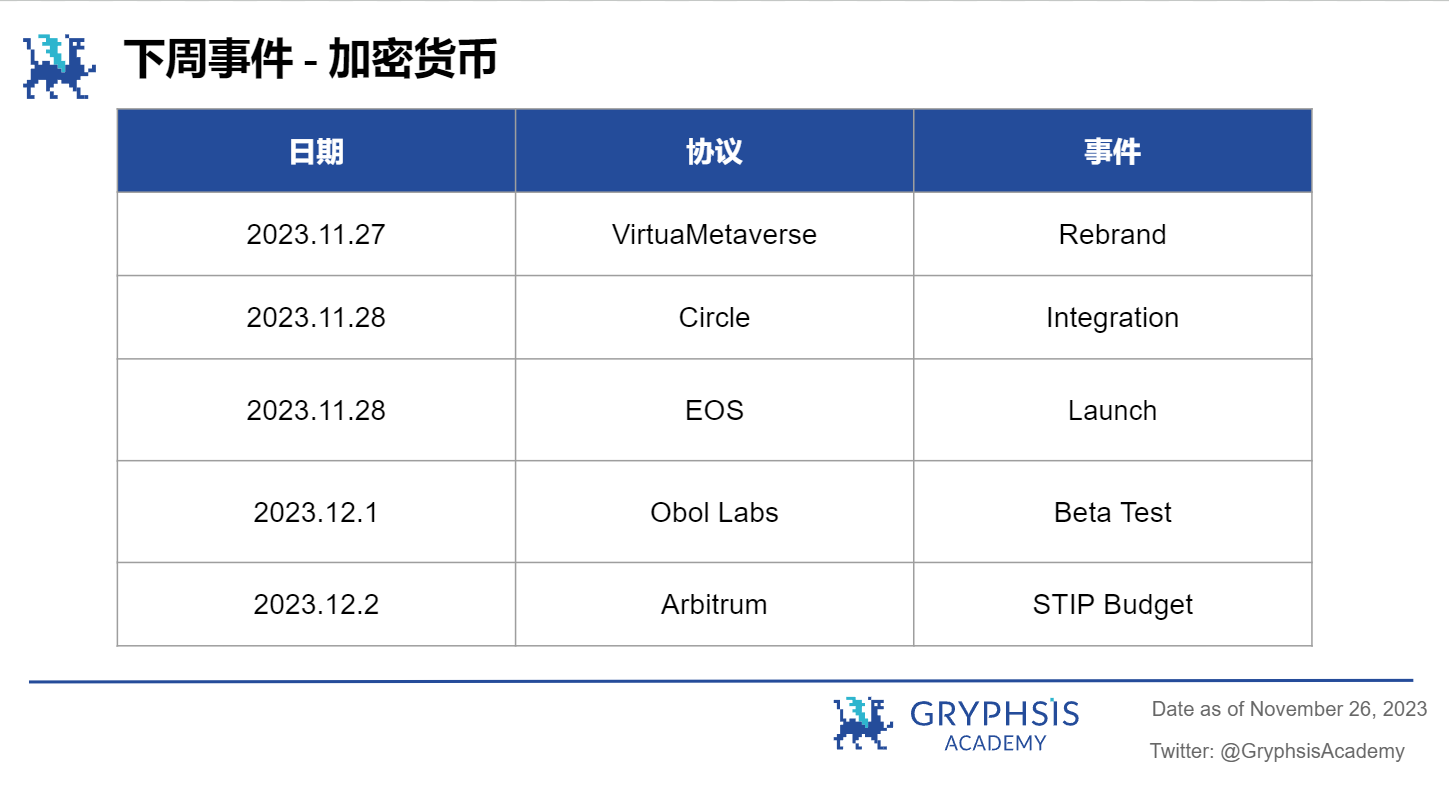

下周事件

新闻来源:

https://www.theblock.co/post/264579/kyberswap-offers-10-bounty-to-hacker-following-47-million-exploit

https://www.theblock.co/post/264204/binance-saw-1-billion-in-net-outflows-over-the-last-24-hours

https://www.coindesk.com/policy/2023/11/21/binance-to-settle-charges-with-us-doj-source/

以上就是本周的全部内容。感谢您阅读本周的周报。希望您从我们的洞见与观察中获益。

可以在 Twitter 和 Medium 上关注我们,获取即时的更新。我们下期再见!

此周报仅用于提供信息。它不应作为投资建议。在做出任何投资决策之前,您应进行自己的研究,并咨询独立的财务,税务或法律顾问。且任何资产的过去表现并不能预示未来结果。