LD赛道周报(2023/07/31):交易量萎靡,黑客攻击频发

摘要

借贷:EraLend 遭遇黑客攻击,流动性大幅出逃;Maker DSR 利率或将上调至 8%

LSD:上周 ETH 质押率上涨至 20.87% ,环比增长 1.70% 。上周有 2509 万枚 ETH 锁定在信标链中,对应质押率 20.87% ,环比增长 1.70% ,连续四周增速提升;其中活跃验证节点 69.86 万个,环比增长 2.14% ,进入队列排队验证节点 8.12 万个,环比下降 1.64% 。

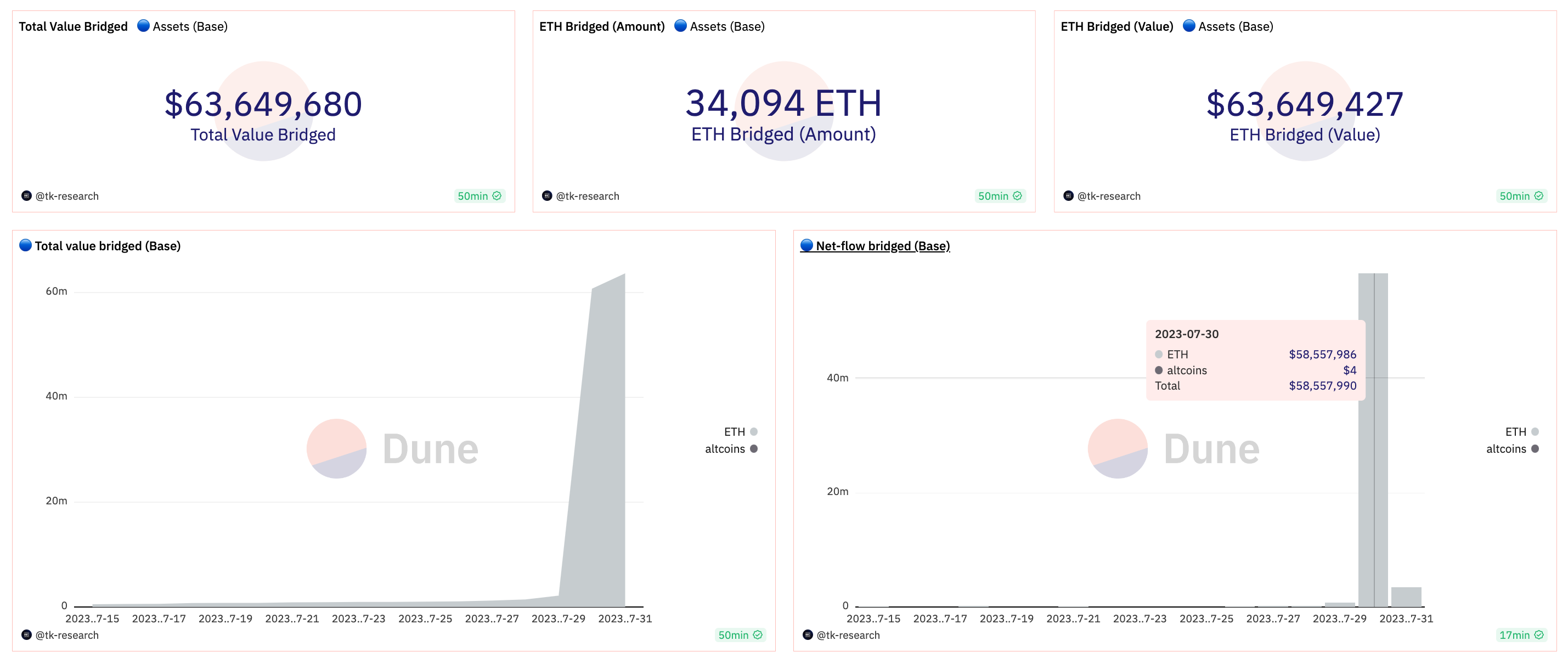

以太坊 L 2 :Layer 2 TVL 总量再次突破百亿美元。Op Mainnet 在 worldcoin 的带动下 TVL 大幅增长 28.15% 。昨日大量资金涌入 Base,单日流入 5855.7 万美元。

DEX:Dex combined TVL 13.15 billion, 较上周减少 1.6 bln。Dex 24 小时交易量 2.26 billion, 7 天交易量 11.15 biliion, 较上周减少 8.1 billion。Curve 底层 Vyper 编译器的多个旧版本发生递归锁故障, 0.2.15 , 0.2.16 , 0.3.0 版本问题尚未修复。理论上任何使用这些 Vyper 版本的协议都会受到攻击,目前受到影响的协议包括 Curve 的 alETH/msETH/pETH 池,以及 CRV ETH 池。其他包括 deBridge、Ellipsis 池累计损失 5200 万美元。5200 万美元中包括 2100 万美元 eth, 2600 万美元 weth, 530 万美元 crv 和 7 万美元 wbnb。

衍生品 DEX:上周(7 月 24 日至 7 月 30 日)衍生品 DEX 的整体交易量持续下跌。9 个主要衍生品 DEX 协议的周交易量约为 74 亿美元,而此前一周的周交易量约为 76 亿美元,跌幅约 2% 。交易量萎缩较为严重,已经接近 2023 年 5 月底 6 月初、以及 2022 年 12 月底的水平,处在相对较低的位置。

借贷

Eralend

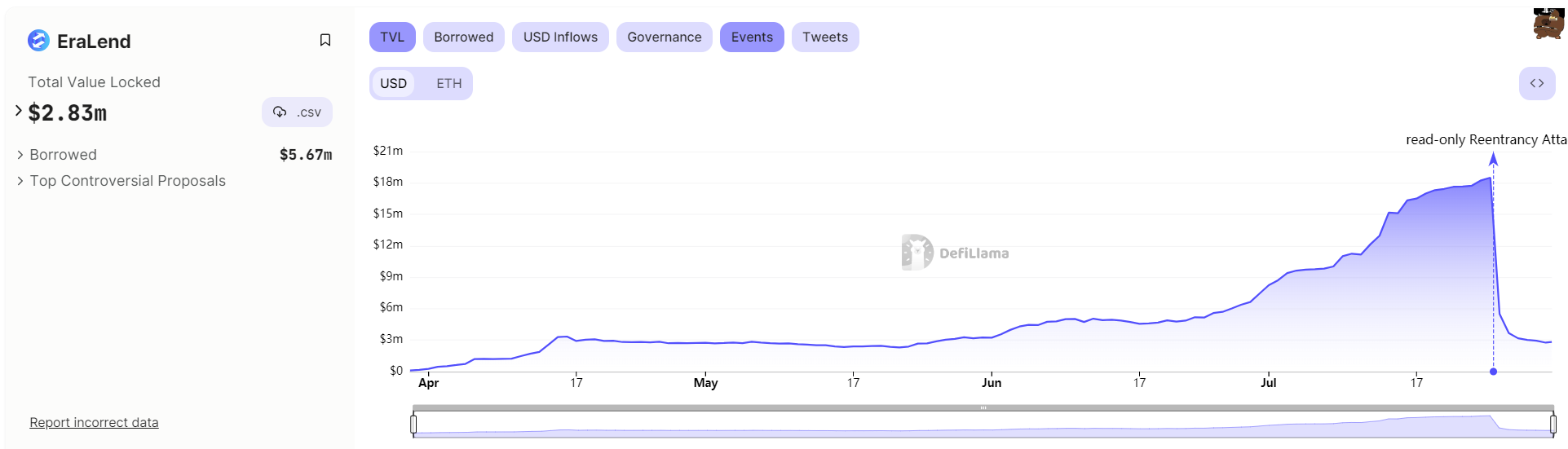

zkSync Era 上原生借贷协议 Eralend 在 7 月 25 日遭遇黑客攻击,通过操纵预言机价格致使 USDC 池损失 276 万美金。事件发生之后,TVL 单日从 1, 851 万美金下跌至 550 万,跌幅超过 70% 。之后流动性持续撤出,目前协议上锁定的资金规模仅剩 283 万美金。

来源:defillama

为了限制进一步的影响,EraLend 暂时停止了借款、USDC 供应和 SyncSwap LP 供应,还大幅降低了 USDC 池的利率,以保护受影响的借款头寸在此期间免遭潜在的清算。

MakerDAO

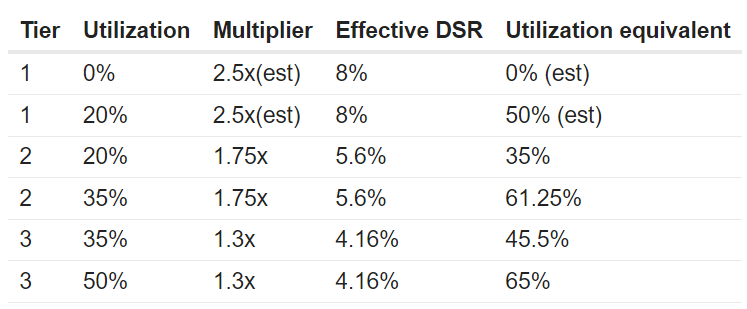

7 月 28 日 Maker 社区投票通过一则提案,引入增强型 DSR(EDSR),即根据 DSR 利用率调整 DSR 存款利率。EDSR 是单向临时机制,首先将其值设置为最高,随着 DSR 利用率的上升而下降,但是在利用率下降之后,DSR 将不会再上升。

来源:Maker 论坛

依据以上利用率标准,DSR 内 DAI 总供应为 3.58 亿,占总发行量(42.9 亿)的 8% 左右,所以 DSR 利率或将上调至 8% 。

Maker 这一举措目的是通过直接上调存款利息的方式刺激 Dai 的采用,稳住目前持续下滑的 Dai 规模,长期来看是有助于 Dai 需求的增长,但是最大的挑战就是直接增加了 Maker 协议的支出,需要由协议收入补贴这部分利息,DSR 现有支出成本将每年多出 1, 000 万左右。

Alchemix

因 Curve Vyper 编译器漏洞影响,Alchemix 被通知其 alETH/ETH 池可能被攻击。Alchemix 迅速采取行动,通过 AMO 合约从 Curve 池中移除 AMO 控制的流动性。

Alchemix 移除流动性需要进行三项操作: 1. 从 Convex 解质押 LP 代币;2. 从 Curve 池中提取 alETH;3. 从 Curve 池中提取 ETH。第一项、第二项操作均已执行,从 Convex 解质押 LP 代币,并从 Curve 池中移除 8, 000 枚 alETH。但是 Curve 池中仍有 AMO 控制的约 5, 000 枚 ETH 流动性。在移除剩余流动性的过程中,alETH/ETH Curve 池被一个攻击者攻击。目前,alETH 储备损失约 5, 000 枚 ETH。不过 Alchemix 金库中的资金是安全的,所有 Alchemix 合约不受影响。

LSD

上周 ETH 质押率上涨至 20.87% ,环比增长 1.70% 。上周有 2509 万枚 ETH 锁定在信标链中,对应质押率 20.87% ,环比增长 1.70% ,连续四周增速提升;其中活跃验证节点 69.86 万个,环比增长 2.14% ,进入队列排队验证节点 8.12 万个,环比下降 1.64% 。

总质押量连续四周增速提升

来源:LD Capital

ETH 质押收益率 4.27%

来源:LD Capital

三大 LSD 协议中,从价格表现来看,LDO 一周下跌 6.1% ,RPL 下跌 4.8% ,FXS 下跌 0.1% ;从 ETH 质押量角度来看,Lido 一周上涨 1.60% ,Rocket Pool 上涨 0.18% ,Frax 上涨 0.97% 。上周 LDO 早期投资人 KR 1 继续抛售 50 万枚 LDO。RPL 继 Nexus 大额存款之后,出现了 6720 枚 ETH 的大额解质押,目前 Rocket Pool 存款池余额 2750 枚 ETH;Mini Pool 队列出清,RPL 质押率 47.34% 。FXS 预计将于一个月内发布 FRAX V 3 ,同时创始人 Sam 在接受 Ouroboros Capital 的采访中提及 Frax 正在进军 RWA 领域,很快会正式宣布业务进度。另外 SSV 将于 UTC 时间 8 月 1 日下午 1 点举行第二次主网电话会议,进入 Limited Launch 阶段,引入合作方运营商。

以太坊 L 2

TVL

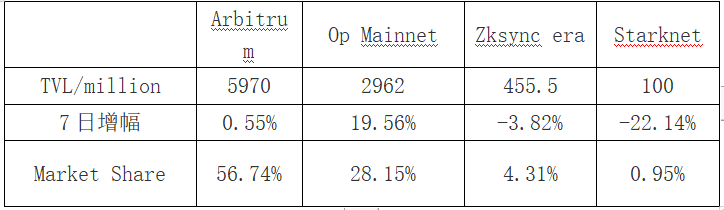

Layer 2 TVL 总量较上周增加 6 亿美元,总锁仓金额 105.5 亿美元,再次突破百亿美元。

数据来源:l 2 b eat

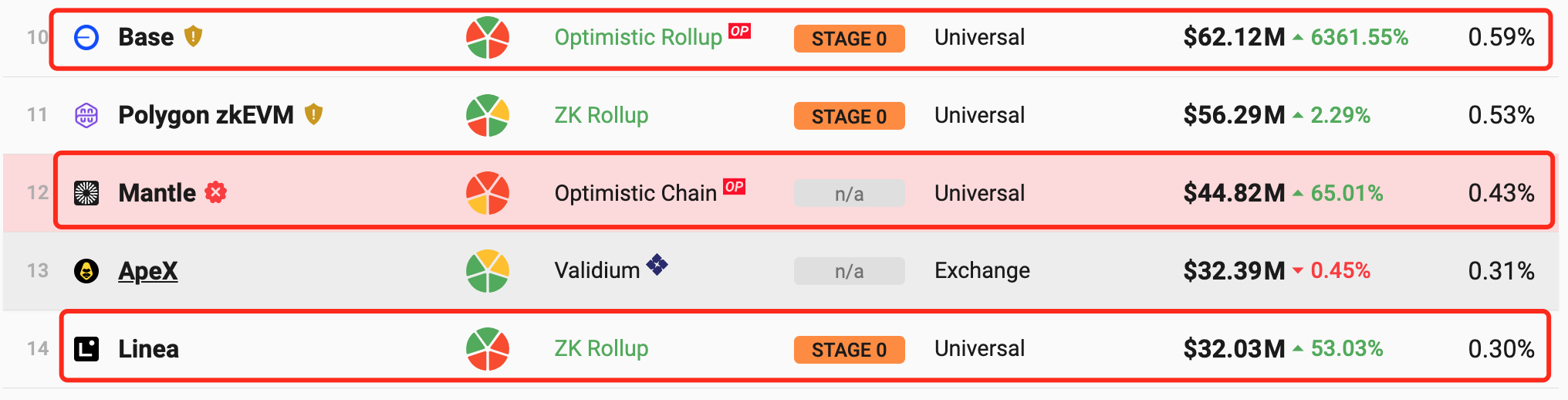

Op Mainnet 在 worldcoin 的带动下 TVL 大幅增长 4.8 亿美元,增长 28.15% ,新上线的 layer 2 base、mantle、linea 对 zksync 和 starknet 造成冲击,Zksync era TVL 已连续一个月出现下滑,Starknet TVL 结束持续上涨的趋势出现拐点,上周跌幅 22% 。

新晋的 layer 2 TVL 增长迅速

Base 主网预计将于 8 月初正式公开发布,尽管主网并未正式向用户发布,已经有大量资金涌入 Base(目前跨链资金只进不出), 7 月 30 日 Base 单日流入 5855.7 万美元。Base 上的 meme $BALD 单日千倍引发热议。

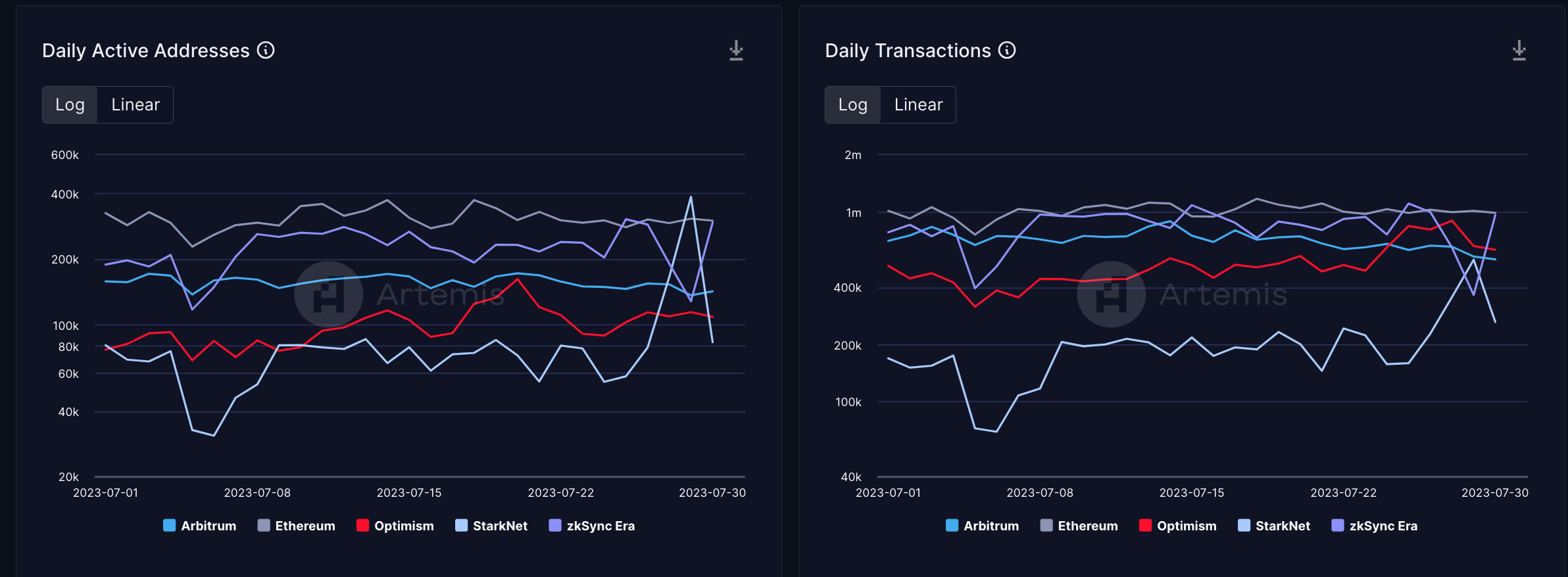

链上活跃度

DEX

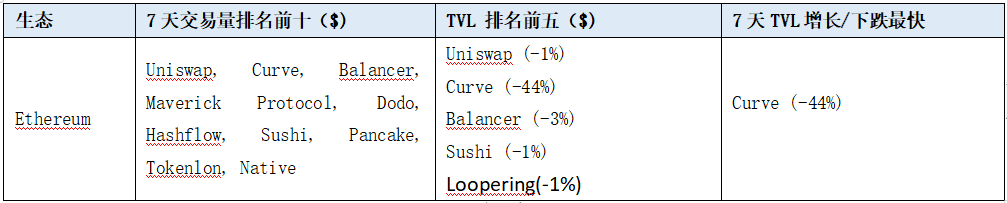

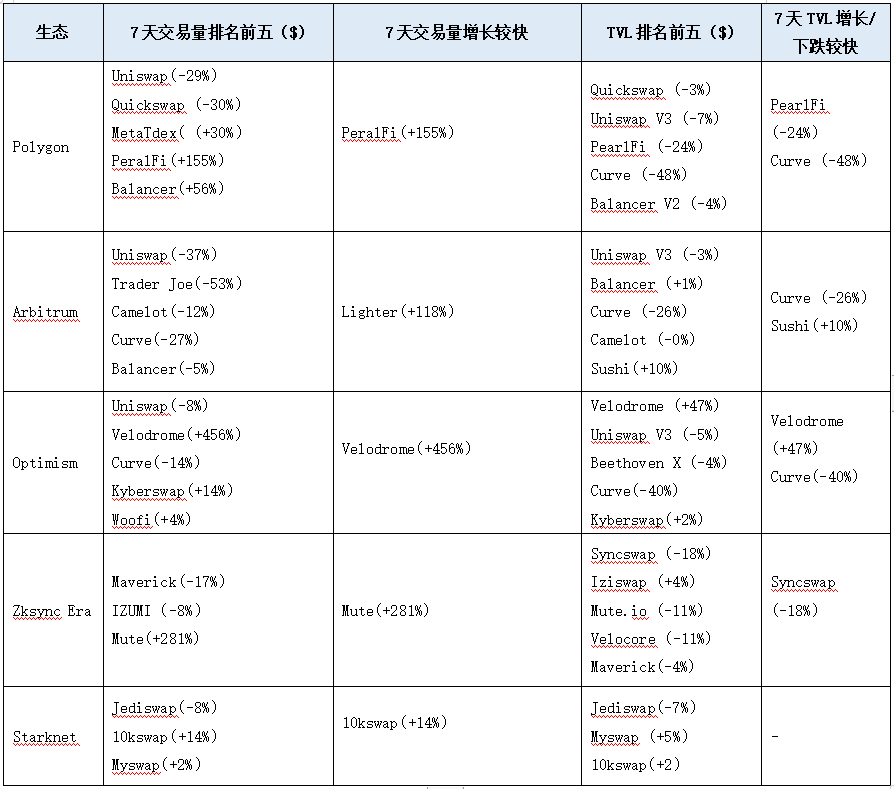

Dex combined TVL 13.15 billion, 较上周减少 1.6 bln。Dex 24 小时交易量 2.26 billion, 7 天交易量 11.15 biliion, 较上周减少 8.1 billion。

Curve 底层 Vyper 编译器的多个旧版本发生递归锁故障, 0.2.15 , 0.2.16 , 0.3.0 版本问题尚未修复。理论上任何使用这些 Vyper 版本的协议都会受到攻击,目前受到影响的协议包括 Curve 的 alETH/msETH/pETH 池,以及 CRV ETH 池。其他包括 deBridge、Ellipsis 池累计损失 5200 万美元。5200 万美元中包括 2100 万美元 eth, 2600 万美元 weth, 530 万美元 crv 和 7 万美元 wbnb。

事件发生至今 Curve TVL 减少 1.5 billion, 下降 44% 。由于 Curve Founder Michael 抵押了大量 CRV 借出稳定币,主要的 4 笔为:Aave 上借 6500 万美元,清算价 0.37 美元;FRAXlend 上借 2100 万 FRAX,清算价 0.4 美元;Abracadabra 借出 1800 万美元,清算价 0.39 美元;Inverse 借出 700 万美元,清算价 0.4 美元,市场可能再次上演多空大战。Curve 作为稳定币,RWA,LSDfi 等多赛道的重要基础设施,其重大攻击事件是对 DeFi 的重大挑战和考验。

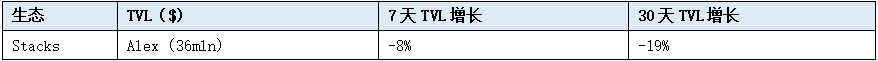

Ethereum

ETH L 2/sidechain

受 Base 带动 OP 上涨影响,Velo 量/TVL 双涨

BTC L 2/sidechain

Alt L 1

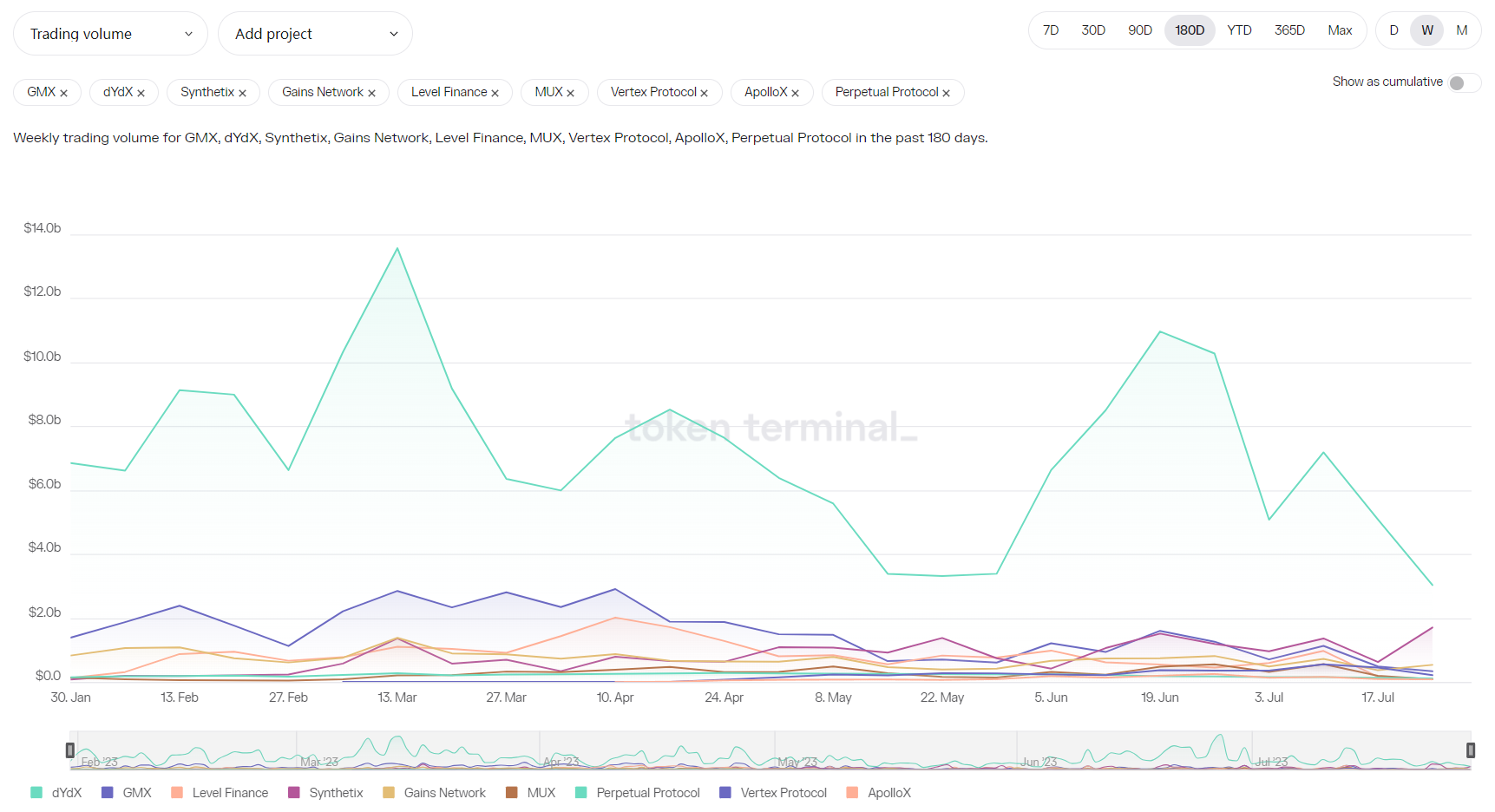

衍生品 DEX

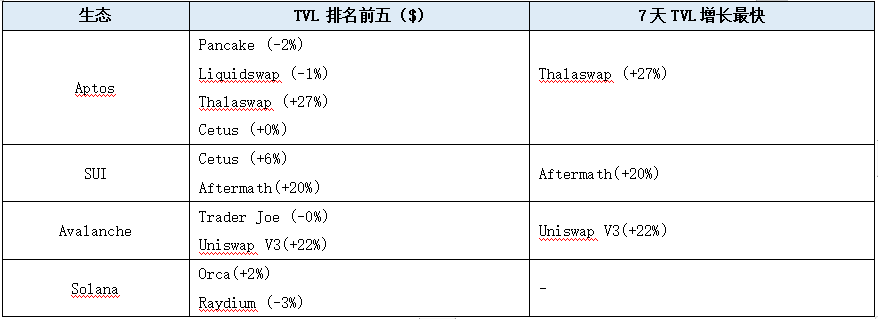

上周(7 月 24 日至 7 月 30 日)衍生品 DEX 的整体交易量持续下跌。9 个主要衍生品 DEX 协议的周交易量约为 74 亿美元,而此前一周的周交易量约为 76 亿美元,跌幅约 2% 。交易量萎缩较为严重,已经接近 2023 年 5 月底 6 月初、以及 2022 年 12 月底的水平,处在相对较低的位置。

GMX 的交易量下降最为严重,在 2023 年 5 月底、 6 月初的下跌中也有类似表现。SNX 的 7 天交易量为 17 亿美元,GMX 仅为 3.3 亿美元。这也导致,SNX 协议收入超过了 GMX。

在 SNX 上(通过前端 kwenta 等)进行合约交易,有 OP 代币作为激励。近期 OP 强势,其获得了大量的交易量。该项激励到 8 月 30 日结束,暂不明确激励是否会继续开展。

除 SNX 外,GMX 还面临二三线永续合约项目的冲击。在这些二三线永续合约平台进行交易,除了手续费奖励外,大多还有代币激励,收益率更高。

TVL 方面,衍生品 DEX 赛道整体 TVL 也在下降, 7 天内资金处于缓慢流出状态。

来源:<a href="https://defillama.com/protocols/Derivatives">Defillama