一览7家上市公司投资比特币的盈亏现状

原创 | Odaily星球日报

作者 | jk

虽然传统互联网大厂增持比特币往往是出于多元资产配置(另类投资)的分散目的,但行业人士常乐观视之为是坚定看多 crypto 的利好信号,甚至抱着“追随聪明钱”的想法跟进操作。

但近期的财报季暴露出这样的现状——加密熊市下,大公司的比特币仓位也多处于浮亏;不同企业的投资策略有异,或逢时减持、套取利润,或按兵不动、惜售 HODL,或坚定买入、降低平均持仓成本。

Odaily星球日报在此汇总了 Microstrategy、Galaxy、特斯拉、Block Inc.、Hut 8、Marathon Digital Holdings、美图这七家公司的业务概括、股价表现、最新进展与比特币持仓信息(当前数量、平均成本、盈亏情况),并友情提示大家,财报披露存在信息滞后性,不宜作为单一的投资参考指标。

Microstrategy

MicroStrategy 是一家提供高度专业化商业智能、移动软件和云解决方案的企业。该公司成立于 1989 年,总部位于美国弗吉尼亚州泰森斯角。MicroStrategy 提供了各种分析和移动软件解决方案,用于数据可视化、报告和仪表板。这些解决方案通常被用于帮助企业更好地理解、监控和利用他们的数据。

公司的最新产品 MicroStrategy ONE 是为一个全面、现代、开放和云驱动的分析平台,目的是成为所有分析用例的单一解决方案。从自助式数据分析和业务报告到高级应用和嵌入式解决方案,该平台旨在“释放数据的力量”,从而帮助企业获得竞争优势。

在首席执行官 Michael Saylor 的领导下,MicroStrategy 还引人注目地成为了超大规模投资比特币的公司之一,将其作为一种资产储备策略。

根据 2023 年第二季度财报,该公司第二季度对其持有的比特币计提了 2410 万美元的减值支出,去年同期为 9.178 亿美元,今年第一季度为 1890 万美元。该公司的数字资产减值反映了比特币价格相对于比特币收购价格的下跌。

MicroStrategy 首席财务官 Andrew Kang 在一份声明中表示:“截至 2023 年 7 月 31 日,我们持有的比特币增加至 152, 800 枚,其中在今年第二季度增持了 12, 333 枚,这是自 2021 年第二季度以来单季度最大增幅。我们通过我们的市场股权计划有效地筹集了资金,并使用运营现金继续增加我们资产负债表上的比特币。我们这样做的背景是,机构的兴趣日益增加,会计透明度取得进展,比特币的监管也越来越清晰。”

目前,Microstrategy 持有的比特币的均价约为 29, 668 美元。

根据 Coingecko 的数据,Microstrategy 持有比特币的总成本为 41.27 亿美元,而这些比特币当前价值约为 39.7 亿美元,约占比特币总供应的 0.728% 。数据显示,MicroStrategy 46% 的比特币资产于 2020 年购入。在 2020 年的第三、第四季度,MicroStrategy 分别购入 38, 250 枚(均价 11, 151 美元)、 32, 220 枚 BTC,截止 8 月 17 日,这些 BTC 占 MicroStrategy 比特币资产的 46.12% 。

截至当前日期,MicroStrategy 的总市值为 49.51 亿美元,每股股价为 351.48 美元。相较于 6 个月前的约 246.91 美元,股价已经有了显著上涨,增长约 42% 。然而,该股票在年内也经历了波动,最高点出现在 7 月初,当时股价达到了约 475.09 美元。从年内最高点至今,股价已经有所回落。这种价格波动可能反映了市场对 MicroStrategy 在商业智能和比特币投资方面战略的多面评价。

Galaxy Digital

Galaxy Digital 是一家位于纽约市的金融服务和投资管理公司,专门从事数字资产和区块链技术。自 2018 年成立以来,该公司正在构建一个全面的金融平台,包括三个互补的运营业务:全球市场、资产管理和数字基础设施解决方案。Galaxy Digital 的目标是将金融复杂性与技术专长相结合,将机构与 Web3 创新联系起来。

公司提供一系列金融服务,其中包括交易、贷款、战略咨询服务、面向机构的投资解决方案、专有的比特币挖矿和托管服务、网络验证服务,以及企业托管技术的开发。Galaxy Digital 在全球范围内拥有多个办公室,包括北美、欧洲和亚洲。

由经验丰富的对冲基金经理和前高盛合伙人 Mike Novogratz 创立并担任 CEO,该公司一直处于推动加密货币和区块链技术在主流金融世界中得到应用和接受的前沿。通过其多元化的业务组合和全球影响力,Galaxy Digital 旨在为零售和机构投资者提供全方位的加密货币和数字资产相关服务。

根据 2023 年第二季度财报显示,Galaxy Digital 在持续的不确定性和监管压力背景下表现良好。Novogratz 表示,由于明智的风险管理实践和强劲的资产负债表,公司正朝着长期增长方向发展。

财务方面,第二季度的净损失为 4600 万美元,相较于 2023 年第一季度的净收入 1.342 亿美元有大幅下降。营业费用在第二季度为 8520 万美元,环比下降了 6% ,同比下降了 34% 。公司的合伙人资本(即权益)在季末为 15 亿美元,较第一季度末的 16 亿美元下降了 3% ,但流动性仍强,截至 2023 年 6 月 30 日为 6.96 亿美元。

在业务方面,Galaxy Global Markets(GGM)的交易收入为 5950 万美元,环比下降了 54% ,主要是由于数字资产和衍生品净实现收益下降。投资银行业务收入为 4.5 万美元,主要由于并购和资本筹集活动减缓。Galaxy Asset Management(GAM)的资产管理收入为 3380 万美元,环比增长了 619% ,主要由于其创投平台上的投资净实现收益增加。Galaxy Digital Infrastructure Solutions(GDIS)的矿业收入为 1540 万美元,环比增长了 51% ,主要由于专有挖矿活动带来的收入增加。

目前,Galaxy 持有约 12545 个比特币,目前价值约为 3.26 亿美元。

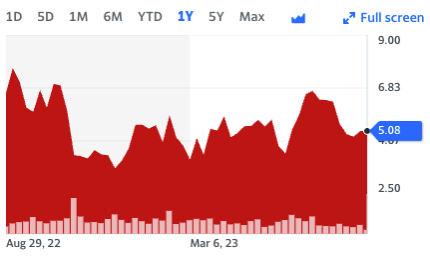

相比其他几家公司,Galaxy 的股价波动幅度相对较小,目前价格为 5.08 美元。在过去一年当中,最低价为 3.33 美元,最高价为 8.3 美元。

Galaxy 一年内股价。来源:Yahoo Finance

特斯拉

为汽车消费者熟悉的是,特斯拉(Tesla, Inc.)是一家美国的电动汽车和清洁能源公司,由 Elon Musk 担任 CEO 和主要股东。公司成立于 2003 年,最初是以生产高性能的电动跑车开始的,但后来逐渐拓展到更广泛的消费市场,推出了 Model S、Model X、Model 3 和 Model Y 等多种电动车型。

除了电动汽车外,特斯拉还涉足于可再生能源产品,包括太阳能板、太阳能屋顶和家用以及商用储能解决方案(如 Powerwall、Powerpack 和 Megapack 等)。公司的目标是加速世界向可持续能源的转变。

在 2023 年第二季度,特斯拉的经济表现超过了华尔街的预期。公司报告称,净收入增长了 20% ,达到 27 亿美元,这一增长主要得益于更便宜的原材料,这些原材料有助于抵消车辆价格的下降。另一方面,虽然新车交付量在 4 月至 6 月期间增长了 83% ,但收入增长没有那么强劲,仅上升了 47% ,达到 249 亿美元。然而,这一收入数据仍超过了 FactSet 调查的分析师的平均预期,即 242 亿美元。

在股票市场上,特斯拉也备受关注。它的股价经历了大幅度的波动,但总体上呈现出强劲的增长趋势,成为全球市值最高的汽车制造商之一。从年初的 108.1 美元到目前的 245.01 美元,特斯拉股价在 2023 年内经历了显著的波动但总体上呈上升趋势。股价最高点达到 290 美元以上。这种增长反映了市场对特斯拉在电动车和可再生能源领域的持续创新和市场领导地位的积极看法。目前,该公司的总市值已经达到了 777.659 亿美元。

在加密货币领域,特斯拉以大规模持有比特币、支持加密货币支付和马斯克本人即为圈内 KOL 的几大元素被持续关注。特斯拉目前连续四个季度没有买卖比特币,现有持仓为 10, 500 个比特币,当前价值约为 2.72 亿美元,约占整个比特币总供应的 0.05% 。

但是,特斯拉因为比特币的投资亏损了不少:特斯拉购买比特币的总成本为 3.36 亿美元,超出现价值 23.5% 。

Block Inc.

Block Inc.(前称 Square Inc.)是一家成立于 2009 年的美国多国科技综合企业,由 Jack Dorsey 和 Jim McKelvey 共同创立。该公司于 2010 年推出了其首个平台,并自 2015 年 11 月起在纽约证券交易所上市,股票代码为 SQ。

Block Inc. 最初是作为一个支付平台开始的,主要针对小型和中型企业,允许他们接受信用卡支付,并使用智能手机或平板电脑作为点销售(POS)系统的支付终端。尽管公司已经更名为 Block Inc.,但其针对小企业的名牌产品仍然被称为“Square”。

随着业务的拓展,Block Inc. 现在有多个业务板块。Cash App 是一款移动应用程序,允许用户之间以及用户和企业之间进行货币转账。Afterpay 则是一项“先消费,后付款”的服务。Weebly 是一个网站托管服务,而 Tidal 则是一个基于订阅的音乐、播客和视频流媒体服务,提供音频和音乐视频。

Block Inc.不仅致力于提供金融和支付解决方案,还在不断地进入新兴金融科技领域,包括加密货币等。总体而言,该公司旨在通过其多样化和全面的金融解决方案,简化支付流程,使之更加无缝和便捷。

Block Inc 年内股价。来源:Yahoo Finance

Block Inc.的股价在今年表现出明显的波动性。从年初的 64.64 美元降至目前的 58.17 美元,其市值现为 354.88 亿美元。值得注意的是,该股在 2 月初达到了最高点,约为 88 美元,但此后便出现下跌。尽管从年初至今整体呈下跌趋势,总体趋势和美股有一定相关性,与加密货币的相关性没有其他股票那么强。其市值仍然相对稳健,显示出市场对这家多元化金融科技公司依然持有一定的信心。

Block Inc. 在 2023 年第二季度的财报中表现出色,尤其在艰难的经济环境下。公司在这三个月内的净收入为 53 亿美元,相比去年同期的 44 亿美元有所增长,也超过了 Refinitiv 的预估。该金融科技公司的毛利润同比增长了 27% ,达到了 18.7 亿美元。此外,公司也上调了其 2023 年的 EBITDA 预测,从原先的 13 亿美元提升至 15 亿美元。

Block 的主要业务 Cash App 的毛利润增长了 37% ,达到了 9.68 亿美元。与此同时,Square 业务的毛利润也增长了 18% ,为 8.88 亿美元。公司董事长 Jack Dorsey 表示,公司将继续专注于国际市场的拓展,但也在寻求控制成本,包括对基于股票的薪酬进行审查。他还提到,公司已经开始更加精准地进行招聘,专注于关键角色,并更注重绩效管理。经调整后,Block 在第二季度每股收益为 39 美分,超过了分析师预测的 36 美分。

根据 Coingecko 的数据,Block 目前持有 8027 枚比特币,持有成本为 2.2 亿美元,如今价值约为 2.09 亿美元,亏损规模相对较小。

Hut 8

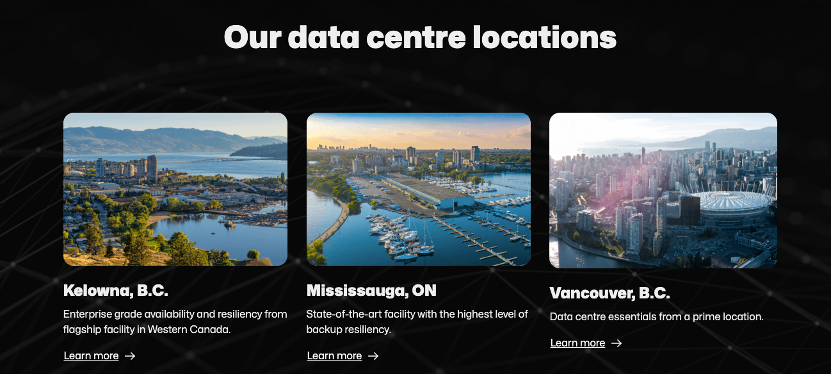

Hut 8 Mining Corp. 是一家加拿大的比特币挖矿公司,主要专注于通过使用高级硬件和数据中心资源来进行比特币挖矿。该公司是北美最大的公开交易的比特币挖矿公司之一,具有相当大的计算能力。Hut 8 不仅仅是一个比特币挖矿企业,它还提供与加密货币相关的其他服务和解决方案,如高性能计算等。

Hut 8 通常在能源成本较低的地区(如加拿大一些偏远的地方)设立其挖矿设施,以降低运营成本并提高效率。这使得公司能够在高度竞争的加密货币挖矿市场中保持竞争力。

Hut 8 的数据中心位置。来源:Hut 8 官网

从年初的 0.818 美元涨至目前的 2.37 美元,Hut 8 的股价在 2023 年内显示出显著的波动性,但总体上呈上升趋势。该股在 7 月中旬达到约 4 美元的年度最高点,之后出现回落。尽管如此,与年初相比,股价仍然有相当大的增长。这种价格动态反映了投资者对公司在比特币挖矿领域的业绩和潜力的看法。目前,Hut 8 的总市值为 5.267 亿美元。

在 2023 年第二季度,Hut 8 的营业收入降至 1920 万美元,相较于去年同期的 4380 万美元有明显下滑。这一期间,公司挖到的比特币数量也减少了近 58% ,只有 399 个,主因包括比特币网络难度的提升、北湾工厂的暂停运营和德兰赫勒工厂持续的电力供应问题。其高性能计算(HPC)业务也略有下降,仅产生 420 万美元的每月常规收入,相比去年同期的 470 万美元减少了。截至季度末,公司的算力达到了 2.6 EH/s(不计北湾工厂),并且保有 9136 枚自家挖掘的比特币。在这一季度,公司通过出售 396 个比特币实现了 1470 万美元的营收。

目前,Hut 8 拥有的比特币市值约为 2.42 亿美元。

上周称,Hut 8 将会和 U.S. Data Mining Group, Inc.(以“US Bitcoin Corp”为商业名称,简称“USBTC”)即将进行并购。该交易预计将创建一个名为“New Hut”的新公司,总部设在美国。新公司将集中于经济高效的比特币挖矿、多元化的收入流,以及行业领先的环境、社会和治理(ESG)实践。

Hut 8 的 CEO Jaime Leverton 表示,他们期待在近期内获得美国证券交易委员会(SEC)对“New Hut”的注册声明的批准,并认为完成这次合并后,新公司将成为一个更强大、更具活力的业务实体。该实体将由比特币和源自强大的北美范围内的托管、挖矿基础设施和高性能计算运营产生的大量法定货币收入支持。

Marathon Digital Holdings

Marathon Digital Holdings(前称为 Marathon Patent Group)是一家美国公司,主要专注于比特币挖矿。该公司成立于 2010 年,并最初是一家专注于知识产权(IP)的公司,但后来转型成为一家致力于加密货币挖矿和相关活动的企业。

Marathon Digital Holdings 运营着大规模的比特币挖矿设施,并在美国各地拥有多个数据中心。这些数据中心装备了高性能的挖矿硬件,旨在通过解决复杂的数学问题来挖掘新的比特币,并通过这种方式参与维护比特币网络。

这家公司的目标是成为北美最大、最高效的比特币挖矿企业之一。由于其大规模的电力需求,Marathon Digital Holdings 还专注于寻找可持续和成本效益高的能源解决方案。

在年中发布的财报中,Marathon 的董事长兼首席执行官 Fred Thiel 说:

“我们在季度末持有 1.137 亿美元的无限制现金和现金等价物,以及大约 12, 538 个比特币,其 6 月 30 日的市值大约为 3.8 亿美元。尽管我们的现金头寸从第一季度减少了 1120 万美元,但我们增持 1, 072 个比特币,其 6 月 30 日的市值大约为 3270 万美元。"

"我们在第二季度加速了进展,显著提高了我们的哈希率和效率……在第二季度,我们将我们的有效哈希率从 11.5 增长到 17.7 艾哈希。通过比网络其余部分更快地增长我们的哈希率,并提高我们的运行时间,我们也增加了我们的比特币产量。在第二季度,我们生产了创纪录的 2, 926 个比特币,占该时期可用的比特币网络奖励的大约 3.3% 。”

但是,Marathon 的盈利和收入均低于分析师预期。目前,Marathon 持有约 12, 964 个比特币,目前约价值 3.36 亿美元。但是,其买入成本仅有 1.89 亿美元,收益率达到了约 78% 。

截至当前,Marathon Digital Holdings 的股价为 12 美元,与年初的约 4.09 美元相比,股价已经大幅上涨,几乎翻了三倍。年内的最高点达到了 19.88 美元。该公司目前的市值为 20.91 亿美元。这样的股价和市值波动可能反映了市场对该公司在比特币挖矿和加密货币投资方面的策略和表现的高度关注。尽管从年内最高点已有所回落,但与年初相比,该公司的股价仍然表现强劲,这可能意味着投资者对其长期前景持乐观态度。然而,考虑到加密货币市场的波动性,这种股价表现也可能随时发生变化。

美图

美图是一家中国科技公司,在香港交易所挂牌上市,专注于开发移动应用软件和智能手机。公司成立于 2008 年,总部位于福建省厦门市,最为人熟知的产品是其同名的照片编辑和美颜应用——美图秀秀,该应用在全球范围内拥有数亿的用户。除了基础的照片编辑功能,应用还提供了各种美颜、滤镜和人工智能驱动的照片增强工具。

美图在 2010 年设立了其研发中心 MT Lab,专注于计算机视觉、深度学习和计算机图形等领域的人工智能和图像创新。

截至 2022 年 12 月,美图的月活跃用户(MAU)达到了 2.43 亿,其中近 8000 万来自海外市场。这些国际用户分布在 22 个国家和地区,每个国家和地区都有 1000 万或更多的用户,包括印度尼西亚、泰国、巴西、巴基斯坦、美国、越南、日本、孟加拉国、菲律宾、韩国、马来西亚、伊朗、墨西哥、尼日利亚、加拿大、土耳其、俄罗斯、缅甸、南非、英国和尼泊尔。

在 2021 年 4 月,美图公司宣布了近 1 亿美元的加密货币持有量。根据最新财报,在 7 月的交易所文件中,美图报告了拥有大约 940 个比特币和 31, 000 个以太坊,总成本分别为 4950 万美元和 5050 万美元。相比于 2021 年的报告规模,美图的数字货币资产已经减少了超过 4 千多万美元。这一减少幅度比上一个季度翻了一番。

其中,成本近 5000 万美元的比特币现在价值仅为 2445 万美元左右。