Do Kwon聊天记录曝光:大瓜不断,远不止伪造交易

原创|Odaily星球日报

作者|Loopy

昨日,一则法庭文件的披露让我们得以一窥百亿美元金融帝国的内部聊天。

SEC 法庭文件披露了一则发生在 2019 年的 Slack 聊天过程,对话双方分别是 Terraform Labs 创始人 Do Kwon 与另外一位联合创始人、支付应用程序 Chai 创始人 Daniel Chin。

内容显示,Do Kwon 近乎直白的承认他们伪造了交易量。除此之外,更多劲爆的“瓜”也潜藏其中,既有对同行的炮轰,也有对散户的鄙夷。其中最令人震惊的,当属自曝预挖 10 亿稳定币。Odaily星球日报带你进入吃瓜时刻,速览 Do Kwon 说了什么。

“我们可以创建看起来真实的交易”

在法庭文件中,最引人注目的莫过于 Do Kwon 对伪造交易的表述。

Do Kwon 向 Chin 表示:“我可以创建看起来真实的虚假交易……这会产生费用。”Chin 问道,如果“人们发现它是假的”怎么办,Do Kwon 回答说:“你不说,我也不说。”

2019 年,Terra 宣布与 Chai 合作,此次合作旨在通过区块链简化支付系统,并以折扣价向商家提供交易费用。在官方的表述中,本次合作将助力 Terra 网络处理“数百万甚至数十亿的交易量”。

然而,SEC 在文件中写道,Chai 并没有使用 Terra 链来处理和结算支付。而是仍通过传统方式进行付款,并将虚假交易复制到了 Terra 链上,以此来伪造成 Terra 进行了大量支付结算的样子。

Daniel Shin 对这一事件进行了一定的质疑,他问道,“人们不会发现它是假的吗?”

Do Kwon 回答道,“所以我会尽力让它变得难以辨别。”

Daniel Shin 表示了同意,“好吧,让我们进行小规模测试。看看会发生什么。”

有趣的是,除了伪造交易外,二者的聊天还包括更多有趣的内容。这其中既包括 Terra 项目本身,也包括对行业其他角色的八卦。

“皇冠上的明珠”

在聊天中, Do Kwon 对 Terra 做出了看起来并不积极的侧面评价(他并未直言)。

针对质押率他做出评论,“只有那些相信 Terra 是皇冠上的明珠(Hashed、1kx)和那些经营质押业务(polychain)的投资者才会进行质押。”

融资注水?

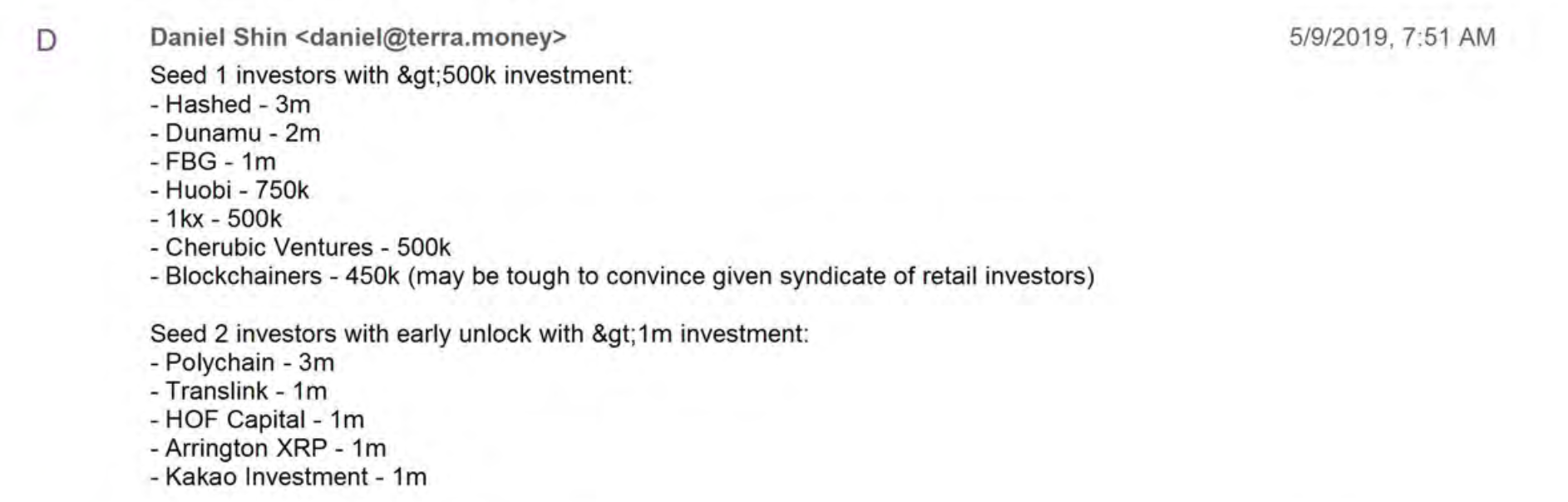

在聊天中,Daniel Shin 列出了 Terra 在 Seed 1 和 Seed 2 两轮融资中的大额投资者。

从数据来看,大额投资者两轮合计投资约 1500 万美元。尽管小额投资者并未披露,但公开信息显示小额投资者数量并不多,仅有约个位数。因此,推测 Terra 种子轮融资应为略超过 1500 万但远非大幅超越的水平。

而 Terra 披露的公关稿显示,该项目种子轮融资高达 3200 万美元。目前来看,这一数据或许是大幅掺水。

“Upbit 列出了所有的垃圾币”

在二者的讨论中,Do Kwon 提到了一个名为 Thunder 的项目正在 Upbit 进行首发上线。而 Daniel 并不知道这一项目,直接做出了“什么是 Thunder?”的疑问。

Do Kwon 简洁明了的回答了他——伯克利大学教授 Elaine Shi 的垃圾币(shitcoin)。

他还继续抱怨道:“Upbit 有什么问题?……世界上所有的垃圾币都被 Upbit 上线了,但没有我们。”

“我预挖了 10 亿稳定币”

尽管 Terra 最著名的稳定币是为人所知的美元稳定币 UST,但远不止于此。Terra 生态系统上生长着庞大的各类稳定币,包括美元稳定币、韩元稳定币、蒙古图格里克稳定币等等。

而其中最为特殊的则是 Terra SDT,SDT 是锚定 IMF 特别提款权(SDR)的稳定币, 1 SDT 价值稳定在 1 SDR。

而更为疯狂的是,Do Kwon 表示:“我还给我们自己预挖了 10 亿枚 SDT。”

Do Kwon 在聊天中坦言,Terra 的价值有些虚高了。“正如您所说,我们现在很难证明 30 亿美元的估值是合理的,无论这个故事(指 Terra 的叙事)究竟有百分之多少被接受。”

尾声

Chai 是一家和 Terra 关系极为密切的公司。该公司创立于 2019 年年中,曾与 Terraform 共享办公室和员工,直到 2020 年两家公司才进行分拆。

目前,Do Kwon 的律师团队已经对这段 Slack 聊天记录被视为证据予以反驳。他的法律团队声称:"美国 SEC 在一项程序性动议中无端歪曲证据,企图损害 Do Kwon 先生的利益,而该动议与美国 SEC 的是非曲直毫无关系"。"这依赖于对不相关证据的错误陈述,以支持其无法从 Do Kwon 处获得证据的虚假说法。"

与此同时,Do Kwon 正被拘留在黑山,而他的律师正在推动美国联邦法院拒绝 SEC 将他引渡到美国的请求。

目前,这一案件仍处在漫长的司法流程之中,最终结果我们仍未所知。

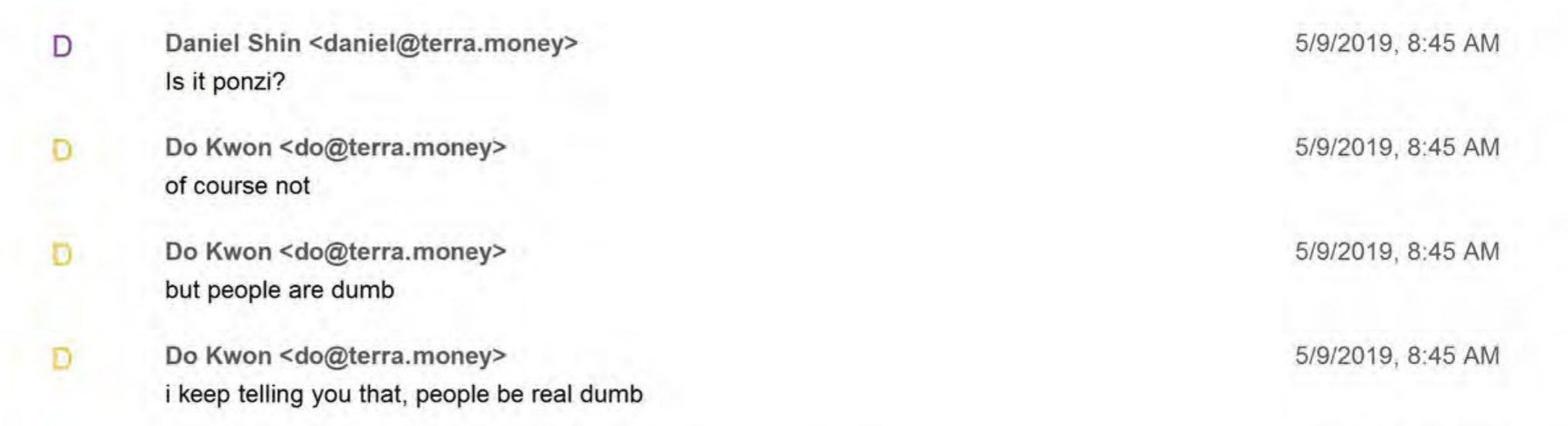

Daniel 曾向 Do Kwon 发起过灵魂拷问:“这是庞氏骗局吗?”

Kwon 回答道:“当然不是,但民众是愚蠢的,我一直在告诉你,民众真的愚蠢。”

Kwon 回答道:“当然不是,但民众是愚蠢的,我一直在告诉你,民众真的愚蠢。”