熊市指南:科学提升资金利用率

原文作者: 0 xFat

7 月 12 日到 8 月 17 日前,比特币在 31000-29000 美元范围内小幅度波动, 8 月 17 开始跌破半月支撑位,最低触及 24300 美元, 18 日恐慌与贪婪指数为 37 ,等级由此前的中性转为恐惧,恐慌值创 3 月 19 日以来新低。

自 2022 年 6 月以来,Web3创新叙事骤减,以太坊为核心的L2赛道,以及比特币铭文热潮均没有成为带动整个市场增长的飞轮,现在作为唯一能吸引增量资金的撸毛暴富活动也迎来寒潮,宏观层面,美联储加息还在继续,整体上并不乐观。

加密金融服务公司 Galaxy Digital 研究主管 Alex Thorn 也指出,本次快速下跌清除了大量杠杆,比特币市场完成了自 FTX 倒闭以来最彻底的盘面重置,在缺乏有力正面催化的情况下,短期仍以下行风险为主, 2.4 万美元和 2.5 万美元被视为关键支撑。如果短期内无法快速反弹,近 90% 的短期持币者处于亏损状态,将带来进一步下行压力,不过,长期持有者和小额持有者均在持续增持。

虽然本次杠杆出清较为彻底,宏观政策继续紧缩,但较于上一轮熊市,加密行业基础设施已经非常完善,一些技术创新仍在继续,不少从业者认为美债 RWA 或许会带动新资金的进场,而比特币 ETF 的落地已是明牌利好,只需耐心等待即可,加上国际支付巨头 paypal 抢滩稳定币市场以及香港加密新规的陆续落地,市场前景仍有巨大发展空间。

所以,对于投资者群体而言,当前最紧要的事情就是合理把控风险,科学提升资金利用效率,等待机会到来。

一、低风险偏好的人,囤币才是首选

2017 年入圈的小美在上半年重仓了自己一直看好的项目。“当时以为是底部了,现在仓位已经缩水 40% 不止”,她说被套真的很难受,但因为长期看好创始团队,也是真心舍不得割肉。

像小美这样的投资者不在少数,尤其是 5 月被 Pepe 等 Meme 币吸引进来的新人,多数都是充满希望的套牢人士,在他们的认知里根本不存在割肉的概念,既如此,还不如选择安全系数高的平台,使用存币生币的金融工具来赚币,OKX 的简单赚币、链上赚币以及囤币宝都比较适合。

简单赚币是一款帮助有空闲的数字资产持有者进行低门槛赚币的产品,入门简单,有不同期限可选,活期简单赚币即对应余币宝,通过在借贷市场出借给杠杆交易用户获取收益,定期简单赚币通过锁定币种获取 PoS 收益或项目方奖励。支持 24 小时随时申购和赎回,活期简单赚币赎回立即到账,定期简单赚币赎回 30 分钟内到账。

https://www.okx.com/cn/earn/simple-earn

链上赚币主要为持币者提供赚取链上收益的机会,主要包括权益证明 (Proof-of-Stake, PoS) 以及去中心化金融协议 (DeFi protocol)两种赚取收益的方式。投资者可以在欧易随时参与 PoS 质押或 DeFi 项目,而无需支付网络费用。

https://www.okx.com/cn/earn/onchain-earn

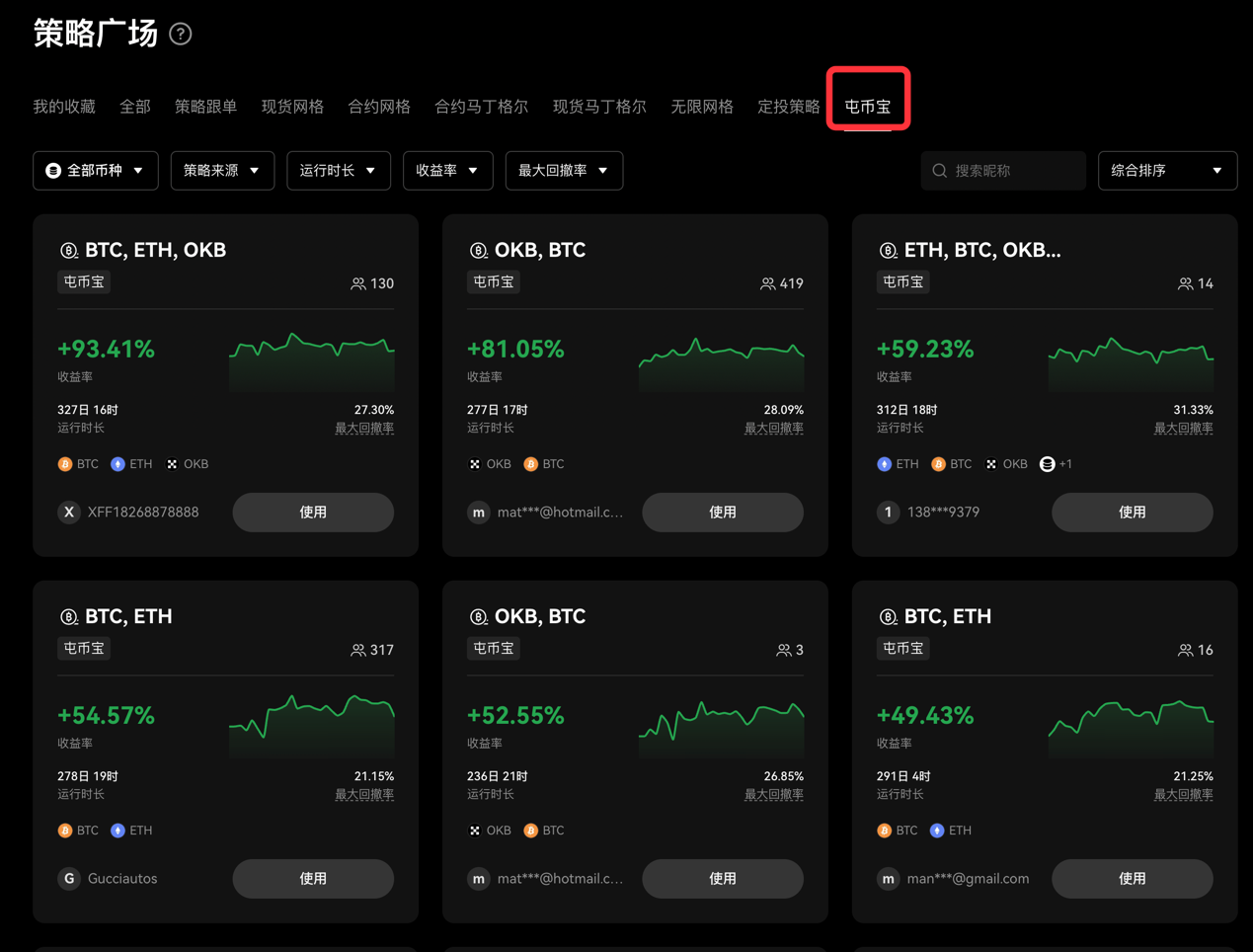

屯币宝是一种自动化策略,可以在投资者选定的币种组合中做智能动态调仓,利用不同币种之间的汇率波动来赚币和屯币,锁定利润并增加潜力币种的持仓,获取超额回报。

需要注意的是屯币宝策略创建后,投入的资金会从交易账户中隔离出去,独立在策略中使用,投资者需要关注资金被转出后给交易账户中整体仓位带来的风险,此外,若在屯币宝策略运行期间,币种遇到停盘、退市等不可预知的异常情况,屯币宝策略将自动停止。

https://www.okx.com/cn/trading-bot

二、专业交易者,建议使用工具获取复利

在传统金融二级市场,交易人士最常用的套利工具就是网格交易机器人,其工作原理为自动执行交易策略,投资者在预期的价格区间内程序化、智能化地实现低买高卖、反复套利的一款交易工具。过去主要被资本金较大的做市商团队所应用,这些做市商通过网格交易的高频交易,实现套利。

相较于传统金融市场,加密货币市场的网格交易在机制上有所创新,以网格产品最齐全的平台 OKX 为例,其网格策略包括现货网格、无限网格、合约网格、天地网格。

当前行情下,现货网格使用的人群较多,其交易逻辑是投资者给定一个上下边界范围,决定在这中间要切分为 N 段,上涨一段就会卖出一部分,下跌一段就会买入一部分,适合震荡行情,自动低买高卖,完成复利。现货网格的优点是更容易拿住币,不至于完全错失行情,既可以赚网格利润,又可以赚浮动价差,投资者也可随时提取利润,拿去做其他交易,更重要的是可以透过机器人持续买低卖高,不用一直看盘,省去不少精力。

当然,其缺点就是如果行情的震荡范围太小会交易不到,如果持续单边行情,就会造成资产的闲置。需要注意的是当前行情下,普通的现货网格的资金效率较低,但 OKX 现货网格支持移动网格功能,能在合理的区间内,根据行情移动网格,有效提高资金利用率。

图为笔者正在体验的现货网格,微震荡行情下, 2 万 u 本金, 9 天的套利收益在 250 u 左右,收益率虽不高,闲置资产的资金利用率却是能得到提高的,总的来说体验较优,但需要注意价格区间的设置。

三、抄底大军,这样配置

除复利外,不少手握资金的投资者都在等待抄底时机,但大家共同的焦虑就是——既怕抄在半山腰,又怕抄不到。

历史的教训告诉我们,千万不要指望能抄到最低点,逐步建仓并选择合适的策略工具也许才是更理性的选择,比如,OKX 的抄底宝、现货定投策略、现货马丁格尔策略,这些都是不错“抄底型”产品。当然如果你持有现货,也可以选择通过币本位合约来进行风险对冲。

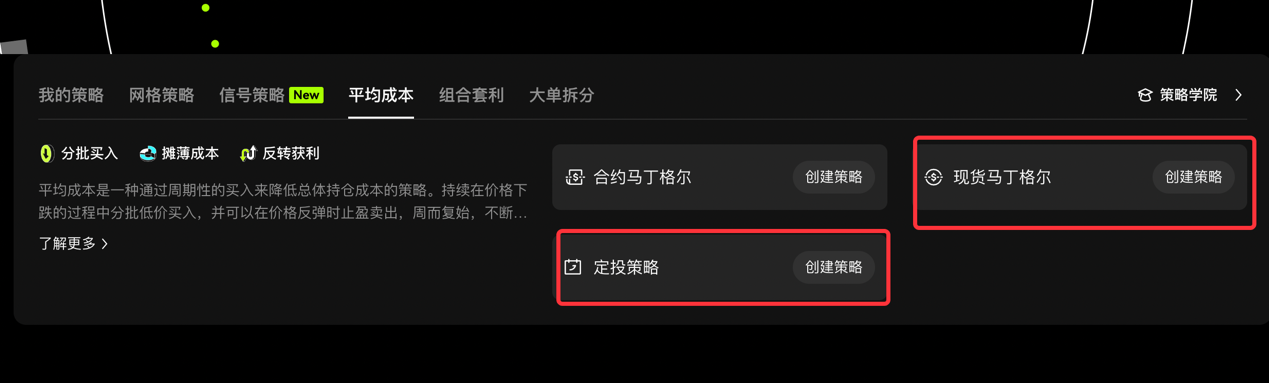

先说马丁格尔策略,该策略比较常用于传统金融中的外汇市场,基本原理是在一个可以买涨买跌的双边市场,总体上只押注一边,如果做反了,就不断反向加码。直到市场回调,即可赚取从低位买入到高位卖出的利润。OKX 的现货马丁格尔策略则结合传统版本基本思路与加密市场特性做出一系列优化,以平衡投资者抄底的平均成本。

当前行情下,投资者可以选择在市场每跌 1-5% 时,就买一笔现货 DCA,通过使用剩余资金分批加仓来降低总持仓成本,待价格反弹的时候即可止盈离场,与简单持有数字货币相比,现货马丁格尔策略更灵活,捕捉小幅反弹的盈利,并持续进行“浮盈变现”。

再说抄底宝,它是在 OKX 期权交易功能基础上衍生出的结构化产品,在投资者既想以低于市场价的价格买入一定数量的资产,却又担心以这一更低的价格限价挂单之后无法成交时非常适用,使用抄底宝挂单,即使策略到期时没有跌到挂单价,系统仍保证你能以低于市场价的挂单价格买入一定比例的资产。

Web 端操作路径如下:

最后是现货定投,这是一种在固定的时间周期,投入固定的金额买入选定币种组合的策略,在市场波动较为剧烈时,运用适当的定投策略,以同样的投资额度可以在低点购入更多的筹码,帮助投资者获得更加可观的收益。该策略适合所有人,尤其是长线投资者,支持一键定投,随时赎回,以及币种自由组合。

创建定投策略的路径是在 OKX 首页点击【交易】-【策略交易】,选择【创建策略】下方的【平均成本】-【定投策略】,随后进入策略创建界面设置币种、定投周期等内容,点击【创建策略】即可。

现货马丁格尔策略和现货定投策略都属于平均成本板块。平均成本是一种通过周期性的买入来降低总体持仓成本的策略。持续在价格下跌的过程中分批低价买入,并在价格反弹时止盈卖出,不断循环套利。

四、大资金理财,选靠谱平台

不管是传统市场与加密货币市场,理财产品一直是提升资金利用率的首选,尤其是大资金持有者,不过,随着链上流动性低迷以及被盗事件频发,DeFi 理财产品并不十分受到市场青睐,大资金更多还是选择 CeFi 平台来投放资产,然而自从 Fcoin、FTX 以及安银相继暴雷后,大资金对于理财平台的资金透明度与安全性的要求变得越来越高。

目前,不管是品牌口碑,风控体系、资金透明度高,还是产品体验,OKX 都在过去几年的表现中经过了市场的检验,他们至今还在每月定期披露 POR 储备金数据,在一定程度上可以说是大资金的首选。

当然,更值得肯定的是,他们是市面上少有的具备系统化的理财产品矩阵的 CeFi 平台,该矩阵包括深受小白投资者喜爱的超短期保本的简单期权产品鲨鱼鳍,适合当前这种波动平稳行情的固收理财产品双币赢,以及被那些有专业交易背景的中型资金投资者青睐的定制化策略产品雪球。

这三种产品基本可以满足不同类型投资者在不同市场行情下的理财需求。但目前来讲,前两者被采用较多,由于最近行情的特殊性,双币赢的使用者似乎有所增加,图为投资者晒出的双币赢收益,仅供参考。

五、To 专业交易员

看到这,你会发现文章介绍的都是 OKX 的产品。

是的!没错。近两年来,不管是产品体验还是风控能力,OKX 都是加密市场里表现最靓眼的仔。除一直走在市场最前沿的Web3团队,OKX 的 CeFi 创新力也一如既往的强悍,除上述产品外,CeFi 团队上周还推出了针对专业交易员的信号策略。

简单来说,OKX 的信号策略功能允许交易员完全自由地在 TradingView 平台上灵活定制其交易信号,以满足特定需求,真正实现交易体验自由化,大幅提升交易效率和准确度的同时减少非理性操作风险。

图为自定义信号入口

OKX 信号策略的核心理念是基于市场的历史数据和模式来预测未来的价格动向。交易者可以通过观察和分析市场信号,寻找可能的买入或卖出机会,以进行交易。

它的优势可用三个关键词来解释,一是信号驱动,OKX 聚合了由全球最聪明、最专业的投资人士和机构组成的顶级信号供应商,为交易者提供最优质的交易信号服务,降低交易员学习成本的同时提高了其交易准确率,以减少情绪问题带来的交易失误;二是自动交易,信号策略能够帮助交易者在确认好信号后第一时间自动执行交易,相比手动交易的时效性更强,效率更高,尽可能地帮助交易员避免踏空;三是低延迟,相比其他平台动辄秒级别的延迟,OKX 的信号策略致力于提供毫秒级别延迟,帮助交易员及时抓住市场机遇。总的来说,信号策略就是为专业交易员提供更理性智能的操作系统,本质还是在帮助他们提高资金效率。

目前,信号策略同时连接了专业交易员、节点、以及普通用户三端。普通用户可以通过 OKX 信号策略让专业人士/机构帮忙赚钱,只需要支付订阅费或者分佣即可;信号供应商可以通过申请成为 OKX 的信号供应商,提供专业交易信号,实现专业知识和认知变现;对节点而言,未来可以与信号供应商合作,获得分润,三者形成了一个交易闭环。据官方人士透露,未来 OKX 还将上线针对普通用户的信号广场,整合展示信号供应商已经完成的交易信号,普通用户可以通过信号广场订阅使用这些信号,并基于此创建自己的信号策略。

回头看,OKX 每一款产品都带着一种踏实且严谨的态度。内部人士说,这种态度源于 CeFi 团队中的两股力量,一股是着多年传统金融经验成员身上的理性与克制,另一股则是擅长用户运营方面的互联网大神的敏锐和务实。蛮好的,平台追求严谨,用户讲究科学,加密货币这个非理性大市场终于要开出“有序”的花了。

风险提示:本文仅供参考,不存在任何投资建议,市场有风险,投资需谨慎。