BTCを大量に保有する機関の損益を一目で見る: 8億米ドルの利益を上げた人もいれば、依然として損失を抱えている人もいる

最近、暗号通貨市場が急騰しています。市場の強気ムードが強い中、ビットコイン価格は一時3万5000ドルを超え、現在はこの価格付近で推移している。

個人投資家がBTCの上昇を応援している一方で、市場の「大手」である機関投資家に視点を戻してみましょう。

この一連の急騰の後、かつて仮想通貨市場を喜ばせていた多数の伝統的な機関の投資ポジションはどうなったのでしょうか?その機関のポジションは現在利益を上げているのでしょうか、それとも損失を出しているのでしょうか?

Coingecko のデータによると、現在世界中でビットコインを保有している上場企業は 28 社あり、合計 239,494 ビットコイン、約 240,000 BTC、総市場価値は約 81 億米ドルを保有しています。

上場企業に加えて、主権国家も仮想通貨の代替「投資家」であり、(司法上の理由により)積極的または消極的に大量のビットコインを保有しており、その中で最も有名なのはエルサルバドルです。

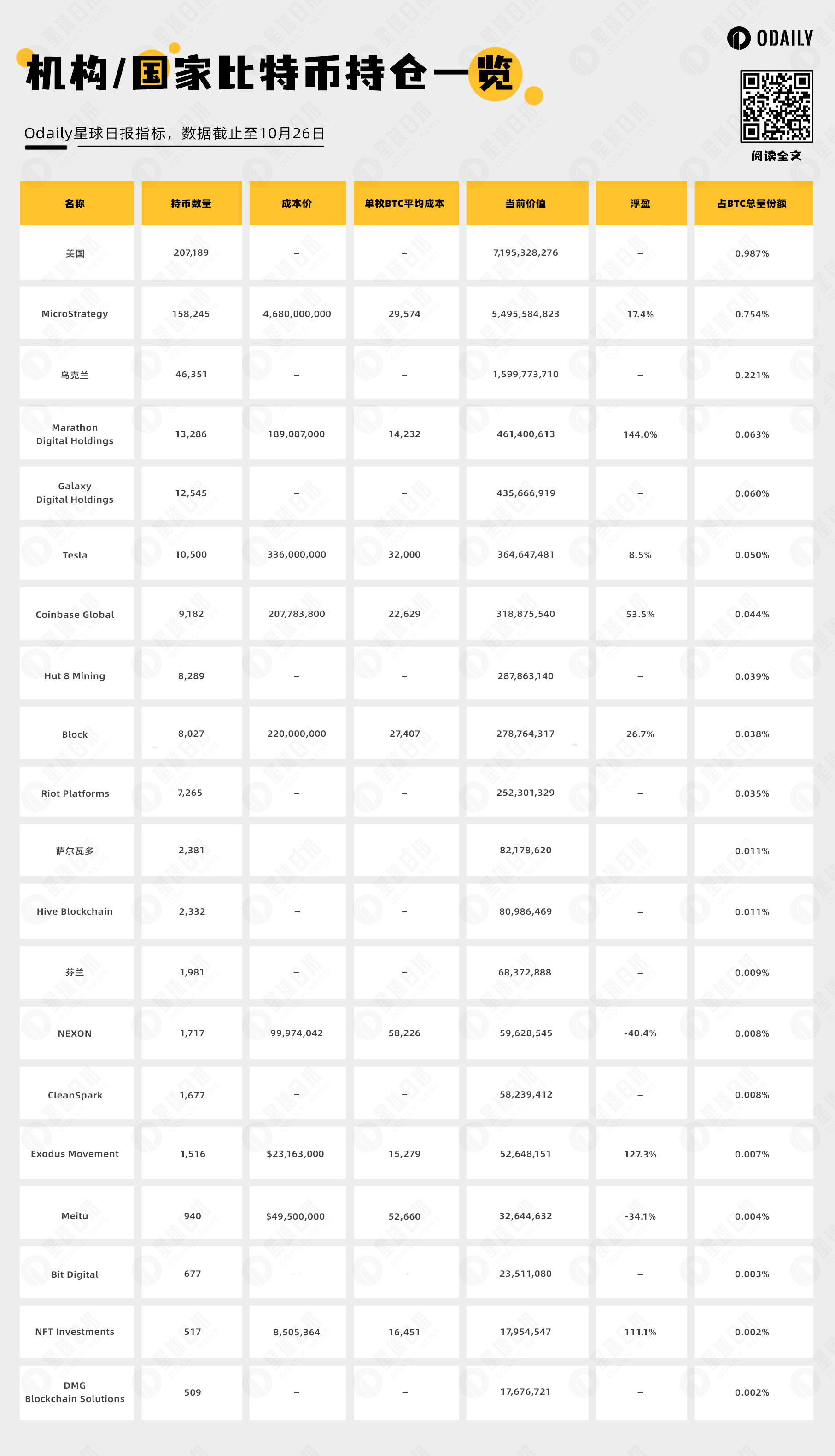

Odaily は主流の機関や国のビットコイン保有状況を集計しており、詳細は次のとおりです。

上場企業28社のうち、16社が500ビットコイン以上を保有している。さらに、500 枚以上のコインを保有する主権国が 4 つあります。

アメリカ政府

ビットコインクジラの中で最も注目すべき存在は米国政府だ。通貨保有者は仮想通貨投資家でも金融機関でもありませんが、知らないうちに、米国政府は仮想通貨の世界でトップクラスのビットコイン富裕層になっています。さらに興味深いのは、このデジタル通貨には無関心であるということです。 。

IRSのサイバー・法医学サービス部門の責任者であるジャロッド・コープマン氏は、「我々は市場で勝負しているわけではない。基本的には我々がプロセスを設定している」と公に述べている。

購入を通じてビットコインを蓄積する他のクジラとは異なり、米国政府のビットコインのほとんどは没収収入から来ています。

最近の3件の押収だけでも、政府の金庫には20万以上のビットコインが残されている。以前、米国政府は一時約 20,000 ビットコインを売却しましたが、米国政府が「清算」するたびに、暗号化市場は混乱します。

Coingecko氏は、米国がまだ20万7000枚以上、約71億9000万ドル相当のビットコインを保有していることを示した。対照的に、ビットコインの「熱狂的ファン」として知られるMicroStrategyは、現在15万8000ビットコインしか保有していない。

関連書籍:

ウォール・ストリート・ジャーナル: 米国政府が保有する50億ドルのビットコインはどこから来たのでしょうか?

米国政府のビットコイン保有状況をひと目で見る:売却時期と売却額の予測

MicroStrategy

浮動利益:約8億1,600万米ドル(17.4%)

MicroStrategy は、大量のビットコインを購入した最初の米国の上場企業であり、最大の通貨を保有する米国の上場企業でもあります。 2020年8月から現在までに、MicroStrategyは合計28回のBTC購入を発表し、合計158,245ビットコインを購入し、合計平均保有価格は29,582ドルでした。

この会社がよく知られている理由は、ビットコイン購入の多さだけではなく、MicroStrategy のビットコインに対する「マニア」によるものでもあります。同社はBTCを購入して以来一度も売却しておらず、そのダイヤモンドの針は強気派と弱気派を行き来している。

Coingeckoのデータによると、同社が購入したBTCは815,584,823米ドル、約8億1,600万米ドル、変動利益17.4%の変動利益を生み出しました。

MicroStrategy が 2020 年 8 月に初めてビットコインを購入して以来、ビットコインはこの期間に 147% 上昇しました。 SP 500は26%上昇、ナスダックは18%上昇し、金は3%下落、銀は19%下落、債券は24%下落した。この期間でビットコインが最もパフォーマンスの高い資産クラスであることは疑いの余地がありません。 MicroStrategy のダイヤモンドハンドは大きな成果を上げています。

ダイヤモンドハンドに加えて、MicroStrategy がさらに注目を集めている興味深い事実は、同社の購買行動が市場に「形而上学的な」影響を与えていることです。

購入のたびに、ソーシャル メディアでは「MicroStrategy を買えば市場は下がる」という弱気な発言がよく見られます。

Odaily はまた、MicroStrategy の 28 BTC 購入を調査し、MicroStrategy による BTC 購入の発表と市場価格との間に何らかの関連があるかどうかを調査しました。

関連書籍:

MicroStrategy が BTC 購入を発表するたびに衰退の兆しがあるのでしょうか?

もう一つの BTC ETF: MicroStrategy が継続的に大量のビットコインを購入している背景

テスラ

変動利益:約3億6,400万米ドル(8.5%)

仮想通貨市場で最も魅力的な「人物」を挙げるとしたら、残念ながらすべての投資家には選択肢が 1 つしかないでしょう - テスラ CEO、スペース X CEO、そして自称「ドージコイン CEO」イーロン・マスクです。

マスク氏が「注文を呼び掛ける」たびに、市場は大きな変動を経験することになる。マスク氏自身が「注文を呼び掛ける」だけでなく、マスク氏率いるテスラは暗号化市場に深く関与しており、大量のビットコインを購入している。

10月中旬、テスラは最新の財務報告書を発表した。財務報告書によると、同社は第3四半期にビットコインの売買を行っておらず、テスラがその地位を変えていないのは5四半期連続となる。

Coingeckoのデータによると、テスラは約1万500ビットコインを保有し、時価総額は約3億6,400万ドルとなっている。

ビットコインマイニング会社

マラソンの変動利益: 約 4 億 6,100 万米ドル (144%)

この記事に掲載されている他の企業の「コイン投機」とは異なり、マイニング会社は機関投資家の中でも比較的特殊な存在です。たとえば、Marathon と HUt 8 は両方とも、自己運営のマイニングとその後の BTC の長期保有と投資のビジネス モデルを採用しています。

そのビットコインは多額の購入に依存していませんが、かなりの部分は独自の生産物から来ています。このため、同社のビットコイン保有コストは他の企業よりもはるかに低いです。リターンの点では、マラソンの 144% のリターンは、上場企業のビットコインのリターンの中で第 1 位にランクされます。

マラソンは 2010 年にネバダ州で Verve Ventures, Inc. として法人化されました。 2017 年、同社はデジタル資産マイニング機器を購入し、デジタル資産マイニング用のデータセンターをカナダに設立しました。しかし、同社は2020年にカナダでの事業を停止し、当時すべての事業を米国に統合した。同社はその後、ビットコインマイニング活動を米国内および国際的に拡大してきました。同社は2021年3月1日付でマラソンデジタルホールディングス株式会社に社名変更した。

現在、同社の主な事業は自社運営のビットコインマイニングです。そのビジネス戦略は、鉱山を展開するためのマイニングマシンの購入に資金を提供し、生産の運営コストを現金で支払い、その後長期投資としてビットコインを保有することです。

Hut 8 はカナダのビットコイン マイニング会社で、高度なハードウェアとデータ センター リソースを使用してビットコインのマイニングに注力しており、北米最大の上場ビットコイン マイニング会社の 1 つです。 Hut 8 は、マイニング業務に加えて、ハイパフォーマンス コンピューティングなど、暗号通貨に関連する他のサービスやソリューションも提供しています。

Hut 8 は通常、運用コストを削減し、効率を高めるために、カナダの一部の遠隔地など、エネルギーコストが低い地域に採掘施設を配置しています。これにより、同社は競争の激しい仮想通貨マイニング市場で競争力を維持することができます。

もう 1 つの興味深いデータは、ビットコインが最近大きな利益を上げているということです。しかし、ビットコインマイニング企業の株はビットコインよりも高いリターンを持っています。

CoinGeckoのデータによると、Argo BlockchainとTeraWulfを除くすべての仮想通貨マイニング株は年初来のリターンでビットコインを上回っており、ビットコインの84.61%と比較して平均約150%となっている。これは、ビットコインに対する市場の楽観的なセンチメントを別の観点から示しています。

関連書籍:

美しい写真

浮動損失:約1,686万米ドル(-34.1%)

この記事に登場する中国企業は Meitu のみです。現在、BTCとETHの保有総額は16,855,368ドルの損失となっています。

先月、Meituは2023年の中間決算報告書を発表した。報告書によると、今年上半期のMeituの収益は前年比29.83%増の12億6,100万香港ドルに達し、純利益は前年比320.4%増の1億5,100万香港ドルに達した。株主帰属利益は前年同期比20%増の2億2,800万香港ドルとなり、利益は従来予想の2億2,000万香港ドルを上回り、2億6,500万香港ドルとなった。

同社の仮想通貨への投資は約6億7,000万香港ドルの帳簿上の損失を被ったが、今年の市場回復により帳簿の減損は1億8,600万香港ドル回復した。

2021年に遡ると、Meituは31,000 ETHと940.89 BTCを購入しました。仮想通貨を保有してきたMeituは、「グループは仮想通貨投資計画に基づいて仮想通貨を売買したことはない」と述べた。