Intent在Web3中的表现形态和破圈效果

原创 | Odaily星球日报

作者 | 0x Sekiro

DeFi 作为区块链世界的基石,一直以来给我们的印象就是严肃专业,只有 Smart Money 和资深的链上玩家,才能通过复杂的交互流程和公式计算,在冰冷但繁荣的代码森林中获得果实。但 AI 的出现,让交互变得具有了艺术性,并将对 DeFi 乃至Web3的范式产生深刻的改变。

诚如 Onekey 创始人王一石所言,Web3的叙事已经从加密货币转向 AI。不仅是 AIGC 对Web3自由创造氛围的推动。更重要的是,由 AI 带来的“以意图为中心(Intent-centric)”的思潮,正在反过来推动 DeFi 的改变。

无论是,通过 API 接口,将 DeFi 产品集成到 Telegram 的 Bot 们,还是像 Dune、Nansen 这种在各自平台接入 AI 服务的平台,亦或是 Anoma 这种以意图识别为核心的生态。我们都可以宽泛的视为意图对Web3生态的推动。

对于意图的重视,为 DeFi 赋予了新的前端需求,并提供了新的战场。在Web3流量见顶的前提下,谁能更有效率地捕获用户意图,就意味着有了多一分破圈、获得增量的可能。

Intent 并不是一个新概念

在Web3语境里,早期1inch相较于 Uniswap 的多 DEX 聚合性,便属于意图解读的范畴。举个例子,在 DeFi 早期,如果没有前端,那么用户要想在 DEX 上最大效用地买到一枚 ETH,就需要手动地去查找不同交易所的兑换价格,还要根据不同池子的深度去拆分自己的交易。

但事实上,我们在1inch上,其实不需要关心 Uniswap 的交易路径是怎么样的。1inch——DEX 聚合器的介入,就会将交易拆分到多个交易所从而获得最佳结果。

这就是1inch读懂了大众用户最基础的意图,并基于 DEX 功能的优化。

宽泛来说,我们日常生活中用到的诸如 Siri、或者其他 Bixby 等智能语音助手,便是传统世界 Intent 的最直观体现,尽管还不够完全智能,但基于一段语音输入,便能明确日程安排的行为,已经成为 Intent 的范例。

“嘿,siri,提醒我明天上午 10 点进行 BTC 合约的平仓。”在这一行为中,Siri 就充当了意图解读者的角色,通过解读用户的话语,拉取移动端的相关应用并代替用户输入指令。除了不能交易。

将这一范式平移到Web3语境中,我们会发现,当前Web3的诸多产品,仍旧无法做到 Siri 那般智能,而涉及到链上交易复杂的逻辑,Siri 以及传统世界也并没有给我们提供更多的路径参考。

Siri 之所以能够高效的解读用户的 Intent,其前置条件在于 IOS 端口强大的整合性,TB 级的数据和十亿级别的应用不断训练,能够给与 Siri 极大地发挥空间。而这一条件,是此前Web3行业所不具备的。

意图是复杂的,人与人之间的意图交互尚且存在误判,机器与人之间,误判恐怕会更深。但 AI 和大语言模型的普及,给意图准确识别带来了可能,这也是为什么近期意图识别在Web3被重视的原因。

意图的三个层次

让 AI 读懂你的意图,这将给你的Web3交易行为带来改变。

在 Paradigm 的一篇关于 AI 的文章《Intent-Based Architectures and Their Risks》中,对于交易方式有不同的说明,这里我们可以扩列为三个层次。我们也可以通过对当前行业内 DeFi 项目的分类,有一个直观的认知。

第一层次,交易策略的自执行:

即用户自己手动完成交易的全部流程。如果你想在 Metamask 中快速地用 USDC 买一些 LINK,那么目前你有两个方式选择:第一种方式,手动打开钱包,选择币种,添加 Gas,点击 Swap。

这一层次基本上是以 AI 大范围普及前的大多数产品为代表。

第二层次,交易策略的意图辅助:

这是行业内目前主流的思路,基于有限的意图辅助,让用户可以较为简单的获得需要的信息或交易结果。

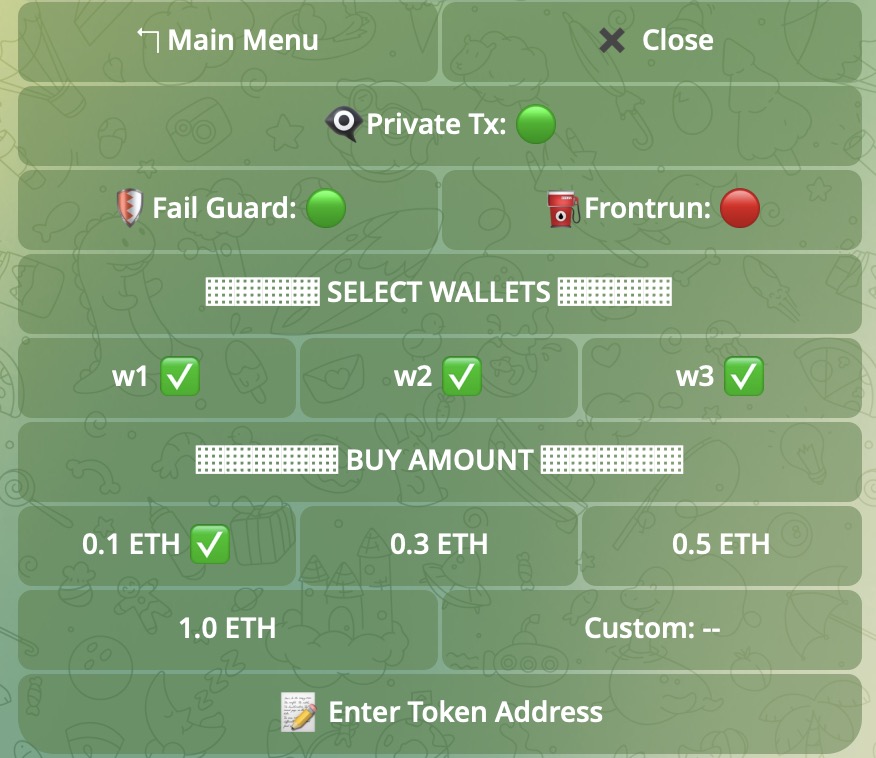

分为三大类:一类是接入不同 DEX 接口,并整合到 Telegram 上的交易机器人。这一类的代表目前主要是以 UniBot、Banana Gun 以及 Maestro 为主。它们普遍为用户提供代币狙击、跟单交易、限价单交易等基础功能。其实质是基于常规 DEX 的逻辑,为用户提供更便利的 DeFi 交互体验。

UniBot 操作界面

第二类则是以项目原有功能为基础,扩列 AI,添加或进一步优化意图解读的产品。这一类代表有:

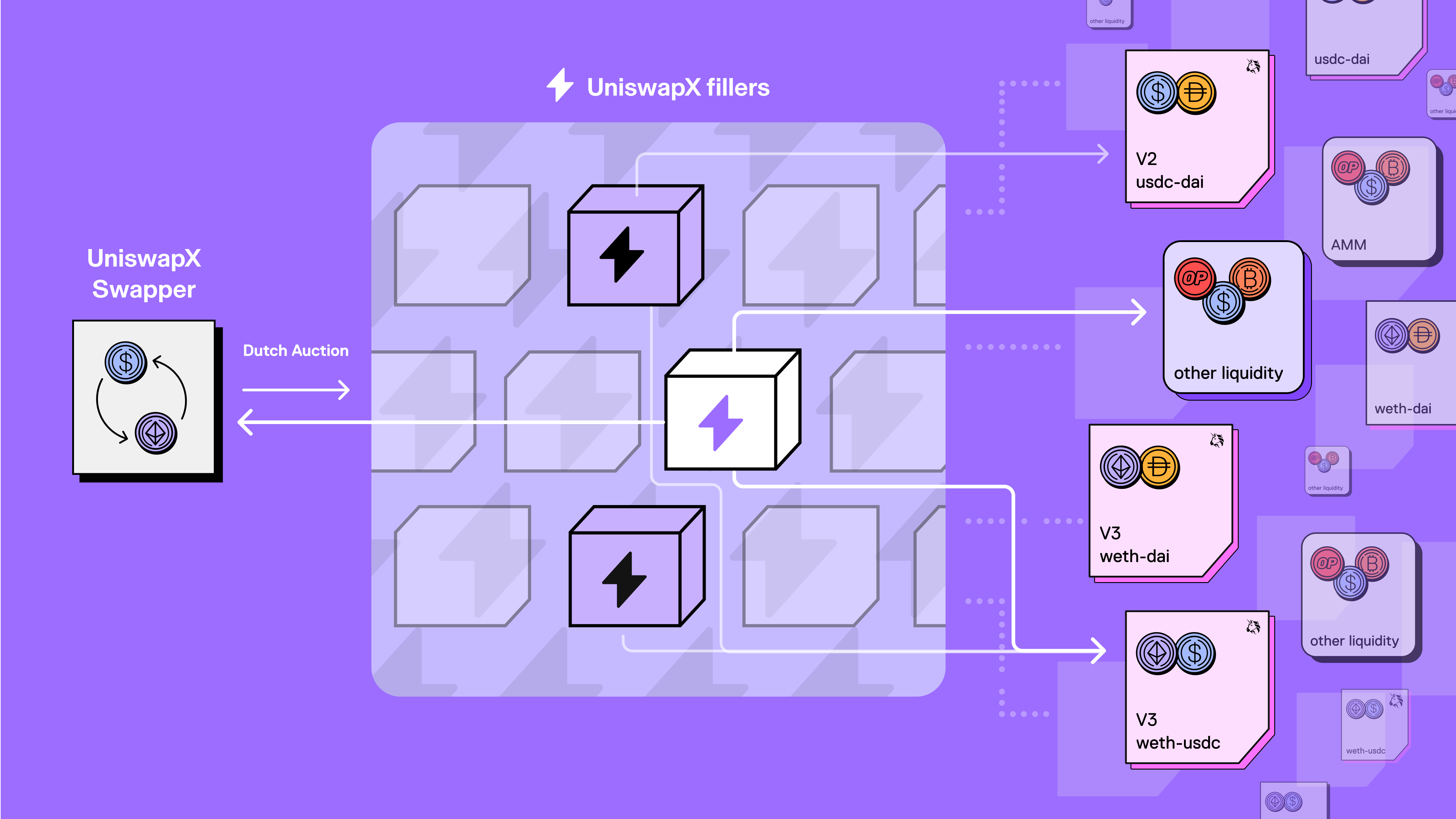

Uniswap X:Uniswap X 是一种采用荷兰拍方式无需许可的协议。通过以意图为中心,着重强调解决流动性分散的问题,帮助用户提供最佳的资产价格,并通过将 Gas 费包裹在交易价格之中并让填充者(用户交易的实际交易者和流动性提供者)承担的方式给用户带来无 Gas 的交易。

Uniswap X 工作原理

Essential:Essential 是基于意图的基础设施,旨在通过模块化意图层来构建一个统一的处理者网络,来捕获用户意图,从而降低用户的交易成本。

Cowswap:CowSwap 是由 Cow Protocol 团队开发的 DEX,采用批量拍卖的价格发现机制,即处理者互相竞争为用户提供交易最佳方案来降低用户的交易成本。

Soul wallet:是利用账户抽象技术来提升 Gas 费支付和赞助灵活性的智能友好钱包,其最值得称道的便是社交恢复功能,即无需助记词,通过与账户相关的可信任成员签订钱包恢复协议,只要得到大多数的认可,访问者的身份便能确定。除此之外,Soul Wallet 还提供双重验证,即用户可以用另一个钱包来批准交易。

与 Soul Wallet 类似的,还有 Argent Wallet,以及基于 Email 来实现钱包恢复的 Unipass。

Anoma:Anoma 是一个多功能意图解决方案,同样也是通过让处理者之间相互竞争的方式来实现用户谋求更低交易成本的意图。

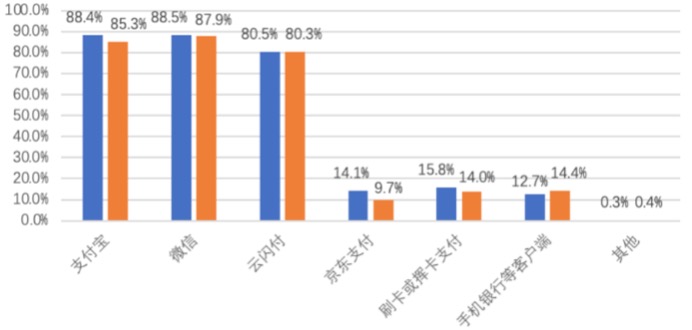

上述两类产品对于意图的捕获,有点类似于微信与支付宝在支付领域的斗争。尽管支付宝具有充足的先发优势,早期在支付领域一骑绝尘。

但后入场的微信,以社交平台为基底,月活跃用户达到了惊人的 13.4 亿。这样庞大的用户数量为微信支付提供了丰富的土壤。以至于微信支付 87.9% 的普及率在 2022 年对支付宝 85.3% 实现了反超。

微信支付和支付宝市场占有率变化。图片来自于http://www.199it.com/archives/1550306.html

在Web3里,以 UniBot 为首的 Bot 们,依托 Telegram 7 亿月活的庞大数据,正在通过不同功能 Bot 的构建来向经典 DEX 们发起挑战。

而以 Uniswap 为代表的经典 DEX,也正在以自己的方式重新构建意图的护城河。

二者殊途,Bot 们更强调便捷性,通过聚合不同 DEX,将并集成到 Telegram 中,DeFi 交易的复杂程度简化,以此来吸引更多用户的使用,但在交易成本上面由于 Bot 交易手续费(UniBot 1% 、Banana Gun 0.5% )的存在,用户并不会感受到成本明显的降低。而 Uniswap X 们则会率先考虑用户的交易成本。

在 ACCapital 的一篇文章《意图:Web3交互智能化的起点》中,将 Anoma 视为自上而下的迭代,将 Bot 视为自下而上的革命。这个观点也正说明了当前的现象。

但最终它们的走向一致,甚至 Banana Gun 区块贿选制度和处理者竞争方案都有异曲同工之处。

即在 AI 的帮助下,产品和用户之间,意图的鸿沟将被缩小甚至消除。这样就来到了 Paradigm 文章所描述的第三层次:

第三层次:交易策略的 AI 自动执行:

用户不再需要具象化的描述指令,而是给与一个抽象的答案:我想要快速买一些 LINK,系统便能自动识别用户需求,并在。这一层次,是当前Web3业态尚未有项目涌现,但大家都在努力的目标。

或许第三层次的到来,你可以在吃早餐的同时,简单说一句话,便能完成复杂的 DeFi 操作。

目前有一些技术提供商,正在探寻基于Web3的人机交互新路径。比如致力于辅助用户交易的 Hummingbot、 3 Commas、HaasOnline、Gekko 等。这些产品致力于帮助用户自动执行交易策略,并且支持当前市面上的多个 DEX 平台。

又或者具有智能信用评级功能,可能解决加密货币信用借贷问题的 Nuo Network、Dharma Protocol。

此外还有辅助用户决策,为用户提供投资思路的 Kaito AI、Messari、Nansen AI 等。

Intent+Web3的未来

互联网上每一次用户体验的迭代,在表现形式上,其实都是后端代码对于封装到前端方式的改进。如上文所言,1inch的 DEX 聚合功能,让用户只需要单纯的点击,便能将你的交易自动拆分到各个流动性池上,而不需去管产品背后的执行逻辑是什么样。

那么伴随着产品对于意图捕获的程度更高,对应到前端的表现就会更智能。比如 Cow Protocol 的 Cow Hooks 聚合了交易、跨链、质押、存款等多种复杂动作只要用户愿意,可以一键实现代币的 Approve、Swap 和跨链的功能。

此外,ChatGPT 对话式的交互方式被广泛应用到了Web3的诸多项目中,尽管目前这种对话还未涉及到具体的交易行为。我们可以做一个展望,当项目的意图捕获足够全面,前端足够智能,那么未来就不难看到基于对话甚至语言模式的交易行为。或许未来,具有交易功能的对话框将成为每一个 DeFi 项目的标准配置。

这样一来,严肃的 DeFi 就不再变得高冷,普通用户,甚至小白用户,要想参与 Curve、GMX 等复杂规则的 DeFi 产品,不再需要熟悉繁琐的交互流程,也不再需要去计算复杂的公式,只需要说出自己的需求,便能完成交易。

这在一定程度上,也成为了Web3领域破圈的重要路径。