Gryphsis加密货币周报:Telegram整合TON网络,更广泛的生态系统和大规模Web3采用的愿景

亲爱的读者,欢迎阅读 Gryphsis 学院的周度加密货币摘要。我们为您带来关键的市场趋势、新兴协议的深度洞察,以及全新的行业动态,所有这些都旨在提升您对加密货币和Web3的专业知识。 关注我们的 Twitter 和 Medium获取更深入的研究和洞见。

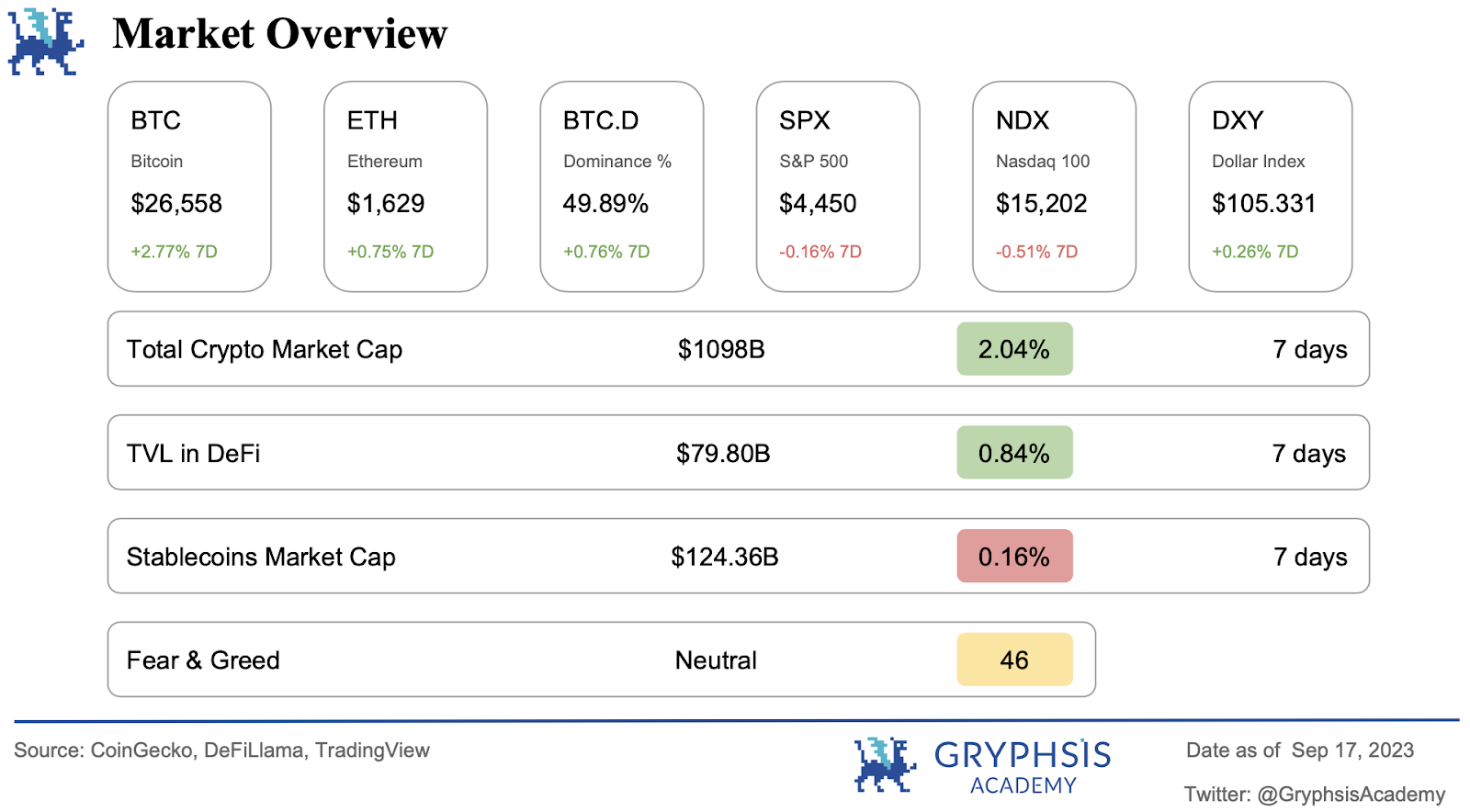

市场和行业快照:

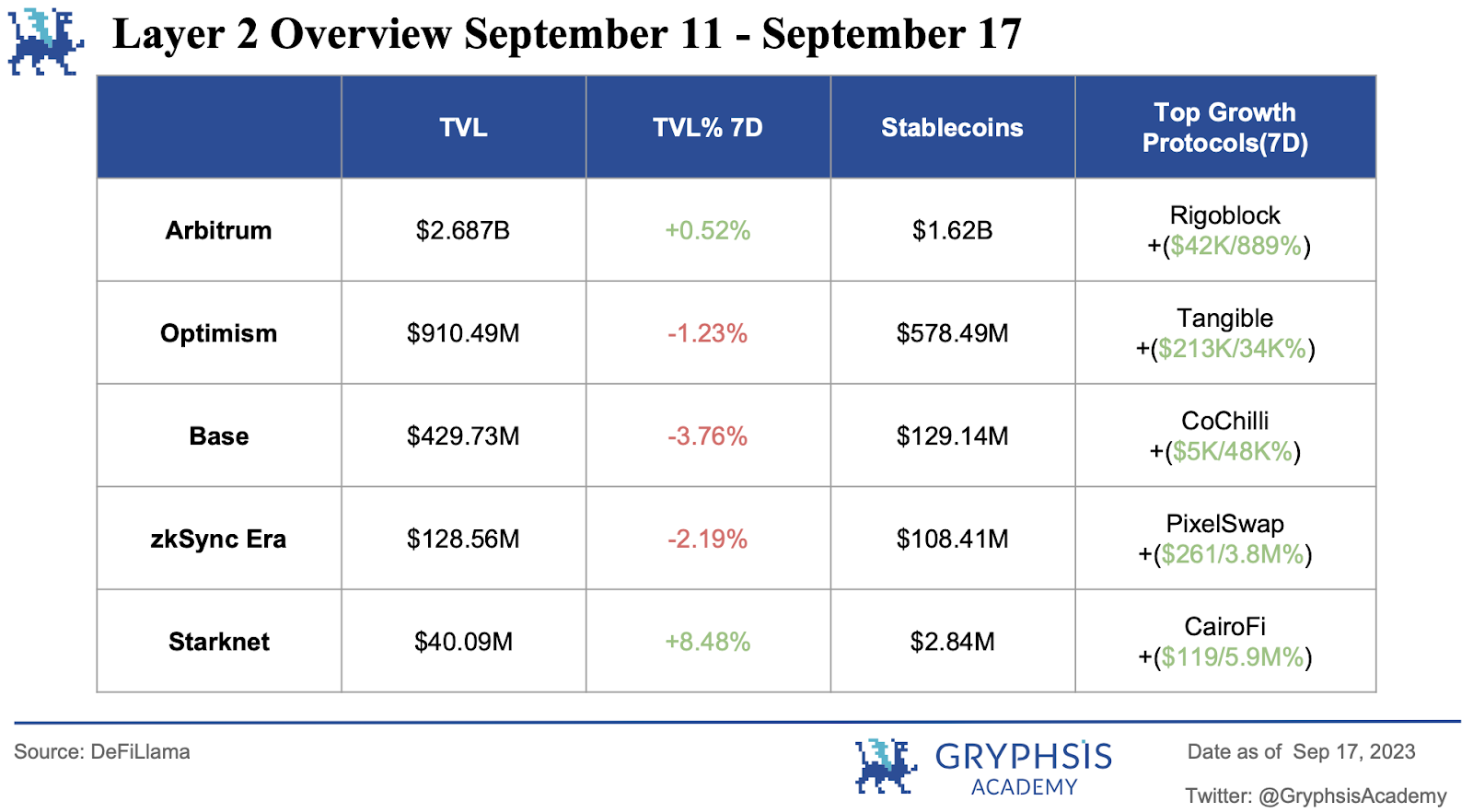

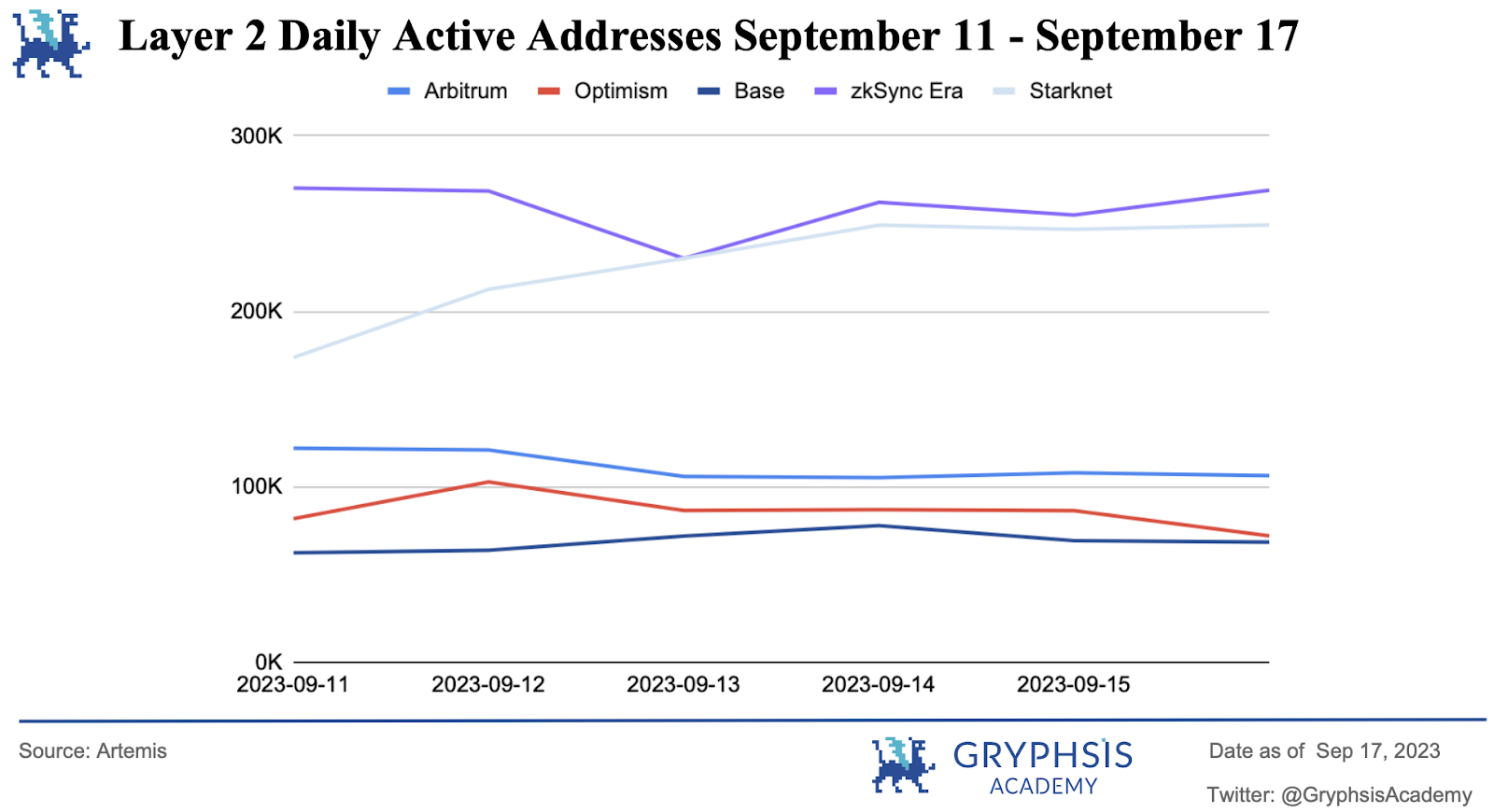

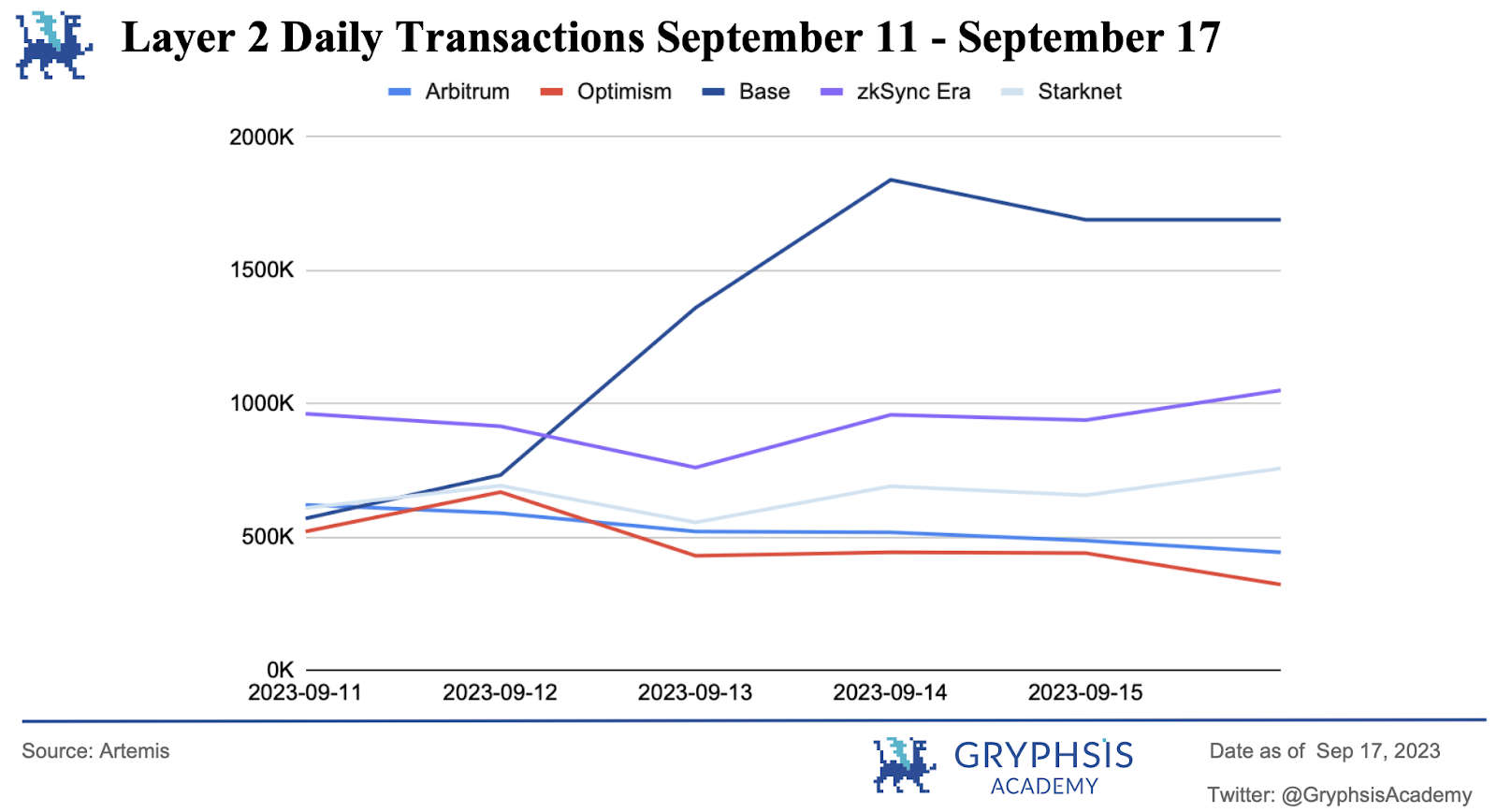

Layer 2 Overview:

过去一周,Layer 2 领域中,Starknet 以 8% 的总锁定价值(TVL)增长率表现出色,而其他大多数平台则略有下滑。至于链上活动,zkSync、Starknet 和 Base 领先群众。几个协议,即 Rigoblock、Tangible、CoChilli 和 PixelsSwap,因其 TVL 出现显著激增而引发了市场的关注。

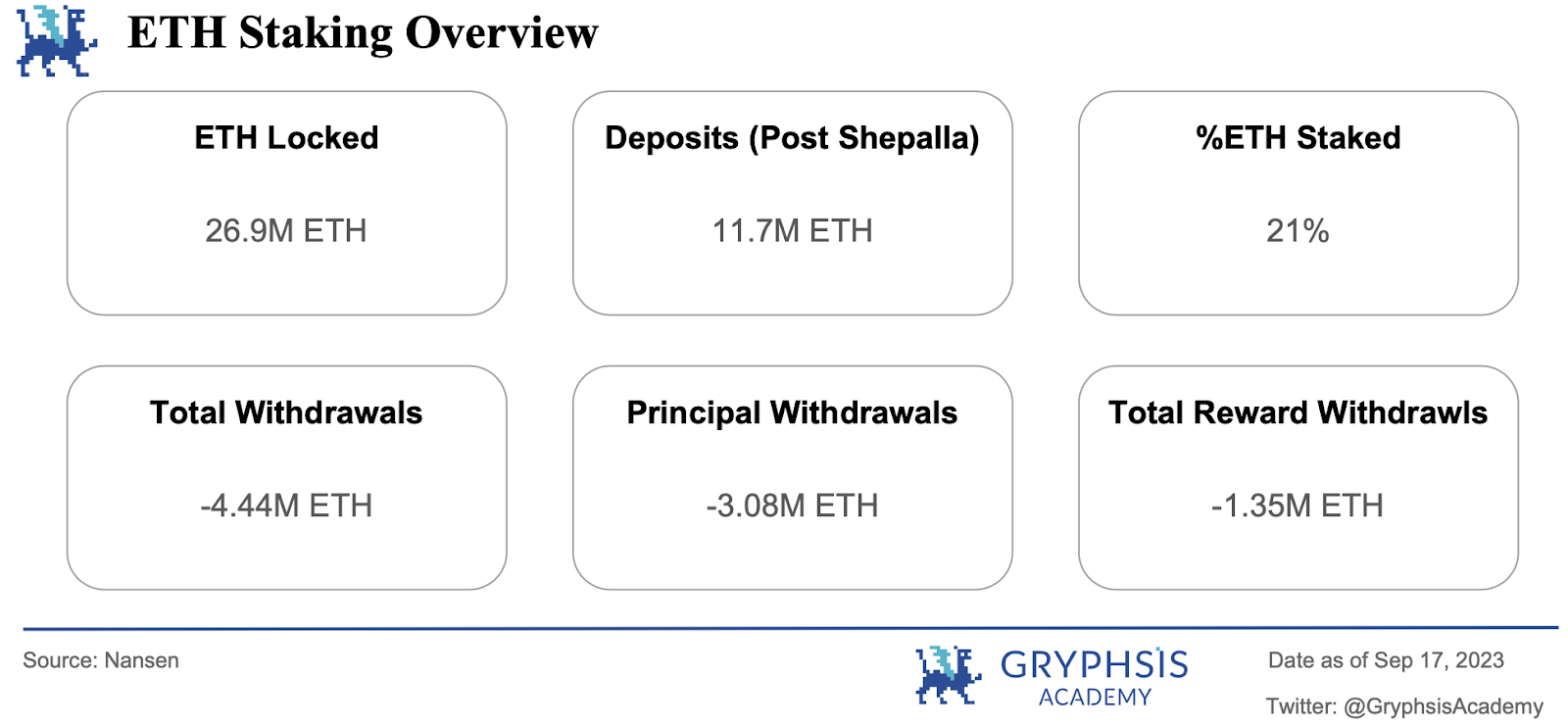

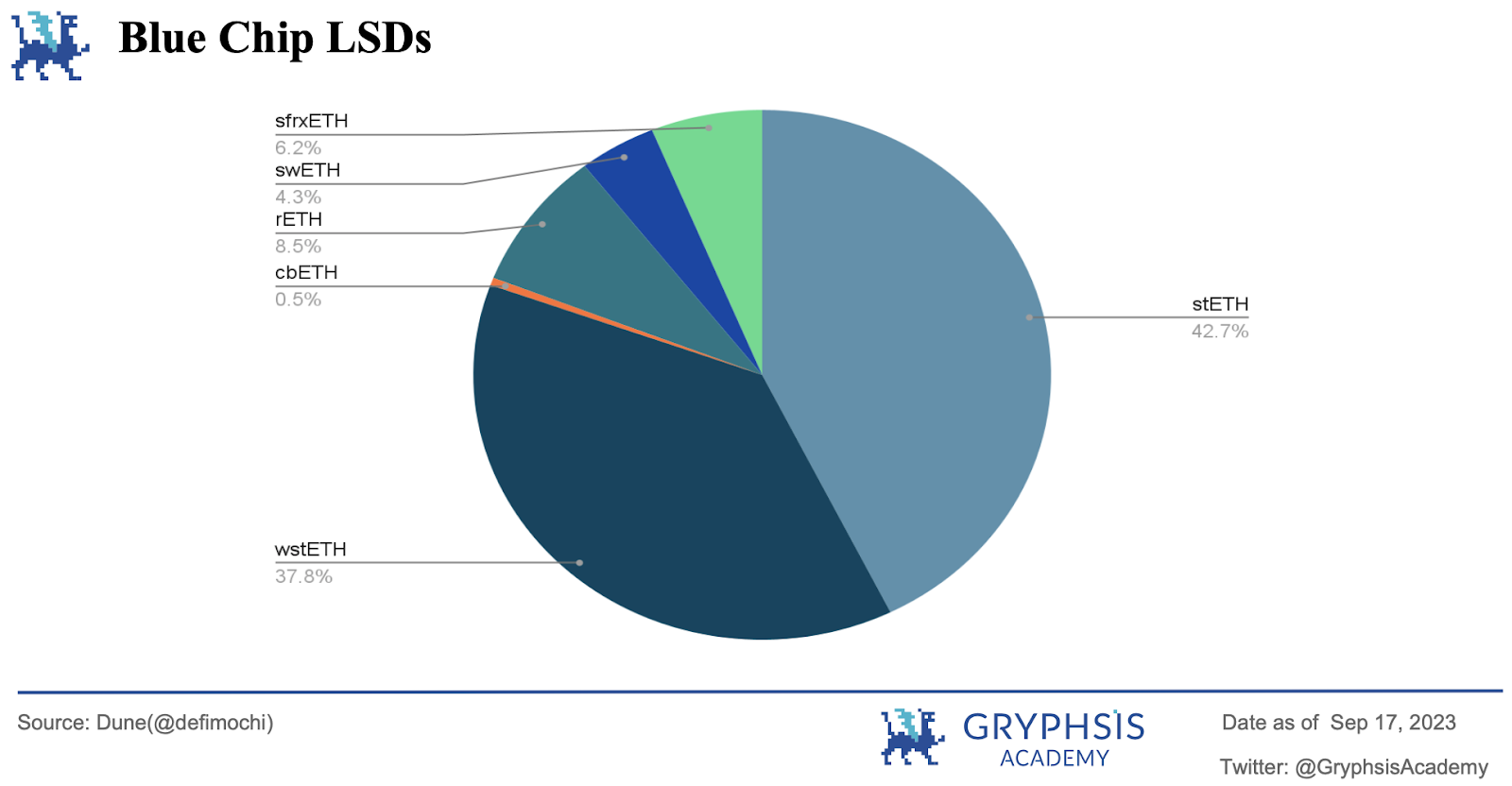

LSD Sector Overview:

与往常一样,Liquid Staking Derivatives(LSD)领域经历了稳定的增长,所有指标都持续上升。Rocket Pool 的 rETH 市场份额持续逐渐增加。

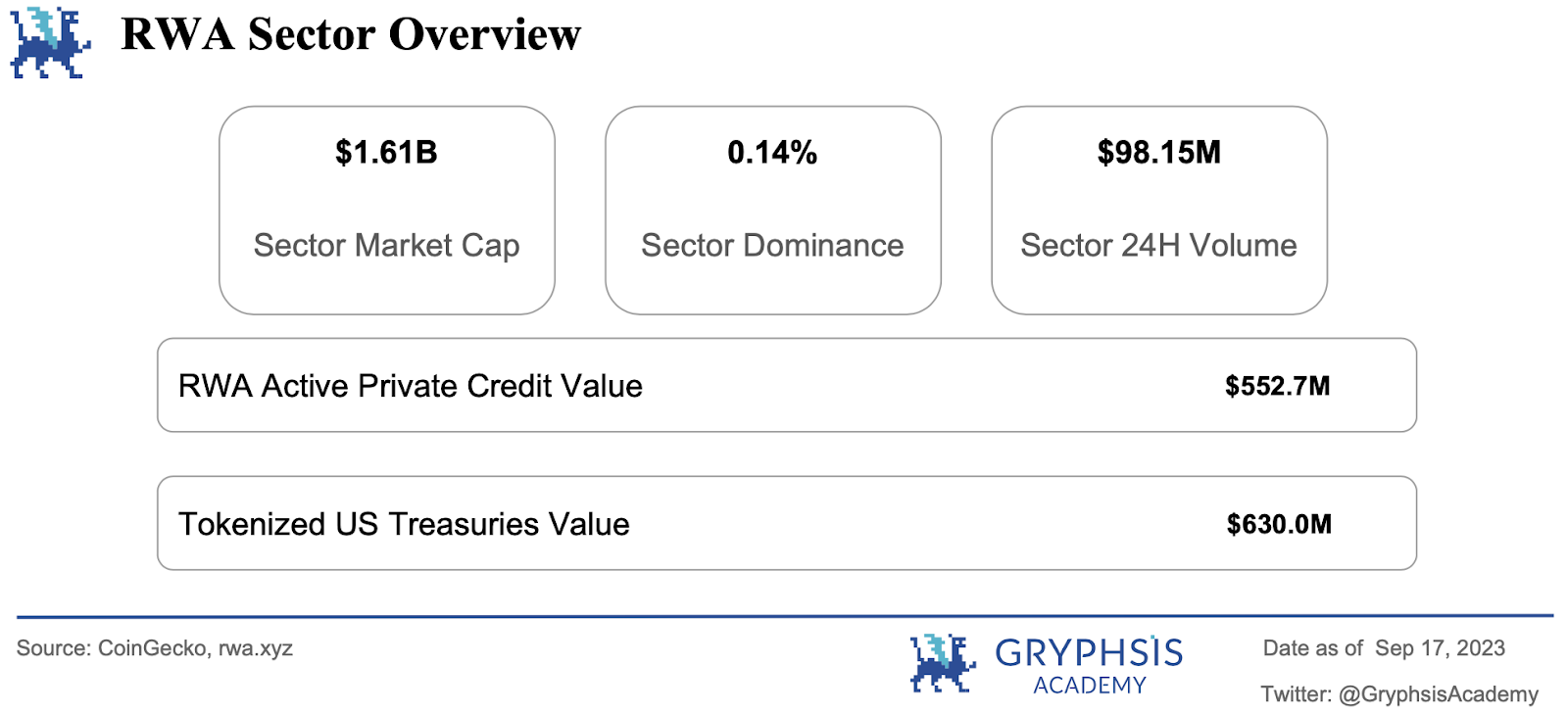

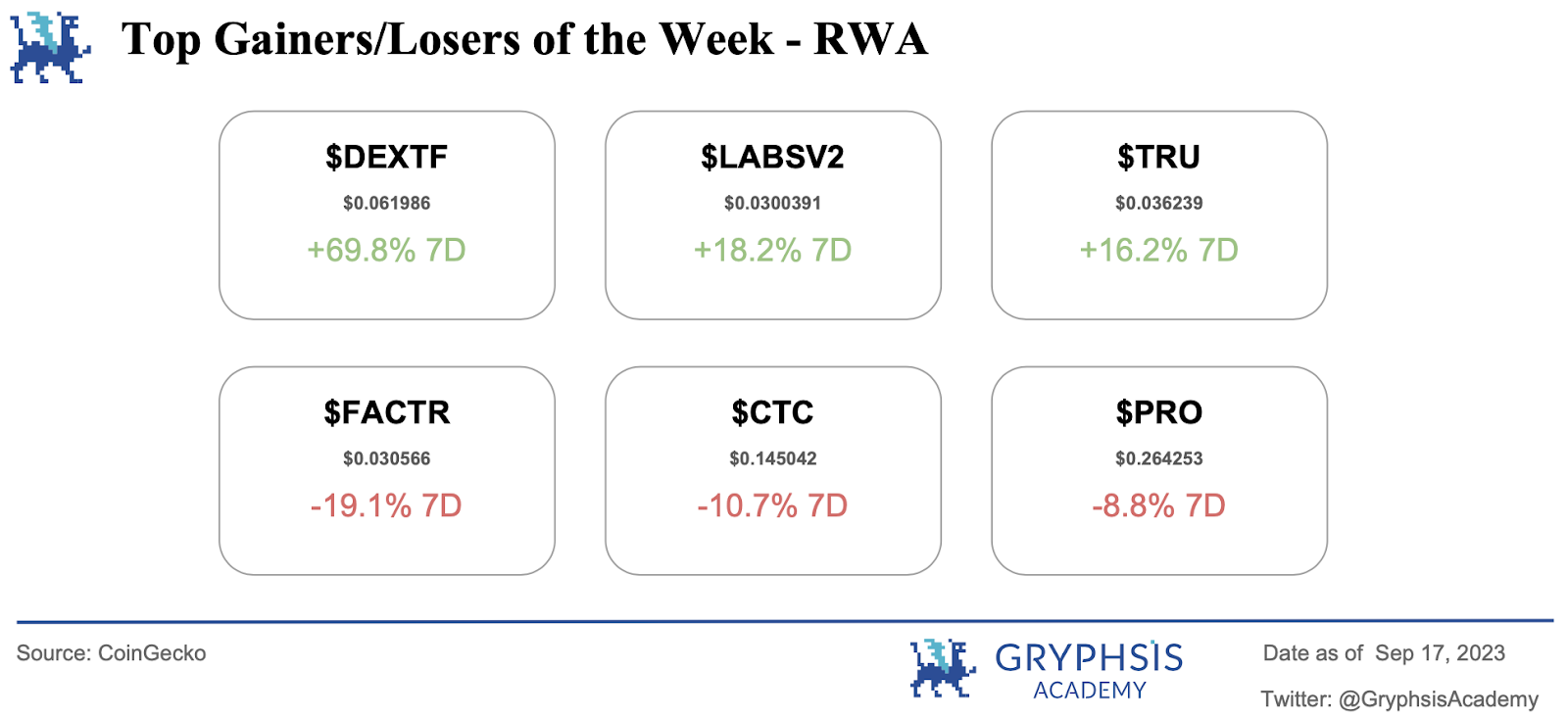

RWA Sector Overview:

与往常一样,Liquid Staking Derivatives(LSD)领域经历了稳定的增长,所有指标都持续上升。Rocket Pool 的 rETH 市场份额持续逐渐增加。

Main Topics

宏观概述:

US Stock V.S. Crypto

本周大事件:

Telegram $TON Wallet

每周协议推荐:

Stadar Labs

Gryphsis Research:

Cosmos, Polkadot, L2 Stacks

每周 VC 投资聚焦

PahdoLabs ($ 15 M)

Mocaverse ($ 20 M)

推特 Alpha:

@CryptoGirNova on the best wallet and best DEX.

@TheDeFinvestor ‘s watch out on big selling pressing next week

@punk 6529 experiences surviving two crypto bear markets

@CryptoMichNL insights on Altcoins’s start trending upwards

Macro Overview

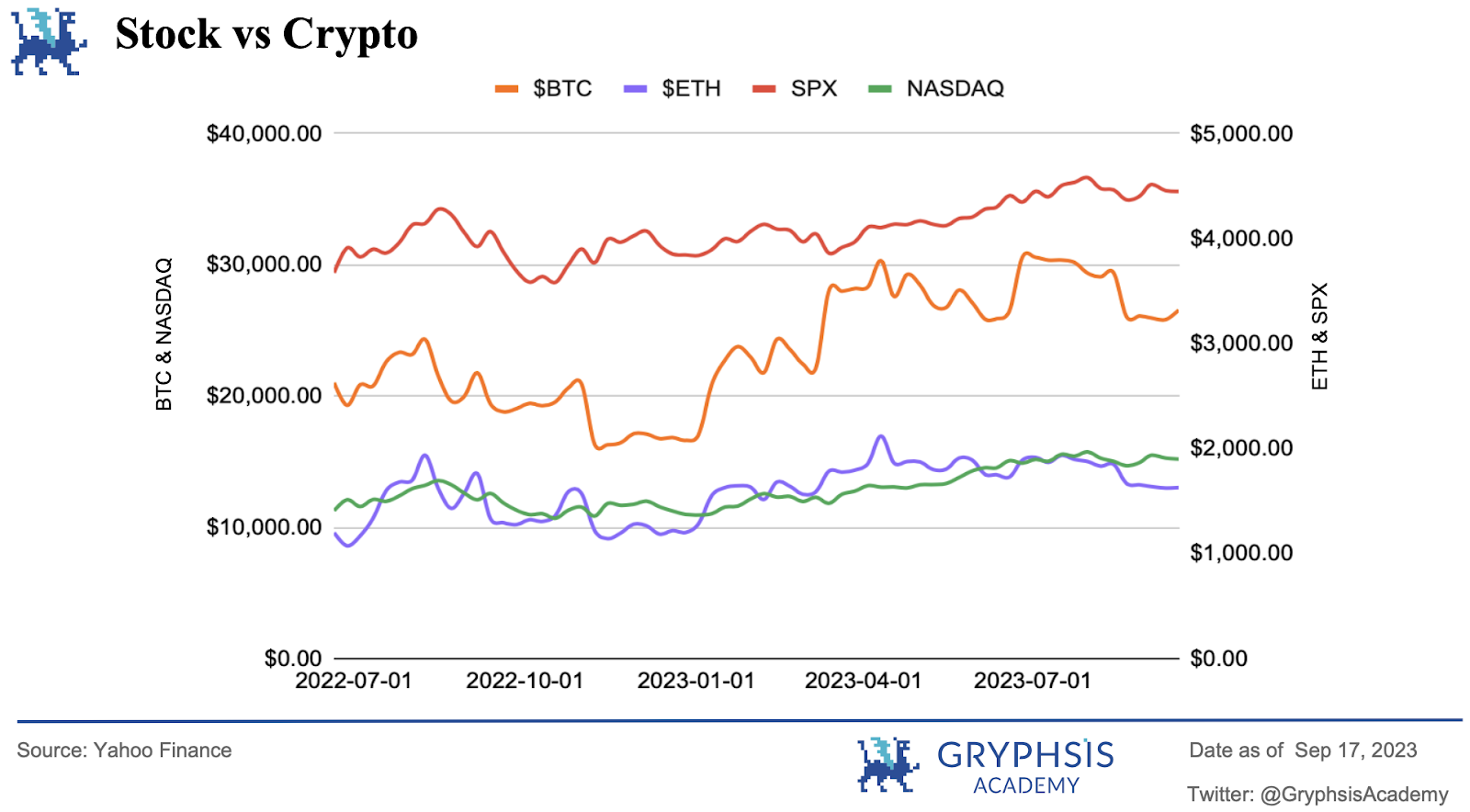

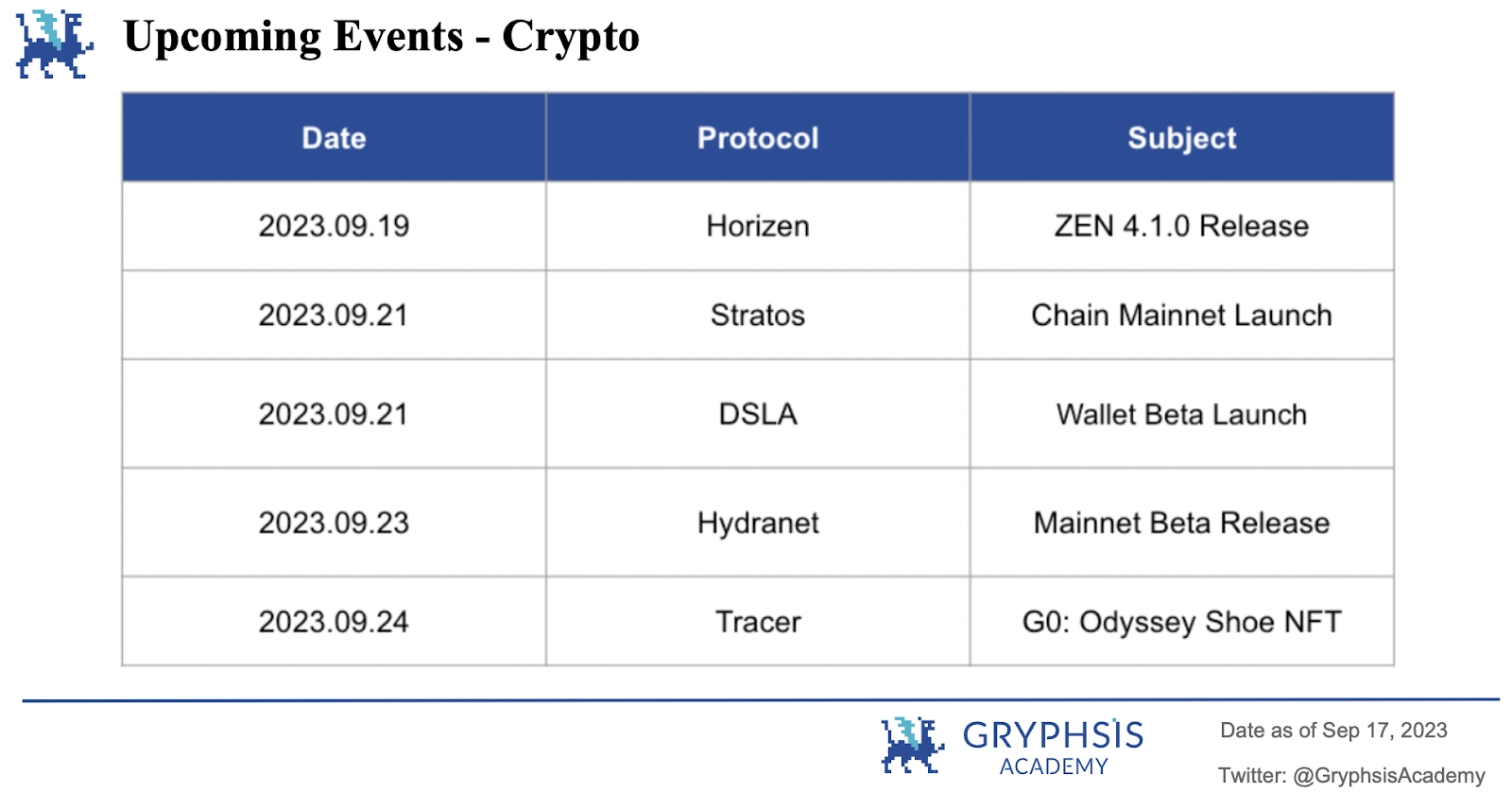

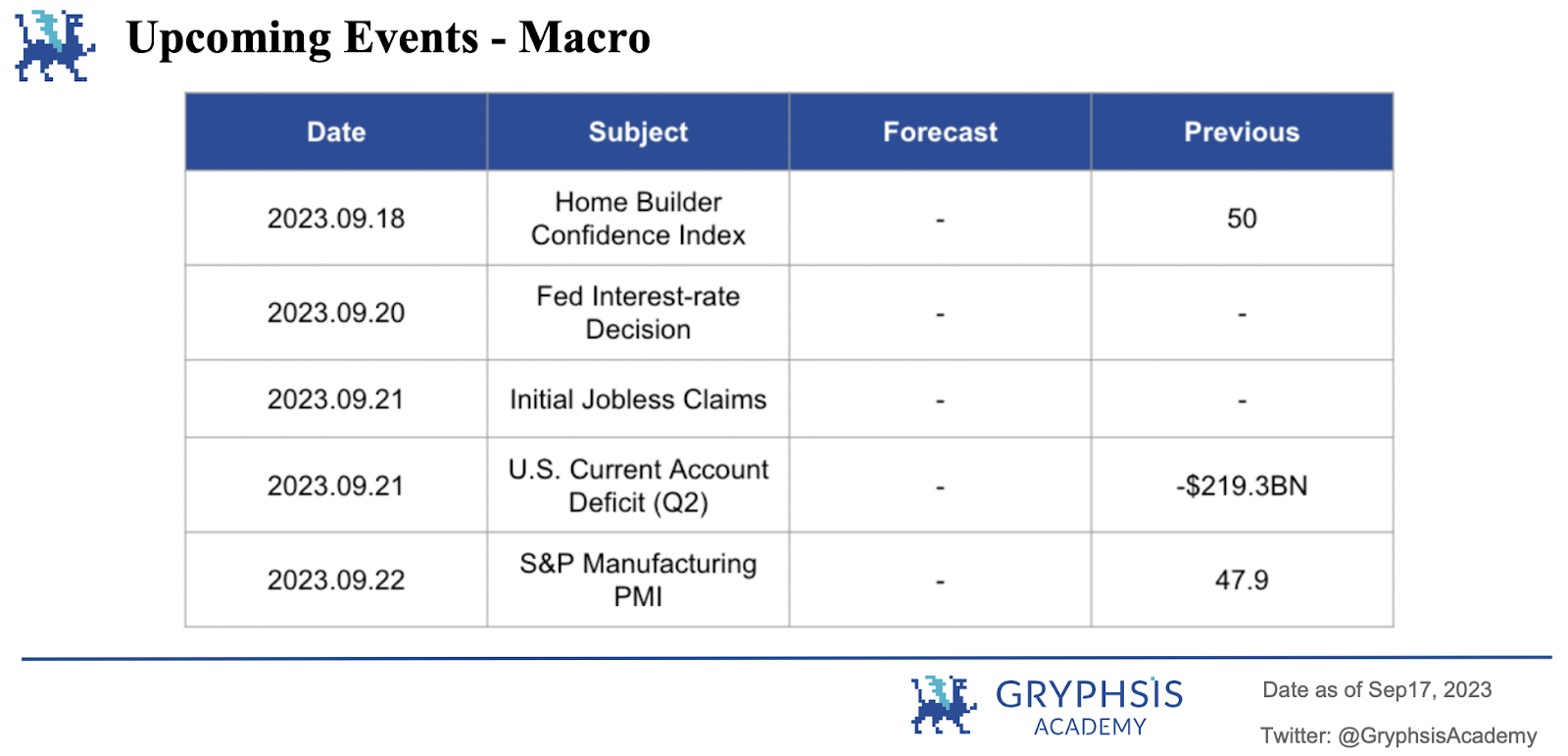

在过去的一周里,股票市场和加密货币市场都没有出现任何重大的价格波动。值得注意的是,BTC 出现了一些积极的价格走势,现在 BTC 的市场统治力接近 50% 。展望未来一周,值得关注的重要事件包括联邦储备利率决定的发布、初次失业金申请人数,以及 S&P 制造业采购经理指数(PMI)。

本周大事件

Telegram 整合 TON 网络:更广泛的生态系统和大规模 Web3 采用的愿景

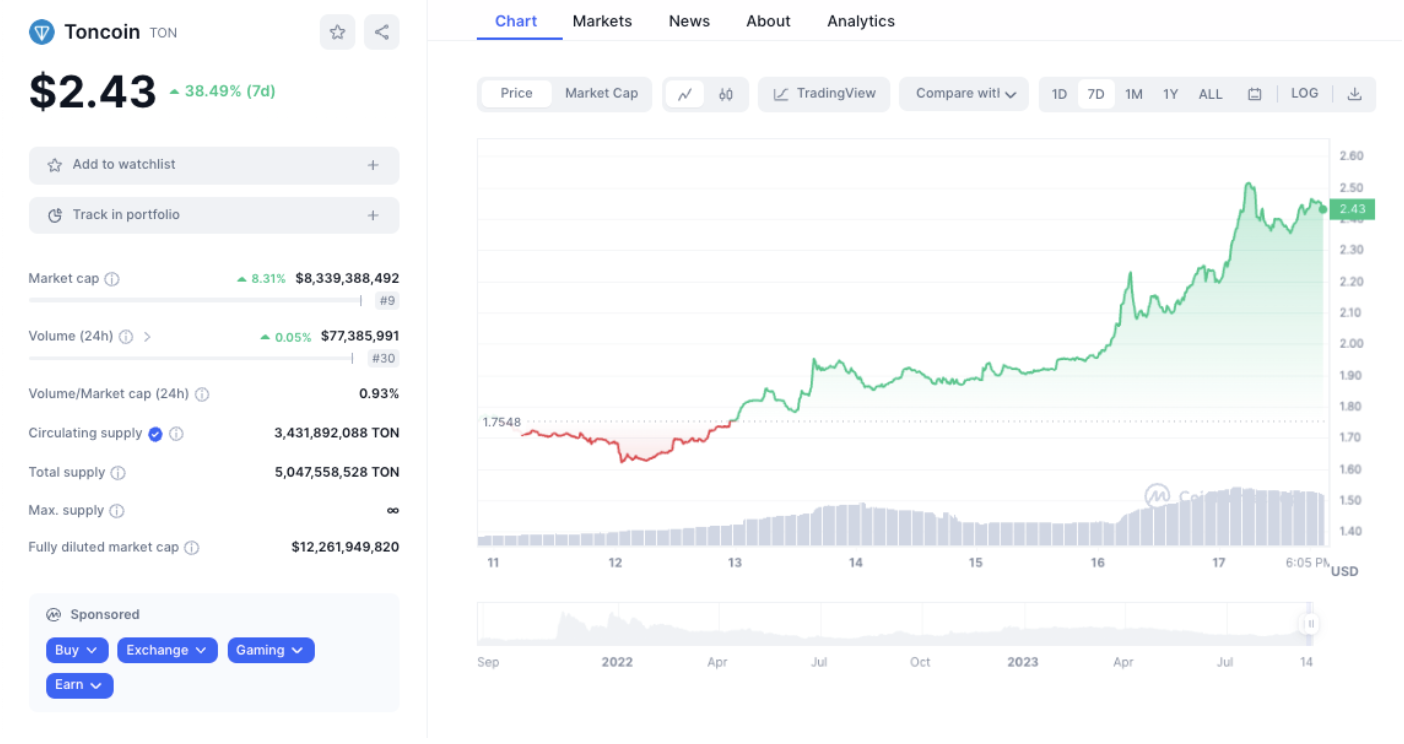

Telegram 官方认可 TON 网络作为其首选的 Web3 基础设施区块链,导致 TON 代币价格上涨了 13% 。作为这一认可的一部分,Telegram 将在其用户界面中集成 TON,并在应用程序内进行独家推广。自初始公告发布近三年后,Telegram 已经推出了与 TON 区块链集成的加密货币钱包,该钱包面向全球 8 亿用户开放。此外,在 TON 区块链上开发的项目将优先获得 Telegram Ads(应用的广告平台)的接入。此次合作旨在促进加密货币的接受并为 Telegram 用户提供进入加密货币世界的入口。

Telegram 的首席投资官 John Hyman 表示,TON 的集成旨在授权全部用户拥有数字所有权,同时为 TON 项目提供接触 Telegram 庞大受众群的途径。Hyman 进一步澄清,TON 将继续作为一个独立的去中心化组织,而 Telegram 的重点仍将放在提供即时通讯平台上。

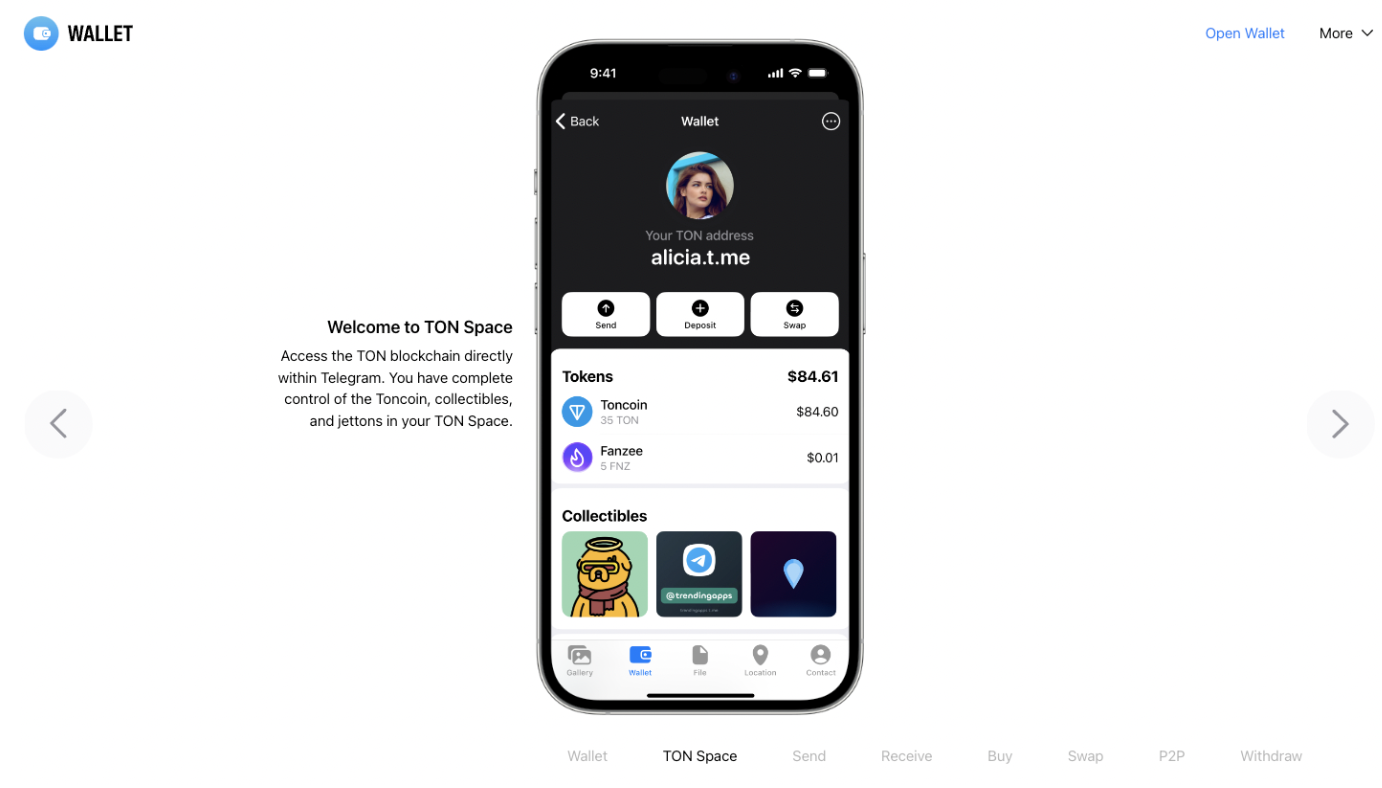

TON Space

已经作为 Telegram 上一个独立机器人吸引了 300 万注册用户的基于 TON 的 Web3 钱包,将很快集成到应用程序中,通过设置扩展到所有 8 亿用户。这款钱包拥有用户友好的界面和一系列便捷功能,包括简单的银行卡充值,选择首选货币,以及轻松购买和交易加密货币。该钱包基于以其快速交易和对去中心化应用(dApps)的支持而著称的 TON 区块链,确保了流畅和无缝的用户体验。其主要目标是向 Telegram 的广泛用户群介绍去中心化的数字资产管理。

此外,美国以外的 Telegram 用户可以期待 TON Space 的推出,这是钱包的自托管版本。TON 基金会预计将在 11 月完成推出。TON Space 赋予用户进行加密货币交易、管理他们的 Telegram 用户名和执行 DNS 相关任务的能力。此外,钱包还包括一个支持加密货币和法定货币之间无缝交易的点对点市场。

这两个钱包结合形成了一个强大的生态系统。托管钱包优化了支付流程和用户引导,而非托管钱包则支持在去中心化金融(DeFi)和游戏领域的高级操作。Telegram 内这一全面的金融工具套件为广泛应用铺平了道路。Telegram 的方法强调赋予用户对其数字资产的控制权,与其成为综合性“超级应用”的愿景保持一致。

Telegram 与 SEC 历史

Telegram 的区块链计划 TON 在 2020 年遭遇了监管障碍,包括来自美国证券交易委员会(SEC)的诉讼。诉讼以 Telegram 支付 1850 万美元的罚款和承诺退还投资者未使用的资金而告终。尽管 Telegram 现在正在重新启动并全球范围内扩张其加密钱包,某些国家(包括美国)被排除在外,这很可能是由于持续的监管挑战。

我们的看法

整合 TON 钱包到 Telegram 是一个重大里程碑,为用户、Telegram 和更广泛的加密行业带来了多个好处和考虑因素。我们从不同方面来审视这些利与弊。

对于 Telegram 用户:

优点:

1. 易于访问:用户可以方便地享受 TON 网络的好处,包括低费用、快速交易和高安全性,而无需离开他们熟悉的聊天界面。

2. 功能扩展:用户可以创建和加入支持 TON 支付的群组和频道,以及参与 TON 区块链上的去中心化应用程序(DApps)。

3. 增加控制:Telegram 保证不会访问用户的私钥或资金,为他们提供更多自由和对资金的控制。

4. 无费用:使用 TON 钱包,Telegram 不收取任何费用。

风险:

1. 托管钱包风险:TON 的托管钱包意味着 Telegram 持有用户的私钥。用户必须信任 Telegram 能安全和可靠地保存他们的资金,这引入了 Telegram 被黑、离线或冻结帐户的风险。

2. 法律风险:Telegram 的钱包在法律灰色地带运营,使用它可能会暴露用户面临的法律风险,如逃税、洗钱或违反制裁。用户还必须遵守可以随时更改的 Telegram 服务条款。

3. 兼容性有限:Telegram 钱包与其他加密钱包或交易所不兼容,降低了选择和灵活性。如果用户失去了对他们的 Telegram 帐户的访问权,这也使得资金恢复更加困难。

对于 TON 和 Telegram:

1. 赋权用户:TON 网络与 Telegram 的集成通过扩大他们对 Web3 采纳的访问权限并增加 Toncoin 的市场价值来赋权用户。

2. Telegram 生态系统的可能性:这次集成为 Telegram 内打开了新应用的可能性和财务工具,类似于 WeChat 生态系统(2022 年交易量为 3.5 万亿元人民币)。这包括应用内购买、电子商务、分账、付费订阅和带有利息的 USD 代币和借款选项的 DeFi 集成。

3. 未来发展的可能性:TON 网络上潜在的未来发展包括去中心化的 P2P 法币到加密货币市场、TON 原生稳定币、多链钱包、AI 代理、面向聊天组的加密游戏、NFT 和会员代币。

4. 挑战:TON 网络面临的一些挑战包括需要改进 TON 钱包帐户、原生稳定资产和用户界面/用户体验。

总体而言,将 TON 网络集成到 Telegram 是一个重大的举措,它赋权用户,扩大了 Web3 的采纳,提高了 Toncoin 的市场价值。它代表了信息传递和区块链集成未来的一步。尽管集成为用户和 TON 和 Telegram 带来了多个好处,也存在与钱包的托管性质和法律含义相关的风险考虑。

每周协议推荐

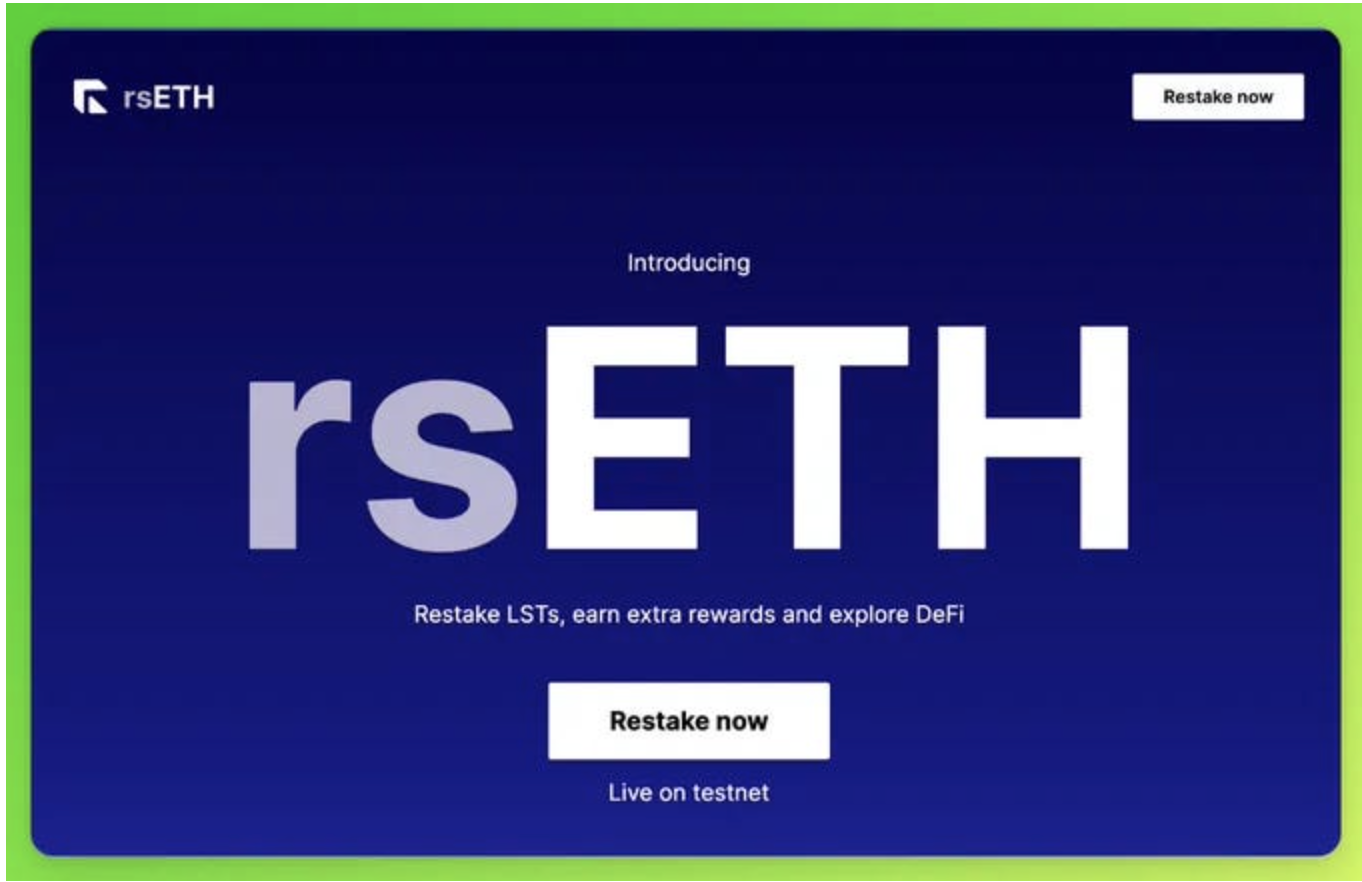

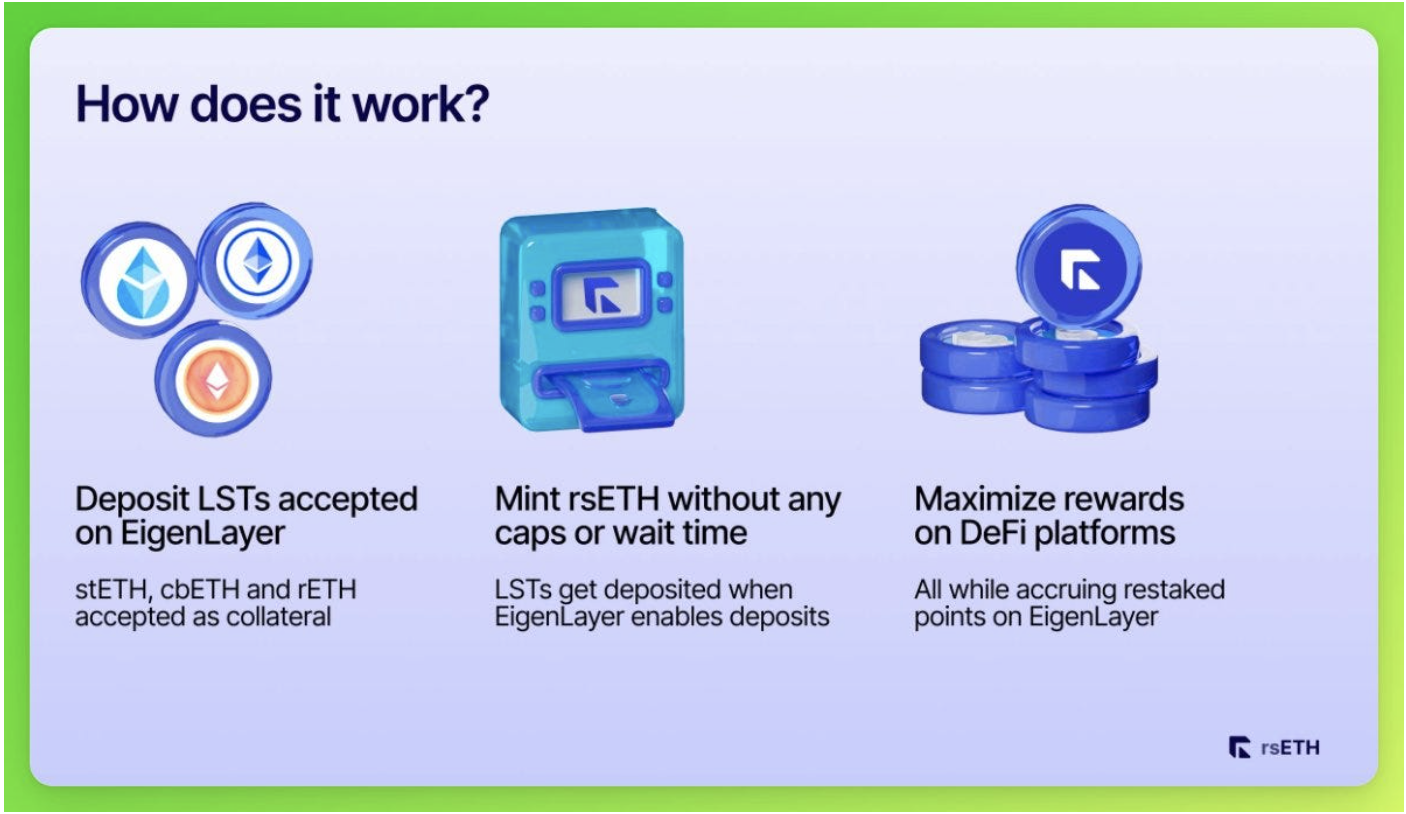

欢迎来到我们的每周协议推荐。本周,我们挑选了 Stadar Labs,该协议提供流动性重新抵押代币(LRT),为存入重新抵押平台(例如 EigenLayer)的非流动性资产提供流动性。

Restaking 已经吸引了 177000 个以太坊(ETH),准备爆发。现在,LRT(流动性重押代币)基础设施已经出现,将重押体验提升到了另一个层次。Stader Labs,一种流动性质押协议,现在推出了流动性重押代币(LRT),即$rsETH,这是一种代表重押 ETH 所有权的合成凭证代币,包括在 EigenLayer 上重押的资产。$rsETH 是首个此类代币,于 2023 年 8 月 21 日在测试网上线。Stader Labs 旨在通过引入 LRT DAO 来解决节点运营的挑战,该 DAO 将负责选择验证者和质押服务。最终用户将能够用 ETH 和 LSTs 兑换 LRTs。然后,LRT 合约将把代币分发给各个节点运营商并累积奖励。

什么是重押(Restaking)?

重押是 EigenLayer 中的一个功能,它是一个中间件,允许你一次性在多个协议(称为主动验证服务,AVS)上质押你的 ETH,从而用合并的安全性同时保护多个网络/服务。

什么是 Eigenlayer?

EigenLayer 是一个基于以太坊的协议,允许用户通过重新质押已经质押的资产来获得额外奖励。重新质押涉及使用 LSTs(流动性质押代币),如 stETH、rETH 或 cbETH,来保护像 rollups、桥接和数据可用性网络等服务。Eigenlayer 充当桥梁,使用户能够在不同的协议和选项(如 AVS)之间重新分配他们的 LSTs。通过使用 EigenLayer 的智能合约,用户可以在获得额外奖励的同时加强其他应用的安全性。

优点:

- 资本效率:质押者可以从多个验证服务中获得奖励,而无需锁定额外资本。

- 增强安全性:EigenLayer 允许新协议利用以太坊现有的安全层。

- 开发者自由:开发者无需建立新的安全层,从而节省时间和资源。

- 经济安全:EigenLayer 使开发者能够有效地为新协议引导经济安全性。

- 灵活性:协议在完善其独特应用特性的同时保持对共识和处罚条件的控制。

缺点:

- 学习难度:重押对于质押者来说可能是一个复杂的概念。

- 节点运营商的发现:重押者需要了解哪些节点运营商符合他们的风险特性。

- 复杂的奖励动态:来自多个来源的不稳定市值的奖励可能会令人不知所措。

- 高昂的燃气费:领取奖励可能会很昂贵,特别是对于小投资者。

- 流动性问题:直到解锁期结束之前,访问或交易重押的 ETH 都受到限制。

- 机会成本:质押者必须在重新质押和探索其他 DeFi 机会之间做出选择。

LRT 如何解决问题?

由于 EigenLayer 重新质押存在很多限制,LRT(流动性重押代币)应运而生,以解决问题。Stader Labs 旨在通过引入 LRT DAO 来解决节点运营的主要挑战。LRT DAO 负责选择质押 ETH 的验证者和服务,为验证者提供无需许可的加入机会。这一过程通过多池架构得以促成,类似于 $ETHx。流动性重押代币(LRT)通过解锁这一流动性并添加另一个杠杆层来提高收益。

以下是其运作方式的详细说明:

- LRT DAO 选择用于重新质押 ETH 的验证者和服务,允许验证者无需许可即可加入。多池架构,类似于$ETHx,有助于选择过程。

- 重新质押者质押他们的$ETH 或 LSTs。

- LRT 合约将代币分发到与 DAO 一起运营的不同 N.O.s。

- LRT 代币的价格假设各种奖励和质押资产的基础价格。

- 重新质押者可以在 AMMs 上将 LRT 代币兑换为其他代币,或赎回基础资产,或利用 DeFi 的组合性。

- LRT DAO 将继续监控要登机的服务和验证者。

- Tokenomics 将确保服务之间质押的分配。

从技术方面了解 Stader 的 rsETH

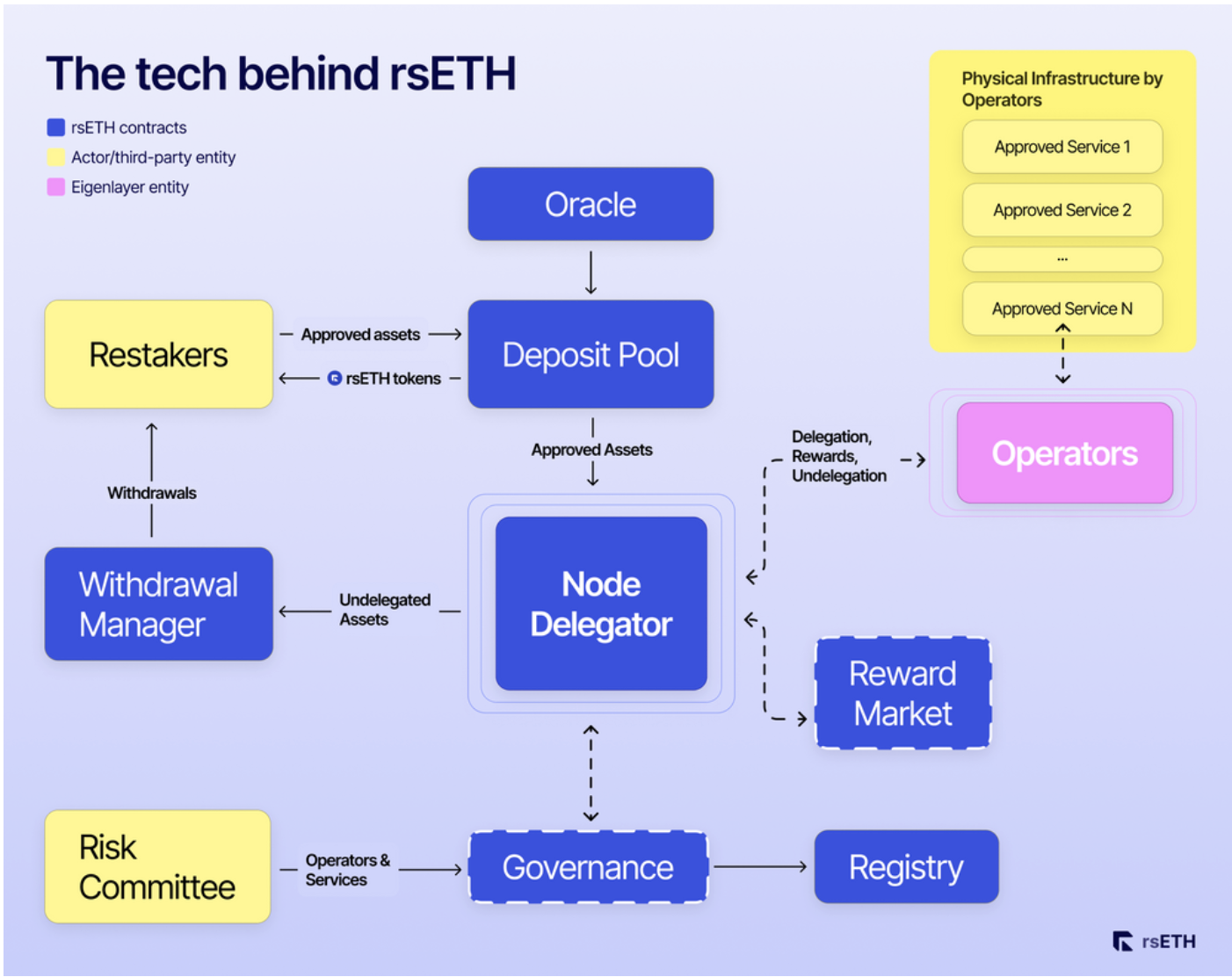

- rsETH 是一种流动性重新质押代币,允许用户在保留流动性和参与 DeFi 的能力的同时,接收以太坊质押和重新质押奖励。推动 rsETH 的主要模块是存款池、节点委托人、奖励市场和提款管理器合约。

- 存款池:一个金库,允许重新质押者根据当前汇率转移其流动质押代币,并收到 rsETH 代币作为回报。它通过抽象奖励和验证者委托的复杂性来简化重新质押的过程。

- 节点委托人:一个处理将存款的流动性质押资产转移到每个运营商合约的模块。每个节点委托人中的资产都委托给选定的运营商,为该运营商操作的所有节点提供经济安全性。节点委托人自动化奖励赎回过程并实现节省燃气费。

- 奖励市场:提供用于与各种奖励互动的不同策略。关于这些策略的决策是通过 DAO 治理进行的。奖励市场帮助 AVS(资产验证系统)避免不良的代币活动,并允许重新质押者获得更好的回报。它作为通过重新质押获得的所有奖励的基础层。

- 提款管理器:一个允许 rsETH 代币持有人将他们的代币转换为协议管理的所有资产份额的模块。赎回者接收由订阅不同 AVS 的运营商的节点委托人赚取的各种奖励的组合。

我们的洞察

流动性重新质押和 LRT 代币的引入为质押世界带来了令人兴奋的变化。LRTs 的核心优势包括改善流动性、更高的收益和节省燃气费、自动化的治理聚合,以及通过多个运营商的多样化降低风险。

然而,也重要的是要考虑与 LRTs 相关的某些风险。

- 削减风险:由于恶意活动,质押的 ETH 有更高的损失风险。

- 集中化风险:如果大量的质押者转向 EigenLayer,以太坊的去中心化有系统性风险。

- 收益风险:协议之间的高度竞争可能会稀释质押奖励。

- LRT 协议风险:LRT 协议还是相对新的,因此重要的是仔细评估技术和协议相关的风险。

总之,LRTs 提供了一个值得关注的引人注目的叙述。它们有潜力造福于流动性重新质押者、AVS 和 LRT DAO 生态系统内的运营商。然而,至关重要的是要承认所涉及的风险。与任何财务杠杆机制类似,LRTs 引入了风险,使系统易受市场波动和系统故障的影响,正如我们在 DeFi 的早期观察到的。虽然以太坊本身可能不受影响,但众多新的 AVS 和 LRTs 的出现可能会稀释投资和注意力,导致治理代币价格下降。还需要关注其他如 Astrid Finance 和 InceptionLST 等 LRT 协议,这些协议可能提供空投奖励,并在这个领域值得关注。

Gryphsis 研究聚焦

欢迎来到本周的 Gryphsis Research 聚光灯,在这里我们将与您分享我们团队的最新见解。我们专门的研究团队不断探索加密领域中的前沿趋势、发展和突破。本周,我们很高兴与您分享我们的研究,题为《Cosmos & Polkadot V.S. Layer 2 Stacks:系列 1 - 底层技术的探究》,旨在加深您对不断发展的加密世界的理解,并激发您的好奇心。

这篇研究探讨了以太坊中 Layer 2 解决方案的现状,例如 Optimism、zkSync、Polygon、Arbitrum 和 StarkNet。这些方案针对可扩展性和高昂的燃气费用,但在代码层面上存在兼容性问题并缺乏主权。以太坊虚拟机(EVM)的通用性妨碍了针对不同类型应用的优化,导致需要进行权衡。此外,所有 Dapps 共享相同的基础架构,并受到 EVM 的管理,限制了它们在没有 EVM 升级的情况下满足特定需求的能力。

为了克服这些挑战,像 Cosmos 和 Polkadot 这样的项目使开发人员能够构建具有独立治理的独立区块链,目标是实现高性能的跨链互操作性和一个链间网络。研究的第一系列将概述并比较各个项目的技术解决方案。

Cosmos

架构框架:

Cosmos Network 是一个由独立、可扩展和可互操作的区块链组成的去中心化网络。

它采用分层架构,有两种类型的区块链:Hubs(中心枢纽链)和 Zones(区域链)。

Hubs 旨在连接多个 Zones 并促进它们之间的通信,降低复杂性。

Cosmos 生态系统中的每条链都以主权方式独立运行,任何链都可以作为 Hub。

关键技术:

IBC(跨链通信)在 Cosmos 生态系统内部实现了代币和数据的转移。

通过最终一致性级别的共识实现跨链通信,确保交易一旦添加到块中就是最终的。

Tendermint BFT 是 Cosmos 使用的基础共识算法和引擎,提供了一个通用的引擎解决方案。

Cosmos SDK 是一个模块化框架,简化了在共识层上的 Dapps 开发,允许创建特定的应用程序或链而无需从头开始编写代码。

链间安全允许独立的链与 Cosmos Hub 共享验证人,实现共享安全并降低新链的准入门槛。

链间帐户使用户能够直接从 Cosmos Hub 访问所有支持 IBC 的 Cosmos 链,促进全链交互。

Polkadot

架构框架:

Polkadot 的架构由作为网络核心部分的中继链组成,旁链围绕其运转。

旁链是连接到中继链的专用链,通过抵押 DOT 代币获得插槽。

类旁链与旁链相似,但它们之间共享插槽,并按照按需付费模型运行。

桥接机制促进了旁链与外部链之间的通信,实现跨链功能。

关键技术:

BABE(用于区块链扩展的盲分配)是 Polkadot 的区块生成机制,随机选择验证人生成新块。

Grandpa 是一个用于最终确定块和解决潜在分叉的机制。

Substrate 是一个支持构建与 Polkadot 兼容的自定义区块链的开发框架,允许原生兼容性和共享安全。

XCM(跨共识消息格式)是用于 Polkadot 生态系统内跨链通信的标准消息格式,使不同的链能够互动。

OP Stack

架构框架:

OP Stack 是由 OP 集团维护的一系列组件,为L2解决方案和治理提供软件解决方案。

它采用分层架构,包括数据可用性层、排序层、衍生层、执行层、结算层和治理层。

以太坊作为安全共识的底层,OP 桥梁促进 OP Stack 内的超链之间的通信。

在 OP Stack 上构建的链可以自定义其功能,并从共享安全性、通信层和统一开发栈中受益。

关键技术:

Op Rollup:通过数据可用性挑战和并行事务执行确保安全性,允许在第 1 层和第 2 层之间进行高效和安全的事务处理。

跨链桥接:在 OP Stack 内的不同链之间实现通信和资产转移。它包括L2消息传递、具有共享排序器的跨链事务以及使用 Plasma 协议的超链事务。

L2消息传递:使用模块化证明解决L2 OP 超链之间的通信问题,根据安全性和延迟需求提供不同的桥接选项。

跨链交易:通过在不同链上的共享排序器实现跨链交易的事务序列共识,减少异步执行的风险。

超链交易:利用 Plasma 协议通过在 Plasma 链上记录数据承诺来增强数据可用性的可扩展性,提高 OP Stack 内的交易可扩展性。

ZK Stack

架构框架:

ZK Stack 是一个基于 ZK Rollup 构建的开源、模块化代码库,允许开发者创建自定义的L2和L3超链。 开发者可以根据他们的特定需求自定义他们的区块链,无论是作为与 zkSync Era 平行的第二层网络,还是建立在其上的第三层。

ZK Rollup 超链独立运行,依赖以太坊L1进行安全性和验证。

关键技术:

ZK Rollup:允许用户提交事务,这些事务由排序器收集,使用零知识证明(STARK/SNARK)进行验证,并在L1上进行更新以进行验证,确保高技术和安全标准。

跨链桥:通过在L1上部署共享桥智能合约来促进超链之间的互操作性,通过 Merkle 证明在超链上验证交易。每个超链上的智能合约异步通信,允许在几分钟内跨链进行资产转移,无需中介。

压缩技术:通过在L3层进行压缩和在L2层进行放大来实现更高的压缩比,降低成本,并在几分钟内每笔交易实现无信任和快速的跨链互操作性。

Polygon 2.0

架构框架:

Staking 层:基于 PoS 协议运行,由验证器管理器负责监督所有 Polygon 链,链管理器负责管理每个单独链的验证器。

互操作性层:包括一个消息队列,用于在 Polygon 链内进行安全的消息传递,以及一个聚合器,用于在 Polygon 和以太坊之间提供高效的服务。

执行层:允许 Polygon 链生成有序交易,具有诸如共识、mempool 和P2P通信等组件。

证明层:使用高性能的 ZK 证明协议为 Polygon 链生成证明,包括一个通用证明器、状态机构造器和可定制的状态机。

关键技术:

zkEVM Validium:是 Polygon 的 PoS 机制的升级版本,基于 zkEVM 原则运行。它提供成本效益和可扩展性,适用于高交易量的应用程序,如 GameFi、SocialFi 和 DeFi 平台。

zkEVM Rollup:Polygon 的 PoS 机制(即将更名为 Polygon Validium)和 zkEVM Rollup 是 Polygon 生态系统内的主要网络。zkEVM Rollup 提供高安全性,但可能有略微更高的费用和有限的吞吐量,适用于安全性至关重要的高价值交易。

每周 VC 投资聚焦

欢迎来到我们的每周投资聚焦,我们在这里为你揭示加密空间中最重大的风险投资动态。每周,我们将重点关注获得最多融资的协议。

PahdoLabs

Pahdo Labs 已获得 1500 万美元的融资,以开发一款动漫风格的角色扮演游戏(RPG)和用户生成内容(UGC)平台。该初创公司旨在通过启用玩家使用 AI 工具和程序生成来彻底改变动漫 RPG 类型。这一轮融资由 Andreessen Horowitz(A16z)牵头,参与者包括 Pear VC、BoxGroup、Long Journey Ventures、Neo 和 Global Founders Capital。该团队即将推出的项目代号为 Halcyon Zero,将结合创造性和社交特性,让玩家塑造自己的动漫风格世界。

Pahdo Labs 已邀请动漫和动作 RPG 爱好者参与即将推出的游戏 Halcyon Zero 的预 alpha 测试。这家位于纽约的工作室旨在创建一个结合了用户生成内容和 AI 的下一代动漫 RPG 平台。所获得的融资使团队得以扩张,并为开发的早期访问阶段确保了资源。

Halcyon Zero 是一个建立在 Godot Engine 上的等角动漫幻想 RPG 和在线游戏创建平台。它提供充满活力的城镇、充满挑战的荒野区域和快节奏的战斗,强调团队合作。游戏设有角色类别,并计划在发布后推出多样化的、受动漫启发的英雄名单。Pahdo Labs 专注于通过强大的级别构建工具和集成用户创建的内容来赋予玩家成为游戏设计师的能力。公司计划最初在 PC 上发布游戏,并在诸如 iOS 和 Switch 之类的平台上引入跨平台功能。核心游戏玩法目前正在开发中,预计在未来几年将进行更大规模的测试。

Movaverse

Animoca Brands 已为其 Mocaverse 项目筹集了 2000 万美元的资金,该项目旨在成为 Web3 游戏、文化和娱乐的身份和积分系统。该轮融资由 CMCC Global 主导,其他投资者如 Kingsway Capital、Liberty City Ventures、GameFi Ventures 以及个人投资者 Aleksander Larsen 和 Gabby Dizon 也参与其中。这些资金将用于推动 Mocaverse 的发展,包括产品开发、促进 Web3 的采用以及确保合作伙伴关系。

Mocaverse 是 Animoca Brands 卓越的公司、项目、投资、股东和合作伙伴家族的会员 NFT 收藏。Mocaverse 旨在通过允许用户创建自己的数字身份、赚取忠诚度积分并访问 Mocaverse 生态系统来赋予游戏、文化和娱乐领域的用户权力。该项目将推出 Moca ID,这是一种不可转让的 NFT 收藏,使用户能够参与该生态系统并赚取忠诚度积分。专注于区块链和 Web3 投资的风险资本公司 CMCC Global 表达了对 Mocaverse 及其为数百万用户提供访问 Web3 和元宇宙生态系统的潜力的支持。

协议事件

SSV.network hits mainnet to increase decentralization of Ethereum staking pools

Polygon 2.0 — MATIC conversion to POL outlined in preliminary improvement proposals

Lidos’ wrapped staked ETH is coming to Cosmos

Tokensoft and Connext Host World’s First Cross-Chain Distribution, Attract ~ 1 Million Registrants

LBank Announces MetaExpand (UMM) as Second Launchpad Project

Particle Network Launches V2 of Its Intent-Centric Modular Access Layer of Web3

Ancient 8 Launches A Web3 Gaming Layer 2 Chain on Ethereum

行业更新

DeFi economic activity drops 15% in August — VanEck

Ethereum launches new testnet ‘Holešky,’ allocates 1.6 B ETH for devs

Bitcoin BSC Crypto ICO Reaches 50% Of Soft Cap After Raising Almost $ 2 Millions in 10 Days

Liquidation cascade puts crypto market into shock: Report

Ether Turns Inflationary As On-chain Activity Slides

Crypto funding: <a href="https://blockworks.co/news/funding-gaming-metaverse-animoca-brands-fintech">Metaverse, gaming and fintechs dominate $ 80 M week

PayPal enables US users to sell cryptocurrency via MetaMask wallet

推特 Alpha

在加密推特中蕴含了许多 Alpha,但在数千条推特线程中导航可能很困难。每周,我们都会花费几个小时进行研究,精选出充满洞见的线程,并为您策划每周的精选列表。让我们深入了解吧!

https://x.com/poopmandefi/status/1701240604804456540?s=20

https://twitter.com/CryptoReviewing/status/1700917190310978035?s=20

https://twitter.com/CryptoGirlNova/status/1701248749815595364?s=20

https://twitter.com/DOLAK1NG/status/1703061354633216470?s=20

下周事件

新闻来源:

https://venturebeat.com/games/pahdo-labs-raises-15m-for-anime-inspired-game-world-and-ugc-platform/

https://www.animocabrands.com/animoca-brands-raises-usd-20m-for-its-mocaverse-project

https://www.staderlabs.com/blogs/understanding-rseth-tech-explainer/

https://www.tekedia.com/telegram-integrates-ton-based-crypto-wallet/

https://mpost.io/telegram-launches-ton-based-crypto-wallet-after-3-year-regulatory-hurdle/

以上就是本周的全部内容。感谢您阅读本周的周报。希望您从我们的洞见与观察中获益。

可以在 Twitter 和 Medium 上关注我们,获取即时的更新。我们下期再见!

此周报仅用于提供信息。它不应作为投资建议。在做出任何投资决策之前,您应进行自己的研究,并咨询独立的财务,税务或法律顾问。且任何资产的过去表现并不能预示未来结果。