PSE Trading:探究RWA的底层商业模式,思索可持续性

原文作者:PSE Trading Analyst, @Yuki

在美联储加息的大环境之下,美国进入「高利率时代」。在持续上扬的美债收益面前,DeFi 世界中的低风险收益明显有些捉襟见肘。加密市场陷入了资金单向外流涌入传统金融市场的窘境。

「把现实世界资产收益引入至 DeFi」将成为留住场内资金、吸引外部资金的重要举措。基于此,加密市场将目光重新聚焦于 2020 年就已出现的 RWA(Real World Assets)概念,试图通过不同业务模式探索出传统金融市场与加密市场之间资金互相流通的最佳方法。

本文将从中短期最适合 RWA 的底层资产出发,对加密市场已有的 RWA 业务模式进行梳理、分析。

1.RWA 底层资产探究

1.1 赛道背景&现状

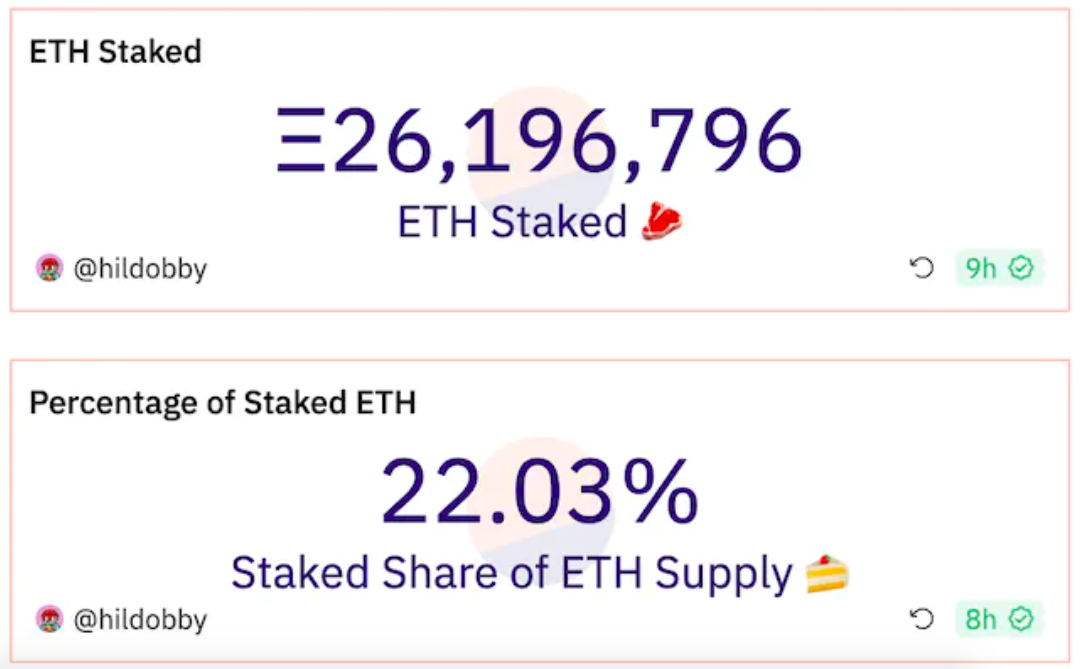

目前,虽然加密市场的总市值仍维持在一万亿美元上下,但是场内却缺乏稳定的低风险收益来源,唯有基于 PoS 机制的 ETH 本位流动性质押得到了场内资金的认可与支持。这也变相说明了 LSDFi 崛起的必然性。

ultrasound.money 的数据显示,以太坊自转 PoS 以来,已经产生了 140 万枚 ETH 的质押收益,而它当前的质押率仅为总供应量的 22.03% 。这意味着以太坊成为了自带 5.3% (Staking Rewards/ETH staked)利息的生息资产,已经为市场带来了 24 亿美元的基础收益(ETH 在笔者写文章时为 1720 美元一枚)。

那么,沿用同样的思路,RWA 代币化(Tokenization)是将现实世界各类资产中的「权益价值」以数字货币的形式直接映射到区块链上,赋予「权益价值」交易流通属性。也就是说 RWA 把现实资产的收益引入了加密行业,可以作为 U 本位资产的真实收益为整个市场注入更好的流动性与活力。

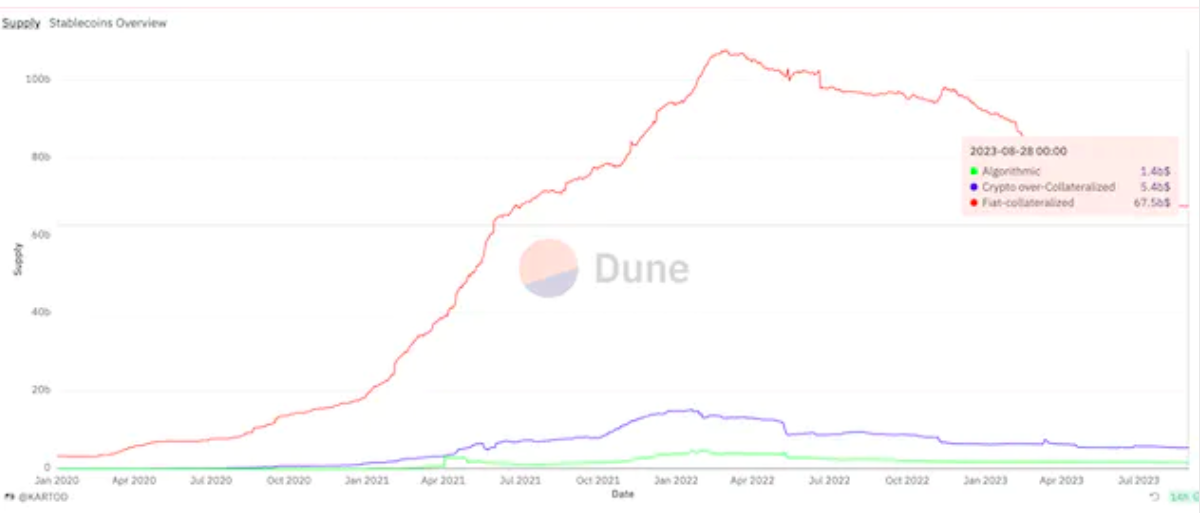

目前,整个加密行业的稳定币规模在 743 亿美元左右,但大部分与美元锚定的稳定币(U 本位资产)并没有稳定的真实收益(与 ETH 的 5% staking 收益相比)。而 RWA 倘若能为 U 本位资产带来同样级别的真实收益(与年化 5% 相近),则可以在每年产生 37 亿美元的基础收益之外,刺激稳定币规模的进一步增长。

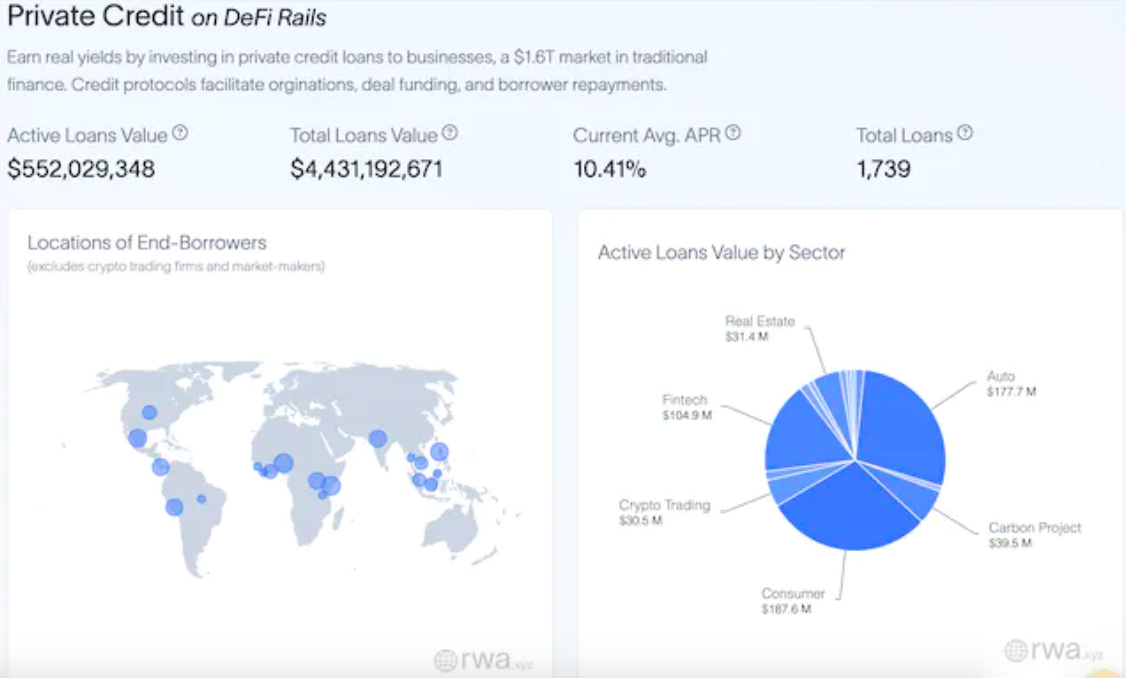

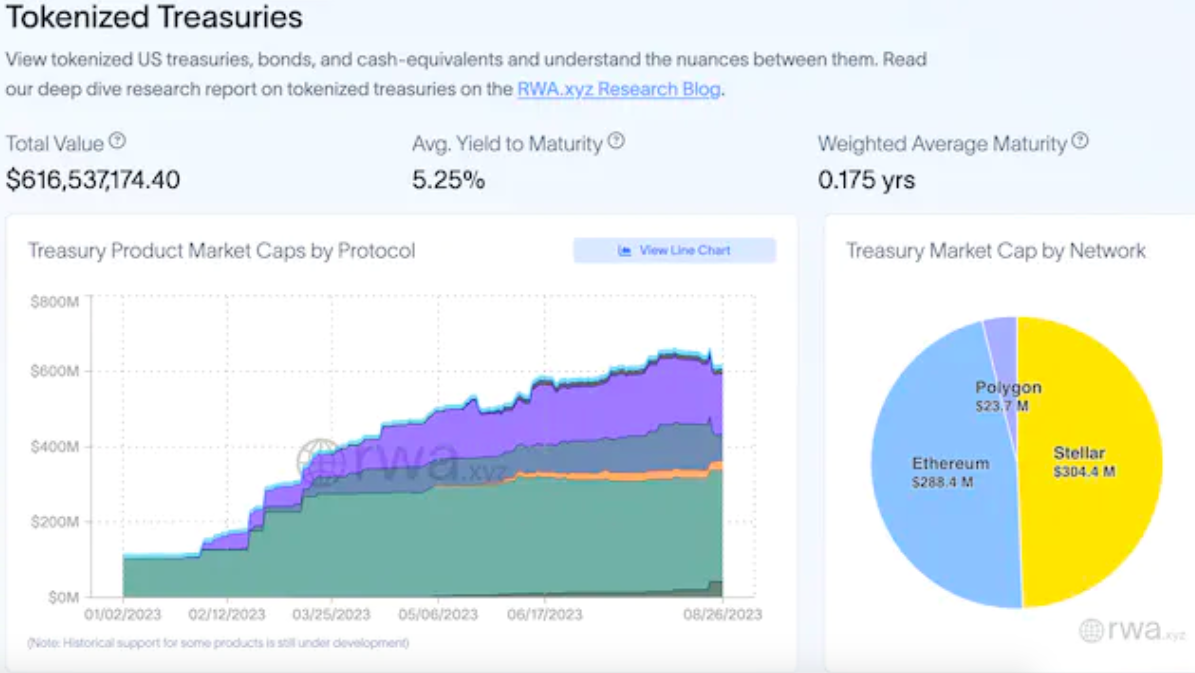

根据 rwa.xyz 统计,已有的 RWA 私人信贷协议累计借款量仅 5 亿多美元(未统计 MakerDAO),而代币化的美债规模也仅有 6.4 亿美元(未统计间接引入模式),共计不到 12 亿美元的规模。

而以短期美债(Treasury Bills)为例,美国财务部在今年 7 月 31 日公布的平均利率为 5.219% ,整体规模为 4.769 万亿美元。如果 RWA 能将这部分收益引入加密市场,理想情况下将产生 2488.9 亿美元的收益规模。对于整体市值不过一万亿美元的加密行业来说,这如洪水般的流动性将浇灌整个行业,重新焕发生机。

BCG 联合 ADDX 发布的报告也预测,全球代币化资产(如房地产、股票、债券和投资基金等)将在 2030 年增长至 16.1 万亿美元,为加密市场带来更多有效关注。

综上,现在的 RWA 仍处于发展早期,但却有着巨大的潜力。正如 ETH 本位资产的真实收益引发了 LSDFi 的野蛮生长,RWA 也可以作为 U 本位资产的真实收益推动整个加密市场的增量发展。

而加密市场内部也已经敏锐地嗅到 RWA 背后的巨大潜力,以 MakerDAO、Compound 为首的 DeFi OG 项目正在积极布局入场。

1.2 中期最佳底层资产:债券

由于 RWA 需要将传统链下资产代币化,因此底层资产的选择将成为最核心的问题。原因在于,底层资产对于后续代币化的复杂度与灵活性、资产管理与风险管理的难度都有着密不可分的重要影响。

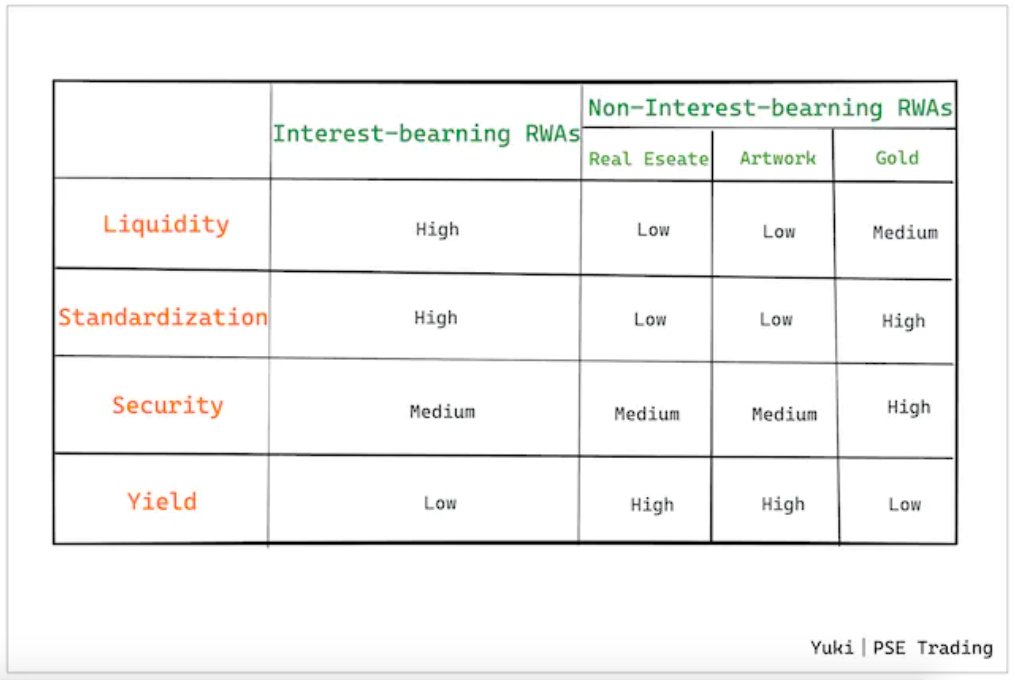

基于上述「RWA 作为加密市场 U 本位资产的真实收益」的逻辑,笔者将 RWA 底层资产直接分为两大类:

生息类 RWA(类比转 PoS 以后的 ETH):债券类资产,以短期美国国债或债券 ETF 为主

非生息类 RWA(类比 PoW 的 ETH):房地产、艺术品、黄金等

在此基础上,再综合考虑到底层资产的流动性、标准化程度、安全性、收益率,我们可以发现,生息类 RWA(以债券为主)虽然在收益率方面或落后于非生息类 RWA(房地产与艺术品收益率上限更高),但是在更重要的流动性和标准化程度方面,有着明显的优势。只有流动性更好、标准化程度更高的底层资产才能支持 RWA 的大规模应用与扩张。

此外,生息类 RWA 与 ETH 本位的生息资产类似,即便底层资产的收益率并不高,但是围绕稳定的「生息」可以进一步提高协议层的可组合性,进而推动更多 DeFi 创新。

综上,笔者认为中期最佳的 RWA 底层资产是以短期美国国债或债券 ETF 为主的债权类资产。其生息属性不仅完美满足加密市场内部对于低风险收益来源的渴望,而且流动性好、标准化程度高的特性也有利于 RWA 的大规模应用。

所以下文,笔者将对基于美债或债券 ETF 为底层资产的代表性 RWA 项目进行「业务模式」层面的深入探讨。

2.基于美债 / 债券 ETF 的 RWA 业务模式

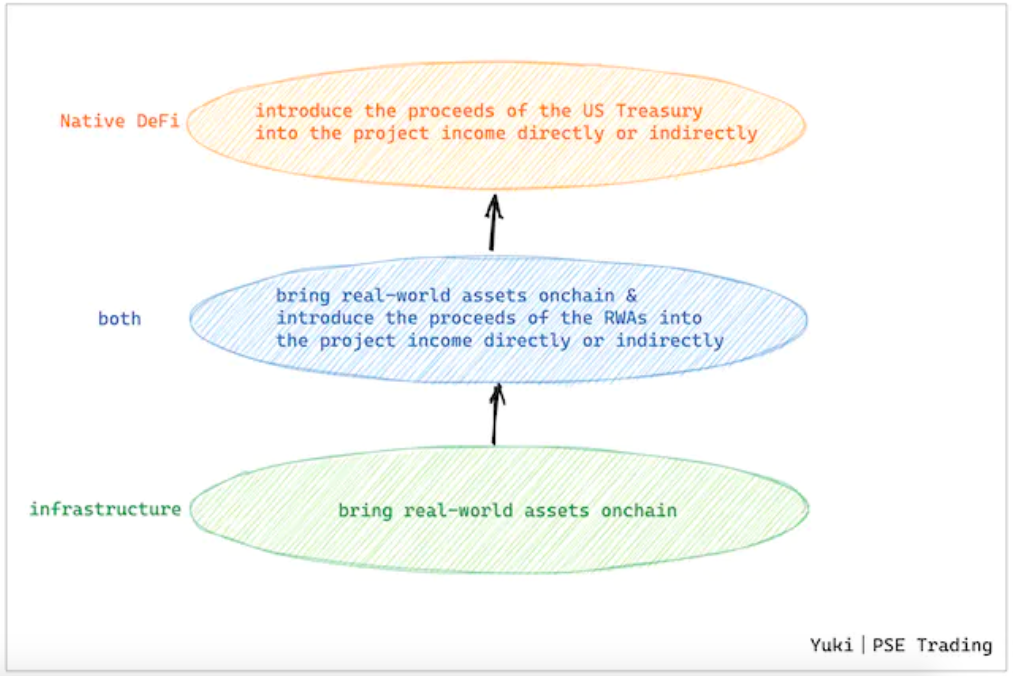

从以美债为底层资产的 RWA 出发,可以发现目前主流的 RWA 存在三层业务模式,分别为:

底层基建业务:负责美债 RWA 上链

中间层混合业务:负责美债 RWA 上链和将美债收益引入 DeFi

上层 DeFi 业务:将美债收益直接作为或间接引入项目收益

三层业务模式对应的 RWA 代币化难易程度与灵活度以及各自面向的客户群体都有很大的区别。

具体来说,底层基建主营的 RWA 代币化业务并不需要直接接触 C 端用户,而是以 B 端项目为主要客群。「创建链下真实世界资产的链上表示」这一步骤不仅需要解决链上与链下的同一性问题,更要考虑到资产的安全问题、监管风险和实现成本。往往这一类业务是难度最高且最复杂的,但这也是 RWA 中必不可少的一环。

而作为上层的 DeFi 原生应用,它们不必考虑「代币化」这一事件的本身,而是可以在已经完成 RWA 代币化的基础上直接或间接地引入 RWA 收益,方式多为选择与基建项目合作或基于 RWA 代币打造 DeFi 产品,因此它们也多直接面向 C 端用户。

中间层则是二者的结合,它们自己在实现 RWA 代币化的同时也为自己的 RWA 代币打造了合适的链上产品,以直接引入 RWA 的收益并与融入 DeFi 世界。

一般来说,只要是涉及到 RWA 代币化业务的项目都有较为严格的 KYC 要求。这一方面是出于安全与监管的要求,但另一方面却与 DeFi 的自由精神内核相悖,无形中提高了 RWA 的准入门槛。

2.1 底层基建:RWA 代币化

将现实世界资产带入链上必不可少的一个步骤就是将资产进行封装,使其在合规的基础上以数字化形式呈现,同时还保留资产的相关重要信息如价值、所有权、期限等。这层业务的重要性相当于为建造大楼打好稳固的地基。

2.1.1 业务模式一:SPV 代币化

RWA 代币化的具体实现路径,目前最主流的方式是参考资产证券化的思路,通过设立特殊目的公司(Special Purpose Vehicle, SPV)来持有底层资产,并实现控制权、管理权和风险隔离。

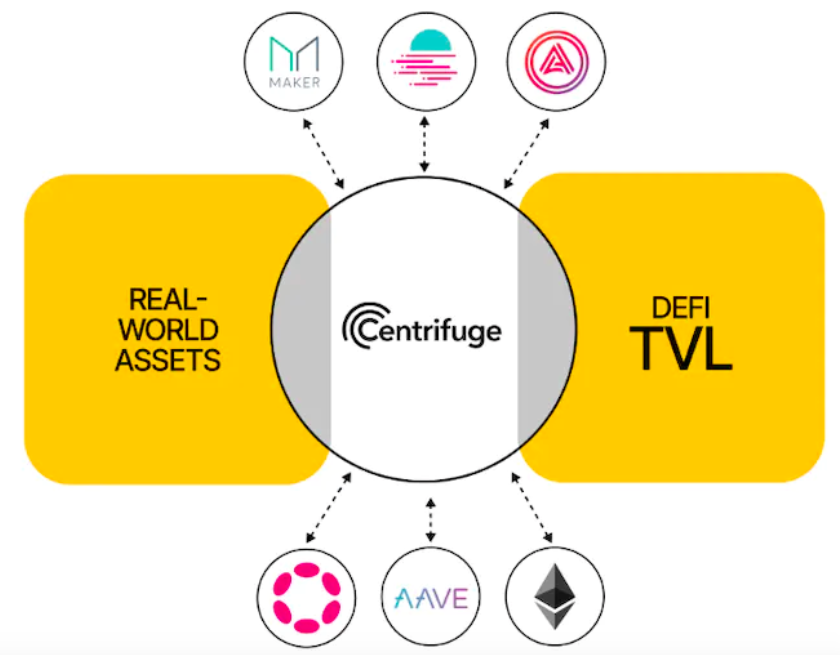

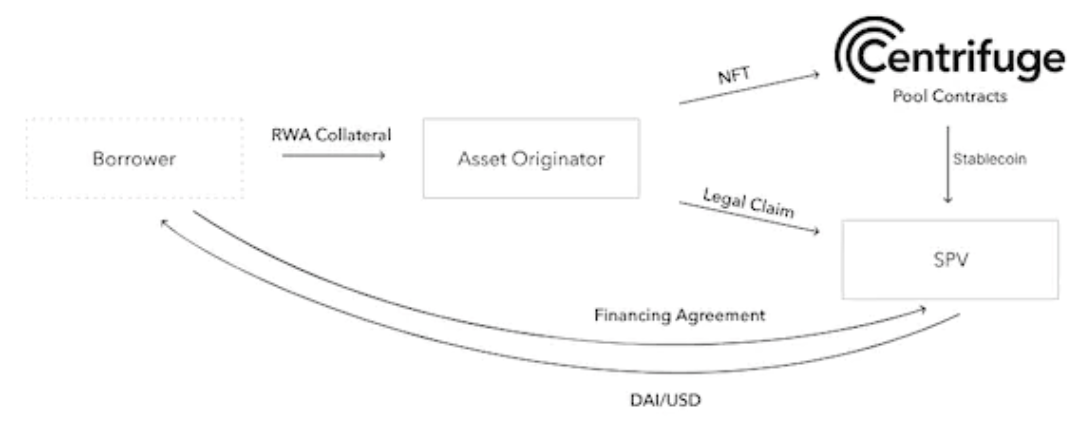

代表项目:Centrifuge

Centrifuge 虽然是一个 RWA 借贷协议,但是它的 SPV 代币化路径却对众多 DeFi 协议实现 RWA 有着重要启示意义。而它推出的 Centrifuge Prime 也是为了给 DAO 投资 RWAs 提供技术和法律框架。

MakerDAO 早在 2021 年 2 月就和 New Silver 通过 Centrifuge 发行了第一个 RWA 002 Vault。此后更大规模引入 RWA 都是基于 SPV 代币化路径。

Centrifuge 的 RWA 业务模式实现路径如下:

资产发起人(Asset Originator) 为每个池设立一个法人实体 ,即 SPV。目的是隔离财务风险,为特定 RWA 作为特定 Centrifuge 池的基础资产提供资金;

借款人通过 AO(承销方)将链下资产代币化为 NFT,用作链上抵押品;

借款人与 SPV 签订融资协议,并要求 AO 将其 NFT 锁定在与 SPV 绑定的 Centrifuge 池中;

NFT 被锁定后,DAI 从 Centrifuge 储备中被提取并转移至 SPV 的钱包,SPV 钱包再将 DAI 兑换成美元,并通过银行转账到借款人的银行账户;

借款人在 NFT 到期日,偿还融资金额加上融资费用。偿还方式可以是直接用 DAI 在链上偿还,也可以是用美元转账给 SPV。SPV 将美元兑换为 DAI 并将其支付给 Centrifuge 池。全额偿后被锁定的 NFT 将还给 AO 并销毁。

来源:https://docs.centrifuge.io/learn/legal-offering/#offering-structure

虽然 Centrifuge 采用了 SPV 隔离风险,也与 Securitize 合作,在 KYC/AML 合规验证上花了很多心思,但是它的 RWA 资产池仍旧存在部分坏账问题。根据 rwa.xyz 数据显示,Centrifuge 共有\( 13, 210, 882 的违约贷款金额,占贷款总额(\) 438, 341, 921)的 3.01% 。

2.1.2 业务模式二:基金份额代币化

另一种比较常见的 RWA 代币化方式则是通过推出基于短期美债的合规基金,用链上记录基金的交易数据,将「基金份额代币化」来实现的。

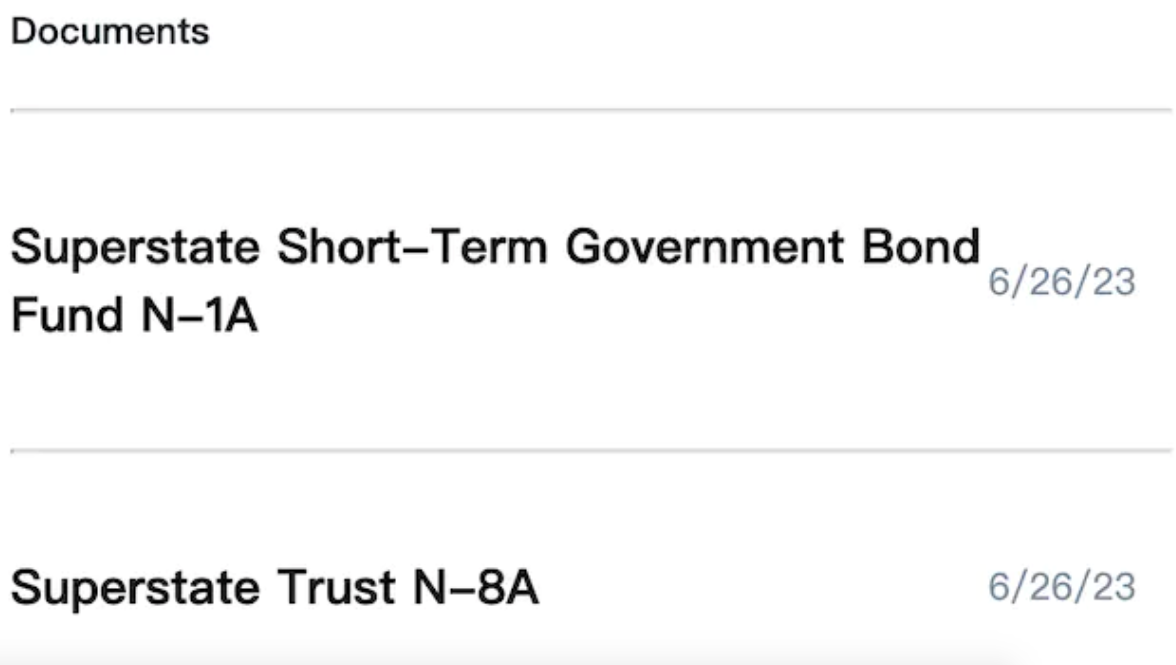

代表项目:Superstate、Franklin Templeton

Compound 创始人 Robert Leshner 在 6 月宣布成立新公司 Superstate,正式进军 RWA。Superstate 计划推出基于短期政府债券的基金,已经向 SEC 递交了相关申请材料,等候批准。值得注意的是,Robert Leshner 本人拥有美政府财政部相关背景,所以在某种程度上具备一定的优势。

来源:https://www.sec.gov/Archives/edgar/data/1982577/000110465923074744/tm2319534d2_n1a.htm

Superstate 的 RWA 业务模式实现路径如下:

Superstate 推出面向美国居民的基于美债和政府机构证券的基金;

用户认购基金,成为基金的股东;

股东可以将其基金份额转化为对应的 Token 形式,并在以太坊上保管记录;

基金份额 Token 持有者需要将地址注册为基金的白名单,非白名单地址无法被执行交易;

基金转账代理的官方记录仍通过簿记形式(book-entry form)管理。当链上记录和链下记录相冲突时,基金管理者会以链下记录为准更新链上记录。

管理资产过万亿美元的上市基金管理公司 Franklin Templeton 实现 RWA 的业务模式和 Superstate 相似,同样是以「基金份额代币化」的方式于 2021 年在 Stellar 链上推出了政府货币市场基金 Franklin OnChain U.S. Government Money Fund - FOBXX),基金的单位份额由 BENJI 代币表示。

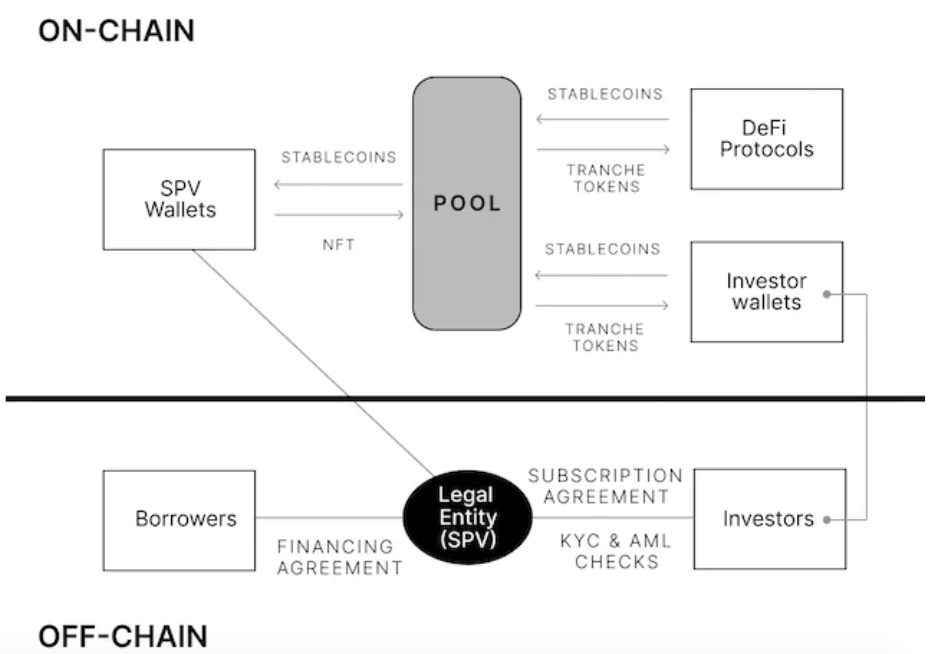

2.2 中间混合层:RWA 代币化 + 与 DeFi 互通

中间层的 RWA 项目业务模式与底层相比,多了一个与 DeFi 直接相互联系、流通的部分。类似于「自产自销」的模式,可以自行决定底层到上层的设计,在控制风险的同时也更便于扩大项目规模。但是由于美债代币化过程依旧需要遵守严格的法律规定,所以 KYC 仍旧无法避免。

2.2.1 业务模式三:基金份额代币化 +DeFi 协议

代表项目:Ondo Finance

Ondo Finance 采用了豁免发行的方式来为机构级别的用户提供服务。豁免发行对用户的要求更为严苛,需要满足 SEC 所定义的「合格投资者」和「合格买家」的要求。

Ondo 的 RWA 业务模式实现路径如下:

用户将 USDC(或其他稳定币)投入 Ondo 的基金产品,获得相应数量的基金代币;

Ondo 将稳定币兑换成美元(由 Coinbase 托管),然后将其保存在银行账户中;

再通过具有经纪商和托管资质的 Clear Street 购买美国国债 ETF;

当这些基础资产赚取收益时,该收益将被再投资于购买更多资产,从而实现自动复利;

在任何时候,如果用户想赎回自己的 USDC,对应的基金代币都会被烧毁,然后收到 USD。

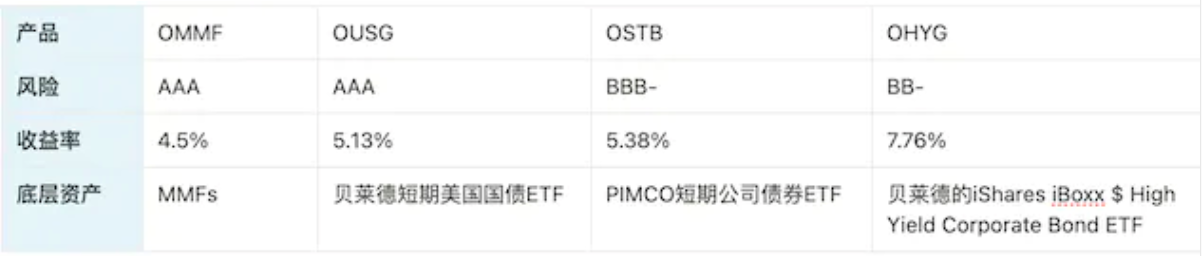

Ondo 目前针对美国用户提供了四种 RWA 产品,由不同的底层资产支持,为不同风险偏好的投资者提供了多样化的选择。

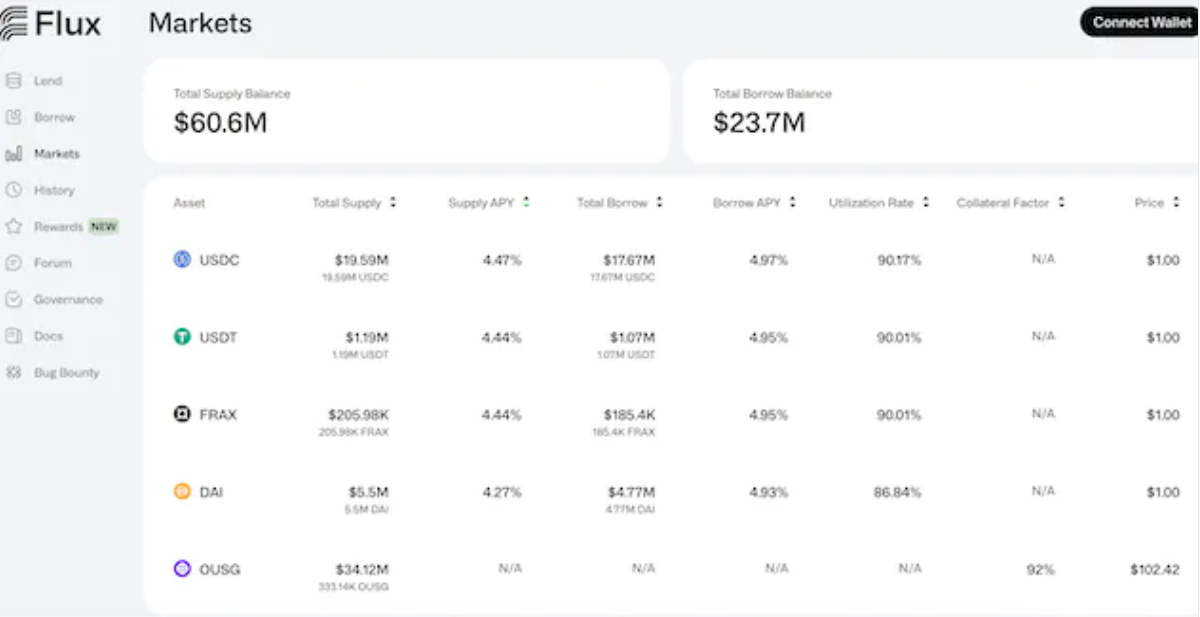

其中规模最大的基金为 OUSG,为了扩大 OUSG 的使用场景,Ondo 专门开发了自己的去中心化借贷协议 Flux Finance。OUSG 持有者可以通过 Flux 抵押 OUSG,借入 USDC、DAI、Frax 等稳定币。

Flux 本身是没有 KYC 限制的,但是采用了白名单清算机制。Flux 存在的意义在于帮助 Ondo 将 RWA 进一步接入原生 DeFi 世界,努力打造「生态闭环」。

来源:https://fluxfinance.com/markets

对于非美国用户,Ondo 计划推出全新的 USDY 产品,这是一种由短期美国财政部和银行活期存款担保的代币化票据。 购买 USDY 后 40-50 天,用户可以在链上进行转让。

2.2.2 业务模式四:SPV 代币化 +DeFi 协议

代表项目:Matrixdock、Maple Finance、Kuma Protocol

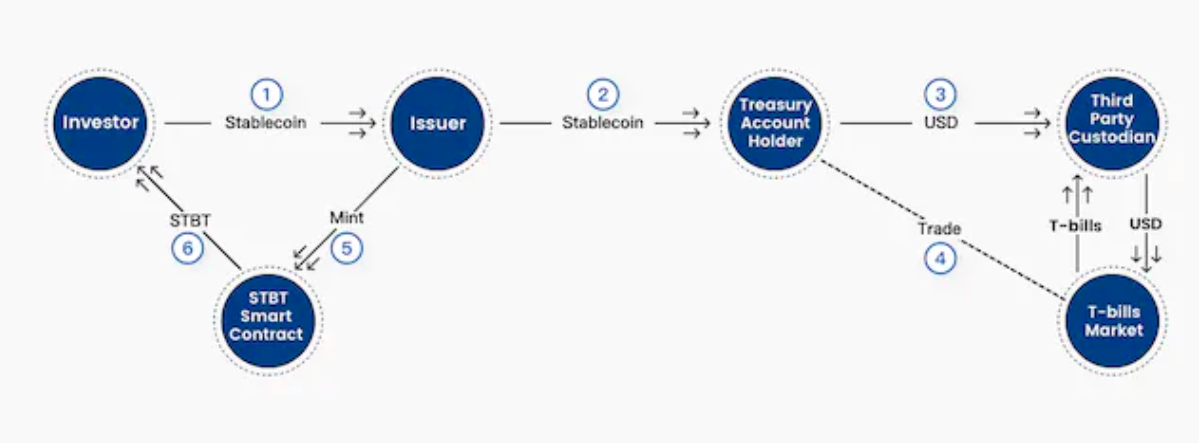

Matricdock 是 Matrixport 推出的链上债券平台,推出了基于短期美债的 STBT(Short-term Treasury Bill Token)产品。STBT 是一种 ERC 1400 标准代币,在每个工作日重新确定利息基数,底层资产为 6 个月内到期的美国国债和逆回购协议。

Matrixdock 的 RWA 业务模式实现路径如下:

Matrixport 单独设立的 SPV 作为 STBT 发行商;

投资人将稳定币存入 SPV,SPV 通过智能合约铸造出相应数量的 STBT;

SPV 通过 Circle 将稳定币兑换成法币,并将持有的美债与现金资产质押给 STBT 的持有者;

法币交由合格第三方托管,并由合格第三方托管通过传统金融机构的美债交易帐户购买六个月内到期的短债,或是投入美联储的隔夜逆回购市场;

STBT 持有者对实体资产池拥有第一优先的清偿权。

STBT 的 mint 和 redeem 机制,来源:https://stbt.matrixdock.com/

需要注意的是,只有通过 KYC 的投资者才能投资 Matrixdock 的产品,STBT 也只允许在白名单用户之间转移,包括在 Curve 池中的 STBT。去中心化 RWA 借贷协议 T Protocol 已经以 STBT 构建了一个无许可投资美债的资金池。

Maple Finance 曾经是一个基于 RWAs 的无抵押借贷项目,但无抵押借贷模式的过高风险给 Maple 留下了超过 5000 万美元的巨额坏账。于是今年 4 月,Maple 转变思路推出了新的现金管理池(与 Matrixdock 模式类似),允许非美国合格投资者和实体通过 USDC 直接参与美债投资。RWA 业务模式实现路径与 Matrixdock 类似,在此不再赘述。

值得注意的是,Maple 近期完成了 500 万美元融资,将利用这笔资金推动其贷款部门 Maple Direct 扩张。Maple Direct 旨在为 DAO 和 web3 公司等客户提供简化的链上访问美债收益的途径。

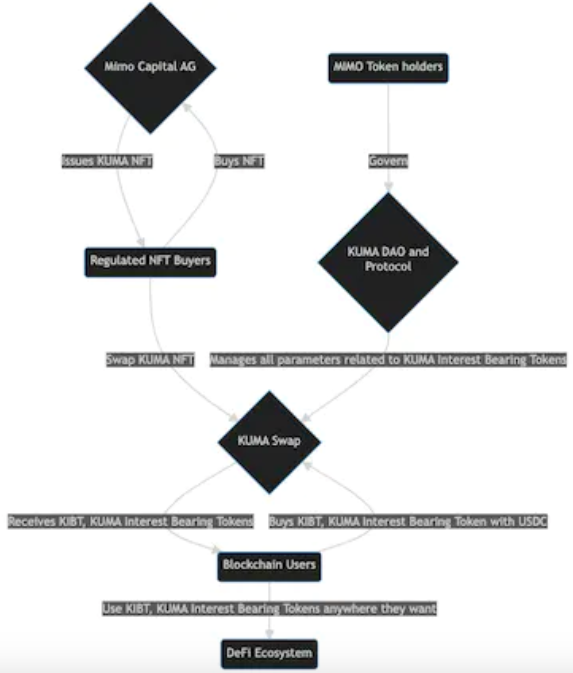

Kuma Protocol 是 Mimo Labs 推出的 RWA 协议,通过发行受监管的 NFT 支持的计息代币KIBT,将 RWA 收益引入 DeFi。目前,Kuma 只接受由主权债券(美债)支持的 NFT。

从本质上来说,KIBT 就是一个生息稳定币,它的余额会随着底层资产的利息增加而增加。KIBT 的意义在于「用户可以在享受底层 RWA 生息的同时将其投入到 defi 世界中使用」。

Kuma Protocol 的 RWA 业务模式实现路径如下:

Mimo Labs 成立了一个 SPV:Mimo Capital AG,并发行由主权债券支持的 KUMA NFT;

用户通过稳定币购入 KUMA NFT,再通过 KUMA Swap 抵押 NFT 铸造生息代币 KIBT;

KIBT 为 rebase 的 ERC 20 代币,目前有两种 KIBT

对于与由 740 天期欧元主权债券支持的 KUMA NFT 相关的 KIBT,被命名为 EGK

对于与由 1 年期美国主权债券支持的 KUMA NFT 相关的 KIBT,被命名为 USK

Kuma Protocol 的关键在于拓展其生息代币 KIBT 的使用场景与流动性。目前项目仍处于早期,其不需要 KYC 的特性是现阶段最大的亮点。

2.3 上层:引入 RWA 收益的 DeFi

作为上层的 DeFi 原生应用,它们开展 RWA 业务时无需考虑「代币化」这一事件的本身和 KYC 的潜在风险,而是可以在已经完成 RWA 代币化的基础上直接或间接地引入 RWA 收益。实现路径多为与基建项目合作或基于 RWA 代币构建 DeFi 产品。

2.3.1 业务模式五:间接引入 RWA 收益

DeFi 原生应用想开展 RWA 业务,一般会有两种思路:一是直接基于 RWA 收益构建项目,二是间接引入 RWA 收益作为协议收入。「间接引入」这一模式目前做的最成功的当属 MakerDAO。

代表项目:MakerDAO、Frax Finance

Dai 虽然已有数十亿的体量,但却始终无法突破更大的规模。为此,MakerDAO 联合创始人 Rune 提出要引入 RWA 作为过渡。根据MakerBurn的数据,MakerDAO 现在共计引入了 10 个 RWA 项目, 24.13 亿美金的资产作为抵押物。这些 RWA 资产为 MakerDAO 贡献了超过 50% 的收益。DSR 的利率上升也与 RWA 收益密不可分。

来源:https://makerburn.com/#/rundown

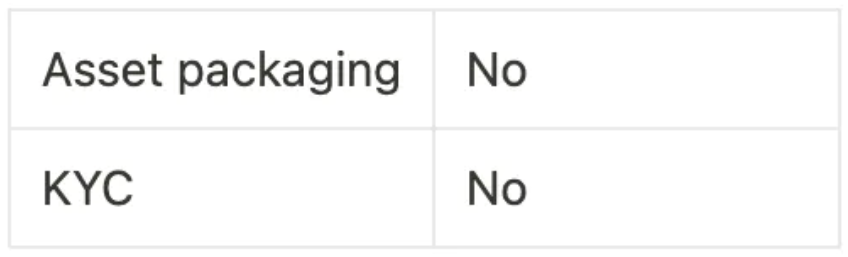

目前 MakerDAO 持有的 RWA 资产中规模最大的是 Monetalis Clydesdale。这是由 Monetalis 创始人 Allan Pedersen 在 2022 年 1 月提出的 MIP 65 提案形成的。

MIP 65 的目的在于利用 MakerDAO 持有的部分稳定币获得更多稳定收益,而方式则为投资高流动性、低风险的债券 ETF。

Monetalis Clydesdale 的 RWA 业务模式实现路径如下:

MakerDAO 投票通过后委托 Monetalis 作为执行方,定期向 MakerDAO 汇报;

Monetalis 作为项目规划和执行者,设计了一整套基于 BVI 的信托架构(如下图),以打通链上与链下的协同性;

MakerDAO 所有的 MKR 持有者为整体受益人,通过治理对信托资产的购买和处置下达指令;

Coinbase 提供 USDC 和 USD 的兑换服务;

资金用于投资两类 ETF:Blackrock 的 iShares US\( Treasury Bond 0-1 yr UCITS ETF 和 Blackrock 的 iShares US\) Treasury Bond 1-3 yr UCITS ETF;

美债 ETF 收益归 MakerDAO 所有,MakerDAO 再通过调整 DAI 的存款利率,将协议收入分给 DAI 持有者。

来源:DigiFT Research

虽然这套复杂且可行的信托结构将美债收益间接引入了 MakerDAO,但是随之而来的还有高昂的支出,包括初始费用和后续维持信托运转而支付给相关机构的持续性费用。随着 RWA 规模的逐渐扩大,MakerDAO 需要探索出成本更低的可行方式。

Frax Finance 的创始人 Sam 最近明确表示 Frax V3 将进军 RWA 赛道,并在治理论坛上发起了一项拟通过 FinresPBC 拓展 RWA 业务的提案。而其实现路径(根据提案)也不外乎在链下成立 SPV 持有 RWA 资产,将收益转化为协议本身收入,以扩大 FRAX 稳定币规模。

很明显,在 MakerDAO 已经证明 RWA 路可行后,越来越多的 DeFi 老项目都将会效仿,为国库闲置资金找到合理的无风险收益。此外,稳定币项目如 Frax,想要提高市占率,RWA 收益确实是不可错失的良机。

2.3.2 业务模式六:直接引入 RWA 收益

代表项目:T protocol、AlloyX

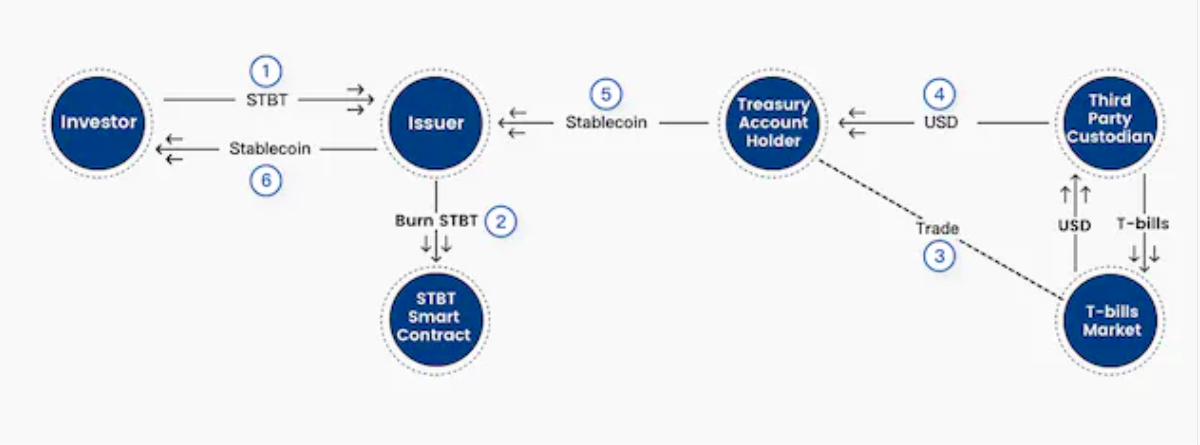

T Protocol 是一个基于 MatrixDock 发行的 STBT 的 RWAFi 协议,项目希望通过代币封装取消 STBT 的白名单限制,实现无需许可(permissionless)的美债代币化产品,为用户降低美债投资门槛。

T Protocol 的 RWA 业务模式实现路径如下:

T Protocol 推出了 TBT,这是 STBT 的封装版本,TBT 采用 rebase 机制发放美债收益,价格锚定在 1 美元;

投资者将 USDC 投入 T Protocol,由 T Protocol 铸造 TBT,获得存款凭证 rUSTP;

T Protocol 通过合作伙伴购入 STBT,也就是 MatrixDock 抵押 STBT,借出 USDC;

rUSTP 以 rebase 形式累积收益,rUSTP 可以与协议稳定币 USTP 1: 1 兑换;

T Protocol 通过去 curve 流动性池中换出 USDC(适合小额交易)或者与 MatrixDock 进行 OTC 换回 USDC(适合大额交易),还给用户。

来源:https://www.tprotocol.io/

T Protocol 的思路是成为非 Matrixdock 用户与 Matrixdock 之间的中介,降低投资者的门槛,使美债收益更加无缝进入原生 DeFi。T Protocol 的无 KYC 策略在未来或许成为一种主流,其发行的 TBT 也可能是稳定币的潜在竞争者。

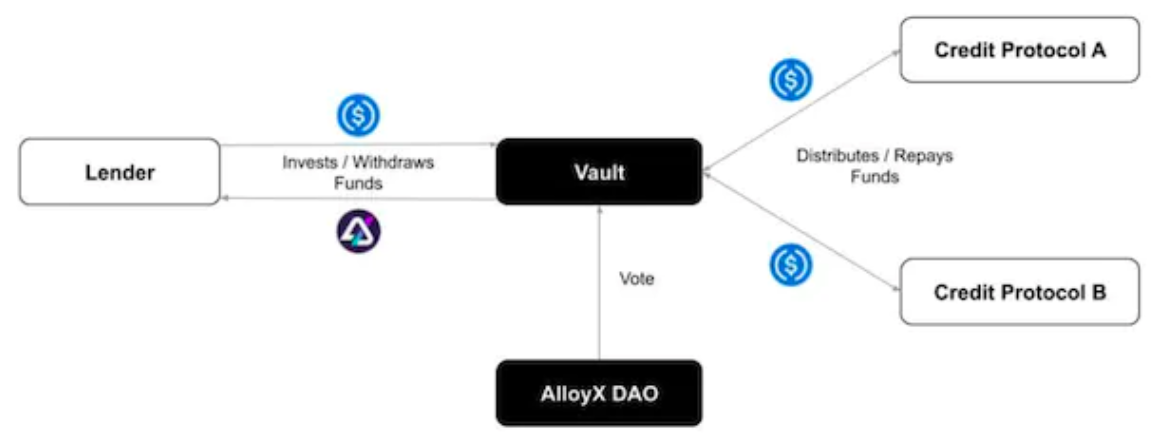

AlloyX 是一个基于 RWA 的 DeFi 协议,主要是通过集成其他信贷协议,为投资者提供不同的可组合的投资策略。AlloyX 已经集成的协议有:Credix、Goldfinch、Centrifuge、Flux Finance 和 Backed Finance 等。

AlloyX 的 RWA 业务模式实现路径如下:

AlloyX 通过 DAO 投票决定具体的投资策略,并上线对应的金库产品;

贷款人以 USDC 的形式向金库产品提供资金,同时收到基于浮动汇率的金库代币并获得收益;

贷款人可以将金库代币换回 USDC。

来源:https://alloyx.gitbook.io/alloyx-documents/vault/overview

AlloyX 最特别的地方其实是在于它集成了很多信贷协议,可以把用户资金灵活分配到不同的协议中,以达到最大化收益,最小化风险,并具备超强的可组合性。但问题也源自于集成第三方信贷协议,一旦信贷协议出现违约困境(AlloyX 无法保证信贷协议的安全性),AlloyX 投资人将承受更大的风险敞口。

3.思考与总结

RWA 的底层资产可以有很多,但是当下最适合 crypto 行业的一定是债券类(以短期美债和 ETF 为主)。相较于房地产、艺术品、黄金等资产,债券类底层资产在标准化程度、流动性、代币化成本方面有着最强的综合优势。

由此,中短期来看,以债券类为底层资产的 RWA 方向更值得深入关注。而以建立加密市场内部 U 本位生息资产为目的,可以发现美债 RWA 在高利率时代自带无风险收益,完美契合市场的需求。

基于美债 RWA,目前存在三层主流业务模式,分别为底层基建业务、中间层混合业务、上层 DeFi 业务。三层业务模式对应的 RWA 代币化难易程度与灵活度以及各自面向的客户群体都有很大的区别。但考虑到法律监管风险和发展上限,上层 DeFi 业务的天花板更高。美债 RWA 上链只是基础的第一步,但围绕「生息属性」与原生 DeFi 进行可组合性的探索才是更值得探索的方向,目前市场上已有不同的尝试,如基于美债 RWA 的稳定币、无许可借贷等。

而长期来看,RWA 将成为彻底打通 TradFi 与 DeFi 的重要载体,形成流动性互通、资金无(低)门槛转换、价值共享。

4.Reference

https://foresightnews.pro/article/detail/38819?utm_source=substack&utm_medium=email

https://docs.centrifuge.io/getting-started/privacy-first-tokenization/

https://tprotocol.gitbook.io/tprotocol-documentation-v2/white-paper/tprotocol-v2-documentation

https://tprotocol.gitbook.io/tprotocol-documentation-v2/white-paper/tprotocol-v2-documentation