SignalPlus: ติดตาม Bitmap Special Edition

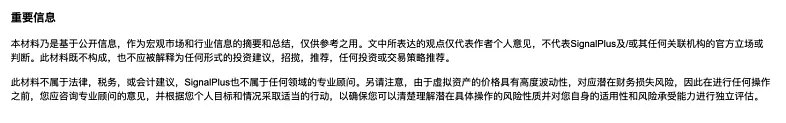

หลังจากที่ Federal Reserve ทำการปรับแผนภูมิจุดที่รุนแรงมากขึ้นเมื่อวันก่อน การติดตามแผนภูมิจุด ได้พิสูจน์แล้วว่าเป็นพฤติกรรมที่เป็นอันตรายต่อตลาดความเสี่ยง และในที่สุดนักลงทุนก็ตื่นขึ้นจากความพึงพอใจอันยาวนาน ในช่วงที่สามของ SPX การลดลงเพียงวันเดียวที่ใหญ่ที่สุดในปีนี้ (-1.6%) ทำให้เกิดอาฟเตอร์ช็อคของ การระงับการปรับขึ้นอัตราดอกเบี้ยอย่างเร่งด่วน ของพาวเวลล์ การลดลงดังกล่าวมีสาเหตุหลักมาจากการลดลง 2.9% ในภาคสินค้าอุปโภคบริโภค และการลดลง 3.5% ภาคอสังหาริมทรัพย์

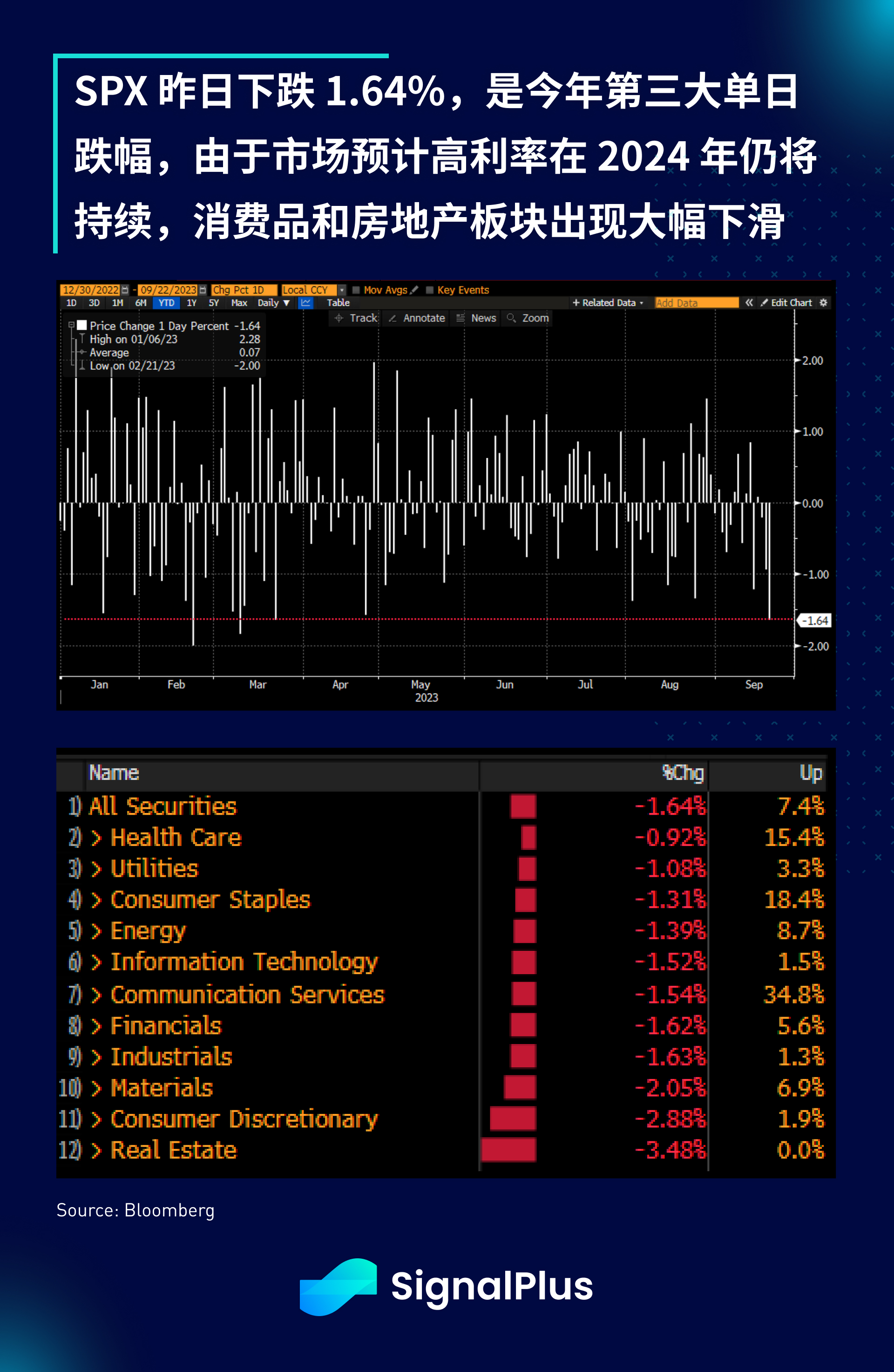

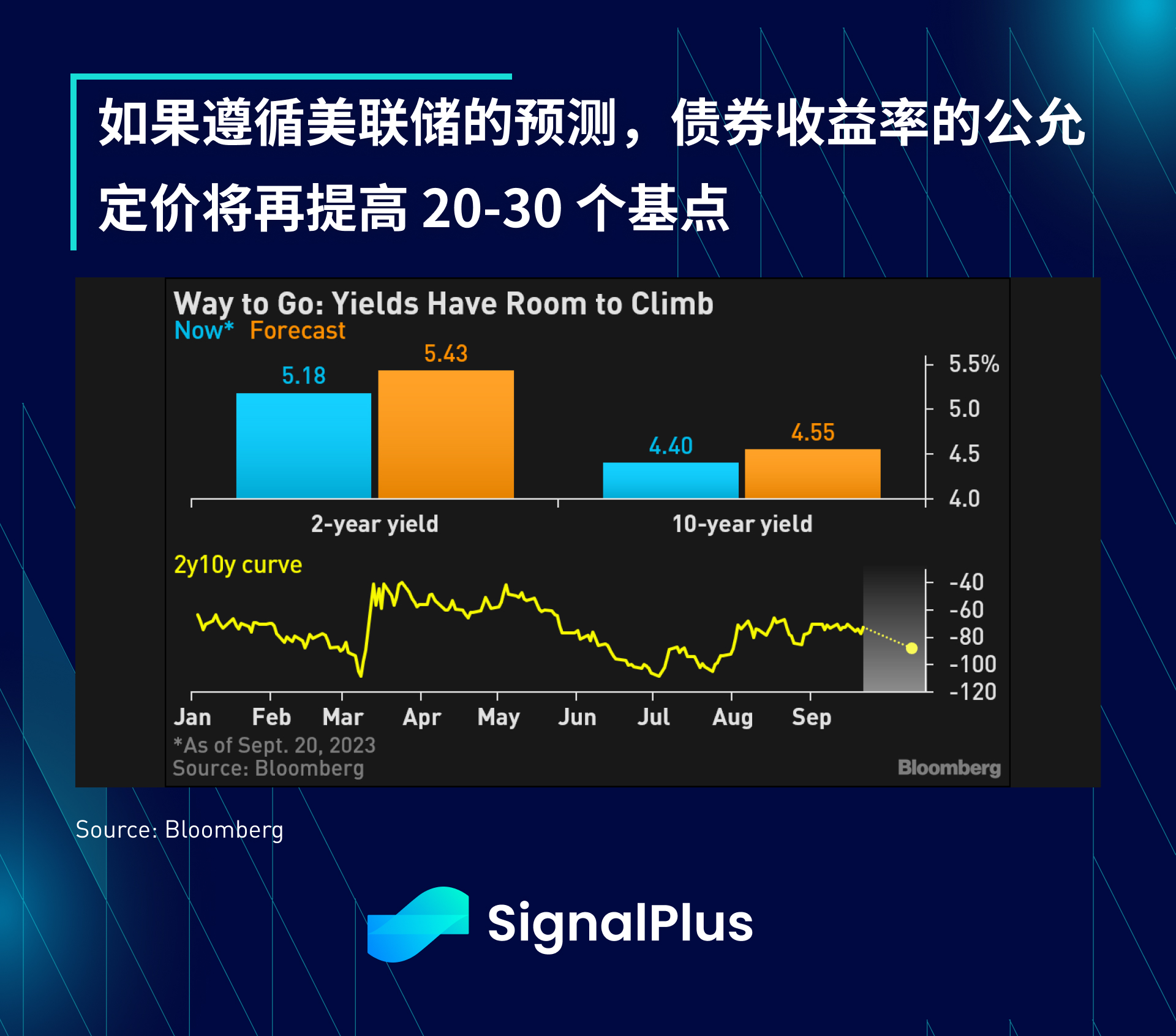

อัตราผลตอบแทนพันธบัตรรัฐบาลสหรัฐฯ อายุ 2 ปี เพิ่มขึ้นสู่ระดับสูงสุดนับตั้งแต่ปี 2549 (5.18%!) ในขณะที่อัตราผลตอบแทนพันธบัตรอายุ 10 ปีแตะระดับสูงสุดในรอบ 15 ปีที่ 4.50% ปัจจุบัน ดัชนีอัตราผลตอบแทนทั่วโลกอยู่ที่ระดับสูงสุดนับตั้งแต่ปี 2551 ในขณะที่ พันธบัตรรัฐบาลสหรัฐฯ ระยะยาว 30 ปีที่ออกในปี 2020 ปัจจุบันซื้อขายอยู่ที่ 48 ดอลลาร์ ซึ่งเป็นราคาที่ลดลง 52% นับตั้งแต่การประมูล นี่คือพันธบัตรรัฐบาลสหรัฐฯ ระยะยาวไร้ความเสี่ยงที่ออกโดยรัฐบาลสหรัฐฯ ซึ่งสูญเสียไปแล้วครึ่งหนึ่ง ของมูลค่าในเวลาเพียง 3 ปี (เนื่องจากคณิตของระยะเวลา) ใครว่าการซื้อขายพันธบัตรเป็นเรื่องน่าเบื่อ?

ไม่ต้องกระจายความตื่นตระหนก แต่หากอัตราผลตอบแทนเป็นไปตามการคาดการณ์ของเฟดอย่างแน่นอน อัตราผลตอบแทนระยะสั้นจะเพิ่มขึ้นอีก 20-30 จุดพื้นฐานจากระดับปัจจุบัน ซึ่งเป็นระดับที่ไม่เคยเห็นมาตั้งแต่ยุคดอทคอม

ที่เลวร้ายยิ่งกว่านั้น สินค้าคงคลังน้ำมันดิบของกระทรวงพลังงานของสหรัฐอเมริกายังคงลดลงอย่างมีนัยสำคัญและกลับไปสู่ระดับของปี 1985 สัญญาซื้อขายล่วงหน้าน้ำมันดิบสวนทางกับแนวโน้มและเพิ่มขึ้นโดยราคายังคงอยู่ใกล้ US$90 เรายังคงเชื่อว่าตลาดปัจจุบันประเมินต่ำเกินไป อัตราเงินเฟ้อที่เกิดจากต้นทุนที่เพิ่มขึ้น ความเสี่ยงในการฟื้นตัว

ในที่สุดหุ้นกลุ่มเทคโนโลยีก็ตอบสนองต่ออัตราผลตอบแทนที่เพิ่มขึ้นโดยผ่านเดือนที่เลวร้ายที่สุด จากมุมมองทางเทคนิค SPX ทะลุแนวรับแนวรับตั้งแต่เดือนมีนาคม และ CDS ระดับการลงทุน 5 ปีก็เพิ่มขึ้นอย่างแข็งแกร่งเช่นกัน ในที่สุด ส่วนต่างของอัตราดอกเบี้ยก็เริ่มแสดงออกมาแล้ว ความสัมพันธ์เชิงบวกกับอัตราดอกเบี้ยที่สูงขึ้น ค่าเงินเยนดูเหมือนจะมีโอกาสดีที่จะลดลงต่ำกว่า 150 และดัชนีดอลลาร์สหรัฐดูเหมือนว่าจะเตรียมที่จะปรับตัวเพิ่มขึ้นต่อไป

เมื่อมองไปข้างหน้า หากแนวโน้มการลดความเสี่ยงยังคงมีอยู่ เราคาดว่าความสัมพันธ์ข้ามสินทรัพย์จะเริ่มขยับเข้าใกล้ 1 มากขึ้น เหลืออีกหนึ่งสัปดาห์ก่อนที่จะมีการปรับสมดุลพอร์ตการลงทุนใหม่ เราคาดว่าราคาสกุลเงินดิจิทัลและอื่นๆ จะยังคงดำเนินต่อไป ติดตามแนวโน้มของอัตราผลตอบแทน เรายังคงแนะนำให้ให้ความสนใจอย่างใกล้ชิดกับการเปลี่ยนแปลงของอัตราผลตอบแทนเพื่อตัดสินทิศทางของราคาสินทรัพย์ในระยะสั้น และไม่แนะนำให้พยายามไล่ล่าความเสี่ยงที่ลดลงในเวลานี้

สุดท้ายนี้ เมื่อเรามีเรื่องต้องจัดการมากเกินไปแล้ว ก็เป็นเรื่องมหัศจรรย์ที่บทภาพยนตร์จะกลับมาเล่นอีกครั้งในขณะที่สภาคองเกรสเร่งดำเนินการให้ทันเส้นตายวันที่ 1 ตุลาคม และเข้าสู่ภาวะเสี่ยงอันตรายอีกครั้ง เพิ่มความเป็นไปได้ที่รัฐบาลจะปิดตัวลงอีกครั้ง .... .