SignalPlus波动率专栏(20230922):BTC下跌,日历价差策略值得关注

2023-09-22 11:24

本文约396字,阅读全文需要约1分钟

BTC在经历一波下跌后缓慢反弹回到26500上方,隐含波动率整体水平再度下降2~3%Vol,期限IV斜率走陡。另一方面,价格下跌过后,BTC/ETH Skew大幅回落,中短期25dRR再度来到负值区间。

AI总结

展开

BTC在经历一波下跌后缓慢反弹回到26500上方,隐含波动率整体水平再度下降2~3%Vol,期限IV斜率走陡。另一方面,价格下跌过后,BTC/ETH Skew大幅回落,中短期25dRR再度来到负值区间。

美国利率市场仍在遭受“鹰派暂停”的余震,低于预期的初请失业金数据(20.1 万人,预期 22.5 万人)公布更是雪上加霜,两年期美债收益率攀升至 2006 年以来的最高点 5.18% ,十年期收益率也触及 4.50% 关口。受此影响,美股三大股指全线承压低开低收,消费品和房地产等板块大幅下跌,致使 SPX 创下今年第三大单日跌幅(-1.6% )。

Source: SignalPlus, Economic Calendar

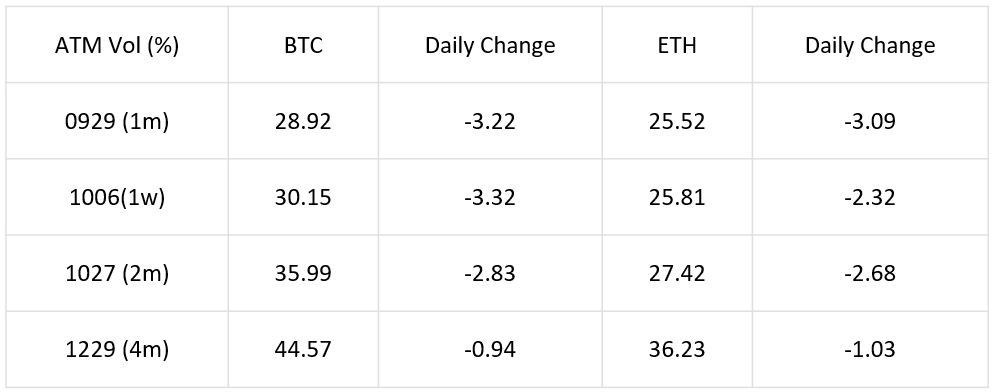

数字货币方面,BTC 在经历一波下跌后缓慢反弹回到 26500 上方,隐含波动率整体水平再度下降 2 ~ 3% Vol,期限 IV 斜率走陡。另一方面,价格下跌过后,BTC/ETH Skew 大幅回落,中短期 25 dRR 再度来到负值区间。

Source: Binance & TradingView

Source: Deribit (截至 22 Sep 16: 00 UTC+ 8)

Source: SignalPlus

Source: SignalPlus

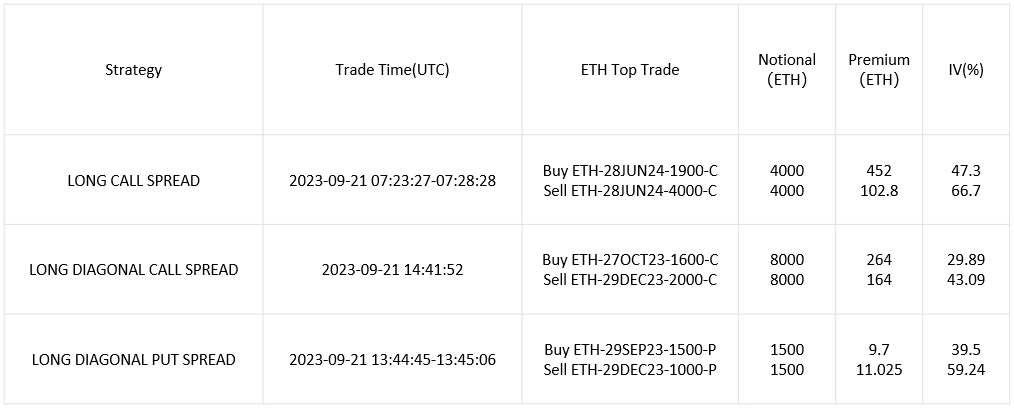

过去 24 小时的大宗策略交易以日历价差策略为主。其中 BTC 近期 Put/Call 均遭到抛售,并为中远期多头建仓提供了 premium 支持。ETH 方面,看涨价差 27 OCT 1600 C vs 29 DEC 2000 C 以单笔 8000 ETH per leg 的庞大数量成为焦点,除此之外,以 29 SEP 1500 P vs 29 DEC 1000 P 为代表的三角价差策略也收受到交易员的青睐,为高利率下承压下行的以太价格提供了保护。

Source: Deribit Block Trade

Source: Deribit Block Trade

BTC

ETH

欢迎加入Odaily官方社群